Asia Pacific Seaweed Fertilizer Market

Market Size in USD Million

CAGR :

%

USD

6.14 Million

USD

11.71 Million

2024

2032

USD

6.14 Million

USD

11.71 Million

2024

2032

| 2025 –2032 | |

| USD 6.14 Million | |

| USD 11.71 Million | |

|

|

|

|

Seaweed Fertilizers Market Size

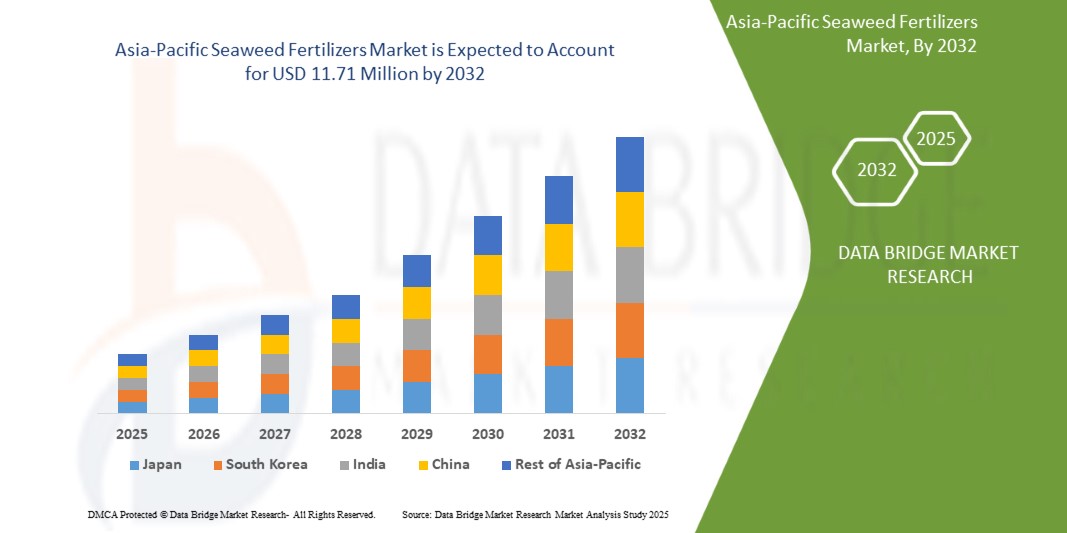

- The Asia-Pacific seaweed fertilizers market size was valued at USD 6.14 million in 2024 and is expected to reach USD 11.71 million by 2032, at a CAGR of 8.46% during the forecast period

- The market growth is largely fueled by the rising demand for sustainable, organic agricultural practices

- Furthermore, seaweed fertilizers enhance crop yield and nutrition. These converging factors are accelerating the uptake of seaweed fertilizers solutions, thereby significantly boosting the industry's growth

Seaweed Fertilizers Market Analysis

- Seaweed fertilizers, derived from natural seaweed extracts, are gaining importance in sustainable agriculture due to their ability to enhance soil health, improve crop yields, and provide eco-friendly nutrient supplementation for various crops

- The growing demand for organic and sustainable farming practices, combined with increasing awareness about the environmental impact of chemical fertilizers, is driving the adoption of seaweed fertilizers

- China is expected to dominate the seaweed fertilizers market with the largest revenue share of 24.93% in 2025, supported by well-established organic farming sectors, government initiatives promoting sustainable agriculture, and a high number of innovative product launches by key market players

- India is expected to be the fastest-growing country in the seaweed fertilizers market during the forecast period, fueled by rapid agricultural modernization, increasing farmer awareness, and rising disposable incomes, particularly in countries like China, India, and Australia

- The ascophyllum segment is expected to dominate the seaweed fertilizers market with a market share of 43.88% in 2025, driven by its ease of application, rapid absorption by plants, and effectiveness in improving plant stress tolerance and nutrient uptake

Report Scope and Seaweed Fertilizers Market Segmentation

|

Attributes |

Seaweed Fertilizers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Seaweed Fertilizers Market Trends

“Rising Demand for Sustainable, Organic Agricultural Practices”

- A major driving force behind the Asia-Pacific seaweed fertilizers market is the rising Asia-Pacific shift towards sustainable and organic agricultural practices, fueled by growing consumer health consciousness and environmental awareness. This trend encourages farmers to adopt eco-friendly farming methods that avoid synthetic chemicals

- For instance, in November 2023, USDA Economic Research Service reported that increasing consumer demand for organic fruits and vegetables has steadily expanded organic cropland acreage since 2000, with organic produce sales surpassing USD 22 billion in retail in 2022

- Seaweed fertilizers, naturally rich in essential nutrients like potassium, nitrogen, and micronutrients, align perfectly with organic farming goals by enhancing soil structure, improving water retention, and stimulating plant growth—leading to higher crop yields and greater disease resilience

- Technological advancements in extraction and processing methods have further boosted the market by improving the efficiency, sustainability, and affordability of seaweed fertilizers, making them more accessible to farmers worldwide

- Additionally, regions such as Asia-Pacific, known for extensive coastal farming and abundant raw material availability, are witnessing heightened awareness of seaweed fertilizers’ ecological benefits, thereby offering strong market potential

- In May 2025, Billy Barraclough highlighted how London’s urban farms are increasingly adopting sustainable methods like no-dig farming and biodiversity promotion to address food inequality and environmental challenges, showcasing how urban agriculture supports community resilience and environmental stewardship

- The growing demand for sustainable and organic agricultural practices is a pivotal factor driving the seaweed fertilizers market, as these products contribute to improved soil health, enhanced crop productivity, and overall environmental sustainability. With continuous technological innovation and rising awareness, the market is well-positioned for robust growth in the years ahead

