Europe Fuel Cards For Commercial Fleet Market

Market Size in USD Billion

CAGR :

%

USD

39.13 Billion

USD

64.28 Billion

2024

2032

USD

39.13 Billion

USD

64.28 Billion

2024

2032

| 2025 –2032 | |

| USD 39.13 Billion | |

| USD 64.28 Billion | |

|

|

|

|

Europe Fuel Cards for Commercial Fleet Market Size

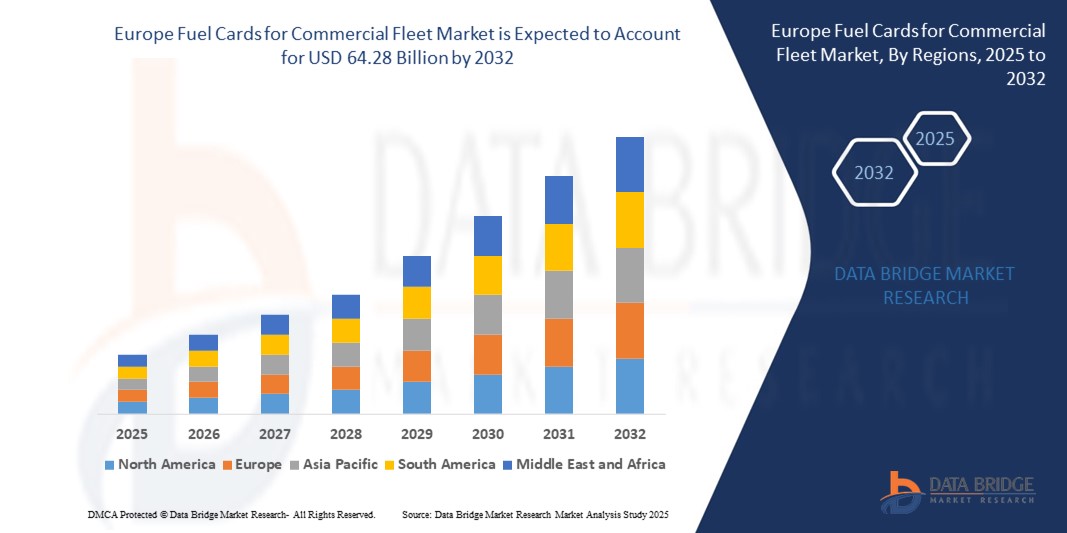

- The Europe fuel cards for commercial fleet market size was valued at USD 39.13 billion in 2024 and is expected to reach USD 64.28 billion by 2032, at a CAGR of 6.40% during the forecast period

- The market growth is largely driven by the increasing need for efficient fuel management systems and cost control measures across commercial fleet operations, encouraging widespread fuel card adoption among fleet managers and logistics providers

- Furthermore, growing demand for real-time fuel tracking, enhanced reporting capabilities, and integrated expense management solutions is positioning fuel cards as a strategic tool in optimizing fleet efficiency. These dynamics are propelling the market forward and reinforcing the role of fuel cards in the evolving European commercial transportation sector

Europe Fuel Cards for Commercial Fleet Market Analysis

- Fuel cards, offering electronic payment solutions specifically for fuel and vehicle-related expenses, are becoming essential tools in managing operational efficiency across Europe’s commercial fleet sector due to their streamlined expense tracking, enhanced control over fuel usage, and integration with fleet management systems

- The growing demand for fuel cards is primarily driven by the rising cost of fuel, increasing pressure on fleet operators to reduce overheads, and the need for real-time data insights to optimize route planning and fuel consumption

- Germany dominated the fuel cards for commercial fleet market with the largest revenue share of 29.9% in 2024, supported by its extensive logistics infrastructure, advanced telematics adoption, and regulatory emphasis on fleet transparency, with major fuel providers and fleet management firms integrating fuel card solutions at scale

- Poland is expected to be the fastest growing country in the European fuel cards for commercial fleet market during the forecast period due to its booming transportation sector, rising cross-border freight movement, and increasing investment in commercial fleet digitalization

- The universal fuel card segment dominated the Europe fuel cards for commercial fleet market with a market share of 48.3% in 2024, driven by its versatility in allowing purchases across multiple fuel brands and compatibility with a broader range of fleet services

Report Scope and Europe Fuel Cards for Commercial Fleet Market Segmentation

|

Attributes |

Europe Fuel Cards for Commercial Fleet Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Fuel Cards for Commercial Fleet Market Trends

