Denmark Industrial Gases Market

Market Size in USD Million

CAGR :

%

USD

260.68 Million

USD

314.99 Million

2024

2032

USD

260.68 Million

USD

314.99 Million

2024

2032

| 2025 –2032 | |

| USD 260.68 Million | |

| USD 314.99 Million | |

|

|

|

|

Industrial Gases Market Size

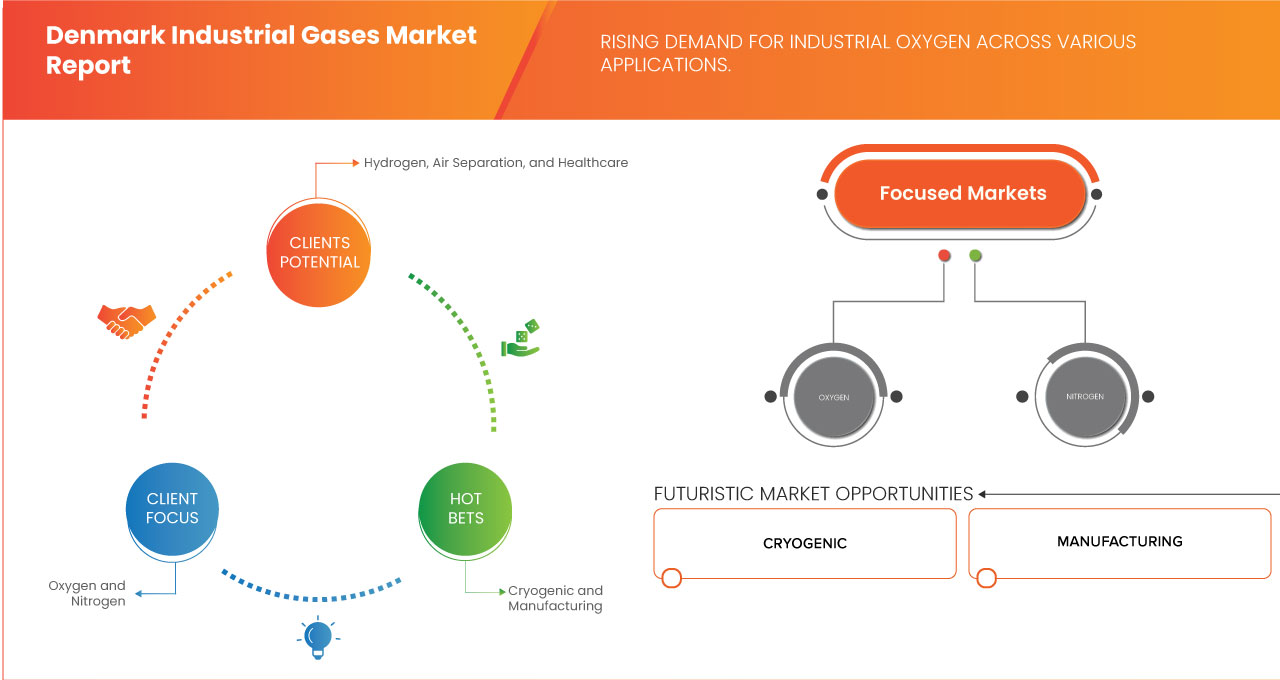

- The Denmark industrial gases market was valued at USD 260.68 million by 2024 and is expected to reach 314.99 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 2.5%, primarily driven by the accelerated digitalization across industries, and rising cybersecurity threats and data breaches

- This growth is driven by factors such as rising demand for industrial oxygen across various applications

Industrial Gases Market Analysis

- Industrial gases are critical computing systems used across various industries, providing high-performance processing, security, and reliability for complex operations. They are extensively utilized in Banking, Financial Services, and Insurance (BFSI), healthcare, and government sectors

- The growing emphasis on environmental sustainability is also driving demand for industrial oxygen

- For instance, the Swiss Federal Office for the Environment (FOEN) published a report on the country's efforts to meet carbon reduction targets. The report highlighted the role of oxygen in cleaner energy production, particularly in oxy-fuel combustion systems used in power plants

- The increased use of industrial oxygen for efficient energy generation is contributing to Denmark's environmental goals, and this demand is expected to grow as the country continues to prioritize green technologies

Report Scope and Industrial Gases Market Segmentation

|

Attributes |

Industrial Gases Key Market Insights |

|

Segments Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Industrial Gases Market Trends

