Asia Pacific Ostomy Devices Market

Market Size in USD Million

CAGR :

%

USD

609.62 Million

USD

942.70 Million

2025

2033

USD

609.62 Million

USD

942.70 Million

2025

2033

| 2026 –2033 | |

| USD 609.62 Million | |

| USD 942.70 Million | |

|

|

|

|

Asia-Pacific Ostomy Devices Market Size

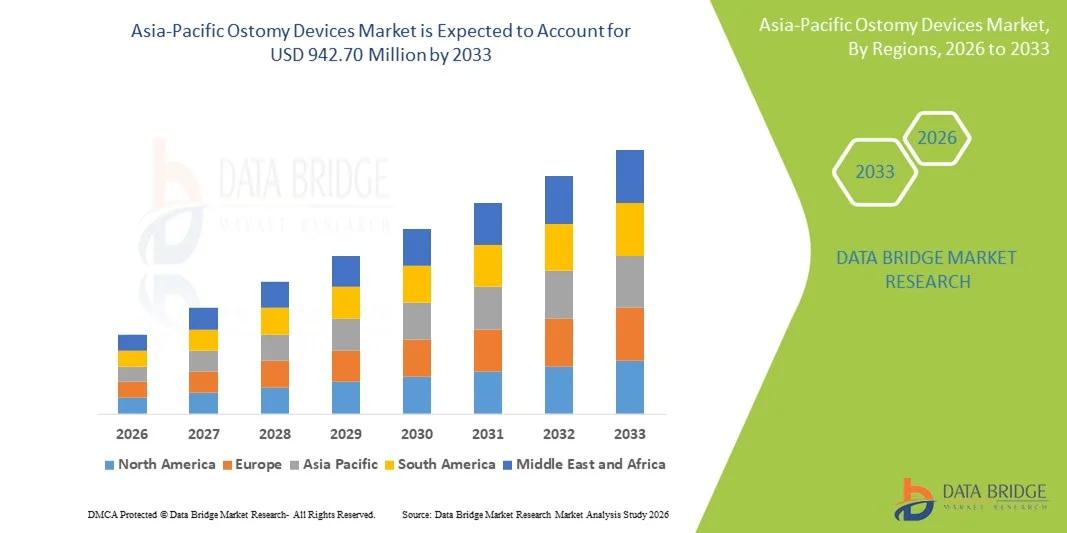

- The Asia-Pacific ostomy devices market size was valued at USD 609.62 million in 2025 and is expected to reach USD 942.70 million by 2033, at a CAGR of 5.60% during the forecast period

- The market growth is largely fueled by the rising prevalence of ostomy-related conditions (such as colorectal cancer, inflammatory bowel disease, and other gastrointestinal disorders), growing awareness around ostomy care products, and expanding geriatric population across key Asia-Pacific countries

- Furthermore, increasing healthcare expenditure, improving healthcare infrastructure, and enhanced patient access to advanced ostomy solutions are driving demand. In addition, technological advancements in ostomy devices that offer better comfort, convenience, and skin protection are further reinforcing adoption. These converging factors are accelerating the uptake of ostomy care products across both hospital and home care settings, thereby significantly boosting the industry’s growth

Asia-Pacific Ostomy Devices Market Analysis

- Ostomy devices including bags, barriers, and accessories used in colostomy, ileostomy, and urostomy care are becoming increasingly essential across Asia-Pacific healthcare systems due to rising GI disease incidence, improved postoperative management, and broader adoption of advanced ostomy care solutions in hospitals and home-care setups

- The demand for ostomy devices is accelerating as colorectal cancer and inflammatory bowel disease cases continue to rise, supported by the region’s rapidly growing aging population and expanding awareness of high-performance ostomy products that provide superior comfort, skin protection, and extended wear time

- Japan dominated the Asia-Pacific ostomy devices market with the largest revenue share of 32.8% in 2025, driven by its sizable elderly population, high colorectal cancer prevalence, strong national reimbursement structure, and widespread availability of advanced ostomy systems through well-established hospital and retail channels

- India is expected to be the fastest-growing country in the Asia-Pacific ostomy devices market during the forecast period, supported by rising cancer incidence, increasing healthcare spending, enhanced hospital capacities, and growing adoption of modern pouching systems among patients and clinicians, with the market showing a rapid transition toward advanced skin-friendly barrier technologies

