Global Activin A Market

Market Size in USD Million

CAGR :

%

USD

323.77 Million

USD

830.73 Million

2025

2033

USD

323.77 Million

USD

830.73 Million

2025

2033

| 2026 –2033 | |

| USD 323.77 Million | |

| USD 830.73 Million | |

|

|

|

|

Activin A Market Size

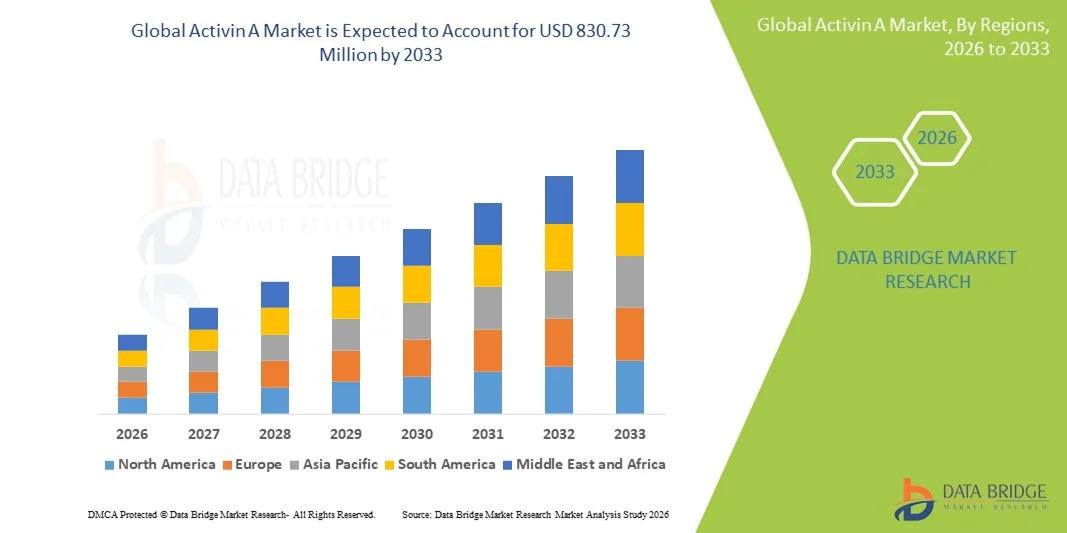

- The global Activin A market size was valued at USD 323.77 million in 2025 and is expected to reach USD 830.73 million by 2033, at a CAGR of 12.50% during the forecast period

- The market growth is largely fueled by increasing research and development in regenerative medicine, tissue engineering, and drug discovery, driving higher demand for Activin A in therapeutic and diagnostic applications

- Furthermore, rising adoption of Activin A in biomarker discovery, clinical research, and pharmaceutical applications is establishing it as a critical molecule for advanced medical research. These converging factors are accelerating the uptake of Activin A solutions, thereby significantly boosting the industry's growth

Activin A Market Analysis

- Activin A, a member of the TGF‑β superfamily, plays critical roles in cell differentiation, inflammation, fibrosis, reproductive biology, and cancer research, making it a key molecule for research, diagnostics, and therapeutics

- The market expansion is significantly fueled by rising R&D investment from pharmaceutical and biotechnology companies focused on developing Activin A-based therapies in areas such as oncology, fibrotic diseases, and regenerative medicine

- North America dominated the Activin A market in 2025 with a revenue share of 42.9%, characterized by a mature biotech ecosystem, high healthcare R&D spending, and the presence of key protein-manufacturing companies, with the U.S. experiencing substantial growth in research and therapeutic applications, particularly in clinical research and biomarker development

- Asia-Pacific is expected to be the fastest-growing region in the Activin A market during the forecast period, due to increasing healthcare investments, rising biotech research, and growing academic-industry collaborations in countries such as China, India, and Japan

- Activin A Human segment dominated the market with a market share of 48.3% in 2025, driven by its extensive use in academic and commercial research, owing to its relevance in human disease modeling and therapeutic development

Report Scope and Activin A Market Segmentation

|

Attributes |

Activin A Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Activin A Market Trends

Expansion of Activin A Use in Regenerative Medicine

- A significant and accelerating trend in the global Activin A market is the increasing use of Activin A in stem cell research and regenerative therapies, enhancing cellular differentiation and tissue repair capabilities

- For instance, Activin A is being used to direct pluripotent stem cells toward endodermal lineages, facilitating liver and pancreatic cell research and potential therapeutic applications

- This integration in regenerative medicine enables more precise control over cell fate and improves experimental reproducibility in clinical and laboratory studies

- The combined use of Activin A with growth factors and biomaterials allows researchers to optimize tissue engineering protocols and enhance translational research outcomes