Seaweed Fertilizers Market Dynamics

Driver

“Seaweed Fertilizers Enhance Crop Yield and Nutrition”

- The increasing adoption of seaweed fertilizers as a natural and sustainable solution for boosting crop productivity is a major driver propelling the Asia-Pacific seaweed fertilizers market. Derived from marine macroalgae such as brown, red, and green seaweed, these fertilizers are rich in essential nutrients, trace elements, amino acids, and plant growth hormones that improve soil structure and plant health

- For instance, in August 2023, a study published by Elsevier B.V. demonstrated that seaweed-based biostimulants significantly enhanced seed germination, plant height, leaf number, and chlorophyll content, ultimately increasing crop yields. Such research highlights the expanding role of seaweed extracts as sustainable alternatives to synthetic fertilizers

- Growing awareness among farmers about the long-term benefits of organic and bio-based inputs is driving demand, as seaweed fertilizers promote soil fertility, increase microbial activity, and improve nutrient bioavailability without degrading soil quality or harming the environment

- Furthermore, as Asia-Pacific concerns about food security and climate change intensify, seaweed fertilizers are increasingly valued for enhancing nutrient uptake and improving the nutritional quality of crops, contributing to higher levels of vitamins, minerals, and antioxidants in produce

- The rising preference for eco-friendly and organic farming inputs, along with proven agronomic and environmental benefits, is steadily increasing the adoption of seaweed fertilizers, making them a cornerstone of modern and future sustainable agriculture practices worldwide

Restraint/Challenge

“High Production and Processing Costs Limit Affordability”

- The labor-intensive nature of seaweed cultivation and harvesting, combined with the need for specialized equipment, creates significant operational cost challenges that limit market expansion. The complex extraction processes required to isolate beneficial compounds add further time and expense to seaweed fertilizer production

- For instance, according to Idea2MakeMoney, setting up a seaweed fertilizer production unit in India demands an investment between USD 7.41 thousand and USD 11.76 thousand, covering machinery, raw materials, labor, and packaging costs

- Furthermore, competition from cheaper synthetic fertilizers offering immediate results continues to challenge the broader adoption of seaweed-based alternatives. For example, in April 2025, WashingtonPost.com highlighted Grenada’s costly efforts to remove invasive sargassum seaweed and convert it into fertilizer, hindered by expensive processing and the need to remove salts and toxins

- While prices may gradually improve with technological advances, high production and processing costs remain a key barrier to adoption, especially in price-sensitive markets. Addressing these challenges through innovation, improved processing efficiency, and supportive policies will be essential to boost the seaweed fertilizer market’s growth and wider acceptance

Seaweed Fertilizers Market Scope

The market is segmented on the basis of type of seaweed, form, function, crop type, treatment, application, and product type.

- By Type of Seaweed

On the basis of type of seaweed, the market is segmented into ascophyllum, laminaria, sargassum, ecklonia, fucus, kappaphycus, gelidium, saccorhiza, and others. In 2025, the ascophyllum segment is expected to dominate the market with a market share of 43.88% in 2025, driven by its high content of bioactive compounds and proven efficacy in enhancing crop productivity. Farmers often prioritize Ascophyllum-based fertilizers for their rich nutrient profile, including essential amino acids, trace minerals, and natural plant growth hormones. The market also sees strong demand for Ascophyllum due to its compatibility with various organic farming practices and the availability of advanced formulations promoting soil health and sustainable agriculture.

The ascophyllum segment is anticipated to witness the fastest growth rate of 9.06% from 2025 to 2032, fueled by increasing adoption in commercial farming and organic agriculture sectors. Ascophyllum-based fertilizers are rich in bioactive compounds that promote plant growth, improve stress resistance, and enhance nutrient uptake. Their natural composition aligns with sustainable farming practices, making them highly desirable for environmentally conscious growers. The versatility and proven efficacy of Ascophyllum in improving crop quality and yield also contribute to its growing popularity across diverse agricultural applications.

- By Form

On the basis of form, the market is segmented into liquid, dry, and others. The liquid segment held the largest market revenue share in 2025, driven by its ease of application, quick absorption by plants, and compatibility with modern irrigation systems such as drip and foliar sprays. Liquid seaweed fertilizers are widely preferred by both large-scale and smallholder farmers due to their uniform nutrient distribution and ability to deliver immediate results. Their effectiveness in enhancing plant growth and stress tolerance makes them a popular choice across diverse crop types and farming practices.

The liquid segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its high bioavailability, ease of application, and rapid absorption by plants, making it ideal for foliar treatments and precision agriculture. Liquid seaweed fertilizers are particularly popular for their compatibility with modern farming practices and irrigation systems, often serving as a primary nutrient delivery method for enhancing plant growth, yield, and stress resistance in both organic and conventional farming setups.

- By Function

On the basis of function, the market is segmented into germination, plant growth, nutrient enhancement, yield efficiency, and others. The germination segment held the largest market revenue share in 2025, driven by the critical role seaweed fertilizers play in enhancing seed vigor and accelerating early-stage plant development. Rich in bioactive compounds like natural hormones and micronutrients, seaweed extracts improve seed germination rates and uniformity, making them a preferred input for organic and sustainable farming.

The germination segment is expected to witness the fastest CAGR from 2025 to 2032, favored for its role in promoting root development, chlorophyll production, and overall plant biomass. Seaweed fertilizers are particularly valued for their ability to stimulate natural growth processes and improve plant resilience under abiotic stress conditions.

- By Crop Type

On the basis of crop type, the market is segmented into fruits & vegetables, oilseeds & pulses, cereals & grains, turf & ornamental, and others. The fruits & vegetables segment accounted for the largest market revenue share in 2025, driven by the rising demand for high-value, nutrient-rich produce and the increasing shift toward organic farming practices. Seaweed fertilizers are widely used in horticulture due to their ability to enhance fruit set, improve taste, increase shelf life, and promote uniform growth—making them a preferred input for fruit and vegetable cultivation.

