Global Acute Myeloid Leukemia Diagnostics Market

Market Size in USD Billion

CAGR :

%

USD

3.09 Billion

USD

7.27 Billion

2024

2032

USD

3.09 Billion

USD

7.27 Billion

2024

2032

| 2025 –2032 | |

| USD 3.09 Billion | |

| USD 7.27 Billion | |

|

|

|

|

Acute Myeloid Leukemia Diagnostics Market Size

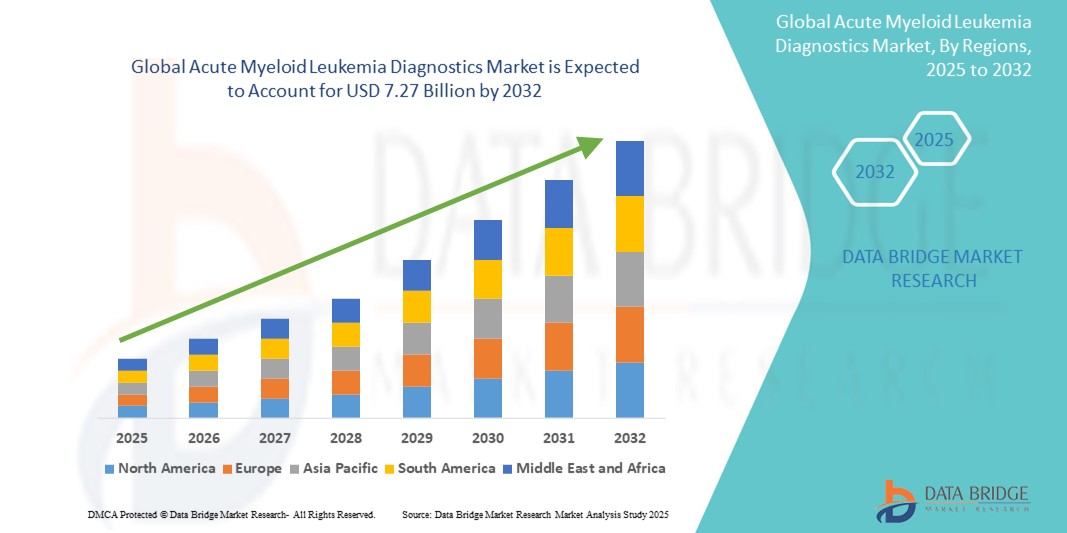

- The global acute myeloid leukemia diagnostics market size was valued at USD 3.09 billion in 2024 and is expected to reach USD 7.27 billion by 2032, at a CAGR of 11.30% during the forecast period

- The market growth is primarily driven by increasing incidences of hematologic malignancies, rising geriatric population, and growing awareness about early cancer detection

- In addition, advancements in molecular diagnostics, next-generation sequencing (NGS), and companion diagnostics are enabling more accurate and personalized AML detection. These factors are collectively enhancing diagnostic efficiency and fostering significant expansion in the AML diagnostics market

Acute Myeloid Leukemia Diagnostics Market Analysis

- AML diagnostics, covering a wide range of tests such as imaging, blood analysis, bone marrow biopsy, immunophenotyping, and genetic profiling, are essential in accurately diagnosing and classifying leukemia subtypes for effective treatment planning across various age groups

- The rising incidence of AML especially among individuals aged 65 and above alongside increasing awareness of hematological malignancies, and the growing demand for early-stage detection tools, is significantly fueling the global adoption of diagnostic solutions

- North America dominated the acute myeloid leukemia diagnostics market with the largest revenue share of 39% in 2024, supported by advanced healthcare infrastructure, high testing volumes across hospitals and cancer research institutes, and increasing use of molecular and biomarker-based tests, particularly in the U.S.

