GCC Region Industrial Drum Market Analysis and Insights

The GCC region industrial drum market is expected to gain significant growth in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 3.8% from 2023 to 2030 and is expected to reach USD 996,275.86 thousand by 2030. The major factor driving the growth of the industrial drum market is increased cross-continent trading among end-users.

Industrial drums commonly transport oils, fuels, chemicals, and many dry/liquid goods. The construction and performance of drums used for the shipment of hazardous materials. The growing demand for growing use for the storage of chemicals, petroleum, and others. The Availability of industrial drums according to customer specifications is expected to drive the market. The increased cross-continent trading among many end-users of petroleum, chemicals, fertilizers, and others in the GCC region has impacted the use of industrial drums for the cross-continent as the industrial is used to store the hazardous and non-hazardous chemicals and for other materials in the transportation of the materials.

The GCC region industrial drum market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, and technological innovations in the market. Contact us for an analyst brief to understand the analysis and the market scenario. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2020- 2015) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

By Type (Plastic Drums, Steel Drums, Fiber Drums, and Salvage Drums), Product Type (Open Head and Tight Head), Capacity (Upto 100 Liter, 100 to 250 Liter, 250 to 500 Liter, and Above 500 Liter), End-User (Building and Construction, Chemical and Fertilizers, Food and Beverages, Paints, Inks, and Dyes, Crude Oil and Petroleum Products, Pharmaceuticals, and Others). |

|

Countries Covered |

Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and United Arab Emirates. |

|

Market Players Covered |

Greif, Time Technoplast Ltd., DANA Group of Companies, Al Fujairah Steel Barrels and Drums L.L.C, Anglo American Steel L.L.C., Balmer Lawrie (UAE) LLC, Drum Express, Al Yamama Plastic Factory, PGTC Group, Al-Babtain Plastic & Insulation Materials Mfg. Co. ltd, Elan Incorporated FZE, VWR International, LLC., STARLINK Dubai LLC, INTC Steel Drums LLC, Emirates Plastic Industries Factory, and Clouds Drums Dubai LLC, among others. |

Market Definition

An industrial drum is a circular, hollow container used for large freight transportation. Plastic, steel, and fiber, among other materials, can be used to make industrial drums. The application determines the material utilized. Steel drums are utilized for chemical processing, whereas plastic drums are used for acidic materials. Fiber drums are used for solid materials. Industrial drums come in a variety of sizes. The 55-gallon drum, which has a capacity of 55 gallons, is the most often utilized drum size for transportation reasons. Oil and gas, petroleum, food and beverage, construction, manufacturing, agriculture, and other sectors use industrial drums.

GCC Region Industrial Drum Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Increased cross-continent trading among end-users

The increased cross-continent trading among many end-users of petroleum, chemicals, fertilizers, and others in the GCC region has impacted the use of industrial drums for the cross-continent as the industrial is used to store the hazardous and non-hazardous chemicals and for other materials in the transportation of the materials.

Industrial drums allow higher operational efficiency and effectiveness in shipping bulk quantities of commodities, especially in liquid form. Industrial drums also offer cost-effective transport packaging solutions for the shipment of hazardous and non-hazardous materials, like chemicals, wines, fruit juices, and others. They also offer high strength, gas barrier properties, and superior processing performance. The ease of shifting and the properties offered by the different industrial drum is the main reason for considering industrial drums for cross-continent trading.

- Growth in the use for the storage of chemicals, petroleum, and others

Industrial drums are very commonly used for the storage and transportation of non-hazardous as well as hazardous goods. The most common application of industrial drums is in petroleum, oils, fertilizer, and chemical industry end uses.

The steel drums are extensively used for packaging semi-solids, liquids, and powders. They are made from carbon or stainless steel material. Further, they can withstand an extreme range of pressure, temperatures, and humidity, while maintaining their structural integrity, irrespective of heat and flame, without any spillage or leakage. Also, it is less likely to implode when proper work conditions remain unaffected by the thermal shocks. They are available in various sizes based on the application required. Also, any food or drink should be stored in drum liners before being placed into a steel drum to avoid cross-contamination. The steel drums are used in chemicals, agriculture, petroleum and lubricants, paints, inks, and food and beverage applications.

