Asia Pacific Orthopedic Braces And Supports Market

Market Size in USD Billion

CAGR :

%

USD

1.07 Billion

USD

1.67 Billion

2025

2033

USD

1.07 Billion

USD

1.67 Billion

2025

2033

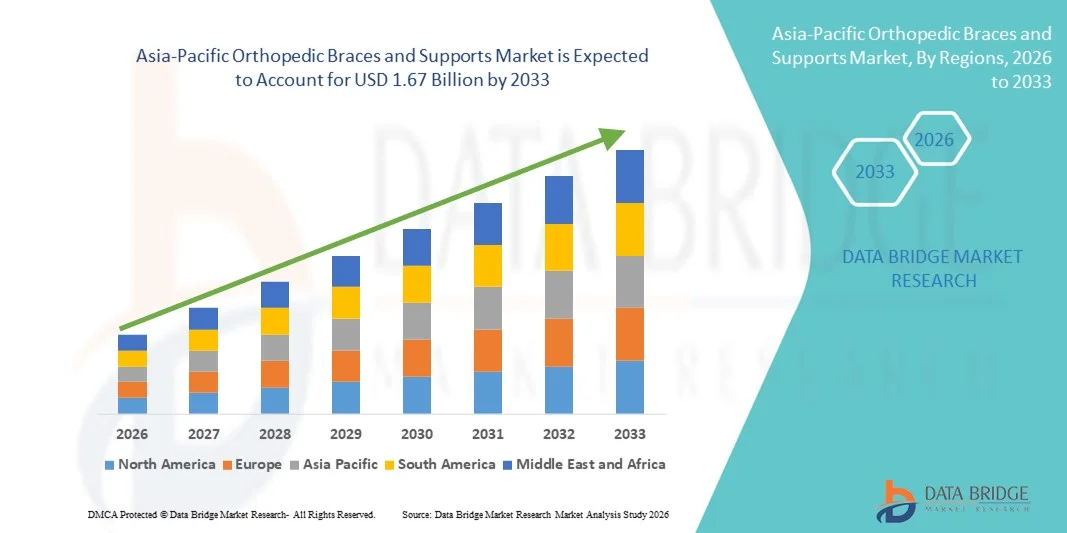

| 2026 –2033 | |

| USD 1.07 Billion | |

| USD 1.67 Billion | |

|

|

|

|

Asia-Pacific Orthopedic Braces and Supports Market Size

- The Asia-Pacific orthopedic braces and supports market size was valued at USD 1.07 billion in 2025 and is expected to reach USD 1.67 billion by 2033, at a CAGR of 5.80% during the forecast period

- The market growth is largely driven by the rising prevalence of musculoskeletal disorders, increasing sports-related injuries, and a growing geriatric population across major economies such as China, India, and Japan, leading to higher demand for non-invasive orthopedic support solutions

- Furthermore, expanding awareness regarding preventive healthcare, improving access to rehabilitation services, and technological advancements in lightweight, durable, and customizable brace materials are establishing orthopedic braces and supports as essential mobility and recovery aids. These converging factors are accelerating product adoption across hospitals, clinics, and homecare settings, thereby significantly boosting the industry's growth

Asia-Pacific Orthopedic Braces and Supports Market Analysis

- Orthopedic braces and supports, designed to stabilize, protect, and rehabilitate injured or weakened joints and muscles, are increasingly essential across hospitals, orthopedic clinics, sports medicine centers, and homecare settings in China due to their effectiveness in pain relief, post-operative recovery, and injury prevention

- The escalating demand for orthopedic braces and supports in China is primarily fueled by the rising prevalence of osteoarthritis and other musculoskeletal disorders, increasing sports participation, a rapidly aging population, and growing awareness of non-invasive treatment alternatives

- China dominated the Asia-Pacific orthopedic braces and supports market with the largest revenue share of 38.6% in 2025, supported by its large patient population, expanding healthcare infrastructure, and rising healthcare expenditure, with strong demand observed in tier-1 and tier-2 cities where access to advanced orthopedic care and rehabilitation services is improving

