Asia Pacific Radiology Services Market

Market Size in USD Billion

CAGR :

%

USD

7.01 Billion

USD

17.74 Billion

2025

2033

USD

7.01 Billion

USD

17.74 Billion

2025

2033

| 2026 –2033 | |

| USD 7.01 Billion | |

| USD 17.74 Billion | |

|

|

|

|

Asia-Pacific Radiology Services Market Size

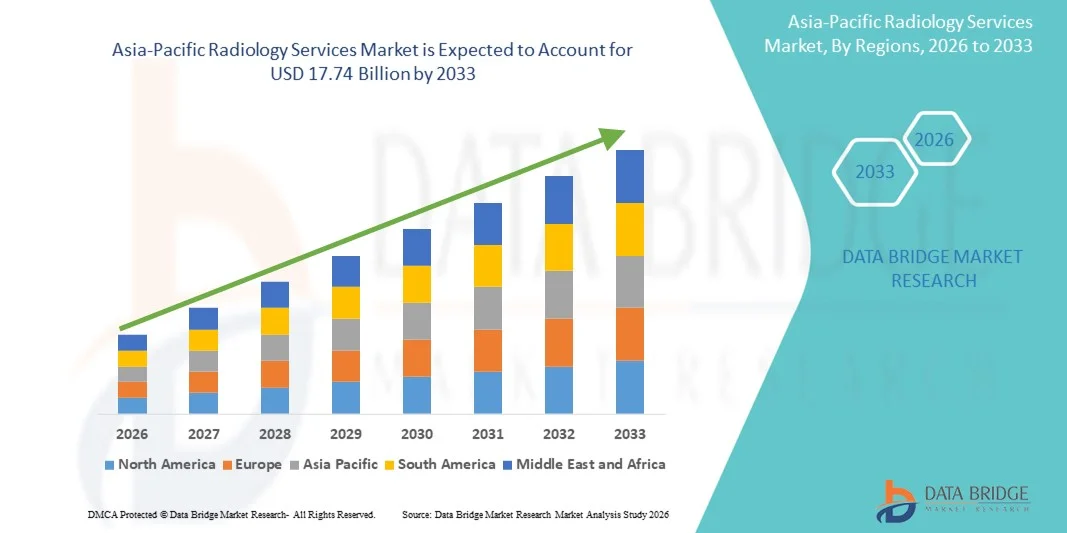

- The Asia-Pacific radiology services market size was valued at USD 7.01 billion in 2025 and is expected to reach USD 17.74 billion by 2033, at a CAGR of 12.30% during the forecast period

- The market growth is largely fueled by the rising prevalence of chronic diseases such as cancer, cardiovascular disorders, and orthopedic conditions, which are driving demand for diagnostic imaging service

- Furthermore, technological advancements in imaging modalities (CT, MRI, PET, and ultrasound), increasing adoption of AI-powered radiology solutions, and expansion of healthcare infrastructure are significantly boosting the uptake of radiology services across hospitals and diagnostic centers

Asia-Pacific Radiology Services Market Analysis

- Radiology services, encompassing diagnostic imaging procedures such as CT, MRI, PET, and ultrasound, are becoming increasingly vital components of modern healthcare systems in both hospitals and diagnostic centers due to their critical role in early disease detection, accurate diagnosis, and treatment planning

- The escalating demand for radiology services is primarily fueled by the rising prevalence of chronic diseases, growing awareness of preventive healthcare, and increasing adoption of advanced imaging technologies and AI-assisted diagnostic tools

- China dominated the Asia-Pacific radiology services market with the largest revenue share of 35.4% in 2025, driven by rapid healthcare infrastructure expansion, rising patient volume, and government initiatives to enhance diagnostic services

- India is expected to be the fastest-growing country in the market during the forecast period due to increasing healthcare expenditure, growing private diagnostic networks, and rising medical tourism

- Stationary Digital Radiology Systems segment dominated the Asia-Pacific radiology services market with a market share of 58.7% in 2025, driven by their widespread use in hospitals and diagnostic centers, high image quality, and ability to handle a large volume of imaging procedures efficiently

Report Scope and Asia-Pacific Radiology Services Market Segmentation

|

Attributes |

Asia-Pacific Radiology Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Radiology Services Market Trends

Advancement Through AI and Teleradiology Integration

- A significant and accelerating trend in the Asia-Pacific radiology services market is the integration of artificial intelligence (AI) and teleradiology solutions, enhancing diagnostic accuracy, remote reporting, and operational efficiency