- Asia-Pacific is projected to be the fastest growing region in the acute myeloid leukemia diagnostics market during the forecast period due to improving diagnostic capabilities, growing patient populations, and expanded access through both direct tender and retail sales channels

- The consumables & accessories segment dominated the acute myeloid leukemia diagnostics market with a share of 55.8% in 2024, due to high usage frequency across independent diagnostic labs and imaging centers

Report Scope and Acute Myeloid Leukemia Diagnostics Market Segmentation

|

Attributes |

Acute Myeloid Leukemia Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Acute Myeloid Leukemia Diagnostics Market Trends

“Precision Diagnostics Through Genomic and Molecular Innovations”

- A significant and accelerating trend in the global AML diagnostics market is the integration of advanced molecular technologies such as next-generation sequencing (NGS), flow cytometry, and companion diagnostics, which are reshaping how AML is detected and classified

- For instance, Illumina’s TruSight Oncology and Thermo Fisher’s Oncomine platforms allow clinicians to identify gene mutations such as FLT3, NPM1, and IDH1/2 that influence treatment planning. Similarly, QIAGEN offers molecular panels for minimal residual disease (MRD) monitoring, which are increasingly used post-treatment

- AI-powered diagnostic platforms are also being employed to enhance lab workflow efficiency, interpret complex datasets, and reduce turnaround times. These systems support early intervention by flagging high-risk genetic profiles and abnormal cell markers

- Liquid biopsy is emerging as a non-invasive diagnostic tool for AML, offering real-time disease monitoring and relapse prediction by analyzing circulating tumor DNA (ctDNA) in blood samples

- The seamless adoption of molecular and AI-integrated diagnostics within specialized cancer centers and research institutions is driving a new standard of precision in AML detection and treatment stratification

- This trend toward individualized, high-accuracy testing is setting new benchmarks for clinical diagnostics, prompting companies such as Bio-Rad and Guardant Health to invest in more sensitive, scalable, and clinically actionable solutions for AML

Acute Myeloid Leukemia Diagnostics Market Dynamics

Driver

“Rising Incidence of AML and Advancements in Early Detection Tools”

- The increasing global burden of AML, particularly among older adults and in regions with aging populations, is a primary driver for the growing demand for accurate and timely diagnostics

- For instance, the Leukemia & Lymphoma Society reported over 20,000 new AML cases annually in the U.S. alone, reinforcing the need for effective early detection strategies. In 2024, Abbott launched an expanded hematologic testing panel aimed at accelerating AML diagnosis in hospital settings

- Diagnostic innovations such as immunophenotyping, cytogenetics, and PCR-based assays are enabling better subtype differentiation and improving treatment decisions, especially in high-risk or treatment-resistant AML cases

- The growing clinical emphasis on early intervention, coupled with rising investments in hematologic cancer research, is accelerating the adoption of multi-parameter diagnostic solutions across hospitals, diagnostic labs, and cancer centers

- In addition, awareness initiatives and screening programs by global health organizations are driving wider availability and usage of AML testing kits, especially in high-incidence regions

Restraint/Challenge

“High Cost of Molecular Testing and Limited Access in Low-Income Regions”

- The relatively high cost of AML molecular diagnostics and NGS panels presents a significant barrier to adoption, particularly in low- and middle-income countries lacking adequate reimbursement systems

- For instance, comprehensive genomic profiling platforms require advanced lab infrastructure, trained professionals, and continuous software updates—elements often missing in resource-constrained regions

- This cost burden is compounded by regulatory complexities and variable insurance coverage, limiting patient access to timely and personalized diagnostics

- To overcome these challenges, global health bodies and diagnostics companies are investing in scalable, cost-effective solutions and public-private partnerships aimed at increasing affordability and access

- Despite these efforts, disparities in diagnostic accessibility persist, underscoring the need for international collaboration, clinical education, and long-term investment in diagnostic capacity building across underserved markets

Acute Myeloid Leukemia Diagnostics Market Scope

The market is segmented on the basis of product type, test type, cancer type, age group, gender, end user, and distribution channel.

