Europe Radiopharmaceuticals Market

Market Size in USD Billion

CAGR :

%

USD

2.47 Billion

USD

3.91 Billion

2024

2032

USD

2.47 Billion

USD

3.91 Billion

2024

2032

| 2025 –2032 | |

| USD 2.47 Billion | |

| USD 3.91 Billion | |

|

|

|

|

Europe Radiopharmaceuticals Market Size

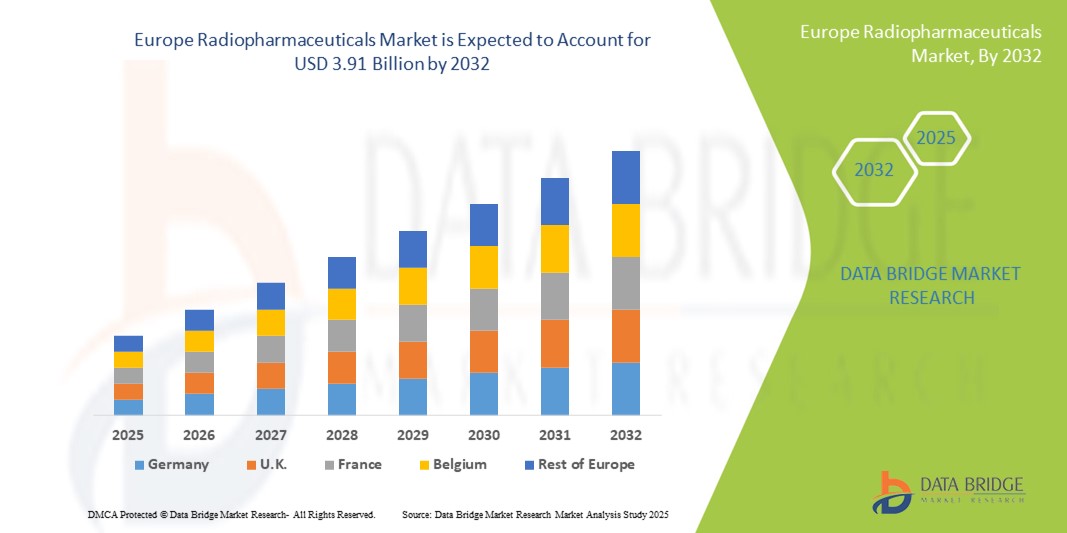

- The Europe radiopharmaceuticals market size was valued at USD 2.47 billion in 2024 and is expected to reach USD 3.91 billion by 2032, at a CAGR of 5.9% during the forecast period

- The market growth is largely fueled by the rising prevalence of cancer, cardiovascular, and neurological disorders, coupled with advancements in nuclear imaging technologies that enhance diagnostic accuracy and therapeutic outcomes

- Furthermore, increasing adoption of targeted radiotherapy, supportive government initiatives for nuclear medicine infrastructure, and growing investments in R&D are positioning radiopharmaceuticals as a critical tool in precision medicine. These converging factors are accelerating the adoption of radiopharmaceutical solutions, thereby significantly boosting the industry’s growth

Europe Radiopharmaceuticals Market Analysis

- Radiopharmaceuticals, used for both diagnostic imaging and targeted therapy, are becoming increasingly vital in Europe’s healthcare landscape due to their ability to deliver precise disease detection and effective treatment across oncology, cardiology, and neurology

- The escalating demand for radiopharmaceuticals is primarily fueled by the rising incidence of chronic diseases, growing preference for non-invasive diagnostic techniques, and the increasing integration of nuclear medicine into precision healthcare

- Germany dominated the Europe radiopharmaceuticals market with the largest revenue share of 32.9% in 2024, supported by strong healthcare infrastructure, advanced research facilities, and significant government investments in nuclear medicine, while France and the U.K. also experienced notable growth with rising clinical adoption of PET and SPECT imaging

- Poland is expected to be the fastest growing country in the Europe radiopharmaceuticals market during the forecast period due to expanding healthcare access, supportive regulatory frameworks, and investments in modern diagnostic infrastructure