- The Colostomy Drainage Bags segment dominated the Asia-Pacific ostomy devices market with a market share of 47.5% in 2025, attributed to high surgical volumes related to colorectal cancer and strong demand for improved leakage-prevention systems, particularly two-piece setups and advanced hydrocolloid barriers designed to maximize comfort and reliability

Report Scope and Asia-Pacific Ostomy Devices Market Segmentation

|

Attributes |

Asia-Pacific Ostomy Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Ostomy Devices Market Trends

Shift Toward Advanced Skin-Friendly and Patient-Adaptive Ostomy Technologies

- A significant and accelerating trend in the Asia-Pacific ostomy devices market is the rapid shift toward advanced, skin-friendly, and patient-adaptive ostomy solutions, driven by rising postoperative care needs, increasing chronic disease burden, and growing attention to long-term stoma management across the region

- For instance, Hollister’s CeraPlus barriers, designed to protect peristomal skin and enhance adhesion, are gaining strong traction in countries such as Japan and Australia where patient awareness and clinical recommendations for skin-sensitive products are rising

- Innovations such as hydrocolloid-based barriers, extended wear-time adhesives, and integrated odor-control technologies are becoming central to product adoption, with companies such as Coloplast introducing adaptive barrier technologies that better conform to irregular stoma shapes and reduce leakage risks

- The growing focus on patient comfort is further supported by lightweight pouching systems, advanced filter technologies, and improved flexibility in one-piece and two-piece solutions, enabling ostomy users to maintain mobility and participate in daily activities with greater ease

- For instance, Convatec’s ActiveLife and Natura systems are increasingly preferred across APAC hospitals for their enhanced durability and discreet design, aligning with rising patient preference for compact, reliable, and easy-to-use appliances

- This trend toward more comfortable, adaptive, and clinically advanced ostomy products is reshaping expectations for stoma care in Asia-Pacific, compelling manufacturers such as Coloplast, Hollister, and Convatec to expand localized product offerings that meet the region’s diverse patient needs

- Telehealth-driven stoma care support is emerging as a growing trend across Asia-Pacific, with digital consultation platforms enabling clinicians to remotely guide patients on pouch changes, skin assessment, and barrier selection, improving adherence and overall patient confidence

Asia-Pacific Ostomy Devices Market Dynamics

Driver

Growing Need Due to Rising Colorectal Cancer Burden and Expanding Surgical Access

- The increasing prevalence of colorectal cancer and inflammatory bowel diseases across Asia-Pacific, combined with the region’s expanding access to advanced gastrointestinal surgeries, is a significant driver supporting the rising demand for ostomy devices

- For instance, in March 2025, Coloplast expanded its ostomy care distribution footprint in India and Southeast Asia to support rising surgical volumes and improve access to modern pouching systems, strengthening its position in key emerging markets

- As more patients undergo colostomy and ileostomy surgeries, hospitals and clinicians are adopting advanced ostomy systems that offer superior adhesion, leak protection, and skin-barrier performance compared to basic traditional products

- Furthermore, growing investments in cancer care centers and the expansion of national screening programs in countries such as China, Japan, and South Korea are increasing the number of early diagnoses, subsequently driving more planned and postoperative ostomy device usage

- The availability of patient-centrically designed products, combined with rising preferences for long-wear, premium pouching systems, is strengthening adoption across both hospital and home-care environments throughout Asia-Pacific

- The rising availability of specialized stoma care nurses and certified ostomy care centers across major countries such as Japan, Australia, and China is significantly improving patient education, fostering increased trust in advanced pouching systems and accessories

- For instance, new stoma-care training initiatives launched across major Indian hospitals in 2025 have enhanced patient awareness and clinical adoption of modern two-piece and extended-wear ostomy products

Restraint/Challenge

Skin Irritation Issues and Regulatory Compliance Hurdle

- Persistent concerns regarding peristomal skin irritation, leakage complications, and improper stoma management present a major challenge to broad ostomy device acceptance, especially among new patients who may experience anxiety regarding lifestyle adjustments

- For instance, reports of skin barrier reactions or improper adhesion in humid climates across Southeast Asia have raised caution among patients and caregivers, making expert guidance an essential component of adoption

- Addressing these concerns through advanced skin-protective materials, educational programs, and clinical support is crucial for improving patient outcomes and reducing reluctance among new users

- In addition, varying regulatory pathways, reimbursement limitations, and the uneven approval process for medical devices across India, Southeast Asia, and China create market entry barriers for manufacturers seeking rapid expansion

