Europe Resting Electrocardiograph Ecg Market

Market Size in USD Billion

CAGR :

%

USD

1.19 Billion

USD

2.07 Billion

2024

2032

USD

1.19 Billion

USD

2.07 Billion

2024

2032

| 2025 –2032 | |

| USD 1.19 Billion | |

| USD 2.07 Billion | |

|

|

|

|

Europe Resting Electrocardiograph (ECG) Market Size

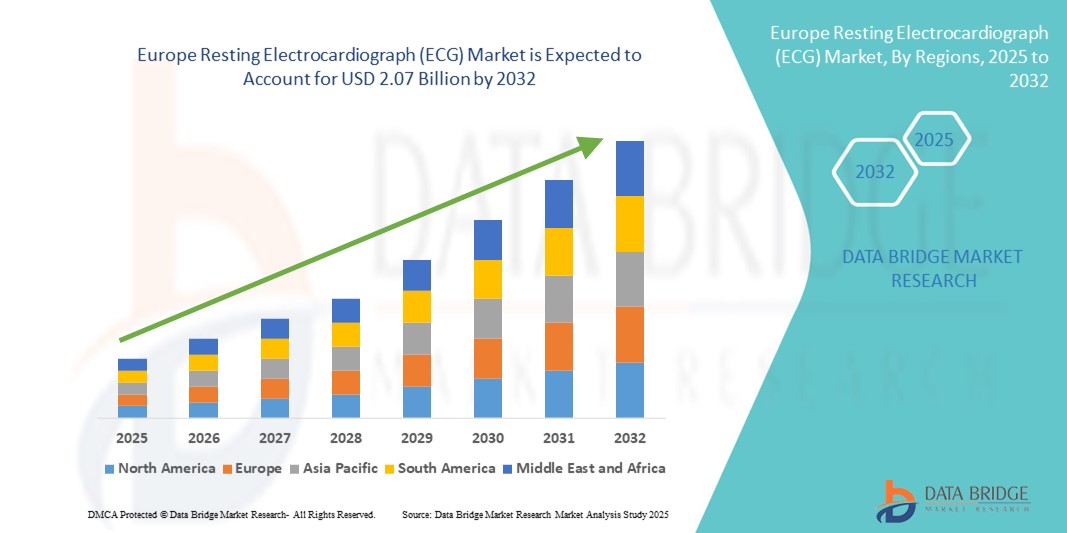

- The Europe resting electrocardiograph (ECG) market size was valued at USD 1.19 billion in 2024 and is expected to reach USD 2.07 billion by 2032, at a CAGR of 7.10% during the forecast period

- The market growth is largely fueled by the growing adoption and technological advancements in medical diagnostics, particularly in cardiac care, leading to increased digitalization and integration of healthcare infrastructure across both hospital and ambulatory settings in Europe

- Furthermore, rising demand for accurate, non-invasive, and real-time cardiac monitoring is establishing resting electrocardiograph (ECG) devices as an essential diagnostic tool. These converging factors are accelerating the uptake of Europe Resting Electrocardiograph (ECG) solutions, thereby significantly boosting the industry's growth

Europe Resting Electrocardiograph (ECG) Market Analysis

- Resting Electrocardiograph (ECG) systems, which capture the heart’s electrical activity while the patient is at rest, are essential diagnostic tools across European healthcare systems due to their reliability, non-invasive design, and effectiveness in detecting cardiovascular conditions such as arrhythmias, myocardial infarction, and heart failure

- The demand for resting ECGs continues to rise across Europe due to the growing elderly population, the increasing incidence of heart-related disorders, and rising awareness of preventive cardiac care. In addition, the integration of digital ECG systems with electronic health records (EHRs), AI-powered analysis tools, and mobile platforms is significantly improving diagnostic speed and accuracy

- Germany dominated the Europe Resting Electrocardiograph (ECG) market with the largest revenue share of 33.3% in 2024, supported by its advanced healthcare infrastructure, strong emphasis on early cardiovascular diagnostics, and widespread adoption of 12-lead ECG systems in both public and private hospitals. The country’s leadership in medical technology manufacturing and investment in telecardiology services is further enhancing ECG adoption

- The U.K. is expected to be the fastest-growing market in Europe Resting Electrocardiograph (ECG) market, registering a CAGR of 10.1% during the forecast period (2025–2032). Growth is driven by the rising burden of cardiovascular disease, increased usage of home-based ECG monitoring for elderly patients, and government-led initiatives to modernize diagnostic services across the NHS with AI-enabled ECG platforms and mobile diagnostic units

- The 12 leads segment dominated the Europe Resting Electrocardiograph (ECG) market in 2024 with a revenue share of 51.3%, due to its standard use in hospitals for comprehensive cardiac assessments. It provides a detailed view of the heart’s electrical activity, aiding in accurate diagnosis

