Europe Potassium Sulfate Fertilizers Market

Market Size in USD Million

CAGR :

%

USD

655.50 Million

USD

923.34 Million

2024

2032

USD

655.50 Million

USD

923.34 Million

2024

2032

| 2025 –2032 | |

| USD 655.50 Million | |

| USD 923.34 Million | |

|

|

|

|

Potassium Sulfate Fertilizers Market Size

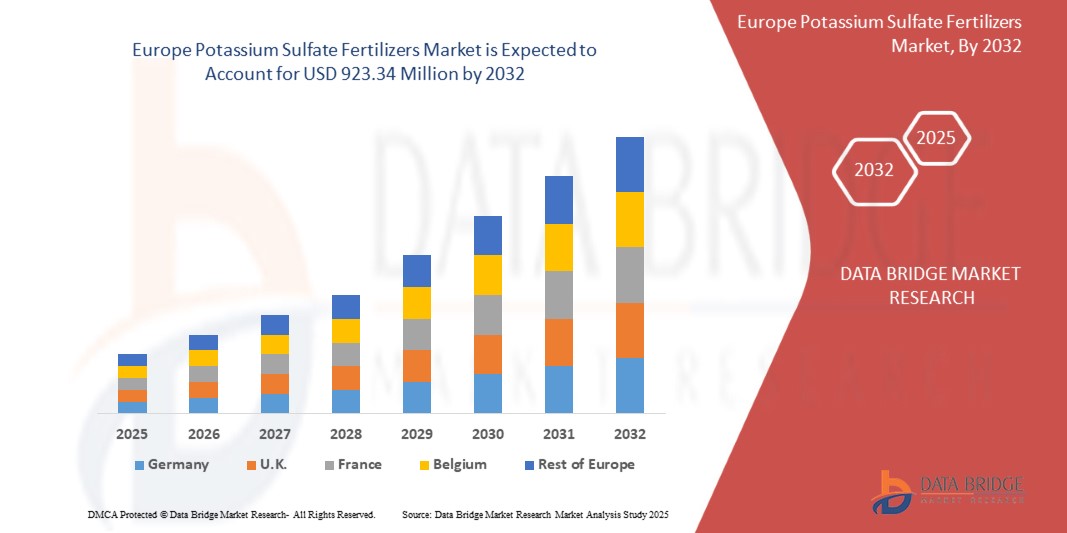

- The Europe potassium sulfate fertilizers market size was valued at USD 655.50 million in 2024 and is expected to reach USD 923.34 million by 2032, at a CAGR of 4.4% during the forecast period

- The market growth is largely fuelled by the rising demand for chloride free fertilizers in high value crop cultivation

- Furthermore, growing shift toward sustainable and organic agriculture worldwide, precision farming adoption boosts need for water soluble nutrient fertilizers are significantly boosting the industry's growth

Potassium Sulphate Fertilizers Market Analysis

- Potassium sulfate fertilizers are gaining prominence due to their vital role in improving crop yield and quality, especially for chloride-sensitive crops such as fruits, vegetables, nuts, and tobacco, where excess chloride can harm growth and reduce market value

- The increasing demand for high-value specialty crops, coupled with rising awareness about balanced nutrient management and the benefits of chloride-free fertilizers, is driving the Europe adoption of potassium sulfate fertilizers

- Germany is expected to dominate the potassium sulfate fertilizers market with the largest revenue share of 16.28% in 2025, driven by expanding high-value crop cultivation, increasing adoption of chloride-free fertilizers, supportive government subsidies, and growing awareness among farmers about improving crop quality and yield sustainably

- Germany is also projected to be the fastest-growing region in the market during the forecast period, driven by population growth, supportive government initiatives to enhance crop productivity, and expanding awareness of chloride-free fertilizers among farmers

- The granular segment is expected to dominate the potassium sulfate fertilizers market with a market share of 61.09% in 2025, owing to its ease of application, longer shelf life, and suitability for a wide range of crops and soil types

Report Scope and Potassium Sulfate Fertilizers Market Segmentation

|

Attributes |

Potassium Sulfate Fertilizers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Potassium Sulfate Fertilizers Market Trends

“Rising Demand for High-Quality Crops and Sustainable Agriculture”

- A major driving force behind the Europe potassium sulfate fertilizers market is the growing demand for high-quality fruits, vegetables, and cash crops, driven by shifting dietary preferences, urbanization, and rising disposable incomes across the globe

