Europe Cell Based Assays Market

Market Size in USD Billion

CAGR :

%

USD

6.86 Billion

USD

16.22 Billion

2025

2033

USD

6.86 Billion

USD

16.22 Billion

2025

2033

| 2026 –2033 | |

| USD 6.86 Billion | |

| USD 16.22 Billion | |

|

|

|

|

Europe Cell Based Assays Market Size

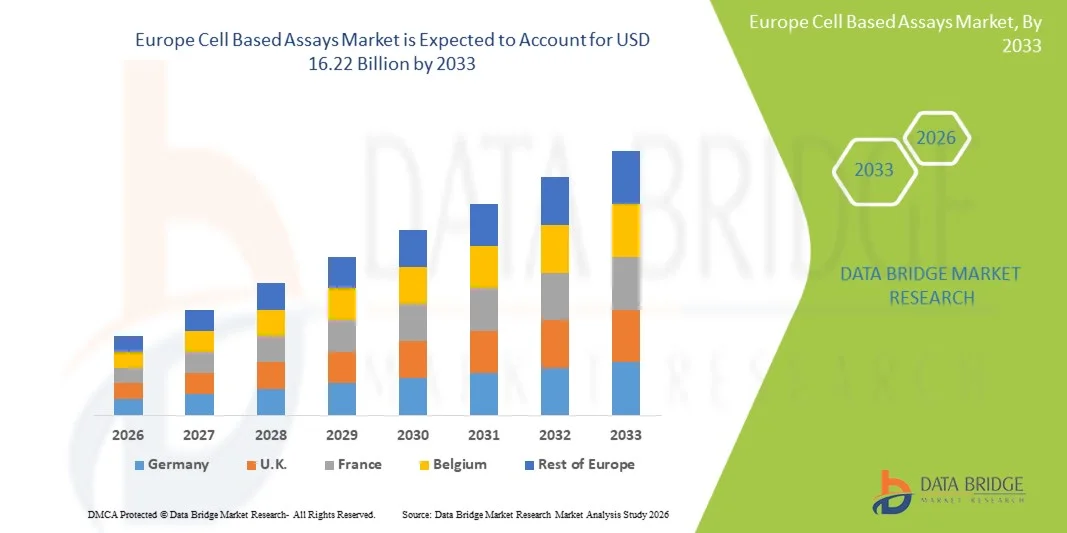

- The Europe cell based assays market size was valued at USD 6.86 billion in 2025 and is expected to reach USD 16.22 billion by 2033, at a CAGR of 11.34% during the forecast period

- The market growth is largely fueled by increasing R&D activities across pharmaceuticals and biotechnology, rising incidence of chronic diseases, and growing adoption of cell-based assays in diagnostics, drug discovery, and research

- Furthermore, supportive government funding, a shift toward physiologically relevant in-vitro models, and stricter regulatory push for alternatives to animal testing are establishing cell-based assays as the modern standard in European drug development and research workflows. These converging factors are accelerating the uptake of cell-based assay solutions, thereby significantly boosting the industry's growth

Europe Cell Based Assays Market Analysis

- Cell-based assays, providing in-vitro testing platforms using living cells for drug discovery, toxicity testing, and disease modeling, are increasingly critical in European pharmaceutical and biotechnology research due to their physiological relevance, high-throughput capabilities, and ability to reduce reliance on animal testing

- The rising demand for cell-based assays is primarily driven by growing R&D investments in drug development, increasing prevalence of chronic diseases, and a shift toward personalized medicine and advanced in-vitro models such as 3D cell cultures and organoids

- Germany dominated the market with the largest revenue share of 28.7% in 2025, supported by strong pharmaceutical and biotech sectors, high research spending, and advanced laboratory infrastructure, with innovations in high-content screening and flow cytometry technologies driving adoption

- The U.K. is expected to be the fastest growing country in the cell-based assays market during the forecast period due to expanding biotech research activities, growing healthcare investments, and increasing collaborations between local research institutes and global pharmaceutical companies

- Cell Viability Assay segment dominated the Europe market with a market share of 35.4% in 2025, driven by its critical role in assessing cellular health and response during drug discovery, cytotoxicity testing, and disease modeling