Report Scope and Europe Resting Electrocardiograph (ECG) Market Segmentation

|

Attributes |

Europe Resting Electrocardiograph (ECG) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Resting Electrocardiograph (ECG) Market Trends

“Advancements in Digital Integration and Diagnostic Precision”

- A significant and accelerating trend in the Europe resting electrocardiograph (ECG) market is the growing integration of artificial intelligence (AI), cloud connectivity, and mobile health platforms into ECG systems. These technological enhancements are significantly improving diagnostic speed, accuracy, and accessibility across both clinical and remote care environments

- For instance, AI-enabled ECG systems can now detect subtle cardiac anomalies earlier than traditional methods by analyzing large volumes of patient data and recognizing complex patterns. Devices from companies such as GE HealthCare and Philips are incorporating machine learning algorithms to assist clinicians in real-time interpretation of ECG data

- Mobile and wireless ECG devices, such as portable single-lead ECG monitors and patch-based systems, are becoming increasingly popular among patients and healthcare providers. These devices allow for continuous monitoring outside of clinical settings and can transmit data to healthcare professionals via Bluetooth or cloud platforms for immediate analysis and intervention

- The integration of ECG systems with telehealth platforms enables remote diagnostics, reducing the need for in-person visits and expanding access to cardiac care, especially in rural and aging populations. This shift is aligned with national healthcare strategies in countries such as the U.K. and Germany to modernize chronic disease management through digital health infrastructure

- Wearable ECG devices and smartphone-connected ECG apps are reshaping the consumer cardiac health segment, offering real-time arrhythmia detection, heart rate tracking, and data syncing with electronic health records (EHRs). Companies such as AliveCor and Withings are leading the way in Europe with CE-marked devices approved for at-home use

- As patients increasingly prioritize real-time monitoring and clinicians seek greater diagnostic support, the demand for intelligent, connected, and user-friendly resting ECG solutions continues to rise across the European market. These innovations are not only improving health outcomes but also streamlining workflow efficiency and enhancing the continuity of care

Europe Resting Electrocardiograph (ECG) Market Dynamics

Driver

“Growing Need Due to Rising Cardiovascular Disease Burden and Digital Health Adoption”

- The increasing prevalence of cardiovascular diseases (CVDs) such as arrhythmias, ischemic heart disease, and heart failure, coupled with a growing emphasis on early diagnosis and preventive care, is significantly driving demand for resting ECG systems across Europe

- For instance, in March 2024, Koninklijke Philips N.V. launched an AI-enabled ECG software platform designed to assist clinicians in more accurately detecting cardiac abnormalities at the point of care, signaling a growing trend toward smart diagnostics. Such strategies are expected to bolster the Europe Resting Electrocardiograph (ECG) market growth in the forecast period

- As healthcare systems prioritize cost-efficiency and outpatient care, resting ECG devices are increasingly adopted in primary clinics, ambulatory settings, and even at home, due to their simplicity and diagnostic utility

- Furthermore, the rising integration of digital health platforms, electronic health records (EHR), and remote cardiac monitoring is making resting ECG systems a vital component of modern diagnostic workflows, supporting clinical decision-making with real-time data insights

- The shift toward compact, wireless, and portable ECG devices—offering ease of use, faster diagnostics, and telehealth compatibility—is further accelerating market uptake in both public and private healthcare facilities. The rise of wearable ECG monitoring and connected devices is also transforming how cardiovascular care is delivered

Restraint/Challenge

“Data Privacy Concerns and High System Integration Costs”

- Despite the benefits of digital ECG solutions, concerns about data privacy, interoperability, and storage security pose significant challenges, especially in cross-border telecardiology services within Europe

- For instance, cybersecurity breaches and concerns over the General Data Protection Regulation (GDPR) compliance have made many healthcare providers cautious about adopting cloud-based ECG data storage and AI analytics

- To overcome these concerns, manufacturers must ensure end-to-end encryption, GDPR-aligned data handling, and robust authentication protocols. Companies such as Schiller AG and GE Healthcare emphasize secure connectivity and compliant data platforms in their marketing

- In addition, the relatively high cost of integrating resting ECG systems with hospital IT infrastructure, PACS (Picture Archiving and Communication System), and EHR software may deter smaller clinics and budget-constrained public hospitals from fully transitioning to digital ECG platforms

- While costs are expected to decline with increased innovation and competition, the upfront investment for high-quality, multi-lead ECG systems remains a barrier to mass adoption, especially in Eastern Europe and underfunded healthcare segments

- Addressing these challenges through scalable pricing models, cloud-based diagnostics, and modular ECG platforms will be essential for achieving deeper market penetration and long-term growth

Europe Resting Electrocardiograph (ECG) Market Scope

The market is segmented on the basis of product, number of leads, technology, modality, device size, connectivity, mode of operation, and end user.