- Diagnostic radiopharmaceuticals segment dominated the Europe radiopharmaceuticals market with a share of 61.7% in 2024, reflecting the growing demand for advanced nuclear imaging procedures in hospitals across Europe

Report Scope and Europe Radiopharmaceuticals Market Segmentation

|

Attributes |

Europe Radiopharmaceuticals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Radiopharmaceuticals Market Trends

Advancements in Targeted Diagnostics and Therapy

- A significant and accelerating trend in the Europe radiopharmaceuticals market is the increasing adoption of targeted diagnostic and therapeutic agents, enabling more precise disease detection and personalized treatment strategies

- For Instance, Lutathera, a radiolabeled peptide, allows targeted therapy for neuroendocrine tumors, reducing off-target effects and improving patient outcomes in specialized clinical settings

- Integration of advanced imaging technologies, such as PET/CT and SPECT/CT, with radiopharmaceuticals enables real-time tracking of disease progression and therapy response, enhancing treatment efficacy and clinical decision-making

- The combination of diagnostics and therapy, known as theranostics, is fostering seamless care pathways, allowing healthcare providers to use the same radiopharmaceutical for both disease detection and treatment monitoring, streamlining patient management

- This trend toward precision medicine and theranostic applications is reshaping expectations for clinical outcomes, prompting companies such as Advanced Accelerator Applications to develop novel radiopharmaceuticals with improved targeting, safety, and efficacy

- The demand for radiopharmaceuticals offering highly specific, effective, and minimally invasive diagnostic and therapeutic options is growing rapidly across hospitals and cancer research institutes in Europe

Europe Radiopharmaceuticals Market Dynamics

Driver

Increasing Demand Due to Rising Prevalence of Chronic Diseases and Precision Healthcare

- The growing incidence of cancer, cardiovascular, and neurological disorders, coupled with the shift toward precision healthcare, is a significant driver of Europe radiopharmaceuticals market growth

- For Instance, in March 2024, Curium announced the launch of a new PET imaging agent for early-stage Alzheimer’s disease diagnosis, reflecting the increasing adoption of specialized radiopharmaceuticals in clinical practice

- As healthcare providers seek more accurate, non-invasive diagnostic options, radiopharmaceuticals provide advanced capabilities for disease detection, staging, and monitoring, offering a compelling advantage over conventional imaging modalities

- Furthermore, government initiatives supporting nuclear medicine infrastructure and R&D investments are enhancing access to radiopharmaceuticals across European countries, driving adoption in hospitals and diagnostic centers

- The convenience of precise imaging, improved therapeutic outcomes, and integration with modern nuclear medicine workflows are key factors propelling the demand for radiopharmaceuticals in both diagnostic and therapeutic applications

Restraint/Challenge

High Production Costs and Regulatory Compliance Hurdles

- The complex production processes, high costs of raw materials, and stringent regulatory requirements for radiopharmaceuticals pose significant challenges to market expansion in Europe

- For Instance, reports of limited cyclotron facilities for producing short-lived isotopes have constrained availability in certain regions, affecting timely supply for hospitals and diagnostic centers

- Ensuring compliance with EU regulations on radiopharmaceutical production, transport, and handling requires substantial investment in quality control and safety measures, which can hinder smaller manufacturers from entering the market

- In addition, the short half-life of many radiopharmaceuticals limits distribution reach, requiring rapid delivery and specialized logistics, which increases operational complexity and costs

- Overcoming these challenges through investments in local isotope production, streamlined regulatory pathways, and collaborative supply networks will be crucial for sustained growth of the Europe radiopharmaceuticals market

Europe Radiopharmaceuticals Market Scope

The market is segmented on the basis of type, application, source, and end user.

