Global 3d Glasses Market

Market Size in USD Billion

CAGR :

%

USD

17.04 Billion

USD

24.19 Billion

2025

2033

USD

17.04 Billion

USD

24.19 Billion

2025

2033

| 2026 –2033 | |

| USD 17.04 Billion | |

| USD 24.19 Billion | |

|

|

|

|

What is the Global 3D Glasses Market Size and Growth Rate?

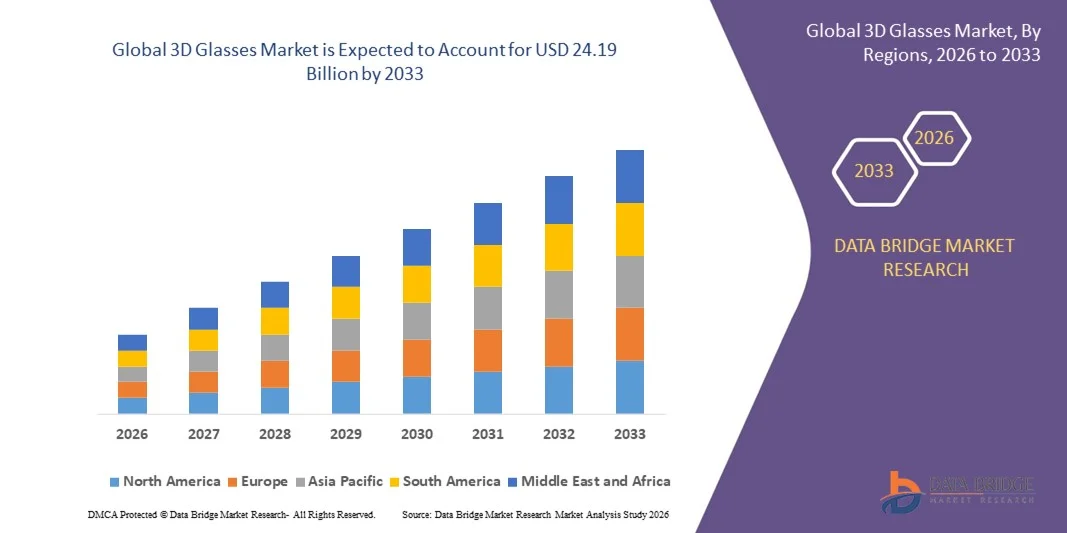

- The global 3D Glasses market size was valued at USD 17.04 billion in 2025 and is expected to reach USD 24.19 billion by 2033, at a CAGR of 4.47% during the forecast period

- The growing availability of technologically advanced computing devices, rising penetration of the internet in various emerging regions, easy access to TV channels and internet services such as on-demand content and catch-up services, growing consumer interest in 3D viewing in emerging nations, reduction in 3D TV prices driving adoption of 3D glasses, emergence of glasses-free technology for 3D TVs are some of the major as well as important factors which will such asly to augment the growth of the 3D glasses market

What are the Major Takeaways of 3D Glasses Market?

- Presence of several key players offering multiple solutions to the customers along with rising preferences for innovative and differentiated solutions to the customers which will further contribute by generating massive opportunities that will lead to the growth of the 3D glasses market in the above mentioned projected timeframe

- Loss of light resulting in dark 3D content along with lack of standard 3D glasses which will such asly to act as market restraints factor for the growth of the 3D glasses

- Asia-Pacific dominated the 3D Glasses market with the largest revenue share of 43.2% in 2025, driven by rising demand for cinema, media, and gaming applications, increasing disposable incomes, and a strong consumer electronics manufacturing base

- North America is projected to witness the fastest growth rate of 9.68% during 2026–2033, fueled by increasing adoption of advanced home theaters, VR/AR applications, and premium cinema experiences

- The Polarized segment dominated the market with the largest revenue share of 47.2% in 2025, owing to its superior visual clarity, reduced flicker, and compatibility with a wide range of 3D displays and cinema systems

Report Scope and 3D Glasses Market Segmentation

|

Attributes |

3D Glasses Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the 3D Glasses Market?

Rising Adoption of Lightweight, High-Performance, and Sustainable 3D Glasses

- The 3D Glasses market is witnessing a significant shift toward lightweight designs, enhanced visual performance, and eco-friendly materials, driven by increasing consumer demand for immersive entertainment and environmentally responsible products. Brands are innovating with biodegradable, recyclable, and reusable components to align with sustainability goals and evolving user expectations

- For instance, Samsung and Sony have introduced 3D glasses with advanced lens coatings, durable frames, and recyclable polymers, combining comfort, visual clarity, and reduced environmental impact. These designs enhance viewer experience while supporting green initiatives

- Consumers’ growing preference for lightweight, ergonomic, and stylish 3D glasses is propelling demand for glasses that can be comfortably worn for extended periods without compromising image quality. This trend is prominent in cinema, home theater, and gaming applications

- Manufacturers are integrating advanced lens technologies such as polarized, active shutter, and anti-reflective coatings to improve color accuracy, contrast, and 3D depth perception. These innovations enhance user comfort and overall viewing experience

- The increasing emphasis on sustainable production, minimal packaging, and compliance with environmental regulations is accelerating adoption of recyclable and reusable 3D glasses in both consumer and commercial sectors

- As consumer demand for immersive experiences and eco-conscious solutions rises, the development of lightweight, durable, and sustainable 3D glasses will remain the defining trend shaping the global market

What are the Key Drivers of 3D Glasses Market?

