Global Ai In Fintech Market

Market Size in USD Billion

CAGR :

%

USD

13.14 Billion

USD

765.34 Billion

2021

2029

USD

13.14 Billion

USD

765.34 Billion

2021

2029

| 2022 –2029 | |

| USD 13.14 Billion | |

| USD 765.34 Billion | |

|

|

|

|

Global Artificial Intelligence in Fintech Market Analysis and Size

Artificial intelligence in fintech enables the management of huge volume of data to derive valuable insights and develops a better understanding of customers and their behavior. Rising number of small and medium scale end users are increasingly understanding the importance of integrating advanced technologies with the financial services. RapidMiner, Inc. (US), SAP SE (Germany), SAS Institute Inc. (US), Microsoft (US), Google, LLC (US), and Hewlett Packard Enterprise Development LP (US) are the some major players operating in this market.

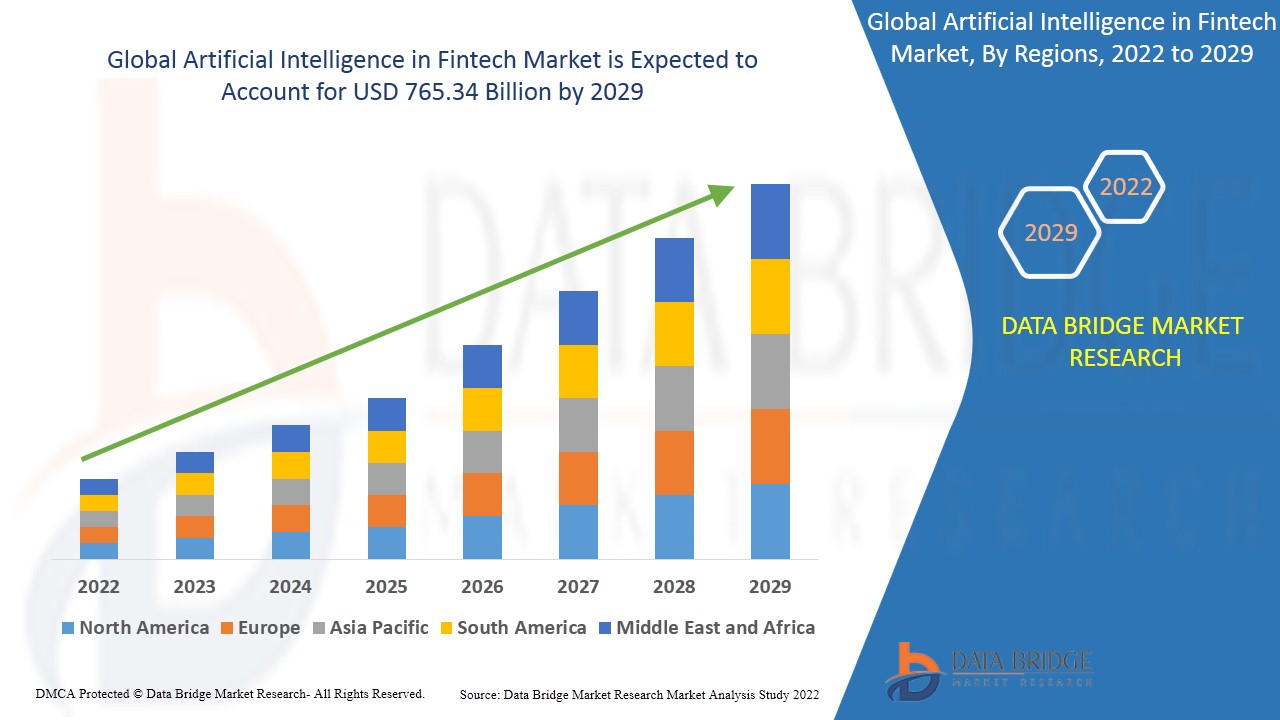

- Data Bridge Market Research analyses that the artificial intelligence in fintech market value, which was USD 13.14 billion in 2021, is expected to reach the value of USD 765.34 billion by 2029, at a CAGR of 66.20% during the forecast period. “Cloud" accounts for the largest deployment mode segment in the artificial intelligence in fintech market owing to the growing number of small and medium scale enterprises.