- While adoption is increasing, the high cost of premium ostomy systems and limited insurance coverage in developing APAC countries continue to pose affordability challenges, particularly for patients requiring long-term or lifelong ostomy care

- Limited awareness of advanced ostomy care options in rural and underserved regions across Asia-Pacific continues to hinder adoption, as many patients rely on basic or outdated pouching products due to lack of education and trained professionals

- For instance, surveys in rural India and parts of Indonesia indicate that many ostomy users face challenges accessing high-quality products or expert guidance, resulting in discomfort and poor long-term clinical outcomes

Asia-Pacific Ostomy Devices Market Scope

The market is segmented on the basis of product type, surgery type, shape of skin barrier, system type, and end user.

- By Product Type

On the basis of product type, the Asia-Pacific ostomy devices market is segmented into bags and accessories. The Bags segment dominated the market with the largest revenue share in 2025, driven by the high and growing number of colostomy, ileostomy, and urostomy surgeries across major countries such as Japan, China, and India. Bags remain the most essential consumable for ostomy patients, requiring frequent replacement and continuous supply, making them the biggest revenue contributor. Growing emphasis on leak prevention, odor management, and longer wear-time performance has further increased the demand for premium pouching systems, strengthening dominance. The introduction of advanced multi-layered film materials, improved filters, and patient-friendly coupling designs continues to expand the popularity of this segment. Continuous product innovation from global leaders such as Coloplast, Hollister, and Convatec also contributes significantly to the segment’s market leadership.

The Accessories segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising demand for supporting products such as skin barrier rings, powders, adhesives, pastes, and deodorizing solutions. Increasing awareness about peristomal skin health, especially among new ostomy users, is substantially boosting the adoption of accessories that help improve appliance fit and reduce skin irritation. Hospitals and stoma care nurses are increasingly recommending accessories as standard care components, particularly for patients with irregular stoma shapes or frequent leakage issues. Continuous product advancements, including hydrocolloid-based barrier rings and extended wear adhesives, are strengthening segment adoption. The shift toward holistic ostomy care, emphasizing comfort, prevention of complications, and long-term skin protection, is expected to sustain rapid growth of accessories throughout the forecast period.

- By Surgery Type

On the basis of surgery type, the market is segmented into ileostomy drainage bags, colostomy drainage bags, and urostomy drainage bags. The Colostomy Drainage Bags segment dominated the market with the largest revenue share of 47.5% in 2025, primarily due to the high prevalence of colorectal cancer across Asia-Pacific, particularly in Japan, China, South Korea, and Australia. Colostomy is one of the most frequently performed ostomy procedures, resulting in high volume demand for colostomy drainage bags across hospitals and home-care settings. The segment also benefits from extensive adoption of two-piece systems and advanced hydrocolloid skin barriers that enhance comfort and reduce leakage, improving overall patient experience. Increasing screening programs and earlier detection of colorectal cancer in APAC are further contributing to the rising volume of colostomy surgeries. Manufacturers are also expanding product lines specifically designed for colostomy patients, supporting segment growth.

The Ileostomy Drainage Bags segment is projected to witness the fastest growth rate from 2026 to 2033, driven by an increasing number of patients with inflammatory bowel diseases, such as Crohn’s disease and ulcerative colitis, especially in urban areas across China, Australia, and South Korea. Ileostomy patients require drainage bags with higher output capacity and stronger adhesive barriers, creating opportunities for premium product adoption. The rising awareness of modern ostomy appliances that offer secure, skin-friendly, and flexible wear has driven demand for high-performance ileostomy bags. Furthermore, growing access to advanced GI surgeries in developing economies such as India and Indonesia is expected to support rapid uptake. With young adult IBD cases increasing and clinical recommendations favoring advanced pouching systems, the ileostomy segment is positioned for sustained long-term growth.

- By Shape of Skin Barrier

On the basis of skin barrier shape, the market is segmented into flat and convex. The Flat skin barrier segment dominated the market with the largest revenue share in 2025, supported by strong adoption among patients with regular stoma protrusion and well-healed peristomal skin. Flat barriers are widely used in hospitals due to ease of application, availability in various adhesive strengths, and compatibility with both one-piece and two-piece systems. Their comparatively lower cost and suitability for a majority of ostomy users further enhance market dominance. Increasing product innovations, including extended-wear hydrocolloid material and improved flexibility, have strengthened user preference in APAC markets. As more patients transition to home care, flat barriers remain the preferred option for their simplicity and reliability.