The fruits & vegetables segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the need for sustainable yield improvement across staple crops. Seaweed fertilizers contribute to better root development, enhanced nutrient uptake, and increased resilience to environmental stress, which are critical for ensuring food security in the face of climate change.

- By Treatment

On the basis of treatment, the market is segmented into foliar treatment, soil treatment, seed treatment, and others. The foliar treatment segment accounted for the largest market revenue share in 2025, driven by its ability to deliver nutrients directly to leaf tissues for rapid absorption, immediate stress relief, and improved photosynthetic efficiency. Farmers favor foliar applications for their ease of use with conventional spraying equipment and their proven effectiveness in boosting crop quality and yield across a wide range of farming systems..

The foliar treatment segment is also expected to witness the fastest CAGR from 2025 to 2032, propelled by the growing adoption of precision agriculture, the need for quick‑response nutrition solutions under climate stress, and the increasing popularity of integrated pest‑and‑nutrient management programs that combine foliar feeding with biological inputs.

- By Application

On the basis of application, the market is segmented into farms, garden, greenhouse, and others. The farms segment accounted for the largest market revenue share in 2025, driven by the rising Asia-Pacific demand for food, expansion of organic farming practices, and increased awareness among large-scale growers about the long-term benefits of seaweed-based inputs. Seaweed fertilizers are extensively used on farms due to their ability to improve soil health, enhance nutrient uptake, and increase crop resilience to stress, thereby supporting higher and more sustainable yields.

The farms segment is also expected to witness the fastest CAGR from 2025 to 2032, propelled by government initiatives promoting eco-friendly agriculture, growing adoption of biofertilizers in conventional farming, and the need for climate-smart solutions to ensure productivity in diverse agro-climatic conditions.

- By Product Type

On the basis of product type, the market is segmented into organic and inorganic. The organic segment accounted for the largest market revenue share in 2025, driven by the Asia-Pacific shift toward sustainable agriculture, increasing consumer preference for organically grown produce, and stricter regulations on chemical fertilizer usage. Organic seaweed fertilizers are favored for their natural composition, environmental safety, and compatibility with organic certification standards, making them a preferred choice for environmentally conscious farmers and agribusinesses.

The organic segment is also expected to witness the fastest CAGR from 2025 to 2032, propelled by rising health awareness, expanding organic farming acreage, and growing governmental support through subsidies and incentives for organic inputs. The increasing adoption of organic seaweed fertilizers across a variety of crops further supports the segment’s robust growth trajectory.

Seaweed Fertilizers Market Country Analysis

- China is expected to dominate the seaweed fertilizers market with the largest revenue share of 24.93% and is projected to grow at the fastest CAGR of 8.29% in 2025, driven by increasing agricultural output, expanding seaweed cultivation, and rising adoption of organic farming practices

- The region’s rich coastal biodiversity, government support for sustainable agriculture, and rising demand for high-yield, eco-friendly farming inputs have positioned China as a leader in seaweed fertilizer production and usage

India Seaweed Fertilizers Market Insight

India is expected to register the fastest CAGR in the region from 2025 to 2032, driven by its strong agricultural sector, rising awareness among farmers about organic and bio-based inputs, and favorable government schemes such as the PM-PRANAM and Paramparagat Krishi Vikas Yojana. The country’s extensive coastline, coupled with low-cost production capabilities, supports the expansion of seaweed farming and its conversion into high-value fertilizers for various crops including cereals, pulses, and vegetables.

South Korea Seaweed Fertilizers Market Insight

In 2025, South Korea is witnessing steady growth in the Asia-Pacific seaweed fertilizers market, driven by its growing focus on sustainable agriculture and a robust seaweed processing infrastructure. Government incentives for green agriculture and the presence of key manufacturers further support market expansion. Meanwhile, China’s large population and rising demand for high-quality, nutritious crops are fueling the widespread adoption of organic inputs like seaweed fertilizers.

Seaweed Fertilizers Market Share

The seaweed fertilizers industry is primarily led by well-established companies, including:

- Biolchim SPA (Italy)

- Haifa Negev technologies LTD (Israel)

- greenriseagroindustries (India)

- Qingdao Haijingling Seaweed Biotechnology Group Co.,Ltd. (China)

- IFFCO (India)

- Eco Organic Garden (Australia)

- Dora Agri-Tech (China)

- Seasol (Australia)

- SUBONEYO Chemicals Pharmaceuticals P Limited (India)

- Agrocart (India)

- Oligro (Turkey)

- Agro Bio Chemicals (India)

- Shandong Jiejing Group Corporation (China)

- Valagro (Italy)

- Kelpak (U.S.)

- ICL (Israel)

Latest Developments in Asia-Pacific Seaweed Fertilizers Market

- In August 2024, ICL announced that its PotashpluS product earned organic certification in both Germany and Spain. This certification validates the product's suitability for organic farming, ensuring that it meets the highest environmental and quality standards. PotashpluS supports soil health, enhances plant growth, and increases crop yields in organic agriculture

- In August 2024, ICL expanded its presence in China, aiming to strengthen its market position in the region. This development will enable ICL to better serve the growing demand for innovative agricultural solutions, providing farmers with access to advanced products that improve crop productivity and sustainability

- In August 2024, ICL Growing Solutions acquired Custom Ag Formulators, a U.S.-based company. This acquisition will enhance ICL's ability to offer customized plant nutrition solutions, expanding their product portfolio. It will enable more tailored offerings for customers, improving crop yields and advancing agricultural sustainability in North America