Opportunities

- Strategic collaboration among companies for industrial drum

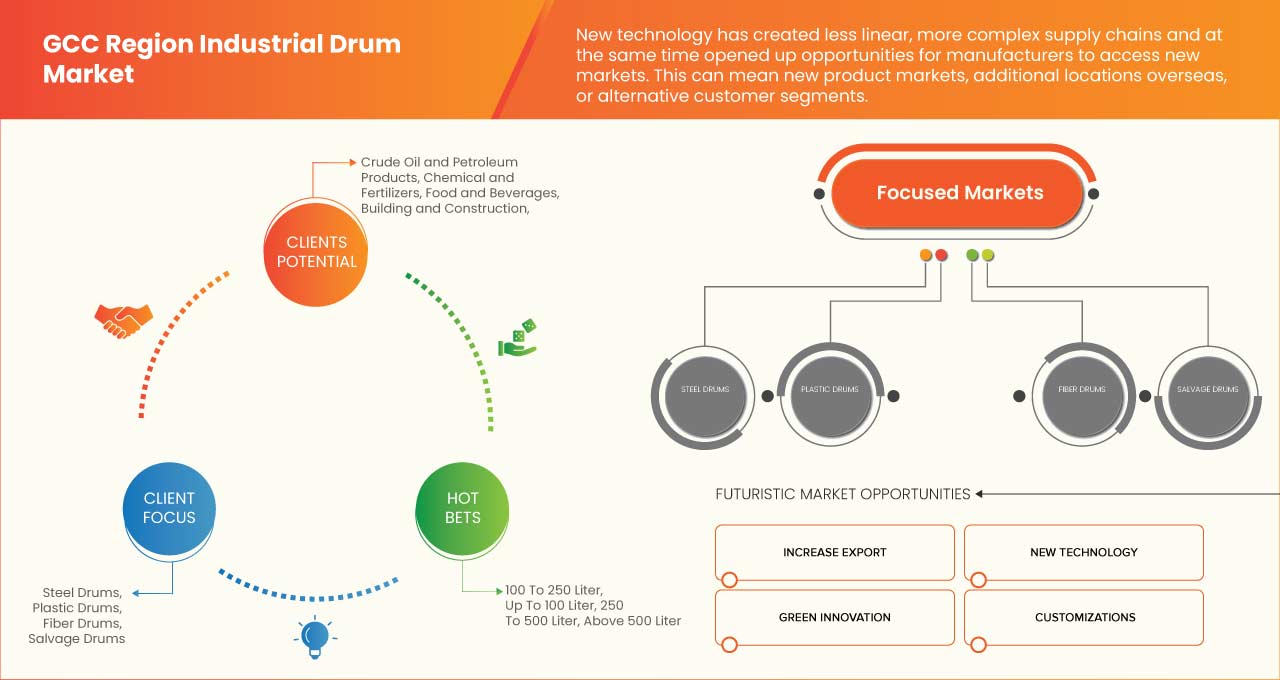

New technology has created less linear, more complex supply chains and, at the same time, opened up opportunities for manufacturers to access new markets. This can mean new product markets, additional locations overseas, or alternative customer segments. Strategic collaboration can be an effective tool for accelerating the new market entry process and making it run more smoothly. Strategic collaborations can provide the ability to enhance products and service offerings. This can help companies both attract new customers and keep existing customers happier.

Strategic alliances are a key part of business strategy for companies of all sizes and in every industry. Any strategic collaboration is made with the idea that new insights are needed for each partner from the other.

- Increase in the export of petroleum and other material

The UAE's exploration projects will create opportunities for Greenfield projects. UAE producers continue to test and implement new extraction technologies to raise recovery rates and prolong output. Unconventional oil and gas resources are of great interest to the UAE. One of the ways Gulf countries plan to extract maximum benefit from hydrocarbons is by catalyzing investment in downstream production and export capacity for petrochemicals and chemicals. Thus the increasing export of petroleum and other chemicals is expected to grow the demand for industrial drums for the shortage and transportation of petroleum and other chemicals.