- By Product

On the basis of product, the Europe Resting Electrocardiograph (ECG) market is segmented into ECG devices, monitors, software & services, implantable loop recorders, and mobile cardiac telemetry devices. The ECG devices segment held the largest market share of 38.6% in 2024, owing to their widespread use in routine cardiac diagnostics across hospitals and clinics. These devices are essential for detecting arrhythmias, ischemic heart disease, and other cardiovascular abnormalities.

The mobile cardiac telemetry devices segment is expected to witness the fastest CAGR of 20.9% from 2025 to 2032, driven by the growing demand for real-time, remote cardiac monitoring and the rising incidence of chronic heart conditions among the aging population.

- By Number of Leads

On the basis of number of leads, the Europe Resting Electrocardiograph (ECG) market is segmented into 12 leads, 15 leads, 18 leads, and others. The 12 leads segment dominated the market in 2024 with a revenue share of 51.3%, due to its standard use in hospitals for comprehensive cardiac assessments. It provides a detailed view of the heart’s electrical activity, aiding in accurate diagnosis.

The 15 leads segment is anticipated to grow at the highest CAGR of 18.7% during the forecast period, as it provides enhanced detection of posterior and right ventricular infarctions, particularly in advanced care and cardiology settings.

- By Technology

On the basis of technology, the market is segmented into digital and analog. The digital segment accounted for the largest revenue share of 72.4% in 2024, owing to its superior accuracy, ability to store and share data electronically, and compatibility with telehealth platforms.

The analog segment, while declining, remains relevant in low-resource settings and is expected to grow modestly due to its affordability and simplicity.

- By Modality

On the basis of modality, the Europe Resting Electrocardiograph (ECG) market is segmented into fixed and mobile ECG systems. The fixed segment held the dominant share of 61.1% in 2024, driven by high installation rates in hospitals and diagnostic centers for long-term usage.

The mobile segment is projected to grow at a fastest CAGR of 22.3% between 2025 and 2032, supported by rising demand for portability, home diagnostics, and telemedicine-enabled healthcare delivery.

- By Device Size

On the basis of device size, the Europe Resting Electrocardiograph (ECG) market is segmented into large, medium, and small. The medium-sized ECG devices segment captured the largest market share of 44.5% in 2024, as they balance portability with functionality, making them ideal for clinics and outpatient facilities.

The small device segment is expected to expand at the highest CAGR of 21.1%, fueled by increased consumer interest in wearable ECG monitors and smartphone-compatible health devices.

- By Connectivity

On the basis of connectivity, the Europe Resting Electrocardiograph (ECG) market is segmented into wired and wireless. The wired segment accounted for the largest market share of 58.6% in 2024, particularly in hospital settings where secure and continuous ECG transmission is critical.

The wireless segment is anticipated to register the fastest growth rate of 23.6% from 2025 to 2032, due to the rapid adoption of Bluetooth and cloud-connected ECG systems that allow remote monitoring and real-time data sharing.

- By Mode of Operation

On the basis of mode of operation, the Europe Resting Electrocardiograph (ECG) market is segmented into automatic, semi-automatic, and manual. The automatic segment held the largest market share of 49.3% in 2024, driven by the preference for systems that reduce operator intervention and enhance diagnostic consistency.

The semi-automatic segment is expected to experience the fastest CAGR of 19.8%, as it offers a cost-effective balance between manual control and automation, especially in mid-tier clinical settings.

- By End User

On the basis of end user, the Europe Resting Electrocardiograph (ECG) market is segmented into hospitals, specialty clinics, ambulatory surgical centers, home care settings, and others. The hospitals segment dominated with a market share of 46.2% in 2024, owing to high patient volumes, availability of advanced diagnostic equipment, and skilled professionals.

The home care setting segment is poised to grow at the highest CAGR of 24.7% during 2025–2032, driven by the shift toward patient-centric care, the rise of chronic disease management at home, and growing use of wearable ECG solutions.

Europe Resting Electrocardiograph (ECG) Market Regional Analysis

- Europe dominated the global resting electrocardiograph (ECG) market with the largest revenue share of 36.7% in 2024, driven by the increasing burden of cardiovascular diseases (CVDs), rising demand for early diagnostic solutions, and government-backed health screening initiatives

- The growing geriatric population, high prevalence of lifestyle-related cardiac conditions, and strong emphasis on preventive healthcare are key factors boosting the adoption of resting ECG systems across hospitals, clinics, and primary care settings in the region

- In addition, the integration of digital technologies such as AI-enabled ECG interpretation, cloud connectivity, and interoperability with EHRs is further supporting market growth by enhancing diagnostic accuracy and clinical workflow efficiency

U.K. Resting Electrocardiograph (ECG) Market Insight

The U.K. global resting electrocardiograph (ECG) market is experiencing strong growth driven by rising cases of arrhythmias and hypertension, coupled with the NHS’s focus on early cardiac diagnosis in primary care. Government-funded heart health campaigns and increased availability of ECG devices in community healthcare settings are encouraging widespread use. The growing integration of AI-powered ECG analysis and mobile ECG solutions is also contributing to faster and more accurate clinical decision-making.

