Global Antifungal Drugs Market

Market Size in USD Billion

CAGR :

%

USD

16.38 Billion

USD

21.58 Billion

2024

2032

USD

16.38 Billion

USD

21.58 Billion

2024

2032

| 2025 –2032 | |

| USD 16.38 Billion | |

| USD 21.58 Billion | |

|

|

|

|

Antifungal Drugs Market Size

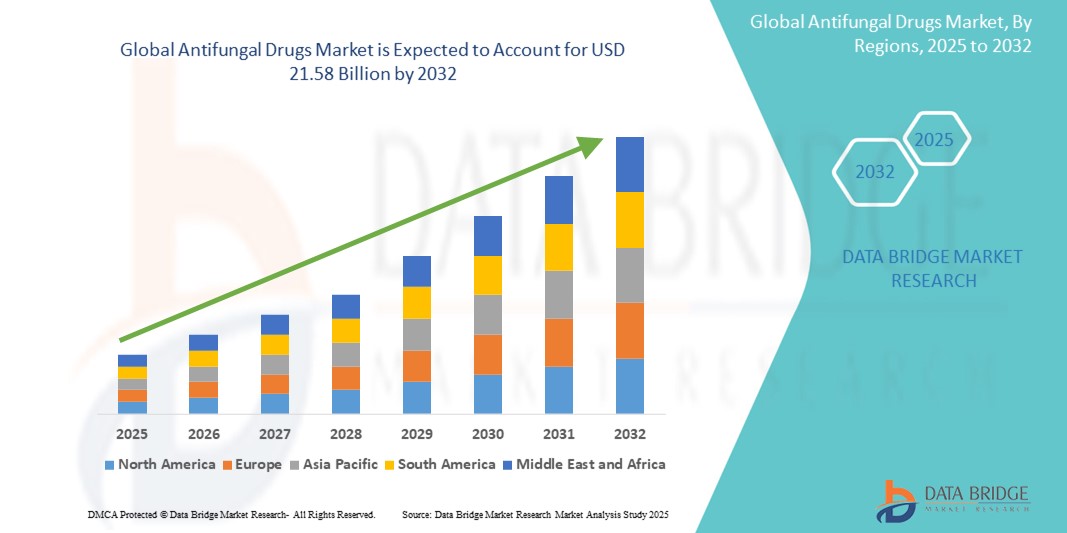

- The global antifungal drugs market size was valued at USD 16.38 billion in 2024 and is expected to reach USD 21.58 billion by 2032, at a CAGR of 3.50% during the forecast period

- The market growth is largely fuelled by the increasing prevalence of fungal infections worldwide, especially among immunocompromised individuals, along with the rising incidence of hospital-acquired infections and chronic diseases such as diabetes and cancer

- Furthermore, growing awareness regarding early diagnosis and treatment, coupled with the introduction of novel antifungal agents with improved efficacy and safety profiles, is establishing antifungal drugs as a vital component in infectious disease management. These converging factors are accelerating the uptake of antifungal drug solutions, thereby significantly boosting the industry's growth

Antifungal Drugs Market Analysis

- Antifungal drugs, which are used to treat a wide range of superficial and systemic fungal infections, are becoming increasingly critical in modern healthcare systems due to the rise in immunocompromised patient populations, including those with cancer, HIV/AIDS, and those undergoing organ transplants

- The escalating demand for antifungal drugs is primarily fueled by the increasing prevalence of fungal infections, the emergence of drug-resistant fungal strains, and the growing awareness of early and effective treatment approaches

- North America dominated the antifungal drugs market with the largest revenue share of 37.6% in 2024, characterized by the presence of advanced healthcare infrastructure, high healthcare expenditure, and robust R&D activity. The U.S. is witnessing substantial growth in antifungal drug adoption due to rising cases of invasive fungal infections and growing approvals of innovative antifungal therapies by regulatory authorities such as the FDA

- Asia-Pacific is expected to be the fastest growing region in the antifungal drugs market with a percentage of 21.7% in the antifungal drugs market during the forecast period due to the increasing burden of fungal diseases, growing geriatric population, and improving access to healthcare in countries such as China and India

- The azoles segment dominated the antifungal drugs market with a market share of 43.2% in 2024, driven by its broad-spectrum activity, lower toxicity, and extensive usage in the treatment of both superficial and systemic fungal infections

Report Scope and Antifungal Drugs Market Segmentation

|

Attributes |

Antifungal Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Antifungal Drugs Market Trends

“Enhanced Efficacy Through Technological Integration”

- A significant and accelerating trend in the global antifungal drugs market is the growing integration of advanced technologies in both drug discovery and diagnostic platforms. This technological convergence is enhancing the precision, speed, and effectiveness of antifungal treatment development and administration

- For instance, leading pharmaceutical companies are leveraging data-driven algorithms to identify novel antifungal compounds, predict resistance mechanisms, and optimize clinical trial designs. High-throughput screening and computational modeling have significantly reduced the time required to identify effective molecules, accelerating the R&D cycle and lowering development costs