Restraints/Challenges

- Stringent Government guidelines for industrial drum

The stringent regulations are technology-based national standards developed on an industry-by-industry basis. They represent the greatest pollutant reductions economically achievable for an industry. These limits are applied uniformly to facilities within the industry scope defined by the regulations, regardless of the condition of the water body receiving the discharge.

If one has stored hazardous substances such as cars or fuel oils inside the empty oil drums, they must be disposed of in a health and safety-compliant matter. After all, those rules protect the health of themselves, their employees, and anyone else who could come into contact with hazardous waste. The business owner must ensure that hazardous waste is handled correctly and safely.

- Volatility of raw material price

Raw materials frequently experience market volatility resulting from supply disruptions, pent-up demand, or significant price peaks and troughs. Commodity prices are highly volatile in markets. It is often blamed for these variations, but drum manufacturers will see that changes in supply and demand are the main determinants of commodity prices. High steel prices continue to present problems for steel drum producers.

The raw material for the industrial drum has been exported from different regions as there can be many reasons for the volatility in the price, such as the current Russia-Ukraine war may affect the price of some raw material used for the manufacturing of the industrial drums on the basics of which type of industrial drum the company is manufacturing. So, if the price of the raw material has been increased, the manufacturer may have to increase the final product's price.

Recent Developments

- In March 2022, The UAE's Steel Producers Committee held an urgent meeting to discuss the current developments within the local rebar market, where it affirmed the member's commitment to supply the UAE market with the necessary rebar requirements as well as maintaining market stability to support the construction sector and the economy respectively.

- In March 2022, according to PSU Connect Media Pvt. Ltd, India, pitches for Collaboration with GCC in the Steel sector. An interactive session on 'Steel Usage in UAE & Collaboration Opportunities for Indian Steel Sector' was held between key steel-producing companies from India and steel user companies of the UAE.