The Convex skin barrier segment is expected to experience the fastest growth rate from 2026 to 2033, driven by rising adoption among patients with retracted, flush, or irregularly shaped stomas—conditions more frequently managed in advanced surgical centers across Japan, Australia, and Singapore. Convex barriers help improve appliance adherence and reduce leakage risks, making them increasingly recommended by stoma care nurses for complex cases. Growing awareness of peristomal skin complications and the effectiveness of convex designs in improving fit and comfort is driving higher use, particularly among long-term ostomy users. Manufacturers are also expanding their convex product portfolios with varied depths and flexible materials, further accelerating adoption across the region.

- By System Type

On the basis of system type, the market is segmented into one-piece system and two-piece system. The Two-piece System segment dominated the market in 2025, owing to its flexibility, convenience, and ability to replace the bag without removing the skin barrier, reducing irritation and improving comfort. Two-piece systems are especially preferred by long-term ostomy patients and are widely recommended by clinicians due to their superior leak protection and durability. The segment benefits from rising adoption in Japan, Australia, and urban centers in China where premium ostomy solutions have strong market penetration. Improvements in coupling mechanisms, odor control filters, and barrier adhesives have further enhanced two-piece system demand. Their ability to offer customized combinations of barriers and bags makes them particularly suited to patients requiring personalized care.

The One-piece System segment is anticipated to witness the fastest growth from 2026 to 2033, driven by increasing acceptance among new ostomy patients who prefer simpler, lightweight, and discreet options. One-piece systems offer a more flexible and comfortable fit, making them particularly attractive for individuals with active lifestyles or those seeking minimal maintenance. Markets such as India and Southeast Asia are seeing strong uptake due to lower price points and ease of use, especially for patients transitioning from hospital to home-care environments. Growing product innovations, including soft convexity, breathable materials, and improved adhesives, are expected to drive rapid expansion of this segment over the forecast period.

- By End User

On the basis of end user, the market is segmented into ambulatory surgical centers, hospitals, home care, and others. The Hospitals segment dominated the market with the largest revenue share in 2025, driven by the high volume of major colorectal, urinary diversion, and bowel surgeries performed across Japan, China, South Korea, and Australia. Hospitals serve as the primary initiation point for ostomy care, where patients first receive pouching systems, education, and product recommendations from stoma care nurses. This early clinical onboarding significantly influences long-term product choices, strengthening hospital-driven demand. Increased investments in surgical infrastructure and cancer care centers across APAC further support segment growth. High adherence to standardized ostomy care guidelines contributes to strong utilization of premium ostomy products in hospitals.

The Home Care segment is projected to witness the fastest growth rate from 2026 to 2033, fueled by the growing preference for home-based recovery, increasing availability of home-care nursing support, and rising adoption of convenient pouching systems suitable for daily lifestyle needs. Patients increasingly seek comfortable, discreet, and long-wear ostomy appliances that allow for greater mobility outside clinical settings. In developing markets such as India and Indonesia, the availability of affordable one-piece systems is accelerating home-care uptake. Digital health platforms offering remote stoma care consultations are further improving patient confidence and product utilization in home settings. As postoperative care shifts toward home management, the segment is expected to expand rapidly across the region.

Asia-Pacific Ostomy Devices Market Regional Analysis

- Japan dominated the Asia-Pacific ostomy devices market with the largest revenue share of 32.8% in 2025, driven by its sizable elderly population, high colorectal cancer prevalence, strong national reimbursement structure, and widespread availability of advanced ostomy systems through well-established hospital and retail channels

- Consumers and healthcare providers in Japan place high value on premium skin-friendly barriers, long-wear pouching systems, and clinically advanced ostomy solutions that enhance comfort, reduce leakage risk, and support long-term stoma management for elderly patients

- This strong adoption is further supported by well-established stoma care programs, widespread availability of certified ostomy nurses, favorable reimbursement structures, and strong presence of leading global manufacturers, positioning Japan as the central growth driver within the Asia-Pacific ostomy devices market

The Japan Ostomy Devices Market Insight

The Japan ostomy devices market is advancing steadily, supported by the country's aging population, high incidence of colorectal cancer, and strong emphasis on postoperative quality of life. Japan’s well-established healthcare system and early adoption of technologically advanced ostomy solutions contribute to high product penetration. Demand is rising for skin-friendly, discreet, and long-wear ostomy bags tailored to patient comfort. In addition, Japan’s preference for high-quality medical products, combined with the presence of leading global brands and strong reimbursement support, continues to propel market growth.

