Global Aerosol Delivery Systems Market

Market Size in USD Billion

CAGR :

%

USD

1.86 Billion

USD

2.97 Billion

2024

2032

USD

1.86 Billion

USD

2.97 Billion

2024

2032

| 2025 –2032 | |

| USD 1.86 Billion | |

| USD 2.97 Billion | |

|

|

|

|

Aerosol Delivery Systems Market Size

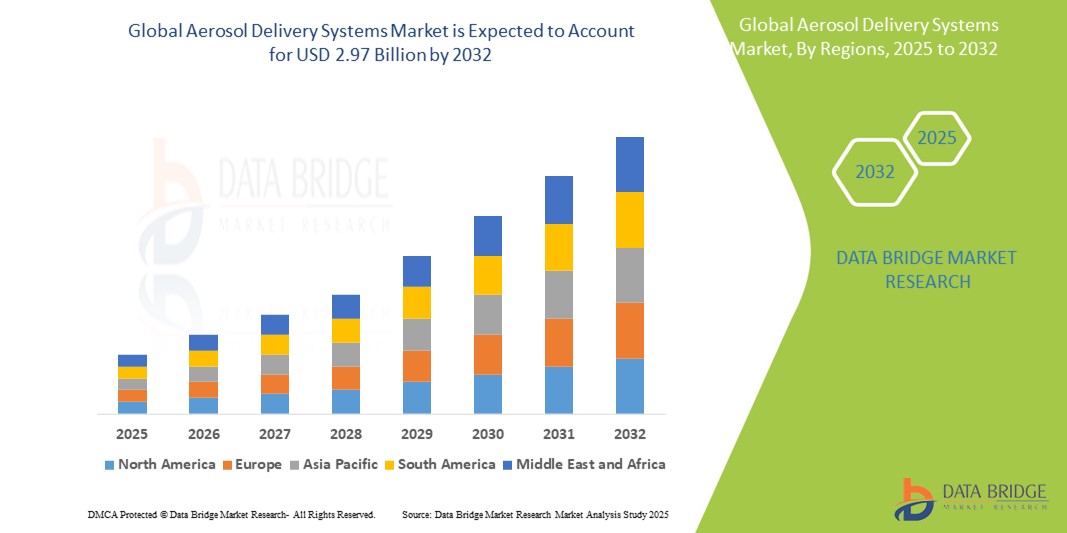

- The global aerosol delivery systems market size was valued at USD 1.86 billion in 2024 and is expected to reach USD 2.97 billion by 2032, at a CAGR of 6.00% during the forecast period

- The market growth is largely fueled by the rising prevalence of respiratory diseases such as asthma and COPD, coupled with continuous technological innovations in inhalation devices

- Furthermore, increasing demand for non-invasive, efficient drug delivery systems driven by an aging population, coupled with the shift towards home healthcare, is accelerating the uptake of aerosol delivery solutions, thereby significantly boosting the industry's growth

Aerosol Delivery Systems Market Analysis

- Aerosol delivery systems, encompassing inhalers and nebulizers, are critical medical devices designed to administer medication directly to the respiratory tract, providing targeted treatment for a range of pulmonary conditions and offering efficient drug absorption with fewer systemic side effects

- The escalating demand for aerosol delivery systems is primarily fueled by the rising global prevalence of chronic respiratory diseases such as asthma and COPD, coupled with significant advancements in inhaler technology, including the emergence of smart inhalers for enhanced patient adherence

- North America dominates the aerosol delivery systems market with the largest revenue share of 35.5% in 2024, characterized by its advanced healthcare infrastructure, high awareness of respiratory conditions, and robust investments in research and development, with the U.S. being a major contributor due to strong regulatory frameworks and a focus on innovative device solutions

- Asia-Pacific is expected to be the fastest growing region in the aerosol delivery systems market with a CAGR of 6.9%, during the forecast period due to increasing urbanization and rising disposable incomes

- Metered dose inhalers segment dominates the aerosol delivery systems market with a market share of 86.5% in 2024, driven by its widespread adoption, convenience, and established efficacy in treating chronic respiratory diseases

Report Scope and Aerosol Delivery Systems Market Segmentation

|

Attributes |

Aerosol Delivery Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Aerosol Delivery Systems Market Trends

“Enhanced Patient Adherence and Monitoring Through Digital Health Solutions and AI Integration”

- A significant and accelerating trend in the global aerosol delivery systems market is the deepening integration with digital health solutions, including smart inhalers, remote monitoring platforms, and increasingly, artificial intelligence (AI). This fusion of technologies is significantly enhancing patient adherence, treatment efficacy, and overall management of chronic respiratory conditions

