Asia Pacific Used Car Market

Market Size in USD Billion

CAGR :

%

USD

410.36 Billion

USD

737.34 Billion

2024

2032

USD

410.36 Billion

USD

737.34 Billion

2024

2032

| 2025 –2032 | |

| USD 410.36 Billion | |

| USD 737.34 Billion | |

|

|

|

|

Used Car Market Size

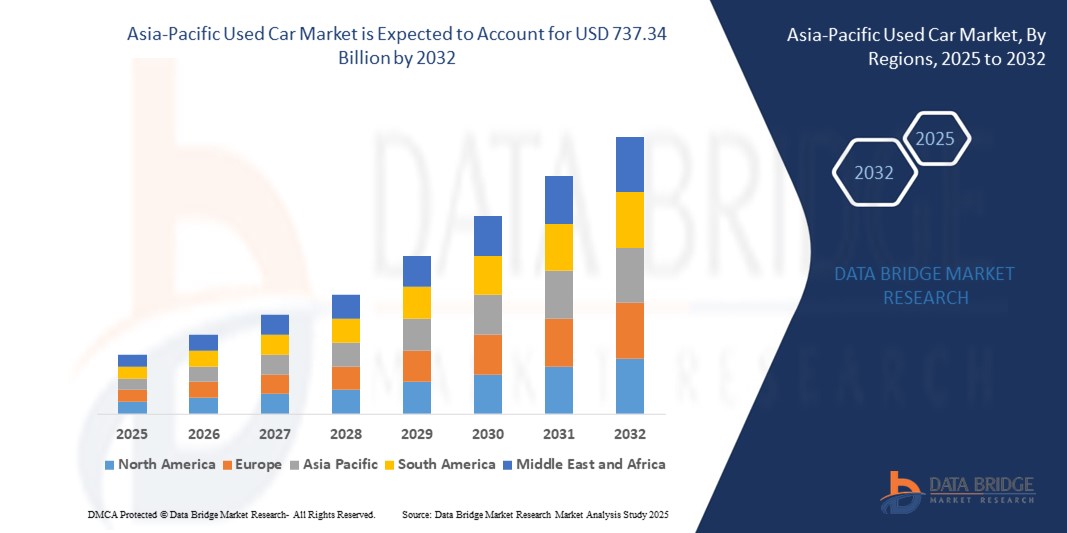

- The Asia-Pacific used car market size was valued at USD 410.36 billion in 2024 and is expected to reach USD 737.34 billion by 2032, at a CAGR of 7.60% during the forecast period

- The market growth is largely fueled by rising affordability, increased vehicle ownership aspirations among middle-income consumers, and expanding digital platforms that simplify the buying and selling process

- Furthermore, the growing trust in certified pre-owned vehicles, availability of flexible financing options, and rising focus on organized dealership networks are accelerating the adoption of used cars, thereby significantly boosting the industry’s growth

Used Car Market Analysis

- Used cars are pre-owned vehicles offered through unorganized sellers, franchised dealerships, or digital platforms, catering to cost-conscious buyers seeking reliable transportation. These vehicles are often certified, refurbished, and sold with limited warranties, offering an economical alternative to new cars

- The growing popularity of used cars is driven by rising new vehicle prices, increasing online penetration in vehicle transactions, and improved transparency through vehicle history reports, financing options, and warranty programs, making them a compelling value proposition for both urban and semi-urban consumers

- China dominated the used car market in 2024, due to its expansive vehicle ownership base, rapid digitalization of used car platforms, and supportive regulatory shifts favoring second-hand vehicle transactions

- India is expected to be the fastest growing region in the used car market during the forecast period due to increasing urbanization, rising disposable incomes, and a fast-expanding base of first-time car buyers

