Europe Frozen Pancakes For Food Services Market

Market Size in USD Million

CAGR :

%

USD

383.28 Million

USD

545.00 Million

2024

2032

USD

383.28 Million

USD

545.00 Million

2024

2032

| 2025 –2032 | |

| USD 383.28 Million | |

| USD 545.00 Million | |

|

|

|

|

Frozen Pancakes for Food Services Market Size

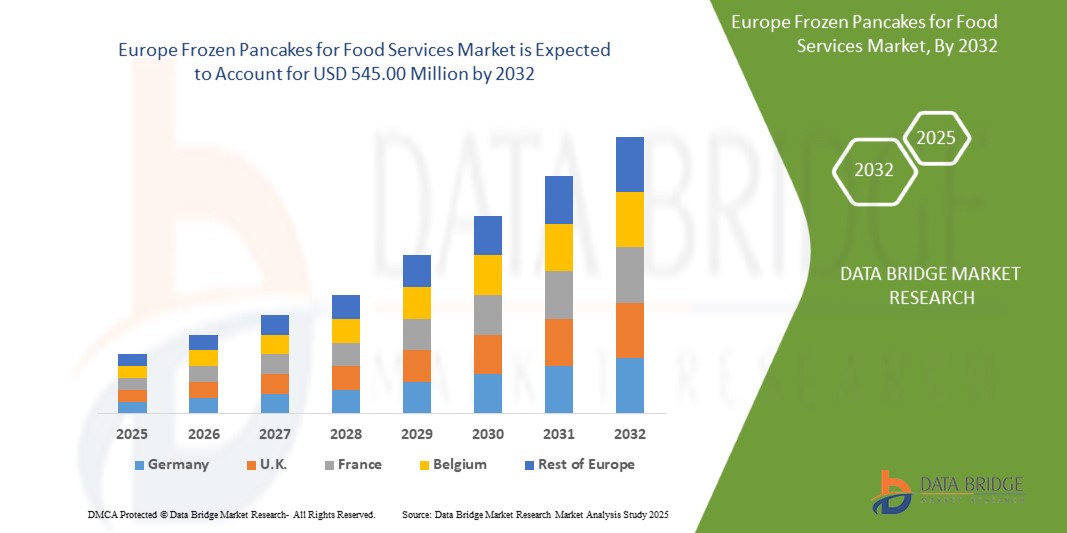

- The Europe frozen pancakes for food services market size was valued at USD 383.28 million in 2024 and is expected to reach USD 545.00 million by 2032, at a CAGR of 4.6% during the forecast period

