Europe Polyimide Film Market

Market Size in USD Thousand

CAGR :

%

USD

750,143.52 Thousand

USD

1,303,777.31 Thousand

2022

2030

USD

750,143.52 Thousand

USD

1,303,777.31 Thousand

2022

2030

| 2023 –2030 | |

| USD 750,143.52 Thousand | |

| USD 1,303,777.31 Thousand | |

|

|

|

Europe Polyimide Films Market Analysis and Size

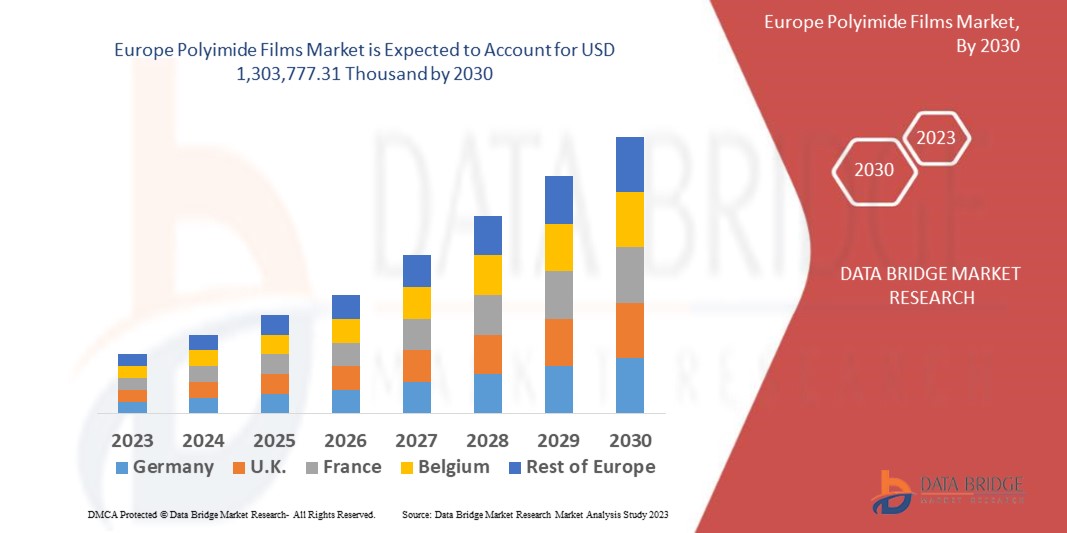

The essential factors contributing to the growth of the Europe polyimide films market in the forecast period of 2023 to 2030 include the rise in the demand of consumer electronics products, increasing demand of electric vehicles and rising usage of polyimide films in aerospace and defense sector.

Data Bridge Market Research analyses that the Europe polyimide films market which was USD 750,143.52 thousand in 2022, is expected to reach USD 1,303,777.31 thousand by 2030, growing at a CAGR of 7.3% during the forecast period of 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Europe Polyimide Films Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD thousand, Volumes in Units, Pricing in USD |

|

Segments Covered |

Raw Materials (Pyromellitic Dianhydride (PMDA), 4,4’-Oxydianiline (ODA), Biphenyl-Tetracarboxylic Acid Dianhydride (BPDA), Phenylenediamine (PDA)), Film Thickness (0.5 mil, 1 mil, 2 mil, 3 mil, 5 mil and Others), Color (Amber, White, Transparent and Others), Distribution Channel (E-Commerce, Specialty Stores and Others), Application (Flexible Printed Circuits, Specialty Fabricated Products, Pressure Sensitive Tapes, Wires and Cables, Motors/Generators, Insulation Blankets, Insulation Tubing, Etching, Lithium-Ion Battery Cell/Pouch Wrap, Ceramic Board Replacement, Thermally Conductive Flex Circuits, Shims and Others), End-User (Electronics, Automotive, Aerospace, Solar, Medical, Mining and Drillings, Building and Construction, Labelling, Chemical Processing, Plastics and Packaging, Industrial, Energy and Others) |

|

Countries Covered |

Germany, U.K., Italy, France, Spain, Switzerland, Russia, Turkey, Belgium, Netherlands, Rest of Europe |

|

Market Players Covered |

DuPont de Nemours, Inc. (U.S.), Saint-Gobain (France), UBE Industries, Ltd. (Japan), Kaneka Corporation (Japan), SKC Kolon PI, Inc.(South Korea), CEN Electronic Material Co., Ltd. (China), FLEXcon Company, Inc. (U.S.), Dunmore Corporation (U.S.), L&L Products, Inc. (U.S.), Shinmax Technology Ltd. (China), Everbrighten Technologies (China), Jiangsu Yabao Insulation Material Inc. (China), Taimide Tech. Inc. (Taiwan), SABIC (Saudi Arabia), Changchun Group (China), among others |

|

Market Opportunities |

|

Market Definition

Polyimide films are the films that are made by polymers of polyimide which is a dielectric material. The polyimide films are used in many end uses such as aerospace, chemical processing, oil and gas, energy, solar, medical and among others. They are basically used maximum in electronics and automotive industry due to the high properties of polyimide films that are used in various electrical components.

