Asia Pacific Surfactant Market

Market Size in USD Billion

CAGR :

%

USD

22.02 Billion

USD

31.94 Billion

2024

2032

USD

22.02 Billion

USD

31.94 Billion

2024

2032

| 2025 –2032 | |

| USD 22.02 Billion | |

| USD 31.94 Billion | |

|

|

|

|

Asia-Pacific Surfactant Market Size

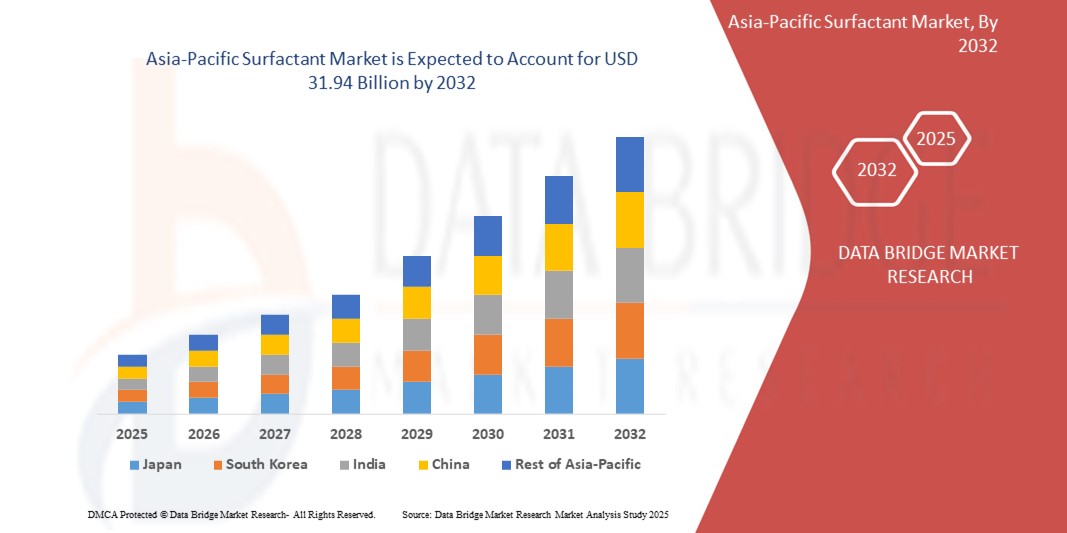

- The Asia-Pacific surfactant market size was valued at USD 22.02 billion in 2024 and is expected to reach USD 31.94 billion by 2032, at a CAGR of 4.76% during the forecast period

- The market's growth is primarily driven by the increasing demand for surfactants in various applications, including personal care, household cleaning, and industrial processes. The rapid urbanization and expanding middle-class population in Asia-Pacific are further fueling demand for consumer goods that incorporate surfactants

- The growing adoption of sustainable surfactant solutions, coupled with advancements in green chemistry, is playing a key role in shaping the market. This shift towards eco-friendly and bio-based surfactants is enhancing the industry's growth, as consumers and businesses alike are becoming more conscious of environmental impacts

Asia-Pacific Surfactant Market Analysis

- Surfactants, which are crucial components in detergents, personal care products, and industrial applications, are becoming increasingly important in the Asia-Pacific region due to their versatile functionality in both consumer and industrial products

- The growing demand for surfactants is mainly driven by the increasing use of cleaning agents, cosmetics, and personal care products, as well as the expansion of the textile, agricultural, and oil & gas industries. The rise in disposable incomes and changing lifestyles in Asia-Pacific also contribute to the increasing consumption of surfactant-containing goods

- China is expected to dominate the Asia-Pacific region with a largest market share of 44%, due to its competitive advantage in production efficiency and cost-effectiveness

- India is projected to be the fastest-growing country in the Asia-Pacific surfactant market during the forecast period due to country’s rapid urbanization and expanding middle class are increasing the demand for personal care and household cleaning products, which are major consumers of surfactants

- Amphoteric surfactants is expected to dominate the Asia-pacific surfactant market with a largest market share of 87% in 2025, due to their mildness and skin-friendly nature which makes them ideal for application in baby care products, sensitive skin products, and high-end cosmetics. They have very excellent properties such as foaming properties, stability in hard water, and great compatibility with other surfactants, which drives their demand

Report Scope and Asia-Pacific Surfactant Market Segmentation

|

Attributes |

Asia-Pacific Surfactant Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Surfactant Market Trends

“Rising Demand Driven by Industrial Growth and Sustainable Solutions”

- A major and accelerating trend in the Asia-Pacific surfactant market is the rising demand from key end-use industries such as personal care, household cleaning, textiles, and agriculture, driven by rapid industrialization and urbanization across the region. This demand surge is particularly strong in emerging economies such as China, India, Indonesia, and Vietnam