China Ostomy Devices Market Insight

The China ostomy devices market is expanding rapidly due to increasing colorectal cancer cases, growing surgical intervention rates, and improving healthcare accessibility across major cities and emerging provinces. Rising patient awareness, expanding private hospital networks, and government-led initiatives to enhance cancer screening are strengthening demand for advanced ostomy care. The presence of domestic manufacturers offering cost-effective solutions, alongside global companies establishing local production and distribution, is significantly widening product availability in China.

India Ostomy Devices Market Insight

The India ostomy devices market accounted for one of the largest revenue shares within Asia Pacific in 2025, driven by rising colorectal cancer incidence, expanding surgical volumes, and increased acceptance of ostomy care products. Growing urbanization, improving healthcare infrastructure, and the availability of affordable ostomy solutions support widespread adoption. India’s expanding health insurance coverage, strong domestic manufacturing landscape, and rising awareness about stoma care in hospitals and clinics further contribute to sustained market growth.

South Korea Ostomy Devices Market Insight

The South Korea ostomy devices market is witnessing steady growth owing to increasing gastrointestinal disease prevalence and the nation’s strong focus on advanced medical treatment standards. High patient awareness, excellent hospital infrastructure, and rapid adoption of premium ostomy solutions contribute to strong market penetration. Demand is growing for barrier rings, adhesive products, and odor-control systems as patients prioritize comfort and long-term wearability. Furthermore, South Korea’s robust innovation ecosystem and partnerships with global medical device companies continue to drive market expansion.

Asia-Pacific Ostomy Devices Market Share

The Asia-Pacific Ostomy Devices industry is primarily led by well-established companies, including:

- Coloplast (Denmark)

- Hollister Incorporated (U.S.)

- ConvaTec Group PLC (U.K.)

- Salts Healthcare (U.K.)

- B. Braun SE (Germany)

- ALCARE Co., Ltd. (Japan)

- Flexicare Medical Ltd. (U.K.)

- Welland Medical Limited (U.K.)

- Oakmed Healthcare (U.K.)

- Pelican Healthcare Ltd. (U.K.)

- Cymed (U.S.)

- Marlen Manufacturing & Development Co. (U.S.)

- Nu-Hope Labs (U.S.)

- Perma-Type Company Inc. (U.S.)

- Torbot Group Inc. (U.S.)

- OxMed International GmbH (Germany)

- 3M (U.S.)

- Smith & Nephew (U.K.)

- Henkel AG & Co. KGaA (Germany)

- Kimberly-Clark Corporation (U.S.)

What are the Recent Developments in Asia-Pacific Ostomy Devices Market?

- In May 2024, Coloplast expanded its ostomy portfolio (new SKUs and accessory launches, including enhancements to SenSura Mio and supporting Brava products) and signalled targeted launches in key markets moves that supported improved local product choice, clinician training and sampling programs across Asia-Pacific

- In April 2024, Convatec announced Esteem Body™ a one-piece soft-convex system combining established adhesives with a soft-convex profile intended to improve seal/security for a wider range of body types. Convatec marketed the product globally and reported strong early uptake across regions, including growth in emerging markets that cover APAC distribution channels. The launch moved Convatec into the growing one-piece soft-convex segment

- In November 2023, Hollister’s CeraPlus™ ostomy products received dermatological accreditation from the Skin Health Alliance. Hollister announced official dermatological accreditation for its CeraPlus™ skin barriers and accessories, a credential that supports product claims around peristomal skin protection and may increase clinician/patient confidence across markets including APAC. Hollister emphasized the accreditation in company communications and product materials directed at global markets

- In February 2022, Coloplast launched the SenSura® Mio range in Singapore. Coloplast introduced its SenSura® Mio portfolio into Singapore to expand reach in Southeast Asia positioning the product for better peristomal fit across diverse body shapes and enabling local clinicians and patients to access the SenSura Mio product family. This rollout was part of Coloplast’s wider regional commercial activity to grow presence across APAC

- In September 2021, Coloplast opened a new global production site that would produce ostomy pouches and supporting products; although the site is in Central America, the expansion was explicitly intended to strengthen global supply-chain capacity (reducing regional shortages and supporting distribution networks, including those serving APAC), which matters to hospitals and distributors across Asia-Pacific

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.