- In July 2024, ICL Potash received organic certification in the EU for its Potash product. This certification affirms the product's suitability for organic farming, meeting rigorous environmental and quality standards. It will enhance soil health, promote sustainable farming practices, and improve crop yields, supporting organic agriculture

- In March 2024, ICL entered a strategic partnership with Kernel UA, a leading agricultural company in Ukraine. This collaboration aims to improve crop production and strengthen the sustainability of Ukrainian agriculture. It will focus on enhancing ICL’s presence in the region and promoting advanced agricultural solutions for greater yield and efficiency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 VALUE CHAIN ANALYSIS

4.1.1 RAW MATERIAL COLLECTION

4.1.2 PRE-PROCESSING AND TRANSPORTATION

4.1.3 PROCESSING AND FORMULATION

4.1.4 PACKAGING AND LABELING

4.1.5 MARKETING AND DISTRIBUTION

4.2 COMPARATIVE ANALYSIS WITH PARENT MARKET

4.2.1 PRODUCT COMPOSITION AND TYPES

4.2.2 SUSTAINABILITY AND ENVIRONMENTAL IMPACT

4.2.3 MARKET DRIVERS

4.2.4 REGIONAL MARKET DYNAMICS

4.2.5 CHALLENGES

4.2.6 CONCLUSION

4.3 FUTURE PERSPECTIVE ON THE ASIA-PACIFIC SEAWEED FERTILIZER MARKET

4.3.1 SUSTAINABLE AGRICULTURE DRIVING DEMAND

4.3.2 TECHNOLOGICAL INNOVATIONS ENHANCING MARKET VALUE

4.3.3 RISING ADOPTION IN EMERGING MARKETS

4.3.4 SUPPORTIVE REGULATORY ENVIRONMENT

4.3.5 CHALLENGES & FUTURE OPPORTUNITIES

4.4 GROWTH STRATEGIES ADOPTED BY KEY MANUFACTURERS

4.4.1 STRATEGIC GEOGRAPHIC EXPANSION

4.4.2 PRODUCT DIVERSIFICATION & INNOVATION

4.4.3 MERGERS, ACQUISITIONS & STRATEGIC ALLIANCES

4.4.4 INVESTMENT IN SUSTAINABLE HARVESTING & TRACEABILITY

4.4.5 DIGITAL MARKETING & DIRECT-TO-FARMER OUTREACH

4.4.6 FOCUS ON REGULATORY COMPLIANCE & CERTIFICATIONS

4.5 NEW PRODUCT LAUNCH STRATEGIES

4.5.1 MARKET-DRIVEN PRODUCT DEVELOPMENT

4.5.2 SUSTAINABILITY AND ORGANIC CERTIFICATION

4.5.3 INNOVATIVE FORMULATIONS AND VALUE-ADDED FEATURES

4.5.4 STRATEGIC COLLABORATIONS AND JOINT VENTURES

4.5.5 DIGITAL MARKETING AND FARMER EDUCATION

4.5.6 BRAND POSITIONING AND PACKAGING

4.5.7 REGULATORY COMPLIANCE AND EXPORT STRATEGY

4.5.8 CONCLUSION

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 SEAWEED CULTIVATION & HARVESTING