- For instance, in March 2025, a report from FAO highlighted that Europe consumption of fruits and vegetables is projected to increase by over 20% by 2030, spurring the need for fertilizers that enhance crop yield, quality, and resilience without harmful chloride content

- Potassium sulfate (SOP) is especially favored in the cultivation of chloride-sensitive crops such as tobacco, potatoes, grapes, and citrus fruits, as it promotes better taste, color, and shelf life while supporting plant resistance to drought and disease

- Additionally, the increasing adoption of sustainable farming practices and precision agriculture techniques in Europe is encouraging farmers to use SOP fertilizers, which have a lower environmental footprint compared to alternatives containing chloride or excessive nitrogen

- In January 2025, a UN Environment Programme study emphasized the critical role of balanced fertilization, including potassium sulfate, in achieving Sustainable Development Goals (SDGs) related to food security, soil health, and climate resilience

Potassium Sulfate Fertilizers Market Dynamics

Driver

“Rising Demand for Chloride Free Fertilizers in High Value Crop Cultivation”

- The shift toward high-value horticultural crops such as fruits, vegetables, nuts, and tobacco is fueling the need for specialized, crop-friendly nutrients that do not compromise soil health or yield quality

- Among these, potassium sulfate (K₂SO₄) has gained strong traction due to its chloride-free nature, making it ideal for chloride-sensitive crops that are prone to yield and quality degradation when exposed to excess chloride ions

- For instance, in January 2025, American Society for Horticultural Science published an article that states, controlled-environment trials in vertical farms showed that increasing potassium concentration to 300–450 mg·L⁻¹ significantly improved leaf area, fruit yield, size, and quality of strawberries—highlighting the critical need for precise, chloride-free potassium sources in high-value systems

- Excessive chloride in soil has been linked to reduced sugar content in fruits, leaf burn in sensitive crops like strawberries and citrus, and deterioration of tobacco leaf texture. Unlike muriate of potash (KCl), which contains up to 47% chloride, potassium sulfate offers the dual benefit of supplying both potassium and sulfur—essential nutrients—without the risk of chloride toxicity

- As high-value crop cultivation continues to expand in Europe, the demand for chloride-free nutrient solutions, such as potassium sulfate, is accelerating. Its compatibility with sensitive crops, superior agronomic performance, and alignment with sustainable farming practices are collectively reinforcing its role as a preferred fertilizer choice, thereby driving significant growth in the Europe potassium sulfate fertilizers market

Restraint/Challenge

“High Production Costs Limit Affordability for Small-Scale Farmers”

- The production of potassium sulfate (K₂SO₄) involves energy-intensive and costly processes such as the Mannheim process or complex natural extraction methods from minerals like kainite and schoenite

- These methods require high-temperature reactions and the handling of corrosive materials, such as sulfuric acid, resulting in elevated capital and operational expenses compared to conventional potassium chloride (KCl) fertilizers

- For instance, In March 2023, a Reuters report highlighted that during the 2022–2023 season, Zimbabwean farmers faced a nearly 30% surge in fertilizer prices, raising the price of a 50 kg bag from approximately USD 35 to approximately USD 45, forcing smallholders to reduce their usage or switch to homemade compost. Many were unable to afford the more expensive K₂SO₄, curbing its adoption among price-sensitive growers

- The elevated production and distribution costs of potassium sulfate significantly restrict its accessibility for small-scale and cost-sensitive farmers. This limits broader adoption, particularly in regions where affordability is a key factor in fertilizer selection

Potassium sulfate fertilizers market Scope

The market is segmented into three notable segments based on form, crop type, and end user.

- By Form

On the basis of form, the market is segmented into granular, powdered, and liquid. In 2025, the granular segment is expected to dominate the market due to its ease of application, better handling and storage properties, and widespread suitability for large-scale agricultural practices across diverse crop types.

The granular segment is anticipated to witness the fastest growth rate of 4.5% from 2025 to 2032, fueled by its ease of application, uniform nutrient distribution, cost-effectiveness for large-scale farming, and rising preference among growers for efficient nutrient management..

- By Crop Type

On the basis of crop type, the market is segmented into fruits, vegetables, cereals & grains, oilseeds, pulses, and turf & ornamentals. In 2025, the fruits segment is expected to dominate the market due to the high demand for potassium sulfate in fruit cultivation, as it enhances fruit quality, improves shelf life, and supports optimal yield without adding excess chloride harmful to sensitive crops.

