Europe Rf Microneedling Market

Market Size in USD Million

CAGR :

%

USD

603.77 Million

USD

1,053.00 Million

2024

2032

USD

603.77 Million

USD

1,053.00 Million

2024

2032

| 2025 –2032 | |

| USD 603.77 Million | |

| USD 1,053.00 Million | |

|

|

|

Radiofrequency (RF) Microneedling Market Analysis

Radiofrequency (RF) microneedling market is expected to increase growth of the market in the forecast period of 2020 to 2029. RF microneedling market has enlarged with improved number of visual actions as compared to the previous few years and increase the prevalence of peel disorders in the developed as well as developed countries. Microneedling is a relatively new treatment option in dermatology that has been recommended for, among other things, skin rejuvenation, acne scarring, rhytides, surgical scars, dyschromia, melasma, enlarged pores, and transdermal drug administration. RF microneedling, also known as radiofrequency microneedling or fractional radiofrequency, directs energy to the most important area of the skin, which is responsible for textural abnormalities, firmness, and elasticity.

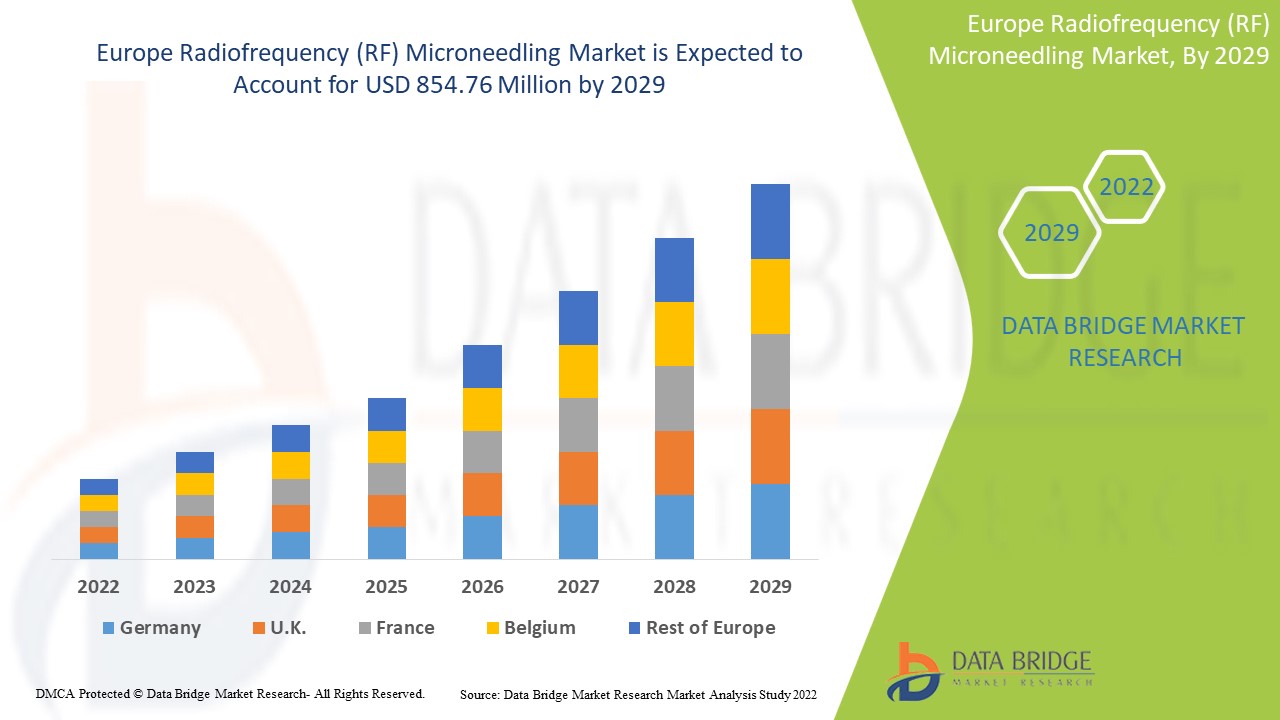

Europe Radiofrequency (RF) Microneedling Market Size

Europe radiofrequency (RF) microneedling market size was valued at USD 603.77 million in 2024 and is projected to reach USD 1053 million by 2032, with a CAGR of 7.20% during the forecast period of 2025 to 2032.

Report Scope and Market Segmentation

|

Attributes |

Radiofrequency (RF) Microneedling Key Market Insights |

|

Segmentation |

|

|

Countries Covered |

Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe |

|

Key Market Players |

Lumenis Be Ltd. (Germany), Cutera (U.S), ENDYMED MEDICAL (U.S), Cartessa Aesthetics (U.S), Veroderm Medical Technologies (Switzerland), nubway Co.Ltd. (China), CANDELA CORPORATION (U.S), LUTRONIC(South Korea), Sincoheren Ltd (China), Beijing Sanhe Beauty S and T Co., Ltd(China), Eclipse (U.S), DermaQuip (U.S), MDPen (U.S), Dermapen World (Australia), Osada, Inc (U.S), Stryker (U.S) , CONMED Corporation (U.S), Medtronic (U.S) |

|

Market Opportunities |

|

Radiofrequency (RF) Microneedling Market Definition

Radiofrequency (RF) microneedling is a negligibly martial aesthetic process which is also familiar as collagen induction therapy, conglomerates straight micro-needling procedure workwise with the component of radio regularity energy. The radiofrequency (RF) microneedling conveys energy into skin by small needles to produce tiny-tiny holes in the top layer of skin which starts social body to creates new elastin and collagen which causes the constriction and tightening of skin.