- India is expected to be the fastest growing country in the Asia-Pacific orthopedic braces and supports market during the forecast period due to increasing healthcare investments, expanding private hospital networks, rising sports injuries, and growing awareness regarding affordable orthopedic rehabilitation solutions

- Knee Braces and Supports segment dominated the Asia-Pacific orthopedic braces and supports market with a market share of 41.3% in 2025, driven by the high incidence of knee osteoarthritis, sports-related ligament injuries, and growing demand for post-surgical rehabilitation and elderly mobility support solutions

Report Scope and Asia-Pacific Orthopedic Braces and Supports Market Segmentation

|

Attributes |

Asia-Pacific Orthopedic Braces and Supports Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Orthopedic Braces and Supports Market Trends

Technological Advancement in Lightweight and Smart Rehabilitation Solutions

- A significant and accelerating trend in the Asia-Pacific orthopedic braces and supports market is the growing adoption of lightweight, breathable, and ergonomically designed materials combined with emerging smart rehabilitation technologies. This evolution is significantly enhancing patient comfort, compliance, and treatment outcomes across diverse care settings

- For instance, several regional and global manufacturers are introducing 3D-knitted knee and ankle braces that provide targeted compression while improving flexibility and durability. Similarly, functional braces integrated with adjustable support systems are gaining traction in post-surgical and sports injury recovery programs

- Integration of sensor-based monitoring systems in advanced orthopedic braces enables tracking of joint movement, rehabilitation progress, and patient adherence to prescribed therapy. For instance, certain smart knee braces can transmit mobility data to connected mobile applications, allowing clinicians to assess recovery remotely and adjust treatment plans accordingly. Furthermore, lightweight composite materials reduce discomfort during prolonged use, encouraging better patient compliance

- The seamless incorporation of orthopedic supports into home-based rehabilitation programs facilitates decentralized care delivery and reduces hospital visits. Through digital platforms, patients can coordinate with physiotherapists while using prescribed braces, creating a more efficient and connected recovery ecosystem

- This trend toward more patient-centric, technology-enabled orthopedic solutions is fundamentally reshaping expectations for musculoskeletal care. Consequently, companies operating in Asia-Pacific are developing customizable braces with enhanced durability, breathable fabrics, and smart monitoring compatibility to meet evolving clinical and consumer demands

- The demand for technologically advanced, comfortable, and digitally integrated orthopedic braces and supports is growing rapidly across hospitals, sports facilities, and homecare environments, as patients increasingly prioritize mobility, convenience, and faster rehabilitation outcomes

- Expansion of e-commerce and direct-to-consumer distribution channels across Asia-Pacific is improving product accessibility, enabling patients to compare features, prices, and clinical benefits more efficiently

Asia-Pacific Orthopedic Braces and Supports Market Dynamics

Driver

Rising Musculoskeletal Disorders and Expanding Geriatric Population

- The increasing prevalence of osteoarthritis, ligament injuries, and other musculoskeletal disorders, coupled with the rapid expansion of the elderly population in Asia-Pacific, is a significant driver for the heightened demand for orthopedic braces and supports

- For instance, rising healthcare investments in countries such as China and India are supporting improved access to orthopedic procedures and post-operative rehabilitation products, thereby stimulating market expansion during the forecast period

- As awareness regarding non-invasive treatment options grows, patients are increasingly opting for braces and supports for pain management, joint stabilization, and injury prevention, offering a practical alternative to surgical interventions in mild to moderate cases

- Furthermore, the expanding sports culture, increasing workplace injuries, and greater participation in physical activities are making orthopedic supports an essential component of preventive and therapeutic care across urban populations

- The availability of diverse product categories, including knee, ankle, spine, and shoulder braces, alongside distribution through hospitals, pharmacies, and e-commerce platforms, is propelling adoption across both developed and emerging economies in the region

- Government initiatives aimed at strengthening domestic medical device manufacturing are supporting local production and reducing dependency on imports, thereby enhancing supply chain resilience

