Asia Pacific Non Hodgkin Lymphoma Diagnostics Market

Market Size in USD Billion

CAGR :

%

USD

11.19 Billion

USD

21.33 Billion

2024

2032

USD

11.19 Billion

USD

21.33 Billion

2024

2032

| 2025 –2032 | |

| USD 11.19 Billion | |

| USD 21.33 Billion | |

|

|

|

|

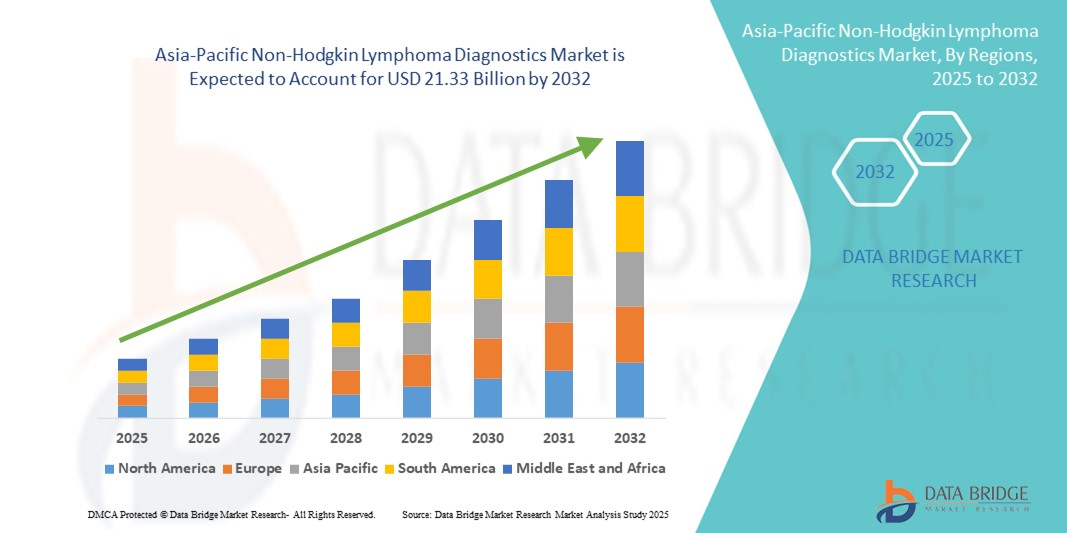

Asia-Pacific Non-Hodgkin Lymphoma Diagnostics Market Size

- The Asia-Pacific non-Hodgkin lymphoma diagnostics market size was valued at USD 11.19 billion in 2024 and is expected to reach USD 21.33 billion by 2032, at a CAGR of 8.40% during the forecast period

- The market growth is largely fueled by increasing awareness, rising healthcare access, and advancements in diagnostic technologies across Asia-Pacific, enabling early detection and accurate classification of Non-Hodgkin Lymphoma (NHL). The region is witnessing a growing prevalence of NHL, particularly in rapidly urbanizing countries such as China, India, and Japan, which is driving demand for advanced diagnostic solutions including flow cytometry, immunohistochemistry, molecular testing, and next-generation sequencing

- Furthermore, escalating investments in healthcare infrastructure, expansion of specialized oncology centers, and increasing public-private partnerships are accelerating innovation and availability of cutting-edge NHL diagnostic tools. Government cancer screening programs, rising healthcare expenditure, and the growing presence of international diagnostic companies along with local manufacturing capabilities are significantly boosting the growth of the Asia-Pacific Non-Hodgkin lymphoma diagnostics market

Asia-Pacific Non-Hodgkin Lymphoma Diagnostics Market Analysis

- The Asia-Pacific Non-Hodgkin lymphoma diagnostics market is witnessing significant growth, driven by the increasing prevalence of NHL, rising awareness about early diagnosis, and advancements in molecular and immunodiagnostic technologies. Countries such as China, India, Japan, and South Korea are strengthening their diagnostic infrastructure and healthcare services, enabling timely detection and improved management of NHL cases