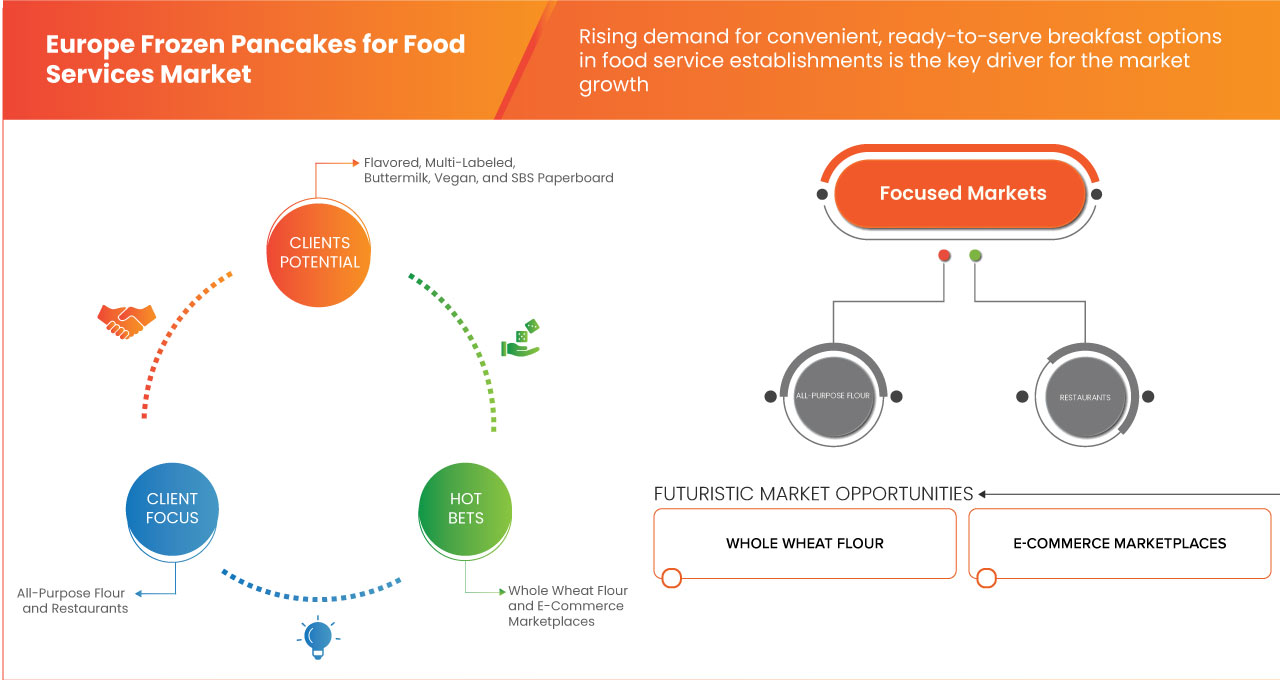

- This growth is driven by factors such as the rising demand for quick, ready to serve breakfast options in foodservice

Frozen Pancakes for Food Services Market Analysis

- Frozen pancakes are increasingly popular in the European food services sector as a convenient, consistent, and time saving breakfast and dessert solution. Their ability to reduce kitchen preparation time and food waste makes them highly attractive to restaurants, hotels, cafeterias, and catering services across the region

- Market growth is driven by the growing demand for ready-to-eat and time-efficient food options in food service channels, coupled with rising labor costs and a greater focus on kitchen efficiency

- Increasing preference for Western breakfast trends and international cuisines has also elevated the adoption of frozen pancakes among commercial food operators

- Germany is expected to dominate the Europe frozen pancakes for food services market, supported by a mature food services industry, a high number of commercial kitchens, and strong demand for consistent food quality

- Germany is projected to witness the fastest growth in the region, driven by rapid urbanization, expansion of quick service restaurant chains, and changing dietary habits. The growing presence of international hotel and restaurant groups, combined with improvements in cold chain infrastructure, is accelerating demand for frozen pancakes in Polish food services

- The all-purpose flour segment is expected to dominate the market share with 57.62% due to its versatility, cost-effectiveness, consistent quality, and ability to meet the demand for traditional pancake recipes in large-scale operations

Report Scope and Frozen Pancakes for Food Services Market Segmentation

|

Attributes |

Frozen Pancakes for Food Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Frozen Pancakes for Food Services Market Trends

“Rise in Demand for Convenient and Versatile Breakfast Offerings in Commercial Kitchens”

- A major trend shaping the European frozen pancakes market for food services is the growing preference for time-saving, ready-to-serve breakfast items that cater to fast-paced lifestyles and consistent food quality in commercial kitchens

- Foodservice providers such as hotels, cafés, and institutional caterers are increasingly turning to frozen pancakes as a reliable solution to offer consistent taste, reduce prep time, and minimize labor costs

For instance,

- In January 2025, several European quick-service restaurant (QSR) chains began expanding their breakfast menus to include pre-portioned frozen pancakes with customizable toppings, responding to the surge in morning dine-out demand and labor efficiency needs

- In addition, the availability of plant-based and gluten-free frozen pancake options is supporting broader customer preferences, including health-conscious and allergen-sensitive consumers, further reinforcing this trend

Frozen Pancakes for Food Services Market Dynamics

Driver

Rising Demand for Convenient, Ready-To-Serve Breakfast Options in Food Service Establishments

- With increasingly busy lifestyles, both consumers and food service operators are prioritizing speed, consistency, and ease of preparation.

- Frozen pancakes offer a quick solution for cafes, hotels, and institutional kitchens to serve standardized, high-quality breakfast dishes without the need for extensive prep time or skilled labor

- The increasing popularity of all-day breakfast menus in quick-service restaurants and casual dining chains is further boosting demand for versatile products like frozen pancakes that can be served beyond morning hours

- Moreover, product innovations such as pre-filled, filled-center, or protein-enriched pancakes are enhancing the appeal of frozen options across diverse customer segments in the European food service landscape

For instance,

- In September 2024, Belgian Boys introduced a new line of grab-and-go, European-inspired breakfast items—such as French crêpes and Belgian waffles—exclusively at Walmart in the U.S., catering to the demand for quick and indulgent morning meals. This launch highlights a broader trend toward convenient, ready-to-serve breakfast options, creating a strong opportunity for food service providers in Europe to expand their offerings with frozen pancakes and similar items that combine traditional flavors with on-the-go convenience to meet evolving consumer lifestyles

- With the increasing adoption of frozen breakfast items in quick-service and institutional food settings, the market is expected to witness robust demand across both Western and Eastern European economies in the coming years

Opportunity

Leveraging Cross-Promotional Strategies with Popular Breakfast Beverage Brands

- By partnering with well-known coffee, tea, or juice brands, pancake manufacturers and food service providers can create bundled breakfast offerings that appeal to consumers seeking convenience and value