- Petrol segment dominated the market with a market share of 51.5% in 2024, due to its widespread availability, lower upfront vehicle costs, and relatively lower maintenance requirements. It remains the most accessible propulsion type across developing nations in the region. The electric vehicle (EV) segment is anticipated to grow at the fastest CAGR from 2025 to 2032, supported by government incentives, increasing EV penetration in the new car market, and consumer interest in eco-friendly alternatives. As battery costs decline and EV infrastructure expands, the secondary market for EVs is expected to become more active and viable

Report Scope and Used Car Market Segmentation

|

Attributes |

Used Car Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Used Car Market Trends

“Increasing Demand for Personal Mobility”

- The Asia Pacific used car market is expanding quickly as consumers increasingly seek affordable personal mobility options to cope with urban congestion and escalating transportation needs

- For instance, companies such as Carro, Carsome, Cars24, OLX Autos, and Maruti Suzuki are driving this growth by offering extensive online marketplaces and certification programs that simplify buying and selling pre-owned vehicles across countries such as India, China, and Southeast Asia

- Digital platforms and mobile apps provide transparent vehicle histories, financing options, and detailed inspections, reducing barriers of trust and improving consumer confidence in used cars

- Rising urban populations and middle-class incomes in countries such as China, India, and Indonesia are increasing demand for flexible ownership models, including leasing and subscription services

- The growing penetration of electric and hybrid used vehicles is emerging as a lucrative segment, supported by infrastructure investments and government incentives promoting green mobility

- Government regulations and policies supporting organized used car sales and vehicle inspections are helping improve quality standards and professionalize the second-hand vehicle ecosystem

Used Car Market Dynamics

Driver

“Growing Urbanization Driving Demand for Used Cars”

- Rapid urbanization in Asia Pacific fuels demand for cost-effective personal transportation solutions in increasingly crowded cities where public transit may be limited or inconvenient

- For instance, in China, companies such as Uxin Limited and Guazi hold significant market shares by targeting urban consumers with digital platforms allowing easy access to inspected and certified used vehicles, catering to the expanding urban middle class

- Growth of tier-2 and tier-3 cities in countries such as India and Vietnam opens new markets where used cars are the preferred option for increasing mobility needs

- Rising income levels in urban areas enable more consumers to afford used cars, reinforcing demand growth

- Increasing digital literacy and internet penetration facilitate online used car purchases, expanding the market reach widely across urban centers

Restraint/Challenge

“Infrastructure Issues Impacting Consumer Behavior”

- Poor transport infrastructure, inconsistent road conditions, and inadequate maintenance services in certain regions restrict the appeal and reliability of used vehicles, particularly for rural and semi-urban consumers

- For instance, in parts of Southeast Asia and India, logistical difficulties and limited servicing facilities increase ownership costs and reduce buyer confidence, limiting market penetration

- Urban areas with heavy traffic congestion and scarce parking reduce consumer willingness to invest in private vehicles, affecting used car sales volumes

- Stringent and varying vehicle emission norms and safety regulations across Asia Pacific countries complicate vehicle import/export and compliance, adding operational hurdles for used car dealers and buyers

- Financing accessibility challenges, especially for rural buyers and first-time used car purchasers, limit the market size despite digital platforms expanding credit availability

Used Car Market Scope

The market is segmented on the basis of vendor type, propulsion, engine capacity, dealership, sales channel, and vehicle type.

- By Vendor Type

On the basis of vendor type, the Asia-Pacific used car market is segmented into organized and unorganized vendors. The unorganized segment dominated the largest market revenue share in 2024, owing to the traditionally fragmented nature of the region's used car ecosystem, especially in countries such as India, Indonesia, and the Philippines. Consumers often prefer unorganized dealers due to localized networks, negotiable pricing, and immediate availability. However, the organized segment is projected to witness the fastest CAGR from 2025 to 2032, driven by increasing digitalization, greater financing options, and rising consumer preference for quality-certified, warranty-backed vehicles. Organized players are also gaining traction by offering transparent history reports, vehicle inspections, and after-sales services.