The fruits segment is expected to witness the fastest CAGR from 2025 to 2032, driven by rising consumer demand for premium-quality produce, increasing export-oriented cultivation, and the need for chloride-free fertilizers to enhance taste, color, and shelf life.

- By End User

On the basis of end user, the market is segmented into commercial farming, horticulture, greenhouse, and household. In 2025, the commercial farming segment is expected to dominate the market due to its critical role in large-scale crop production, where potassium sulfate delivers essential potassium and sulfur nutrients efficiently, catering to the rising Europe food demand and sustainable agricultural practices.

The commercial farming segment is expected to witness the fastest CAGR from 2025 to 2032, favored for its large-scale adoption of specialty fertilizers to maximize yield, improve crop quality, and meet growing demand for high-value produce.

Potassium Sulfate Fertilizers Market Regional Analysis

- Germany is expected to dominates the potassium sulfate fertilizers market with the largest revenue share of 16.28% and is projected to grow at the fastest CAGR of 6.2% in 2025, driven by expanding high-value crop cultivation, increasing adoption of chloride-free fertilizers, supportive government subsidies, and growing awareness among farmers about improving crop quality and yield sustainably

- The region’s strong regulatory framework, targeted agricultural development programs, and presence of major market players such as K+S Kali GmbH, Compass Minerals, and Yara International contribute to leadership in potassium sulfate fertilizer production and distribution

- Major economies such as Germany, France, and U.K. are investing heavily in modernizing agricultural practices, promoting balanced fertilization, and improving access to high-quality fertilizers to boost productivity in horticulture and cash crops

Europe Potassium Sulfate Fertilizers Market Insight

Europe held a substantial share of the Europe potassium sulfate fertilizers market in 2025, propelled by stringent environmental regulations, widespread use of precision agriculture technologies, and strong demand for high-quality horticultural produce. EU policies promoting sustainable fertilizer use and organic farming practices are supporting continued market growth.

France Potassium Sulfate Fertilizers Market Insight

France is experiencing steady market growth due to expanding fruit and vegetable production, focus on improving crop yields sustainably, and rising preference for chloride-free fertilizers in viticulture and horticulture. Collaboration between cooperatives and Europe suppliers is strengthening potassium sulfate adoption across key agricultural regions.

Potassium Sulfate Fertilizers Market Share

The potassium sulfate fertilizers industry is primarily led by well-established companies, including:

- Yara (Norway)

- K+S Aktiengesellschaft (Germany)

- ICL (Israel)

- Ameropa AG (Switzerland)

- SQM S.A. (Chile)

- Haifa Negev Technologies LTD (Israel)

- Hebei Sanyuanjiuqi Fertilizer Co., Ltd. (China)

- Utkarsh Agrochem (India)

Latest Developments in Potassium Sulfate Fertilizers Market

- In November 2024, Petrobras and Yara have signed two agreements in a next step towards structuring a potential partnership within fertilizers and industrial products, both based on resumed production in Araucaria Nitrogenados S.A. (ANSA), a wholly-owned subsidiary of Petrobas

- In October 2024, the management of Yara Tertre has informed workers representatives of Yara’s intention to transform the site. The proposed transformation would entail closure of the ammonia unit and shifting production towards the site’s most competitive products, premium nitrate fertilizers and industrial nitrogen chemicals

- In July 2024, Yara and ATOME PLC, a leading developer of international green fertilizer projects, sign Heads of Terms for offtake from ATOME’s renewable CAN project in Villeta, Paraguay. The Heads of Terms covers the long-term supply of all of the Calcium Ammonium Nitrate from ATOME’s renewable production facility in Villeta, Paraguay

- In July 2024, PepsiCo Europe and Yara announced today a long-term partnership in Europe aimed at providing farmers with crop nutrition programs to help decarbonize the food value chain. As part of the partnership, which spans multiple countries, participating PepsiCo Europe farmers will be equipped with best-in-class crop nutrition products and advice as well as precision farming digital tools

- In January 2025, K+S Aktiengesellschaft introduced its C:LIGHT line potassium and magnesium fertilizers produced using power-to-heat (PtH) tech, enabling up to 90% lower CO₂ footprint compared to traditional products. Up to 90% lower CO₂ emissions gives K+S a significant first-mover advantage in green fertilizer production. It improves their ESG (Environmental, Social, Governance) scores, making them more attractive to sustainability-focused investors and partners

