Global Ambulatory Equipment Market

Market Size in USD Million

CAGR :

%

USD

608.90 Million

USD

948.73 Million

2024

2032

USD

608.90 Million

USD

948.73 Million

2024

2032

| 2025 –2032 | |

| USD 608.90 Million | |

| USD 948.73 Million | |

|

|

|

|

Ambulatory Equipment Market Size

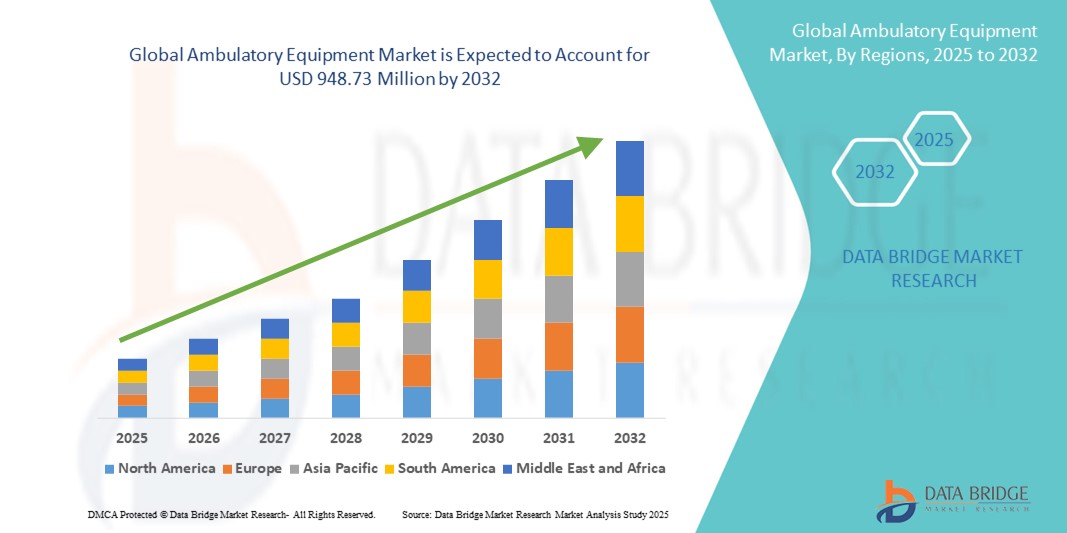

- The global ambulatory equipment market size was valued at USD 608.90 million in 2024 and is expected to reach USD 948.73 million by 2032, at a CAGR of 5.70% during the forecast period

- The market growth is largely fueled by the increasing shift toward outpatient care, cost-effective treatment options, and the rising prevalence of chronic diseases requiring ongoing monitoring and mobility assistance, driving adoption across diverse healthcare settings

- Furthermore, growing technological advancements in lightweight, ergonomic, and patient-friendly designs, coupled with the demand for efficient, portable, and integrated healthcare solutions, are positioning ambulatory equipment as a critical enabler of modern patient care. These converging factors are accelerating the uptake of ambulatory solutions, thereby significantly boosting the industry's growth

Ambulatory Equipment Market Analysis

- Ambulatory equipment, encompassing mobility aids, patient monitoring devices, and portable medical instruments, is an increasingly essential component of modern healthcare delivery, enabling treatment, monitoring, and patient mobility outside traditional hospital settings due to their portability, ease of use, and adaptability across diverse care environments

- The escalating demand for ambulatory equipment is primarily fueled by the global shift toward outpatient care, the growing prevalence of chronic diseases, an aging population, and the need for cost-effective, patient-centered treatment solutions

- North America dominated the ambulatory equipment market with the largest revenue share of 41.8% in 2024, supported by advanced healthcare infrastructure, high healthcare spending, and early adoption of innovative patient mobility and monitoring technologies, with the U.S. experiencing strong uptake in home healthcare and ambulatory surgical centers driven by technological upgrades and supportive reimbursement policies

- Asia-Pacific is expected to be the fastest growing region in the ambulatory equipment market during the forecast period due to expanding healthcare access, increasing geriatric populations, and rising investments in community-based care

- Wheelchairs segment dominated the ambulatory equipment market with a market share of 45.1% in 2024, driven by their indispensable role in enhancing patient independence, wide applicability across multiple care settings, and continuous product innovations in lightweight and ergonomic designs

Report Scope and Ambulatory Equipment Market Segmentation

|

Attributes |

Ambulatory Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ambulatory Equipment Market Trends

Rising Adoption of Portable, Connected, and AI-Enhanced Healthcare Solutions

- A significant and accelerating trend in the global ambulatory equipment market is the integration of advanced connectivity features, artificial intelligence (AI), and ergonomic designs to enhance patient mobility, monitoring, and care efficiency outside traditional hospital settings. This evolution is reshaping how outpatient and home-based healthcare is delivered