- For instance, companies such as Propeller Health have developed smart inhalers that attach to existing devices, providing real-time data on usage patterns, dose reminders, and even environmental triggers. Similarly, Philips offers portable nebulizers designed for home use that can be integrated into broader digital health ecosystems

- AI integration in aerosol delivery systems enables features such as learning user inhalation patterns to optimize drug delivery, predicting exacerbations based on usage data, and providing more intelligent alerts for non-adherence. For instance, some smart inhaler platforms utilize AI to identify suboptimal technique and offer personalized coaching. Furthermore, remote monitoring capabilities allow healthcare providers to track patient progress and intervene proactively, reducing the need for frequent in-person visits

- The seamless integration of aerosol delivery devices with digital health platforms facilitates centralized control over various aspects of a patient's respiratory health. Through a single interface, users and clinicians can manage medication schedules, track symptoms, and even share data with electronic health records, creating a unified and more personalized care experience

- This trend towards more intelligent, intuitive, and interconnected aerosol delivery systems is fundamentally reshaping patient expectations for managing their respiratory health. Consequently, companies are focusing on developing devices with enhanced connectivity and data-driven insights to improve patient outcomes and reduce healthcare burdens

- The demand for aerosol delivery systems that offer seamless digital health integration and AI-powered insights is growing rapidly across home healthcare settings and clinical environments, as both patients and providers increasingly prioritize convenience, adherence, and comprehensive disease management

Aerosol Delivery Systems Market Dynamics

Driver

“Growing Need Due to Rising Prevalence of Respiratory Diseases and Aging Population”

- The increasing global prevalence of chronic respiratory diseases such as asthma, Chronic Obstructive Pulmonary Disease (COPD), and cystic fibrosis, coupled with the rapidly expanding geriatric population, is a significant driver for the heightened demand for aerosol delivery systems

- For instance, the World Health Organization (WHO) estimates that hundreds of millions of people worldwide suffer from asthma and COPD, necessitating effective and convenient drug delivery solutions. As the aging population grows, individuals become more susceptible to these conditions, further increasing the patient pool requiring long-term respiratory care

- As public awareness of respiratory health rises and diagnostic capabilities improve, more individuals are seeking and receiving appropriate treatment. Aerosol delivery devices offer distinct advantages, such as direct medication delivery to the lungs, rapid onset of action, and reduced systemic side effects compared to oral medications, making them the preferred choice for managing these chronic conditions

- Furthermore, environmental factors such as increasing air pollution and rising smoking rates contribute to the escalating incidence of respiratory disorders. This necessitates readily available and efficient aerosol delivery devices for both symptomatic relief and long-term disease management

- The convenience and portability of modern inhalers and nebulizers, allowing for self-administration and home-based care, are key factors propelling their adoption in both developed and developing regions. The focus on improving patient adherence through user-friendly designs further contributes to market growth

Restraint/Challenge

“Patient Adherence Issues and Stringent Regulatory Landscape”

- The ensuring consistent patient adherence to aerosol therapy remains a significant challenge, directly impacting treatment efficacy and posing a restraint to market growth. Many patients, particularly those with chronic conditions, struggle with proper inhalation technique, forgetfulness, or a lack of understanding regarding their device's instructions, leading to suboptimal drug delivery

- For instance, studies consistently show that a high percentage of patients misuse their Metered Dose Inhalers (MDIs) or Dry Powder Inhalers (DPIs), even after receiving instruction. This improper use can result in inadequate medication reaching the lungs, leading to poor disease control and increased healthcare costs. Addressing these adherence issues requires continuous patient education, simplified device designs, and the integration of digital tools such as smart inhalers

- Furthermore, the stringent regulatory landscape governing aerosol delivery systems, particularly in major markets such as North America and Europe, presents another significant hurdle. The process for gaining approval for new inhaler designs, drug formulations, and combination products is lengthy, complex, and costly, requiring extensive clinical trials to demonstrate both safety and efficacy

- Compliance with evolving environmental standards, especially regarding the phase-out of certain propellants in MDIs, adds another layer of complexity and cost to research and development. This regulatory burden can delay market entry for innovative solutions and disproportionately affect smaller manufacturers with limited resources

- Overcoming these challenges through robust patient education programs, user-friendly device innovations, and strategic navigation of regulatory pathways will be vital for sustained market growth and ensuring that the benefits of aerosol therapy reach a wider patient population

Aerosol Delivery Systems Market Scope

The market is segmented on the basis of product, application, and distribution channel.