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCE MODEL

4.2 SUPPLY CHAIN ANALYSIS

4.2.1 RAW MATERIAL SOURCING

4.2.2 PRODUCTION AND MANUFACTURING

4.2.3 STORAGE AND PACKAGING

4.2.4 DISTRIBUTION AND LOGISTICS

4.2.5 RETAIL AND END USERS

4.2.6 REGULATORY AND SUSTAINABILITY FACTORS

4.2.7 CONCLUSION

4.3 PRODUCTION CONSUMPTION ANALYSIS

4.4 SWOT ANALYSIS:

4.5 PRICING ANALYSIS

4.6 COMPANY EVALUATION QUADRANT

4.6.1 MARGIN RANGE BY PRODUCT TYPE

4.6.2 DOMINANT PLAYERS

4.6.3 EMERGING PLAYERS

4.6.4 PARTICIPANTS

4.7 CONSUMER BUYING BEHAVIOUR

4.7.1 FUNCTIONAL AND CROP-SPECIFIC DEMAND

4.7.2 PRICE SENSITIVITY AND ECONOMIC CONSTRAINTS

4.7.3 INFLUENCE OF EDUCATION AND AWARENESS

4.7.4 DISTRIBUTION CHANNELS AND BRAND LOYALTY

4.7.5 CONCLUSION

4.8 COST ANALYSIS BREAKDOWN

4.8.1 RAW MATERIALS

4.8.2 ENERGY CONSUMPTION

4.8.3 LABOR AND OPERATIONAL COSTS

4.8.4 RESEARCH AND DEVELOPMENT

4.9 FACTORS INFLUENCING BUYING DECISION OF END USERS IN THE EUROPE POTASSIUM SULFATE FERTILIZER MARKET

4.9.1 CROP-SPECIFIC NUTRITIONAL NEEDS

4.9.2 NUTRIENT QUALITY AND PRODUCT CONSISTENCY

4.9.3 AGRONOMIC ADVISORY AND PEER INFLUENCE

4.9.4 PRICE SENSITIVITY AND AFFORDABILITY

4.9.5 SUPPLIER REPUTATION AND REGIONAL AVAILABILITY

4.9.6 PACKAGING, TRANSPORTATION, AND HANDLING

4.9.7 ENVIRONMENTAL REGULATIONS AND SUSTAINABILITY GOALS

4.9.8 MARKETING, EDUCATION, AND EXTENSION SERVICES

4.9.9 CONCLUSION

4.1 IMPACT OF ECONOMIC SLOWDOWN ON THE EUROPE POTASSIUM SULFATE FERTILIZERS MARKET

4.11 INDUSTRY ECOSYSTEM ANALYSIS OF THE EUROPE POTASSIUM SULFATE FERTILIZERS MARKET

4.12 INNOVATION TRACKER AND STRATEGIC ANALYSIS–

4.12.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.12.1.1 JOINT VENTURES

4.12.1.2 MERGERS AND ACQUISITIONS

4.12.1.3 LICENSING AND PARTNERSHIP

4.12.1.4 TECHNOLOGY COLLABORATIONS

4.12.1.5 STRATEGIC DIVESTMENTS

4.12.1.6 NUMBER OF PRODUCTS IN DEVELOPMENT

4.12.2 STAGE OF DEVELOPMENT

4.12.3 INNOVATION STRATEGIES AND METHODOLOGIES

4.12.4 RISK ASSESSMENT AND MITIGATION

4.12.5 FUTURE OUTLOOK

4.13 PATENT ANALYSIS

4.13.1 PATENT QUALITY AND STRENGTH

4.13.2 PATENT FAMILIES

4.13.3 LICENSING AND COLLABORATIONS

4.13.4 COMPANY PATENT LANDSCAPE

4.13.5 REGION PATENT LANDSCAPE

4.13.6 IP STRATEGY AND MANAGEMENT

4.13.7 SUMMARY OF PATENT TRENDS AND INSIGHTS

4.14 PRODUCT ADOPTION SCENARIO

4.14.1 OVERVIEW

4.14.2 PRODUCT AWARENESS

4.14.3 PRODUCT INTEREST

4.14.4 PRODUCT EVALUATION

4.14.5 PRODUCT TRIAL

4.14.6 PRODUCT ADOPTION

4.14.7 CONCLUSION

4.15 PRODUCTION CAPACITY OUTLOOK

4.15.1 CAPACITY EXPANSION AND MODERNIZATION

4.15.2 STRATEGIC RESOURCE UTILIZATION

4.15.3 SUSTAINABILITY AND REGULATORY COMPLIANCE

4.15.4 AUTOMATION AND PROCESS OPTIMIZATION

4.15.5 STRATEGIC PARTNERSHIPS AND EUROPE EXPANSION

4.15.6 CONCLUSION

4.16 PROFIT MARGINS SCENARIO

4.16.1 MARGIN RANGE BY PRODUCT TYPE

4.16.2 KEY FACTORS INFLUENCING MARGINS