- Collaborations can enhance brand visibility, drive impulse purchases, and encourage repeat business, especially in quick-service and on-the-go dining formats

- This strategy not only strengthens customer engagement but also opens up new marketing channels and promotional campaigns, ultimately supporting market expansion and revenue growth

For instance,

- In January 2025, Bristol Live reported that a new pancake restaurant, the Pancake Man, has opened at Wapping Wharf in Bristol, offering free pancakes to the first 50 customers as part of its grand launch. Known from its appearances at local markets, the brand is now offering its popular 'Mini Bites' and customizable pancake options from a permanent location. This launch highlights a valuable opportunity for the Europe frozen pancakes for food services market

- These collaborations can enhance customer experience, increase sales through bundled offerings, and create strong brand associations that drive repeat purchases. Effectively leveraging such partnerships can play a key role in unlocking new growth opportunities and expanding market reach

Restraint/Challenge

Fluctuations in Raw Material Prices, Especially Dairy and Wheat, Impact Cost Margins

- Fluctuations in the prices of key raw materials such as dairy and wheat pose a significant restraint to the growth of the Europe frozen pancakes for food services market, as these ingredients are central to pancake production

- As input costs rise, food service providers may be forced to increase menu prices or reduce portion sizes, potentially dampening consumer demand and limiting broader market expansion

For instance,

- In March 2025, as per Foodcom, dairy prices across Europe have surged sharply in 2025, with significant increases seen in butter, cheese, cream, and milk fat—largely driven by limited supply, rising raw milk costs, and the impact of the foot-and-mouth disease outbreak in Hungary. These disruptions, coupled with global demand fluctuations, have intensified cost pressures on dairy-based products. Such volatility underscores how raw material price instability, particularly in dairy and wheat, poses a key restraint for the market by squeezing profit margins for producers

Frozen Pancakes for Food Services Market Scope

The market is segmented on the basis, product, flavor, labelling, packaging material, number of pieces, end-use, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Flavor |

|

|

By Labelling |

|

|

By Packaging Material |

|

|

By Number of Pieces |

|

|

By End-Use |

|

|

By Distribution Channel |

|

In 2025, the all-purpose flour segment is projected to dominate the market with a largest share in product segment

The all-purpose flour segment is expected to dominate the Frozen pancakes for food services market with a market share of 57.62% in 2025 due to its versatility, cost-effectiveness, consistent quality, and ability to meet the demand for traditional pancake recipes in large-scale operations.

The flavored segment is expected to account for the largest share during the forecast period in flavor segment

In 2025, the flavored segment is expected to dominate the market with a market share of 58.02% due to its rich flavor, moist texture, and consumer preference for indulgent, premium-quality pancakes in foodservice establishments.

Frozen Pancakes for Food Services Market Regional Analysis

“Germany Holds the Largest Share in the Frozen Pancakes for Food Services Market”

- Germany dominates the Europe frozen pancakes for food services market due to its well-established foodservice industry and strong demand for convenient, ready-to-eat breakfast options

- In addition, major foodservice chains and bakeries in Germany actively incorporate frozen pancakes into their menus, boosting market growth

“Germany is Projected to Register the Highest CAGR in the Frozen Pancakes for Food Services Market”

- Germany is emerging as the fastest-growing country in the Europe frozen pancakes for food service market, driven by a rising preference for quick-service breakfast solutions and increased consumption of international cuisine

- The growth is further supported by the expansion of café chains, hotels, and institutional foodservice providers that are increasingly adopting frozen pancakes to meet consumer demand for convenient, high-quality offerings

- In addition, innovation in product variety and flavors tailored to French tastes is accelerating market traction

Frozen Pancakes for Food Services Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Central Foods Ltd (U.K.)

- Caterite Foodservice (U.K.)

- Celtic Fish & Game (U.K.)

- Kellanova (U.S.)

- ALDI International (U.S.)

- BIRDS EYE LIMITED (U.K.)

- Cérélia (France)

- EUROPASTRY SA ( Spain)

- Le Monde des Crêpes (France)

- Rozell & Cake (France)

- Traiteur de Paris (France)

- Les Délices du Chef (France)

- Società Italiana Alimenti & Conserviera Adriatica (Itay)

- Farm Frites (Netherlands)

- McCain Foods Limited (Canada)

- ATRIAN (Portugal)

- Signature Flatbreads (UK) Ltd. (U.K.)

- Cocotine (France)

- Wm Morrison Supermarkets Limited (U.K.)

- Mason Foodservice Limited (U.K.)