4.6.2 RAW MATERIAL HANDLING & TRANSPORTATION

4.6.3 PROCESSING & FORMULATION

4.6.4 PACKAGING & QUALITY CONTROL

4.6.5 DISTRIBUTION & LOGISTICS

4.6.6 END-USER DELIVERY & SUPPORT SERVICES

5 COVID-19 PANDEMIC IMPACT

5.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

5.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

5.3 STRATEGIC DECISIONS FOR SEAWEED FERTILIZER MANUFACTURERS POST COVID-19 TO GAIN COMPETITIVE MARKET SHARE:

5.4 PRICE IMPACT

5.5 IMPACT OF DEMAND

5.6 IMPACT OF SUPPLY CHAIN

5.7 CONCLUSION

6 REGULATORY COVERAGE

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING DEMAND FOR SUSTAINABLE, ORGANIC AGRICULTURAL PRACTICES

7.1.2 SEAWEED FERTILIZERS ENHANCE CROP YIELD AND NUTRITION

7.1.3 NATURAL PEST CONTROL PROPERTIES ENHANCING THE DEMAND

7.1.4 GOVERNMENT INCENTIVES BOOSTING ORGANIC FERTILIZER PRODUCT ADOPTION

7.2 RESTRAINTS

7.2.1 HIGH PRODUCTION AND PROCESSING COSTS LIMIT AFFORDABILITY

7.2.2 LIMITED FARMER AWARENESS, ESPECIALLY IN DEVELOPING REGIONS

7.3 OPPORTUNITIES

7.3.1 ORGANIC FOOD MARKET GROWTH BOOSTS FERTILIZER DEMAND

7.3.2 BOOST IN THE HOME GARDENING MARKET

7.3.3 INNOVATIVE FORMULATIONS IMPROVE USABILITY AND PRODUCT PERFORMANCE

7.4 CHALLENGES

7.4.1 VARIABILITY IN SEED QUALITY HINDERS PRODUCT CONSISTENCY

7.4.2 COMPLEX REGULATIONS ACROSS REGIONS RESTRICT PRODUCT APPROVAL

8 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET, BY TYPE OF SEAWEED

8.1 OVERVIEW

8.2 ASCOPHYLLUM

8.3 LAMINARIA

8.4 SARGASSUM

8.5 ECKLONIA

8.6 FUCUS

8.7 KAPPAPHYCUS

8.8 GELIDIUM

8.9 SACCORHIZA

8.1 OTHERS

9 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET, BY FORM

9.1 OVERVIEW

9.2 LIQUID

9.2.1 LIQUID, BY SEAWEED TYPE

9.3 DRY

9.3.1 DRY, BY SEAWEED TYPE

9.4 OTHER

9.4.1 OTHER, BY SEAWEED TYPE

10 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET, BY FUNCTION

10.1 OVERVIEW

10.2 GERMINATION

10.3 PLANT GROWTH

10.4 NUTRIENT ENHANCEMENT

10.5 YIELD EFFICIENCY

10.6 OTHERS

11 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET, BY CROP TYPE

11.1 OVERVIEW

11.2 FRUITS & VEGETABLES

11.2.1 FRUITS & VEGETABLES, BY CROP TYPE

11.3 OILSEEDS & PULSES

11.3.1 OILSEEDS & PULSES, BY CROP TYPE

11.4 CEREALS & GRAINS

11.4.1 CEREALS & GRAINS, BY CROP TYPE

11.5 TURF & ORNAMENTAL

11.6 OTHER

12 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET, BY TREATMENT

12.1 OVERVIEW

12.2 FOLIAR TREATMENT

12.3 SOIL TREATMENT

12.4 SEED TREATMENT

12.5 OTHERS

13 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 FARMS

13.3 GARDEN

13.4 GREENHOUSE

13.5 OTHERS

14 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET, BY PRODUCT TYPE

14.1 OVERVIEW

14.2 ORGANIC

14.3 INORGANIC

15 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET, BY REGION

15.1 ASIA PACIFIC

15.1.1 CHINA

15.1.2 SOUTH KOREA

15.1.3 JAPAN

15.1.4 INDONESIA

15.1.5 INDIA

15.1.6 PHILIPPINES

15.1.7 THAILAND

15.1.8 MALAYSIA

15.1.9 VIETNAM

15.1.10 AUSTRALIA

15.1.11 NEW ZEALAND

15.1.12 SINGAPORE

15.1.13 REST OF ASIA-PACIFIC

16 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

17 COMPANY PROFILE

17.1 ICL

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT/NEWS

17.1.6 SWOT ANALYSIS

17.2 KELPAK

17.2.1 COMPANY SNAPSHOT

17.2.2 COMPANY SHARE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 SWOT ANALYSIS

17.2.5 RECENT DEVELOPMENT

17.3 HAIFA NEGEV TECHNOLOGIES LTD

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 SWOT ANALYSIS

17.3.5 RECENT DEVELOPMENT

17.4 SHANDONG JIEJING GROUP CORPORATION

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 SWOT ANALYSIS

17.4.5 RECENT DEVELOPMENTS

17.5 MAXICROP USA, INC

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 SWOT ANALYSIS

17.5.5 RECENT DEVELOPMENTS

17.6 AGRO BIO CHEMICALS

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 SWOT ANALYSIS

17.6.4 RECENT DEVELOPMENTS

17.7 AGROCART

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 SWOT ANALYSIS

17.7.4 RECENT DEVELOPMENTS

17.8 ALGASBRAS

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 SWOT ANALYSIS

17.8.4 RECENT DEVELOPMENT

17.9 BIOLCHIM SPA.

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 SWOT ANALYSIS

17.9.4 RECENT DEVELOPMENT

17.1 DORA AGRI-TECH

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 SWOT ANALYSIS

17.10.4 RECENT DEVELOPMENT

17.11 FOXFARM SOIL & FERTILIZER CO

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 SWOT ANALYSIS

17.11.4 RECENT DEVELOPMENT

17.12 GREENRISEAGROINDUSTRIES

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 SWOT ANALYSIS

17.12.4 RECENT DEVELOPMENT

17.13 IFFCO

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 SWOT ANALYSIS

17.13.4 RECENT DEVELOPMENT

17.14 OCEAN ORGANICS

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 SWOT ANALYSIS

17.14.4 RECENT DEVELOPMENTS

17.15 ECO ORGANIC GARDEN

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 SWOT ANALYSIS

17.15.4 RECENT DEVELOPMENT

17.16 OLIGRO

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 SWOT ANALYSIS

17.16.4 RECENT DEVELOPMENT

17.17 QINGDAO HAIJINGLING SEAWEED BIOTECHNOLOGY GROUP CO.,LTD.

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 SWOT ANALYSIS

17.17.4 RECENT DEVELOPMENT

17.18 SEASOL

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 SWOT ANALYSIS

17.18.4 RECENT DEVELOPMENTS

17.19 SUBONEYO CHEMICALS PHARMACEUTICALS P LIMITED

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 SWOT ANALYSIS

17.19.4 RECENT DEVELOPMENTS

17.2 TERRALINK HORTICULTURE INC.

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 SWOT ANALYSIS

17.20.4 RECENT DEVELOPMENT

17.21 THE ESPOMA COMPANY

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 SWOT ANALYSIS

17.21.4 RECENT DEVELOPMENTS

17.22 VALAGRO

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 SWOT ANALYSIS

17.22.4 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 REGULATORY COVERAGE

TABLE 2 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET, BY TYPE OF SEAWEED, 2018-2032 (USD)

TABLE 3 ASIA-PACIFIC ASCOPHYLLUM IN SEAWEED FERTILIZERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 4 ASIA-PACIFIC LAMINARIA IN SEAWEED FERTILIZERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 5 ASIA-PACIFIC SARGASSUM IN SEAWEED FERTILIZERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 6 ASIA-PACIFIC ECKLONIA IN SEAWEED FERTILIZERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 7 ASIA-PACIFIC FUCUS IN SEAWEED FERTILIZERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 8 ASIA-PACIFIC KAPPAPHYCUS IN SEAWEED FERTILIZERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 9 ASIA-PACIFIC GELIDIUM IN SEAWEED FERTILIZERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 10 ASIA-PACIFIC SACCORHIZA IN SEAWEED FERTILIZERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 11 ASIA-PACIFIC OTHERS IN SEAWEED FERTILIZERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 12 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 13 ASIA-PACIFIC LIQUID IN SEAWEED FERTILIZERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 14 ASIA-PACIFIC LIQUID IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 15 ASIA-PACIFIC DRY IN SEAWEED FERTILIZERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 16 ASIA-PACIFIC DRY IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 17 ASIA-PACIFIC OTHER IN SEAWEED FERTILIZERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 18 ASIA-PACIFIC OTHER IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 19 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET, BY FUNCTION, 2018-2032 (USD)

