Asia Pacific Wet Milling Market

Market Size in USD Million

CAGR :

%

USD

148.51 Million

USD

183.04 Million

2022

2030

USD

148.51 Million

USD

183.04 Million

2022

2030

| 2023 –2030 | |

| USD 148.51 Million | |

| USD 183.04 Million | |

|

|

|

|

Asia-Pacific Wet-Milling Market Analysis and Size

In many industrial processes, especially in the food and beverage sector, wet milling is a widely used technique. It entails soaking grains in water, such as corn, wheat, or rice, and then dissecting them mechanically to determine their constituent parts. Wet milling's primary goal is to remove valuable components from the grains such as starch, oil, protein, and fiber for use in other processes or applications.

Wet milling is widely used in the food and beverage industry to create a variety of goods. The extraction of maize starch is one frequent use. After being extracted, this starch can be converted into a variety of sweeteners, including high-fructose corn syrup and corn syrup, both of which are widely used in the food industry.

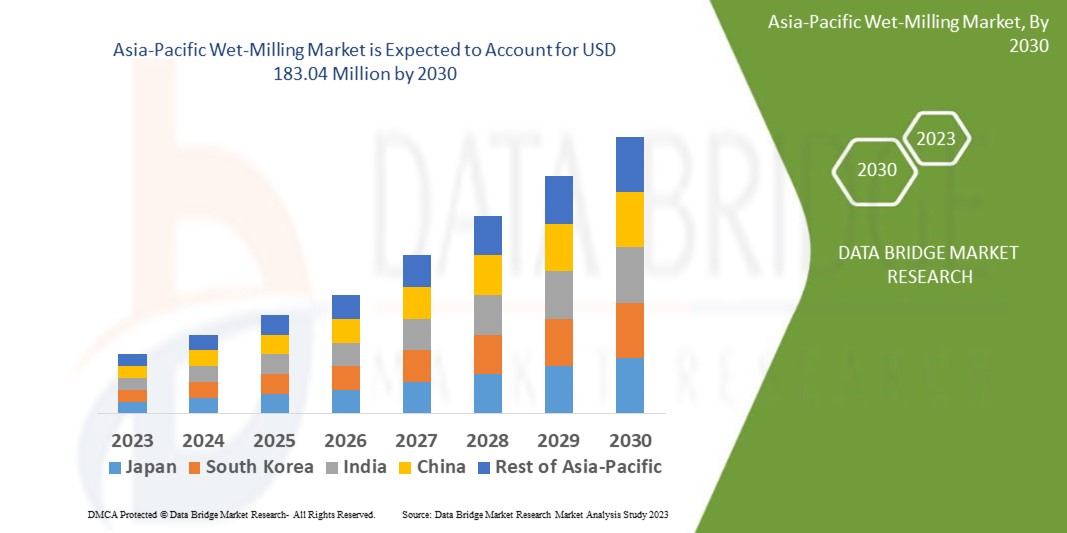

Data Bridge Market Research analyses that the Asia-Pacific Wet-Milling market, which was USD 148.51 million in 2022, would rocket up to USD 183.04 million by 2030, and is expected to undergo a CAGR of 2.60% during the forecast period. “Milling Equipment” dominates the equipment segment in the market owing to the growing demand for industrial practices.

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Asia-Pacific Wet-Milling Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Year |

2021 (Customizable to 2014-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Equipment (Milling Equipment, Steeping Equipment, Centrifuge System, Washing & Filtration System, and Others), Processing Size (Medium Line Processing and Large Line Processing), Source (Corn, Wheat, Cassava, Potato, and Others), End Product (Starch, Sweetener, Ethanol, Corn Gluten Meal & Gluten Feed, Corn Oil, Corn Steep Liquor, Proteins, and Others), Application (Feed, Food, Steep Water, Oil Processing, Fermentation/Bioprocessing, Waste Treatment, Mill, Refinery, Ethanol Production, Starch Modification, and Others) |

|

Countries Covered |

China, India, Japan, Australia, South Korea, Malaysia, Singapore, Thailand, Indonesia, Philippines, Rest of Asia-Pacific |

|

Market Players Covered |

GEA Group Aktiengesellschaft (Germany), ALFA LAVAL (Sweden), Bühler AG (Switzerland), ANDRITZ (Austria), INGETECSA (Spain), Thai German Processing Co., Ltd. (Thailand), Henan Yonghan Machinery Equipment Co., Ltd. (China), NETZSCH-Feinmahltechnik GmbH (Germany), Hanningfield Process Systems Ltd (U.K.), Willy A. Bachofen AG (Switzerland), Universal Engineers (India), Tate & Lyle (London), ADM (U.S.), Cargill, Incorporated (U.S.), Global Bio-chem Technology Group Company Limited (China), Roquette Frères (France), AGRANA Beteiligungs-AG (Austria), and Ingredion Incorporated (U.S.) among others |

|

Market Opportunities |

|

Market Definition

Wet-milling, also known as wet-media milling, is a combination of mechanical and chemical techniques. It is a process in which feed material is steeped in water, usually with Sulphur dioxide, to soften the seed kernel to help separate the kernel’s various components. It is done to get all components of grains such as corn, wheat, and roots such as potato separately. In case of corn, through wet-milling process, corn starch, corn oil, glucose, and many other components are extracted.

