Global Agricultural Lighting Market

Market Size in USD Billion

CAGR :

%

USD

12.79 Billion

USD

31.89 Billion

2024

2032

USD

12.79 Billion

USD

31.89 Billion

2024

2032

| 2025 –2032 | |

| USD 12.79 Billion | |

| USD 31.89 Billion | |

|

|

|

|

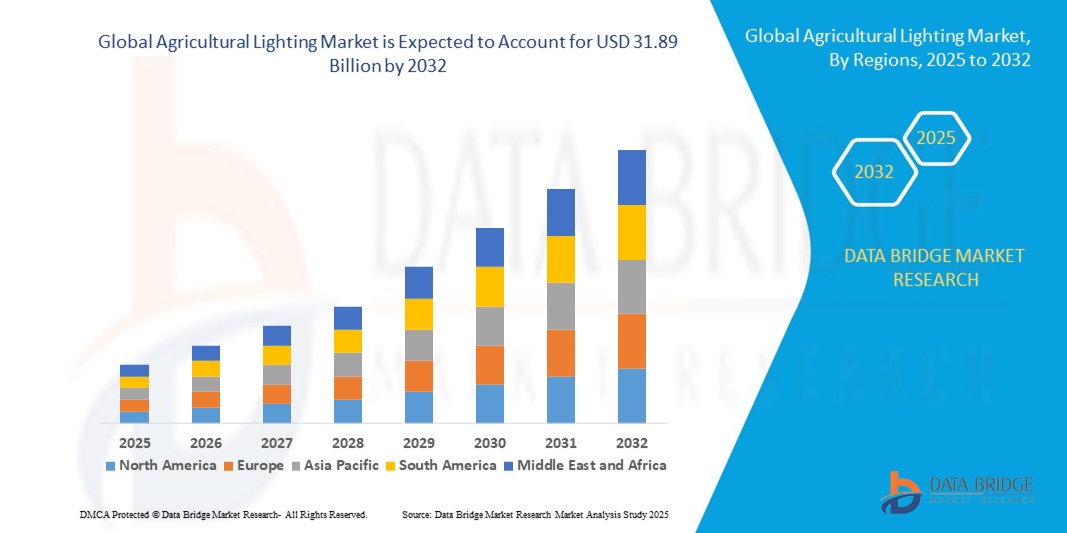

What is the Global Agricultural Lighting Market Size and Growth Rate?

- The global agricultural lighting market size was valued at USD 12.79 billion in 2024 and is expected to reach USD 31.89 billion by 2032, at a CAGR of 12.10% during the forecast period

- The market growth is driven by increasing adoption of energy-efficient and technologically advanced lighting solutions in agriculture, enabling optimized plant growth, livestock productivity, and aquaculture efficiency

- Furthermore, rising demand for automated, smart, and sustainable lighting systems is accelerating the integration of agricultural lighting into modern farming and controlled-environment agriculture setups. The combination of efficiency, convenience, and productivity enhancement is significantly boosting the industry’s expansion

What are the Major Takeaways of Agricultural Lighting Market?

- Agricultural Lighting systems, providing energy-efficient illumination for horticulture, livestock, and aquaculture applications, are becoming essential in modern farming and controlled-environment agriculture. These systems support plant growth cycles, improve livestock welfare, and enhance aquaculture productivity, while offering remote control and programmable settings

- The increasing preference for smart, sustainable, and automated farming solutions is fueling the adoption of agricultural lighting systems. Rising awareness of productivity optimization, energy savings, and cost efficiency are key drivers, making these lighting solutions indispensables in both commercial and large-scale agricultural operations

- North America dominated the agricultural lighting market with the largest revenue share of 38.5% in 2024, driven by the rising adoption of smart agricultural systems, automated greenhouse setups, and precision farming technologies

- Asia-Pacific agricultural lighting market is poised to grow at the fastest CAGR of 6.7% from 2025 to 2032, driven by rapid urbanization, technological advancements, and rising adoption of precision agriculture in countries such as China, Japan, and India

- The hardware segment dominated the market with the largest revenue share of 52.6% in 2024, driven by the essential role of lighting fixtures, drivers, and control units in agricultural setups

Report Scope and Agricultural Lighting Market Segmentation

|

Attributes |

Agricultural Lighting Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Agricultural Lighting Market?