GCC Region Industrial Drum Market Scope

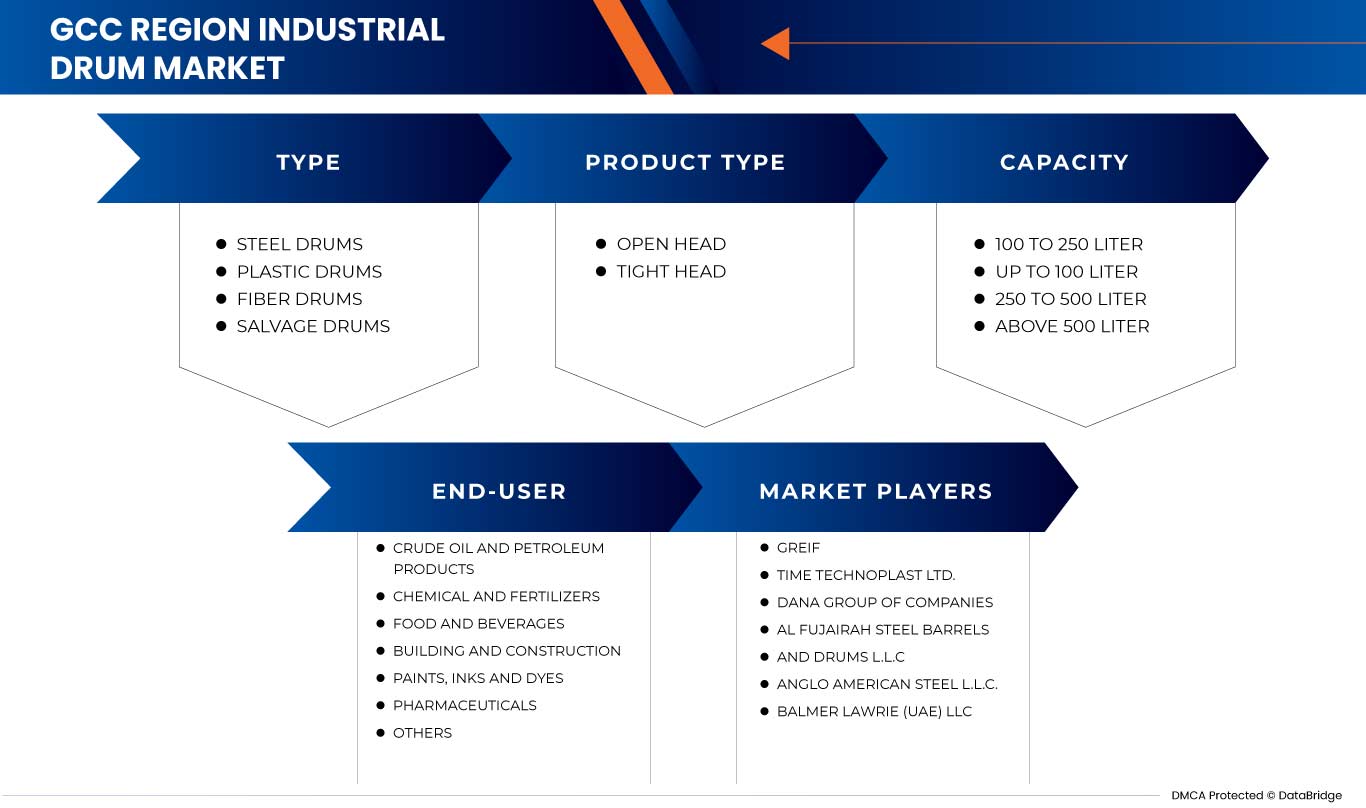

The GCC region industrial drum market is categorized based on type, product type, capacity, and end-user. The growth amongst four segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

BY TYPE

- PLASTIC DRUMS

- STEEL DRUMS

- FIBER DRUMS

- SALVAGE DRUMS

Based on type, the GCC region industrial drum market is classified into four segments plastic drums, steel drums, fiber drums, and salvage drums.

BY PRODUCT TYPE

- OPEN HEAD

- TIGHT HEAD

Based on product type, the GCC region industrial drum market is classified into two segments open head and tight head.

BY CAPACITY

- UP TO 100 LITER

- 100 TO 250 LITER

- 250 TO 500 LITER

- ABOVE 500 LITER

Based on capacity, the GCC region industrial drum market is classified into four segments Up to 100 liter, 100 to 250 liter, 250 to 500 liter, and above 500 liter.

BY END-USER

- BUILDING AND CONSTRUCTION

- CHEMICAL AND FERTILIZERS

- FOOD AND BEVERAGES

- PAINTS, INKS, AND DYES

- CRUDE OIL AND PETROLEUM PRODUCTS

- PHARMACEUTICALS

- OTHERS

Based on end-user, the GCC region industrial drum market is classified into six segments building and construction, chemical and fertilizers, food and beverages, paints, inks, and dyes, crude oil and petroleum products, pharmaceuticals, and others.

GCC Region Industrial Drum Market Regional Analysis/Insights

The GCC region industrial drum market is segmented based on type, product type, capacity, and end-user.

The countries in the GCC region industrial drum market are Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and United Arab Emirates. Saudi Arabia is dominating the GCC region industrial drum market in terms of market share and market revenue due to an increase in demand for industrial drums for storage and transportation.

The country section of the report also provides individual market-impacting factors and market regulation changes that impact the market's current and future trends. Data point downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some pointers used to forecast the market scenario for individual countries. Also, the presence and Availability of GCC brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and GCC Region Industrial Drum Market Share Analysis

GCC region industrial drum market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies' focus related to the GCC region industrial drum market.