AI-Driven Telematics and Expense Integration

- A significant and accelerating trend in the Europe fuel cards for commercial fleet market is the integration of fuel card solutions with artificial intelligence (AI) and advanced telematics systems. This convergence is significantly enhancing real-time tracking, fuel efficiency, and cost control for fleet operators across the region

- For instance, UTA Edenred has introduced AI-enabled fleet platforms that combine fuel card data with GPS and driver behavior analytics to optimize routes and improve mileage. Similarly, Shell’s Fleet App integrates with telematics providers to offer insights on fuel consumption patterns and carbon footprint management

- AI integration enables predictive analytics for maintenance, fraud detection, and automated VAT recovery processes. For instance, DKV Mobility’s solutions use machine learning to detect irregular fuel transactions and recommend cost-effective fueling locations based on route history and pricing trends

- The seamless combination of fuel cards with telematics and AI platforms facilitates centralized fleet control through a single dashboard, allowing managers to track fuel use, expenses, emissions, and driver performance in real time. This creates a smarter and more efficient fleet environment

- This trend towards intelligent and automated fuel card solutions is fundamentally reshaping expectations in the commercial fleet sector. Consequently, companies such as WEX Europe Services are investing in AI-driven platforms that offer integrated tolling, maintenance, and fuel payment capabilities across multiple countries

- The demand for connected, AI-enhanced fuel card systems is growing rapidly across logistics and transportation sectors, as operators increasingly prioritize cost optimization, operational transparency, and cross-border fleet efficiency

Europe Fuel Cards for Commercial Fleet Market Dynamics

Driver

Rising Need for Cost Optimization and Regulatory Compliance

- The increasing pressure on commercial fleet operators to manage costs more effectively, combined with evolving regulatory requirements across Europe, is a significant driver for the growing demand for fuel cards

- For instance, in March 2024, BP launched an upgraded version of its BP Plus Fuel Card in Europe, integrating advanced expense tracking and emissions reporting features to support compliance with EU sustainability mandates. Such innovations are expected to accelerate market growth during the forecast period

- As companies face fluctuating fuel prices and complex taxation across multiple jurisdictions, fuel cards offer benefits such as centralized invoicing, simplified VAT reclaim, and detailed spending reports providing a clear advantage over traditional reimbursement systems

- Furthermore, the integration of fuel cards with fleet management software enables real-time monitoring of fuel transactions, route optimization, and fraud prevention, allowing businesses to improve operational efficiency

- The convenience of multi-country usability, consolidated billing, and compatibility with a wide network of fuel stations and toll services makes fuel cards increasingly vital to cross-border logistics operators. This, coupled with growing investments in digital fleet infrastructure, continues to drive market adoption across small and large fleet segments

Restraint/Challenge

Cybersecurity Concerns and Cross-Border Compatibility Limitations

- Concerns surrounding cybersecurity vulnerabilities and inconsistent acceptance across European countries pose a significant challenge to wider fuel card adoption. As fuel card systems become more integrated with digital platforms, they are exposed to risks such as data breaches and fraudulent transactions

- For instance, reports of unauthorized card use and system intrusions have heightened caution among fleet managers, particularly in the context of increasingly digital and cloud-based fleet management platforms

- Addressing these cybersecurity concerns through secure authentication, transaction monitoring, and advanced encryption is essential to ensuring data protection and trust in the system. Companies such as TotalEnergies and DKV are actively investing in real-time fraud detection tools to address these threats

- In addition, limited interoperability of certain fuel cards across fuel networks or national tolling systems remains a key obstacle, especially for operators managing cross-border routes. Inconsistencies in tax documentation and lack of multilingual support further hinder smooth adoption

- While leading providers offer pan-European coverage, smaller fleet operators may find advanced solutions cost-prohibitive or difficult to implement. Overcoming these challenges through enhanced system compatibility, robust security features, and tailored solutions for SMEs will be critical to sustaining long-term growth in the European market

Europe Fuel Cards for Commercial Fleet Market Scope

The market is segmented on the basis of card type, features, subscription type, utility, fleet type, and industry.

- By Card Type

On the basis of card type, the Europe fuel cards for commercial fleet market is segmented into universal fuel cards, branded fuel cards, and merchant fuel cards. The universal fuel cards segment dominated the market with the largest market revenue share of 48.3% in 2024, owing to their flexibility in being accepted at a wide range of fuel stations across brands and countries. These cards are favored by large and multinational fleet operators for their centralized billing, simplified tax reporting, and broad acceptance, especially for cross-border operations.

