Europe Minimally Invasive Surgery Market

Market Size in USD Billion

CAGR :

%

USD

12.41 Billion

USD

22.63 Billion

2025

2033

USD

12.41 Billion

USD

22.63 Billion

2025

2033

| 2026 –2033 | |

| USD 12.41 Billion | |

| USD 22.63 Billion | |

|

|

|

|

Europe Minimally Invasive Surgery Market Size

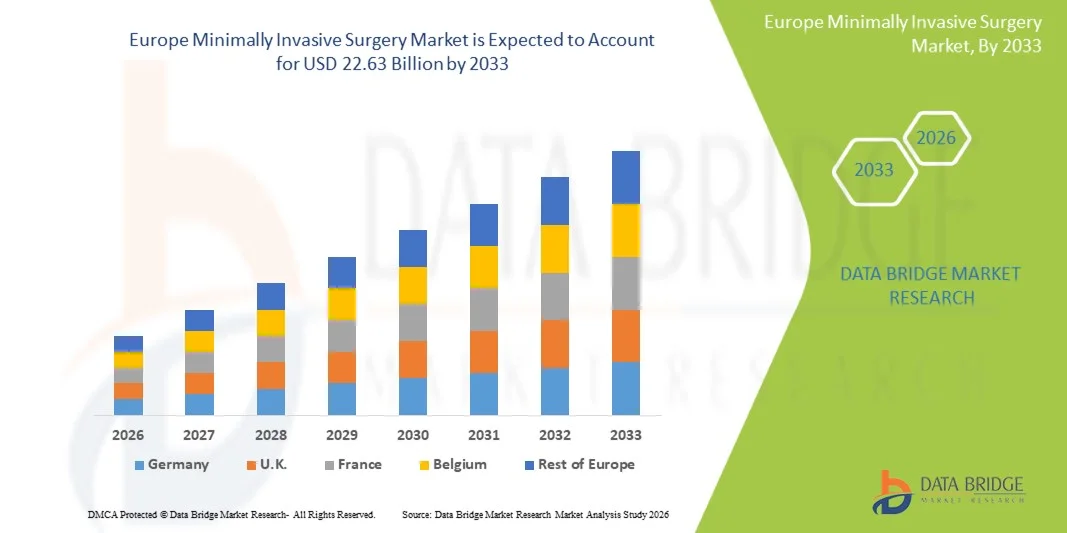

- The Europe minimally invasive surgery market size was valued at USD 12.41 billion in 2025 and is expected to reach USD 22.63 billion by 2033, at a CAGR of 7.8% during the forecast period

- The market growth is largely fueled by the rising adoption of minimally invasive surgical techniques, technological advancements in surgical devices, and increasing demand for procedures that reduce recovery times and complications across hospitals and clinics throughout Europe

- Furthermore, growing patient awareness of the benefits of minimally invasive procedures, improvements in imaging and laparoscopic technology, and investments in healthcare infrastructure are driving the uptake of these solutions, positioning minimally invasive approaches as the preferred choice for a range of surgical applications and significantly boosting the industry’s growth

Europe Minimally Invasive Surgery Market Analysis

- Minimally invasive surgical (MIS) procedures, which involve performing surgeries through small incisions using specialized instruments and imaging guidance, are increasingly critical in modern healthcare due to reduced patient trauma, faster recovery times, and lower risk of complications compared to traditional open surgeries

- The rising adoption of minimally invasive techniques is primarily driven by technological advancements in laparoscopic, robotic, and endoscopic devices, increasing patient awareness of the benefits of MIS, and a growing focus on improving surgical outcomes and hospital efficiency

- Germany dominated the Europe minimally invasive market with the largest revenue share of 27.5% in 2025, fueled by advanced healthcare infrastructure, high healthcare spending, and a strong presence of leading medical device manufacturers, with widespread adoption of robotic-assisted and laparoscopic procedures in major hospitals

- Poland is expected to be the fastest-growing country in the Europe minimally invasive market during the forecast period due to expanding healthcare access, rising investments in hospital modernization, and increasing availability of trained surgeons

- The laparoscopy surgery segment dominated the Europe minimally invasive market with a market share of 45.8% in 2025, driven by its established clinical efficacy, widespread surgeon expertise, and versatility across multiple surgical specialties

Report Scope and Europe Minimally Invasive Surgery Market Segmentation

|

Attributes |

Europe Minimally Invasive Surgery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Minimally Invasive Surgery Market Trends

“Advancement Through Robotic and Image-Guided Surgery”

- A significant and accelerating trend in the Europe minimally invasive market is the growing integration of robotic-assisted systems and advanced imaging technologies such as 3D laparoscopy and fluoroscopy, enhancing precision, reducing surgical errors, and improving patient outcomes