Global Artificial Intelligence in Fintech Market Definition

From the name itself, it is clear that fintech or financial technology is the incorporation of advanced technologies such as artificial intelligence with the financial services which helps to protect against fraudulent activities. The role of artificial intelligence in fintech is to facilitate the operation of robo-advisors to provide financial planning services.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Component (Solutions and Services), Development Mode (Cloud and On-Premises), Application (Virtual Assistant, Business Analytics and Reporting, Customer Behavioural Analytics and Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America. |

|

Market Players Covered |

BigML, Inc. (US), Cisco Systems, Inc. (US), FICO (US), Hewlett Packard Enterprise Development LP (US), RapidMiner, Inc. (US), SAP SE (Germany), SAS Institute Inc. (US), Microsoft (US), Google, LLC (US), Salesforce.com Inc. (US), IBM (US), Intel Corporation (US), Amazon Web Services, Inc. (US), Inbenta Technologies (US), IPsoft (US), Nuance Communications (US), and ComplyAdvantage (UK) |

|

Market Opportunities |

|

Global Artificial Intelligence in Fintech Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers:

- Growth in investment for research and development to carve way for innovations

The rising number of strategic market collaborations has led to the rise in funds to be allocated for the growth and development of advanced and automated technology/ machinery against fraudulent activities. Further, growth in the level of investment for research and development proficiencies would carve the way for innovations in information technology. Rising integration of artificial intelligence and machine learning technologies will further prove to be a boon for the market.

- Increased number of industries globally to induce greater demand and supply in emerging nations

Growing number of small and medium scale enterprises all around the globe is one of the major factors fostering the growth of the market. In other words, increased number of banking, financial services, and insurance (BFSI), education, energy and utilities, government and public sector, healthcare and life sciences, manufacturing, retail and e-commerce, telecommunication, and IT industries, is directly influencing the growth rate of the market.

- Growing number of cyber-attacks to present numerous opportunities for small scale businesses

Owing to the global economic rise, there is a huge scope of growth for the information and communication technology industry. However, with the rising volume of organizational data, there is a rise in the number of cyber-criminal activities. This could hamper an organizations goodwill and manipulate the records. This will further create a good scope of growth.

Opportunities:

- Cloud based firewalls to present many opportunities

Rising urbanization, modernization, and globalization drive market value growth. In other words, growing awareness about the benefits of cloud based firewalls among small and medium size enterprises especially in the developing economies to develop the infrastructure will present very many opportunities for the growth of the market.

Growing industrial infrastructure and prevalence of limited number of vendors offering services, increasing adoption of centralized policy management and simplified installation, and increased volume of organizational data set are other market growth determinants. Furthermore, rising proliferation of high speed internet in the developing economies will extend profitable opportunities to the market players in the forecast period of 2022 to 2029. Additionally, rising need to fortify the enterprises network against unauthorised and unprecedented strikes and rising usages of the services due to seamless scalability will further expand the future growth of the market.

Restrictions/ challenges Global Artificial Intelligence in Fintech Market

- Increased number of regulations to limit the scope of growth in the long run

The increasing number of multiple regulatory compliance along with limited technical expertise will create hindrances for the growth of the market. Also, lack of skilled consultants to develop artificial intelligence in fintech will narrow down the scope of growth for the market. Further, suspension of business activity on account of the coronavirus pandemic will yet again create hindrances.

- Complexities will pose a threat to the unprecedentedly growing market demand

Complexities associated with the deployment of cloud based deployment models will challenge the market growth rate. Further, penetration of cloud based deployment model is confined to large enterprises which will further derail the market growth rate.

Also, dearth of awareness in underdeveloped regions and high costs associated with deployment will act as growth restraints for the market. Lack of strong infrastructural facilities in the backward economies and dearth of concerns towards the security will also challenge the market growth rate.

This artificial intelligence in fintech market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the artificial intelligence in fintech market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Artificial Intelligence in Fintech Market

The recent outbreak of coronavirus has proven to be a boon for the market. The pandemic has led to the suspension of business activity on account of the coronavirus pandemic and has resulted in disruptions in global supply chains, border restrictions, and travel restrictions by government bodies. This has resulted in shift towards work from home culture across banks and fintech agencies. Further, rapid adoption of artificial intelligence and machine learning tools in banking organizations for performing critical jobs across the globe further created a good scope of growth for the market. Moreover, at the end of 2020, global companies witnessed rising investments in cloud solutions to facilitate easy remote working.

Recent Developments

- In April 2020,Fenergo, the provider of digital transformation, customer journey, and client lifecycle management (CLM) solutions for financial institutions, and IBM signed an original equipment manufacturing (OEM) agreement that may allow companies to collaborate on solutions that can help clients address the multitude of financial risks they face.?

