Global Aircraft Mro Market

Market Size in USD Billion

CAGR :

%

USD

91.35 Billion

USD

678.58 Billion

2024

2032

USD

91.35 Billion

USD

678.58 Billion

2024

2032

| 2025 –2032 | |

| USD 91.35 Billion | |

| USD 678.58 Billion | |

|

|

|

|

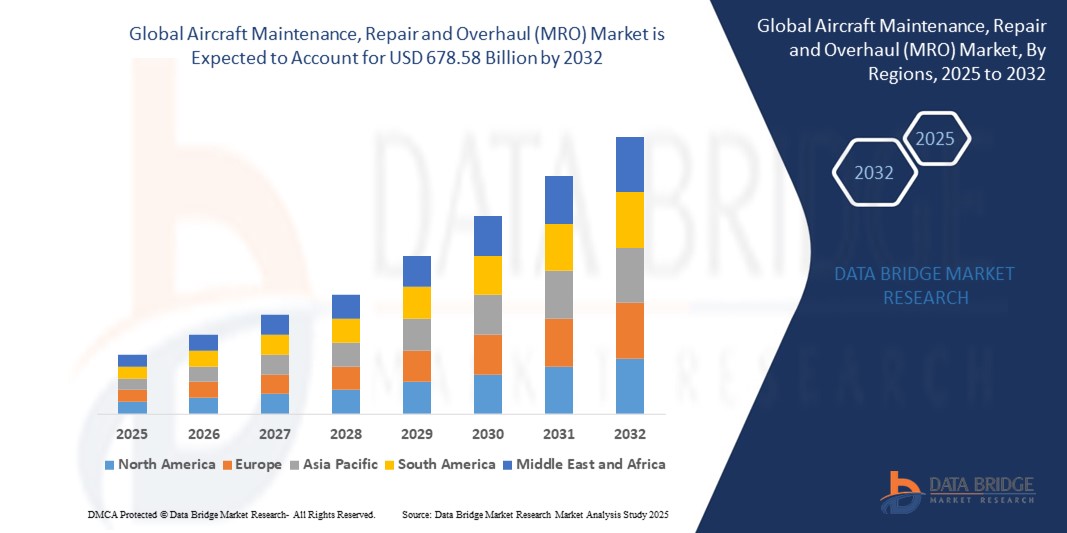

What is the Global Aircraft Maintenance, Repair and Overhaul (MRO) Market Size and Growth Rate?

- The global Aircraft Maintenance, Repair and Overhaul (MRO) market size was valued at USD 91.35 billion in 2024 and is expected to reach USD 678.58 billion by 2032, at a CAGR of 5.25% during the forecast period

- In the aircraft maintenance, repair, and overhaul (MRO) market, innovative technologies such as predictive maintenance software and drones equipped with sensors are transforming operations

- These advancements streamline inspections, detect defects early, and enhance safety. Moreover, 3D printing is gaining traction for producing replacement parts, reducing costs, and minimizing aircraft downtime, propelling the industry forward

- For instance, in February 2021, SIA Engineering Company Ltd. launched the Engine Services Division to pioneer advanced aircraft engine servicing, repairs, and wing testing

What are the Major Takeaways of Aircraft Maintenance, Repair and Overhaul (MRO) Market?

- Modern MRO firms leverage artificial intelligence, drones, and robots to significantly expedite maintenance and repairs. These innovations enhance efficiency, minimize downtime, and mark a transformative shift in the aerospace industry's approach to maintenance operations

- North America dominated the Aircraft Maintenance, Repair and Overhaul (MRO) market with the largest revenue share of 27.01% in 2024, driven by a robust aviation infrastructure, the presence of leading MRO providers, and high commercial air traffic

- Asia-Pacific (APAC) region is projected to grow at the fastest CAGR of 15.26% from 2025 to 2032, driven by a rapidly expanding aviation sector, growing air passenger traffic, and rising investments in regional MRO capabilities

- The Engine Overhaul segment dominated the market with the largest market revenue share of 38.6% in 2024, owing to the high cost and criticality of engine maintenance, which requires specialized skills, parts, and certifications

Report Scope and Aircraft Maintenance, Repair and Overhaul (MRO) Market Segmentation

|

Attributes |

Aircraft Maintenance, Repair and Overhaul (MRO) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Aircraft Maintenance, Repair and Overhaul (MRO) Market?