Latest Developments in Frozen Pancakes for Food Services Market

- In February 2025, Wm Morrison Supermarkets Limited partnered with Purpl to offer a 10% discount on online grocery orders over USD 25.8 for disabled customers who verified their status through the Purpl platform. The initiative aimed to help disabled households save over USD 567 annually. This partnership benefited Morrisons by enhancing its brand image as an inclusive retailer, expanding its customer base, increasing online traffic and More Card loyalty usage, and strengthening its commitment to social responsibility

- In April 2025, Kellanova partnered with Wendy’s to launch a new dessert innovation Pop-Tarts Strawberry Frosty Fusion. The collaboration introduced Frosty Fusions, blending Wendy’s classic Frosty with sauces and mix-ins like strawberry Pop-Tarts, OREO, and caramel crunch. The Pop-Tarts mix in marked its debut in the QSR frozen dessert space. This partnership helped Kellanova expand Pop-Tarts into foodservice and strengthened Wendy’s dessert lineup, enhancing brand visibility and offering unique experiences to dessert lovers nationwide

- In July 2024, Kellanova unveiled new products for the K-12 foodservice industry, including various Eggo items such as Eggo Grahams, Froot Loops Waffles, and Mini Pancakes in Blueberry flavor. These new offerings are designed to be nutritious, convenient, and appealing to students. The Eggo Mini Pancakes provide 35g of whole grain per serving and are made with natural flavors and no high fructose corn syrup. They are easy to serve as part of breakfast or lunch and can be either heated or served thawed, saving time for foodservice operators. Kellanova's innovations support its commitment to delivering high-quality, child-friendly meals while addressing nutritional needs in schools

- In October 2020, Birds Eye's Farming collaborative was awarded GOLD LEVEL status by the SAI Platform in their Farming Sustainability Assessment. The company became the first UK farming group and the first globally to achieve this prestigious recognition. By following the SAI Platform’s sustainability principles, Birds Eye ensures its farming practices are environmentally responsible and socially beneficial. This award highlights the company’s commitment to sustainable agriculture and strengthens its position as a leader in environmentally conscious food production

- In September 2023, the ALDI SOUTH Group received the Humanity Business Award from the Heinrich-Treichl Foundation of the Austrian Red Cross for its humanitarian efforts. ALDI donated over Euro 1 million in 2022–2023 to support victims of the Russia-Ukraine war, and Euro 500,000 in 2023 for earthquake relief in Turkey and Syria. These contributions provided essential items like food, water, and medical supplies, and funded ambulances and mobile health units. This recognition highlighted ALDI’s strong commitment to human rights and social responsibility, enhancing its global reputation as a socially conscious and compassionate retailer

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRODUCT TIMELINE CURVE

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 MARKET END-USE COVERAGE GRID

2.8 MULTIVARIATE MODELLING

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PRODUCTION CONSUMPTION ANALYSIS

4.2 CONSUMER BUYING BEHAVIOR

4.3 FACTORS AFFECTING BUYING DECISION

4.4 PRODUCT ADOPTION SCENARIO

4.5 PORTERS ANALYSIS

4.6 REGULATION COVERAGE: EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET

4.7 RAW MATERIAL SOURCING ANALYSIS – EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET

4.8 IMPORT EXPORT SCENARIO

4.8.1 IMPORT DATA SETS

4.8.2 EXPORT DATA SETS

4.9 PATENT ANALYSIS

4.1 COST ANALYSIS BREAKDOWN - EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET

4.11 PROFIT MARGINS SCENARIO – EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET

4.12 COMPANY EVALUATION

4.13 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.13.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.13.1.1 JOINT VENTURES

4.13.1.2 MERGERS AND ACQUISITIONS

4.13.1.3 LICENSING AND PARTNERSHIP

4.13.1.4 TECHNOLOGY COLLABORATIONS

4.13.1.5 STRATEGIC DIVESTMENTS

4.13.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.13.3 STAGE OF DEVELOPMENT

4.13.4 TIMELINES AND MILESTONES

4.13.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.13.6 RISK ASSESSMENT AND MITIGATION

4.13.7 FUTURE OUTLOOK

4.14 TARIFFS & IMPACT ON THE MARKET

4.14.1 TARIFFS & IMPACT ON THE MARKET

4.14.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

4.14.3 VENDOR SELECTION CRITERIA DYNAMICS

4.14.4 IMPACT ON SUPPLY CHAIN

4.14.4.1 RAW MATERIAL PROCUREMENT

4.14.4.2 MANUFACTURING AND PRODUCTION

4.14.4.3 LOGISTICS AND DISTRIBUTION

4.14.4.4 PRICE PITCHING AND POSITION OF MARKET

4.14.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.14.5.1 SUPPLY CHAIN OPTIMIZATION