- In May 2020,Sentifi AG announced the expanded alternative data-based analytics to surface investment opportunities and manage risks. Sentifi’s new analytics solution includes detection of the sector, industry outliers, ESG events with potential asset valuation impact, and investment themes trending real-time while offering investors the ability to detect outliers within their portfolios.

Global Artificial Intelligence in Fintech Market Scope

The artificial intelligence in fintech market is segmented on the basis of component, deployment mode and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Solutions

- Services

On the basis of components, artificial intelligence in fintech market is segmented into solutions and services. On the basis of solutions, the market is further segmented into software tools and platforms. On the basis of service, the market is further segmented into managed and professional.

Deployment mode

- Cloud

- On-Premises

Based on deployment mode, artificial intelligence in fintech market has been segmented into cloud and on-premises.

Application

- Virtual Assistant

- Business Analytics and Reporting

- Customer Behavioural Analytics

- Others

On the basis of application, artificial intelligence in fintech market has been segmented into virtual assistant, business analytics and reporting, customer behavioural analytics and others.

Artificial Intelligence in Fintech Market Regional Analysis/Insights

The artificial intelligence in fintech market is analysed and market size insights and trends are provided by country, component, deployment mode and application as referenced above.

The countries covered in the artificial intelligence in fintech market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America is dominating the market owing to the robust presence of prominent artificial intelligence software and system suppliers, combined investment by government and private organizations for the development and growth of research and development activities while Asia-Pacific region will expect to grow in the forecast period of 2022-2029 due to the increasing advancement in technology along with rising need to prevent cybercrimes.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Artificial Intelligence in Fintech Market Share Analysis

The artificial intelligence in fintech market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to artificial intelligence in fintech market.

Some of the major players operating in the artificial intelligence in fintech market are:

- BigML, Inc. (US)

- Cisco Systems, Inc. (US)

- FICO (US)

- Hewlett Packard Enterprise Development LP (US)

- RapidMiner, Inc. (US)

- SAP SE (Germany)

- SAS Institute Inc. (US)

- Microsoft (US)

- Google, LLC (US)

- Salesforce.com Inc. (US)

- IBM (US)

- Intel Corporation (US)

- Amazon Web Services, Inc. (US)

- Inbenta Technologies (US)

- IPsoft (US)

- Nuance Communications (US)

- ComplyAdvantage (UK)

Research Methodology : Global Artificial Intelligence in Fintech Market

Data collection and base year analysis is done using data collection modules with large sample sizes. The stage includes the obtainment of market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analyzed and estimated using market statistical and coherent models. Also market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis.

To know more about the research methodology, drop in an inquiry to speak to our industry experts

https://www.databridgemarketresearch.com/speak-to-analyst/?dbmr=global-ai-in-fintech-market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ARTIFICIAL INTELLIGENCE IN FINTECH MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ARTIFICIAL INTELLIGENCE IN FINTECH MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 MULTIVARIATE MODELLING

2.2.6 STANDARDS OF MEASUREMENT

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL ARTIFICIAL INTELLIGENCE IN FINTECH MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