- By Product

On the basis of product, the aerosol delivery systems market is segmented into dry powder inhalers (DPIs), metered dose inhalers, and nebulizers. metered dose inhalers segment. The metered dose inhalers segment dominates the largest market revenue share of 86.5% in 2024, driven by their long-standing use, established clinical efficacy, and broad patient familiarity. MDIs offer consistent dosing, portability, and are the primary choice for managing prevalent respiratory diseases such as asthma and COPD. Their robust demand is further supported by continuous advancements in propellant technology and the development of "smart MDI" variants enhancing patient adherence

The dry powder inhalers segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing patient preference for propellant-free devices, which are often easier to use without coordination challenges. Advancements in powder formulations and device designs offer improved drug delivery efficiency. Their growing adoption in the management of asthma and COPD, coupled with their inherent portability and environmental benefits, contributes significantly to their expanding popularity

- By Application

On the basis of application, the aerosol delivery systems market is segmented into asthma, chronic obstructive pulmonary disease (COPD), cystic fibrosis, and non-respiratory disease. The COPD segment held the largest market revenue share in 2024, driven by the escalating global prevalence of COPD, particularly within the aging population and those exposed to environmental risk factors. COPD is a progressive and chronic condition requiring continuous medication, making aerosol delivery systems essential. Ongoing innovation in therapies and devices specifically tailored for COPD management further underpins this segment's leading position

The non-respiratory disease segment is expected to witness the fastest CAGR from 2025 to 2032, driven by robust research and development exploring systemic drug delivery via the pulmonary route for conditions beyond the lungs. This includes promising applications such as inhaled insulin for diabetes, pain management, and the delivery of biologics. The advantages of rapid absorption, avoidance of first-pass metabolism, and the non-invasive nature position it as a highly attractive and rapidly expanding area

- By Distribution Channel

On the basis of distribution channel, the aerosol delivery systems market is segmented into Retail Pharmacies, Hospital Pharmacies, and E-commerce. The Retail Pharmacies segment held the largest market revenue share in 2024, driven by their widespread accessibility, established consumer trust, and convenience for patients to purchase both prescription and over-the-counter aerosol medications and devices for ongoing disease management. They serve as a primary point for prescription refills and patient counseling on device usage

The E-commerce segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the increasing global internet penetration, growing consumer preference for online shopping, competitive pricing, and the convenience of direct-to-home delivery. The accelerating trend towards home healthcare and remote patient monitoring, especially post-pandemic, further propels the demand for purchasing aerosol delivery systems and associated medications through online platforms.

Aerosol Delivery Systems Market Regional Analysis

- North America dominates the aerosol delivery systems market with the largest revenue share of 35.5% in 2024, driven by its advanced healthcare infrastructure, high awareness of respiratory conditions, and robust investments in research and development

- Consumers and healthcare providers in the region highly value the availability of technologically advanced devices, access to effective and innovative treatments, and strong reimbursement policies for respiratory therapies

- This widespread adoption is further supported by high patient awareness, a large aging population susceptible to chronic lung conditions, and the presence of numerous key industry players focusing on device innovation and improved patient outcomes, establishing aerosol delivery systems as a crucial component of respiratory care in both clinical and home settings

U.S. Aerosol Delivery Systems Market Insight

The U.S. aerosol delivery systems market captured the largest revenue share within North America in 2024, fueled by the high prevalence of chronic respiratory diseases and a robust healthcare infrastructure. Consumers and healthcare providers increasingly prioritize effective and convenient drug delivery methods. The growing adoption of advanced inhalation therapies, combined with strong demand for personalized medicine and digital health integration, further propels the industry. Moreover, significant investments in R&D by pharmaceutical and device companies are contributing to market expansion

Europe Aerosol Delivery Systems Market Insight

The Europe aerosol delivery systems market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the increasing incidence of respiratory conditions and a well-developed healthcare system. The aging population, coupled with rising awareness of respiratory health, is fostering the adoption of sophisticated aerosol devices. European consumers and healthcare systems are also drawn to the efficiency and reduced side effects these delivery methods offer. The region is experiencing significant growth across hospital, clinic, and home care applications, with a strong focus on innovative and patient-friendly solutions

U.K. Aerosol Delivery Systems Market Insight

The U.K. aerosol delivery systems market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the escalating burden of respiratory diseases and a desire for improved patient outcomes. In addition, national health initiatives focusing on better management of chronic conditions are encouraging both patients and healthcare providers to choose advanced inhalation therapies. The UK’s embrace of digital health technologies, alongside its robust healthcare infrastructure, is expected to continue to stimulate market growth

Germany Aerosol Delivery Systems Market Insight

The Germany aerosol delivery systems market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of respiratory health and the demand for technologically advanced, high-quality medical solutions. Germany’s well-developed healthcare infrastructure, combined with its emphasis on precision engineering and patient compliance, promotes the adoption of sophisticated aerosol devices. The integration of these systems with digital health platforms is also becoming increasingly prevalent, with a strong preference for secure and effective drug delivery solutions aligning with local healthcare standards