TABLE 20 ASIA-PACIFIC GERMINATION IN SEAWEED FERTILIZERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 21 ASIA-PACIFIC PLANT GROWTH IN SEAWEED FERTILIZERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 22 ASIA-PACIFIC NUTRIENT ENHANCEMENT IN SEAWEED FERTILIZERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 23 ASIA-PACIFIC YIELD EFFICIENCY IN SEAWEED FERTILIZERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 24 ASIA-PACIFIC OTHERS IN SEAWEED FERTILIZERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 25 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 26 ASIA-PACIFIC FRUITS & VEGETABLES IN SEAWEED FERTILIZERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 27 ASIA-PACIFIC FRUITS & VEGETABLE IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 28 ASIA-PACIFIC OILSEEDS & PULSES IN SEAWEED FERTILIZERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 29 ASIA-PACIFIC OILSEEDS & PULSES IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 30 ASIA-PACIFIC CEREALS & GRAINS IN SEAWEED FERTILIZERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 31 ASIA-PACIFIC CEREALS & GRAINS IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 32 ASIA-PACIFIC TURF & ORNAMENTAL IN SEAWEED FERTILIZERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 33 ASIA-PACIFIC OTHERS IN SEAWEED FERTILIZERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 34 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET, BY TREATMENT, 2018-2032 (USD)

TABLE 35 ASIA-PACIFIC FOLIAR TREATMENT IN SEAWEED FERTILIZERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 36 ASIA-PACIFIC SOIL TREATMENT IN SEAWEED FERTILIZERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 37 ASIA-PACIFIC SEED TREATMENT IN SEAWEED FERTILIZERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 38 ASIA-PACIFIC OTHERS IN SEAWEED FERTILIZERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 39 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 40 ASIA-PACIFIC FARMS IN SEAWEED FERTILIZERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 41 ASIA-PACIFIC GARDEN IN SEAWEED FERTILIZERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 42 ASIA-PACIFIC GREENHOUSE IN SEAWEED FERTILIZERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 43 ASIA-PACIFIC OTHERS IN SEAWEED FERTILIZERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 44 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET, BY PRODUCT TYPE, 2018-2032 (USD)

TABLE 45 ASIA-PACIFIC ORGANIC IN SEAWEED FERTILIZERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 46 ASIA-PACIFIC INORGANIC IN SEAWEED FERTILIZERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 47 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET, BY COUNTRY, 2018-2032 (USD)

TABLE 48 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET, BY TYPE OF SEAWEED, 2018-2032 (USD)

TABLE 49 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 50 ASIA-PACIFIC LIQUID IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 51 ASIA-PACIFIC DRY IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 52 ASIA-PACIFIC OTHER IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 53 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET, BY FUNCTION, 2018-2032 (USD)

TABLE 54 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 55 ASIA-PACIFIC FRUITS & VEGETABLE IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 56 ASIA-PACIFIC OILSEEDS & PULSES IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 57 ASIA-PACIFIC CEREALS & GRAINS IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 58 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET, BY TREATMENT, 2018-2032 (USD)

TABLE 59 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 60 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET, BY PRODUCT TYPE, 2018-2032 (USD)

TABLE 61 CHINA SEAWEED FERTILIZERS MARKET, BY TYPE OF SEAWEED, 2018-2032 (USD)

TABLE 62 CHINA SEAWEED FERTILIZERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 63 CHINA LIQUID IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 64 CHINA DRY IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 65 CHINA OTHER IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 66 CHINA SEAWEED FERTILIZERS MARKET, BY FUNCTION, 2018-2032 (USD)

TABLE 67 CHINA SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 68 CHINA FRUITS & VEGETABLE IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 69 CHINA OILSEEDS & PULSES IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 70 CHINA CEREALS & GRAINS IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 71 CHINA SEAWEED FERTILIZERS MARKET, BY TREATMENT, 2018-2032 (USD)

TABLE 72 CHINA SEAWEED FERTILIZERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 73 CHINA SEAWEED FERTILIZERS MARKET, BY PRODUCT TYPE, 2018-2032 (USD)

TABLE 74 SOUTH KOREA SEAWEED FERTILIZERS MARKET, BY TYPE OF SEAWEED, 2018-2032 (USD)

TABLE 75 SOUTH KOREA SEAWEED FERTILIZERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 76 SOUTH KOREA LIQUID IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 77 SOUTH KOREA DRY IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 78 SOUTH KOREA OTHER IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 79 SOUTH KOREA SEAWEED FERTILIZERS MARKET, BY FUNCTION, 2018-2032 (USD)

TABLE 80 SOUTH KOREA SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 81 SOUTH KOREA FRUITS & VEGETABLE IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 82 SOUTH KOREA OILSEEDS & PULSES IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 83 SOUTH KOREA CEREALS & GRAINS IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 84 SOUTH KOREA SEAWEED FERTILIZERS MARKET, BY TREATMENT, 2018-2032 (USD)

TABLE 85 SOUTH KOREA SEAWEED FERTILIZERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 86 SOUTH KOREA SEAWEED FERTILIZERS MARKET, BY PRODUCT TYPE, 2018-2032 (USD)

TABLE 87 JAPAN SEAWEED FERTILIZERS MARKET, BY TYPE OF SEAWEED, 2018-2032 (USD)