4.16.3 DOMESTIC VS. EXPORT MARKET MARGINS

4.17 RAW MATERIAL SOURCING ANALYSIS

4.17.1 POTASSIUM CHLORIDE (MOP)

4.17.2 SULFURIC ACID

4.17.3 LANGBEINITE / SULFATE MINERALS

4.17.4 BRINE SOURCES / SALT LAKE DEPOSITS

4.18 TARIFFS AND THEIR IMPACT ON THE MARKET

4.18.1 CURRENT TARIFF RATES IN TOP-5 COUNTRY MARKETS

4.18.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

4.18.3 VENDOR SELECTION CRITERIA DYNAMICS

4.19 IMPACT ON SUPPLY CHAIN

4.19.1 RAW MATERIAL PROCUREMENT

4.19.2 MANUFACTURING AND VALUE ADDITION

4.19.3 LOGISTICS AND DISTRIBUTION

4.19.4 PRICE PITCHING AND POSITION OF MARKET

4.2 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.20.1 SUPPLY CHAIN REALIGNMENT

4.20.2 LOCAL PROCESSING INITIATIVES

4.21 REGULATORY INCLINATION

4.21.1 FTA-DRIVEN TARIFF RELIEF

4.21.2 INDUSTRIAL INCENTIVES

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND FOR CHLORIDE FREE FERTILIZERS IN HIGH VALUE CROP CULTIVATION

6.1.2 GROWING SHIFT TOWARD SUSTAINABLE AND ORGANIC AGRICULTURE WORLDWIDE

6.1.3 PRECISION FARMING ADOPTION BOOSTS NEED FOR WATER SOLUBLE NUTRIENT FERTILIZERS

6.1.4 GOVERNMENT SUBSIDIES AND INITIATIVES SUPPORT SPECIALTY FERTILIZER USAGE

6.2 RESTRAINTS

6.2.1 HIGH PRODUCTION COSTS LIMIT AFFORDABILITY FOR SMALL-SCALE FARMERS

6.2.2 LIMITED AVAILABILITY OF NATURAL RESOURCES FOR POTASSIUM EXTRACTION

6.3 OPPORTUNITIES

6.3.1 RISING ADOPTION OF POTASSIUM SULFATE IN HYDROPONIC FARMING SYSTEMS

6.3.2 DIGITAL AGRICULTURE PLATFORMS AND E-COMMERCE DISTRIBUTION

6.3.3 DEVELOPMENT OF ENVIRONMENTALLY FRIENDLY, SLOW-RELEASE POTASSIUM FERTILIZER SOLUTIONS

6.4 CHALLENGES

6.4.1 COMPLEX PRODUCTION PROCESS RESTRICTS LARGE-SCALE MANUFACTURING CAPABILITY

6.4.2 VOLATILE RAW MATERIAL PRICES IMPACT PROFIT MARGINS AND SUPPLY

7 EUROPE POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM

7.1 OVERVIEW

7.2 GRANULAR

7.3 POWDERED

7.4 LIQUID

8 EUROPE POTASSIUM SULFATE FERTILIZERS MARKET, BY CROP TYPE

8.1 OVERVIEW

8.2 FRUITS

8.3 VEGETABLES

8.4 CEREALS & GRAINS

8.5 OILSEEDS

8.6 PULSES

8.7 TURF & ORNAMENTALS

9 EUROPE POTASSIUM SULFATE FERTILIZERS MARKET, BY END USER

9.1 OVERVIEW

9.2 COMMERCIAL FARMING

9.3 HORTICULTURE

9.4 GREENHOUSE

9.5 HOUSEHOLD

10 EUROPE POTASSIUM SULFATE FERTILIZERS MARKET, BY REGION

10.1 EUROPE

10.1.1 GERMANY

10.1.2 FRANCE

10.1.3 U.K

10.1.4 RUSSIA

10.1.5 ITALY

10.1.6 SPAIN

10.1.7 TURKEY

10.1.8 BELGIUM

10.1.9 POLAND

10.1.10 SWITZERLAND

10.1.11 SWEDEN

10.1.12 DENMARK

10.1.13 NETHERLANDS

10.1.14 NORWAY

10.1.15 REST OF EUROPE

11 EUROPE POTASSIUM SULFATE FERTILIZERS MARKET

11.1 COMPANY SHARE ANALYSIS: EUROPE

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 YARA

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS/NEWS

13.2 K+S AKTIENGESELLSCHAFT

13.2.1 1.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARA ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENT

