According to the expatrist, projections indicated that e-commerce is poised to encompass close to 10 percent of used-car retail transactions by 2025. Notably, AutoScout24 commands a prominent stature as a premier marketplace for sourcing both new and pre-owned vehicles across the entirety of Europe. With a wide-ranging presence spanning 19 European countries and a substantial inventory of over 2 million vehicles, AutoScout24 stands as a pivotal player in the automotive e-commerce landscape. Therefore, the Europe and South America used car market is estimated to increase rapidly in the near future.

Access Full Report @ https://www.databridgemarketresearch.com/reports/europe-and-south-america-used-car-market

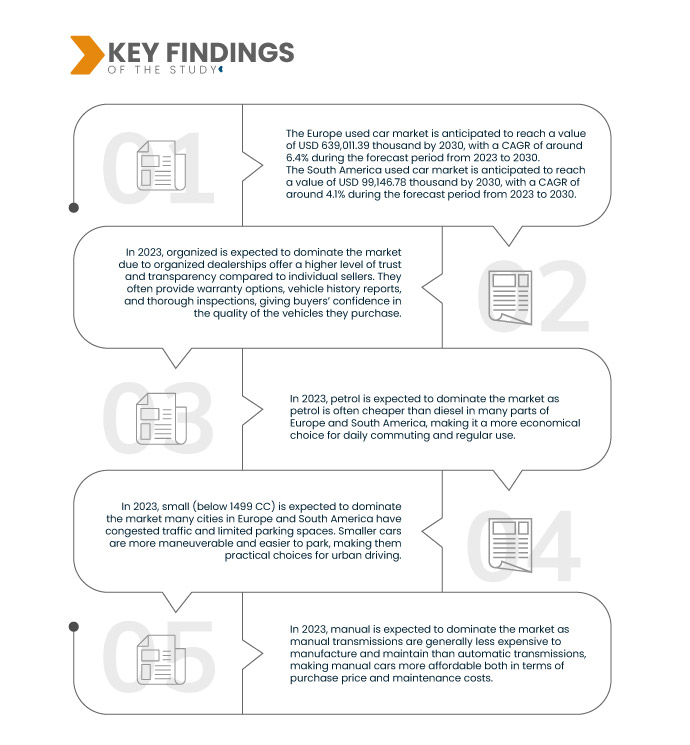

Data Bridge Market Research analyses that the Europe Used Car Market is expected to grow at a CAGR of 6.4% in the forecast period of 2023 to 2030 and is expected to reach USD 639,011.39 million by 2030 and South America user car market is expected to grow at a CAGR of 4.1% in the forecast period of 2023 to 2030 and is expected to reach USD 99,146.78 million by 2030. The increasing penetration of the internet has also facilitated an online marketplace around the world. With that, consumers have several choices including unlimited varieties, styles, prices, and model comparison features in the online portals. Most dealerships list new and used car details online so that customers can find information along with pictures on almost any vehicle of interest. Furthermore, if pricing and incentive information is not available, the user can just call and approach many dealers available online and get the required information about the car model.

Key Findings of the Study

Emergence of Different E-Commerce Platform in Europe and South America Regions is Expected to Drive the Growth of the Market

A used car, which is also known as a pre-owned vehicle, or a secondhand car, is a vehicle that has previously had one or more owners. Recently there is a lower rate of car ownership among millennials due to the high cost of vehicles and maintenance cost of a personal car. In addition, users are inclined towards cutting costs on cars, and thus majorly opt for used cars to travel. Moreover, a lot of people are not able to buy new cars due to financial constraints, which have further paved the way for used cars in the market. This also allows industry participants to make various investments to establish their dealership network in the market.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015 - 2020)

|

|

Quantitative Units

|

Revenue in USD Million

|

|

Segments Covered

|

Vendor Type (Organized, Unorganized), Propulsion Type (Petrol, Diesel, Electric, LPG, and CNG), Engine Capacity (Small (Below 1499 CC), Mid-Size (1500-2499 CC), and Full Size (Above 2500 CC)), Dealership (Franchised, Independent), Transmission (Manual, Automatic), Vehicle Type (SUV, Sedan, Crossover, Coupe, Hatchback, MPV, Convertible, Sports Cars, and Others), Pricing Category (High (More than USD 20,000), Medium (USD 5501-USD 20000), and Low (Less than USD 5500), Sales Channel (Offline, Online)

|

|

Countries Covered

|

Germany, U.K., France, Italy, Spain, Russia, Poland, Netherlands, Belgium, Switzerland, Denmark, Finland, Sweden, Norway, Turkey and Rest of Europe, Brazil, Argentina and Rest of South America

|

|

Market Players Covered

|

AUTO1 Group (Germany), Penske Automotive Group, Inc. (U.S.), Lookers PLC (U.S.) , PENDRAGON (U.S.), Emil Frey AG (Switzerland), Group1 Automotive, Inc. (U.S.), Arnold Clark Automobiles Limited (U.K.), Gottfried Schultz Automobile Trading SE (Germany), OLX GROUP (Netherlands), Alibaba Group Holding Limited (China), Auto Trader Group plc. (U.K.), KAVAK (Mexico), HELLMAN & FRIEDMAN LLC (U.S.), leboncoin (France), mobile.de GmbH (Germany) and Gumtree.com Limited (U.K.) and among others