- Increasing health insurance penetration and reimbursement coverage for orthopedic rehabilitation products in select Asia-Pacific countries are further supporting sustained demand growth

Restraint/Challenge

Product Affordability Constraints and Regulatory Compliance Hurdles

- Concerns surrounding the high cost of advanced orthopedic braces and the varying regulatory standards across Asia-Pacific countries pose significant challenges to broader market penetration. Premium and technologically enhanced braces may remain unaffordable for price-sensitive populations in developing markets

- For instance, stringent medical device approval processes and differing reimbursement frameworks across countries can delay product launches and limit accessibility for certain patient groups

- Addressing affordability issues through local manufacturing, cost optimization strategies, and expanded insurance coverage is crucial for improving product accessibility. Companies are increasingly focusing on value-based product lines to cater to middle-income populations while maintaining quality and durability standards. In addition, limited awareness in rural areas regarding proper brace usage and benefits can restrict adoption rates despite clinical necessity

- While healthcare infrastructure is improving, disparities between urban and rural regions may hinder equitable access to advanced orthopedic rehabilitation products. Variations in pricing and distribution networks further influence market reach and patient uptake

- Overcoming these challenges through streamlined regulatory harmonization, enhanced reimbursement support, patient education initiatives, and expansion of affordable product portfolios will be vital for sustaining long-term market growth across Asia-Pacific

- Intense price competition among domestic and international manufacturers may pressure profit margins and limit investment in research and product innovation

- Risk of improper sizing or unsupervised usage without professional guidance can reduce product effectiveness, potentially affecting patient outcomes and brand credibility

Asia-Pacific Orthopedic Braces and Supports Market Scope

The market is segmented on the basis of product, type, application, and end user.

- By Product

On the basis of product, the Asia-Pacific orthopedic braces and supports market is segmented into ankle braces and supports, foot walkers and orthoses, hip, back, and spine braces and supports, knee braces and supports, shoulder braces and supports, elbow braces and supports, hand/wrist braces and supports, and facial braces and supports. The knee braces and supports segment dominated the market with the largest revenue share of 41.3% in 2025, primarily driven by the high prevalence of knee osteoarthritis, ligament tears, and sports-related injuries across China, Japan, and India. The aging population and rising obesity rates have significantly increased knee-related musculoskeletal conditions, strengthening segment demand. In addition, knee braces are widely prescribed for post-operative rehabilitation following ACL and meniscus surgeries. Their broad availability across hospitals, pharmacies, and online platforms further reinforces market leadership. Continuous product innovation, including adjustable and lightweight designs, supports sustained adoption.

The shoulder braces and supports segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising sports participation, increasing cases of rotator cuff injuries, and expanding awareness regarding early-stage orthopedic intervention. Growing urbanization and gym culture across metropolitan cities are contributing to shoulder strain and injury cases. Technological advancements in compression-based and posture-corrective shoulder supports are enhancing product effectiveness. Increased access to physiotherapy services and rehabilitation centers further supports segment expansion. Moreover, demand for non-invasive recovery solutions is accelerating adoption among working professionals and athletes.

- By Type

On the basis of type, the market is segmented into soft and elastic braces and supports, hard and rigid braces and supports, and hinged braces and supports. The soft and elastic braces and supports segment held the largest market revenue share in 2025 due to their affordability, comfort, and widespread use in mild injury management and preventive care. These braces are commonly recommended for early-stage osteoarthritis, muscle strain, and daily joint support. Their lightweight structure and breathable materials enhance patient compliance for long-term use. Easy availability through retail pharmacies and e-commerce platforms further strengthens their market penetration. Increasing preference for non-bulky and flexible orthopedic aids continues to drive segment dominance.