- For instance, the da Vinci Xi Surgical System allows surgeons to perform complex procedures with smaller incisions and greater dexterity, improving post-operative recovery and minimizing complications

- Image-guided techniques in MIS enable real-time visualization of tissues and critical structures, allowing surgeons to perform highly precise procedures, reduce intraoperative risks, and tailor interventions to patient-specific anatomy

- The combination of robotics and imaging technologies facilitates minimally invasive procedures across multiple specialties, including urology, gynecology, and cardiothoracic surgery, creating a more standardized and efficient surgical workflow

- This trend towards intelligent, precise, and technology-enhanced surgical systems is reshaping expectations in European hospitals, driving demand for advanced MIS solutions, and prompting manufacturers such as Intuitive Surgical and Medtronic to continually innovate in robotic and imaging-assisted devices

- The integration of tele-surgery and remote monitoring capabilities is emerging as a trend, enabling expert surgeons to guide or assist procedures remotely, which increases accessibility of MIS in smaller or rural hospitals

- Miniaturization of instruments and development of flexible endoscopic devices is gaining traction, allowing surgeons to perform complex procedures through even smaller incisions, reducing patient trauma and expanding MIS applications

Europe Minimally Invasive Surgery Market Dynamics

Driver

“Rising Preference for Less Invasive Procedures and Faster Recovery”

- The increasing demand for procedures that minimize patient trauma, reduce hospitalization, and enable faster return to daily activities is a significant driver of the Europe minimally invasive market

- For instance, hospitals in Germany are adopting robotic-assisted laparoscopic surgeries to reduce post-operative pain and complications in colorectal and gynecological procedures

- Patients and surgeons are increasingly prioritizing MIS due to lower complication rates, reduced blood loss, and smaller scars compared to traditional open surgeries, making these procedures highly desirable

- Furthermore, the expansion of private healthcare facilities and day-care surgical centers in countries such as France and Italy is supporting greater adoption of MIS solutions

- The rising prevalence of chronic conditions and aging populations in Europe is fueling demand for minimally invasive approaches, enabling safer procedures for high-risk patient groups while reducing healthcare costs

- Increasing government initiatives and reimbursement policies supporting minimally invasive procedures are encouraging hospitals to adopt advanced surgical technologies

- Collaborations between hospitals and device manufacturers for clinical trials and training programs are driving faster adoption of MIS technologies across European countries

Restraint/Challenge

“High Cost of Advanced Devices and Training Requirements”

- The relatively high cost of robotic and specialized MIS equipment, combined with extensive surgeon training requirements, poses a significant challenge to widespread market adoption

- For instance, smaller hospitals in Eastern Europe often face budget constraints that limit the acquisition of robotic surgical systems despite their clinical advantages

- The complexity of operating advanced MIS devices necessitates ongoing training and certification, which can slow adoption in facilities with limited skilled personnel

- Furthermore, regulatory approvals and compliance requirements for advanced surgical devices in the EU add time and cost burdens for manufacturers and healthcare providers

- While the long-term benefits of MIS are well established, the upfront investment and operational costs can deter some institutions from adopting these solutions rapidly

- Overcoming these challenges through cost-effective device solutions, surgeon training programs, and supportive reimbursement policies will be essential for sustained growth of the Europe minimally invasive market

- Limited awareness and experience among surgeons in smaller markets can delay adoption of new MIS technologies despite their clinical benefits

- Maintenance and servicing requirements for advanced robotic systems add operational costs and logistical challenges, particularly for hospitals with limited technical support infrastructure

Europe Minimally Invasive Surgery Market Scope

The market is segmented on the basis of product type, application, technology, and end users.

- By Product Type

On the basis of product type, the Europe minimally invasive surgery market is segmented into surgical devices, monitoring & visualization systems, laparoscopy devices, endosurgical equipment, and electrosurgical equipment. The laparoscopy devices segment dominated the market with the largest revenue share of 45% in 2025, driven by their versatility across multiple surgical specialties, established clinical efficacy, and widespread surgeon expertise. Hospitals prefer laparoscopy devices due to their ability to perform complex procedures through small incisions, reducing patient trauma, recovery time, and risk of infection. In addition, the extensive availability of training programs and familiarity among surgeons further supports their continued dominance. Laparoscopy devices are also compatible with robotic-assisted and image-guided surgery systems, enhancing procedural precision and workflow efficiency.

The robotic-assisted surgical devices segment is anticipated to witness the fastest growth rate of 19.8% CAGR from 2026 to 2033, fueled by increasing adoption in advanced hospitals across Germany, France, and the U.K. Robotic systems offer improved dexterity, accuracy, and access to difficult-to-reach anatomical sites, making them ideal for complex procedures. Rising investments by manufacturers in R&D, coupled with the growing patient preference for minimally invasive, precise surgeries, are driving market expansion. The integration of AI, haptic feedback, and 3D imaging further enhances the appeal of robotic-assisted devices, especially in high-volume surgical centers.