- For instance, the growing middle-class population in India and China is fueling consumption of personal care and home care products, leading to increased demand for anionic and non-ionic surfactants used in shampoos, detergents, and fabric softeners. Additionally, multinational companies like Unilever and P&G are expanding their operations in the region to tap into this booming consumer base

- Environmental concerns and regulatory pressures are also shaping the market, encouraging manufacturers to develop bio-based and biodegradable surfactants. Companies such as Galaxy Surfactants and Kao Corporation are investing in sustainable product lines that reduce ecological impact, meet green certification standards, and appeal to environmentally conscious consumers

- Technological advancements in surfactant synthesis are enabling the production of high-performance surfactants with better efficiency, lower toxicity, and targeted functionality. For example, specialty surfactants are gaining traction in sectors such as pharmaceuticals, agrochemicals, and oilfield chemicals due to their ability to enhance solubility and performance under extreme conditions

- Regional governments are supporting domestic production through favorable policies, subsidies, and R&D investments, particularly in countries like China and India. This is fostering local innovation and reducing dependency on imports, contributing to a more resilient and competitive market landscape

- The Asia-Pacific surfactant market is also witnessing increased investment in distribution networks and strategic partnerships to meet the diverse and growing needs of regional markets. As a result, major players are establishing joint ventures and expanding manufacturing facilities across Southeast Asia to capitalize on the region’s economic growth and rising demand

- This ongoing trend of industrial expansion, sustainability focus, and technological innovation is fundamentally transforming the Asia-Pacific surfactant market. Consequently, both global and regional manufacturers are adapting their strategies to address the evolving consumer preferences and regulatory landscapes, reinforcing Asia-Pacific as a critical hub in the global surfactant industry

Asia-Pacific Surfactant Market Dynamics

Driver

“Growing Need Due to Expanding End-Use Industries and Urbanization”

- The rapid growth of key end-use industries such as personal care, home care, textiles, agriculture, and industrial cleaning in the Asia-Pacific region is a primary driver of increasing demand for surfactants. This expansion is largely fueled by rising disposable incomes, urbanization, and evolving consumer lifestyles across major economies including China, India, Indonesia, and Thailand

- For instance, according to industry reports, the personal care and cosmetics market in India is expected to grow significantly by 2031, supported by the demand for shampoos, facial cleansers, and skincare products all of which heavily rely on surfactants as key functional ingredients

- Furthermore, the region’s fast-growing population and increasing awareness of hygiene and cleanliness are driving the consumption of detergents, disinfectants, and cleaning agents, which directly supports the surfactant market. Governments are also promoting hygiene campaigns, particularly in rural areas, further boosting product penetration

- The rising focus on sustainable and bio-based surfactants due to environmental concerns and regulatory pressures is encouraging innovation and investment in green chemistry. Regional manufacturers are increasingly shifting toward plant-based surfactants to align with consumer preferences and comply with international environmental standards

- Another significant factor is the expansion of industrial and agricultural sectors, particularly in countries such as China and Vietnam. Surfactants are used in formulations for pesticides, emulsifiers, and wetting agents, where growing demand for crop productivity solutions supports market growth

- Moreover, favorable government initiatives supporting local manufacturing, infrastructure development, and FDI inflows in chemicals and personal care sectors are fostering regional production capacity and creating long-term growth opportunities for surfactant manufacturers

- This combination of industrial expansion, consumer-driven demand, and increasing regulatory focus on sustainability is reinforcing the Asia-Pacific region’s position as one of the fastest-growing and most dynamic surfactant markets globally. Major players are responding by scaling up production, diversifying portfolios, and establishing strategic partnerships across the region

Restraint/Challenge

“Environmental Regulations and Volatile Raw Material Prices”

- Stringent environmental regulations and growing concerns regarding the ecological impact of synthetic surfactants present a significant challenge to the Asia-Pacific surfactant market. Many conventional surfactants, especially those derived from petrochemicals, are non-biodegradable and can contribute to water pollution, prompting regulatory scrutiny and consumer resistance

- For instance, government bodies and environmental agencies across countries like China, Japan, and India are increasingly implementing policies aimed at reducing the use of environmentally harmful chemicals, encouraging manufacturers to shift toward green and sustainable alternatives—a transition that requires significant R&D investment and adaptation of manufacturing processes

- The Asia-Pacific region faces the ongoing challenge of volatile raw material prices, particularly for petroleum-based inputs such as linear alkylbenzene and ethylene oxide. These fluctuations can affect production costs and profit margins, making pricing unpredictable for both producers and end-users

- Dependence on imported raw materials in several countries adds another layer of complexity, exposing local manufacturers to international supply chain disruptions, currency fluctuations, and geopolitical tensions. The COVID-19 pandemic and recent global logistics bottlenecks have highlighted these vulnerabilities, causing delays and increased operational costs

- Smaller and mid-sized players in the region often face difficulties in complying with evolving regulatory standards and managing cost pressures simultaneously, which can hinder market competitiveness and innovation. Moreover, transitioning to bio-based alternatives is not only capital intensive but also dependent on consistent availability of plant-based feedstock, which may not always be assured

- Addressing these challenges requires coordinated efforts toward sustainable raw material sourcing, investment in greener production technologies, and building regional supply chain resilience. While the market shows strong growth potential, overcoming these constraints is essential for achieving long-term sustainability and regulatory compliance across the Asia-Pacific surfactant industry

Asia-Pacific Surfactant Market Scope

The market is segmented on the basis of type, substrate, and application.