13.3 ICL

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARA ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS/NEWS

13.4 AMEROPA AG

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARA ANALYSIS

13.4.3 BUSINESS PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 SQM S.A.

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARA ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENT

13.6 HAIFA NEGEV TECHNOLOGIES LTD

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENTS/NEWS

13.7 HEBEI SANYUANJIUQI FERTILIZER CO., LTD.

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 IFFCO

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENTS/NEWS

13.9 KSM INC.

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 UTKARSH AGROCHEM

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENTS/NEWS

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 DEVELOPMENT STAGE OF COMPANIES

TABLE 2 RISK ASSESSMENT AND MITIGATION

TABLE 3 REGULATORY COVERAGE

TABLE 4 YEAR-WISE DETAILS OF FUNDS RELEASED UNDER PARAMPARAGAT KRISHI VIKAS YOJANA (PKVY) AND MISSION ORGANIC VALUE CHAIN DEVELOPMENT FOR NORTH EASTERN REGION (MOVCDNER) SCHEME FROM 2021-22 TO 2023-24

TABLE 5 EUROPE POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 6 EUROPE POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (THOUSAND TONS)

TABLE 7 EUROPE GRANULAR IN POTASSIUM SULFATE FERTILIZERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 EUROPE POWDERED IN POTASSIUM SULFATE FERTILIZERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 EUROPE LIQUID IN POTASSIUM SULFATE FERTILIZERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 EUROPE POTASSIUM SULFATE FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 EUROPE FRUITS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 EUROPE FRUITS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 EUROPE CITRUS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 EUROPE VEGETABLES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 EUROPE VEGETABLES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 EUROPE CEREALS & GRAINS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 EUROPE CEREALS & GRAINS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 EUROPE OILSEEDS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 EUROPE OILSEEDS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 EUROPE PULSES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 EUROPE PULSES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 EUROPE PEAS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 EUROPE TURF & ORNAMENTALS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 EUROPE POTASSIUM SULFATE FERTILIZERS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 25 EUROPE COMMERCIAL FARMING IN POTASSIUM SULFATE FERTILIZERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 EUROPE HORTICULTURE IN POTASSIUM SULFATE FERTILIZERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 EUROPE GREENHOUSE IN POTASSIUM SULFATE FERTILIZERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 EUROPE HOUSEHOLD IN POTASSIUM SULFATE FERTILIZERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 EUROPE POTASSIUM SULFATE FERTILIZERS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 30 EUROPE POTASSIUM SULFATE FERTILIZERS MARKET, BY COUNTRY, 2018-2032 (THOUSAND TONS)

TABLE 31 EUROPE POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 32 EUROPE POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (THOUSAND TONS)

TABLE 33 EUROPE POTASSIUM SULFATE FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 EUROPE FRUITS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 EUROPE CITRUS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 EUROPE VEGETABLES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 EUROPE CEREALS & GRAINS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 EUROPE OILSEEDS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 EUROPE PULSES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 EUROPE PEAS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 EUROPE POTASSIUM SULFATE FERTILIZERS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 42 GERMANY POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 43 GERMANY POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (THOUSAND TONS)

TABLE 44 GERMANY POTASSIUM SULFATE FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 GERMANY FRUITS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 GERMANY CITRUS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 GERMANY VEGETABLES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 GERMANY CEREALS & GRAINS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 GERMANY OILSEEDS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 GERMANY PULSES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 GERMANY PEAS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 GERMANY POTASSIUM SULFATE FERTILIZERS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 53 FRANCE POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 54 FRANCE POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (THOUSAND TONS)

TABLE 55 FRANCE POTASSIUM SULFATE FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 FRANCE FRUITS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 FRANCE CITRUS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 FRANCE VEGETABLES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 FRANCE CEREALS & GRAINS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 FRANCE OILSEEDS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 FRANCE PULSES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 FRANCE PEAS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 FRANCE POTASSIUM SULFATE FERTILIZERS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 64 U.K. POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 65 U.K. POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (THOUSAND TONS)