Integration with Smart and Energy-Efficient Lighting Solutions

- A dominant and accelerating trend in the global agricultural lighting market is the integration of advanced LED lighting systems with IoT-enabled controls and energy-efficient solutions. This allows growers to optimize light intensity, spectrum, and timing to maximize crop yield and energy efficiency

- For instance, Fluence by OSRAM and California LightWorks offer smart LED horticultural lighting systems that can be programmed and monitored via mobile applications, enabling precision lighting tailored to plant growth stages

- Smart Agricultural Lightings also feature adaptive controls that adjust light output based on environmental conditions, such as sunlight availability or temperature, providing consistent and optimal illumination while reducing energy costs

- The adoption of connected lighting systems allows centralized control over multiple greenhouses or indoor farms, integrating climate control, irrigation, and nutrient delivery systems for holistic automation

- This trend toward intelligent, programmable, and sustainable lighting solutions is transforming grower expectations, with companies such as Gavita and LumiGrow developing systems compatible with IoT, cloud-based monitoring, and automated scheduling.

- The demand for smart and energy-efficient agricultural lighting is rising rapidly, driven by the need for higher crop productivity, cost reduction, and sustainable agricultural practices

What are the Key Drivers of Agricultural Lighting Market?

- The increasing adoption of indoor farming, greenhouse cultivation, and vertical farming practices is a primary driver of the agricultural lighting market, as growers seek precise lighting control to enhance crop yield

- For instance, in 2024, California LightWorks expanded its smart LED offerings for vertical farms, enabling tailored light recipes for different crops, illustrating the rising demand for customizable lighting solutions

- Rising energy costs and the need for sustainable farming practices are pushing growers toward LED-based, energy-efficient lighting solutions, which offer lower operational costs and reduced environmental impact

- The growing popularity of controlled environment agriculture (CEA) and the integration of smart farming technologies are fostering widespread adoption, enabling real-time monitoring and remote management of lighting systems

- The ease of automation, remote control via apps, and compatibility with IoT sensors for monitoring plant health and growth metrics are further propelling market growth in both commercial and small-scale farming setups

Which Factor is Challenging the Growth of the Agricultural Lighting Market?

- The high initial investment required for advanced smart lighting solutions, especially for LED-based and IoT-integrated systems, remains a key barrier for small-scale and budget-conscious growers

- For instance, while basic LED grow lights are becoming more affordable, premium solutions from companies such as Fluence or Gavita with integrated sensors, cloud monitoring, and automation can be cost-prohibitive

- In addition, technological complexity and lack of knowledge about optimal light recipes or system setup can limit adoption among traditional growers, creating a learning curve barrier

- Concerns regarding system maintenance, connectivity issues, and energy management also pose challenges, particularly in regions with unstable power supply or limited technical support

- Overcoming these challenges through cost-effective modular solutions, grower education programs, and simplified installation and maintenance options will be critical for expanding market penetration and sustaining growth

How is the Agricultural Lighting Market Segmented?

The market is segmented on the basis of component, light source, installation type, and application.

- By Component

On the basis of component, the agricultural lighting market is segmented into hardware, software, and services. The hardware segment dominated the market with the largest revenue share of 52.6% in 2024, driven by the essential role of lighting fixtures, drivers, and control units in agricultural setups. Hardware demand is fueled by the expansion of controlled-environment agriculture, where growers prioritize energy-efficient, durable, and high-performance lighting solutions. Advanced hardware such as LED fixtures, automated dimming controls, and modular lighting systems continues to see robust adoption, particularly in greenhouse and vertical farming applications.

The software segment is anticipated to witness the fastest CAGR of 18.9% from 2025 to 2032, driven by the increasing need for intelligent lighting management systems, predictive analytics, and integration with IoT-enabled farm management platforms. Software solutions allow growers to optimize light spectra, automate schedules, and improve energy efficiency, creating significant operational and cost advantages.

- By Light Source

On the basis of light source, the agricultural lighting market is segmented into fluorescent, high intensity discharge (HID), LED, and others. The LED segment dominated the market with a revenue share of 61.4% in 2024, owing to its superior energy efficiency, long lifespan, and spectrum customization capabilities suitable for varied crop growth cycles. LEDs are increasingly preferred in controlled-environment agriculture for their ability to provide targeted wavelengths, reduce heat output, and lower operational costs.