- For instance, Aidoc’s AI platform assists radiologists in detecting abnormalities in CT scans, enabling faster and more accurate diagnosis across hospitals and diagnostic centers in urban and semi-urban regions

- AI integration in radiology services enables features such as automated image analysis, prioritization of critical cases, and predictive insights for disease progression. For instance, Qure.ai’s deep learning models can flag potential tuberculosis cases in chest X-rays, helping streamline patient care

- The seamless adoption of teleradiology platforms facilitates centralized reporting and expert consultations across multiple facilities, enabling radiologists to review images remotely. For instance, vRad allows hospitals in smaller cities to access specialist interpretations in real-time

- This trend towards AI-driven, interconnected, and remote imaging services is reshaping expectations for healthcare delivery. For instance, companies such as DeepTek are developing AI-enabled radiology platforms capable of automated reporting, workflow optimization, and integration with hospital information systems

- The demand for radiology services that leverage AI and teleradiology integration is growing rapidly across both urban and semi-urban healthcare settings, as hospitals increasingly prioritize faster diagnosis and operational efficiency

Asia-Pacific Radiology Services Market Dynamics

Driver

Rising Prevalence of Chronic Diseases and Preventive Healthcare Awareness

- The increasing prevalence of chronic diseases such as cancer, cardiovascular disorders, and musculoskeletal conditions, coupled with growing preventive healthcare awareness, is a significant driver for the demand for radiology services

- For instance, in March 2025, Apollo Hospitals in India expanded its diagnostic imaging network, integrating AI-assisted MRI and CT scanners to handle the rising patient load efficiently

- As patients seek early detection and precise diagnosis, radiology services offer advanced imaging modalities and AI-assisted tools, providing better clinical decision-making support

- Furthermore, government initiatives and private investments in healthcare infrastructure are expanding access to advanced imaging facilities, making radiology services more widely available. For instance, China’s National Health Commission launched programs to upgrade diagnostic centers with digital radiology systems, enhancing service reach in tier-2 and tier-3 cities

- Increasing medical tourism in countries such as India and Thailand, driven by affordable yet high-quality diagnostic imaging services, is further propelling market growth

- Growing awareness campaigns about early diagnosis and preventive care are encouraging patients to seek imaging services proactively. For instance, Japan’s Ministry of Health conducts nationwide cancer screening programs leveraging advanced radiology equipment

Restraint/Challenge

High Equipment Costs and Skilled Workforce Shortage

- The high capital expenditure required for advanced radiology equipment, coupled with a shortage of trained radiologists and technicians, poses a significant challenge to market expansion

- For instance, hospitals in smaller cities of India and Indonesia often face difficulties in acquiring and maintaining high-end MRI or CT scanners due to budget constraints

- Addressing these challenges requires investments in training programs and cost-effective diagnostic solutions, ensuring accessibility and service quality

- Furthermore, disparities in healthcare infrastructure across countries in the Asia-Pacific region limit the uniform adoption of advanced radiology services. For instance, rural healthcare centers in Southeast Asia may lack digital radiology systems or teleradiology connectivity, slowing market penetration

- Overcoming these challenges through workforce development, affordable imaging solutions, and government support will be vital for sustained market growth

- Regulatory approvals and compliance requirements for medical devices can delay the introduction of new radiology equipment. For instance, delays in registration of new MRI systems in Thailand affect adoption timelines

- Maintenance and operational costs of advanced imaging equipment remain high, making it difficult for smaller clinics to invest. For instance, private clinics in Indonesia often rely on shared diagnostic centers to reduce expenses

Asia-Pacific Radiology Services Market Scope

The market is segmented on the basis of type, procedure, patient age, radiation type, application, and end users.

- By Type

On the basis of type, the Asia-Pacific radiology services market is segmented into stationary digital radiology systems and portable digital radiology systems. The Stationary Digital Radiology Systems segment dominated the market with the largest revenue share of 58.7% in 2025, driven by its widespread use in hospitals and large diagnostic centers. Stationary systems provide high-resolution imaging, can handle large patient volumes efficiently, and are suitable for complex procedures such as CT and MRI scans. Hospitals often prefer stationary systems due to their robust hardware, long lifespan, and ability to integrate with advanced PACS (Picture Archiving and Communication Systems) for image storage and remote access. In addition, the presence of skilled radiologists and dedicated infrastructure in urban centers further supports the dominance of this segment. The segment is also favored due to consistent maintenance, technical support, and compatibility with AI-assisted diagnostic tools.