4.14.5.2 JOINT VENTURE ESTABLISHMENTS

4.14.6 IMPACT ON PRICES

4.14.7 REGULATORY INCLINATION

4.14.7.1 GEOPOLITICAL SITUATION

4.14.7.2 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

4.14.7.2.1 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

4.14.7.2.2 ALLIANCES ESTABLISHMENTS

4.14.7.3 STATUS ACCREDITATION (INCLUDING MFTN)

4.14.7.4 DOMESTIC COURSE OF CORRECTION

4.14.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

4.14.7.4.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES/INDUSTRIAL PARKS

4.15 PRODUCTION CAPACITY FOR TOP COMPANIES

4.16 BRAND OUTLOOK

4.17 BRAND COMPARATIVE ANALYSIS

4.18 PRICING ANALYSIS

4.19 IMPACT OF ECONOMIC SLOWDOWN

4.2 SUPPLY CHAIN ANALYSIS

4.20.1 LOGISTICS COST SCENARIO

4.20.2 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.21 INDUSTRY ECOSYSTEM ANALYSIS

4.21.1 PROMINENT COMPANIES

4.21.2 SMALL & MEDIUM SIZE COMPANIES

4.21.3 END USERS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND FOR CONVENIENT, READY-TO-SERVE BREAKFAST OPTIONS IN FOOD SERVICE ESTABLISHMENTS

5.1.2 EXPANSION OF THE HORECA (HOTEL, RESTAURANT, CAFE) SECTOR ACROSS MAJOR EUROPEAN ECONOMIES

5.1.3 SHIFTING CONSUMER PREFERENCE TOWARD AMERICAN-STYLE BREAKFAST TRENDS

5.1.4 INTRODUCTION OF HEALTHIER VARIANTS SUCH AS GLUTEN-FREE, VEGAN, AND HIGH-PROTEIN PANCAKES

5.2 RESTRAINTS

5.2.1 FLUCTUATIONS IN RAW MATERIAL PRICES, ESPECIALLY DAIRY AND WHEAT, IMPACT COST MARGINS

5.2.2 LIMITED COLD STORAGE INFRASTRUCTURE IN CERTAIN COUNTRIES HINDERS PRODUCT DISTRIBUTION

5.3 OPPORTUNITIES

5.3.1 LEVERAGING CROSS-PROMOTIONAL STRATEGIES WITH POPULAR BREAKFAST BEVERAGE BRANDS

5.3.2 STRATEGIC PARTNERSHIPS AND ACQUISITIONS OF MARKET PLAYERS

5.3.3 EXPANSION INTO INSTITUTIONAL CATERING MARKETS SUCH AS SCHOOLS, HOSPITALS, AND CORPORATE CANTEENS

5.4 CHALLENGES

5.4.1 NAVIGATING STRINGENT EU (EUROPEAN UNION) FOOD SAFETY REGULATIONS AND LABELING REQUIREMENTS

5.4.2 MANAGING SUPPLY CHAIN DISRUPTIONS CAUSED BY GEOPOLITICAL TENSIONS OR TRANSPORTATION DELAYS

6 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 ALL-PURPOSE FLOUR

6.3 WHOLE WHEAT FLOUR

6.4 RICE FLOUR

6.5 BUCKWHEAT FLOUR

6.6 ALMOND FLOUR

6.7 COCONUT FLOUR

6.8 OTHERS

7 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY FLAVOR

7.1 OVERVIEW

7.2 FLAVORED

7.3 PLAIN

8 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY LABELLING

8.1 OVERVIEW

8.2 MULTI-LABELED

8.3 GLUTEN-FREE

8.4 VEGAN

8.5 ORGANIC CERTIFIED

8.6 NO PRESERVATIVES

8.7 OTHERS

9 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PACKAGING MATERIAL

9.1 OVERVIEW

9.2 PLASTIC

9.3 SBS PAPERBOARD

9.4 CARDBOARD

9.5 BROWN KRAFT

9.6 OTHERS

10 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY NUMBER OF PIECES

10.1 OVERVIEW

10.2 11-20 PIECES

10.3 20-35 PIECES

10.4 LESS THAN 10 PIECES

10.5 35-50 PIECES

10.6 MORE THAN 50 PIECES

11 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY END-USE

11.1 OVERVIEW

11.2 RESTAURANTS

11.3 HOTELS

11.4 CANTEENS

11.5 CAFETERIAS

11.6 CLOUD KITCHENS

11.7 OTHERS

12 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 OFFLINE RETAIL

12.3 ONLINE RETAIL

13 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET

13.1 EUROPE

13.1.1 GERMANY

13.1.2 FRANCE

13.1.3 U.K.

13.1.4 ITALY

13.1.5 SPAIN

13.1.6 NETHERLANDS

13.1.7 POLAND

13.1.8 TURKEY

13.1.9 SWEDEN

13.1.10 BELGIUM

13.1.11 SWITZERLAND

13.1.12 NORWAY

13.1.13 RUSSIA

13.1.14 DENMARK

13.1.15 UKRAINE

13.1.16 HUNGARY

13.1.17 PORTUGAL

13.1.18 BULGARIA

13.1.19 FINLAND

13.1.20 REST OF EUROPE

14 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 KELLANOVA

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 BRAND PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 WM MORRISON SUPERMARKETS LIMITED