6 GLOBAL ARTIFICIAL INTELLIGENCE IN FINTECH MARKET, BY COMPONENT

6.1 OVERVIEW

6.2 SOLUTION

6.2.1 SOFTWARE TOOL

6.2.1.1. DATA DISCOVERY

6.2.1.2. DATA QUALITY AND DATA GOVERNANCE

6.2.1.3. DATA VISUALIZATION

6.2.2 PLATFORM

6.3 SERVICES

6.3.1 MANAGED SERVICES

6.3.2 PROFESSIONAL SERVICES

7 GLOBAL ARTIFICIAL INTELLIGENCE IN FINTECH MARKET, BY DEPLOYMENT MODE

7.1 OVERVIEW

7.2 CLOUD

7.3 ON-PREMISE

8 GLOBAL ARTIFICIAL INTELLIGENCE IN FINTECH MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 MACHINE LEARNING

8.3 NLP

8.4 DEEP LEARNING

8.5 OTHERS

9 GLOBAL ARTIFICIAL INTELLIGENCE IN FINTECH MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 VIRTUAL ASSISTANT

9.2.1 MARKET BY DEPLOYMENT MODE

9.2.1.1. CLOUD

9.2.1.2. ON-PREMISE

9.3 BUSINESS ANALYTICS AND REPORTING

9.3.1 MARKET BY TYPE

9.3.1.1. REGULATORY AND COMPLIANCE MANAGEMENT

9.3.1.2. PREDICTIVE ANALYTICS

9.3.2 MARKET BY DEPLOYMENT MODE

9.3.2.1. CLOUD

9.3.2.2. ON-PREMISE

9.4 CUSTOMER BEHAVIOURAL ANALYTICS

9.4.1 MARKET BY TYPE

9.4.1.1. CREDIT SCORING

9.4.1.2. ASSET AND PORTFOLIO MANAGEMENT

9.4.1.3. DEBT COLLECTION

9.4.1.4. INSURANCE PREMIUM

9.4.2 MARKET BY DEPLOYMENT MODE

9.4.2.1. CLOUD

9.4.2.2. ON-PREMISE

9.5 OTHERS

9.5.1 MARKET BY DEPLOYMENT MODE

9.5.1.1. CLOUD

9.5.1.2. ON-PREMISE

10 GLOBAL ARTIFICIAL INTELLIGENCE IN FINTECH MARKET, BY REGION

GLOBAL ARTIFICIAL INTELLIGENCE IN FINTECH MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

10.2 EUROPE

10.2.1 GERMANY

10.2.2 FRANCE

10.2.3 U.K.

10.2.4 ITALY

10.2.5 SPAIN

10.2.6 RUSSIA

10.2.7 TURKEY

10.2.8 BELGIUM

10.2.9 NETHERLANDS

10.2.10 SWITZERLAND

10.2.11 REST OF EUROPE

10.3 ASIA PACIFIC

10.3.1 JAPAN

10.3.2 CHINA

10.3.3 SOUTH KOREA

10.3.4 INDIA

10.3.5 AUSTRALIA

10.3.6 SINGAPORE

10.3.7 THAILAND

10.3.8 MALAYSIA

10.3.9 INDONESIA

10.3.10 PHILIPPINES

10.3.11 REST OF ASIA PACIFIC

10.4 SOUTH AMERICA

10.4.1 BRAZIL

10.4.2 ARGENTINA

10.4.3 REST OF SOUTH AMERICA

10.5 MIDDLE EAST AND AFRICA

10.5.1 SOUTH AFRICA

10.5.2 EGYPT

10.5.3 SAUDI ARABIA

10.5.4 U.A.E

10.5.5 ISRAEL

10.5.6 REST OF MIDDLE EAST AND AFRICA

11 GLOBAL ARTIFICIAL INTELLIGENCE IN FINTECH MARKET,COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: GLOBAL

11.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.3 COMPANY SHARE ANALYSIS: EUROPE