- For instance, AI-enabled portable ECG monitors and wearable blood pressure devices can track patient data in real time, sending automated alerts to healthcare providers for early intervention. Similarly, lightweight, foldable wheelchairs with IoT sensors are being adopted to monitor usage patterns and maintenance needs

- AI integration in ambulatory equipment enables predictive analytics for chronic disease management, optimizing treatment plans based on patient mobility and vital sign trends. For example, some advanced ambulatory infusion pumps now use AI to adjust flow rates automatically, enhancing safety and comfort for patients

- Connectivity with telehealth platforms allows healthcare professionals to access live patient data, improving diagnosis and care coordination. Patients can now use a single interface to manage mobility aids, monitoring devices, and rehabilitation tools alongside other home healthcare systems

- This shift towards portable, intelligent, and patient-friendly ambulatory devices is redefining expectations for outpatient care. Consequently, companies such as Invacare Corporation and Hillrom (Baxter International Inc.) are investing heavily in connected mobility aids and smart patient monitoring equipment to cater to both aging populations and the growing home healthcare market

- Demand for connected and AI-enabled ambulatory equipment is rising rapidly across both developed and emerging economies, as patients and providers increasingly value convenience, proactive care, and integrated health solutions

Ambulatory Equipment Market Dynamics

Driver

Increasing Demand Due to Aging Population and Shift Toward Outpatient Care

- The growing global geriatric population, coupled with the rising prevalence of chronic conditions such as cardiovascular disease, diabetes, and arthritis, is a major driver for ambulatory equipment adoption

- For instance, in January 2024, Sunrise Medical launched its new range of lightweight, customizable wheelchairs aimed at improving patient independence while maintaining ergonomic comfort. Such innovations are expected to accelerate market growth during the forecast period

- As healthcare systems focus on reducing hospital stays and shifting toward cost-effective outpatient care, demand for ambulatory aids and portable medical devices has surged. These solutions allow patients to recover and manage conditions at home while maintaining mobility and independence

- The convenience of portable monitoring devices, mobility aids, and home-use medical equipment enhances quality of life, reduces readmission rates, and aligns with the growing adoption of telehealth and remote patient monitoring programs

- In addition, the expansion of ambulatory surgical centers (ASCs) in both developed and developing regions is further boosting demand for equipment that supports same-day procedures and post-operative mobility

Restraint/Challenge

High Cost of Advanced Devices and Limited Reimbursement in Emerging Markets

- The relatively high cost of technologically advanced ambulatory equipment, such as AI-integrated mobility aids and smart monitoring devices, poses a challenge to adoption, particularly in price-sensitive markets

- For instance, advanced power wheelchairs with IoT connectivity or multi-parameter portable monitors can cost significantly more than traditional models, creating affordability barriers for individuals and smaller healthcare providers

- Limited or inconsistent reimbursement policies for certain types of ambulatory equipment in emerging economies further hinder market penetration, as patients often bear the full out-of-pocket expense

- Addressing these challenges requires manufacturers to develop cost-effective, modular solutions while working with policymakers to expand insurance coverage and reimbursement frameworks

- Companies focusing on affordable innovation—such as Drive DeVilbiss Healthcare’s launch of budget-friendly, foldable mobility aids—are well positioned to tap into underserved market segments

Ambulatory Equipment Market Scope

The market is segmented on the basis of equipment, specialty, ownership, and center type.

- By Equipment

On the basis of equipment, the global ambulatory equipment market is segmented into transfer boards, canes, crutches, walkers, wheelchairs, and support surfaces. The wheelchairs segment dominated the market with the largest revenue share of 45.1% in 2024, driven by their indispensable role in enabling mobility for elderly and disabled populations. Wheelchairs are also widely used in rehabilitation centers, post-operative recovery, and home care settings. Continuous innovations such as lightweight aluminum frames, foldable designs for easy storage, and powered wheelchairs with smart connectivity are further driving adoption. Manufacturers are also integrating AI and IoT features for remote monitoring and enhanced patient safety. The growing demand for personalization, including ergonomic seating and adjustable components, enhances the appeal of wheelchairs across both residential and clinical settings.

The walkers segment is anticipated to witness the fastest growth rate of 21.3% from 2025 to 2032, fueled by an increasing geriatric population and rising incidence of orthopedic procedures such as knee and hip replacements. Walkers are essential for fall prevention, rehabilitation, and safe mobility for elderly or disabled patients. Design advancements, including height-adjustable frames, ergonomic grips, integrated seating, and foldable models, make walkers more user-friendly and suitable for long-term use. Integration with monitoring devices and alert systems further enhances patient safety. In addition, the increasing preference for home-based rehabilitation programs supports higher adoption.