Some of the prominent participants operating in the GCC region industrial drum market are Greif, Time Technoplast Ltd., DANA Group of Companies, Al Fujairah Steel Barrels and Drums L.L.C, Anglo American Steel L.L.C., Balmer Lawrie (UAE) LLC, Drum Express, Al Yamama Plastic Factory, PGTC Group, Al-Babtain Plastic & Insulation Materials Mfg. Co. ltd, Elan Incorporated FZE, VWR International, LLC., STARLINK Dubai LLC, INTC Steel Drums LLC, Emirates Plastic Industries Factory, and Clouds Drums Dubai LLC, among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GCC REGION INDUSTRIAL DRUM MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE FORCES:

4.2.1 THE THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 PRODUCTION AND CONSUMPTION ANALYSIS

4.4 IMPORT-EXPORT SCENARIO

4.5 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.6 VENDOR SELECTION CRITERIA

4.7 RAW MATERIAL COVERAGE

4.8 REGULATION COVERAGE

5 SUPPLY CHAIN ANALYSIS

5.1 RAW MATERIAL PROCUREMENT

5.2 MANUFACTURING AND PACKING

5.3 MARKETING AND DISTRIBUTION

5.4 END USERS

6 CLIMATE CHANGE SCENARIO

6.1 ENVIRONMENTAL CONCERNS

6.2 INDUSTRY RESPONSE

6.3 GOVERNMENT'S ROLE

6.4 ANALYST RECOMMENDATION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWTH IN THE USE FOR THE STORAGE OF CHEMICALS, PETROLEUM, AND OTHERS