The hinged braces and supports segment is expected to witness the fastest CAGR from 2026 to 2033, driven by increasing demand for advanced stabilization solutions in ligament injuries and post-surgical recovery. Hinged braces provide controlled joint movement while preventing excessive strain, making them suitable for moderate to severe injuries. Rising sports injuries and orthopedic surgical procedures across Asia-Pacific are boosting demand for these specialized products. Technological improvements in adjustable hinge systems enhance customization and patient outcomes. Growing awareness among orthopedic specialists regarding advanced bracing solutions further contributes to segment growth.

- By Application

On the basis of application, the market is segmented into preventive care, ligament injury, post-operative rehabilitation, osteoarthritis, compression therapy, and others. The osteoarthritis segment dominated the market in 2025 due to the rapidly aging population and increasing incidence of degenerative joint disorders across the region. Countries such as Japan and China report high rates of age-related knee and hip degeneration, significantly driving brace utilization. Orthopedic supports are frequently prescribed to reduce pain, improve joint alignment, and delay surgical intervention. Growing awareness of conservative treatment approaches further accelerates demand. Expanding geriatric care services and rehabilitation infrastructure also support sustained segment leadership.

The post-operative rehabilitation segment is projected to grow at the fastest rate during the forecast period, supported by rising volumes of orthopedic surgeries and improved healthcare access. Increasing availability of minimally invasive procedures is boosting recovery-focused brace adoption. Structured rehabilitation programs in hospitals and clinics are encouraging consistent use of orthopedic supports. Technological advancements enabling better immobilization and recovery tracking further strengthen demand. Rising patient preference for home-based recovery solutions In addition accelerates segment growth.

- By End User

On the basis of end user, the market is segmented into hospitals, clinics, home healthcare, and others. The hospitals segment accounted for the largest revenue share in 2025 due to high patient inflow for orthopedic surgeries, trauma management, and advanced musculoskeletal treatments. Hospitals remain the primary point of prescription for braces and supports, particularly for complex and post-surgical cases. Availability of specialized orthopedic professionals and diagnostic facilities supports segment dominance. Bulk procurement practices and established supplier relationships further strengthen hospital-based sales. Growing investments in tertiary care infrastructure across Asia-Pacific continue to sustain demand.

The home healthcare segment is anticipated to witness the fastest growth from 2026 to 2033, driven by increasing preference for cost-effective and convenient rehabilitation solutions. Rising telehealth adoption and availability of remote physiotherapy consultations are supporting brace usage at home. Elderly patients increasingly prefer home-based mobility support to avoid frequent hospital visits. Expanding e-commerce distribution channels enhance product accessibility for home users. Moreover, growing awareness regarding preventive orthopedic care further accelerates segment expansion in home settings.

Asia-Pacific Orthopedic Braces and Supports Market Regional Analysis

- China dominated the Asia-Pacific orthopedic braces and supports market with the largest revenue share of 38.6% in 2025, supported by its large patient population, expanding healthcare infrastructure, and rising healthcare expenditure, with strong demand observed in tier-1 and tier-2 cities where access to advanced orthopedic care and rehabilitation services is improving

- Patients in the region highly value the affordability, availability, and clinical effectiveness offered by orthopedic braces and supports for pain management, post-operative recovery, and injury prevention across both urban and semi-urban populations

- This widespread adoption is further supported by a rapidly aging population, improving healthcare infrastructure, increasing healthcare expenditure, and growing awareness regarding non-invasive musculoskeletal treatment options, establishing orthopedic braces and supports as essential mobility and rehabilitation solutions across hospitals, clinics, and homecare settings

The China Orthopedic Braces and Supports Market Insight

The China orthopedic braces and supports market captured the largest revenue share in 2025 within Asia-Pacific, fueled by the rising prevalence of osteoarthritis, increasing sports injuries, and a rapidly expanding geriatric population. Patients are increasingly prioritizing non-invasive pain management and mobility enhancement solutions through clinically recommended braces and supports. The growing preference for home-based rehabilitation, combined with expanding hospital infrastructure and orthopedic specialty centers, further propels market growth. Moreover, rising healthcare expenditure and government support for domestic medical device manufacturing are significantly contributing to the market’s expansion.