TABLE 66 U.K. POTASSIUM SULFATE FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 U.K. FRUITS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 U.K. CITRUS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 U.K. VEGETABLES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 U.K. CEREALS & GRAINS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 U.K. OILSEEDS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 U.K. PULSES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 U.K. PEAS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 U.K. POTASSIUM SULFATE FERTILIZERS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 75 RUSSIA POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 76 RUSSIA POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (THOUSAND TONS)

TABLE 77 RUSSIA POTASSIUM SULFATE FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 RUSSIA FRUITS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 RUSSIA CITRUS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 RUSSIA VEGETABLES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 RUSSIA CEREALS & GRAINS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 RUSSIA OILSEEDS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 RUSSIA PULSES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 RUSSIA PEAS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 RUSSIA POTASSIUM SULFATE FERTILIZERS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 86 ITALY POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 87 ITALY POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (THOUSAND TONS)

TABLE 88 ITALY POTASSIUM SULFATE FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 ITALY FRUITS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 ITALY CITRUS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 ITALY VEGETABLES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 ITALY CEREALS & GRAINS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 ITALY OILSEEDS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 ITALY PULSES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 ITALY PEAS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 ITALY POTASSIUM SULFATE FERTILIZERS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 97 SPAIN POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 98 SPAIN POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (THOUSAND TONS)

TABLE 99 SPAIN POTASSIUM SULFATE FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 SPAIN FRUITS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 SPAIN CITRUS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 SPAIN VEGETABLES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 SPAIN CEREALS & GRAINS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 SPAIN OILSEEDS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 SPAIN PULSES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 SPAIN PEAS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 SPAIN POTASSIUM SULFATE FERTILIZERS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 108 TURKEY POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 109 TURKEY POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (THOUSAND TONS)

TABLE 110 TURKEY POTASSIUM SULFATE FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 TURKEY FRUITS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 TURKEY CITRUS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 TURKEY VEGETABLES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 TURKEY CEREALS & GRAINS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 TURKEY OILSEEDS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 TURKEY PULSES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 TURKEY PEAS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 TURKEY POTASSIUM SULFATE FERTILIZERS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 119 BELGIUM POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 120 BELGIUM POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (THOUSAND TONS)

TABLE 121 BELGIUM POTASSIUM SULFATE FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 BELGIUM FRUITS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 BELGIUM CITRUS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 BELGIUM VEGETABLES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 BELGIUM CEREALS & GRAINS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 BELGIUM OILSEEDS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 BELGIUM PULSES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 BELGIUM PEAS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 BELGIUM POTASSIUM SULFATE FERTILIZERS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 130 POLAND POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 131 POLAND POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (THOUSAND TONS)

TABLE 132 POLAND POTASSIUM SULFATE FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 POLAND FRUITS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 POLAND CITRUS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 POLAND VEGETABLES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 POLAND CEREALS & GRAINS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 POLAND OILSEEDS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 POLAND PULSES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 POLAND PEAS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 POLAND POTASSIUM SULFATE FERTILIZERS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 141 SWITZERLAND POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 142 SWITZERLAND POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (THOUSAND TONS)

TABLE 143 SWITZERLAND POTASSIUM SULFATE FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 SWITZERLAND FRUITS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 SWITZERLAND CITRUS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 SWITZERLAND VEGETABLES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 SWITZERLAND CEREALS & GRAINS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 SWITZERLAND OILSEEDS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 SWITZERLAND PULSES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 SWITZERLAND PEAS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 SWITZERLAND POTASSIUM SULFATE FERTILIZERS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 152 SWEDEN POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 153 SWEDEN POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (THOUSAND TONS)

TABLE 154 SWEDEN POTASSIUM SULFATE FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 SWEDEN FRUITS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 SWEDEN CITRUS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 SWEDEN VEGETABLES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 SWEDEN CEREALS & GRAINS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 SWEDEN OILSEEDS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 SWEDEN PULSES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 SWEDEN PEAS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 SWEDEN POTASSIUM SULFATE FERTILIZERS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 163 DENMARK POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 164 DENMARK POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (THOUSAND TONS)

TABLE 165 DENMARK POTASSIUM SULFATE FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 DENMARK FRUITS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 DENMARK CITRUS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 DENMARK VEGETABLES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 DENMARK CEREALS & GRAINS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 DENMARK OILSEEDS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 DENMARK PULSES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 DENMARK PEAS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 DENMARK POTASSIUM SULFATE FERTILIZERS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 174 NETHERLANDS POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 175 NETHERLANDS POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (THOUSAND TONS)