- By Propulsion

On the basis of propulsion, the market is segmented into petrol, diesel, CNG, LPG, electric, and others. The petrol segment held the largest market revenue share of 51.5% in 2024, largely due to its widespread availability, lower upfront vehicle costs, and relatively lower maintenance requirements. It remains the most accessible propulsion type across developing nations in the region. The electric vehicle (EV) segment is anticipated to grow at the fastest CAGR from 2025 to 2032, supported by government incentives, increasing EV penetration in the new car market, and consumer interest in eco-friendly alternatives. As battery costs decline and EV infrastructure expands, the secondary market for EVs is expected to become more active and viable.

- By Engine Capacity

On the basis of Engine Capacity, the market is segmented into full size (above 2500 CC), mid-size (1500–2499 CC), and small (below 1499 CC). The mid-size segment accounted for the largest market share in 2024, as vehicles in this category offer a balance of power, efficiency, and affordability, catering well to family and urban driving needs. This segment includes a large portion of sedans and compact SUVs, which are in high demand among middle-class consumers. The small engine capacity segment is expected to witness the fastest growth from 2025 to 2032, driven by rising demand for compact hatchbacks and city cars in densely populated urban centers with lower average income levels and increasing focus on fuel economy.

- By Dealership

On the basis of dealership, the market is bifurcated into franchised and independent dealerships. Franchised dealerships dominated the market share in 2024 due to strong brand trust, certified vehicle offerings, and access to manufacturer-backed service networks. Consumers prefer franchised outlets for the perceived reliability, extended warranties, and structured financing options. Meanwhile, independent dealerships are projected to grow at the fastest CAGR from 2025 to 2032, as they expand online presence, improve transparency, and cater to cost-conscious buyers with a broader variety of vehicle brands and pricing flexibility.

- By Sales Channel

The sales channel segment includes online and offline. The offline segment held the largest share in 2024 due to the traditional preference for in-person vehicle inspection, price negotiation, and physical verification before purchase. In emerging markets, trust remains a major factor, and face-to-face transactions dominate. However, the online segment is expected to experience the fastest CAGR from 2025 to 2032, spurred by increased internet penetration, rising millennial and Gen Z consumer base, and the growing influence of digital marketplaces that offer end-to-end services including financing, delivery, and return policies.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into passenger cars, light commercial vehicles (LCVs), heavy commercial vehicles (HCVs), and electric vehicles. Passenger cars held the largest market revenue share in 2024, supported by growing middle-class car ownership, urbanization, and affordability of used compact sedans and hatchbacks. The electric vehicle segment is forecasted to grow at the fastest rate from 2025 to 2032, as supportive policies, declining battery prices, and improved consumer confidence around EV longevity and resale value stimulate secondary market participation.

Used Car Market Regional Analysis

- China dominated the used car market with the largest revenue share in 2024, driven by its expansive vehicle ownership base, rapid digitalization of used car platforms, and supportive regulatory shifts favoring second-hand vehicle transactions

- The government's relaxation of inter-regional vehicle transfer policies and growing trust in certified pre-owned programs have significantly boosted cross-province sales, especially in Tier II and Tier III cities

- China's strong ecosystem of online used car marketplaces, rising middle-class affordability, and evolving consumer attitudes toward value-oriented vehicle ownership have cemented its role as the largest and most mature used car market in the region

Japan Used Car Market Insight

Japan’s used car market is expected to experience stable growth from 2025 to 2032, underpinned by the country's highly regulated vehicle inspection system, superior vehicle maintenance standards, and a strong resale culture. The domestic market benefits from rising demand among budget-conscious households, retirees, and rural consumers seeking dependable, cost-efficient mobility. Furthermore, Japan remains a major exporter of used vehicles to Asia, Africa, and the Middle East, with strong global demand driven by the reputation of Japanese vehicles for quality and durability. Structured dealership networks, reliable certification systems, and technological integration into auction platforms support continued market resilience.