- By Product Type

On the basis of product type, the acute myeloid leukemia diagnostics market is segmented into instruments and consumables & accessories. The consumables & accessories segment dominated the market with the largest market revenue share of 55.8% in 2024, driven by their frequent usage in diagnostic workflows, including reagents, slides, and assay kits used across multiple test formats. These are essential components in repeated tests such as blood counts, bone marrow evaluations, and molecular diagnostics.

The instruments segment is anticipated to witness the fastest growth rate of 9.8% from 2025 to 2032, fueled by technological advancements and rising demand for high-throughput, automated systems in diagnostic labs. Increasing investment in cancer centers and laboratory automation is also contributing to this growth.

- By Test Type

On the basis of test type, the acute myeloid leukemia diagnostics market is segmented into imaging test, blood test, bone marrow test, biomarker test, immunophenotyping, genetic testing, and others. The genetic testing segment dominated the market with the largest market revenue share of 22.8% in 2024, driven by its critical role in detecting key AML mutations such as FLT3 and NPM1 that directly impact treatment decisions. Precision oncology is heavily reliant on this diagnostic tool, particularly for identifying patients eligible for targeted therapies.

The immunophenotyping segment is anticipated to witness the fastest growth rate of 10.6% from 2025 to 2032, due to its value in subtype classification and its increasing incorporation into standard diagnostic panels. Immunophenotyping enhances diagnostic accuracy and is widely used in both initial diagnosis and relapse monitoring.

- By Cancer Type

On the basis of cancer type, the acute myeloid leukemia diagnostics market is segmented into myeloblastic (M0), myeloblastic (M1), myeloblastic (M2), promyelocytic (M3), myelomonocytic (M4), monocytic (M5), erythroleukemia (M6), and megakaryocytic (M7). The myeloblastic (M2) segment held the largest market revenue share of 21.4% in 2024, owing to its higher prevalence and clearer cytogenetic profiles, making it easier to detect and treat using current diagnostic modalities.

The promyelocytic (M3) segment is projected to grow at the fastest CAGR of 11.2% from 2025 to 2032, supported by its responsiveness to targeted treatments such as ATRA and arsenic trioxide, which require precise and early diagnosis for optimal outcomes.

- By Age Group

On the basis of age group, the acute myeloid leukemia diagnostics market is segmented into 65 and above, 30–65, 21–29, and below 21. The 65 and above segment dominated the market with the largest revenue share of 46.7% in 2024, driven by the significantly higher incidence of AML in elderly populations. Age-related genetic mutations and immune system decline contribute to this trend, making diagnostics especially critical in this group.

The 30–65 segment is expected to witness the fastest growth rate of 9.4% from 2025 to 2032, fueled by increasing awareness, proactive health screenings, and greater access to advanced diagnostic services among the working-age population.

- By Gender

On the basis of gender, the acute myeloid leukemia diagnostics market is segmented into male and female. The male segment held the largest market revenue share of 58.1% in 2024, consistent with epidemiological patterns showing a slightly higher incidence of AML in men. Higher diagnostic rates among males may also be linked to earlier detection due to occupational screenings.

The female segment is expected to grow steadily during forecast period, driven by improved awareness, expanding access to diagnostic services, and increasing inclusion in clinical trials and cancer screening initiatives globally.

- By End User

On the basis of end user, the acute myeloid leukemia diagnostics market is segmented into hospital, associated labs, independent diagnostic laboratories, diagnostic imaging centres, cancer research institutes, and others. The hospital segment dominated the market with the largest revenue share of 37.6% in 2024, attributed to the availability of comprehensive diagnostic services and integrated care under one roof, especially for acute and emergency AML cases.

The independent diagnostic laboratories segment is anticipated to witness the fastest growth rate of 10.1% from 2025 to 2032, driven by outsourcing trends, quicker turnaround times, and expansion of specialized molecular diagnostic services beyond traditional hospital settings.

- By Distribution Channel

On the basis of distribution channel, the acute myeloid leukemia diagnostics market is segmented into direct tender and retail sales. The direct tender segment held the largest market revenue share of 61.4% in 2024, driven by large-volume purchases by public healthcare institutions, cancer centers, and government-funded laboratories.