Report Scope and Europe Cell Based Assays Market Segmentation

|

Attributes |

Europe Cell Based Assays Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Cell Based Assays Market Trends

“Adoption of Advanced 3D Cell Culture and High-Content Screening”

- A significant and accelerating trend in the Europe cell-based assays market is the increasing adoption of 3D cell culture models and high-content screening (HCS) technologies. This shift is enhancing the physiological relevance and predictive accuracy of in-vitro studies

- For instance, researchers in Germany are integrating 3D spheroid and organoid models with HCS platforms to better mimic in-vivo cellular environments, enabling more precise drug response and toxicity evaluation

- Advanced assay platforms now allow multiplexed readouts and automated analysis, accelerating the drug discovery process while reducing experimental variability and reliance on animal models

- The seamless combination of 3D cell culture systems with automated imaging and data analytics provides centralized, high-throughput experimental workflows for pharmaceutical and biotech laboratories, improving research efficiency

- This trend towards more predictive, automated, and physiologically relevant assays is reshaping expectations for preclinical testing standards, with companies such as PerkinElmer and Sartorius developing integrated solutions that combine 3D cell models with HCS platforms

- The demand for cell-based assays that offer high accuracy, reproducibility, and compatibility with advanced screening technologies is growing rapidly across both academic and industrial research sectors

- Growing collaborations between European universities, research institutes, and biotech companies are driving innovation in assay design and automation, facilitating faster adoption of cutting-edge cell-based assays

- Integration of AI and machine learning into assay analysis is emerging as a trend, enabling predictive modeling, pattern recognition, and more efficient interpretation of large datasets in drug discovery and basic research

Europe Cell Based Assays Market Dynamics

Driver

“Rising R&D Investments and Chronic Disease Prevalence”

- The increasing R&D expenditure by pharmaceutical and biotechnology companies, along with the rising incidence of chronic diseases such as cancer and cardiovascular disorders, is a significant driver for the Europe cell-based assays market

- For instance, in April 2025, Germany’s BioNTech initiated advanced cell-based screening programs for oncology drug candidates, integrating high-throughput and high-content assays into their discovery pipelines

- As companies aim to develop safer and more effective therapeutics, cell-based assays provide critical insights into cellular responses, mechanism-of-action studies, and early toxicity screening, which traditional biochemical assays cannot fully capture

- Furthermore, the growing emphasis on personalized medicine and targeted therapies is increasing the reliance on physiologically relevant cell-based models, making these assays an essential tool for preclinical development

- The scalability, reproducibility, and high-throughput capabilities of modern cell-based assay platforms are also contributing to adoption, allowing researchers to accelerate discovery timelines while maintaining robust data quality

- Increasing government funding and grants for life sciences research in countries such as France and Switzerland are enabling broader access to cell-based assay technologies across academic and industrial labs

- Rising collaborations between European biotech firms and global pharmaceutical companies are further boosting the adoption of advanced cell-based assay platforms for preclinical research and drug discovery

Restraint/Challenge

“High Costs and Technical Complexity”

- The high cost of advanced cell-based assay platforms and the technical complexity associated with implementing and standardizing these systems pose significant challenges to broader adoption

- For instance, smaller biotech firms in Eastern Europe have reported difficulties in integrating high-content screening or 3D cell culture systems due to expensive instrumentation and specialized training requirements

- Ensuring assay reproducibility, data quality, and proper handling of complex cell models requires skilled personnel, robust laboratory infrastructure, and ongoing maintenance, which can limit access for resource-constrained laboratories

- In addition, the need for regulatory compliance and validation of novel assay platforms in drug development pipelines adds an extra layer of cost and complexity, potentially slowing market uptake

- While collaborative programs and contract research organizations (CROs) help mitigate some barriers, high entry costs and operational challenges continue to be key hurdles for widespread adoption

- Overcoming these challenges through technological simplification, cost reduction, and training programs will be crucial for sustained growth in the Europe cell-based assays market

- Limited standardization across different cell-based assay platforms can result in variability of results, posing challenges for reproducibility and regulatory acceptance

- The slow adoption of newer, complex technologies in smaller or less-funded labs may hinder uniform market growth across all European countries

Europe Cell Based Assays Market Scope

The market is segmented on the basis of type, product and services, technology, application, end user, and distribution channel.