- Rising consumption of 3D entertainment, including movies, gaming, and virtual reality experiences, is a primary growth driver for the 3D Glasses market. Consumers increasingly seek high-performance glasses that enhance visual depth, color fidelity, and comfort

- For instance, NVIDIA’s partnerships with VR and gaming platforms have accelerated adoption of active shutter 3D glasses, particularly in North America and Europe, by providing enhanced 3D graphics and smooth visual performance

- Increasing environmental awareness and sustainability initiatives are pushing manufacturers to design 3D glasses using recyclable plastics, biodegradable frames, and reusable lenses. Global brands are investing in eco-friendly production to meet regulatory and consumer demands

- Technological advancements in lens materials, polarization techniques, and frame ergonomics are improving durability, clarity, and comfort, making glasses suitable for extended use in cinemas, homes, and gaming setups

- Expansion of home theaters, immersive gaming, and VR applications is driving demand for consumer-friendly, lightweight, and cost-effective 3D glasses, aligning with the market’s focus on convenience and user experience

- As industries focus on combining performance with sustainability, ongoing innovations in lightweight frames, anti-glare coatings, and recyclable components are expected to propel growth of the 3D Glasses market globally

Which Factor is Challenging the Growth of the 3D Glasses Market?

- High material and production costs of advanced lenses, polarized coatings, and lightweight yet durable frames pose a significant challenge to market growth. Premium materials and multi-layer optical technologies increase manufacturing complexity and expenses

- For instance, smaller 3D glasses manufacturers in Asia-Pacific and Europe have reported difficulty competing with larger global producers due to cost-intensive production of high-quality, environmentally friendly glasses

- Regulatory differences regarding recycling standards and disposal requirements across regions, particularly between the U.S., EU, and Asia-Pacific, hinder consistent adoption of sustainable materials

- Technical limitations such as maintaining optical clarity, color accuracy, and durability while using recycled or biodegradable materials restrict scalable production. Manufacturers struggle to balance performance with eco-friendly design

- Fluctuating raw material prices, especially for specialty polymers and optical-grade plastics, create financial uncertainty and reduce profit margins, discouraging smaller players from entering or expanding in the market

- To overcome these challenges, key market players are investing in R&D, strategic collaborations, and automation in lens and frame manufacturing. Over time, standardized sustainability guidelines and scalable eco-friendly materials are expected to reduce costs and support broader market growth

How is the 3D Glasses Market Segmented?

The market is segmented on the basis of product Type, application and type.

- By Product Type

On the basis of product type, the 3D Glasses market is segmented into Active Shutter, Polarized, and Anaglyph glasses. The Polarized segment dominated the market with the largest revenue share of 47.2% in 2025, owing to its superior visual clarity, reduced flicker, and compatibility with a wide range of 3D displays and cinema systems. Polarized glasses are widely adopted in commercial cinemas, home theaters, and gaming setups due to their lightweight design, cost-effectiveness, and ability to provide a comfortable viewing experience over long durations. Manufacturers are increasingly using recyclable and eco-friendly materials in polarized glasses, aligning with sustainability initiatives and consumer expectations.

The Active Shutter segment is projected to register the fastest CAGR from 2026 to 2033, driven by growing adoption in high-end home theaters, virtual reality systems, and professional simulation applications. Advanced electronics, battery-efficient designs, and enhanced 3D depth perception are supporting the rapid growth of active shutter glasses globally.

- By Application

On the basis of application, the 3D Glasses market is categorized into Media and Cinemas. The Cinemas segment dominated the market with the largest revenue share of 53.1% in 2025, supported by the continued popularity of 3D movies, premium cinema experiences, and multiplex expansion worldwide. Movie theaters are investing in high-quality polarized or active shutter glasses to enhance audience engagement and visual immersion. Manufacturers are innovating lightweight, reusable, and recyclable cinema glasses to reduce environmental impact and meet growing sustainability demands.

The Media segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by the surge in 3D content consumption on TVs, smartphones, VR platforms, and streaming services. Increasing consumer demand for immersive at-home entertainment, coupled with the availability of affordable 3D devices and glasses, is driving strong growth in this segment.

- By Type

On the basis of type, the 3D Glasses market is segmented into Active Glasses and Passive Glasses. The Passive Glasses segment dominated the market with the largest revenue share of 50.4% in 2025, owing to their affordability, lightweight design, and compatibility with polarized 3D display systems in cinemas and classrooms. Passive glasses are widely preferred for large-scale viewing applications, as they do not require batteries or electronics, reducing maintenance costs and enabling reusable designs.