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 FARM FRITES

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 RECENT DEVELOPMENT

16.4 ALDI INTERNATIONAL

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT NEWS

16.5 CÉRÉLIA

16.5.1 COMPANY SNAPSHOT

16.5.2 BRAND PORTFOLIO

16.5.3 RECENT DEVELOPMENT

16.6 ATRIAN

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 BIRDS EYE LIMITED

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT NEWS

16.8 CATERITE FOODSERVICE

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT NEWS

16.9 CELTIC FISH & GAME

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT NEWS

16.1 CENTRAL FOODS LTD

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS/NEWS

16.11 COCOTINE

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT NEWS

16.12 EUROPASTRY SA

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 LE MONDE DES CRÊPES

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 LES DÉLICES DU CHEF

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 MASON FOODSERVICE LIMITED

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 MCCAIN FOODS LIMITED

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS/NEWS

16.17 ROZELL & CAKE

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 SIGNATURE FLATBREADS (UK) LTD.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS/NEWS

16.19 SOCIETÀ ITALIANA ALIMENTI & CONSERVIERA ADRIATICA

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 TRAITEUR DE PARIS

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 PRODUCTION

TABLE 2 CONSUMPTION

TABLE 3 CONSUMER BUYING BEHAVIOR MATRIX

TABLE 4 KEY DECISION FACTORS BY PRIORITY LEVEL

TABLE 5 KEY ADOPTION TRENDS

TABLE 6 MAJOR ADOPTERS IN MARKET

TABLE 7 REGULATORY SUMMARY TABLE

TABLE 8 SUMMARY OF ESTIMATED COST STRUCTURE FOR THE EUROPEAN FROZEN PANCAKES MARKET

TABLE 9 BRANDED VS. PRIVATE LABEL DYNAMICS

TABLE 10 CUSTOMER SEGMENT IMPACT

TABLE 11 CURRENT TARIFF RATES

TABLE 12 TARIFF RATE FACTORS

TABLE 13 VENDOR SELECTION DYNAMICS

TABLE 14 MARKET PRICING TRENDS

TABLE 15 NOTABLE JOINT VENTURES & COLLABORATIONS

TABLE 16 FREE TRADE AGREEMENTS

TABLE 17 FREE TRADE AGREEMENTS

TABLE 18 PRODUCTION CAPACITY FOR TOP COMPANIES

TABLE 19 IMPACT OF ECONOMIC SLOWDOWN

TABLE 20 AVERAGE RAW MILK PRICES IN THE SIX MAIN PRODUCERS IN THE EUROPE

TABLE 21 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 22 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 23 EUROPE FLAVORED IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY LABELLING, 2018-2032 (USD THOUSAND)

TABLE 25 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 26 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY NUMBER OF PIECES, 2018-2032 (USD THOUSAND)

TABLE 27 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 28 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 29 EUROPE OFFLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 EUROPE ONLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY COUNTRIES, 2018-2032 (USD THOUSAND)

TABLE 32 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY COUNTRIES, 2018-2032 (TONS)

TABLE 33 GERMANY FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 34 GERMANY FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 35 GERMANY FLAVORED IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 GERMANY FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY LABELLING, 2018-2032 (USD THOUSAND)

TABLE 37 GERMANY FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 38 GERMANY FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY NUMBER OF PIECES, 2018-2032 (USD THOUSAND)

TABLE 39 GERMANY FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 40 GERMANY FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 41 GERMANY OFFLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 GERMANY ONLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 FRANCE FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 44 FRANCE FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 45 FRANCE FLAVORED IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 FRANCE FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY LABELLING, 2018-2032 (USD THOUSAND)

TABLE 47 FRANCE FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 48 FRANCE FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY NUMBER OF PIECES, 2018-2032 (USD THOUSAND)

TABLE 49 FRANCE FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 50 FRANCE FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 51 FRANCE OFFLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 FRANCE ONLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 U.K. FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 54 U.K. FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 55 U.K. FLAVORED IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 U.K. FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY LABELLING, 2018-2032 (USD THOUSAND)