The retail sales segment is expected to grow at a steady CAGR of 8.5% from 2025 to 2032, supported by increasing decentralization of diagnostic services, growing demand for point-of-care testing kits, and expanded access to diagnostic consumables through pharmacies and online platforms.

Acute Myeloid Leukemia Diagnostics Market Regional Analysis

- North America dominated the acute myeloid leukemia diagnostics market with the largest revenue share of 39% in 2024, supported by advanced healthcare infrastructure, high testing volumes across hospitals and cancer research institutes, and increasing use of molecular and biomarker-based tests, particularly in the U.S.

- Healthcare providers and patients in the region increasingly rely on precision diagnostics such as flow cytometry, genetic testing, and biomarker assays to guide early detection and personalized treatment planning for AML

- This regional growth is further supported by strong healthcare expenditure, well-established cancer care networks, and favorable reimbursement policies for advanced diagnostic services, positioning North America as a leader in the adoption and advancement of AML diagnostics across both hospital and specialized laboratory settings

U.S. Acute Myeloid Leukemia Diagnostics Market Insight

The U.S. acute myeloid leukemia diagnostics market captured the largest revenue share of 79.6% in 2024 within North America, driven by high disease prevalence, well-established cancer screening infrastructure, and the widespread adoption of advanced diagnostic methods. Precision tools such as genetic testing and flow cytometry are commonly utilized for early diagnosis and treatment monitoring. In addition, favorable reimbursement frameworks, increased awareness programs, and strong federal funding for leukemia research continue to bolster market expansion in the U.S., particularly across hospital and research laboratory settings.

Europe Acute Myeloid Leukemia Diagnostics Market Insight

The Europe acute myeloid leukemia diagnostics market is projected to grow at a substantial CAGR throughout the forecast period, fueled by growing investments in cancer research, the implementation of national cancer control plans, and an aging population susceptible to hematological malignancies. The increasing demand for early and accurate diagnosis, combined with technological advances in molecular diagnostics and imaging, is boosting market adoption. Moreover, pan-European collaborations and standardized clinical guidelines are encouraging the integration of novel diagnostics across hospital networks and specialized oncology labs.

U.K. Acute Myeloid Leukemia Diagnostics Market Insight

The U.K. acute myeloid leukemia diagnostics market is expected to grow at a noteworthy CAGR during the forecast period, driven by strong government support for precision medicine and early detection initiatives. The increasing incidence of AML in older adults and access to NHS-backed diagnostic services support growth. Further, the adoption of next-generation sequencing (NGS) and other molecular testing technologies is rising, while partnerships between academic institutions and biotech firms are driving innovation and enhancing diagnostic accuracy.

Germany Acute Myeloid Leukemia Diagnostics Market Insight

The Germany acute myeloid leukemia diagnostics market is anticipated to expand at a considerable CAGR over the forecast period, propelled by a robust healthcare infrastructure and high adoption of advanced laboratory technologies. With a strong emphasis on early cancer detection and a growing geriatric population, diagnostic tools such as cytogenetic analysis, bone marrow biopsy, and immunophenotyping are witnessing increased utilization. Germany’s strategic focus on personalized medicine also supports the demand for genomics-based AML diagnostics.

Asia-Pacific Acute Myeloid Leukemia Diagnostics Market Insight

The Asia-Pacific acute myeloid leukemia diagnostics market is poised to grow at the fastest CAGR of 23.3% from 2025 to 2032, supported by rising cancer awareness, improving healthcare access, and expanding diagnostic capabilities in key countries such as China, India, and Japan. Government initiatives focused on healthcare modernization and cancer screening are driving growth, along with increased private investment in diagnostic labs. Lower costs of testing services and growing availability of skilled professionals are enhancing diagnostic reach across urban and semi-urban centers.

