Global Aero Engine Coating Market

Market Size in USD Billion

CAGR :

%

USD

60.71 Billion

USD

93.88 Billion

2024

2032

USD

60.71 Billion

USD

93.88 Billion

2024

2032

| 2025 –2032 | |

| USD 60.71 Billion | |

| USD 93.88 Billion | |

|

|

|

Aero-Engine Coating Market Analysis

The Aero-Engine Coating Market is witnessing significant growth due to the increasing demand for efficient and high-performance coatings for engine components. These coatings are essential for improving engine performance, reducing wear and tear, enhancing corrosion resistance, and extending the lifespan of engine parts. With advancements in materials and technologies, coatings now offer superior protection for critical components such as turbine blades, combustors, and compressors.

Recent innovations, such as thermal barrier coatings (TBCs), environmentally friendly coatings, and ceramic coatings, have contributed to enhanced engine efficiency, allowing aircraft to operate at higher temperatures without compromising safety or performance. For instance, ceramic-based coatings are increasingly used to protect turbine sections from extreme heat and reduce fuel consumption.

The market is also benefiting from the rise in aircraft production, both commercial and military, and the growing demand for high-performance coatings in response to stricter environmental regulations and the need for cost-effective solutions. Furthermore, the continuous development of 3D printing technologies and advanced coating application techniques is enhancing the capabilities of aero-engine coatings. As a result, the aero-engine coating market is poised for robust growth driven by both technological advancements and rising demand for advanced, durable coatings in the aerospace industry.

Aero-Engine Coating Market Size

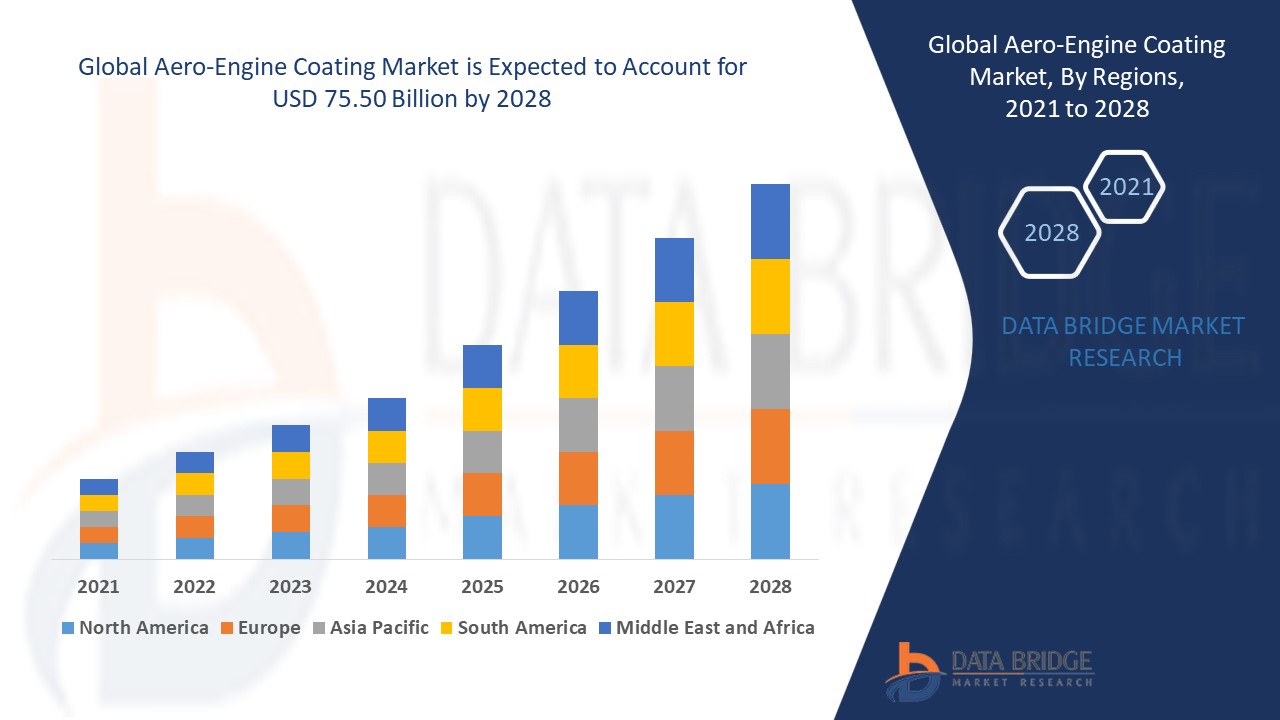

The global aero-engine coating market size was valued at USD 60.71 billion in 2024 and is projected to reach USD 93.88 billion by 2032, with a CAGR of 5.60% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Aero-Engine Coating Market Trends

“Increasing Use of Environmentally friendly coatings”

One key trend in the aero-engine coating market is the increasing use of environmentally friendly coatings, driven by the aerospace industry's push toward sustainability and reducing environmental impact. Traditional coatings often contain hazardous materials, but new innovations are focusing on eco-friendly alternatives that maintain high-performance standards while minimizing environmental harm. For instance, low-VOC (volatile organic compound) coatings and water-based coatings are gaining traction in the market. Companies such as PPG Industries have developed environmentally conscious coatings that offer corrosion protection and reduce the emissions associated with the coating application process. These eco-friendly coatings are particularly important as regulations around emissions and waste management tighten in both commercial and military aviation. The shift toward greener solutions is expected to continue as the aerospace sector seeks more sustainable alternatives without compromising on the performance, durability, and safety of engine components. This trend towards sustainable coating solutions is driving innovation and growth within the aero-engine coating market.