- By Type

On the basis of type, the Europe cell-based assays market is segmented into cell viability assay, cytotoxicity assay, cell death assay, cell proliferation assay, and others. Cell Proliferation Assay segment dominated the market with the largest market revenue share of 35.4% in 2025, driven by its essential role in evaluating cellular growth, drug efficacy, and disease progression. Researchers rely heavily on proliferation assays to monitor the effect of compounds on cell growth, particularly in oncology and regenerative medicine. These assays are compatible with high-throughput and automated platforms, supporting large-scale screening. They integrate well with multiple detection technologies such as flow cytometry and high-content screening, enabling versatile experimental workflows. Growing emphasis on personalized medicine and targeted therapies further drives the adoption in both academic and industrial laboratories. Pharmaceutical and biotechnology companies prefer proliferation assays for preclinical testing due to their reliability and reproducibility.

Cell Viability Assay segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing applications in drug screening, cytotoxicity testing, and toxicity profiling. Viability assays provide rapid and quantitative insights into cellular health, making them highly valuable for R&D. Advancements in assay reagents and compatibility with 3D cell culture models have accelerated adoption. They are widely used for safety assessment in preclinical studies. Rising prevalence of chronic diseases and cancer research further supports the segment’s growth. Regulatory emphasis on preclinical safety evaluation also contributes to increasing demand across European laboratories.

- By Product and Services

On the basis of product and services, the market is segmented into consumables, services, instruments, and software. Consumables segment dominated the Europe market in 2025 due to continuous demand for reagents, culture media, plates, and other disposable materials required for routine cell-based assays. Consumables are essential for maintaining assay reproducibility and accuracy, driving their consistent consumption across research labs. Frequent repeat purchases ensure steady revenue for manufacturers. High-throughput and large-scale screening facilities further increase consumable usage. Academic institutions, CROs, and pharmaceutical companies significantly contribute to this dominance. Expansion of drug discovery and preclinical research in Germany, the U.K., and France also supports high consumable consumption.

Instruments segment is expected to witness the fastest CAGR from 2026 to 2033, driven by rising investments in automated imaging systems, plate readers, and flow cytometers. Instrument adoption is increasing due to the need for high-throughput, accurate, and reproducible results. Integration with advanced technologies such as high-content screening accelerates market growth. Instruments enable complex workflows including 3D models and multi-parametric analyses. Pharmaceutical and biotech companies drive demand due to the need for efficient and reliable experimental platforms. Technological advancements and user-friendly interfaces further boost adoption across labs.

- By Technology

On the basis of technology, the market is segmented into flow cytometry, high throughput screening, high content screening, and label-free detection. High Content Screening (HCS) segment dominated the Europe market in 2025 due to its ability to generate multiparametric data, analyzing cell morphology, viability, and signaling pathways simultaneously. HCS platforms are widely used in drug discovery, oncology, and toxicity testing. Automation reduces human error and improves reproducibility. The segment benefits from strong adoption in Germany, France, and the U.K. Advanced imaging and analytics integration enhances assay efficiency. HCS allows researchers to scale experiments rapidly while maintaining high data quality. Growing preference for physiologically relevant 3D models also strengthens this segment’s position.

Flow Cytometry segment is expected to witness the fastest growth from 2026 to 2033, driven by its high sensitivity, versatility, and quantitative capabilities. Flow cytometry is increasingly used for immunophenotyping, apoptosis detection, and cell cycle analysis. Technological improvements, miniaturization, and user-friendly software have enhanced adoption. The method allows rapid multiparametric analysis of large cell populations. Flow cytometry’s integration with automated platforms supports high-throughput screening. Growing demand in personalized medicine and immune-oncology research accelerates its adoption across Europe.

- By Application

On the basis of application, the market is segmented into drug discovery, basic research, and others. Drug Discovery segment dominated the Europe market in 2025 due to high demand from pharmaceutical and biotech companies for reliable in-vitro models to evaluate drug efficacy and toxicity. Drug discovery relies heavily on cell-based assays for preclinical screening and target validation. Integration with automated platforms and high-throughput technologies enhances efficiency and reproducibility. Adoption is strongest in oncology, neurodegenerative, and immunology research. Rising R&D investments across Germany, France, and the U.K. further support growth. Drug discovery applications consistently consume both instruments and consumables, strengthening market dominance.