Japan Acute Myeloid Leukemia Diagnostics Market Insight

The Japan acute myeloid leukemia diagnostics market is gaining traction due to the country’s aging population and widespread healthcare coverage, which supports routine cancer screening and diagnostics. Japan’s focus on innovation and medical technology is accelerating the adoption of genomic testing, biomarker profiling, and integrated diagnostic platforms. In addition, collaborations between hospitals and biotech firms are advancing the availability of sophisticated AML testing services within both urban and rural regions.

India Acute Myeloid Leukemia Diagnostics Market Insight

The India acute myeloid leukemia diagnostics market held the largest market revenue share in Asia-Pacific in 2024, driven by increasing leukemia incidence, expanding diagnostic infrastructure, and rising awareness of blood cancers. Government-led initiatives to improve cancer care access, coupled with growing public and private sector investments in pathology and molecular diagnostics, are key market drivers. Cost-effective diagnostic solutions, along with digital healthcare innovations, are extending AML testing services to a broader patient base across Tier I and Tier II cities.

Acute Myeloid Leukemia Diagnostics Market Share

The acute myeloid leukemia diagnostics industry is primarily led by well-established companies, including:

- F. Hoffmann-La Roche Ltd (Switzerland)

- Abbott (U.S.)

- QIAGEN N.V. (Netherlands)

- Bio-Rad Laboratories, Inc. (U.S.)

- Illumina, Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- BD (U.S.)

- Sysmex Corporation (Japan)

- Beckman Coulter, Inc. (U.S.)

- Siemens Healthineers AG (Germany)

- GE HealthCare (U.S.)

- PerkinElmer (U.S.)

- Invitae Corporation (U.S.)

- Natera, Inc. (U.S.)

- Oxford Nanopore Technologies plc (U.K.)

- Guardant Health, Inc. (U.S.)

- Myriad Genetics, Inc. (U.S.)

- Biomérieux (France)

- Cepheid (U.S.)

What are the Recent Developments in Global Acute Myeloid Leukemia Diagnostics Market?

- In May 2023, Sysmex Corporation (Japan), a leader in hematology diagnostics, announced the launch of an enhanced flow cytometry-based AML testing platform aimed at improving the precision and speed of leukemia diagnosis. The new platform integrates automated analysis with advanced software algorithms, enabling clinicians to differentiate AML subtypes more accurately. This development emphasizes Sysmex’s commitment to advancing hematological diagnostics and improving clinical outcomes for AML patients globally

- In April 2023, F. Hoffmann-La Roche Ltd (Switzerland) expanded access to its next-generation sequencing (NGS) solutions for leukemia diagnosis through its NAVIFY® Mutation Profiler, designed to assist oncologists in interpreting genetic data. By streamlining complex genomic insights, this tool enhances personalized treatment planning for AML patients. This launch reinforces Roche’s strategic focus on precision oncology and the increasing role of genomics in AML diagnostics

- In March 2023, Bio-Rad Laboratories, Inc. (U.S.) unveiled its updated QX600 Droplet Digital PCR (ddPCR) system, optimized for detecting low-frequency mutations associated with AML. The technology enables sensitive detection of minimal residual disease (MRD), aiding clinicians in monitoring disease progression and therapeutic response. This advancement showcases Bio-Rad’s emphasis on enabling early and accurate disease monitoring using advanced molecular diagnostics

- In February 2023, Illumina, Inc. (U.S.) partnered with regional oncology centers in Asia to implement comprehensive NGS-based panels for leukemia, including AML. The collaboration aims to expand access to high-quality diagnostic solutions in emerging markets by providing customized genomic testing protocols and clinical interpretation support. This effort illustrates Illumina’s global expansion strategy and its dedication to democratizing access to high-precision cancer diagnostics

- In January 2023, Agilent Technologies Inc. (U.S.) launched a new myeloid panel within its SureSelect portfolio, designed specifically for the detection of clinically relevant mutations in AML. The panel integrates seamlessly with NGS workflows and is intended to support research and diagnostics in clinical laboratories. This innovation reflects Agilent’s growing investment in oncology and the rising demand for targeted, gene-based AML testing solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.