“Increasing Demand for Sustainable and Green Energy Solutions”

- The increasing trend of demand for sustainable and green energy solutions is a significant driver for the market, as the country strives to meet its ambitious environmental goals and transition to a low-carbon economy

- The rise of industrial gases such as hydrogen is set to increase significantly as Denmark scales up its green hydrogen production capacity

- For instance, in February 2025, as per Guardian News & Media Limited, Denmark is leading the North Sea's transformation into Europe's "green power plant" by pioneering offshore wind projects and green hydrogen production. The 1,000MW Thor wind power plant, set to be operational by 2026, will supply over 1 million households with clean electricity

- As Denmark continues to prioritize decarbonization and energy sustainability, the demand for industrial gases will continue to rise, positioning the country at the forefront of the green energy revolution in Europe

Industrial Gases Market Dynamics

Driver

“Rising Demand for Industrial Oxygen Across Various Applications”

- The increasing use of industrial oxygen is driven by technological advancements, the expansion of industrial activities, and the growing need for oxygen in medical treatments and environmental solutions

- In healthcare, the rising number of patients requiring respiratory support, particularly due to the aging population and increasing prevalence of chronic respiratory diseases, has significantly boosted the demand for medical oxygen

- Denmark's advanced manufacturing industry, particularly in sectors such as automotive, aerospace, and electronics, is increasingly reliant on industrial gases like oxygen for precision processes

For instance,

- As per Danish energy-intensive industries are transitioning to biogas to replace fossil fuels in high-temperature processes. This shift necessitates oxygen for efficient combustion, thereby increasing industrial oxygen demand

- In September 2023, according to State of Green, Denmark's focus on resource efficiency has led industries to adopt energy-efficient technologies. For instance, Grundfos has implemented solutions to reduce energy consumption in Arla's production facilities, which may involve oxygen use in optimized processes

- With an aging population, the push for greener industrial practices, and the ongoing demand for advanced manufacturing processes, the demand for industrial oxygen is expected to continue growing, driving further expansion in Denmark's industrial gases market

Opportunity

“Rising Investment in Clean Energy and Industrial Decarbonization”

- The rising investment in clean energy and industrial decarbonization presents significant opportunities for Denmark industrial gases market

- With growing demand for hydrogen and carbon-reducing technologies, industrial gas companies can leverage innovation and sustainability-driven initiatives to expand their market presence and contribute to Denmark’s long-term environmental goals

- Denmark's industrial gases market is set for significant growth due to rising investments in clean energy and industrial decarbonization

For instance,

- In April 2024, as reported by the Danish Ministry of Climate, Energy, and Utilities, Denmark adopted a new hydrogen roadmap to accelerate the development of a domestic hydrogen market, with a focus on Power-to-X technologies. This initiative is part of the country's broader strategy to achieve net-zero emissions by 2050

- In January 2021, as per the news release by Ørsted, Ørsted and partners launched a major green hydrogen project in Esbjerg, Denmark, aimed at producing hydrogen from offshore wind power. The facility is expected to produce 100,000 tonnes of green hydrogen annually by 2030, supporting Denmark's decarbonization goals and enhancing its energy security

- In February 2025, as per the Danish Technical University (DTU), Denmark’s industrial decarbonization initiatives are being further strengthened by ongoing research in energy-efficient gas technologies. DTU’s partnership with various industries aims to optimize industrial processes, reduce emissions, and enhance sustainability across sectors

- Moreover, Denmark's strong research ecosystem and technological advancements in cryogenic gas separation and gas recycling are enhancing industrial gas applications

Restraint/Challenge

“Stringent Regulatory Framework and Compliance Challenges”

- Denmark has some of the most rigorous environmental and safety regulations in the world, which industrial gas companies must comply with when producing, distributing, and utilizing gases in various sectors, such as healthcare, manufacturing, and energy

- While Denmark’s strong regulatory environment ensures high levels of safety and environmental protection, it also poses challenges for industrial gas companies

For instance,

- According to Nordic Council of Ministers, Denmark enforces several EU directives, such as the Industrial Emissions Directive (2010/75/EU), which mandates strict control over industrial emissions. These directives are integrated into national laws, requiring companies to navigate both EU and Danish regulations, often adhering to the more stringent standards when overlaps occur

- As per Danish Safety Technology Authority, The implementation of the EU Gas Appliance Directive through Danish legislation imposes additional compliance requirements on gas-related equipment, affecting manufacturers and suppliers who must ensure their products meet these standards