The Portable Digital Radiology Systems segment is expected to witness the fastest growth rate of 14.8% from 2026 to 2033, fueled by the increasing adoption in smaller clinics, ambulatory centers, and rural healthcare facilities. Portable systems offer mobility, ease of use, and flexibility for bedside imaging, emergency care, and temporary setups. They are increasingly used in scenarios where conventional stationary systems are impractical or unavailable, such as field hospitals or remote diagnostic centers. Rising investments in mobile healthcare units and telemedicine initiatives are further boosting demand for portable radiology solutions. The affordability and rapid deployment of portable systems make them attractive for emerging markets. In addition, portable systems often incorporate user-friendly interfaces, allowing technicians with limited training to operate them efficiently.

- By Procedure

On the basis of procedure, the market is segmented into conventional and digital radiology. The Digital radiology segment dominated the Asia-Pacific market with the largest share of 61.3% in 2025, driven by superior image quality, faster processing times, and reduced radiation exposure compared to conventional radiography. Digital procedures are highly preferred in modern hospitals and diagnostic centers for facilitating AI-assisted analysis, teleradiology, and electronic medical record integration. Hospitals benefit from workflow efficiency, immediate image availability, and lower long-term operational costs. In addition, digital radiology supports cloud-based storage and remote consultation. The segment also allows for easier image sharing and collaboration across multiple facilities, improving diagnostic speed and accuracy.

The Conventional radiology segment is anticipated to witness the fastest growth from 2026 to 2033 in semi-urban and rural regions, due to cost-effectiveness and ease of adoption where digital infrastructure is limited. Conventional X-ray systems continue to be used in primary care centers, smaller clinics, and emerging markets that cannot afford high-end digital setups. This segment benefits from affordability, ease of maintenance, and widespread technician familiarity, making it an attractive choice for budget-constrained facilities. Conventional radiography also remains relevant in emergency care scenarios. Many clinics combine conventional and digital procedures to optimize workflow and manage patient volume efficiently.

- By Patient Age

On the basis of patient age, the market is segmented into adults and pediatric. The Adults segment dominated the Asia-Pacific market with a share of 72.5% in 2025, driven by higher prevalence of chronic diseases such as cardiovascular, musculoskeletal, and oncological conditions among adults. Adults typically require a higher volume of imaging procedures for routine checkups, early diagnosis, and follow-up treatments. Hospitals and diagnostic centers prioritize adult imaging due to its revenue potential and higher patient throughput. The segment also benefits from government health programs targeting adult diseases. Furthermore, adult patients often require repeated imaging for disease monitoring, boosting utilization of radiology services. Advanced imaging protocols and AI-assisted analysis are mainly applied in adult diagnostic care due to complexity of cases.

The Pediatric segment is expected to witness the fastest growth rate of 13.5% from 2026 to 2033, fueled by rising awareness of early diagnosis in children and increasing availability of child-friendly imaging equipment. Pediatric radiology is increasingly integrated with low-radiation protocols, sedation-free procedures, and specialized workflows to improve safety and comfort. Government initiatives promoting pediatric health screenings and vaccination programs also contribute to segment growth. Specialized pediatric imaging centers and hospital wards are enhancing the adoption of this segment. Parents’ focus on preventive care is driving demand for early diagnostic imaging. Pediatric radiology services also integrate AI-based monitoring to reduce errors in delicate imaging procedures.

- By Radiation Type

On the basis of radiation type, the market is segmented into diagnostics and interventional radiology. The Diagnostics segment dominated the Asia-Pacific market with a share of 65.1% in 2025, driven by its critical role in detecting chronic diseases, injuries, and cancers. Diagnostic imaging services, including X-ray, CT, MRI, and ultrasound, are widely used in routine examinations, preventive health checkups, and preoperative evaluations. Hospitals and diagnostic centers prefer diagnostic procedures due to high patient demand and frequent repeatability of imaging services. This segment also supports teleradiology and AI-assisted reporting. The high adoption in urban hospitals ensures consistent revenue generation. Furthermore, diagnostic procedures are critical for population-level screening programs.

The Interventional Radiology segment is expected to witness the fastest growth rate of 15.2% from 2026 to 2033, fueled by the increasing adoption of minimally invasive procedures such as angiography, biopsy guidance, and targeted therapies. Interventional radiology reduces recovery time and hospital stays, improving patient outcomes. Rising investments in specialized equipment, physician training, and integration with AI-assisted navigation are driving rapid adoption across the region. The segment is gaining traction in tertiary hospitals and specialty centers. Growing awareness among patients regarding minimally invasive options also boosts demand. Interventional procedures are increasingly preferred for cardiology, oncology, and neurology applications.