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis:

Europe and South America used car market is segmented into eight notable segments which are based on vendor type, propulsion type, engine capacity, dealership, transmission, pricing category, sales channel, and vehicle type.

- On the basis of vendor type, the Europe used car market is segmented into organized & and unorganized. In 2023, organized is expected to dominate the Europe used card market with a 58.00% market share due to organized dealerships offering a higher level of trust and transparency compared to individual sellers.

- On the basis of vendor type, the South America used car market is segmented into organized & and unorganized. In 2023, organized is expected to dominate the South America used card market with a 61.61% market share due to organized dealerships offering a higher level of trust and transparency compared to individual sellers.

- On the basis of propulsion type, the Europe and South America used car market is segmented into petrol, diesel, electric, LPG, and CNG.

In 2023, petrol is expected to dominate Europe and South America used car market.

In 2023 petrol is expected to dominate in Europe used car market with a market share of 51.23%, as petrol is often cheaper than diesel in many parts of Europe.

In 2023, petrol is expected to dominate in South America used car market with a market share of 66.87% due to in many South American countries, petrol is more readily available and has a more extensive distribution network compared to alternative fuels like diesel or electric charging infrastructure.

- On the basis of engine capacity, the Europe used car market is segmented into full-size (above 2500 CC), mid-size (between 1500-2499 CC), and small (below 1499 CC).

In 2023, small (below 1499 CC) is expected to dominate Europe and South America used car market

In 2023, small (below 1499 CC) is expected to dominate the Europe used card market with a 50.00% market share and South America with 54.04% market share due to many cities in Europe have congested traffic and limited parking spaces. Smaller cars are more maneuverable and easier to park, making them practical choices for urban driving.

- On the basis of transmission, the Europe used car market is segmented into automatic and manual. In 2023, manual is expected to dominate the Europe used car market with a market share of 67.82%.

- On the basis of transmission, the South America used car market is segmented into automatic and manual. In 2023, manual is expected to dominate the South America used car market with a market share of 68.69%.

- On the basis of pricing category, the Europe used car market is segmented into High (More than USD 20,000), Medium (USD 5501-USD 20000), and Low (Less than USD 5500). In 2023, the high (more than USD 20,000) segment is expected to dominate the Europe used car market with a market share of 46.46.

- On the basis of pricing category, the South America used car market is segmented into High (More than USD 20,000), Medium (USD 5501-USD 20000), and Low (Less than USD 5500). In 2023, the high (more than USD 20,000) segment is expected to dominate the South America used car market with a market share of 49.13%.

- On the basis of dealerships, the Europe used car market is segmented into franchised & and independent. In 2023, franchised dealership is expected to dominate the Europe used car market with a market share of 60.96%.

- On the basis of dealerships, the South America used car market is segmented into franchised & and independent. In 2023, franchised dealership is expected to dominate the South America used car market with a market share of 66.68%.

- On the basis of sales channel, the Europe used car market is segmented into online & and offline. In 2023, offline is expected to dominate the Europe used car market with a market share of 67.50%.

- On the basis of sales channel, the South America used car market is segmented into online & and offline. In 2023, offline is expected to dominate the South America used car market with a market share of 69.49%.

- On the basis of vehicle type, the Europe used car market is segmented into SUV, sedan, crossover, coupe, hatchback, MPV, convertible, sports cars, and others. In 2023, SUV is expected to dominate the Europe used car market with a market share of 36.62%.

- On the basis of vehicle type, the South America used car market is segmented into SUV, sedan, crossover, coupe, hatchback, MPV, convertible, sports cars, and others. In 2023, SUV is expected to dominate the South America used car market with the market share of 37.37%.

Major Players

Data Bridge Market Research recognizes the following companies as the major used car market players in used car market are AUTO1 Group (Germany), Penske Automotive Group, Inc. (U.S.), Lookers PLC (U.S.) , PENDRAGON (U.S.), Emil Frey AG (Switzerland), and among others.