- This trend towards broader applications in regenerative therapies is fundamentally reshaping research strategies, and companies such as PeproTech are providing high-quality recombinant Activin A for stem cell differentiation and tissue engineering studies

- The demand for Activin A in regenerative medicine and advanced cellular research is growing rapidly across both academic and commercial sectors, as scientists prioritize efficiency and reproducibility in cell-based therapies

- For instance, increasing collaborations between biotech firms and academic institutions are leveraging Activin A to develop next-generation organoid models for drug testing and disease modeling

- Activin A’s integration with high-throughput screening platforms is enabling faster discovery of novel therapeutics, further enhancing its adoption in preclinical research

Activin A Market Dynamics

Driver

Rising Demand for Biomarker Applications in Therapeutics

- The increasing adoption of Activin A as a biomarker in disease diagnosis, prognosis, and therapeutic monitoring is a significant driver for market growth

- For instance, Activin A levels are being monitored in oncology and inflammatory disorders to guide treatment decisions and evaluate patient response

- As research advances, Activin A’s role as a biomarker provides more precise therapeutic targeting and contributes to personalized medicine strategies.

- Furthermore, the growing pharmaceutical and biotech R&D investments are enabling the development of Activin A-based diagnostic kits and assay platforms, enhancing its clinical utility

- The ability of Activin A to act as a biomarker for fibrosis, cancer, and reproductive disorders is expanding its applications and increasing its demand across research and clinical use

- For instance, partnerships between diagnostics companies and academic researchers are driving the creation of point-of-care assays using Activin A for early disease detection

- Activin A’s use in predictive toxicology and drug safety studies is providing additional value to pharmaceutical companies, further boosting its market demand

Restraint/Challenge

High Production Costs and Limited Large-Scale Clinical Use

- Concerns relatively high cost of producing recombinant Activin A and related assay kits poses a significant challenge to market expansion

- For instance, scaling production for clinical-grade Activin A is expensive due to complex protein expression and purification requirements, limiting widespread availability

- Limited adoption in large-scale clinical applications and regulatory hurdles constrain broader commercialization, impacting market growth

- Furthermore, the complexity of Activin A’s biological pathways and variable activity in different experimental systems adds challenges to standardization and consistency

- Overcoming these challenges through cost-effective manufacturing processes, improved protein stability, and regulatory approvals will be critical for sustaining long-term growth in the Activin A market

- For instance, the lack of global regulatory harmonization for protein therapeutics slows clinical adoption across regions

- The market growth is also restrained by intense competition from alternative biomarkers and signaling proteins, which can reduce the reliance on Activin A in certain research applications

Activin A Market Scope

The market is segmented on the basis of type, application, end-users, and distribution channel.

- By Type

On the basis of type, the Activin A market is segmented into Activin A Human and Activin A Mouse/Rat. The Activin A Human segment dominated the market with the largest revenue share of 48.3% in 2025, driven by its extensive use in academic and commercial research related to human disease modeling, drug discovery, and therapeutic development. Researchers prefer Activin A Human for its direct relevance in human cellular pathways, enabling more accurate preclinical and translational studies. Pharmaceutical and biotech companies are increasingly adopting Activin A Human in the development of fibrosis, cancer, and reproductive disorder therapies, which further fuels market demand. The segment benefits from high-quality recombinant protein availability, supporting consistent experimental outcomes. In addition, its compatibility with advanced high-throughput screening platforms and organoid models makes it a preferred choice for large-scale research projects. The growing emphasis on precision medicine and personalized therapeutics also reinforces its dominance in the market.

The Activin A Mouse/Rat segment is anticipated to witness the fastest growth from 2026 to 2033 due to its extensive use in preclinical studies and translational research. Mouse/Rat models are critical for early-stage drug discovery and validation of therapeutic targets before human trials. Researchers leverage these models to study mechanistic pathways, toxicity, and efficacy of potential therapies. The segment benefits from lower costs compared to human proteins and the availability of genetically engineered animal models, making it suitable for diverse research applications. Increasing investment in biopharmaceutical R&D in Asia-Pacific and Europe is expected to drive adoption of Activin A Mouse/Rat. Furthermore, collaborations between academic institutions and biotech companies enhance its utilization in disease modeling and experimental therapeutics, supporting strong growth prospects.

- By Application

On the basis of application, the Activin A market is segmented into Academic Research, Commercial Research, and Others. The Academic Research segment dominated with a market share of 46% in 2025, as Activin A is widely used in fundamental biology, stem cell differentiation, and organoid development. Academic researchers prioritize Activin A for its role in cell signaling, inflammation, and fibrosis studies, providing critical insights for therapeutic innovation. Universities and research institutes increasingly integrate Activin A into high-throughput assays and biomarker studies to accelerate discovery. In addition, the segment benefits from robust funding and grants supporting experimental research. The ongoing expansion of global biotech hubs further strengthens the dominance of academic applications.