TABLE 88 JAPAN SEAWEED FERTILIZERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 89 JAPAN LIQUID IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 90 JAPAN DRY IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 91 JAPAN OTHER IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 92 JAPAN SEAWEED FERTILIZERS MARKET, BY FUNCTION, 2018-2032 (USD)

TABLE 93 JAPAN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 94 JAPAN FRUITS & VEGETABLE IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 95 JAPAN OILSEEDS & PULSES IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 96 JAPAN CEREALS & GRAINS IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 97 JAPAN SEAWEED FERTILIZERS MARKET, BY TREATMENT, 2018-2032 (USD)

TABLE 98 JAPAN SEAWEED FERTILIZERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 99 JAPAN SEAWEED FERTILIZERS MARKET, BY PRODUCT TYPE, 2018-2032 (USD)

TABLE 100 INDONESIA SEAWEED FERTILIZERS MARKET, BY TYPE OF SEAWEED, 2018-2032 (USD)

TABLE 101 INDONESIA SEAWEED FERTILIZERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 102 INDONESIA LIQUID IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 103 INDONESIA DRY IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 104 INDONESIA OTHER IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 105 INDONESIA SEAWEED FERTILIZERS MARKET, BY FUNCTION, 2018-2032 (USD)

TABLE 106 INDONESIA SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 107 INDONESIA FRUITS & VEGETABLE IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 108 INDONESIA OILSEEDS & PULSES IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 109 INDONESIA CEREALS & GRAINS IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 110 INDONESIA SEAWEED FERTILIZERS MARKET, BY TREATMENT, 2018-2032 (USD)

TABLE 111 INDONESIA SEAWEED FERTILIZERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 112 INDONESIA SEAWEED FERTILIZERS MARKET, BY PRODUCT TYPE, 2018-2032 (USD)

TABLE 113 INDIA SEAWEED FERTILIZERS MARKET, BY TYPE OF SEAWEED, 2018-2032 (USD)

TABLE 114 INDIA SEAWEED FERTILIZERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 115 INDIA LIQUID IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 116 INDIA DRY IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 117 INDIA OTHER IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 118 INDIA SEAWEED FERTILIZERS MARKET, BY FUNCTION, 2018-2032 (USD)

TABLE 119 INDIA SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 120 INDIA FRUITS & VEGETABLE IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 121 INDIA OILSEEDS & PULSES IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 122 INDIA CEREALS & GRAINS IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 123 INDIA SEAWEED FERTILIZERS MARKET, BY TREATMENT, 2018-2032 (USD)

TABLE 124 INDIA SEAWEED FERTILIZERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 125 INDIA SEAWEED FERTILIZERS MARKET, BY PRODUCT TYPE, 2018-2032 (USD)

TABLE 126 PHILIPPINES SEAWEED FERTILIZERS MARKET, BY TYPE OF SEAWEED, 2018-2032 (USD)

TABLE 127 PHILIPPINES SEAWEED FERTILIZERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 128 PHILIPPINES LIQUID IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 129 PHILIPPINES DRY IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 130 PHILIPPINES OTHER IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 131 PHILIPPINES SEAWEED FERTILIZERS MARKET, BY FUNCTION, 2018-2032 (USD)

TABLE 132 PHILIPPINES SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 133 PHILIPPINES FRUITS & VEGETABLE IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 134 PHILIPPINES OILSEEDS & PULSES IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 135 PHILIPPINES CEREALS & GRAINS IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 136 PHILIPPINES SEAWEED FERTILIZERS MARKET, BY TREATMENT, 2018-2032 (USD)

TABLE 137 PHILIPPINES SEAWEED FERTILIZERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 138 PHILIPPINES SEAWEED FERTILIZERS MARKET, BY PRODUCT TYPE, 2018-2032 (USD)

TABLE 139 THAILAND SEAWEED FERTILIZERS MARKET, BY TYPE OF SEAWEED, 2018-2032 (USD)

TABLE 140 THAILAND SEAWEED FERTILIZERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 141 THAILAND LIQUID IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 142 THAILAND DRY IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 143 THAILAND OTHER IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 144 THAILAND SEAWEED FERTILIZERS MARKET, BY FUNCTION, 2018-2032 (USD)

TABLE 145 THAILAND SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 146 THAILAND FRUITS & VEGETABLE IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 147 THAILAND OILSEEDS & PULSES IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 148 THAILAND CEREALS & GRAINS IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 149 THAILAND SEAWEED FERTILIZERS MARKET, BY TREATMENT, 2018-2032 (USD)

TABLE 150 THAILAND SEAWEED FERTILIZERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 151 THAILAND SEAWEED FERTILIZERS MARKET, BY PRODUCT TYPE, 2018-2032 (USD)

TABLE 152 MALAYSIA SEAWEED FERTILIZERS MARKET, BY TYPE OF SEAWEED, 2018-2032 (USD)

TABLE 153 MALAYSIA SEAWEED FERTILIZERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 154 MALAYSIA LIQUID IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 155 MALAYSIA DRY IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 156 MALAYSIA OTHER IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 157 MALAYSIA SEAWEED FERTILIZERS MARKET, BY FUNCTION, 2018-2032 (USD)

TABLE 158 MALAYSIA SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 159 MALAYSIA FRUITS & VEGETABLE IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 160 MALAYSIA OILSEEDS & PULSES IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 161 MALAYSIA CEREALS & GRAINS IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 162 MALAYSIA SEAWEED FERTILIZERS MARKET, BY TREATMENT, 2018-2032 (USD)

TABLE 163 MALAYSIA SEAWEED FERTILIZERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 164 MALAYSIA SEAWEED FERTILIZERS MARKET, BY PRODUCT TYPE, 2018-2032 (USD)