Asia-Pacific Aerosol Delivery Systems Market Insight

The Asia-Pacific aerosol delivery systems market is poised to grow at the fastest CAGR of 6.9% during the forecast period of 2025 to 2032, driven by increasing urbanization, rising disposable incomes, and the escalating prevalence of respiratory diseases in countries such as China, India, and Japan. The region's growing access to healthcare, supported by government initiatives promoting public health, is driving the adoption of aerosol delivery systems. Furthermore, as APAC emerges as a manufacturing hub for medical devices, the affordability and accessibility of aerosol devices are expanding to a wider consumer base

Japan Aerosol Delivery Systems Market Insight

The Japan aerosol delivery systems market is gaining momentum due to the country’s high incidence of respiratory allergies, rapid urbanization, and demand for advanced healthcare. The Japanese market places a significant emphasis on patient adherence and precise medication delivery, and the adoption of aerosol systems is driven by a sophisticated healthcare system. The integration of smart inhalers with other digital health devices is fueling growth. Moreover, Japan's aging population is likely to spur demand for easier-to-use, effective respiratory solutions in both hospital and home care settings

India Aerosol Delivery Systems Market Insight

The India aerosol delivery systems market accounted for a significant market revenue share in Asia Pacific in 2024, attributed to the country's expanding patient base with respiratory conditions, rapid urbanization, and increasing access to healthcare facilities. India stands as a growing market for medical devices, and aerosol delivery systems are becoming increasingly popular across hospitals, clinics, and individual homes. The push towards improving public health infrastructure and the availability of affordable and effective aerosol device options, alongside strong domestic manufacturing capabilities, are key factors propelling the market in India

Aerosol Delivery Systems Market Share

The aerosol delivery systems industry is primarily led by well-established companies, including:

- AstraZeneca (U.K.)

- GSK plc. (U.K.)

- Boehringer Ingelheim International GmbH (Germany)

- Novartis AG (Switzerland)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Koninklijke Philips N.V. (Netherlands)

- OMRON Corporation (Japan)

- AptarGroup, Inc. (U.S.)

- Viatris Inc. (U.S.)

- PARI Respiratory Equipment, Inc. (U.S.)

- Aerogen (Ireland)

- 3M (U.S.)

- Merck & Co., Inc. (U.S.)

- Sanofi (France)

- Cipla Limited (India)

- Amphastar Pharmaceuticals, Inc. (U.S.)

- Kindeva Drug Delivery L.P. (U.S.)

- Chiesi Farmaceutici S.p.A. (Italy)

- Vectura Group plc (U.K.)

- Medline Industries, LP (U.S.)

Latest Developments in Global Aerosol Delivery Systems Market

- In April 2024, Development. Teva Pharmaceuticals, Inc. and Launch Therapeutics entered a clinical collaboration agreement aimed at fast-tracking the development of a dual-action asthma rescue inhaler (ICS-SABA/TEV-’248) respiratory program. This collaboration highlights a focus on bringing advanced, combined therapies to market more quickly to address patient needs in respiratory conditions

- In May 2024, Amphastar Pharmaceuticals, Inc. announced that the U.S. FDA granted approval for its Abbreviated New Drug Application (ANDA) for Albuterol Sulfate Inhalation Aerosol. This approval marks Amphastar's first generic inhalation product, offering a more accessible and cost-effective treatment option for bronchospasm, and signifies advancements in generic complex drug product manufacturing

- In May 2024, Aptar Pharma showcased its extensive portfolio of respiratory drug delivery solutions, including advancements in sustainable pressurized Metered Dose Inhalers (pMDIs) and an expanding range of connected devices for digital medicines at the Respiratory Drug Delivery (RDD) 2024 conference. This demonstrates an industry focus on sustainability and integrating digital health for enhanced patient outcomes

- In July 2023, Viatris launched Breyna inhalation aerosol, the first FDA-approved generic version of Symbicort (budesonide and formoterol fumarate dihydrate) for asthma and COPD patients in the U.S., in collaboration with Kindeva. This launch increases patient access to affordable, critical combination therapies for chronic respiratory conditions

- In January 2023, AstraZeneca announced the FDA approval of AIRSUPRA® (albuterol/budesonide) inhalation aerosol for the as-needed treatment or prevention of asthma symptoms and to help prevent sudden severe breathing problems in adults. This represents a significant advancement as the first FDA-approved anti-inflammatory rescue option for asthma, combining a SABA and an inhaled corticosteroid

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.