The fluorescent segment is projected to witness the fastest CAGR of 17.3% from 2025 to 2032, driven by its cost-effectiveness, ease of installation, and suitability for small-scale growers and indoor farming setups. Fluorescent solutions continue to be a viable option for nurseries, propagation areas, and low-intensity growth requirements, contributing to steady adoption in emerging agricultural regions.

- By Installation Type

On the basis of installation type, the agricultural lighting market is segmented into new and retrofit installations. The new installation segment dominated the market with a revenue share of 57.2% in 2024, driven by rapid growth in modern greenhouse constructions, vertical farms, and technologically advanced livestock facilities. New setups allow growers to implement the latest energy-efficient lighting systems and IoT-enabled automation solutions from the outset, improving operational efficiency and crop yields.

The retrofit segment is expected to witness the fastest CAGR of 19.1% from 2025 to 2032, fueled by the increasing need to upgrade existing lighting infrastructure in older greenhouses, livestock barns, and aquaculture facilities. Retrofit projects are motivated by energy cost savings, regulatory compliance, and the desire to integrate smart lighting solutions into legacy setups without extensive reconstruction.

- By Application

On the basis of application, the agricultural lighting market is segmented into horticulture, livestock, and aquaculture. The horticulture segment dominated the market with the largest revenue share of 64.3% in 2024, driven by the expanding adoption of greenhouse and vertical farming practices, controlled-environment agriculture, and high-value crop cultivation. Horticultural lighting solutions focus on optimizing light spectra to enhance photosynthesis, improve crop quality, and increase yield cycles.

The livestock segment is projected to witness the fastest CAGR of 18.7% from 2025 to 2032, fueled by growing awareness of the benefits of artificial lighting in improving animal productivity, welfare, and breeding cycles. Lighting solutions for livestock also help in regulating circadian rhythms, reducing stress, and enhancing feed efficiency, making them a critical investment for modern farms.

Which Region Holds the Largest Share of the Agricultural Lighting Market?

- North America dominated the agricultural lighting market with the largest revenue share of 38.5% in 2024, driven by the rising adoption of smart agricultural systems, automated greenhouse setups, and precision farming technologies

- Farmers and commercial growers in the region prioritize energy-efficient, high-performance lighting solutions that support plant growth optimization, livestock productivity, and aquaculture operations

- The widespread adoption is further reinforced by advanced infrastructure, access to modern technologies, and strong government support for sustainable agriculture, making North America a leading market for agricultural lighting solutions

U.S. Agricultural Lighting Market Insight

U.S. agricultural lighting market captured the largest revenue sharein 2024 within North America, propelled by the growing adoption of LED-based horticultural lighting, controlled-environment agriculture, and livestock lighting solutions. Farmers are increasingly investing in smart lighting systems that allow spectrum adjustment, automated schedules, and remote monitoring via mobile apps. The trend toward vertical farming, greenhouse modernization, and sustainable agricultural practices further drives the market. In addition, integration with IoT platforms and energy-efficient solutions contributes to reducing operational costs while enhancing crop yields, supporting long-term adoption across commercial and residential agricultural operations.

Europe Agricultural Lighting Market Insight

Europe agricultural lighting market is projected to grow steadily, supported by strict energy efficiency standards, increasing urban farming initiatives, and government incentives for sustainable agriculture. The market is fueled by demand for modern greenhouses, high-tech horticulture, and livestock management systems. European farmers are adopting smart lighting solutions to optimize plant growth, improve feed efficiency in livestock, and reduce energy consumption. Countries such as France, the Netherlands, and Italy are witnessing rapid adoption due to technological advancements in controlled-environment agriculture and a focus on reducing operational costs while ensuring higher productivity.

U.K. Agricultural Lighting Market Insight

U.K. agricultural lighting market is expected to grow at a notable CAGR during the forecast period, driven by the adoption of modern greenhouse setups, vertical farming, and automated livestock facilities. Increasing awareness of energy efficiency, sustainability, and precision farming encourages farmers and agribusinesses to implement smart lighting solutions. In addition, the growth of horticulture and aquaculture sectors, combined with a well-established e-commerce and technology infrastructure, supports the accessibility and adoption of advanced agricultural lighting systems across the U.K.

Germany Agricultural Lighting Market Insight

Germany agricultural lighting market is anticipated to expand at a considerable CAGR, fueled by government-led sustainability initiatives, the push for energy-efficient agricultural practices, and advanced smart farming adoption. German growers are increasingly implementing LED and IoT-enabled lighting systems in greenhouses, livestock barns, and aquaculture facilities to enhance productivity and reduce energy costs. The preference for eco-conscious solutions, combined with strong infrastructure and a technology-driven agricultural sector, promotes the market’s growth, particularly in high-value crop cultivation and precision livestock farming.