TABLE 57 U.K. FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 58 U.K. FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY NUMBER OF PIECES, 2018-2032 (USD THOUSAND)

TABLE 59 U.K. FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 60 U.K. FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 61 U.K. OFFLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 U.K. ONLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 ITALY FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 64 ITALY FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 65 ITALY FLAVORED IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 ITALY FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY LABELLING, 2018-2032 (USD THOUSAND)

TABLE 67 ITALY FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 68 ITALY FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY NUMBER OF PIECES, 2018-2032 (USD THOUSAND)

TABLE 69 ITALY FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 70 ITALY FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 71 ITALY OFFLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 ITALY ONLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 SPAIN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 74 SPAIN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 75 SPAIN FLAVORED IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 SPAIN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY LABELLING, 2018-2032 (USD THOUSAND)

TABLE 77 SPAIN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 78 SPAIN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY NUMBER OF PIECES, 2018-2032 (USD THOUSAND)

TABLE 79 SPAIN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 80 SPAIN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 81 SPAIN OFFLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 SPAIN ONLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 NETHERLANDS FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 84 NETHERLANDS FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 85 NETHERLANDS FLAVORED IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 NETHERLANDS FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY LABELLING, 2018-2032 (USD THOUSAND)

TABLE 87 NETHERLANDS FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 88 NETHERLANDS FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY NUMBER OF PIECES, 2018-2032 (USD THOUSAND)

TABLE 89 NETHERLANDS FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 90 NETHERLANDS FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 91 NETHERLANDS OFFLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 NETHERLANDS ONLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 POLAND FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 94 POLAND FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 95 POLAND FLAVORED IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 POLAND FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY LABELLING, 2018-2032 (USD THOUSAND)

TABLE 97 POLAND FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 98 POLAND FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY NUMBER OF PIECES, 2018-2032 (USD THOUSAND)

TABLE 99 POLAND FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 100 POLAND FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 101 POLAND OFFLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 POLAND ONLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 TURKEY FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 104 TURKEY FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 105 TURKEY FLAVORED IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 TURKEY FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY LABELLING, 2018-2032 (USD THOUSAND)

TABLE 107 TURKEY FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 108 TURKEY FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY NUMBER OF PIECES, 2018-2032 (USD THOUSAND)

TABLE 109 TURKEY FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 110 TURKEY FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 111 TURKEY OFFLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 TURKEY ONLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 SWEDEN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 114 SWEDEN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 115 SWEDEN FLAVORED IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 SWEDEN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY LABELLING, 2018-2032 (USD THOUSAND)

TABLE 117 SWEDEN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 118 SWEDEN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY NUMBER OF PIECES, 2018-2032 (USD THOUSAND)

TABLE 119 SWEDEN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 120 SWEDEN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 121 SWEDEN OFFLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 SWEDEN ONLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 BELGIUM FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 124 BELGIUM FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 125 BELGIUM FLAVORED IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 BELGIUM FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY LABELLING, 2018-2032 (USD THOUSAND)

TABLE 127 BELGIUM FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 128 BELGIUM FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY NUMBER OF PIECES, 2018-2032 (USD THOUSAND)

TABLE 129 BELGIUM FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 130 BELGIUM FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 131 BELGIUM OFFLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 BELGIUM ONLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 SWITZERLAND FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 134 SWITZERLAND FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 135 SWITZERLAND FLAVORED IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 SWITZERLAND FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY LABELLING, 2018-2032 (USD THOUSAND)

TABLE 137 SWITZERLAND FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 138 SWITZERLAND FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY NUMBER OF PIECES, 2018-2032 (USD THOUSAND)

TABLE 139 SWITZERLAND FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 140 SWITZERLAND FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 141 SWITZERLAND OFFLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 SWITZERLAND ONLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 NORWAY FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 144 NORWAY FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 145 NORWAY FLAVORED IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 NORWAY FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY LABELLING, 2018-2032 (USD THOUSAND)

TABLE 147 NORWAY FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 148 NORWAY FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY NUMBER OF PIECES, 2018-2032 (USD THOUSAND)

TABLE 149 NORWAY FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 150 NORWAY FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 151 NORWAY OFFLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 NORWAY ONLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 RUSSIA FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 154 RUSSIA FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 155 RUSSIA FLAVORED IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 RUSSIA FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY LABELLING, 2018-2032 (USD THOUSAND)

TABLE 157 RUSSIA FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 158 RUSSIA FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY NUMBER OF PIECES, 2018-2032 (USD THOUSAND)