- Strict compliance with environmental, safety, and product approval regulations adds to operational costs, delays product development, and requires continuous investment in technology and safety measures, limiting flexibility and increasing the financial burden for businesses in the industrial gases sector

Industrial Gases Market Scope

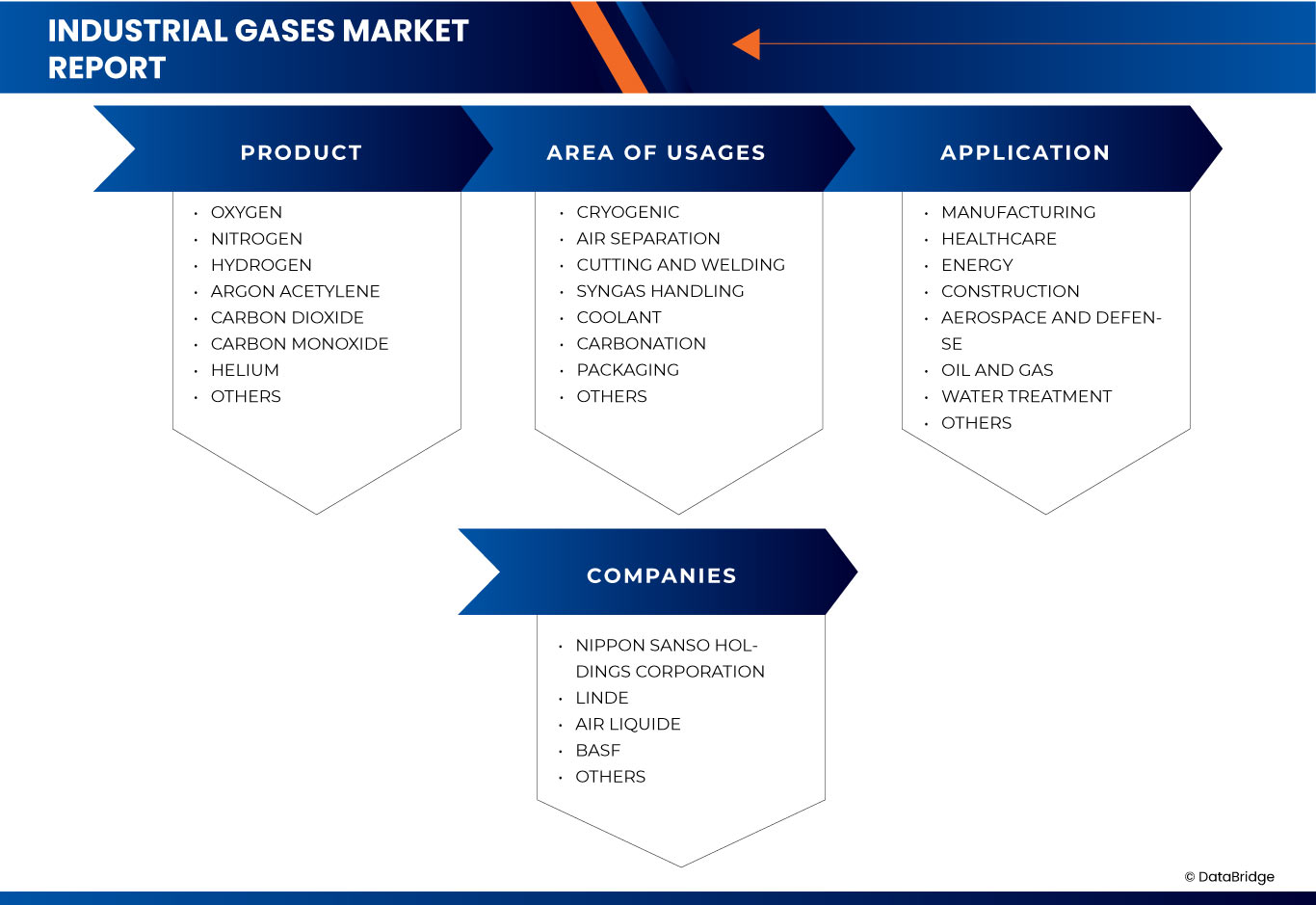

The market is segmented on the basis of product, area of usages, and application.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Area Of Usages |

|

|

By Application |

|

Industrial Gases Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- NIPPON SANSO HOLDINGS CORPORATION (Japan)

- Linde (Ireland)