TABLE 176 NETHERLANDS POTASSIUM SULFATE FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 NETHERLANDS FRUITS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 NETHERLANDS CITRUS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 NETHERLANDS VEGETABLES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 NETHERLANDS CEREALS & GRAINS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 NETHERLANDS OILSEEDS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 NETHERLANDS PULSES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 NETHERLANDS PEAS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 NETHERLANDS POTASSIUM SULFATE FERTILIZERS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 185 NORWAY POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 186 NORWAY POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (THOUSAND TONS)

TABLE 187 NORWAY POTASSIUM SULFATE FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 NORWAY FRUITS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 NORWAY CITRUS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 NORWAY VEGETABLES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 NORWAY CEREALS & GRAINS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 NORWAY OILSEEDS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 NORWAY PULSES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 NORWAY PEAS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 NORWAY POTASSIUM SULFATE FERTILIZERS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 196 REST OF EUROPE POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 197 REST OF EUROPE POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (THOUSAND TONS)

List of Figure

FIGURE 1 EUROPE POTASSIUM SULFATE FERTILIZERS MARKET

FIGURE 2 EUROPE POTASSIUM SULFATE FERTILIZERS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE POTASSIUM SULFATE FERTILIZERS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE POTASSIUM SULFATE FERTILIZERS MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE POTASSIUM SULFATE FERTILIZERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE POTASSIUM SULFATE FERTILIZERS MARKET: MULTIVARIATE MODELLING

FIGURE 7 EUROPE POTASSIUM SULFATE FERTILIZERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE POTASSIUM SULFATE FERTILIZERS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE POTASSIUM SULFATE FERTILIZERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE POTASSIUM SULFATE FERTILIZERS MARKET: MARKET END USER COVERAGE GRID

FIGURE 11 EUROPE POTASSIUM SULFATE FERTILIZERS MARKET: SEGMENTATION

FIGURE 12 EUROPE POTASSIUM SULFATE FERTILIZERS MARKET: EXECUTIVE SUMMARY

FIGURE 13 THREE SEGMENTS COMPRISE THE EUROPE POTASSIUM SULFATE FERTILIZERS MARKET: BY FORM

FIGURE 14 EUROPE POTASSIUM SULFATE FERTILIZERS MARKET: STRATEGIC DECISIONS

FIGURE 15 RISING DEMAND FOR CHLORIDE FREE FERTILIZERS IN HIGH VALUE CROP CULTIVATION IS EXPECTED TO DRIVE THE EUROPE POTASSIUM SULFATE FERTILIZERS MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 16 THE GRANULAR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE POTASSIUM SULFATE FERTILIZERS MARKET IN 2025 AND 2032

FIGURE 17 PORTER’S FIVE FORCES

FIGURE 18 PRODUCTION CONSUMPTION ANALYSIS: EUROPE POTASSIUM SULFATE FERTILIZER MARKET

FIGURE 19 EUROPE POTASSIUM SULFATE FERTILIZERS MARKET, 2025-2032, AVERAGE SELLING PRICE (USD/KG)

FIGURE 20 NUMBER OF PATENT VS PUBLISHING YEARS

FIGURE 21 NUMBER OF PATENTS BY APPLICANTS

FIGURE 22 NUMBER OF PATENTS BY COUNTRY

FIGURE 23 PRODUCT ADOPTION SCENARIO

FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES FOR THE EUROPE POTASSIUM SULFATE FERTILIZERS MARKET

FIGURE 25 ORGANIC FARMING BY COUNTRY (2025)

FIGURE 26 AGRITECH COMPANIES RECEIVED INVESTMENTS (2000-2021)

FIGURE 27 LEVEL OF INVESTMENT (PAST 5 YEARS)

FIGURE 28 EUROPE POTASSIUM SULFATE FERTILIZERS MARKET: BY FORM, 2024

FIGURE 29 EUROPE POTASSIUM SULFATE FERTILIZERS MARKET: BY CROP TYPE, 2024

FIGURE 30 EUROPE POTASSIUM SULFATE FERTILIZERS MARKET: BY END USER, 2024

FIGURE 31 EUROPE POTASSIUM SULFATE FERTILIZERS MARKET: SNAPSHOT (2024)

FIGURE 32 EUROPE POTASSIUM SULFATE FERTILIZERS MARKET: COMPANY SHARE 2024 (%)

Europe Potassium Sulfate Fertilizers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Potassium Sulfate Fertilizers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Potassium Sulfate Fertilizers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.