“Enhanced Efficiency through AI and Predictive Maintenance”

- A pivotal trend in the global Aircraft Maintenance, Repair and Overhaul (MRO) market is the accelerated adoption of artificial intelligence (AI) and predictive analytics to enhance maintenance efficiency, reduce downtime, and optimize aircraft availability. This technological evolution is transforming traditional MRO operations into more data-driven and proactive services

- AI-integrated MRO systems can forecast component failures before they occur by analyzing real-time data streams from aircraft sensors. This allows MRO providers to schedule maintenance more effectively and avoid costly unscheduled repairs. For instance, Rolls-Royce’s Intelligent Engine initiative leverages AI and big data to predict service needs with high precision

- Predictive maintenance tools are now capable of identifying wear patterns, analyzing engine health, and improving turnaround times. Lufthansa Technik, through its AVIATAR platform, uses AI to predict part degradation, improving operational reliability and fleet management

- Furthermore, AI-driven platforms offer automated diagnostics, fault detection, and recommendation systems that guide engineers through optimized repair strategies. This significantly cuts down on manual inspection time and error margins

- Companies such as GE Aviation, Honeywell Aerospace, and Airbus are increasingly investing in AI-powered MRO systems that integrate seamlessly with airline operational databases. These platforms are reshaping industry benchmarks in terms of aircraft readiness, cost savings, and lifecycle management

- This shift toward intelligent and interconnected MRO solutions is improving safety and reliability and setting a new standard for efficiency in the aerospace sector

What are the Key Drivers of Aircraft Maintenance, Repair and Overhaul (MRO) Market?

- Rising global air traffic, aging fleets, and stricter regulatory requirements are major drivers for the expanding demand for efficient MRO services. Airlines and operators are under pressure to minimize aircraft downtime while maintaining safety standards

- For instance, in February 2024, Air France Industries-KLM Engineering & Maintenance partnered with Donecle to implement drone-based visual inspections, drastically reducing the time required for aircraft checks

- The growth of low-cost carriers and fleet expansion, particularly in Asia-Pacific and the Middle East, is further propelling MRO demand, as airlines seek cost-effective solutions to ensure aircraft availability and reduce operational cost

- In addition, digital transformation initiatives across the aerospace industry, including paperless maintenance logs and automated inventory management, are streamlining MRO workflows, improving turnaround times, and lowering maintenance costs

- The increasing need for third-party MRO providers—especially in regions lacking in-house airline capabilities—is also encouraging investments in new MRO facilities, partnerships, and workforce training programs

- Collectively, these factors are contributing to a robust growth outlook for the MRO sector, with a strong emphasis on speed, cost-efficiency, and operational excellence

Which Factor is challenging the Growth of the Aircraft Maintenance, Repair and Overhaul (MRO) Market?

- Cybersecurity vulnerabilities and data integrity concerns are emerging as critical challenges as MRO systems become increasingly digitized and connected. With rising use of cloud-based platforms and IoT-integrated diagnostics, the risk of cyberattacks and data breaches is growing

- In a notable instance, Boeing’s 2023 security audit revealed potential threats to its MRO digital platforms, leading to the implementation of more stringent cybersecurity protocols across its digital toolsets

- MRO providers must now comply with strict aviation cybersecurity regulations such as the EU Aviation Cybersecurity Strategy and U.S. FAA guidelines. These compliance requirements demand continuous software updates, secure data encryption, and robust authentication measure

- Moreover, shortage of skilled labor, particularly in digital and AI-focused MRO roles, is another pressing issue. The demand for technicians proficient in software-based diagnostics is outpacing supply, creating a talent bottleneck

- In addition, the high initial investment in AI and predictive systems—combined with long integration timelines can deter smaller players from adopting these technologies

- Overcoming these challenges will require coordinated industry efforts in workforce development, cybersecurity innovation, and affordability improvements to ensure sustainable and scalable MRO advancements

How is the Aircraft Maintenance, Repair and Overhaul (MRO) Market Segmented?

The market is segmented on the basis of service type, application, organization type, aircraft type, and generation.

- By Service Type

On the basis of service type, The Aircraft Maintenance, Repair and Overhaul (MRO) market is segmented into Engine Overhaul, Airframe Maintenance, Line Maintenance, Modification, and Components. The Engine Overhaul segment dominated the market with the largest market revenue share of 38.6% in 2024, owing to the high cost and criticality of engine maintenance, which requires specialized skills, parts, and certifications. As engines represent the most expensive part of an aircraft, operators prioritize their upkeep to ensure safety, efficiency, and compliance with aviation regulations.

The Modification segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for cabin retrofits, passenger experience upgrades, and aircraft performance enhancements. Airlines are investing in modernization to meet new emission norms, improve operational efficiency, and cater to evolving customer expectations.

- By Organization Type

On the basis of organization type, the Aircraft Maintenance, Repair and Overhaul (MRO) market is categorized into Airline/Operator MRO, Independent MRO, and OEM MRO. The Independent MRO segment held the largest market revenue share of 41.2% in 2024, benefiting from flexibility, cost competitiveness, and cross-platform servicing capabilities. These providers cater to multiple airlines and aircraft types, making them attractive partners for cost-conscious operators.