- The rising demand for advanced diagnostic solutions, including flow cytometry, PCR-based tests, immunohistochemistry, and next-generation sequencing, is supported by increasing government funding, expanding healthcare access, and the growing adoption of precision medicine approaches across Asia-Pacific. Furthermore, partnerships between diagnostic companies, research institutes, and hospital networks are fostering innovation and accessibility of NHL diagnostics

- China dominated the Asia-Pacific non-Hodgkin lymphoma diagnostics market, accounting for the largest revenue share of 36.5% in 2024, driven by a large patient population, advanced hospital networks, and widespread integration of molecular and immunodiagnostic solutions in tertiary care centers. Government initiatives supporting early cancer detection and reimbursement policies are further encouraging adoption of NHL diagnostics

- India is projected to register the fastest CAGR of 12.8% in the Asia-Pacific non-Hodgkin lymphoma diagnostics market during the forecast period, fueled by rising awareness, increasing affordability and accessibility of advanced diagnostic tests, and expanding private laboratory networks in tier 2 and tier 3 cities. National health programs and private investments in oncology diagnostics are accelerating the adoption of modern NHL detection methods

- Aggressive lymphomas dominated the Asia-Pacific non-Hodgkin lymphoma diagnostics market with a share of 59.6% in 2024, as these rapidly progressing cancers demand prompt, accurate diagnostics for immediate therapeutic intervention

Report Scope and Asia-Pacific Non-Hodgkin Lymphoma Diagnostics Market Segmentation

|

Attributes |

Asia-Pacific Non-Hodgkin Lymphoma Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Non-Hodgkin Lymphoma Diagnostics Market Trends

Accelerating Molecular Diagnostics and Precision Oncology Initiatives

- A significant and accelerating trend in the Asia-Pacific non-Hodgkin lymphoma diagnostics market is the increasing focus on molecular diagnostic innovations and precision oncology research—particularly targeting early detection, accurate subtype classification, and personalized treatment strategies

- For instance, various diagnostic laboratories, hospitals, and research institutes across Asia-Pacific are investing in next-generation technologies, including flow cytometry, PCR assays, next-generation sequencing (NGS), and immunophenotyping, which allow for faster, more accurate identification of NHL subtypes and associated biomarkers

- The increasing adoption of precision oncology models across hospitals and specialized cancer centers is enabling tailored treatment approaches based on individual molecular profiles, improving therapy effectiveness and reducing unnecessary interventions

- Collaborations between regional biotech companies, academic research institutions, and government health programs are helping to expand access to advanced NHL diagnostics by streamlining regulatory pathways, enhancing reimbursement mechanisms, and providing specialized professional training for clinical staff

- As Asia-Pacific continues to strengthen its healthcare infrastructure, invest in clinical research, and promote early cancer detection initiatives, the non-Hodgkin lymphoma diagnostics market is poised for sustained growth, driven by innovation, improved diagnostic precision, and rising demand for personalized oncology solutions

Asia-Pacific Non-Hodgkin Lymphoma Diagnostics Market Dynamics

Driver

Growing Need Due to Rising Diagnosis Rates and Advancements in Genetic Research

- The increasing prevalence of non-Hodgkin lymphoma (NHL) across Asia-Pacific, supported by growing awareness and enhanced diagnostic capabilities, is significantly driving market growth. Countries such as China, India, Japan, and South Korea are strengthening their healthcare infrastructure and screening programs, enabling earlier detection, accurate staging, and timely intervention for NHL patients

- For instance, in March 2023, Grail Inc. expanded its multi-cancer early detection program in Asia, integrating next-generation sequencing (NGS) technologies for high-sensitivity detection of hematological malignancies. Such innovations are expected to catalyze the growth of advanced diagnostic solutions, thereby accelerating the Asia-Pacific Non-Hodgkin Lymphoma Diagnostics market over the forecast period

- Rising interest in precision medicine, coupled with the availability of next-generation molecular and genetic testing platforms, is prompting a shift from conventional diagnostic methods to more customized, predictive, and prognostic solutions tailored for NHL management