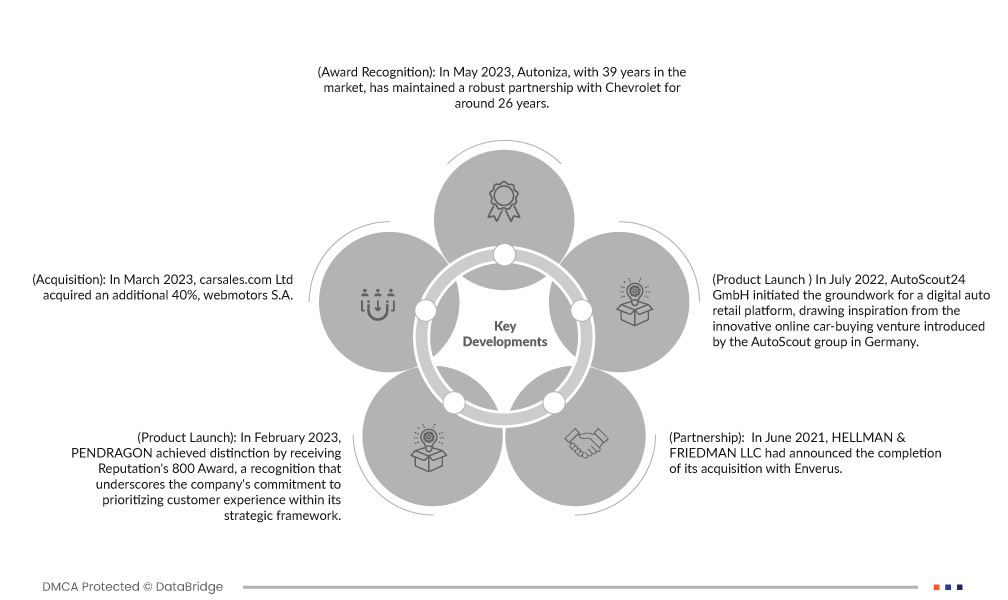

Market Developments

- In May 2023, Autoniza, with 39 years in the market, has maintained a robust partnership with Chevrolet for around 26 years. According to Lince, this collaboration has been earned through fleet sales, high-end Chevrolet products, extensive product knowledge, and diverse segment offerings. Sharing insights on the automotive sector's challenges and opportunities positioned Autoniza as a thought leader in the industry. This can lead to increased credibility among customers, peers, and partners.

- In March 2023, carsales.com Ltd acquired an additional 40%, webmotors S.A. This move will raise car sales stake in webmotors to 70%, enhancing the latter's market position while benefiting from car sales digital expertise, and maintaining Santander's exclusive role as the credit and financial solutions partner on the webmotors platform. The strategic alignment aims to capitalize on the synergies between the companies and foster long-term success and growth in the Brazilian automotive market.

- In February, PENDRAGON achieved distinction by receiving Reputation's 800 Award, a recognition that underscores the company's commitment to prioritizing customer experience within its strategic framework. This accolade highlights Pendragon's success in aligning its operations with customer feedback, resulting in the customer voice driving its achievements. With an impressive total of 39 dealerships from its Stratstone, Evans Halshaw, and CarStore brands being acknowledged for the 2023 800 Award, Pendragon demonstrates its dedication to exceptional customer satisfaction.

- In June 2021, HELLMAN & FRIEDMAN LLC announced the completion of its acquisition with Enverus. This data analytics and SaaS technology firm that provides market-leading software and analytics solutions for organizations has reached a critical milestone with the completion of this deal. With this, the company has made incredible growth in the premium market.

- In July 2022, AutoScout24 GmbH initiated the groundwork for a digital auto retail platform, drawing inspiration from the innovative online car-buying venture introduced by the AutoScout group in Germany. This strategic move positions AutoScout24 Netherlands to tap into the growing demand for digital automotive solutions, potentially expanding its market reach and enhancing its competitive edge in the sector.

Regional Analysis

Geographically, the countries covered in the used car market report are Germany, U.K., France, Italy, Spain, Russia, Poland, Netherlands, Belgium, Switzerland, Denmark, Finland, Sweden, Norway, Turkey and Rest of Europe, Brazil, Argentina and Rest of South America.

As per Data Bridge Market Research analysis:

U.K. & Barzil is expected to be the dominating and fastest growing country in the Europe & South America used car during the forecast period 2023 - 2030

In 2023, U.K. is expected to dominate and fastest growing country in Europe used car market as the it is known for its innovation in the fintech space. London, in particular, is a global hub for fintech startups and companies. Brazil is expected to dominate and the fastest growing country in South America used car market due to rise in demand for off-lease cars & subscription service by the franchise.

For more detailed information about the surgical visualization products market report, click here – https://www.databridgemarketresearch.com/reports/europe-and-south-america-used-car-market