India Used Car Market Insight

India is anticipated to register the fastest CAGR in the Asia-Pacific used car market during the forecast period of 2025 to 2032, fueled by increasing urbanization, rising disposable incomes, and a fast-expanding base of first-time car buyers. The market is transitioning rapidly from unorganized to organized players, supported by digital platforms offering financing, insurance, and standardized vehicle inspections. Government policies encouraging vehicle recycling and the scrappage of older vehicles are also contributing to a more dynamic used car supply pipeline. Moreover, the demand for certified, warranty-backed used cars is rising in metro and Tier II cities, driven by shifting consumer preference toward value-for-money alternatives to new vehicles.

Used Car Market Share

The used car industry is primarily led by well-established companies, including:

- Group1 Automotive, Inc. (U.S.)

- AutoNation (U.S.)

- HELLMAN and FRIEDMAN LLC (U.S.)

- PENDRAGON (U.K.)

- CarMax Enterprise Services, LLC (U.S.)

- Manheim (U.S.)

- THE HERTZ CORPORATION (U.S.)

- Cox Automotive (U.S.)

- Sun Toyota (U.S.)

- eBay Inc. (U.S.)

- TrueCar, Inc. (U.S.)

- VROOM (U.S.)

- Asbury Automotive Group (U.S.)

- Lithia Motors, Inc. (U.S.)

- Hendrick Automotive Group (U.S.)

Latest Developments in Asia-Pacific Used Car Market

- In June 2024, Toyota Kirloskar Motor (TKM) inaugurated its second company-owned Toyota Used Car Outlet (TUCO) in India, located in New Delhi, under the brand “Toyota U-Trust.” The 15,000 sq ft facility showcases over 20 certified vehicles and is designed to offer a premium, trustworthy, and structured experience in used Toyota car transactions. This expansion reflects Toyota's growing focus on formalizing the used car sector through OEM-backed infrastructure that assures quality, transparent pricing, and post-sale support—catering to an increasingly discerning Indian customer base seeking assurance in second-hand purchases

- In June 2023, Jardine Cycle & Carriage Limited, the investment arm of Jardine Matheson, partnered with Southeast Asia’s leading car marketplace Carro. This strategic collaboration aims to integrate Carro’s digital retail capabilities with Jardine’s Republic Auto brand, thereby expanding the reach and quality of used car inventory across Southeast Asia. The alliance strengthens Carro’s cross-border operations while enhancing user experience through digitized services and end-to-end vehicle solutions, contributing to regional market consolidation and scalability

- In August 2022, Lexus, a luxury division of Toyota, launched the Lexus Certified Programme in India to offer existing Lexus owners a reliable platform for resale and trade-in. The program is designed to assure buyers of verified vehicle condition, premium servicing, and higher retained value. This move marks Lexus’s entry into the certified pre-owned luxury segment in India, helping formalize a traditionally underpenetrated premium resale market and appealing to aspirational buyers looking for luxury at a relatively lower price point

- In 2022, Spinny, a full-stack used car platform in India, rolled out its first nationwide marketing campaign titled “Khushiyon Ki Long Drive”. Featuring cricket legend Sachin Tendulkar and Olympic medalist PV Sindhu, the campaign highlights the emotional journey of owning a car and builds on the brand’s vision of making car buying simple, joyful, and trustworthy. This campaign has reinforced Spinny’s emotional connect with buyers, strengthening consumer loyalty and brand visibility in a highly competitive and emotionally driven market

- In March 2022, Cars24 diversified into the new car segment by launching an aggregator platform for OEMs and dealerships, signaling a shift toward creating an integrated super app for all automotive needs. This initiative is strategically positioned to capture a broader spectrum of customers, increase cross-selling opportunities, and solidify Cars24’s presence across both new and used car domains. The unified approach simplifies decision-making for consumers and strengthens the brand’s ecosystem dominance across the vehicle lifecycle

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.