- By Application

On the basis of application, the market is segmented into gastrointestinal surgery, gynecology surgery, urology surgery, cosmetic surgery, thoracic surgery, vascular surgery, orthopedic & spine surgery, bariatric surgery, breast surgery, cardiac surgery, adrenalectomy surgery, anti-reflux surgery, cancer surgery, cholecystectomy surgery, colectomy surgery, colon & rectal surgery, ear, nose & throat surgery, and obesity surgery. The gynecology surgery segment dominated the market with a revenue share of 22.7% in 2025, driven by the increasing number of laparoscopic hysterectomies, myomectomies, and endometriosis treatments. Minimally invasive gynecological procedures reduce post-operative pain, hospital stay, and recovery time, which is particularly critical for female patients of reproductive age. Hospitals across Germany, France, and Italy prioritize MIS for gynecological care due to better clinical outcomes and lower complication rates. The widespread availability of specialized gynecologic MIS instruments also reinforces the dominance of this segment.

The urology surgery segment is expected to witness the fastest growth rate of 20.5% CAGR from 2026 to 2033, driven by rising adoption of robotic-assisted prostatectomies, nephrectomies, and ureteral procedures. Increasing prevalence of prostate cancer and kidney disorders in Europe is boosting demand for precise, minimally invasive interventions. Urology procedures benefit significantly from enhanced imaging and robotic guidance, improving surgical accuracy and patient outcomes. Expansion of outpatient and day-care urology centers further fuels growth, enabling quicker patient turnover and reduced healthcare costs.

- By Technology

On the basis of technology, the market is segmented into transcatheter surgery, laparoscopy surgery, non-visual imaging, and medical robotics. The laparoscopy surgery segment dominated the market with a share of 45.8% in 2025, due to its established clinical efficacy, low complication rates, and wide adoption across hospitals and private clinics. Surgeons prefer laparoscopy over open procedures for gastrointestinal, gynecological, and bariatric surgeries because of faster recovery, reduced blood loss, and smaller scars. Availability of standardized laparoscopic instruments and broad surgeon expertise supports its market dominance. Furthermore, compatibility with robotic-assisted and imaging-guided systems enhances procedural efficiency and safety.

The medical robotics segment is expected to witness the fastest CAGR of 21.2% from 2026 to 2033, fueled by growing investments in robotic platforms, AI integration, and image-guided surgical assistance. Robotic systems are increasingly deployed in urology, gynecology, and thoracic procedures for enhanced precision and minimally invasive access. Rising patient awareness of better outcomes and reduced hospital stays drives hospital adoption. Technological advancements, such as haptic feedback, 3D visualization, and remote assistance capabilities, further strengthen growth prospects.

- By End Users

On the basis of end users, the market is segmented into hospital surgical departments, outpatient surgery patients, group practices, and individual surgeons. The hospital surgical departments segment dominated the market with a revenue share of 63% in 2025, driven by the high volume of surgeries, advanced infrastructure, and availability of specialized surgical teams. Hospitals prefer minimally invasive approaches to reduce patient stay, optimize workflow, and improve clinical outcomes. Government and private funding in countries such as Germany, France, and the U.K. supports adoption of advanced MIS technologies. High patient inflow, along with multi-specialty surgical requirements, makes hospital departments the largest consumers of MIS devices and equipment.

The outpatient surgery patients segment is expected to witness the fastest growth rate of 18.9% CAGR from 2026 to 2033, as rising preference for day-care minimally invasive procedures reduces hospitalization and associated costs. Outpatient surgical centers are increasingly equipped with portable and flexible MIS systems, allowing a variety of procedures from orthopedic to cosmetic surgeries. Patient convenience, faster recovery, and lower operational costs for healthcare providers are key drivers. Growing investments in outpatient infrastructure and rising patient awareness of minimally invasive options fuel the segment’s rapid expansion.

Europe Minimally Invasive Surgery Market Regional Analysis

- Germany dominated the Europe minimally invasive market with the largest revenue share of 27.5% in 2025, fueled by advanced healthcare infrastructure, high healthcare spending, and a strong presence of leading medical device manufacturers, with widespread adoption of robotic-assisted and laparoscopic procedures in major hospitals

- Patients and hospitals in Germany increasingly prefer minimally invasive procedures due to reduced post-operative pain, shorter hospital stays, faster recovery, and lower complication rates, particularly in gynecology, urology, and gastrointestinal surgeries

- This widespread adoption is further supported by government initiatives, reimbursement policies, high healthcare spending, and a technologically skilled surgical workforce, establishing minimally invasive surgery as the preferred approach in both public and private hospitals

The Germany Minimally Invasive Surgery Market Insight

The Germany minimally invasive surgery market dominated Europe with the largest revenue share of 27.5% in 2025, driven by advanced healthcare infrastructure, strong government support, and high adoption of robotic and laparoscopic procedures. Hospitals and surgical centers prioritize MIS to reduce post-operative pain, accelerate recovery, and improve patient outcomes in gynecology, urology, and colorectal surgeries. In addition, Germany’s emphasis on medical innovation, surgeon training programs, and the presence of leading device manufacturers supports widespread adoption. The integration of image-guided systems and robotics further enhances surgical precision, efficiency, and workflow optimization in German healthcare facilities.