- By Specialty

On the basis of specialty, the global ambulatory equipment market is segmented into single specialty and multi-specialty. The multi-specialty segment held the largest market share in 2024, supported by the establishment of ambulatory centers offering multiple services under one roof. These centers cater to orthopedic, cardiovascular, gastroenterology, ophthalmology, and diagnostic imaging services, attracting a larger patient base. Multi-specialty centers improve operational efficiency by consolidating resources and enabling shared staff expertise across departments. Patients benefit from coordinated care and reduced waiting times. Rising urbanization and increased disposable incomes further drive demand for these integrated facilities.

The single specialty segment is projected to record the fastest CAGR during the forecast period, driven by the growing demand for specialized outpatient services such as ophthalmology, dental care, gastroenterology, and dermatology. Single specialty centers allow for targeted expertise, lower operational costs, and customized patient care. They are particularly attractive in emerging economies due to easier setup and lower capital requirements. High patient satisfaction from focused services further contributes to the market growth. Additionally, technological advancements and specialized medical equipment adoption accelerate the expansion of single-specialty ambulatory centers.

- By Ownership

On the basis of ownership, the global ambulatory equipment market is segmented into hospital only, physician only, corporation only, physician and corporation, and hospital and corporation. The hospital and corporation segment dominated the market in 2024, benefiting from strategic collaborations between hospitals and corporate entities. These partnerships combine hospital-based clinical expertise with corporate operational efficiency and resource management. The model allows for standardized protocols, advanced equipment adoption, and seamless patient care across multiple locations. Hospitals gain access to innovative technologies without heavy capital investment, while corporations benefit from operational scalability. The rising trend of joint ventures in healthcare infrastructure further supports the segment’s growth.

The physician only segment is anticipated to grow the fastest from 2025 to 2032, as individual physicians increasingly invest in ambulatory setups to deliver personalized and efficient care. Physician-owned centers allow doctors to retain autonomy while reducing operational overhead compared to hospital-based setups. These centers focus on specific patient needs and provide flexible treatment schedules. Advanced ambulatory equipment, such as mobility aids and portable monitoring devices, is being integrated to enhance patient outcomes. The trend toward outpatient care and shorter hospital stays further fuels growth in this segment.

- By Center Type

On the basis of center type, the global ambulatory equipment market is segmented into hospital-based and free-standing centers. The hospital-based segment accounted for the largest market revenue share in 2024, driven by the integration of ambulatory services within hospital networks. These centers provide access to advanced diagnostics, surgical facilities, and specialist care under one roof. Hospital-based centers benefit from existing infrastructure, trained staff, and established patient trust, supporting higher adoption of ambulatory equipment. Patients also experience continuity of care when transitioning from inpatient to outpatient services.

The free-standing segment is expected to witness the highest CAGR during the forecast period, supported by lower construction and operational costs compared to hospital-based centers. Free-standing centers offer flexibility in location, allowing providers to reach underserved communities or areas with high patient demand. Shorter wait times and convenient access attract more patients to these centers. Additionally, they enable faster adoption of portable and connected ambulatory equipment, catering to home-based and outpatient care services. The growing trend of independent clinics and urgent care centers is further driving the growth of this segment.

Ambulatory Equipment Market Regional Analysis

- North America dominated the ambulatory equipment market with the largest revenue share of 41.8% in 2024, supported by advanced healthcare infrastructure, high healthcare spending, and early adoption of innovative patient mobility and monitoring technologies

- Consumers and healthcare providers in the region highly value the portability, durability, and technological advancements in ambulatory equipment, including IoT-enabled monitoring systems and ergonomically designed mobility aids

- This widespread adoption is further supported by high healthcare spending, favorable reimbursement policies, and the growing preference for home healthcare and outpatient services, positioning ambulatory equipment as a critical enabler for improving patient independence and reducing hospital readmissions

U.S. Ambulatory Equipment Market Insight

The U.S. ambulatory equipment market captured the largest revenue share of 82% in 2024 within North America, fueled by advanced healthcare infrastructure, high healthcare spending, and a strong emphasis on outpatient care. The swift uptake of home healthcare solutions, combined with the rising prevalence of chronic diseases and mobility impairments, is driving demand for wheelchairs, walkers, and portable monitoring devices. The increasing adoption of connected and AI-enabled ambulatory equipment, along with favorable reimbursement policies, further strengthens market growth.

Europe Ambulatory Equipment Market Insight

The Europe ambulatory equipment market is projected to expand at a substantial CAGR throughout the forecast period, driven by an aging population, growing preference for home-based care, and the region’s commitment to improving patient mobility. Stringent healthcare quality standards and increased funding for assistive devices are fostering adoption. The market is experiencing growth across hospital-based, community care, and rehabilitation settings, with both public and private healthcare systems integrating modern ambulatory solutions into patient care pathways.