- Regulatory bodies across Asia-Pacific, such as the Pharmaceuticals and Medical Devices Agency (PMDA) in Japan and the National Medical Products Administration (NMPA) in China, are increasingly supporting diagnostic innovation through fast-track approvals and clinical trial support, fostering rapid market access for advanced NHL diagnostic technologies

- Collaborations among regional biotech firms, academic research centers, and oncology associations are strengthening the innovation ecosystem in Asia-Pacific. These partnerships are instrumental in expanding patient access to state-of-the-art diagnostics, scaling clinical research initiatives, and enhancing awareness of early NHL detection and precision treatment options across diverse populations

Restraint/Challenge

Challenges from Infrastructure Constraints and Inconsistent Clinical Adoption

- High costs associated with advanced NHL diagnostic procedures—including genetic testing, biomarker panels, and high-end imaging—pose a substantial barrier to widespread adoption, particularly in rural or underfunded regions of Asia-Pacific

- The development and deployment of cutting-edge diagnostic platforms often involve lengthy and expensive validation processes, making them less accessible to healthcare providers with budget constraints

- Moreover, specialized hematology-oncology expertise and multidisciplinary diagnostic teams are often concentrated in urban centers, forcing patients in remote areas to travel long distances for proper NHL evaluation

- Another challenge is the lack of standardized diagnostic protocols for certain molecular and genetic tests in NHL. Limited clinical data, inconsistent laboratory capacities, and variable physician familiarity—especially in low-volume centers—restrict adoption of innovative diagnostic solutions

- To overcome these challenges, policy reforms, enhanced government funding, regional research collaboration, and the establishment of dedicated oncology diagnostic hubs across Asia-Pacific will be essential in expanding access and achieving sustainable growth in the Asia-Pacific non-hodgkin lymphoma diagnostics market

Asia-Pacific Non-Hodgkin Lymphoma Diagnostics Market Scope

The market is segmented on the basis of test type, cancer stage, tumor type, product, technology, application, end user, and distribution channel.

- By Test Type

On the basis of test type, the Asia-Pacific non-Hodgkin lymphoma diagnostics market is segmented into imaging, biopsy, immunohistochemistry, biomarker, genetic test, cytogenetics, lumbar puncture, blood test, cytochemistry, and others. The imaging segment dominated the market with a share of 32.4% in 2024, attributed to its widespread utilization in initial disease diagnosis, cancer staging, and ongoing patient monitoring across hospitals and diagnostic centers. Imaging technologies such as CT scans, MRI, and PET scans play a critical role in detecting lymphoma involvement in lymph nodes and extranodal sites, enabling oncologists to make timely and informed treatment decisions. The increasing adoption of hybrid imaging modalities (such as, PET/CT, PET/MRI) and continuous improvements in image resolution and sensitivity are further strengthening their demand in clinical workflows.

The genetic test segment is projected to grow at the fastest CAGR of 11.3% from 2025 to 2032, driven by the rising adoption of precision medicine and personalized oncology treatment plans. The growing integration of molecular diagnostic platforms helps identify specific genetic alterations, chromosomal abnormalities, and mutations associated with Non-Hodgkin Lymphoma. This allows oncologists to stratify patients based on risk, monitor disease progression, and guide targeted therapies, thereby improving treatment outcomes. The expanding role of next-generation sequencing (NGS) and the falling cost of genetic testing are expected to further accelerate market growth.

- By Cancer Stage

On the basis of cancer stage, the Asia-Pacific non-Hodgkin lymphoma diagnostics market is segmented into Stage IV, Stage III, Stage II, Stage I, and Stage 0. The Stage IV diagnostics segment held the largest market share of 28.7% in 2024, reflecting the high prevalence of advanced-stage Non-Hodgkin Lymphoma in Asia-Pacific. Patients diagnosed at this stage often require comprehensive diagnostic testing, including advanced imaging, biomarker analysis, and molecular profiling, to evaluate disease spread and tailor treatment strategies. The demand is also supported by the need for multimodal diagnostic approaches to monitor treatment response and recurrence in late-stage patients.