- By Type

On the basis of type, the Asia-Pacific surfactant market is segmented into anionic surfactants, non-ionic surfactants, cationic surfactants, amphoteric surfactants, silicone surfactants, and others. The amphoteric surfactants segment dominates and holds the largest market revenue share of 87%, driven by their ability to perform effectively across a broad pH range while minimizing irritation. Their compatibility with both anionic and cationic surfactants enhances formulation flexibility, making them a preferred choice for shampoos, facial cleansers, and baby care items.

The non-ionic surfactants segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand across industries such as food processing, agriculture, and pharmaceuticals. Their low toxicity, biodegradability, and stability in hard water make non-ionic surfactants ideal for eco-friendly and industrial formulations. Additionally, their rising use in emulsifiers and wetting agents aligns with the region's growing focus on sustainable and high-performance products.

- By Substrate

On the basis of substrate, the Asia-Pacific surfactant market is segmented into synthetic surfactants, and bio-based surfactant. Synthetic surfactants dominate the market in 2025, holding the largest revenue share. Their widespread use is attributed to their cost-effectiveness, superior performance, and ease of mass production. Synthetic surfactants, such as anionic surfactants (such as linear alkylbenzene sulfonate) and non-ionic surfactants (such as ethoxylates), are prevalent in cleaning agents, personal care products, and detergents.

The bio-based surfactants segment is expected to witness the fastest compound annual growth rate from 2025 to 2032, driven by increasing consumer demand for sustainable, eco-friendly products. Bio-based surfactants, derived from renewable sources like plant oils and sugars, offer a lower environmental impact compared to synthetic alternatives. These surfactants are gaining significant traction in personal care, food processing, and agricultural applications due to their biodegradability, mildness, and lower toxicity.

By Application

On the basis of application, the Asia-Pacific surfactant market is segmented into household soaps and detergents, personal care, textile processing, industrial and institutional cleaning, mining, pharmaceuticals, paints & coatings, oilfield chemicals, food processing, agricultural chemicals, pulp & paper, leather manufacturing, emulsion polymerization, foaming agents, lubricants and fuel additives, plastics and elastomers, adhesives, electroplating, and others. The household soaps and detergents segment holds the largest market revenue share in 2025, driven by continued high demand for cleaning products, including laundry detergents, dishwashing liquids, and all-purpose cleaners. Surfactants in this category offer strong cleaning power and foaming properties, making them essential for everyday household use.

The personal care segment is anticipated to witness rapid growth during the forecast of 2025 to 2032 due to increasing consumer preference for high-quality personal care products such as shampoos, body washes, and skincare products. Surfactants in personal care applications serve as emulsifiers, foaming agents, and skin conditioning agents, meeting consumer demands for products that are both effective and mild. As consumers increasingly prioritize sustainable and natural ingredients, bio-based surfactants are gaining popularity in this segment.

Asia-Pacific Surfactant Market Regional Analysis

- China dominates the Asia-Pacific surfactant market with the largest revenue share of approximately 44%, driven by its large manufacturing base and robust demand for surfactants in personal care, household cleaning, and industrial applications. China’s strong industrial growth, coupled with an increasing consumer preference for high-quality cleaning and personal care products, propels the demand for surfactants

- Consumers in China are increasingly opting for sustainable and eco-friendly products, driving demand for bio-based surfactants in personal care and household cleaning products. The growing awareness of environmental issues and government regulations promoting green chemicals are also contributing to the growth of this segment

- The growing popularity of bio-based surfactants in India is aligned with the shift toward more sustainable and eco-friendly product formulations, especially in the personal care and agricultural chemicals segments

India Asia-Pacific Surfactant Market Insight

The India surfactant market is poised to grow at the fastest CAGR of 6% during the forecast period of 2025 to 2032, driven by rapid industrialization, rising disposable incomes, and an increasing demand for personal care, household cleaning, and textile products. The country's expanding middle class, coupled with growing urbanization, is boosting the consumption of surfactants across various sectors. Furthermore, the growing awareness of hygiene and sanitation, along with the rise of eco-conscious consumers, is spurring demand for bio-based and sustainable surfactants. The government's focus on promoting green chemicals and the increasing adoption of sustainable formulations will further fuel the market growth in India