Radiofrequency (RF) Microneedling Market Dynamics

Drivers

- Rising demand of fractional RF microneedling

Fractional Radiofrequency technology is a cutting-edge design that treats the target area with a quick penetration of an insulated microneedle while avoiding substantial epidermal damage. For fractional RF skin resurfacing and no ablative skin tightening, RF procedures have proven to be safe and effective. For aesthetic treatments, RF technology is also the preferred method. It's used to treat fine lines and wrinkles, acne and chickenpox scarring, mild to moderate sagging, and uneven skin texture. RF skin tightening treatments are popular because they heat the subcutaneous tissues and dermis, encouraging dermal collagen remodelling.

- Increase in demand for minimally invasive procedure

The demand for non-invasive, minimally invasive skin rejuvenation and body contouring operations employing innovative radiofrequency (RF) technologies is rapidly increasing. These minimally invasive treatments have become one of aesthetic medicine's fastest expanding fields. Body contouring, skin tightening, and cellulite reduction are all frequent uses for RF microneedling, a minimally invasive, non-ablative treatment. The electromagnetic technology works by generating and delivering thermal energy to the deep dermis and subcutaneous fat, which stimulates the production of collagen, elastin, and hyaluronic acid, resulting in skin tightening and lifting while causing minimal damage to the skin's superficial structures. As a result, the Europe RF microneedling market is expected to be driven by an increase in demand for minimally invasive procedures.

- Increased number of aesthetic procedures

RF microneedling market has increased with increased number of aesthetic procedures as compared to the past few years and demand of anti-aging procedures in the Europe region. The market value is expanding due to the rising prevalence of skin problems and increased knowledge of aesthetic operations. For instance, the Department of Dermatology at Nepal Medical College and Teaching Hospital conducted a survey on cosmetic dermatology procedures awareness among tertiary care hospital health workers.

Opportunities

As RF microneedling has repeatedly demonstrated its high rates of efficiency for treating acne scars, wrinkles, skin tightening, irregular skin texture and tone, hyperpigmentation, fine lines, enlarged pores, stretch marks, face lifts, and other aesthetic operations, the market value is expanding. Various research studies are now underway, which are likely to give producers with a competitive advantage in developing new and innovative RF microneedling devices, as well as a variety of additional opportunities in the RF microneedling market.

Restraints/Challenges

The high cost of RF microneedling procedures and strict restrictions for RF microneedling procedures are projected to limit market growth, as obtaining approvals is a tough and complex task, and RF microneedling device manufacturers and researchers face monetary responsibility. In contrast, factors such as high procedural cost, sophistication, and training involved with aesthetic operations are driving the Europe RF microneedling market. According to the projections made by company professionals and leaders for the continuing forecast period of 2021-2028, if these continue to grow and achieve significant market momentum, they have the potential to stifle the growth of the RF microneedling market.

This RF microneedling market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the RF microneedling market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Radiofrequency (RF) Microneedling Market Scope

The RF microneedling market is segmented on the basis of technique, product, material application and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Technique

- Manual

- Automated

Product

- Dermapen

- Dermaroller

- RF Microneedling Devices

- Others

Material

- Silicon

- Titanium

- Stainless Steel

- Polymers

- Others

Application

- Skin Rejuvenation

- Scarring

- Acne

- Wrinkles

- Others

End-user

- Hospitals

- Dermatology Clinics

- Homecare Settings

- Others

Radiofrequency (RF) Microneedling Market Regional Analysis

The radiofrequency (RF) microneedling market is analyzed and market size insights and trends are provided by country, technique, product, material application and end-user as referenced above.

The countries covered in the radiofrequency (RF) microneedling market report are Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points for example down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Radiofrequency (RF) Microneedling Market Share

The radiofrequency (RF) microneedling market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to RF microneedling market.

Radiofrequency (RF) Microneedling Market Leaders Operating in the Market Are:

- Lumenis Be Ltd. (Germany)

- Cutera (U.S)

- ENDYMED MEDICAL (U.S)

- Cartessa Aesthetics (U.S)

- Veroderm Medical Technologies (Switzerland)

- nubway Co.Ltd. (China)

- CANDELA CORPORATION (U.S)

- LUTRONIC (South Korea)

- Sincoheren Ltd (China)

- Beijing Sanhe Beauty S and T Co., Ltd (China)

- Eclipse (U.S)

- DermaQuip (U.S)

- MDPen (U.S)

- Dermapen World (Australia)

- Osada, Inc. (U.S)

- Stryker (U.S)

- CONMED Corporation (U.S)

- Medtronic (U.S)

Latest Developments in Radiofrequency (RF) Microneedling Market

- Lumenis released Pro+, a new multi-application platform based on RF current technology, in April 2019. The company is employed on enhancing their reliability in the market and growing their customer base in order to create more money with the launch of their new RF microneedling platform

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.