Report Scope and Aero-Engine Coating Market Segmentation

|

Attributes |

Aero-Engine Coating Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

A&A Thermal Spray Coatings (U.S.), Airbus (France), Akzo Nobel N.V. (Netherlands), Boeing (U.S.), Chromalloy Gas Turbine LLC (U.S.), DuPont (U.S.), INDESTRUCTIBLE PAINT INC (U.S.), Lincotek Rubbiano S.p.A. (Italy), OC Oerlikon Management AG (Switzerland), and PPG Industries, Inc. (U.S.) |

|

Market Opportunities |

Increasing Military and Defense Spending |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Aero-Engine Coating Market Definition

Aero-engine coating refers to specialized coatings applied to various engine components, such as turbine blades, compressors, combustors, and other critical parts of aircraft engines, to improve their performance, durability, and resistance to harsh operating conditions. These coatings serve multiple purposes, including thermal protection, corrosion resistance, wear resistance, and enhanced fuel efficiency.

Aero-Engine Coating Market Dynamics

Drivers

- Rising Demand for Fuel Efficiency

The increasing demand for fuel efficiency in aviation is a significant driver for the aero-engine coating market. As airlines and military operators strive to reduce operational costs and minimize environmental impact, the push for advanced technologies that improve engine performance becomes critical. Thermal barrier coatings (TBCs) are a key instance of this innovation. These coatings enable engine components, particularly turbine blades, to withstand higher operating temperatures, allowing engines to run more efficiently and use less fuel. By improving heat resistance, TBCs reduce the need for extra fuel to maintain engine performance under high-stress conditions, which directly contributes to lower fuel consumption and carbon emissions. For instance, General Electric has incorporated advanced thermal barrier coatings in its engines, enabling higher combustion temperatures that improve fuel efficiency and engine performance, thus making the coatings a vital technology to meet the growing demand for fuel-efficient engines. As fuel efficiency continues to be a top priority in aviation, the growing adoption of these high-performance coatings is expected to drive market expansion.

- Increased Focus on Emission Reduction

Reducing carbon emissions is another key factor fueling the demand for advanced aero-engine coatings. With global regulations tightening, such as the International Civil Aviation Organization (ICAO) targets to reduce carbon emissions from aviation, there is a clear push for technologies that can improve environmental sustainability. Advanced coatings such as ceramic coatings and environmentally friendly coatings play a crucial role in this shift by enabling engines to operate at optimal performance with lower emissions. These coatings enhance fuel efficiency and contribute to reducing the overall carbon footprint of aircraft engines. For instance, Rolls-Royce incorporates eco-friendly coatings in its engines, which help in meeting environmental standards while maintaining high performance. As governments enforce stricter environmental laws, the demand for coatings that support emissions reduction and fuel efficiency will drive the growth of the aero-engine coating market.

Opportunities

- Increasing Advancements in Coating Technologies

Advancements in coating technologies have become a crucial driver for the aero-engine coating market, as innovations continue to improve engine performance and longevity. Ceramic coatings, abrasion-resistant coatings, and environmentally friendly coatings are among the cutting-edge technologies shaping the future of aero-engine coatings. These coatings provide superior protection against extreme temperatures, abrasive particles, and corrosive elements, all of which significantly extend the life of engine components. For instance, ceramic coatings are used in the turbine sections of jet engines to withstand high heat, enabling engines to operate more efficiently at higher temperatures. Companies such as General Electric and Rolls-Royce have been pioneering the use of such coatings to enhance fuel efficiency, reduce wear, and improve the overall durability of their engines. With the ongoing development of coatings that offer better protection and reduce maintenance costs, the demand for these advanced coating solutions is expected to rise. This ongoing innovation presents a market opportunity as more manufacturers and operators seek ways to reduce downtime and extend the lifespan of critical engine parts.