The branded fuel cards segment is anticipated to witness the fastest growth rate of 19.4% from 2025 to 2032, fueled by loyalty programs, fuel discounts, and exclusive services provided by major fuel suppliers. Branded cards appeal to regional fleet operators who prioritize cost efficiency, reward points, and reliable network coverage within specific fuel chains.

- By Features

On the basis of features, the Europe fuel cards for commercial fleet market is segmented into mobile payment & cardless transactions, vehicle reporting, real-time updates, EMV compliant, tokenization, and others. The vehicle reporting segment held the largest market revenue share in 2024, driven by rising demand for telematics-based analytics and driver-level fuel tracking. Fleet operators increasingly rely on detailed reports to monitor fuel usage, detect irregularities, and improve operational efficiency.

The mobile payment & cardless transactions segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the adoption of digital wallets, smartphone apps, and tap-to-pay solutions. These features enhance security and user convenience, aligning with broader trends in contactless fleet management and remote authorization.

- By Subscription Type

On the basis of subscription type, the Europe fuel cards for commercial fleet market is segmented into registered card and bearer card. The registered card segment dominated the market with the largest revenue share in 2024, supported by its enhanced security features, driver-specific usage tracking, and access control capabilities. Fleet managers prefer registered cards for monitoring individual driver spending, enforcing policy compliance, and generating personalized reports.

The bearer card segment is projected to grow at a steady pace during the forecast period due to its flexibility and ease of issuance. These cards are particularly useful for temporary drivers or smaller fleets that require quick, low-maintenance fuel payment options without linking to individual profiles.

- By Utility

On the basis of utility, the Europe fuel cards for commercial fleet market is segmented into fuel fee payment, fleet maintenance, vehicle parking fees, toll fee payment, and others. The fuel fee payment segment accounted for the largest market share in 2024, as fuel remains the primary expense for most commercial fleets. Fuel cards simplify the fueling process while providing transaction transparency, cost control, and centralized expense management.

The fleet maintenance segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by growing adoption of predictive maintenance services and integration of repair and servicing costs into fuel card platforms. Fleet operators are increasingly using fuel cards for broader vehicle-related expenses to streamline operations and improve budgeting accuracy.

- By Fleet Type

On the basis of fleet type, the Europe fuel cards for commercial fleet market is segmented into delivery fleets, taxi cab fleets, car rental fleets, public utility fleets, and others. The delivery fleets segment held the largest market revenue share in 2024, driven by the surge in last-mile logistics and e-commerce. High-frequency fueling needs and route-intensive operations make fuel cards essential for optimizing fuel expenses and maintaining timely deliveries.

The car rental fleets segment is expected to witness the fastest growth rate of 21.3% from 2025 to 2032, fueled by increasing demand for cost-efficient fuel tracking and mobility services in short-term rental and corporate leasing markets. Fuel cards offer rental operators simplified fleet oversight and reduced administrative burden.

- By Industry

On the basis of industry, the Europe fuel cards for commercial fleet market is segmented into transportation and logistics, construction, corporate, automotive, food and beverages, healthcare, chemical, and others. The transportation and logistics segment dominated the market with the largest revenue share in 2024, owing to the sector’s large-scale dependence on fuel and cross-border fleet movement. Fuel cards support this industry by offering simplified fuel procurement, VAT reclaim assistance, and comprehensive data analytics.

The corporate segment is projected to witness the fastest CAGR from 2025 to 2032, driven by the growing use of company-owned or leased vehicles for employee mobility and business travel. Businesses are adopting fuel cards to manage expenses, ensure policy compliance, and integrate fuel usage data with broader enterprise resource planning (ERP) systems.

Europe Fuel Cards for Commercial Fleet Market Regional Analysis

- Germany dominated the fuel cards for commercial fleet market with the largest revenue share of 29.9% in 2024, supported by its extensive logistics infrastructure, advanced telematics adoption, and regulatory emphasis on fleet transparency, with major fuel providers and fleet management firms integrating fuel card solutions at scale

- Fleet operators in the country prioritize operational efficiency, cost transparency, and digital tools that streamline expense tracking making fuel cards an essential component of modern fleet operations

- This widespread adoption is further supported by strong infrastructure, a high density of fuel station networks, and increasing regulatory requirements for fuel and emissions reporting, positioning Germany as a leading market for advanced fuel card systems across both domestic and cross-border logistics fleet

The Germany Fuel Cards for Commercial Fleet Market Insight

The Germany fuel cards for commercial fleet market captured the largest market revenue share in Europe in 2024, underpinned by its advanced logistics infrastructure, high commercial vehicle usage, and well-established fuel station networks. The country’s strong emphasis on digital fleet operations and regulatory compliance drives widespread adoption of fuel cards across both national and international transport companies. German fleet managers increasingly favor AI-integrated solutions that combine fuel expense control with emissions tracking and tolling services. Furthermore, innovation-led providers are offering value-added features such as real-time fuel analytics, secure mobile payments, and automated tax reclaim capabilities.