Fastest Growing Region: Asia-Pacific Agricultural Lighting Market

Asia-Pacific agricultural lighting market is poised to grow at the fastest CAGR of 6.7% from 2025 to 2032, driven by rapid urbanization, technological advancements, and rising adoption of precision agriculture in countries such as China, Japan, and India. The region benefits from government initiatives supporting smart farming, IoT integration in agriculture, and energy-efficient technologies. Increasing awareness about sustainable farming practices and high demand for modern horticulture and aquaculture solutions further accelerates market growth.

Japan Agricultural Lighting Market Insight

Japan agricultural lighting market is witnessing significant growth due to the country’s high-tech agricultural practices, aging farmer population, and demand for easy-to-use, automated lighting solutions. The integration of agricultural lighting with IoT devices, climate-controlled greenhouses, and vertical farming systems drives adoption. Farmers prioritize convenience, productivity enhancement, and energy efficiency, making Japan a key growth market in the Asia-Pacific region.

China Agricultural Lighting Market Insight

China agricultural lighting market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid urbanization, modernization of agricultural practices, and the expanding middle-class investment in smart farming technologies. Controlled-environment agriculture, commercial greenhouses, and vertical farms increasingly adopt LED-based lighting systems. The government’s push toward smart city and precision agriculture initiatives, coupled with the presence of domestic manufacturers offering affordable solutions, is propelling market expansion across horticulture, livestock, and aquaculture applications.

Which are the Top Companies in Agricultural Lighting Market?

The agricultural lighting industry is primarily led by well-established companies, including:

- Agrolux (Netherlands)

- California LightWorks (U.S.)

- Cree, Inc. (U.S.)

- Current, powered by GE (U.S.)

- Fluence by OSRAM (U.S.)

- Gavita International (Netherlands)

- GE Current, a Daintree Company (U.S.)

- Heliospectra AB (Sweden)

- Hortilux Schréder B.V. (Netherlands)

- Illumitex Inc. (U.S.)

- LumiGrow Inc. (U.S.)

- OSRAM GmbH (Germany)

- Savant Systems Inc. (U.S.)

- Signify Holding (Philips Lighting) (Netherlands)

- Valoya Ltd. (Finland)

- VividGro (U.S.)

- Bridgelux Inc. (U.S.)

- EYE Hortilux (U.S.)

- Maxigrow Ltd (U.K.)

- GE Lighting (U.S.)

- Hortilux Schreder (Netherlands)

- Osram Licht AG (Germany)

- Gavita International BV (Netherlands)

- Lumileds (U.S.)

- Hubbell Lighting (U.S.)

What are the Recent Developments in Global Agricultural Lighting Market?

- In January 2023, California LightWorks partnered with Virex Technologies in Spain to expand its European distribution, focusing on crop illumination, reducing installation costs, and saving energy by producing less heat, establishing a stronger foothold for efficient agricultural lighting solutions in Europe

- In January 2023, Energous Corporation in the U.S., a leading developer of RF-based charging for wireless power networks, collaborated with ams-OSRAM AG, a global leader in optical solutions, on a wirelessly powered multi-spectral light sensor for controlled-environment agriculture and vertical farming, enhancing precise lighting management for growers

- In February 2023, ams-OSRAM AG, a global leader in optical solutions, announced a collaboration with Revolution Microelectronics in the U.S., a designer of controlled agriculture environments, to provide lighting for GreenCare Collective's new futuristic facility, supporting the facility’s perpetual harvest methodology to produce an extra crop annually

- In September 2022, Signify Saudi Arabia signed an MoU with MEWA to address the growing agricultural demands in the Kingdom of Saudi Arabia, focusing on smart animal farms with dynamic lighting systems, horticulture smart farms with GrowWise control systems, and aquaculture smart farms with optimized lighting, promoting sustainable and predictable crop and livestock production

- In December 2021, Hortilux collaborated with LLC DTK, Russia's leading rose company, to provide Hortilux's HPS NXT2 fixtures, which offered excellent light distribution, ease of maintenance, and high reliability, successfully supporting the cultivation of roses across a three-hectare area

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Agricultural Lighting Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Agricultural Lighting Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Agricultural Lighting Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.