Europe Polyimide Films Market Dynamics

Drivers

- Rise in the Demand of Consumer Electronics Products

The electronics and electrical industry is a significant driver of the polyimide films market. These films are used in flexible printed circuit boards (FPCBs), wire and cable insulation, and various electronic components. As electronic devices become smaller and more complex, there is a growing need for thinner and more heat resistant materials, making polyimide films essential

With the rapid advancements in consumer electronics, polyimide films are used in applications such as flexible displays, wearable devices, and smartphones. These films enable the development of thinner, lighter, and more flexible electronic products

- Increasing Use of Polyimide Films in Aerospace and Defense Sector

The aerospace and defense sectors demand polyimide films due to their exceptional performance at high temperatures and in harsh environments. These films are used in aircraft components, sensors, insulation for wiring, and thermal shielding applications. The increasing aerospace and defense expenditures worldwide are boosting the demand for polyimide films

Opportunities

- Increasing Demand of Electric Vehicles

In the automotive sector, polyimide films are used for applications such as wire harnesses, sensors, and thermal barriers in exhaust systems. The automotive industry's focus on lightweight materials, improved fuel efficiency, and the electrification of vehicles is driving the use of polyimide films

- Expansion of Healthcare Sector

Polyimide films are used in medical devices such as catheters, probes, and flexible circuits. The medical industry's continuous innovations and demand for biocompatible and sterilizable materials have increased the use of polyimide films. The expansion of healthcare facilities, especially in response to the pandemic, has increased the demand for polyimide films in medical equipment

Restraints/Challenges

- High Manufacturing Costs

Polyimide films are produced through complex and costly processes that involve high-temperature polymerization and specialized equipment. The cost of manufacturing polyimide films is relatively high compared to other polymer films, which can limit their adoption, particularly in cost-sensitive industries

- Limited Supply of Raw Materials

Polyimide films are typically made from polyimide precursors, and the availability of these raw materials can be limited. Any disruptions in the supply chain of these precursors can affect the production of polyimide films and result in price fluctuations

This polyimide films market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the Polyimide films market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth

Recent Development

- In July 2020, TAIFLEX Scientific Co., Ltd signed an agreement with a group of banks in order to get syndicate loan. This will help Taiflex Scientific Co., Ltd in the expansion with rise in revenue and sales value of Taiflex Scientific Co., Ltd

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions. Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Europe Polyimide Films Market Scope

The Europe polyimide films market is segmented on the basis of raw materials, film thickness, color, distribution channel, application and end-user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Raw Materials

- Pyromellitic Dianhydride (PMDA)

- 4,4’-Oxydianiline (ODA)

- Biphenyl-Tetracarboxylic Acid Dianhydride (BPDA)

- Phenylenediamine (PDA)

Film Thickness

- 0.5 mil

- 1 mil

- 2 mil

- 3 mil

- 5 mil

- Others

Color

- Amber

- White

- Transparent

- Others

Distribution Channel

- E-Commerce

- Specialty Stores

- Others

Application

- Flexible Printed Circuits

- Specialty Fabricated Products

- Pressure Sensitive Tapes

- Wires and Cables

- Motors/Generators

- Insulation Blankets

- Insulation Tubing

- Etching

- Lithium-Ion Battery Cell/Pouch Wrap

- Ceramic Board Replacement

- Thermally Conductive Flex Circuits

- Shims

- Others

End-User

- Electronics

- Automotive

- Aerospace

- Solar

- Medical

- Mining and Drillings

- Building and Construction

- Labelling

- Chemical Processing

- Plastics and Packaging

- Industrial

- Energy

- Others

Europe Polyimide Films Market Regional Analysis/Insights

The Europe polyimide films market is analysed and market size insights and trends are provided by raw materials, film thickness, color, distribution channel, application and end-user as referenced above.

The countries covered in the Europe polyimide films market report are Germany, U.K., Italy, France, Spain, Switzerland, Russia, Turkey, Belgium, Netherlands, and Rest of Europe.

Germany is expected to dominate the Europe polyimide films market due to the rising demand for polyimide films from automotive industry.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and up-stream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe Polyimide films Market Share Analysis

The Europe polyimide films market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the company’s focus related to Polyimide films market.

Some of the major players operating in the Europe polyimide films market are:

- DuPont de Nemours, Inc. (U.S.)

- Saint-Gobain (France)

- UBE Industries, Ltd. (Japan)

- Kaneka Corporation (Japan)

- SKC Kolon PI, Inc.(South Korea)

- CEN Electronic Material Co., Ltd. (China)

- FLEXcon Company, Inc. (U.S.)

- Dunmore Corporation (U.S.)

- L&L Products, Inc. (U.S.)

- Shinmax Technology Ltd. (China)

- Everbrighten Technologies (China)

- Jiangsu Yabao Insulation Material Inc. (China)

- Taimide Tech. Inc. (Taiwan)

- SABIC (Saudi Arabia)

- Changchun Group (China)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Polyimide Film Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Polyimide Film Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Polyimide Film Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.