Meanwhile, early-stage diagnostics (Stage I and II) are projected to register the fastest CAGR of 9.8% during 2025–2032, fueled by growing awareness programs, national screening initiatives, and increasing participation in preventive health check-ups. Governments and healthcare organizations in Asia-Pacific are actively promoting early detection campaigns, improving access to diagnostic tools, and investing in screening infrastructure to ensure timely disease identification and better survival outcomes.

- By Tumor Type

On the basis of tumor type, the Asia-Pacific non-Hodgkin lymphoma diagnostics market is segmented into aggressive lymphomas and indolent lymphomas. The aggressive lymphoma segment accounted for the largest market share of 59.6% in 2024, as these fast-growing cancers demand rapid and accurate diagnostics for immediate therapeutic intervention. Aggressive lymphomas such as diffuse large B-cell lymphoma (DLBCL) often require urgent diagnosis through imaging, biopsy, and molecular tests to prevent disease progression. The segment’s growth is also driven by the high disease burden and need for advanced testing solutions that can support timely treatment initiation.

The indolent lymphoma segment is expected to grow at a CAGR of 8.5% from 2025 to 2032, supported by the increasing demand for long-term monitoring and predictive diagnostic testing. Indolent lymphomas, which progress slowly, require repeated follow-ups and surveillance diagnostics to track disease course, monitor therapeutic response, and manage relapse risks. Growing interest in chronic disease management and patient-centered care models is fueling the adoption of diagnostics tailored for these patients.

- By Product

On the basis of product, the Asia-Pacific non-Hodgkin lymphoma diagnostics market is segmented into instrument-based products, platform-based products, kits and reagents, and other consumables. The instrument-based products segment held the largest market share of 41.2% in 2024, due to their accuracy, reliability, and widespread adoption in hospitals and high-volume diagnostic centers. Instruments such as automated sequencers, imaging systems, and flow cytometers provide robust diagnostic outputs, enabling clinicians to make precise and timely treatment decisions. Investments in digital pathology systems and AI-driven diagnostic platforms are further strengthening this segment’s position.

The kits and reagents segment is expected to grow at the fastest CAGR of 10.2% during 2025–2032, owing to their portability, affordability, and adaptability in smaller laboratories, research institutions, and point-of-care testing facilities. Their increasing usage in biomarker detection and genetic testing assays supports precision diagnostics, while the rising demand for rapid, cost-efficient solutions is expanding their adoption across emerging economies.

- By Technology

On the basis of technology, the Asia-Pacific non-Hodgkin lymphoma diagnostics market is segmented into Fluorescent In Situ Hybridization (FISH), Next Generation Sequencing (NGS), Fluorimmunoassay, Comparative Genomic Hybridization (CGH), Immunohistochemical, and Others. The FISH segment dominated the market with a share of 34.5% in 2024, largely due to its established role in identifying chromosomal abnormalities, translocations, and oncogenic rearrangements critical for lymphoma diagnosis. Its high sensitivity and ability to detect subtle genetic variations make it a gold standard in cytogenetic diagnostics. The increasing availability of FISH probe kits and its integration into standard oncology workflows are driving adoption.

The NGS segment is forecasted to expand at the fastest CAGR of 12.1% from 2025 to 2032, as it enables deep genomic profiling, rare mutation detection, and precision treatment planning. The rise of personalized cancer therapies, adoption of liquid biopsy-based NGS, and reducing costs of sequencing are major contributors to growth. NGS is increasingly being integrated into clinical practice to improve accuracy in diagnosis, guide therapy selection, and enhance patient outcomes.

- By Application

On the basis of application, the Asia-Pacific non-Hodgkin lymphoma diagnostics market is segmented into screening, diagnostic and predictive, prognostic, and research. The diagnostic and predictive segment accounted for the largest share of 46.8% in 2024, driven by the rising demand for accurate disease classification, subtype identification, and risk stratification. The adoption of predictive diagnostics allows oncologists to optimize treatment regimens, improve survival rates, and reduce unnecessary interventions. The growth is also supported by the rising prevalence of NHL cases across Asia-Pacific, which increases the demand for reliable diagnostic testing.