Basic Research segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by expanding academic research, government-funded programs, and interest in cellular biology and disease modeling. Basic research labs increasingly adopt advanced assays to study gene expression, signaling pathways, and cellular mechanisms. Growing collaborations between universities and biotech firms drive adoption. Academic institutions prefer technologies compatible with 3D models and high-content screening. Rising grants and funding programs in countries such as France and Switzerland support segment growth. Increasing focus on fundamental research in cell biology accelerates adoption of innovative assay platforms.

- By End User

On the basis of end user, the market is segmented into pharmaceutical and biotechnology companies, CROs, academic and research institutions, government organizations, and others. Pharmaceutical and Biotechnology Companies segment dominated the Europe market in 2025 due to high demand for preclinical drug testing, assay reproducibility, and integration with high-throughput platforms. Pharma and biotech companies drive consistent demand for all assay types, consumables, and instruments. Strong R&D infrastructure in Germany, France, and Switzerland supports market dominance. Growing focus on oncology, immunology, and personalized medicine further strengthens adoption. The segment benefits from continuous investments in automation and assay standardization. Integration with advanced detection technologies ensures robust experimental outcomes.

Academic and Research Institutions segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing funding, collaborations, and adoption of advanced assay technologies for fundamental research. Expansion of university research programs and government grants accelerates uptake of both instruments and consumables. Research institutions adopt 3D models, high-content screening, and flow cytometry to study cellular mechanisms. Rising collaborations with biotech and pharmaceutical companies enhance access to advanced technologies. Increasing emphasis on translational research and mechanistic studies fuels segment growth. Academic labs also benefit from cost-effective solutions provided by vendors to drive adoption.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct and indirect. Direct segment dominated the Europe market in 2025 due to strong B2B relationships between assay manufacturers and end users, enabling tailored solutions, bulk orders, and technical support. Direct sales facilitate faster deployment of instruments and high-value consumables. Pharma, biotech, and academic labs prefer direct procurement for reliable supply and service agreements. Technical support and customization options drive preference for direct channels. Large-scale laboratories benefit from negotiated pricing and priority support. Direct distribution strengthens long-term partnerships between vendors and key customers.

Indirect segment is expected to witness the fastest CAGR from 2026 to 2033, driven by the increasing role of distributors, resellers, and e-commerce platforms in providing access to consumables, instruments, and assay kits. Indirect channels help smaller labs and emerging biotech firms procure necessary materials efficiently. Growing e-commerce adoption in Europe facilitates easy ordering and faster delivery. Indirect distribution enables wider market penetration in countries with smaller research infrastructure. Vendors use distributors to expand geographic reach and reduce logistical challenges. Increasing partnerships between distributors and vendors support adoption in under-served markets.

Europe Cell Based Assays Market Regional Analysis

- Germany dominated the market with the largest revenue share of 28.7% in 2025, supported by strong pharmaceutical and biotech sectors, high research spending, and advanced laboratory infrastructure, with innovations in high-content screening and flow cytometry technologies driving adoption

- Researchers and companies in the region highly value the accuracy, reproducibility, and scalability offered by cell-based assays, which are essential for drug discovery, toxicity testing, and disease modelling

- This widespread adoption is further supported by government funding for life sciences research, collaborations between academic institutions and biotech firms, and the growing emphasis on personalized medicine, establishing cell-based assays as a critical tool for both industrial and academic laboratories

The Germany Cell-Based Assays Market Insight

The Germany cell-based assays market captured the largest revenue share in Europe in 2025, fueled by strong pharmaceutical and biotechnology sectors, high R&D investments, and advanced laboratory infrastructure. Researchers and companies are increasingly prioritizing accurate, reproducible, and scalable assay platforms for drug discovery, toxicity testing, and disease modeling. The growing emphasis on personalized medicine, coupled with collaborations between academic institutions and biotech firms, is further propelling market growth. Germany’s supportive regulatory environment, adoption of high-content screening, and advanced laboratory automation are significant contributors to market expansion. Moreover, both new research facilities and modernization of existing laboratories are driving the uptake of sophisticated assay systems.