7.1.2 INCREASED CROSS-CONTINENT TRADING AMONG END-USERS

7.1.3 AVAILABILITY OF INDUSTRIAL DRUM ACCORDING TO CUSTOMER SPECIFICATION

7.2 RESTRAINTS

7.2.1 VOLATILITY OF RAW MATERIAL PRICE

7.2.2 COMPLEXITY IN THE SUPPLY CHAIN

7.3 OPPORTUNITIES

7.3.1 INCREASE IN THE EXPORT OF PETROLEUM AND OTHER MATERIAL

7.3.2 STRATEGIC COLLABORATION AMONG COMPANIES FOR INDUSTRIAL DRUM

7.4 CHALLENGES

7.4.1 STRINGENT GOVERNMENT GUIDELINES FOR INDUSTRIAL DRUM

7.4.2 ECOLOGICAL EFFECT BY RAW MATERIAL USED FOR MANUFACTURING THE INDUSTRIAL DRUM

8 GCC REGION INDUSTRIAL DRUM MARKET, BY TYPE

8.1 OVERVIEW

8.2 STEEL DRUMS

8.3 PLASTIC DRUMS

8.4 FIBER DRUMS

8.5 SALVAGE DRUMS

9 GCC REGION INDUSTRIAL DRUM MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 OPEN HEAD

9.3 TIGHT HEAD

10 GCC REGION INDUSTRIAL DRUM MARKET, BY CAPACITY

10.1 OVERVIEW

10.2 100 TO 250 LITER

10.3 UP TO 100 LITER

10.4 250 TO 500 LITER

10.5 ABOVE 500 LITER

11 GCC REGION INDUSTRIAL DRUM MARKET, BY END-USER

11.1 OVERVIEW

11.2 CRUDE OIL AND PETROLEUM PRODUCTS

11.2.1 STEEL DRUMS

11.2.2 PLASTIC DRUMS

11.2.3 SALVAGE DRUMS

11.2.4 FIBER DRUMS

11.3 CHEMICAL AND FERTILIZERS

11.3.1 STEEL DRUMS

11.3.2 PLASTIC DRUMS

11.3.3 SALVAGE DRUMS

11.3.4 FIBER DRUMS

11.4 FOOD AND BEVERAGES

11.4.1 STEEL DRUMS

11.4.2 PLASTIC DRUMS

11.4.3 FIBER DRUMS

11.4.4 SALVAGE DRUMS

11.5 BUILDING AND CONSTRUCTION

11.5.1 PLASTIC DRUMS

11.5.2 STEEL DRUMS

11.5.3 FIBER DRUMS

11.5.4 SALVAGE DRUMS

11.6 PAINTS, INKS AND DYES

11.6.1 PLASTIC DRUMS

11.6.2 STEEL DRUMS

11.6.3 FIBER DRUMS

11.6.4 SALVAGE DRUMS

11.7 PHARMACEUTICALS

11.7.1 PLASTIC DRUMS

11.7.2 FIBER DRUMS

11.7.3 STEEL DRUMS

11.7.4 SALVAGE DRUMS

11.8 OTHERS

11.8.1 PLASTIC DRUMS

11.8.2 FIBER DRUMS

11.8.3 STEEL DRUMS

11.8.4 SALVAGE DRUMS

12 GCC REGION INDUSTRIAL DRUM MARKET, BY COUNTRY

12.1 SAUDI ARABIA

12.2 UNITED ARAB EMIRATES

12.3 OMAN

12.4 KUWAIT

12.5 QATAR

12.6 BAHRAIN

13 GCC REGION INDUSTRIAL DRUM MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GCC REGION

13.2 CERTIFICATION

13.3 ACQUISITION

13.4 AWARD

13.5 AGREEMENT

13.6 NEW WEBSITE

13.7 NEW PLANT

13.8 PARTNERSHIP

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 GREIF

15.1.1 COMPANY SNAPSHOT

15.1.2 SWOT ANALYSIS

15.1.3 REVENUE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 TIME TECHNOPLAST LTD.

15.2.1 COMPANY SNAPSHOT

15.2.2 SWOT ANALYSIS

15.2.3 REVENUE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 VWR INTERNATIONAL, LLC.

15.3.1 COMPANY SNAPSHOT

15.3.2 SWOT ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 STARLINK DUBAI LLC

15.4.1 COMPANY SNAPSHOT

15.4.2 SWOT ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 ELAN INCORPORATED FZE

15.5.1 COMPANY SNAPSHOT

15.5.2 SWOT ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 AL FUJAIRAH STEEL BARRELS AND DRUMS L.L.C

15.6.1 COMPANY SNAPSHOT

15.6.2 SWOT ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 AL YAMAMA PLASTIC FACTORY

15.7.1 COMPANY SNAPSHOT

15.7.2 SWOT ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 AL-BABTAIN PLASTIC & INSULATION MATERIALS MFG, CO. LTD.

15.8.1 COMPANY SNAPSHOT

15.8.2 SWOT ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 ANGLO AMERICAN STEEL L.L.C.

15.9.1 COMPANY SNAPSHOT

15.9.2 SWOT ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 BALMER LAWRIE (UAE) LLC

15.10.1 COMPANY SNAPSHOT

15.10.2 SWOT ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 CLOUDS DRUMS DUBAI LLC

15.11.1 COMPANY SNAPSHOT

15.11.2 SWOT ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 DANA GROUP OF COMPANIES

15.12.1 COMPANY SNAPSHOT

15.12.2 SWOT ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 DRUM EXPRESS

15.13.1 COMPANY SNAPSHOT

15.13.2 SWOT ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 EMIRATES PLASTIC INDUSTRIES FACTORY

15.14.1 COMPANY SNAPSHOT

15.14.2 SWOT ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENTS

15.15 INTC STEEL DRUMS LLC

15.15.1 COMPANY SNAPSHOT

15.15.2 SWOT ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENTS

15.16 PGTC GROUP

15.16.1 COMPANY SNAPSHOT

15.16.2 SWOT ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 REGULATORY FRAMEWORK

TABLE 2 GCC REGION INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 3 GCC REGION INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 4 GCC REGION INDUSTRIAL DRUM MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 GCC REGION INDUSTRIAL DRUM MARKET, BY CAPACITY, 2021-2030 (USD THOUSAND)

TABLE 6 GCC REGION INDUSTRIAL DRUM MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 7 GCC REGION CRUDE OIL AND PETROLEUM PRODUCTS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 8 GCC REGION CHEMICAL AND FERTILIZERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 9 GCC REGION FOOD AND BEVERAGE IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 10 GCC REGION BUILDING AND CONSTRUCTION IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 11 GCC REGION PAINTS, INKS AND DYES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 12 GCC REGION PHARMACEUTICALS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 13 GCC REGION OTHERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 14 GCC REGION INDUSTRIAL DRUM MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 15 GCC REGION INDUSTRIAL DRUM MARKET, BY COUNTRY, 2021-2030 (THOUSAND UNITS)