- Air Liquide (France)

- BASF (Germany)

Latest Developments in Industrial Gases Market

- In March 2025, BASF's Care Chemicals division released its third Responsible Sourcing Report, highlighting key sustainability achievements. The company increased certified castor oil seed cultivation to 100,000 metric tons and achieved 98.1% RSPO certification for sourced palm oil. It also strengthened partnerships to promote sustainable palm oil production in Colombia. Additionally, 92.8% of its bioactives raw materials are bio-based, and 58.5% of its botanicals are sustainably sourced, reinforcing its commitment to responsible sourcing

- In June 2024, CSSC Power (Group) Corporation Limited (CPGC) and BASF signed a Framework Agreement to implement BASF's OASE blue gas treatment technology in CPGC's Onboard Carbon Capture System (OCCS) for liquefied natural gas (LNG) carriers. This collaboration aims to advance low-carbon solutions in the shipping industry by capturing CO₂ emissions directly on vessels. Performance tests of the OCCS prototype, validated by marine classification societies, have demonstrated its effectiveness. Both companies are now optimizing the system's design for commercial application across various ship types

- In November 2023, BASF received funding approval from the German Federal Ministry for Economic Affairs and Climate Action and the State of Rhineland-Palatinate to construct a 54-megawatt proton exchange membrane (PEM) electrolyzer at its Ludwigshafen site. This facility is expected to produce up to 8,000 metric tons of CO₂-free hydrogen annually, reducing the site's greenhouse gas emissions by up to 72,000 metric tons per year. BASF plans to use this hydrogen to manufacture products with a reduced carbon footprint and to support hydrogen mobility in the Rhine-Neckar Metropolitan Region. The project, in collaboration with Siemens Energy, is scheduled to begin operations in 2025

- In October, Taiyo Nippon Sanso Corporation (TNSC) announced a collaboration with Toho Gas Co., Ltd. to advance the hydrogen business and support carbon neutrality efforts. Toho Gas is constructing a hydrogen production plant at its Chita-Midorihama factory in Aichi Prefecture, scheduled to begin operations in June 2024 with a production capacity of 1.7 metric tons per day. TNSC will procure a portion of the hydrogen produced at this plant and, in partnership with Chita Kouatsu Gas Co., Ltd., expand hydrogen sales channels. This collaboration aims to establish a regional hydrogen supply chain and promote a sustainable society

- In November 2024, Air Liquide has announced a new renewable hydrogen production project in partnership with TotalEnergies at the La Mède biorefinery in France. This project will produce 25,000 tonnes of renewable hydrogen per year, using biogenic by-products as feedstock instead of fossil hydrocarbons. The hydrogen will be primarily used for biofuel and Sustainable Aviation Fuel (SAF) production

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 CURRENCY AND PRICING

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 MULTIVARIATE MODELING

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 DBMR VENDOR SHARE ANALYSIS

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTE PRODUCTS

4.2.5 INDUSTRY RIVALRY

4.2.6 CONCLUSION

4.3 VENDOR SELECTION CRITERIA

4.3.1 QUALITY AND CONSISTENCY

4.3.2 TECHNICAL EXPERTISE

4.3.3 SUPPLY CHAIN RELIABILITY

4.3.4 COMPLIANCE AND SUSTAINABILITY

4.3.5 COST AND PRICING STRUCTURE

4.3.6 FINANCIAL STABILITY

4.3.7 FLEXIBILITY AND CUSTOMIZATION

4.3.8 RISK MANAGEMENT AND CONTINGENCY PLANS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND FOR INDUSTRIAL OXYGEN ACROSS VARIOUS APPLICATIONS