The OEM MRO segment is expected to grow at the fastest CAGR from 2025 to 2032, driven by rising OEM efforts to capture aftermarket revenue streams. OEMs such as Airbus, Boeing, and Rolls-Royce are expanding MRO offerings to ensure integration with proprietary components and to leverage long-term service agreements (LTAs).

- By Aircraft Type

On the basis of aircraft type, The Aircraft Maintenance, Repair and Overhaul (MRO) market is segmented into Narrow-Body, Wide-Body, Regional Jet, and Others. The Narrow-Body segment led the market with the largest market revenue share of 47.5% in 2024, supported by its dominance in short-haul and domestic routes and the higher frequency of flight cycles requiring more frequent maintenance. Aircraft such as the Boeing 737 and Airbus A320 families account for a significant portion of global fleets, increasing demand for narrow-body MRO services.

The Wide-Body segment is projected to witness the fastest CAGR from 2025 to 2032, attributed to growing international air traffic and the resurgence of long-haul routes post-pandemic. The complexity and scale of wide-body maintenance also contribute to higher value MRO contracts.

- By Generation

On the basis of application, the Aircraft Maintenance, Repair and Overhaul (MRO) market is segmented into Old Generation, Mid Generation, and New Generation aircraft. The Mid Generation segment held the largest revenue share of 44.8% in 2024, driven by the extensive global fleet of aging aircraft still in operation, especially in developing markets. These aircraft require frequent maintenance and component replacement, sustaining demand for MRO services.

The New Generation segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increased deliveries of fuel-efficient and technologically advanced aircraft such as the Boeing 787 Dreamliner and Airbus A350. These aircraft often require specialized digital MRO support and updated tooling.

- By Application

On the basis of application, the Aircraft Maintenance, Repair and Overhaul (MRO) market is segmented into Commercial, Cargo, and Defense Services. The Commercial segment dominated the market with the largest revenue share of 55.3% in 2024, owing to the size of commercial fleets, high aircraft utilization rates, and stringent safety standards. Commercial airlines account for the bulk of global MRO spending as they prioritize fleet availability and compliance.

The Cargo segment is projected to grow at the fastest CAGR from 2025 to 2032, boosted by the sustained rise in e-commerce and the conversion of passenger aircraft into freighters. Increased air freight volumes and specialized cargo handling requirements are driving tailored MRO solutions in this segment.

Which Region Holds the Largest Share of the Aircraft Maintenance, Repair and Overhaul (MRO) Maret?

- North America dominated the Aircraft Maintenance, Repair and Overhaul (MRO) market with the largest revenue share of 27.01% in 2024, driven by a robust aviation infrastructure, the presence of leading MRO providers, and high commercial air traffic

- The region benefits from mature airline fleets and regular aircraft utilization, increasing the need for scheduled maintenance and overhaul services.

- Supportive regulatory frameworks, investments in digital MRO platforms, and the integration of AI and predictive maintenance systems are enhancing service efficiency. This has further fueled demand for both line and base maintenance across commercial, cargo, and defense aviation segments.

U.S. Aircraft Maintenance, Repair and Overhaul (MRO) Market Insight

U.S. dominated North America's MRO market share in 2024, making it the largest contributor regionally. This dominance stems from the size of the U.S. commercial fleet, the strong presence of OEMs and independent MRO providers, and continued investments in aviation infrastructure. The adoption of next-gen technologies such as digital twins, IoT diagnostics, and predictive maintenance platforms is revolutionizing MRO operations in the country. In addition, the U.S. Department of Defense's recurring contracts and fleet modernization efforts further fuel growth in the military aviation MRO segment.

Europe Aircraft Maintenance, Repair and Overhaul (MRO) Market Insight

Europe is projected to expand at a substantial CAGR during the forecast period, driven by regulatory compliance requirements, fleet modernization programs, and the growth of low-cost carriers. Countries such as Germany, France, and the U.K. are focusing on sustainability-driven maintenance practices and increasing investments in hybrid-electric aircraft platforms. The region's emphasis on eco-friendly aviation, rising air passenger volumes, and support for cross-border MRO collaboration through pan-European regulatory frameworks are accelerating demand for comprehensive MRO services.

U.K. Aircraft Maintenance, Repair and Overhaul (MRO) Market Insight

U.K. MRO market is expected to grow at a noteworthy CAGR, backed by strong government and private sector involvement in aviation R&D, especially around next-generation propulsion and sustainable aviation fuels. The presence of legacy aerospace manufacturers and MRO hubs in locations such as Manchester and Birmingham boosts demand. In addition, post-Brexit aviation agreements are reshaping the country’s approach to EASA-compliant MRO services while maintaining global competitiveness.