The Active Glasses segment is projected to register the fastest CAGR from 2026 to 2033, driven by advancements in active shutter technology, high-definition 3D content consumption, and adoption in premium home theaters, gaming, and simulation industries. Enhanced 3D depth perception, adaptive refresh rates, and ergonomic designs are supporting rapid adoption of active glasses globally, making them a key growth segment for the future.

Which Region Holds the Largest Share of the 3D Glasses Market?

- Asia-Pacific dominated the 3D Glasses market with the largest revenue share of 43.2% in 2025, driven by rising demand for cinema, media, and gaming applications, increasing disposable incomes, and a strong consumer electronics manufacturing base. The region benefits from robust 3D content production, widespread adoption of advanced display technologies, and favorable government initiatives supporting digital media infrastructure

- Continuous investment in R&D, mass production capabilities, and technological innovation by key regional players is further reinforcing Asia-Pacific’s leadership in the global 3D Glasses market

- Growing urbanization, rapid expansion of multiplex cinemas, and rising penetration of VR and AR applications are accelerating market adoption across countries such as China, India, Japan, and South Korea

China 3D Glasses Market Insight

China is the largest contributor in Asia-Pacific, supported by its robust electronics manufacturing ecosystem, large-scale 3D content consumption, and investments in Active Shutter and Polarized glasses production. Strong exports of consumer electronics, increasing adoption of 3D cinema technologies, and government support for digital media industries are fueling growth. Sustainable and recyclable glasses production is gaining traction, enhancing China’s dominance in the regional market.

India 3D Glasses Market Insight

India is witnessing rapid growth, driven by the expansion of multiplex cinemas, digital content streaming, and gaming sectors. Government initiatives promoting electronics manufacturing and digital entertainment, combined with rising disposable income and urbanization, are fostering adoption. Local producers are focusing on cost-effective, lightweight, and reusable 3D glasses, which are creating significant opportunities for market expansion.

North America 3D Glasses Market Insight

North America is projected to witness the fastest growth rate of 9.68% during 2026–2033, fueled by increasing adoption of advanced home theaters, VR/AR applications, and premium cinema experiences. The region benefits from strong technological capabilities, widespread consumer electronics penetration, and investments from major players in Active Shutter and Polarized glasses innovations. Rising demand for immersive media experiences in the U.S. and Canada, along with consumer preference for lightweight and reusable glasses, is driving rapid growth.

U.S. 3D Glasses Market Insight

The U.S. market leads growth in North America, supported by extensive VR/AR adoption, home cinema systems, and gaming consoles. Strong consumer awareness, e-commerce penetration, and technological innovation in Active Glasses and Polarized glasses are boosting market expansion. Leading manufacturers are investing in eco-friendly, durable, and high-performance 3D glasses, further accelerating growth.

Canada 3D Glasses Market Insight

Canada is contributing steadily, driven by increasing cinema attendance, gaming adoption, and digital media consumption. Local initiatives promoting sustainable manufacturing and recyclable materials in electronics and glasses production are supporting market penetration. Advanced distribution networks and consumer preference for high-quality 3D experiences are further enhancing growth prospects.

Which are the Top Companies in 3D Glasses Market?

The 3D Glasses industry is primarily led by well-established companies, including:

- Epson America, Inc. (U.S.)

- NVIDIA Corporation (U.S.)

- Panasonic Corporation of North America (U.S.)

- Samsung Electronics (South Korea)

- Sony India (India)

- American Paper Optics (U.S.)

- eDimensional Inc. (U.S.)

- LG Electronics (South Korea)

- Optoma Asia (China)

- Quantum3D (U.S.)

- RealD Inc. (U.S.)

- SCHOTT AG (Germany)

- Nippon Electric Glass Co., Ltd. (Japan)

- AGC Inc. (Japan)

- G-TECH Optoelectronics Corporation (Taiwan)

- Softonic International S.A. (Luxembourg)

- Rainbow Symphony, Inc. (U.S.)

- 3D Glass Solutions (U.S.)

- OFILM (China)

- Corning Incorporated (U.S.)

What are the Recent Developments in Global 3D Glasses Market?

- In April 2025, Samsung launched a glasses-free 3D display along with a 27-inch QD-OLED monitor priced at €2250 / £1900 / $2000, delivering an immersive 3D experience and allowing users to see themselves, significantly enhancing user engagement and market appeal

- In December 2024, MOPIC, a leader in glasses-free 3D technology, showcased its innovative solutions at CES 2025, targeting global partnerships including those in the U.S. market, further strengthening its position in the 3D display segment

- In April 2022, Arts Alliance Media, a digital software and support service provider, partnered with Shenzhen Timewaying Co. Ltd to develop LED and 3D software solutions by becoming an authorized seller of HeyLED, expanding its footprint in the interactive 3D solutions market

- In February 2021, Perfect Corp. launched an augmented reality virtual try-on service for 3D eyewear glasses that is easy to use and set up, enhancing customer attraction and retention through innovative marketing strategies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.