Japan Orthopedic Braces and Supports Market Insight

The Japan orthopedic braces and supports market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the country’s aging population and high incidence of degenerative joint disorders. Increasing awareness regarding preventive orthopedic care and structured rehabilitation programs is fostering adoption. Japanese consumers place strong emphasis on quality, comfort, and technologically advanced healthcare products, encouraging innovation in lightweight and ergonomic brace designs. The integration of rehabilitation supports within home healthcare services is further supporting steady market development across residential and clinical settings.

India Orthopedic Braces and Supports Market Insight

The India orthopedic braces and supports market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising cases of musculoskeletal injuries, expanding sports participation, and improving healthcare accessibility. In addition, increasing awareness regarding affordable orthopedic rehabilitation solutions is encouraging adoption among middle-income populations. India’s growing network of private hospitals, physiotherapy centers, and e-commerce medical supply platforms is expected to continue stimulating market growth. Government initiatives aimed at strengthening domestic medical device production further support long-term expansion.

Australia Orthopedic Braces and Supports Market Insight

The Australia orthopedic braces and supports market is expected to expand at a considerable CAGR during the forecast period, fueled by strong healthcare infrastructure and increasing demand for sports injury management solutions. Australia’s active sports culture and aging demographic profile promote steady adoption of knee, ankle, and shoulder supports. Growing awareness regarding preventive care and post-operative rehabilitation enhances product utilization across hospitals and outpatient settings. The preference for high-quality, clinically approved orthopedic products aligns with consumer expectations for safety and performance.

Asia-Pacific Orthopedic Braces and Supports Market Share

The Asia-Pacific Orthopedic Braces and Supports industry is primarily led by well-established companies, including:

- DJO, LLC (U.S.)

- Össur hf. (Iceland)

- Smith & Nephew (U.K.)

- DeRoyal Industries (U.S.)

- Bauerfeind AG (Germany)

- Orthofix Medical Inc. (U.S.)

- Zimmer Biomet (U.S.)

- 3M (U.S.)

- Trulife (Canada)

- Thuasne Group (France)

- medi GmbH & Co. KG (Germany)

- Ottobock SE & Co. KGaA (Germany)

- CONMED Corporation (U.S.)

- MicroPort Orthopedics, Inc. (China)

- Aspen Medical Products (U.S.)

- Bird & Cronin, LLC (U.S.)

- McDavid Inc. (U.S.)

- Mueller Sports Medicine, Inc. (U.S.)

- BORT Medical GmbH (Germany)

- ALCARE Co., Ltd. (Japan)

What are the Recent Developments in Asia-Pacific Orthopedic Braces and Supports Market?

- In September 2025, G-Medics Korea expanded its global reach with its biodegradable resin orthopedic cast product BONGIPS, preparing to export to Southeast Asia, Europe, and North America after strong domestic uptake and clinician recognition

- In September 2025, South Asia’s first SkyWalker™ Orthopedic Robotic System designed to improve knee joint alignment and recovery outcomes with robotic precision was launched at **Yenepoya Specialty Hospital in Mangaluru, India, enhancing clinical capabilities for joint procedures that often require subsequent orthopedic support and rehabilitation devices

- In September 2025, Apollo Hospitals hosted the Advanced Orthopaedics Symposium 2025 in Hyderabad, gathering over 250 orthopedic surgeons to showcase advancements in knee care, joint preservation technologies, robotics, and digital diagnostics highlighting the region’s clinical innovation focus in musculoskeletal car

- In March 2025, Apollo Hospitals launched the Apollo Joint Preservation Program in Chennai, an initiative to provide early intervention, personalized treatment plans, and rehabilitation services for joint pain, arthritis, ligament injuries, and other musculoskeletal conditions aimed at preserving joint health and avoiding or delaying surgery

- In March 2025, Apollo Hospitals nationwide launched its ‘Joint Preservation Programme’ in India focused on comprehensive treatment pathways including rehabilitation, physiotherapy, and lifestyle support for patients with joint pain and related conditions.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.