Germany Aircraft Maintenance, Repair and Overhaul (MRO) Market Insight

Germany’s MRO market is forecasted to grow steadily, supported by a strong engineering base, automation in aircraft inspection processes, and a rising number of narrow-body aircraft operations. The focus on digital transformation and innovation aligns with national sustainability targets, while increasing collaboration between airlines and MRO providers enhances operational efficiency. Germany also serves as a gateway for servicing both Western and Eastern European fleets, strengthening its regional importance.

Which Region is the Fastest Growing in the Aircraft Maintenance, Repair and Overhaul (MRO) Market?

Asia-Pacific (APAC) region is projected to grow at the fastest CAGR of 15.26% from 2025 to 2032, driven by a rapidly expanding aviation sector, growing air passenger traffic, and rising investments in regional MRO capabilities. Countries such as China, Japan, and India are significantly investing in localizing MRO services to reduce dependency on overseas facilities. Government initiatives, low-cost carrier expansion, and the establishment of MRO clusters in Southeast Asia are transforming APAC into a global MRO hotspot.

Japan Aircraft Maintenance, Repair and Overhaul (MRO) Market Insight

Japan’s MRO market is growing steadily, supported by the country’s precision-focused engineering culture, aging commercial fleet, and investments in automation and robotics in maintenance operations. Japan’s emphasis on aircraft reliability and efficiency, alongside its adoption of AI-powered inspection and scheduling systems, is enhancing MRO output quality. The country’s push to become a regional hub for MRO services is expected to increase international partnerships and capacity.

China Aircraft Maintenance, Repair and Overhaul (MRO) Market Insight

China led the APAC MRO market in 2024, driven by its rapidly growing aviation sector, increasing aircraft deliveries, and a large domestic travel market. The government’s “Made in China 2025” initiative includes MRO capability development as a strategic priority. Domestic airlines are expanding in-house MRO services, while the government supports the creation of aviation maintenance zones with tax and infrastructure incentives, making China a central player in regional MRO dynamics.

Which are the Top Companies in Aircraft Maintenance, Repair and Overhaul (MRO) Market?

The Aircraft Maintenance, Repair and Overhaul (MRO) industry is primarily led by well-established companies, including:

- AAR (U.S.)

- AIRBUS (France)

- Delta Air Lines, Inc. (U.S.)

- Hong Kong Aircraft Engineering Company Limited (Hong Kong)

- KLM UK Engineering Limited (U.K.)

- Lufthansa Technik (Germany)

- MTU Aero Engines AG(Germany)

- ST Engineering (Singapore)

- TAP (Portugal)

- RTX (U.S.)

- General Electric (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- SIA Engineering Company (Singapore)

- Rolls-Royce plc (U.K.)

- AFI KLM E&M (France)

What are the Recent Developments in Global Aircraft Maintenance, Repair and Overhaul (MRO) Market?

- In March 2024, C&L Aviation Group acquired two Citation Sovereign and two Citation XLS aircraft for teardown operations. Two of the disassembly projects were completed at the company’s MRO facility in Bangor, Maine, with the remaining two currently underway. With a growing shortage of aircraft parts in the market, this move is aimed at inspecting and reselling the salvaged components for maintenance and repair purposes. This initiative strengthens C&L Aviation Group’s aftermarket supply chain and supports continued service capability

- In March 2024, AAR Corp. completed the acquisition of Triumph Group’s Product Support Business, enhancing its service offerings in both the commercial and defense aerospace sectors. The acquisition enables AAR to provide more specialized repair, maintenance, and overhaul solutions for high-demand aircraft components. This strategic move reinforces AAR’s footprint in critical MRO service segments

- In February 2024, GE Aerospace, the aircraft engine division of General Electric Company, announced an USD 11 million investment to establish a Smart Factory at its Aircraft Engine Repair facility in Singapore. The initiative is designed to modernize engine repair processes while upskilling its workforce to handle next-generation technologies. This investment underscores GE’s commitment to digital transformation and future-ready MRO infrastructure

- In December 2021, Korean Air introduced an innovative drone swarm technology for aircraft fuselage inspections. Using four drones, the airline developed a system to autonomously capture images of specific aircraft areas through a pre-programmed inspection route. This advancement marks a significant step in enhancing inspection efficiency and reducing aircraft downtime

- In December 2021, Frontier Airlines selected Lufthansa Technik to provide repair and overhaul services for 21 CFM56-5B engines, along with Mobile Engine Services support. Over a five-year period, Lufthansa Technik will service engines from Frontier’s fleet of 112 Airbus A320 family aircraft, with overhauls carried out in Hamburg, Germany, and surgical repairs managed at the Tulsa, Oklahoma facility. This partnership enhances Frontier’s engine reliability and long-term operational support

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.