The Commercial Research segment is expected to witness the fastest growth during 2026–2033, driven by rising investment from pharmaceutical and biotechnology companies in drug discovery and therapeutic development. Activin A is extensively used in preclinical testing, biomarker validation, and regenerative medicine applications. Its integration with automated screening platforms and organ-on-chip technologies enhances efficiency and reduces time-to-market for novel therapies. Increasing collaborations between biotech startups and large pharmaceutical companies further accelerate adoption. The growing focus on personalized medicine and predictive toxicology studies contributes to the rapid expansion of this segment.

- By End-Users

On the basis of end-users, the Activin A market is segmented into Clinic, Hospital, and Others. Clinics dominated the market with a 40% share in 2025, primarily utilizing Activin A for diagnostics, biomarker assays, and specialized research applications. Clinics focus on disease monitoring and therapeutic evaluation, particularly in oncology and reproductive health, where Activin A levels are relevant. The segment benefits from direct collaborations with academic research and pharmaceutical testing labs, increasing demand. High reliability and reproducibility of recombinant Activin A products make it preferred for clinical investigations. The integration of Activin A-based assays with clinical workflow systems also supports its market dominance.

The Hospital segment is projected to witness the fastest growth from 2026 to 2033, driven by increasing adoption of Activin A in hospital-based research, translational studies, and clinical trial support. Hospitals utilize Activin A to assess disease progression, therapeutic efficacy, and patient biomarker profiling. The segment growth is supported by expanding hospital research infrastructures, particularly in North America and Asia-Pacific. Rising collaborations with biotech firms for clinical validation studies further enhance utilization. Hospitals also adopt Activin A for personalized treatment planning and regenerative therapy research, contributing to the segment’s rapid growth.

- By Distribution Channel

On the basis of distribution channel, the Activin A market is segmented into Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy. The Hospital Pharmacy segment dominated in 2025 with a 45% share, providing direct access to research-grade and clinical-grade Activin A for hospitals and research institutions. Hospital pharmacies ensure quality control, regulatory compliance, and timely availability for high-priority research projects. The segment is strengthened by partnerships between hospitals and biotech suppliers for custom protein production and assay kits. Hospitals also rely on these pharmacies for bulk procurement, supporting large-scale studies. In addition, the ability to integrate Activin A products into hospital research programs reinforces the segment’s dominance.

The Online Pharmacy segment is expected to witness the fastest growth during 2026–2033, driven by the increasing preference for convenient, direct-to-lab delivery of research-grade Activin A. Online platforms provide access to a wide range of product variants, enabling researchers and commercial labs to order in small or large quantities with rapid delivery. The growth of e-commerce in life sciences and improved logistics networks enhances accessibility. Online pharmacies also offer detailed product specifications, batch information, and technical support, making them an attractive channel for small biotech firms and startups. Rising adoption of remote procurement strategies in research institutions supports the segment’s rapid expansion.

Activin A Market Regional Analysis

- North America dominated the Activin A market in 2025 with a revenue share of 42.9%, characterized by a mature biotech ecosystem, high healthcare R&D spending, and the presence of key protein-manufacturing companies

- Researchers and pharmaceutical companies in the region highly value the accuracy, reproducibility, and human relevance offered by Activin A in preclinical studies, disease modeling, and therapeutic development

- This widespread adoption is further supported by the presence of leading protein manufacturers, extensive collaborations between academia and industry, and growing investments in regenerative medicine and personalized therapeutics, establishing Activin A as a critical molecule for both research and clinical applications

U.S. Activin A Market Insight

The U.S. Activin A market captured the largest revenue share of 38% in 2025 within North America, fueled by the rapid growth of biotechnology research and the expanding trend of precision medicine. Researchers and pharmaceutical companies are increasingly prioritizing the use of Activin A in preclinical studies, regenerative medicine, and disease modeling. The growing focus on personalized therapeutics, combined with robust adoption in academic and commercial research, further propels the Activin A industry. Moreover, the increasing integration of Activin A with high-throughput screening platforms and organoid models is significantly contributing to the market's expansion.

Europe Activin A Market Insight

The Europe Activin A market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising investments in biopharmaceutical R&D and advanced diagnostics. The increase in academic-industry collaborations, coupled with the demand for human-relevant models, is fostering the adoption of Activin A. European researchers are also drawn to the accuracy and reproducibility provided by recombinant Activin A products. The region is experiencing significant growth across academic research, commercial research, and clinical applications, with Activin A being incorporated into both fundamental studies and therapeutic development projects.