The research segment is expected to grow at the fastest CAGR of 10.5% during 2025–2032, owing to expanding investments in clinical trials, academic studies, and pharmaceutical R&D for novel therapeutics. The adoption of advanced technologies, collaborations between diagnostic companies and research institutes, and rising government support for cancer research are accelerating growth in this segment.

- By End User

On the basis of end user, the Asia-Pacific non-Hodgkin lymphoma diagnostics market is segmented into hospitals, diagnostic centers, cancer research centers, academic institutes, ambulatory surgical centers, and others. The hospital segment dominated the market with a significant share of 49.1% in 2024, primarily due to their robust infrastructure, availability of highly advanced diagnostic equipment, and well-trained healthcare professionals. Hospitals act as the central hubs for patient diagnosis and treatment, providing a comprehensive range of services from routine imaging and biopsies to sophisticated molecular and genetic testing. Their ability to manage large patient volumes while offering integrated care—from early detection to follow-up monitoring—makes them the most critical end users of Non-Hodgkin Lymphoma diagnostic solutions. Moreover, hospitals are often the first point of contact for patients, further solidifying their leading role in market demand.

The diagnostic centers segment, on the other hand, is projected to record the fastest growth at a CAGR of 9.7% during 2025–2032. This is driven by patients’ growing preference for specialized and outpatient-based services that are both cost-effective and convenient. Unlike hospitals, diagnostic centers offer shorter waiting times, faster reporting, and targeted diagnostic solutions, which appeal to patients seeking efficiency. The rapid proliferation of private diagnostic networks across Asia-Pacific, coupled with investments in modern imaging technologies, next-generation sequencing, and biomarker testing, is fueling this segment’s expansion. Additionally, their increasing role in early disease detection and personalized medicine makes diagnostic centers an attractive alternative for patients and healthcare providers alike.

- By Distribution Channel

On the basis of distribution channel, the Asia-Pacific non-Hodgkin lymphoma diagnostics market is segmented into direct tender, retail sales, and others. The direct tender segment accounted for the largest market share of 51.3% in 2024, supported by the dominance of centralized procurement systems in government and large institutional healthcare settings. In many countries, public hospitals and government programs procure diagnostic kits, instruments, and reagents in bulk to ensure cost efficiency and supply chain consistency. This procurement model not only guarantees lower prices through economies of scale but also ensures standardized availability of diagnostic products across large networks of hospitals. Ongoing government-led initiatives to strengthen public healthcare infrastructure and streamline distribution have further cemented the dominance of direct tenders in the region.

The retail sales segment is anticipated to expand at the fastest CAGR of 11.0% during 2025–2032, driven by the growing penetration of e-commerce platforms, online pharmacies, and decentralized distribution models. This channel is increasingly bridging the gap between manufacturers and smaller healthcare providers, including independent diagnostic centers, clinics, and laboratories. Retail availability of diagnostic kits, reagents, and consumables has significantly improved accessibility, particularly in remote and underserved areas. The rising trend of at-home testing and the growing role of retail pharmacies in providing point-of-care solutions are also contributing to this channel’s robust growth trajectory.

Asia-Pacific Non-Hodgkin Lymphoma Diagnostics Market Regional Analysis

- Asia-Pacific held a market share of 30.3% in the global non-Hodgkin lymphoma diagnostics market in 2024, driven by the region's expanding oncology infrastructure, growing cancer awareness, and rapid adoption of advanced molecular and immunodiagnostic solutions

- Strong regulatory frameworks, widespread reimbursement policies, and increasing patient awareness are fostering growth across both public and private healthcare sectors. Government initiatives supporting early cancer detection, along with public-private partnerships to enhance diagnostic capabilities, are accelerating the adoption of advanced NHL testing methods

- Furthermore, Asia-Pacific hosts several leading diagnostic companies and research centers, facilitating continuous product innovation and clinical evaluation

China Asia-Pacific Non-Hodgkin Lymphoma Diagnostics Market Insight

The China non-Hodgkin lymphoma diagnostics market dominated the Asia-Pacific Non-Hodgkin Lymphoma Diagnostics market, accounting for the largest revenue share of 36.5% in 2024. This leadership is driven by a large patient population, advanced hospital networks, and widespread integration of molecular and immunodiagnostic solutions in tertiary care centers. Government initiatives supporting early cancer detection, coupled with favorable reimbursement policies, are further encouraging adoption of NHL diagnostics.