Japan Asia-Pacific Surfactant Market Insight

Japan's surfactant market continues to witness stable growth, driven by high demand for specialized surfactants in personal care, automotive, and industrial applications. The country's technological advancements and emphasis on high-quality, premium products make it a significant market for non-ionic, silicone, and bio-based surfactants. Japan's aging population is also contributing to the demand for personal care products with skin-friendly and eco-conscious formulations. The growing preference for sustainable and green chemicals in personal care and household cleaning is expected to continue propelling the market in Japan

China Asia-Pacific Surfactant Market Insight

China dominates the Asia-Pacific surfactant market, holding the largest market revenue share of 44% in 2025. The country’s rapid industrialization, expanding middle class, and high technological adoption are key factors driving demand for surfactants in personal care, cleaning products, textiles, and industrial applications. China is also witnessing a significant shift towards sustainable and bio-based surfactants, driven by growing consumer awareness of environmental issues and stricter government regulations promoting sustainability. As one of the largest manufacturing hubs globally, China’s domestic production of surfactants makes these products highly accessible and affordable, contributing to widespread usage across both residential and industrial sectors.

Asia-Pacific Surfactant Market Share

The smart lock industry is primarily led by well-established companies, including:

- Galaxy Surfactants Ltd. (India)

- Aarti Industries Ltd. (India)

- KLK OLEO (Malaysia)

- Indorama Ventures Public Company Limited (Thailand)

- Godrej Industries Limited (India)

- Reliance Industries Limited (India)

- Kao Corporation (Japan)

- Lion Corporation (Japan)

- SABIC (Saudi Arabia)

- Sumitomo Chemical Co., Ltd. (Japan)

- Cepsa (Spain)

- Bayer AG (Germany)

- SANYO CHEMICAL INDUSTRIES, LTD. (Japan)

- Croda International Plc (United Kingdom)

- Zanyu Technology Group (China)

- Ashland (United States)

- GALAXY (India)

- EOC Group (Taiwan)

- Lankem (Sri Lanka)

- DKS Co., Ltd. (Japan)

Latest Developments in Asia-Pacific Surfactant Market

- In January 2024, Evonik Industries AG successfully launched its first product from its industrial-scale plant for sustainable bio-surfactants in Slovakia, completing the facility ahead of schedule. This state-of-the-art plant is the world’s first to produce sustainable rhamnolipid biosurfactants, marking a significant milestone in the industry. This development is growing demand for sustainable and eco-friendly surfactants. As the region continues to experience rapid industrial growth and increasing consumer preference for green chemicals, Evonik's innovative bio-surfactant solutions position the company to meet the rising demand for sustainable alternatives

- In October 2023, Sasol Chemicals, a division of Sasol Ltd., introduced two new brands, CARINEX and LIVINEX, aimed at expanding the company’s sustainable product portfolio. The initial products launched under these brands, CARINEX SL and LIVINEX SL, are biosurfactants that represent a significant addition to Sasol's offerings in the sustainable surfactant space. This launch is increasingly prioritizing sustainable and eco-friendly solutions. As consumer demand for green and bio-based surfactants continues to rise, particularly in personal care, household cleaning, and industrial applications, Sasol’s new biosurfactants align with the region’s growing commitment to sustainability

- In October 2023, Ashland unveiled its Easy-Wet substrate wetting agents, a new category of silicone-free, high-performance oligomeric alkyl polyether polyols specifically designed for premium industrial coating applications. This innovation allows Ashland to deliver transformative solutions for the coating industry. This development demand for advanced and environmentally friendly surfactants is rapidly increasing, particularly in the coatings sector. As the region continues to emphasize sustainability and high-performance solutions, Ashland’s Easy-Wet wetting agents provide a compelling alternative to traditional silicone-based products

- In January 2023, Holiferm Limited and Sasol Chemicals, a business unit of Sasol Ltd., announced a strategic collaboration to jointly develop and commercialize rhamnolipids and mannosylerythritol lipids (MELs)—two advanced classes of biosurfactants. This agreement builds upon their initial partnership established in March 2022, which focused on the development and market introduction of sophorolipids. This partnership holds strong relevance for the Asia-Pacific Surfactant Market, where demand for sustainable and high-performance biosurfactants is accelerating, particularly in sectors such as personal care, home care, and industrial cleaning

- In January 2023, Cepsa Química launched NextLab, the world’s first sustainable Linear Alkylbenzene (LAB) line designed specifically for homecare products. The announcement was made at the annual ACI Convention in Orlando. This innovation is particularly relevant to the Asia-Pacific Surfactant Market, where demand for sustainable and low-emission raw materials is rising rapidly, especially in the homecare and cleaning sectors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Surfactant Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Surfactant Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Surfactant Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.