5.1.2 EXPANDING USE OF INDUSTRIAL GASES IN THE OIL AND GAS INDUSTRY

5.1.3 INCREASING DEMAND FOR SUSTAINABLE AND GREEN ENERGY SOLUTIONS

5.2 RESTRAINTS

5.2.1 STRINGENT REGULATORY FRAMEWORK AND COMPLIANCE CHALLENGES

5.2.2 HIGH OPERATIONAL COSTS DUE TO LABOR AND INFRASTRUCTURE EXPENSES

5.3 OPPORTUNITIES

5.3.1 RISING INVESTMENT IN CLEAN ENERGY AND INDUSTRIAL DECARBONIZATION

5.3.2 TECHNOLOGICAL ADVANCEMENTS IN INDUSTRIAL GAS APPLICATIONS

5.4 CHALLENGES

5.4.1 HIGH INITIAL CAPITAL REQUIREMENT

5.4.2 ENERGY SUPPLY DEPENDENCE AND VULNERABILITY TO MARKET FLUCTUATIONS

6 DENMARK INDUSTRIAL GASES MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 OXYGEN

6.3 NITROGEN

6.4 HYDROGEN

6.5 ARGON

6.6 ACETYLENE

6.7 CARBON DIOXIDE

6.8 CARBON MONOXIDE

6.9 HELIUM

6.1 OTHERS

7 DENMARK INDUSTRIAL GASES MARKET, BY AREA OF USAGES

7.1 OVERVIEW

7.2 CRYOGENIC

7.3 AIR SEPARATION

7.4 CUTTING AND WELDING

7.5 SYNGAS HANDLING

7.6 COOLANT

7.7 CARBONATION

7.8 PACKAGING

7.9 OTHERS

8 DENMARK INDUSTRIAL GASES MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 MANUFACTURING

8.3 HEALTHCARE

8.4 ENERGY

8.5 CONSTRUCTION

8.6 AEROSPACE AND DEFENSE

8.7 OIL AND GAS

8.8 WATER TREATMENT

8.9 OTHERS

9 DENMARK INDUSTRIAL GASES MARKET: COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: DENMARK

10 SWOT ANALYSIS

11 COMPANY PROFILES

11.1 NIPPON SANSO HOLDINGS CORPORATION

11.1.1 COMPANY SNAPSHOTS

11.1.2 REVENUE ANALYSIS

11.1.3 PRODUCT PORTFOLIO

11.1.4 RECENT DEVELOPMENT

11.2 LINDE

11.2.1 COMPANY SNAPSHOT

11.2.2 REVENUE ANALYSIS

11.2.3 PRODUCT PORTFOLIO

11.2.4 RECENT DEVELOPMENT

11.3 AIR LIQUID

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 PRODUCT PORTFOLIO

11.3.4 RECENT DEVELOPMENT

11.4 BASF

11.4.1 COMPANY SNAPSHOTS

11.4.2 REVENUE ANALYSIS AND SEGMENTED ANALYSIS

11.4.3 PRODUCT PORTFOLIO

11.4.4 RECENT DEVELOPMENT

12 QUESTIONNAIRE

13 RELATED REPORTS

List of Figure

FIGURE 1 DENMARK INDUSTRIAL GASES MARKET

FIGURE 2 DENMARK INDUSTRIAL GASES MARKET: DATA TRIANGULATION

FIGURE 3 DENMARK INDUSTRIAL GASES MARKET: DROC ANALYSIS

FIGURE 4 DENMARK INDUSTRIAL GASES MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 DENMARK INDUSTRIAL GASES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 DENMARK INDUSTRIAL GASES MARKET: MULTIVARIATE MODELLING

FIGURE 7 DENMARK INDUSTRIAL GASES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 DENMARK INDUSTRIAL GASES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 DENMARK INDUSTRIAL GASES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 DENMARK INDUSTRIAL GASES MARKET: SEGMENTATION

FIGURE 11 RISING DEMAND FOR INDUSTRIAL OXYGEN ACROSS VARIOUS APPLICATIONS IS EXPECTED TO DRIVE THE DENMARK INDUSTRIAL GASES MARKET IN THE FORECAST PERIOD (2025-2032)

FIGURE 12 THE OXYGEN IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE DENMARK INDUSTRIAL GASES MARKET IN 2025 AND 2032

FIGURE 13 NINE SEGMENTS COMPRISE THE DENMARK INDUSTRIAL GASES MARKET, BY PRODUCT (2024)

FIGURE 14 EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DEVELOPMENT

FIGURE 16 PESTEL ANALYSIS

FIGURE 17 PORTER’S FIVE FORCES

FIGURE 18 VENDOR SELECTION CRITERIA

FIGURE 19 DROC ANALYSIS

FIGURE 20 DENMARK INDUSTRIAL GASES MARKET: BY PRODUCT, 2024

FIGURE 21 DENMARK INDUSTRIAL GASES MARKET: BY AREA OF USAGES, 2024

FIGURE 22 DENMARK INDUSTRIAL GASES MARKET: BY APPLICATION, 2024

FIGURE 23 DENMARK: COMPANY SHARE 2024 (%)

Denmark Industrial Gases Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Denmark Industrial Gases Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Denmark Industrial Gases Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.