Japan Asia-Pacific Non-Hodgkin Lymphoma Diagnostics Market Insight

The Japan non-Hodgkin lymphoma diagnostics market accounted for 20.3% of the Asia-Pacific market share in 2024, supported by a highly developed healthcare infrastructure, strong insurance coverage, and robust clinical research capabilities. Increasing adoption of next-generation diagnostic platforms and precision medicine approaches is strengthening the country’s position in NHL diagnostics.

India Asia-Pacific Non-Hodgkin Lymphoma Diagnostics Market Insight

The India non-Hodgkin lymphoma diagnostics market is projected to register the fastest CAGR of 12.8% during the forecast period, fueled by rising awareness, increasing affordability, and expanding accessibility of advanced diagnostic tests. Growth is further supported by expanding private laboratory networks in tier 2 and tier 3 cities, along with national health programs and private investments in oncology diagnostics.

Asia-Pacific Non-Hodgkin Lymphoma Diagnostics Market Share

The Asia-Pacific non-Hodgkin lymphoma diagnostics industry is primarily led by well-established companies, including:

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Koninklijke Philips N.V. (Netherlands)

- Siemens Healthineers AG (Germany)

- Danaher Corporation (U.S.)

- Bio-Rad Laboratories, Inc (U.S.)

- General Electric Company (U.S.)

- Sysmex Corporation (Japan)

- Grail (U.S.)

- F. Hoffmann-La Roche (Switzerland)

- Neusoft Corporation (China)

- Agilent Technologies, Inc. (U.S.)

- NeoGenomics Laboratories (U.S.)

- Hologic, Inc (U.S.)

- Integrated DNA Technologies, Inc. (U.S.)

- CENTOGENE N.V. (Germany)

- Merit Medical Systems (U.S.)

- Invitae Corporation (U.S.)

- PerkinElmer (U.S.)

- QIAGEN (U.S.)

- GeneDx, LLC (U.S.)

Latest Developments in Asia-Pacific Non-Hodgkin Lymphoma Diagnostics market

- In November 2022, Australia introduced Medicare Benefits Schedule (MBS) item 61612 to fund FDG PET/CT for initial staging of rare and uncommon cancers, explicitly including indolent non-Hodgkin’s lymphoma, improving nationwide access to advanced imaging for NHL work-ups

- In March 2023, Illumina launched Connected Insights, a software platform to streamline tertiary analysis and reporting for oncology NGS, supporting labs (including those in APAC) in faster interpretation of cancer variants for precision diagnostics workflows applicable to hematologic malignancies

- In August 2023, Illumina opened its India Solutions Center in Bengaluru, expanding hands-on enablement for oncology sequencing and bioinformatics across South Asia and the broader APAC region—boosting local capacity for hematology/oncology diagnostics programs

- In June 2024, Roche announced the VENTANA Kappa and Lambda Dual ISH mRNA Probe Cocktail (CE-marked), an in-situ hybridization assay that helps pathologists differentiate clonal B-cell populations—directly supporting B-cell lymphoma work-ups in labs that adopt CE-IVD workflows across APAC

- In February 2024, Roche Tissue Diagnostics and PathAI entered an exclusive collaboration to develop AI-enabled digital pathology algorithms for companion diagnostics, integrating into Roche’s NAVIFY/uPath ecosystem—paving the way for more standardized, scalable lymphoma slide interpretation in APAC labs

- In April 2024, China’s NMPA approved chidamide (tucidinostat) + R-CHOP for MYC/BCL2-expressing DLBCL. Although a therapy decision, the approval formally ties treatment to biomarker status, reinforcing the need for validated IHC/FISH testing (MYC, BCL2) and thereby stimulating diagnostic demand in NHL across China

- In July 2023 (effective ongoing), Australia added MBS item 61644 as an ongoing PET nuclear medicine service, supporting sustained access to reimbursed PET imaging—an important modality for staging and response assessment in lymphoma

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.