Asia-Pacific Wet-Milling Market Dynamics

Drivers

- Increasing Demand for Corn-Based Products

The Asia-Pacific wet-milling market is significantly fuelled by the rising demand for corn-based products such as sweeteners, starches, and ethanol. The food and beverage, pharmaceutical, and biofuel industries are just few sectors where these products are used. This, in turn, has carved the way for market growth.

- Growing Food and Beverage Industry

The demand for wet-milled products is being driven by Asia-Pacific's expanding food and beverage sector. By extracting starch, sweeteners, and other valuable components from grains through wet milling, the food and beverage industry can meet its wide range of demands.

- Technological Advancements

Efficiency, productivity, and product quality have all increased as a result of developments in wet milling technologies. The overall performance of wet milling operations has improved, thanks to innovation in machinery, procedures, and techniques, increasing their allure for manufacturers.

Opportunities

- Product Diversification

Wet-milling manufacturers can take advantage of the chance to diversify their product offerings. Specialty ingredients, functional additives, and modified starches are increasingly in demand across a number of industries. Companies can meet changing customer needs and access new market segments by diversifying their product offerings and creating cutting-edge solutions.

-

Increased Demand For Biofuel

The focus on sustainable and renewable energy sources has led to an increased demand for biofuels like ethanol. Wet milling plays a crucial role in ethanol production, as it enables the separation of starch from grains for fermentation and subsequent ethanol distillation.

Restraint/Challenge

- Fluctuating Raw Material Prices

Rice, wheat, and other agricultural products, in particular, are heavily reliant on the wet-milling sector. Manufacturers may face difficulties as a result of price fluctuations for these raw materials. The cost of production, profitability, and pricing strategies can all be impacted by volatile commodity prices, which can also have an impact on the overall stability of the market.

The Asia-Pacific wet-milling market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the Asia-Pacific wet-milling market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Development

- In April 2023, It was announced by Global Bio-chem Technology Group Company Limited (GBT, collectively with its subsidiaries, the "GBT Group," stock code 00809) and Global Sweeteners Holdings Limited (GSH, collectively with its subsidiaries, the "GSH Group," stock code 03889) that the GBT Group would be selling 47% of the issued share capital of GSH to Mr. Kong Zhanpeng and Mr. Wang Tieguang (the "Joint Offerors"). Additionally, the Dihao Sale and Purchase Agreements between GSH Group and GBT Group were signed in order for GSH Group to transfer to GBT Group all equity interests in Changchun Dihao Crystal Sugar Industry Development Co., Ltd. ("Dihao Crystal Sugar") and Changchun Dihao Foodstuff Development Co., Ltd. ("Dihao Foodstuff).

Asia-Pacific Wet-Milling Market Scope

The Asia-Pacific wet-milling market is segmented based on equipment, processing size, source, end product, and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Equipment

- Milling Equipment

- Steeping Equipment

- Centrifuge System

- Washing & Filtration System

- Others

Processing Size

- Medium Line Processing

- Large Line Processing

Source

- Corn

- Dent Corn

- Waxy Corn

- Wheat

- Cassava

- Potato

- Others

End Product

- Starch

- Sweetener

- Ethanol

- Corn Gluten Meal & Gluten Feed

- Corn Oil

- Corn Steep Liquor

- Proteins

- Others

Application

- Feed

- Food

- Steepwater

- Oil Processing

- Fermentation/Bioprpcessing

- Waste Treatment

- Mill

- Refinery

- Ethanol Production

- Starch Modification

- Others

Asia-Pacific Wet-Milling Market Regional Analysis/Insights

The Asia-Pacific wet-milling market is analyzed and market size insights and trends are provided by country, equipment, processing size, source, end product, and application as referenced above.

The countries covered in this market report are China, India, Japan, Australia, South Korea, Malaysia, Singapore, Thailand, Indonesia, Philippines, and rest of Asia-Pacific.

China is expected to dominate the market due to the strong base of manufacturing facilities, strong presence of major players in the market, increasing demand for corn-based products among consumers, and rising number of business strategies in the country.

China is expected to witness significant growth during the forecast period of 2023 to 2030 due to the increasing demand for corn-based products, rise in biofuel demands, growing research activities in the region, availability of massive untapped markets, and large population pool.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Wet-Milling Market Share Analysis

The Asia-Pacific wet-milling market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, regional presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to wet-milling market.

Some of the major players operating in the Asia-Pacific wet-milling market are:

- GEA Group Aktiengesellschaft (Germany)

- ALFA LAVAL (Sweden)

- Bühler AG (Switzerland)

- ANDRITZ (Austria)

- INGETECSA (Spain)

- Thai German Processing Co., Ltd. (Thailand)

- Henan Yonghan Machinery Equipment Co., Ltd. (China)

- NETZSCH-Feinmahltechnik GmbH (Germany)

- Hanningfield Process Systems Ltd (U.K.)

- Willy A. Bachofen AG (Switzerland)

- Universal Engineers (India)

- Tate & Lyle (London)

- ADM (U.S.)

- Cargill, Incorporated (U.S.)

- Global Bio-chem Technology Group Company Limited (China)

- Roquette Frères (France)

- AGRANA Beteiligungs-AG (Austria)

- Ingredion Incorporated (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Wet Milling Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Wet Milling Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Wet Milling Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.