TABLE 16 SAUDI ARABIA INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 17 SAUDI ARABIA INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 18 SAUDI ARABIA INDUSTRIAL DRUM MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 19 SAUDI ARABIA INDUSTRIAL DRUM MARKET, BY CAPACITY, 2021-2030 (USD THOUSAND)

TABLE 20 SAUDI ARABIA INDUSTRIAL DRUM MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 21 SAUDI ARABIA CRUDE OIL AND PETROLEUM PRODUCTS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 22 SAUDI ARABIA CHEMICAL AND FERTILIZERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 SAUDI ARABIA FOOD AND BEVERAGES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 24 SAUDI ARABIA BUILDING AND CONSTRUCTION IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 25 SAUDI ARABIA PAINTS, INKS AND DYES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 26 SAUDI ARABIA PHARMACEUTICALS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 27 SAUDI ARABIA OTHERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 28 UNITED ARAB EMIRATES INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 29 UNITED ARAB EMIRATES INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 30 UNITED ARAB EMIRATES INDUSTRIAL DRUM MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 UNITED ARAB EMIRATES INDUSTRIAL DRUM MARKET, BY CAPACITY, 2021-2030 (USD THOUSAND)

TABLE 32 UNITED ARAB EMIRATES INDUSTRIAL DRUM MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 33 UNITED ARAB EMIRATES CRUDE OIL AND PETROLEUM PRODUCTS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 UNITED ARAB EMIRATES CHEMICAL AND FERTILIZERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 UNITED ARAB EMIRATES FOOD AND BEVERAGES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 UNITED ARAB EMIRATES BUILDING AND CONSTRUCTION IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 UNITED ARAB EMIRATES PAINTS, INKS AND DYES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 UNITED ARAB EMIRATES PHARMACEUTICALS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 UNITED ARAB EMIRATES OTHERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 OMAN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 41 OMAN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 42 OMAN INDUSTRIAL DRUM MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 OMAN INDUSTRIAL DRUM MARKET, BY CAPACITY, 2021-2030 (USD THOUSAND)

TABLE 44 OMAN INDUSTRIAL DRUM MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 45 OMAN CRUDE OIL AND PETROLEUM PRODUCTS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 OMAN CHEMICAL AND FERTILIZERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 47 OMAN FOOD AND BEVERAGES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 OMAN BUILDING AND CONSTRUCTION IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 OMAN PAINTS, INKS AND DYES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 50 OMAN PHARMACEUTICALS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 OMAN OTHERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 KUWAIT INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 53 KUWAIT INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 54 KUWAIT INDUSTRIAL DRUM MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 KUWAIT INDUSTRIAL DRUM MARKET, BY CAPACITY, 2021-2030 (USD THOUSAND)

TABLE 56 KUWAIT INDUSTRIAL DRUM MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 57 KUWAIT CRUDE OIL AND PETROLEUM PRODUCTS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 KUWAIT CHEMICAL AND FERTILIZERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 KUWAIT FOOD AND BEVERAGES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 60 KUWAIT BUILDING AND CONSTRUCTION IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 KUWAIT PAINTS, INKS AND DYES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 62 KUWAIT PHARMACEUTICALS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 KUWAIT OTHERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 QATAR INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 QATAR INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 66 QATAR INDUSTRIAL DRUM MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 QATAR INDUSTRIAL DRUM MARKET, BY CAPACITY, 2021-2030 (USD THOUSAND)

TABLE 68 QATAR INDUSTRIAL DRUM MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 69 QATAR CRUDE OIL AND PETROLEUM PRODUCTS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 QATAR CHEMICAL AND FERTILIZERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 71 QATAR FOOD AND BEVERAGES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 72 QATAR BUILDING AND CONSTRUCTION IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 73 QATAR PAINTS, INKS AND DYES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 QATAR PHARMACEUTICALS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 75 QATAR OTHERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 76 BAHRAIN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 77 BAHRAIN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 78 BAHRAIN INDUSTRIAL DRUM MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 79 BAHRAIN INDUSTRIAL DRUM MARKET, BY CAPACITY, 2021-2030 (USD THOUSAND)