U.K. Ambulatory Equipment Market Insight

The U.K. ambulatory equipment market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising need for mobility aids among the elderly and individuals recovering from surgery or injury. Government initiatives to expand community-based care and reduce hospital stays are supporting demand. The adoption of lightweight, foldable wheelchairs, ergonomic walkers, and remote patient monitoring devices is increasing across both the NHS and private healthcare sectors.

Germany Ambulatory Equipment Market Insight

The Germany ambulatory equipment market is expected to expand at a considerable CAGR during the forecast period, fueled by high healthcare expenditure, a robust medical device manufacturing base, and a strong focus on innovation. The country’s emphasis on advanced, eco-friendly designs and connected health solutions is boosting demand for smart mobility aids and digital patient monitoring devices. Germany’s well-developed rehabilitation infrastructure further supports steady market adoption.

Asia-Pacific Ambulatory Equipment Market Insight

The Asia-Pacific ambulatory equipment market is poised to grow at the fastest CAGR of 23.5% from 2025 to 2032, driven by rapid urbanization, rising healthcare investments, and an increasing elderly population in countries such as China, Japan, and India. Government-backed programs to improve access to healthcare and the expansion of home healthcare services are accelerating adoption. Local manufacturing capabilities and affordability are expanding market reach, especially in emerging economies.

Japan Ambulatory Equipment Market Insight

The Japan ambulatory equipment market is gaining momentum due to its aging population, high healthcare technology adoption, and strong rehabilitation care infrastructure. Demand is rising for mobility aids, patient transfer devices, and portable monitoring systems that cater to elderly individuals and those in post-operative recovery. Integration of AI and IoT into mobility devices is increasingly common, aligning with Japan’s reputation for tech-forward healthcare solutions.

India Ambulatory Equipment Market Insight

The India ambulatory equipment market accounted for the largest revenue share in Asia-Pacific in 2024, supported by a rapidly growing population, expanding middle class, and rising awareness of mobility aids and home-based patient care. The government’s push toward strengthening primary healthcare and increasing accessibility to assistive devices is fueling growth. Domestic manufacturing and affordable product options are making ambulatory equipment more accessible to both urban and rural markets.

Ambulatory Equipment Market Share

The Ambulatory Equipment industry is primarily led by well-established companies, including:

- Invacare Corporation (U.S.)

- Sunrise Medical LLC (U.S.)

- Drive DeVilbiss Healthcare (U.S.)

- Pride Mobility Products Corporation (U.S.)

- Medline Industries, LP (U.S.)

- GF Health Products, Inc. (U.S.)

- Etac AB (Sweden)

- Ottobock SE & Co. KGaA (Germany)

- Permobil AB (Sweden)

- Arjo AB (Sweden)

- Handicare Group AB (Sweden)

- TOPRO Industri AS (Norway)

- Karman Healthcare, Inc. (U.S.)

- Meyra GmbH (Germany)

- Karma Medical Products Co., Ltd. (Taiwan)

- Besco Medical Limited (United Kingdom)

- Hoveround Corporation (U.S.)

- Rehasense (Luxembourg)

- N.V. Vermeiren (Belgium)

- Matsunaga Manufactory Co., Ltd. (Japan)

What are the Recent Developments in Global Ambulatory Equipment Market?

- In June 2025, GenHealth.ai unveiled an AI-powered order automation solution tailored for Home and Durable Medical Equipment (HME/DME) providers. This innovation automates ordering workflows for ambulatory equipment such as mobility aids and monitoring devices enhancing efficiency, reducing errors, and streamlining supply chains for care providers and patients asuch as

- In June 2025, Cardinal Health launched its Kendall DL Multi System in the U.S., a single-patient-use monitoring cable and lead-wire system that enables continuous monitoring of ECG, oxygen saturation, and temperature with one connection designed for seamless patient transport from admission to discharge

- In May 2025, a research team unveiled a novel non-wearable support robot engineered to replicate natural standing-up motions, offering new promise for elderly care and rehabilitative mobility. This innovative assistive device uses a four-link mechanism aligned with human hip and knee trajectories. Testing demonstrated high accuracy with positioning errors within approximately 4% of total seat displacement and confirmed its durability, thermal safety, and reliability for indoor use

- In February 2025, NYC Health + Hospitals’ NYC Care announced the launch of a durable medical equipment (DME) benefit, enabling eligible members to access low- and no-cost ambulatory equipment such as wheelchairs, rolling walkers, and CPAP machines—expanding real patient access to critical ambulatory tools

- In July 2024, the World Health Organization (WHO) introduced MeDevIS, the Medical Devices Information System a global, open-access platform designed to help governments, procurement bodies, and health professionals make informed decisions about medical devices, including equipment used in ambulatory and rehabilitation care. This represents a key step toward improving accessibility, standardization, and transparency across ambulatory healthcare technologies in global healthcare systems.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.