U.K. Cell-Based Assays Market Insight

The U.K. cell-based assays market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by expanding academic research, increasing government funding, and strong pharmaceutical R&D activities. The growing trend of personalized medicine and demand for high-throughput, physiologically relevant assay platforms is encouraging both academic institutions and biotech companies to adopt advanced cell-based assays. The U.K.’s robust laboratory infrastructure, collaborative research networks, and focus on translational research continue to stimulate market growth. In addition, the increasing collaborations with pharmaceutical firms help accelerate preclinical research efficiency and assay deployment.

France Cell-Based Assays Market Insight

The France cell-based assays market is expected to expand at a considerable CAGR during the forecast period, fueled by government initiatives supporting life sciences research, expansion of biotech startups, and increasing collaborations between research institutions and pharmaceutical companies. France’s growing focus on oncology, immunology, and regenerative medicine is fueling the adoption of advanced assays. Investments in modern laboratory infrastructure and high-content screening technologies are increasing the accessibility and efficiency of cell-based assays. The country is also witnessing growth in contract research organization (CRO) activities, enhancing market reach across multiple research applications.

Italy Cell-Based Assays Market Insight

The Italy cell-based assays market is poised to grow at a substantial CAGR during the forecast period, driven by increasing adoption of advanced assay technologies in academic institutions and CROs. Italy’s research focus on oncology, immunology, and regenerative medicine is boosting demand for high-quality, reproducible cell-based assays. Government funding and partnerships with pharmaceutical companies further facilitate market growth. The market is also benefiting from the modernization of laboratory infrastructure and increasing use of automated platforms. Rising awareness of regulatory requirements and quality standards encourages adoption across industrial and academic labs.

Europe Cell Based Assays Market Share

The Europe Cell Based Assays industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Merck KGaA (Germany)

- Bio Rad Laboratories, Inc. (U.S.)

- Corning Incorporated (U.S.)

- BD (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Lonza (Switzerland)

- Promega Corporation (U.S.)

- Cell Signaling Technology, Inc. (U.S.)

- Eurofins Scientific SE (Luxembourg)

- Charles River Laboratories (U.S.)

- Sartorius AG (Germany)

- Miltenyi Biotec GmbH (Germany)

- Evotec SE (Germany)

- Tecan Group Ltd (Switzerland)

- GE Healthcare (U.S.)

- BMG Labtech GmbH (Germany)

- Cytiva (Germany)

- 3H Biomedical AB (Sweden)

- IBIDI GmbH (Germany)

What are the Recent Developments in Europe Cell Based Assays Market?

- In September 2025, a new GMP‑grade manufacturing facility by Sartorius (at its French subgroup) was announced in Illkirch, France expanding production capacity for transfection reagents essential for cell and gene therapy workflows. This boost in manufacturing infrastructure underpins the broader growth and reliability of cell- and gene-therapy–related cell-based assays across Europe

- In July 2025, Sartorius launched the Incucyte CX3 Live‑Cell Analysis System, a next‑generation live‑cell imaging platform designed for 3D cell‑culture applications offering confocal fluorescence imaging, high throughput (up to six microplates in parallel), and improved workflows to accelerate drug discovery and complex cell‑based assays

- In March 2025, Sartorius also updated its live-cell imaging software (part of the Incucyte product line), introducing advanced analytical modules including 3D Object Classification and improved data workflows enhancing the utility of cell-based assays and enabling researchers to handle 3D cultures, organoids, and complex morphology analyses more efficiently

- In August 2024, Eurofins Biopharma Product Testing Italy and Cellply entered a strategic partnership to offer VivaCyte‑based single-cell functional characterization services, bringing advanced cell‑based immunotherapy analytics to a leading European contract research organization (CRO) expanding availability and adoption of sophisticated assays across Europe

- In January 2024, Cellply announced the launch of its single-cell potency‑characterization platform VivaCyte, enabling high-throughput, multiparametric immune cell assays delivering rapid functional characterization of cell therapy candidates at single-cell resolution, significantly reducing time and complexity compared to traditional bulk assays

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.