TABLE 80 BAHRAIN INDUSTRIAL DRUM MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 81 BAHRAIN CRUDE OIL AND PETROLEUM PRODUCTS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 BAHRAIN CHEMICAL AND FERTILIZERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 BAHRAIN FOOD AND BEVERAGES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 84 BAHRAIN BUILDING AND CONSTRUCTION IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 85 BAHRAIN PAINTS, INKS AND DYES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 86 BAHRAIN PHARMACEUTICALS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 87 BAHRAIN OTHERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

List of Figure

FIGURE 1 GCC REGION INDUSTRIAL DRUM MARKET: SEGMENTATION

FIGURE 2 GCC REGION INDUSTRIAL DRUM MARKET: DATA TRIANGULATION

FIGURE 3 GCC REGION INDUSTRIAL DRUM MARKET: DROC ANALYSIS

FIGURE 4 GCC REGION INDUSTRIAL DRUM MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 GCC REGION INDUSTRIAL DRUM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GCC REGION INDUSTRIAL DRUM MARKET: TYPE LIFE LINE CURVE

FIGURE 7 GCC REGION INDUSTRIAL DRUM MARKET: MULTIVARIATE MODELLING

FIGURE 8 GCC REGION INDUSTRIAL DRUM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 GCC REGION INDUSTRIAL DRUM MARKET: DBMR MARKET POSITION GRID

FIGURE 10 GCC REGION INDUSTRIAL DRUM MARKET: APPLICATION COVERAGE GRID

FIGURE 11 GCC REGION INDUSTRIAL DRUM MARKET: CHALLENGE MATRIX

FIGURE 12 GCC REGION INDUSTRIAL DRUM MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 GCC REGION INDUSTRIAL DRUM MARKET: SEGMENTATION

FIGURE 14 AVAILABILITY OF INDUSTRIAL DRUMS ACCORDING TO CUSTOMER SPECIFICATION IS EXPECTED TO DRIVE THE GCC REGION INDUSTRIAL DRUM MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 STEEL DRUMS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GCC REGION INDUSTRIAL DRUM MARKET IN 2023 & 2030

FIGURE 16 GCC REGION INDUSTRIAL DRUM MARKET: PRODUCTION AND CONSUMPTION ANALYSIS, 2021-2023 (THOUSAND UNITS)

FIGURE 17 IMPORT-EXPORT SCENARIO (USD THOUSAND)

FIGURE 18 SUPPLY CHAIN ANALYSIS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GCC REGION INDUSTRIAL DRUM MARKET

FIGURE 20 GCC REGION INDUSTRIAL DRUM MARKET: BY TYPE, 2022

FIGURE 21 GCC REGION INDUSTRIAL DRUM MARKET: BY PRODUCT TYPE, 2022

FIGURE 22 GCC REGION INDUSTRIAL DRUM MARKET: BY CAPACITY, 2022

FIGURE 23 GCC REGION INDUSTRIAL DRUM MARKET: BY END-USER, 2022

FIGURE 24 GCC REGION INDUSTRIAL DRUM MARKET: SNAPSHOT (2022)

FIGURE 25 GCC REGION INDUSTRIAL DRUM MARKET: BY COUNTRY (2022)

FIGURE 26 GCC REGION INDUSTRIAL DRUM MARKET: BY COUNTRY (2023 & 2030)

FIGURE 27 GCC REGION INDUSTRIAL DRUM MARKET: BY COUNTRY (2022 & 2030)

FIGURE 28 GCC REGION INDUSTRIAL DRUM MARKET: BY TYPE (2023-2030)

FIGURE 29 GCC REGION INDUSTRIAL DRUM MARKET: COMPANY SHARE 2022 (%)

Gcc Region Industrial Drum Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Gcc Region Industrial Drum Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Gcc Region Industrial Drum Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.