- By Type

On the basis of type, the Europe radiopharmaceuticals market is segmented into diagnostic radiopharmaceuticals and therapeutic radiopharmaceuticals. The diagnostic radiopharmaceuticals segment dominated the market with the largest revenue share of 61.7% in 2024, driven by the increasing adoption of advanced imaging procedures such as PET and SPECT scans across hospitals and diagnostic centers. Diagnostic radiopharmaceuticals are preferred for their ability to provide non-invasive, accurate disease detection, particularly in oncology, cardiology, and neurology. The widespread use of these agents in early disease detection, disease staging, and therapy monitoring further supports their market dominance. In addition, hospitals and diagnostic centers are increasingly integrating diagnostic radiopharmaceuticals into routine workflows, enhancing clinical decision-making and treatment planning. Companies are continuously investing in R&D to develop new tracers with improved specificity, safety, and imaging capabilities, reinforcing the segment’s leading position.

The therapeutic radiopharmaceuticals segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rising adoption of targeted radionuclide therapy in oncology. These agents enable precise treatment of tumors while minimizing damage to healthy tissues, making them highly attractive for personalized medicine. The growth is also supported by increasing clinical approvals, expansion of nuclear medicine facilities, and rising awareness among healthcare providers about theranostic approaches. Technological advancements in radiolabeling and isotope delivery are further accelerating adoption. Moreover, therapeutic radiopharmaceuticals are gaining traction in cancer research institutes and specialty treatment centers, driving regional market expansion.

- By Application

On the basis of application, the Europe radiopharmaceuticals market is segmented into diagnostic and therapeutic use. The diagnostic application segment dominated with a revenue share of 60.5% in 2024, attributed to the high demand for accurate, non-invasive imaging techniques for disease detection and progression monitoring. Diagnostic applications benefit from strong adoption across hospitals and diagnostic centers, supported by government healthcare initiatives and rising patient awareness. They are integral to oncology, cardiology, and neurology imaging workflows, enabling early-stage diagnosis and effective treatment planning. The segment is further reinforced by continuous development of new tracers with enhanced sensitivity and specificity. Adoption of PET and SPECT imaging systems in routine clinical practice continues to drive consistent demand for diagnostic radiopharmaceuticals.

The therapeutic application segment is expected to witness the fastest growth during the forecast period due to increasing prevalence of cancer and chronic diseases. Therapeutic radiopharmaceuticals allow targeted therapy with minimal side effects, aligning with precision medicine trends. The segment is gaining popularity in specialized cancer institutes and ambulatory surgical centers for both established and experimental treatments. Increased clinical trials and regulatory approvals for new radiopharmaceutical therapies are also driving adoption. In addition, the rise of theranostics, combining diagnostic and therapeutic applications, is supporting the segment’s rapid growth trajectory.

- By Source

On the basis of source, the Europe radiopharmaceuticals market is segmented into nuclear reactors and cyclotrons. The nuclear reactors segment dominated with a market share of 68.4% in 2024, primarily due to their capability to produce a large volume of high-purity isotopes required for both diagnostic and therapeutic radiopharmaceuticals. Nuclear reactors remain the primary source for commonly used isotopes such as molybdenum-99 and iodine-131, which are essential for clinical imaging and treatment. The established reactor infrastructure in countries such as Germany and France ensures reliable supply for hospitals and diagnostic centers. Long-standing operational experience, regulatory familiarity, and the ability to meet bulk demand reinforce the segment’s dominance.

The cyclotron segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing investments in local isotope production for short-lived tracers used in PET imaging. Cyclotrons enable on-site generation of isotopes, reducing dependency on reactor-based supply chains and transportation challenges. The rise of hospital-based and research center cyclotrons is facilitating faster access to novel tracers, particularly for theranostic applications. Technological advancements and decreasing setup costs are further accelerating cyclotron adoption. Countries such as Poland and Italy are witnessing rapid growth in cyclotron installations, supporting localized production and enhancing clinical availability of radiopharmaceuticals.