TABLE 159 RUSSIA FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 160 RUSSIA FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 161 RUSSIA OFFLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 RUSSIA ONLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 DENMARK FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 164 DENMARK FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 165 DENMARK FLAVORED IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 DENMARK FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY LABELLING, 2018-2032 (USD THOUSAND)

TABLE 167 DENMARK FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 168 DENMARK FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY NUMBER OF PIECES, 2018-2032 (USD THOUSAND)

TABLE 169 DENMARK FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 170 DENMARK FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 171 DENMARK OFFLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 DENMARK ONLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 UKRAINE FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 174 UKRAINE FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 175 UKRAINE FLAVORED IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 UKRAINE FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY LABELLING, 2018-2032 (USD THOUSAND)

TABLE 177 UKRAINE FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 178 UKRAINE FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY NUMBER OF PIECES, 2018-2032 (USD THOUSAND)

TABLE 179 UKRAINE FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 180 UKRAINE FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 181 UKRAINE OFFLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 UKRAINE ONLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 HUNGARY FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 184 HUNGARY FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 185 HUNGARY FLAVORED IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 HUNGARY FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY LABELLING, 2018-2032 (USD THOUSAND)

TABLE 187 HUNGARY FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 188 HUNGARY FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY NUMBER OF PIECES, 2018-2032 (USD THOUSAND)

TABLE 189 HUNGARY FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 190 HUNGARY FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 191 HUNGARY OFFLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 HUNGARY ONLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 PORTUGAL FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 194 PORTUGAL FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 195 PORTUGAL FLAVORED IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 PORTUGAL FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY LABELLING, 2018-2032 (USD THOUSAND)

TABLE 197 PORTUGAL FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 198 PORTUGAL FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY NUMBER OF PIECES, 2018-2032 (USD THOUSAND)

TABLE 199 PORTUGAL FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 200 PORTUGAL FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 201 PORTUGAL OFFLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 PORTUGAL ONLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 BULGARIA FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 204 BULGARIA FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 205 BULGARIA FLAVORED IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 BULGARIA FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY LABELLING, 2018-2032 (USD THOUSAND)

TABLE 207 BULGARIA FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 208 BULGARIA FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY NUMBER OF PIECES, 2018-2032 (USD THOUSAND)

TABLE 209 BULGARIA FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 210 BULGARIA FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 211 BULGARIA OFFLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 BULGARIA ONLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 FINLAND FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 214 FINLAND FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 215 FINLAND FLAVORED IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 FINLAND FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY LABELLING, 2018-2032 (USD THOUSAND)

TABLE 217 FINLAND FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 218 FINLAND FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY NUMBER OF PIECES, 2018-2032 (USD THOUSAND)

TABLE 219 FINLAND FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 220 FINLAND FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 221 FINLAND OFFLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 FINLAND ONLINE RETAIL IN FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 REST OF EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET: SEGMENTATION

FIGURE 2 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET: DROC ANALYSIS

FIGURE 4 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET: MARKET END-USE COVERAGE GRID

FIGURE 8 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET: MULTIVARIATE MODELLING

FIGURE 9 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET: SEGMENTATION

FIGURE 12 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET: EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 THE EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY PRODUCT (2024)

FIGURE 15 RISING DEMAND FOR CONVENIENT, READY-TO-SERVE BREAKFAST OPTIONS IN FOODSERVICE ESTABLISHMENTS IS DRIVING THE GROWTH OF THE EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET FROM 2025 TO 2032

FIGURE 16 THE WHOLE WHEAT FLOUR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE OF THE EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET IN 2025 AND 2032

FIGURE 17 TOTAL NUMBER OF DEALS (YEAR-WISE)

FIGURE 18 DEALS BY TYPE

FIGURE 19 DEALS BY SEGMENT

FIGURE 20 PRICE TREND ANALYSIS, 2024 (USD/UNIT)

FIGURE 21 IMPACTING FACTORS BY ECONOMIC SLOWDOWN

FIGURE 22 SUPPLY CHAIN ANALYSIS FOR THE EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET

FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET

FIGURE 24 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET: BY PRODUCT, 2024

FIGURE 25 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET: BY FLAVOR, 2024

FIGURE 26 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET: BY LABELLING, 2024

FIGURE 27 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET: BY PACKAGING MATERIAL, 2024

FIGURE 28 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET: BY NUMBER OF PIECES, 2024

FIGURE 29 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET, BY END-USE, 2024

FIGURE 30 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 31 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET: SNAPSHOT, 2024

FIGURE 32 EUROPE FROZEN PANCAKES FOR FOOD SERVICES MARKET: COMPANY SHARE 2024 (%)

Europe Frozen Pancakes For Food Services Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Frozen Pancakes For Food Services Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Frozen Pancakes For Food Services Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.