- Increasing Military and Defense Spending

The increase in military and defense spending globally is another key opportunity driving the growth of the aero-engine coating market. As countries around the world invest more in their defense capabilities, there is a growing demand for high-performance coatings to ensure the durability, efficiency, and reliability of military aircraft engines. Military engines are subject to extreme conditions, including high-speed operations, rapid temperature fluctuations, and harsh environmental exposure, all of which require specialized coatings to enhance performance and extend component life. For instance, U.S. defense contractors such as Lockheed Martin and Northrop Grumman rely on advanced coatings for military aircraft engines to ensure combat readiness and longevity, particularly for fighter jets and bomber aircraft that endure challenging operational environments. As defense budgets increase, the need for robust, high-performance coatings tailored to military applications presents a significant market opportunity. The aero-engine coating market can capitalize on this trend, offering solutions that meet the unique demands of military aviation.

Restraints/Challenges

- Stringent Regulatory Requirements

The aerospace industry is highly regulated, with strict standards governing the materials used in engine components, including coatings. Aero-engine coatings must meet rigorous requirements for safety, durability, and performance, which can make the development and approval process slow and expensive. Manufacturers must comply with regulations from bodies such as the Federal Aviation Administration (FAA) and European Union Aviation Safety Agency (EASA), which can delay the introduction of new coating technologies. These stringent requirements can be a market challenge, as they increase the cost and time needed for product development and certification.

- High Development and Production Costs

The development and production of specialized aero-engine coatings, such as thermal barrier coatings (TBCs) and corrosion-resistant coatings, require significant investments in research, materials, and technology. These coatings often need to withstand extreme conditions, such as high temperatures and mechanical stress, which increases the cost of raw materials and manufacturing processes. In addition, advanced coatings may involve the use of rare or expensive materials, driving up production costs. The high cost of development and production can limit the affordability and accessibility of these coatings, particularly for smaller manufacturers or in emerging markets.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Aero-Engine Coating Market Scope

The market is segmented on the basis of aircraft type, engine type, process type, form type, and application type. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Aircraft Type

- Commercial Aircraft

- Military Aircraft

- Regional Aircraft

- General Aviation

- Helicopter

Engine Type

- Turbofan Engine

- Turbojet Engine

- Turboprop Engine

- Turboshaft Engine

Process Type

- Spray Process

- EBPVD Process

- Others

Form Type

- Powder Coatings

- Liquid Coatings

- Wired Coatings

Application Type

- Turbine Section

- Combustion Section

- Compressor Section

- Afterburner Section

- Bearings and Accessories

Aero-Engine Coating Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, aircraft type, engine type, process type, form type, and application type as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the aero-engine coating market driven by a surge in the procurement of new aircraft and an increasing demand for military aircraft engines. The region is also witnessing a rise in the production rates of commercial and regional aircraft, which further fuels market growth. In addition, the development of high-thrust engines and the growing need for advanced, high-performance coatings, especially for complex-shaped engine parts, are key factors supporting the market. As these trends continue, North America is expected to maintain its dominant position in the market.

Asia Pacific is projected to experience the highest growth rate in the aero-engine coating market during the forecast period. This growth is driven by increasing investments in aviation infrastructure, a rising demand for both commercial and military aircraft, and expanding air travel in emerging economies. In addition, countries such as China and India are ramping up their aerospace manufacturing capabilities, which fuels the demand for high-quality coatings for engines. With the region's growing focus on advanced technologies and aviation modernization, the market in Asia Pacific is expected to thrive.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Aero-Engine Coating Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Aero-Engine Coating Market Leaders Operating in the Market Are:

- A&A Thermal Spray Coatings (U.S.)

- Airbus (France)

- Akzo Nobel N.V. (Netherlands)

- Boeing (U.S.)

- Chromalloy Gas Turbine LLC (U.S.)

- DuPont (U.S.)

- INDESTRUCTIBLE PAINT INC (U.S.)

- Lincotek Rubbiano S.p.A. (Italy)

- OC Oerlikon Management AG (Switzerland)

- PPG Industries, Inc. (U.S.)

Latest Developments in Aero-Engine Coating Market

- In December 2023, DuPont announced the introduction of a range of new products, including printed Tedlar PVF solutions and PVF coatings, by Coryor Surface Treatment Company Ltd. and Nippon Paint Taiwan. These offerings were unveiled at the Taipei Building Show, Taiwan's largest building materials exhibition

- In September 2023, ST Engineering’s Commercial Aerospace business expanded its MRO capacity in Singapore by opening a new airframe maintenance facility at Singapore Changi Airport. The groundbreaking ceremony took place near the Changi Airfreight Centre, with industry and government stakeholders in attendance

- In September 2023, Satys Aerospace entered into a new agreement with the Mohammed Bin Rashid Aerospace Hub (MBRAH) to construct a state-of-the-art paint hangar at Dubai South - Al Maktoum International Airport (DWC)

- In April 2023, AkzoNobel launched the Interpon D2000 superdurable powder coating for architects and designers in North America. This product offers aluminum surfaces the natural look and texture of stone, without the costs or complexities associated with using actual stone materials

- In March 2021, Socomore launched a new alkaline degreaser as part of its surface treatment range. Approved by major OEMs such as Airbus and Safran, the product is designed to effectively clean parts by removing inks, oils, grease, and other contaminants from surfaces

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.