- By End User

On the basis of end user, the Europe radiopharmaceuticals market is segmented into hospitals, diagnostic centers, cancer research institutes, ambulatory surgical centers, and others. The hospitals segment dominated with a market share of 55.7% in 2024, owing to the high patient volume and comprehensive diagnostic and therapeutic services offered in hospital settings. Hospitals are primary consumers of both diagnostic and therapeutic radiopharmaceuticals, supported by in-house imaging facilities and nuclear medicine departments. Integration of radiopharmaceuticals into standard care pathways and rising adoption of advanced imaging systems further reinforce the segment’s dominance. Hospitals also benefit from established supply chains and partnerships with radiopharmaceutical manufacturers. Strong R&D collaborations and clinical trials in hospitals enhance the adoption of new tracers, maintaining the segment’s leading position.

The cancer research institutes segment is expected to witness the fastest growth during the forecast period due to increasing investment in experimental and targeted radiopharmaceutical therapies. These institutes focus on developing novel agents, optimizing dosimetry, and advancing theranostic applications, driving early adoption of cutting-edge radiopharmaceuticals. Growth is also supported by collaborations with pharmaceutical companies and government research funding. Rising focus on personalized medicine and experimental clinical trials further accelerates demand in research settings. In addition, specialized infrastructure in research institutes allows for safe handling and application of short-lived isotopes, enhancing segment growth.

Europe Radiopharmaceuticals Market Regional Analysis

- Germany dominated the Europe radiopharmaceuticals market with the largest revenue share of 32.9% in 2024, supported by strong healthcare infrastructure, advanced research facilities, and significant government investments in nuclear medicine, while France and the U.K. also experienced notable growth with rising clinical adoption of PET and SPECT imaging

- Healthcare providers and hospitals in Germany highly value the precision, efficiency, and diagnostic accuracy offered by radiopharmaceuticals in imaging and targeted therapy applications, particularly in oncology, cardiology, and neurology

- This widespread adoption is further supported by significant investments in R&D, well-established supply chains for isotopes, and growing awareness among clinicians of the benefits of nuclear medicine, establishing radiopharmaceuticals as a preferred solution for both diagnostic and therapeutic applications across the country

The Germany Radiopharmaceuticals Market Insight

The Germany radiopharmaceuticals market is expected to expand at a considerable CAGR during the forecast period, fueled by advanced healthcare infrastructure, strong research capabilities, and widespread clinical adoption of nuclear medicine. The country’s hospitals and diagnostic centers prioritize accurate imaging and targeted therapy solutions, driving demand for both diagnostic and therapeutic radiopharmaceuticals. Germany’s focus on innovation, regulatory support, and investments in modern imaging technologies is promoting the adoption of novel radiopharmaceuticals. Integration with advanced PET/SPECT systems and theranostic applications is becoming increasingly prevalent, aligning with local clinical needs and precision medicine initiatives. In addition, partnerships between manufacturers, research institutes, and hospitals facilitate faster introduction of new tracers, supporting sustained market growth. The emphasis on patient safety, treatment efficacy, and efficiency reinforces Germany’s leading position in the European radiopharmaceuticals landscape.

France Radiopharmaceuticals Market Insight

The France radiopharmaceuticals market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing adoption of nuclear imaging techniques and targeted radiotherapy. Growing awareness among physicians and patients about the benefits of radiopharmaceuticals in oncology and cardiology is fueling demand. French healthcare facilities are investing in advanced PET and SPECT systems, facilitating the integration of diagnostic radiopharmaceuticals into routine practice. Government initiatives supporting R&D and reimbursement policies for nuclear medicine are further accelerating market expansion. Research institutes and hospitals are actively collaborating with pharmaceutical companies to develop novel tracers and therapeutic agents. The focus on precision medicine and enhanced patient care continues to drive adoption across both diagnostic and therapeutic applications.