- By Application

On the basis of application, the market is segmented into cardiovascular, oncology, gynecology, neurology, urology, dental, pelvic and abdominal, musculoskeletal, and others. The Oncology segment dominated the Asia-Pacific radiology services market with a share of 28.4% in 2025, driven by rising incidence of cancer and the critical need for early detection, diagnosis, and treatment planning. Advanced imaging modalities such as PET-CT, MRI, and digital mammography are widely used in cancer diagnostics, boosting segment dominance. Hospitals and specialized cancer centers prioritize oncology imaging due to high demand and continuous follow-up requirements. Early detection programs further drive volume in this segment. Oncology imaging also supports AI-assisted analysis for precision medicine. Rising investments in cancer care infrastructure strengthen segment growth.

The Cardiovascular segment is anticipated to witness the fastest growth rate of 16.1% from 2026 to 2033, fueled by increasing prevalence of cardiovascular diseases, rising awareness of early diagnosis, and government initiatives for heart health screening. Advanced imaging procedures such as CT angiography and cardiac MRI are increasingly adopted to assess heart function and vascular health. Rising investments in interventional cardiology and AI-enabled cardiac imaging platforms further contribute to growth. Cardiovascular imaging demand is also supported by outpatient clinics and preventive screening programs. Hospitals are upgrading imaging facilities to accommodate growing patient numbers. Cardiology-focused diagnostic centers are emerging as key adopters.

- By End Users

On the basis of end users, the market is segmented into hospitals, ambulatory centers, diagnostic centers, and clinics. The Hospitals segment dominated the Asia-Pacific radiology services market with a share of 52.3% in 2025, driven by well-established infrastructure, availability of advanced imaging equipment, and high patient throughput. Hospitals often serve as referral centers for complex cases and attract a larger patient base, supporting higher utilization of radiology services. The segment benefits from specialized radiology departments, skilled staff, and integration with hospital information systems. Hospitals also invest in AI-assisted and hybrid imaging solutions. Urban hospitals see continuous adoption of latest imaging technology. High patient volume ensures steady revenue streams for radiology services.

The Diagnostic Centers segment is expected to witness the fastest growth rate of 14.6% from 2026 to 2033, fueled by the increasing number of standalone imaging centers, rising demand for outpatient services, and cost-effective diagnostic solutions. Diagnostic centers provide convenient, localized imaging services to urban and semi-urban populations. Integration of AI-assisted reporting and digital record systems enhances operational efficiency and patient experience. These centers are expanding rapidly due to affordable setups and shorter waiting times. Growing partnerships with hospitals and telemedicine providers are accelerating adoption. Patients increasingly prefer diagnostic centers for preventive checkups and minor procedures.

Asia-Pacific Radiology Services Market Regional Analysis

- China dominated the Asia-Pacific radiology services market with the largest revenue share of 35.4% in 2025, driven by rapid healthcare infrastructure expansion, rising patient volume, and government initiatives to enhance diagnostic services

- Patients and healthcare providers in the region increasingly prioritize early disease detection, high-quality imaging, and AI-assisted diagnostic solutions, leading to widespread adoption of radiology services across hospitals and large diagnostic centers

- This strong demand is further supported by urbanization, rising disposable incomes, growing awareness of preventive healthcare, and increased medical tourism, establishing radiology services as a critical component of modern healthcare delivery across Asia-Pacific

The China Radiology Services Market Insight

China dominated the Asia-Pacific radiology services market with the largest revenue share of 35.4% in 2025, driven by government-led healthcare infrastructure upgrades, rising patient inflow, and increasing investments in AI-enabled imaging systems. Hospitals and large diagnostic centers in metropolitan areas are adopting high-end CT, MRI, and PET-CT systems to handle growing demand. For instance, government programs are enhancing rural diagnostic coverage through teleradiology, improving accessibility to specialized imaging services. Rapid urbanization and high population density in major cities further increase demand for radiology procedures. China’s focus on preventive healthcare and chronic disease management is stimulating continuous adoption of advanced radiology solutions. Increasing collaborations between hospitals and AI imaging technology providers are also supporting market growth.