France Minimally Invasive Surgery Market Insight

The France minimally invasive surgery market is expected to grow at a significant CAGR during the forecast period, driven by increasing patient preference for outpatient and day-care procedures, expanding hospital infrastructure, and strong adoption of laparoscopic and robotic-assisted surgeries. French hospitals prioritize MIS for reduced hospital stay and lower complication rates, particularly in bariatric, gastrointestinal, and gynecological procedures. Government support, reimbursement policies, and continuous investments in modern surgical technologies further drive market growth. The rising focus on patient comfort and faster recovery is encouraging the integration of MIS across both public and private healthcare facilities.

U.K. Minimally Invasive Surgery Market Insight

The U.K. minimally invasive surgery market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by rising demand for minimally invasive solutions in orthopedic, gastrointestinal, and urological procedures. Hospitals and private surgical centers are increasingly adopting robotic-assisted and laparoscopic procedures to improve clinical outcomes, reduce post-operative complications, and shorten hospital stays. The U.K.’s strong healthcare infrastructure, skilled workforce, and patient awareness of MIS benefits are supporting rapid adoption. In addition, the integration of MIS solutions in both elective and emergency procedures is increasing, with a focus on efficiency and patient-centric care.

Poland Minimally Invasive Surgery Market Insight

The Poland minimally invasive surgery market is expected to witness the fastest growth in Europe during the forecast period, fueled by expanding healthcare access, increasing investments in hospital modernization, and the growing availability of trained surgeons. Hospitals and clinics are gradually adopting laparoscopic and robotic-assisted procedures to improve surgical outcomes and reduce patient recovery time. Rising patient awareness of the benefits of MIS, government healthcare initiatives, and partnerships with medical device manufacturers are accelerating adoption. Cost-effective MIS solutions and the establishment of outpatient surgical centers are further driving market growth in Poland.

Europe Minimally Invasive Surgery Market Share

The Europe Minimally Invasive Surgery industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Olympus Corporation (Japan)

- Siemens Healthineers AG (Germany)

- GE Healthcare (U.S.)

- Abbott (U.S.)

- Intuitive Surgical (U.S.)

- Smith & Nephew (U.K.)

- Stryker (U.S.)

- Zimmer Biomet (U.S.)

- Boston Scientific Corporation (U.S.)

- Cook (U.S.)

- B. Braun SE (Germany)

- CONMED Corporation (U.S.)

- Karl Storz SE & Co. KG (Germany)

- Renishaw plc (U.K.)

- Distalmotion (Switzerland)

- CMR Surgical (U.K.)

- Think Surgical (U.S.)

What are the Recent Developments in Europe Minimally Invasive Surgery Market?

- In July 2025, Medtronic received CE Mark approval for its LigaSure™ RAS vessel‑sealing technology on the Hugo™ robotic‑assisted surgery system, expanding its capabilities in gynecologic, general, and urologic minimally invasive procedures across Europe and marking a significant advancement in robotic surgical instrumentation

- In July 2025, Intuitive’s da Vinci 5 Surgical System received CE Mark approval for use in Europe, enabling its deployment for adult and pediatric minimally invasive endoscopic procedures across abdominopelvic, urologic, gynecologic, and thoracoscopic surgeries, representing a major upgrade to surgical robotics available in the region

- In January 2024, Intuitive’s da Vinci Single‑Port (SP) surgical system received CE Mark approval for use in Europe for a range of complex minimally invasive procedures including endoscopic and transanal colorectal surgeries, expanding surgical options and reducing invasiveness for patients

- In June 2023, IMPLANET launched its MIS Range, a new minimally invasive pedicle screw positioning system in Europe for orthopedic spine procedures, providing surgeons with advanced tools that reduce tissue trauma and improve recovery compared with traditional open spine surgery

- In October 2021, the Medtronic Hugo™ Robotic‑Assisted Surgery (RAS) System received CE Mark approval in Europe, allowing hospitals across the continent to install and use the modular robotic platform for urologic and gynecologic minimally invasive surgeries, significantly broadening access to robotic surgical care

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.