Poland Radiopharmaceuticals Market Insight

The Poland radiopharmaceuticals market is expected to witness the fastest CAGR during the forecast period due to increasing investments in nuclear medicine infrastructure and growing accessibility of advanced diagnostic and therapeutic solutions. Hospitals and cancer research institutes are rapidly adopting PET and SPECT imaging technologies, enhancing disease detection and treatment monitoring. Local cyclotron facilities are expanding production of short-lived isotopes, improving availability of diagnostic and therapeutic radiopharmaceuticals. Government support and funding for healthcare modernization initiatives are further driving adoption. Increasing clinical awareness and training programs for healthcare professionals are accelerating the integration of radiopharmaceuticals into routine workflows. The market is also benefiting from collaborations between local research institutes and international pharmaceutical companies to introduce innovative tracers and targeted therapies.

U.K. Radiopharmaceuticals Market Insight

The U.K. radiopharmaceuticals market is projected to grow at a substantial CAGR, supported by rising cancer incidence and the demand for advanced diagnostic and therapeutic solutions. Hospitals and diagnostic centers in the U.K. are increasingly adopting PET and SPECT imaging systems, while research institutes focus on developing novel radiopharmaceutical therapies. National healthcare policies and government incentives promoting precision medicine are facilitating market expansion. Integration of radiopharmaceuticals with theranostic approaches is gaining momentum, improving treatment efficacy and patient outcomes. Growing clinical awareness and training in nuclear medicine techniques further support adoption. The market is also strengthened by collaborations between U.K.-based research institutions and global pharmaceutical manufacturers for innovative tracer development.

Europe Radiopharmaceuticals Market Share

The Europe radiopharmaceuticals industry is primarily led by well-established companies, including:

- Curium Pharma (U.S.)

- Eczacıbaşı-Monrol (Turkey)

- Isotopia (Israel)

- Telix Pharmaceuticals Limited (Australia)

- AIXIAL (France)

- Advanced Accelerator Applications SA (France)

- Alpha-9 Oncology, Inc. (U.S.)

- Life Molecular Imaging (U.S.)

- Nuclear Medicine Europe (Belgium)

- Eckert & Ziegler (Belgium)

- Telix Pharmaceuticals Limited (Australia)

- GE Healthcare (U.K.)

- Siemens Healthineers AG (Germany)

- Novartis AG (Switzerland)

- Bayer AG (Germany)

- Cardinal Health (U.S.)

- IRE ELiT (Belgium)

- RadioMedic s.r.o. (Czech Republic)

What are the Recent Developments in Europe Radiopharmaceuticals Market?

- In April 2025, the European Medicines Agency (EMA) issued recommendations to address vulnerabilities in the radiopharmaceutical supply chain. The guidance encourages EU member states to map their supply chains, coordinate transport solutions, and include new radiopharmaceuticals in horizon scanning activities to ensure a stable supply

- In February 2025, the 7th Targeted Radiopharmaceuticals Summit EU convened to discuss advancements in the field. The summit focused on accelerating regulatory approvals, clinical progress, and commercialization of targeted radiopharmaceuticals. Key topics included isotope supply, clinical study design, dosimetry, and novel molecular design

- In October 2024, Sanofi announced a EUR 300 million investment to acquire a 16% stake in OranoMed, a subsidiary of the French nuclear fuel company Orano. This partnership focuses on developing targeted radiopharmaceuticals using lead-212 isotopes for neuroendocrine tumors. The collaboration aims to leverage OranoMed's control over the manufacturing chain to address supply challenges in the radiopharmaceutical sector

- In September 2024, Sanofi partnered with OranoMed to develop a radiopharmaceutical using lead-212 isotopes for treating neuroendocrine tumors. This collaboration aims to address supply chain challenges by utilizing OranoMed's integrated manufacturing capabilities, positioning both companies at the forefront of radiopharmaceutical innovation in oncology

- In June 2024, Sanofi invested USD 300 million for a 16% stake in OranoMed, a subsidiary of the French nuclear fuel company Orano. This partnership focuses on developing targeted radiopharmaceuticals using lead-212 isotopes for neuroendocrine tumors. The collaboration aims to leverage OranoMed's control over the manufacturing chain to address supply challenges in the radiopharmaceutical sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.