Japan Radiology Services Market Insight

The Japan radiology services market is gaining momentum due to the country’s advanced healthcare infrastructure, high patient awareness, and increasing adoption of AI-assisted and digital imaging systems. The Japanese market emphasizes early disease detection, with hospitals and diagnostic centers investing in PET-CT, MRI, and CT systems. Integration of radiology services with hospital information systems and teleradiology networks is facilitating faster and more accurate reporting. For instance, AI-based imaging tools are used to detect cancer and cardiovascular conditions, improving clinical outcomes. Japan’s aging population is driving demand for imaging solutions that are safer and easier to use, particularly in outpatient and elderly care facilities. Continuous technological advancements and government support for digital health initiatives are further boosting market growth.

India Radiology Services Market Insight

The India radiology services market accounted for the largest market revenue share in Asia-Pacific after China in 2025, attributed to rapid urbanization, increasing healthcare expenditure, and rising awareness of preventive care. The expanding middle class and growth of private hospitals and diagnostic centers are driving demand for advanced imaging modalities. For instance, AI-assisted CT and MRI services are increasingly adopted in metropolitan hospitals and tertiary care centers. Government initiatives promoting smart hospitals and digital health infrastructure are supporting broader access to radiology services. In addition, India’s position as a medical tourism hub is contributing to high patient volumes for imaging procedures. Affordable radiology solutions and the presence of domestic manufacturers are enabling wider adoption in both urban and semi-urban areas.

Japan Radiology Services Market Insight

The Japan radiology services market is gaining momentum due to the country’s advanced healthcare infrastructure, high patient awareness, and increasing adoption of AI-assisted and digital imaging systems. The Japanese market emphasizes early disease detection, with hospitals and diagnostic centers investing in PET-CT, MRI, and CT systems. Integration of radiology services with hospital information systems and teleradiology networks is facilitating faster and more accurate reporting. For instance, AI-based imaging tools are used to detect cancer and cardiovascular conditions, improving clinical outcomes. Japan’s aging population is driving demand for imaging solutions that are safer and easier to use, particularly in outpatient and elderly care facilities. Continuous technological advancements and government support for digital health initiatives are further boosting market growth.

Asia-Pacific Radiology Services Market Share

The Asia-Pacific Radiology Services industry is primarily led by well-established companies, including:

- GE HealthCare (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Siemens Healthineers AG (Germany)

- FUJIFILM Holdings Corporation (Japan)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd (China)

- Shimadzu Corporation (Japan)

- Hitachi, Ltd. (Japan)

- Samsung Medison Co., Ltd. (South Korea)

- Carestream Health, Inc. (U.S.)

- Agfa-Gevaert Group (Belgium)

- Konica Minolta, Inc. (Japan)

- Esaote S.p.A. (Italy)

- Analogic Corporation (U.S.)

- Varian Medical Systems (U.S.)

- Perlove Medical (China)

- United Imaging Healthcare Co., Ltd. (China)

- Planmed Oy (Finland)

- Ziehm Imaging GmbH (Germany)

- Hologic, Inc. (U.S.)

What are the Recent Developments in Asia-Pacific Radiology Services Market?

- In February 2025, AsiaMedic (in partnership with Sunway Group) officially launched the new AsiaMedic Sunway Imaging centre in Novena (Singapore), a ~6,000 sq ft facility equipped with advanced MRI and CT technologies. This expansion nearly doubles AsiaMedic’s imaging capacity, broadening access to advanced diagnostic services for patients in the region

- In January 2025, Philips launched its AI‑enabled CT 5300 system at the 23rd Asian Oceanian Congress of Radiology (AOCR 2025), featuring advanced AI workflows, and promoted a helium‑free 1.5T wide‑bore MRI with “BlueSeal” magnet technology potentially helping hospitals across Asia‑Pacific improve diagnostic accuracy, workflow efficiency, and reduce reliance on scarce helium supplies

- In December 2024, Singapore General Hospital (SGH) and Philips announced the opening of a first‑of‑its‑kind MRI Training Centre in Singapore, aimed at upskilling radiographers from public and private hospitals in APAC, thereby strengthening regional imaging capabilities and standardizing high‑quality radiology practices

- In March 2024, AsiaMedic reported record revenue attributing the growth to its expanded diagnostic imaging and radiology services bolstered by the earlier addition of the 3.0T MRI and subsequent technology upgrades. This reflects strong demand and increasing adoption of advanced imaging services among patients and referring physicians

- In August 2023, AsiaMedic became the first centre in Asia‑Pacific to install the SIGNA Hero 3.0T MRI scanner (by GE HealthCare), offering enhanced imaging quality, faster scan times, broader diagnostic coverage, and improved patient comfort marking a significant upgrade in high‑field MRI access within the region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.