Global Animal Genetics Market

Market Size in USD Billion

CAGR :

%

USD

7.11 Billion

USD

14.93 Billion

2024

2032

USD

7.11 Billion

USD

14.93 Billion

2024

2032

| 2025 –2032 | |

| USD 7.11 Billion | |

| USD 14.93 Billion | |

|

|

|

|

Animal Genetics Market Size

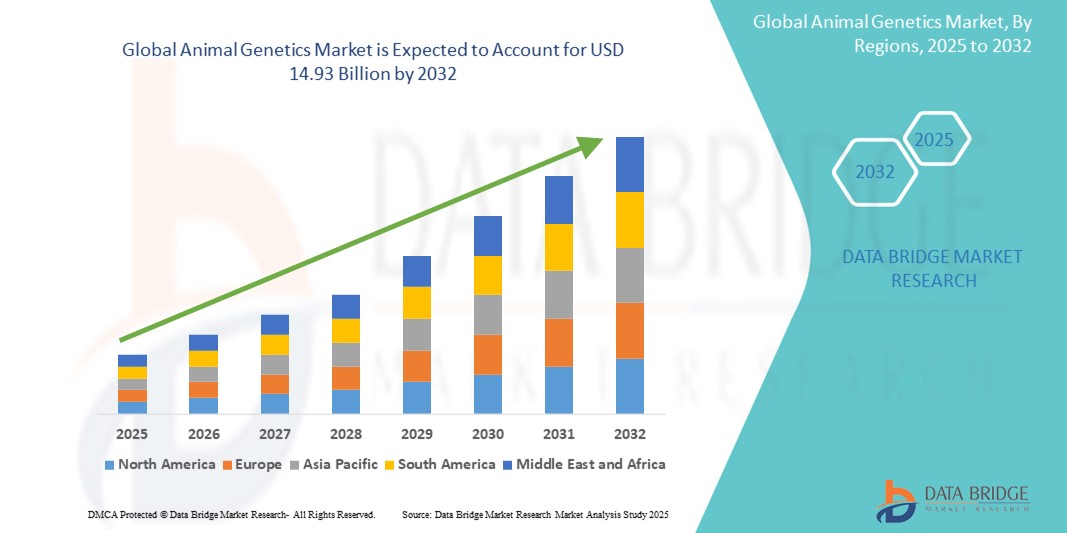

- The global animal genetics market size was valued at USD 7.11 billion in 2024 and is expected to reach USD 14.93 billion by 2032, at a CAGR of 9.70% during the forecast period

- This growth is driven by factors such as the rising demand for high-quality animal protein, advancements in genetic technologies, and increasing adoption of artificial insemination and embryo transfer techniques

Animal Genetics Market Analysis

- Animal genetics plays a pivotal role in improving livestock productivity, health, and reproductive efficiency through the study and manipulation of hereditary traits. It supports genetic advancement in both companion and production animals through selective breeding and biotechnological tools

- The demand for animal genetics is significantly driven by the growing global demand for animal protein, increasing focus on livestock productivity, and the adoption of advanced genetic technologies such as genomic selection and artificial insemination

- North America is expected to dominate the animal genetics market with a market share of 33.5%, due to its advanced veterinary healthcare infrastructure, strong research capabilities, and widespread adoption of genetic technologies in livestock breeding

- Asia-Pacific is expected to be the fastest growing region in the animal genetics market with a market share of 26.5%, during the forecast period due to growing demand for meat and dairy products, increasing investments in agricultural biotechnology, and rising awareness of genetic improvement in livestock

- Poultry segment is expected to dominate the market with a market share of 35.9% due its high global consumption, shorter breeding cycles, and cost-effective production

Report Scope and Animal Genetics Market Segmentation

|

Attributes |

Animal Genetics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Animal Genetics Market Trends

“Advancements in Genomic Selection & Reproductive Technologies in Animal Genetics”

- One prominent trend in the evolution of the animal genetics market is the increasing adoption of genomic selection and advanced reproductive technologies to improve breeding outcomes

- These innovations enable the identification of desirable genetic traits, accelerating selective breeding for traits such as disease resistance, productivity, and adaptability