TABLE 165 VIETNAM SEAWEED FERTILIZERS MARKET, BY TYPE OF SEAWEED, 2018-2032 (USD)

TABLE 166 VIETNAM SEAWEED FERTILIZERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 167 VIETNAM LIQUID IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 168 VIETNAM DRY IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 169 VIETNAM OTHER IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 170 VIETNAM SEAWEED FERTILIZERS MARKET, BY FUNCTION, 2018-2032 (USD)

TABLE 171 VIETNAM SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 172 VIETNAM FRUITS & VEGETABLE IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 173 VIETNAM OILSEEDS & PULSES IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 174 VIETNAM CEREALS & GRAINS IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 175 VIETNAM SEAWEED FERTILIZERS MARKET, BY TREATMENT, 2018-2032 (USD)

TABLE 176 VIETNAM SEAWEED FERTILIZERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 177 VIETNAM SEAWEED FERTILIZERS MARKET, BY PRODUCT TYPE, 2018-2032 (USD)

TABLE 178 AUSTRALIA SEAWEED FERTILIZERS MARKET, BY TYPE OF SEAWEED, 2018-2032 (USD)

TABLE 179 AUSTRALIA SEAWEED FERTILIZERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 180 AUSTRALIA LIQUID IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 181 AUSTRALIA DRY IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 182 AUSTRALIA OTHER IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 183 AUSTRALIA SEAWEED FERTILIZERS MARKET, BY FUNCTION, 2018-2032 (USD)

TABLE 184 AUSTRALIA SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 185 AUSTRALIA OILSEEDS & PULSES IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 186 AUSTRALIA CEREALS & GRAINS IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 187 AUSTRALIA SEAWEED FERTILIZERS MARKET, BY TREATMENT, 2018-2032 (USD)

TABLE 188 AUSTRALIA SEAWEED FERTILIZERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 189 AUSTRALIA SEAWEED FERTILIZERS MARKET, BY PRODUCT TYPE, 2018-2032 (USD)

TABLE 190 NEW ZEALAND SEAWEED FERTILIZERS MARKET, BY TYPE OF SEAWEED, 2018-2032 (USD)

TABLE 191 NEW ZEALAND SEAWEED FERTILIZERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 192 NEW ZEALAND LIQUID IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 193 NEW ZEALAND DRY IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 194 NEW ZEALAND OTHER IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 195 NEW ZEALAND SEAWEED FERTILIZERS MARKET, BY FUNCTION, 2018-2032 (USD)

TABLE 196 NEW ZEALAND SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 197 NEW ZEALAND FRUITS & VEGETABLE IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 198 NEW ZEALAND OILSEEDS & PULSES IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 199 NEW ZEALAND CEREALS & GRAINS IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 200 NEW ZEALAND SEAWEED FERTILIZERS MARKET, BY TREATMENT, 2018-2032 (USD)

TABLE 201 NEW ZEALAND SEAWEED FERTILIZERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 202 NEW ZEALAND SEAWEED FERTILIZERS MARKET, BY PRODUCT TYPE, 2018-2032 (USD)

TABLE 203 SINGAPORE SEAWEED FERTILIZERS MARKET, BY TYPE OF SEAWEED, 2018-2032 (USD)

TABLE 204 SINGAPORE SEAWEED FERTILIZERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 205 SINGAPORE LIQUID IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 206 SINGAPORE DRY IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 207 SINGAPORE OTHER IN SEAWEED FERTILIZERS MARKET, BY SEAWEED TYPE, 2018-2032 (USD)

TABLE 208 SINGAPORE SEAWEED FERTILIZERS MARKET, BY FUNCTION, 2018-2032 (USD)

TABLE 209 SINGAPORE SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 210 SINGAPORE FRUITS & VEGETABLE IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 211 SINGAPORE OILSEEDS & PULSES IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 212 SINGAPORE CEREALS & GRAINS IN SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD)

TABLE 213 SINGAPORE SEAWEED FERTILIZERS MARKET, BY TREATMENT, 2018-2032 (USD)

TABLE 214 SINGAPORE SEAWEED FERTILIZERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 215 SINGAPORE SEAWEED FERTILIZERS MARKET, BY PRODUCT TYPE, 2018-2032 (USD)

TABLE 216 REST OF ASIA-PACIFIC SEAWEED FERTILIZERS MARKET, BY TYPE OF SEAWEED, 2018-2032 (USD)

List of Figure

FIGURE 1 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET

FIGURE 2 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET: ASIA-PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET: MULTIVARIATE MODELLING

FIGURE 7 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET: SEGMENTATION

FIGURE 12 RISING DEMAND FOR SUSTAINABLE, ORGANIC AGRICULTURAL PRACTICES IS EXPECTED TO DRIVE THE ASIA-PACIFIC SEAWEED FERTILIZERS MARKET IN THE FORECAST PERIOD

FIGURE 13 THE ASCOPHYLLUM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC SEAWEED FERTILIZERS MARKET IN 2025 AND 2032

FIGURE 14 VALUE CHAIN OF ASIA-PACIFIC SEAWEED FERTILIZERS MARKET

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR ASIA-PACIFIC SEAWEED FERTILIZERS MARKET

FIGURE 16 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET: BY TYPE OF SEAWEED, 2024

FIGURE 17 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET, BY FORM, 2024

FIGURE 18 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET, BY FUNCTION, 2024

FIGURE 19 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET, BY CROP TYPE, 2024

FIGURE 20 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET, BY TREATMENT, 2024

FIGURE 21 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET, BY APPLICATION, 2024

FIGURE 22 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET, BY PRODUCT TYPE, 2024

FIGURE 23 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET: SNAPSHOT (2024)

FIGURE 24 ASIA-PACIFIC SEAWEED FERTILIZERS MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.