Germany Resting Electrocardiograph (ECG) Market Insight

The Germany global resting electrocardiograph (ECG) market holds a leading share with a percent of 33.3% in the Europe resting ECG market due to its advanced cardiology infrastructure, broad adoption of digital health solutions, and high healthcare expenditure. The country’s robust regulatory support for medtech innovation and the increasing demand for non-invasive cardiac diagnostics among elderly patients are fueling the adoption of portable and multi-lead ECG systems in both urban hospitals and rural clinics.

France Resting Electrocardiograph (ECG) Market Insight

The France global resting electrocardiograph (ECG) market is expanding steadily, supported by government mandates for routine cardiac screening and emphasis on stroke prevention. The adoption of cloud-based ECG platforms, particularly in public hospitals, is improving access to cardiology diagnostics across underserved regions. In addition, collaborative efforts between healthcare institutions and ECG device manufacturers are enhancing training and implementation of digital ECG tools.

Italy Resting Electrocardiograph (ECG) Market Insight

The Italy global resting electrocardiograph (ECG) market is driven by the rising burden of coronary artery disease and government programs promoting cardiovascular risk assessments in aging populations. The Italian healthcare system’s increasing shift toward home-based care and outpatient monitoring is creating demand for compact, user-friendly ECG systems. The integration of ECG diagnostics in telecardiology platforms is also gaining momentum.

Spain Resting Electrocardiograph (ECG) Market Insight

The Spain global resting electrocardiograph (ECG) market is witnessing significant growth in the adoption of resting ECG devices, primarily due to expanding cardiac care infrastructure and public-private partnerships aimed at modernizing diagnostics. Increased awareness of sudden cardiac arrest (SCA) and the importance of ECG screening in sports and occupational health settings are supporting market penetration, especially in community clinics and wellness centers.

Europe Resting Electrocardiograph (ECG) Market Share

The Europe resting electrocardiograph (ECG) industry is primarily led by well-established companies, including:

- GE Healthcare (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Baxter (U.S.)

- SCHILLER AG (Switzerland)

- Cardioline S.P.A. (Italy)

- EDAN Instruments, Inc. (China)

- FUKUDA DENSHI (Japan)

- Personal MedSystems GmbH (Germany)

- VYAIRE MEDICAL, INC. (U.S.)

- Innomed Medical Inc. (Hungary)

- Norav Medical (U.S.)

- OSI Systems, Inc. (Spacelabs Healthcare) (U.S.)

- Lepu Medical Technology (Beijing) Co., Ltd. (China)

- Dawei Medical (China)

- Gima S.P.A. (Italy)

- Zimmer Benelux BV (Germany)

- AMEDTEC Medizintechnik Aue GmbH (Germany)

- BTL (India)

- Contec Medical Systems Co., Ltd (China)

Latest Developments in Europe Resting Electrocardiograph (ECG) Market

- In March 2022, Cardioline S.P.A., a leading ECG technology manufacturer based in Italy, joined the PariSanté Campus initiative to foster digital healthcare innovation in Europe. Through this partnership, the company aims to accelerate development in ECG diagnostics and integrate AI-based analytics for better cardiovascular risk assessment

- In April 2023, Philips launched its latest 12-lead resting ECG solution integrated with AI, aimed at hospitals and specialty clinics across Europe. This system enhances diagnostic accuracy through advanced signal processing and supports remote ECG interpretation—facilitating care delivery in both urban and rural settings

- In February 2023, GE HealthCare introduced the MAC VU360 ECG system across Germany, France, and the U.K. This premium ECG device is designed to support automated workflow in large hospitals and diagnostic labs. The system’s deep-learning algorithms offer improved arrhythmia detection and faster reporting for cardiac teams

- In January 2023, Schiller AG, a Switzerland-based ECG technology firm, announced a partnership with several Eastern European hospitals to expand access to its CARDIOVIT AT-102 G2 ECG system. This device, equipped with USB and wireless capabilities, is helping modernize cardiology departments in mid-size clinics across the EU

- In December 2022, Nihon Kohden Europe GmbH unveiled its enhanced Cardiofax S ECG system, optimized for use in high-throughput cardiology centers across the U.K. and Germany. It includes advanced lead-off detection, faster printout capabilities, and seamless integration with hospital information systems (HIS)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.