- For instance, genomic tools such as SNP genotyping and CRISPR-based gene editing are being used to enhance genetic gain in cattle and swine, leading to healthier, more productive livestock

- These advancements are revolutionizing animal breeding, enhancing livestock performance, and driving the demand for high-precision genetic solutions globally

Animal Genetics Market Dynamics

Driver

“Rising Demand for High-Quality Animal Protein and Productivity”

- The increasing global population and shifting dietary preferences toward animal-based proteins are major factors driving the demand for genetically superior livestock

- With growing concerns over food security and sustainable animal farming, producers are turning to genetic technologies to enhance productivity, disease resistance, and reproductive efficiency

- The adoption of advanced genetic tools such as artificial insemination, embryo transfer, and genomic selection helps in producing high-yielding and resilient animal breeds, supporting long-term agricultural sustainability

For instance,

- According to the Food and Agriculture Organization (FAO), global meat consumption is projected to rise by nearly 14% by 2030, emphasizing the need for improved animal genetics to meet this demand efficiently

- As a result, the need to improve livestock quality, productivity, and disease resilience is significantly boosting the demand for animal genetic solutions across the globe

Opportunity

“Harnessing Genomic Innovation and Precision Breeding Technologies”

- The integration of genomic technologies in animal genetics presents a significant opportunity to revolutionize livestock breeding by enabling precise identification of desirable traits such as disease resistance, feed efficiency, and reproductive performance

- Advanced techniques such as CRISPR gene editing, SNP genotyping, and whole-genome sequencing allow for the development of superior animal breeds with enhanced productivity and resilience

- In addition, these tools support early detection of genetic disorders, optimize breeding strategies, and accelerate genetic gain, making livestock production more efficient and sustainable

For instance,

- In October 2023, a report published by the International Livestock Research Institute highlighted how genomic selection programs in low- and middle-income countries led to a 20–30% increase in milk yield among dairy cattle, showcasing the impact of precision breeding

- The growing availability of affordable genomic solutions and rising investment in livestock biotechnology are opening new avenues for improving animal health, boosting farmer income, and ensuring food security globally

Restraint/Challenge

“High Cost of Genetic Technologies Limiting Adoption”

- The high cost associated with advanced genetic technologies such as genomic selection, CRISPR gene editing, and DNA typing presents a significant barrier to widespread adoption, particularly among small and medium-scale livestock producers

- Implementation of these technologies requires substantial investment in infrastructure, skilled personnel, and ongoing research, which may not be feasible for resource-constrained settings or low-income regions

- This cost barrier often restricts access to modern breeding techniques, limiting their use to large commercial farms and research institutions while smaller producers continue relying on traditional, less efficient methods

For instance,

- According to a 2023 report by the International Service for the Acquisition of Agri-biotech Applications (ISAAA), the average cost of setting up a functional animal genomics lab can exceed USD 500,000, excluding recurring costs, making it unaffordable for many stakeholders in developing economies

- Consequently, the high financial burden of adopting cutting-edge genetic tools can hinder market penetration, slow technological diffusion, and contribute to disparities in productivity and animal health across regions

Animal Genetics Market Scope

The market is segmented on the basis of product and service, material, and end user

|

Segmentation |

Sub-Segmentation |

|

By Animal Genetic Products |

|

|

By Service |

|

|

By Material |

|

|

By End User

|

|

In 2025, the poultry is projected to dominate the market with a largest share in animal genetic products segment

The poultry segment is expected to dominate the animal genetics market with the largest share of 35.9% in 2025 due to its high global consumption, shorter breeding cycles, and cost-effective production. The rising demand for eggs and poultry meat, especially in developing regions, is driving the adoption of genetically improved poultry breeds. In addition, advancements in genetic tools are enhancing disease resistance and productivity in poultry, further boosting segment growth

The DNA typing is expected to account for the largest share during the forecast period in service market

In 2025, the DNA typing segment is expected to dominate the market with the largest market share of 34.8% due to its critical role in identifying desirable genetic traits and improving breeding accuracy. It enables precise selection for productivity, disease resistance, and adaptability in livestock. The growing use of genomic tools and increasing demand for data-driven breeding decisions are further driving the adoption of DNA typing in animal genetics