U.K. Activin A Market Insight

The U.K. Activin A market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing focus on stem cell research, disease modeling, and drug discovery. In addition, the rising demand for biomarkers and translational research applications is encouraging academic and pharmaceutical institutions to adopt Activin A extensively. The U.K.’s robust biotech ecosystem, alongside advanced laboratory infrastructure and strong government support for research, is expected to continue to stimulate market growth.

Germany Activin A Market Insight

The Germany Activin A market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of regenerative medicine applications and clinical research opportunities. Germany’s well-developed research infrastructure, combined with an emphasis on innovation and quality in life sciences, promotes the adoption of Activin A, particularly in academic research institutes, hospitals, and pharmaceutical labs. Integration with biomarker studies and translational research programs is becoming increasingly prevalent, with a strong preference for reliable, high-purity recombinant proteins aligning with local research standards.

Asia-Pacific Activin A Market Insight

The Asia-Pacific Activin A market is poised to grow at the fastest CAGR of 22% during the forecast period of 2026 to 2033, driven by increasing investments in biotechnology research, rising government funding for healthcare innovation, and growing academic-industry collaborations in countries such as China, Japan, and India. The region's growing focus on stem cell research, regenerative medicine, and biomarker discovery is driving the adoption of Activin A. Furthermore, as APAC emerges as a hub for biotech manufacturing and research services, the affordability and accessibility of high-quality recombinant Activin A are expanding to a wider range of academic and commercial users.

Japan Activin A Market Insight

The Japan Activin A market is gaining momentum due to the country’s advanced biotechnology sector, focus on translational research, and high adoption of innovative laboratory technologies. Japanese researchers place significant emphasis on disease modeling, organoid development, and regenerative therapy studies, and the use of Activin A is increasing in these areas. Integration of Activin A with automated screening platforms and precision medicine workflows is fueling growth. Moreover, Japan’s aging population and focus on regenerative medicine are such asly to spur demand for novel research tools and therapeutic development applications in both academic and commercial sectors.

India Activin A Market Insight

The India Activin A market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s rapidly growing biotechnology sector, increasing academic research activities, and high adoption of innovative laboratory techniques. India stands as one of the largest markets for preclinical studies, stem cell research, and commercial research applications, and Activin A is becoming increasingly popular in universities, research institutes, and biotech companies. The push towards biotech innovation hubs, government-funded research initiatives, and availability of cost-effective recombinant proteins, alongside growing domestic manufacturing capabilities, are key factors propelling the market in India.

Activin A Market Share

The Activin A industry is primarily led by well-established companies, including:

- Merck KGaA (Germany)

- Enzo Life Sciences, Inc. (U.S.)

- StemRD, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Ajinomoto Co., Inc. (Japan)

- Bio-Techne Corporation (U.S.)

- STEMCELL Technologies Inc. (Canada)

- Proteintech Group, Inc. (U.S.)

- Prospec-Tany Technogene Ltd. (Israel)

- Tecan Trading AG (Switzerland)

- Sino Biological Inc. (China)

- PeproTech, Inc. (U.S.)

- REPROCELL, Inc. (U.S.)

- Ansh Labs (U.S.)

- BioLegend, Inc. (U.S.)

- Cell Guidance Systems Ltd. (U.K.)

- CellGenix GmbH (Germany)

- Miltenyi Biotec (Germany)

- Qkine Ltd. (U.K.)

- RayBiotech Life, Inc. (U.S.)

What are the Recent Developments in Global Activin A Market?

- In May 2025, researchers published (via Bioengineer) findings that GDF8 and Activin A jointly limit muscle mass in postmenopausal women, suggesting that blocking Activin A (along with GDF8) could be a strategy to counter age-related muscle loss (sarcopenia) in this population

- In March 2025, Keros announced the topline results of its Phase 1 clinical trial for KER-065, demonstrating a favorable safety profile and evidence of biological activity (on bone, muscle) validating its strategy of targeting Activin A in metabolic and musculoskeletal diseases

- In December 2023, a study in eLife identified a novel progenitor cell population (PPCs) in bone fractures that expresses Activin A and showed that recombinant Activin A implantation markedly accelerates fracture healing in mice pointing to therapeutic bone repair potential.

- In October 2023, Regeneron published Phase 2 results from the LUMINA‑1 trial showing that garetosmab, a monoclonal antibody that blocks Activin A, reduced the activity and growth of heterotopic ossification lesions in adults with fibrodysplasia ossificans progressiva (FOP)

- In October 2023, Keros Therapeutics presented preclinical data for its ligand-trap RKER-065 (which targets Activin A and myostatin), showing robust increases in muscle mass, function, and bone formation in a Duchenne muscular dystrophy mouse model

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.