11.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

11.5 MERGERS & ACQUISTIONS

11.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

11.7 EXPANSIONS

11.8 REGULATORY CHANGES

11.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

12 GLOBAL ARTIFICIAL INTELLIGENCE IN FINTECH MARKET, SWOT AND DBMR ANALYSIS

13 GLOBAL ARTIFICIAL INTELLIGENCE IN FINTECH MARKET, COMPANY PROFILE

13.1 IBM

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 GEOGRAPHIC PRESENCE

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 INTEL CORPORATION

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 GEOGRAPHIC PRESENCE

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 IPSOFT INC

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 GEOGRAPHIC PRESENCE

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 COMPLY ADVANTAGE

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 GEOGRAPHIC PRESENCE

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 SAMSUNG

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 GEOGRAPHIC PRESENCE

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 NARRATIVE SCIENCE

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 GEOGRAPHIC PRESENCE

13.6.4 PRODUCT PORTFOLIO

13.6.5 RECENT DEVELOPMENTS

13.7 MICROSOFT

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 GEOGRAPHIC PRESENCE

13.7.4 PRODUCT PORTFOLIO

13.7.5 RECENT DEVELOPMENTS

13.8 AMAZON WEB SERVICES

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 GEOGRAPHIC PRESENCE

13.8.4 PRODUCT PORTFOLIO

13.8.5 RECENT DEVELOPMENTS

13.9 NUANCE COMMUNICATIONS

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 GEOGRAPHIC PRESENCE

13.9.4 PRODUCT PORTFOLIO

13.9.5 RECENT DEVELOPMENTS

13.1 GOOGLE

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 GEOGRAPHIC PRESENCE

13.10.4 PRODUCT PORTFOLIO

13.10.5 RECENT DEVELOPMENTS

13.11 INBENTA TECHNOLOGIES

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 GEOGRAPHIC PRESENCE

13.11.4 PRODUCT PORTFOLIO

13.11.5 RECENT DEVELOPMENTS

13.12 SALESFORCE.COM

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 GEOGRAPHIC PRESENCE

13.12.4 PRODUCT PORTFOLIO

13.12.5 RECENT DEVELOPMENTS

13.13 NEXT IT CORP.

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 GEOGRAPHIC PRESENCE

13.13.4 PRODUCT PORTFOLIO

13.13.5 RECENT DEVELOPMENTS

13.14 ONFIDO

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 GEOGRAPHIC PRESENCE

13.14.4 PRODUCT PORTFOLIO

13.14.5 RECENT DEVELOPMENTS

13.15 RIPPLE LABS INC.

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 GEOGRAPHIC PRESENCE

13.15.4 PRODUCT PORTFOLIO

13.15.5 RECENT DEVELOPMENTS

13.16 ACTIVE.AI

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 GEOGRAPHIC PRESENCE

13.16.4 PRODUCT PORTFOLIO

13.16.5 RECENT DEVELOPMENTS

13.17 TIBCO SOFTWARE (ALPINE DATA LABS)

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 GEOGRAPHIC PRESENCE

13.17.4 PRODUCT PORTFOLIO

13.17.5 RECENT DEVELOPMENTS

13.18 TRIFACTA SOFTWARE INC.

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 GEOGRAPHIC PRESENCE

13.18.4 PRODUCT PORTFOLIO

13.18.5 RECENT DEVELOPMENTS

13.19 DATA MINR INC.

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 GEOGRAPHIC PRESENCE

13.19.4 PRODUCT PORTFOLIO

13.19.5 RECENT DEVELOPMENTS

13.2 ZEITGOLD GMBH

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 GEOGRAPHIC PRESENCE

13.20.4 PRODUCT PORTFOLIO

13.20.5 RECENT DEVELOPMENTS

13.21 SIFT SCIENCE INC.

13.21.1 COMPANY SNAPSHOT

13.21.2 REVENUE ANALYSIS

13.21.3 GEOGRAPHIC PRESENCE

13.21.4 PRODUCT PORTFOLIO

13.21.5 RECENT DEVELOPMENTS

13.22 PEFIN HOLDINGS LLC

13.22.1 COMPANY SNAPSHOT

13.22.2 REVENUE ANALYSIS

13.22.3 GEOGRAPHIC PRESENCE

13.22.4 PRODUCT PORTFOLIO

13.22.5 RECENT DEVELOPMENTS

13.23 BETTERMENT HOLDINGS

13.23.1 COMPANY SNAPSHOT

13.23.2 REVENUE ANALYSIS

13.23.3 GEOGRAPHIC PRESENCE

13.23.4 PRODUCT PORTFOLIO

13.23.5 RECENT DEVELOPMENTS

13.24 WEALTHFRONT INC.

13.24.1 COMPANY SNAPSHOT

13.24.2 REVENUE ANALYSIS

13.24.3 GEOGRAPHIC PRESENCE

13.24.4 PRODUCT PORTFOLIO

13.24.5 RECENT DEVELOPMENTS

13.25 SENTIFI AG

13.25.1 COMPANY SNAPSHOT

13.25.2 REVENUE ANALYSIS

13.25.3 GEOGRAPHIC PRESENCE

13.25.4 PRODUCT PORTFOLIO

13.25.5 RECENT DEVELOPMENTS

13.26 AYASDI

13.26.1 COMPANY SNAPSHOT

13.26.2 REVENUE ANALYSIS

13.26.3 GEOGRAPHIC PRESENCE

13.26.4 PRODUCT PORTFOLIO

13.26.5 RECENT DEVELOPMENTS

13.27 BRIGHTERION

13.27.1 COMPANY SNAPSHOT

13.27.2 REVENUE ANALYSIS

13.27.3 GEOGRAPHIC PRESENCE

13.27.4 PRODUCT PORTFOLIO

13.27.5 RECENT DEVELOPMENTS

13.28 APPZEN

13.28.1 COMPANY SNAPSHOT

13.28.2 REVENUE ANALYSIS

13.28.3 GEOGRAPHIC PRESENCE

13.28.4 PRODUCT PORTFOLIO

13.28.5 RECENT DEVELOPMENTS

13.29 NEXT IT

13.29.1 COMPANY SNAPSHOT

13.29.2 REVENUE ANALYSIS

13.29.3 GEOGRAPHIC PRESENCE

13.29.4 PRODUCT PORTFOLIO

13.29.5 RECENT DEVELOPMENTS

13.3 AIDA TECHNOLOGIES

13.30.1 COMPANY SNAPSHOT

13.30.2 REVENUE ANALYSIS

13.30.3 GEOGRAPHIC PRESENCE

13.30.4 PRODUCT PORTFOLIO

13.30.5 RECENT DEVELOPMENTS

14 CONCLUSION

15 QUESTIONNAIRE

16 RELATED REPORTS

17 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.