Animal Genetics Market Regional Analysis

“North America Holds the Largest Share in the Animal Genetics Market”

- North America dominates the animal genetics market with a market share of estimated 33.5%, driven, by its advanced veterinary healthcare infrastructure, strong research capabilities, and widespread adoption of genetic technologies in livestock breeding

- U.S. holds a market share of 60.5%, due to high demand for animal protein, government support for biotechnology innovation, and presence of major industry players investing in genomic research

- The region benefits from well-established livestock farming systems, greater use of artificial insemination and embryo transfer techniques, and favorable regulations promoting animal welfare and productivity

- In addition, the emphasis on sustainability and precision breeding to meet protein demand while reducing environmental impact further boosts market growth across North America

“Asia-Pacific is Projected to Register the Highest CAGR in the Animal Genetics Market”

- Asia-Pacific is expected to witness the highest growth rate in the animal genetics market with a market share of 26.5%, driven by growing demand for meat and dairy products, increasing investments in agricultural biotechnology, and rising awareness of genetic improvement in livestock

- Countries such as China, India, and Indonesia are emerging as major contributors due to their large livestock populations, government initiatives to improve animal productivity, and adoption of modern breeding practices

- China, with its strategic focus on food security and modernization of animal farming, is rapidly adopting advanced genetic tools to enhance livestock yield and disease resistance

- India is projected to register the highest CAGR in the region, supported by strong government programs for livestock development, increasing per capita meat consumption, and growing interest in crossbreeding and genomic selection technologie

Animal Genetics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Neogen Corporation (U.S.)

- URUS Group LP. (U.S.)

- EW Group GmbH (Germany)

- TOPIGS NORSVIN (Netherlands)

- Zoetis Services LLC (U.S.)

- Hendrix Genetics BV (Netherlands)

- SIA "GENERA" (Latvia)

- Tropical Animal Genetics (India)

- Trans Ova Genetics (U.S.)

- SEMEX (Canada)

- Cobb-Vantress, LLC (U.S.)

- Milk Source (U.S.)

- EW Nutrition (Germany)

- GENEX Cooperative (U.S.)

- ANICAM ENTERPRISES INC. (U.S.)

- Genus (U.K.)

- CRV (Netherlands)

- Animal Genetics, Inc. (U.S.)

- Groupe Grimaud La Corbière SA (Franch)

- Alta Genetics Inc. (Canada)

Latest Developments in Global Animal Genetics Market

- In April 2025, UK-based Genus achieved a significant milestone by obtaining U.S. FDA approval for its gene-edited pigs resistant to Porcine Reproductive and Respiratory Syndrome (PRRS). This approval is expected to enhance disease resistance in swine populations and reduce economic losses in the pork industry. Genus is also pursuing regulatory approvals in other major markets, including Canada, Mexico, Japan, and China

- In January 2025, Gemini Genetics, based in Shropshire, UK, offers pet cloning services by collecting DNA samples from pets and coordinating with U.S. laboratories for the cloning process. Despite the high cost of approximately GBP 40,000 per pet, the service has gained attention among pet owners seeking to replicate their beloved animals. The procedure involves somatic cell nuclear transfer to create genetically identical animals

- In May 2024, NB Genetics, an Angus seedstock operation near Chinchilla, Australia, partnered with ABS Global to introduce "NuEra" genetics into their cattle breeding program. This initiative aims to improve carcass quality and production efficiency in Australian beef through advanced genetic technologies. The program involves implanting NuEra T14 male sexed embryos into recipient cows, marking a first in the country

- In June 2022, Zoetis, a global animal health company, acquired Basepaws, a company specializing in pet genetics. This acquisition enhances Zoetis's capabilities in genetic testing and data analytics, allowing for more advanced approaches to animal care and personalized pet health solutions

- In May 2022, Neogen Corporation and Gencove launched InfiniSEEK, an affordable genome sequencing and SNP analysis tool designed for bovines. Capable of assessing over 400 genetic traits and conditions, InfiniSEEK aims to provide comprehensive and cost-effective genetic testing options to enhance livestock management and breeding decisions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.