U.K. Fuel Cards for Commercial Fleet Market Insight

The U.K. fuel cards for commercial fleet market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the expanding logistics sector and growing demand for digitalized fleet operations. British fleet operators are adopting fuel cards for enhanced transaction control, cost forecasting, and integration with mobile and GPS-based fleet systems. Rising fuel prices and evolving carbon reduction mandates are pushing companies toward fuel-efficient solutions, making data-rich card platforms essential. The trend toward electric vehicle adoption also opens up opportunities for multi-energy card services that cover both fuel and EV charging.

France Fuel Cards for Commercial Fleet Market Insight

The France fuel cards for commercial fleet market is gaining traction due to the country's focus on fleet sustainability and smart transportation initiatives. French transport and logistics companies are investing in telematics-linked fuel card systems that offer end-to-end fleet monitoring and cost control. Government incentives for clean mobility and the deployment of low-emission zones are accelerating the demand for data-driven fuel card solutions. In addition, France’s growing e-commerce sector is fueling demand for fuel card-enabled delivery fleets, with a strong focus on user-specific access controls and multilingual digital platforms.

Poland Fuel Cards for Commercial Fleet Market Insight

The Poland fuel cards for commercial fleet market is expected to grow at the fastest CAGR in Europe during the forecast period, supported by the country’s strategic location in European trade corridors and expanding cross-border transportation activities. The rise in organized logistics services and increasing digital adoption by fleet operators are driving demand for flexible, pan-European fuel card solutions. Polish fleet managers value tools that offer real-time tracking, automated tax processing, and support for multiple currencies and tolling networks. Fuel card providers offering tailored solutions for SMEs and freight operators are gaining strong market traction.

Europe Fuel Cards for Commercial Fleet Market Share

The Europe fuel cards for commercial fleet industry is primarily led by well-established companies, including:

- Shell plc (U.K.)

- BP p.l.c. (U.K.)

- TotalEnergies SE (France)

- DKV Mobility Service Group GmbH (Germany)

- WEX Inc. (U.S.)

- Eurowag (Czech Republic)

- Radius Payment Solutions Limited (U.K.)

- Fleetcor Technologies, Inc. (U.S.)

- Aral AG (Germany)

- UTA Edenred (Germany)

- Allstar Business Solutions Limited (U.K.)

- Eni S.p.A. (Italy)

- OMV Aktiengesellschaft (Austria)

- Repsol S.A. (Spain)

- AVIA International (Switzerland)

- Neste Oyj (Finland)

- Esso (ExxonMobil) (U.S.)

- Circle K AS (Norway)

- AS 24 (France)

- OKQ8 AB (Sweden)

What are the Recent Developments in Europe Fuel Cards for Commercial Fleet Market?

- In May 2025, DKV Mobility, a European leader in fleet payment solutions, announced a strategic partnership with Fuuse, a UK-based EV charge point management platform. This collaboration adds over 2,400 EV charge points to DKV’s network, accessible using the DKV Card +Charge and the DKV Mobility app, enhancing availability and ease of charging for fleets

- In April 2025, four leading EV charging operators Atlante (Italy), IONITY (Germany), Fastned (Netherlands), and Electra (France) announced the formation of the Spark Alliance. This consortium will establish a unified network of 11,000 ultra-fast charging points across 25 European countries, allowing drivers to access and pay for charging sessions through any member app

- In February 2023, DKV Mobility, the leading European B2B platform for on-the-road payments and solutions, have signed a cooperation agreement with TotalEnergies to include over 2,000 new public charge points in the UK. The new charge points are part of the public charging network Source London, operated by TotalEnergies. These charge points will be accessible via the DKV Card +Charge and the DKV Mobility App.

- In April 2022, Volkswagen Group and BP launched a strategic partnership to rapidly roll out ultra-fast EV chargers across Europe. The initiative aimed to deploy up to 4,000 charge points in Germany and the UK within 24 months, with the potential to reach 8,000 across Europe

- In February 2021, Aral BP’s German fuel retail arm accelerated the expansion of its Aral pulse ultra-fast charging network, deploying 500 charging points across more than 120 locations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.