- Technological advancements are also playing a transformative role in diagnostics. Enhanced molecular diagnostics and automated platforms are improving the accuracy of early detection, especially in immunocompromised patients. These tools can differentiate fungal infections from bacterial or viral infections more rapidly, leading to earlier and more targeted treatment

- In hospital settings, advanced health information systems are being used to monitor patient risk factors and provide timely alerts for potential fungal infections, allowing for prompt intervention. These systems can also assist in selecting the most appropriate antifungal therapy based on patient profiles and infection type

- This seamless integration of technology into antifungal drug development and clinical practice is enabling more proactive, personalized, and effective healthcare. Companies such as Gilead Sciences and Pfizer are investing heavily in such platforms to enhance their antifungal pipelines and strengthen their competitive edge

- The demand for antifungal solutions powered by innovative diagnostics and precision medicine tools is growing rapidly across hospitals and specialty care clinics, as healthcare providers increasingly prioritize timely intervention, resistance management, and improved patient outcomes

Antifungal Drugs Market Dynamics

Driver

“Growing Need Due to Rising Fungal Infections and Drug Resistance”

- The increasing prevalence of fungal infections, especially among immunocompromised individuals, along with the emergence of drug-resistant fungal strains, is a major driver fueling demand in the antifungal drugs market

- For instance, in April 2024, Gilead Sciences announced progress in its next-generation echinocandin antifungal therapy, aiming to combat resistant infections such as Candida auris—a significant threat in hospital settings. Such advancements by key pharmaceutical players are expected to drive the antifungal drugs industry growth in the forecast period

- As the global burden of superficial and systemic fungal infections rises, particularly in regions with high rates of HIV, cancer, or organ transplants, there is an urgent need for more effective, safe, and accessible antifungal treatment options

- Furthermore, rising awareness among healthcare professionals and patients regarding early diagnosis and treatment, along with improved diagnostic technologies, is increasing the uptake of antifungal therapies

- The availability of oral, topical, and intravenous formulations offers flexibility in treatment, supporting broader use across hospital and outpatient settings. In addition, growing R&D investments in antifungal drug development and pipeline innovations are contributing to market expansion

- The trend toward combination therapy and the increasing use of antifungals in prophylactic care—particularly in intensive care units and oncology wards—are also propelling market growth

Restraint/Challenge

“Concerns Regarding Drug Resistance and High Treatment Costs”

- The growing resistance of fungal pathogens to existing antifungal drugs presents a significant challenge to effective treatment. Species such as Aspergillus fumigatus and Candida auris have shown resistance to first-line therapies, complicating treatment protocols and increasing morbidit

- For instance, high-profile studies have highlighted rising azole resistance in multiple regions, prompting concern over limited treatment options. This issue is particularly severe in low-resource settings, where access to advanced antifungals and diagnostics is already constrained

- Addressing these concerns requires the development of new antifungal classes, improved stewardship programs, and continuous surveillance of resistance patterns. Leading companies such as Pfizer and Scynexis are working on newer-generation antifungals to tackle resistance more effectively

- In addition, the high cost of antifungal treatment—especially for invasive infections requiring long-term hospitalization—remains a barrier to adoption, particularly in developing countries with limited healthcare budgets. While generic formulations have reduced costs in some segments, newer antifungal agents and patented therapies often remain unaffordable for many patients and healthcare systems

- Overcoming these challenges will depend on public-private partnerships to improve drug affordability, better diagnostic access, and ongoing investment in antifungal innovation to stay ahead of resistance trends

Antifungal Drugs Market Scope

The market is segmented on the basis of drug class, indication, dosage, route of administration, end-users, and distribution channel.

• By Drug Class

On the basis of drug class, the antifungal drugs market is segmented into azoles, echinocandins, polyenes, allylamines, and others. The azoles segment dominated the market with a revenue share of 38.5% in 2024, due to their broad-spectrum activity and frequent usage in systemic and superficial fungal infections.

The echinocandins segment is expected to grow at the fastest CAGR of 8.7% from 2025 to 2032, driven by their effectiveness against invasive candidiasis and reduced toxicity in high-risk patients.

• By Indication

On the basis of indication, the antifungal drugs market is segmented into dermatophytosis, aspergillosis, candidiasis, and others. The candidiasis segment held the largest revenue share of 41.2% in 2024, due to its high global prevalence and increasing incidence in immunocompromised individuals.

The aspergillosis segment is projected to witness the fastest CAGR of 9.4% from 2025 to 2032, owing to rising cases of pulmonary and invasive aspergillosis, especially in post-viral and ICU patients.

• By Dosage

On the basis of dosage, the antifungal drugs market is segmented into tablet, ointment, cream, and others. The tablet segment accounted for the largest revenue share of 36.9% in 2024, driven by high patient compliance and effectiveness in systemic treatments.

The ointment segment is forecasted to grow at the fastest CAGR of 8.9% from 2025 to 2032, supported by increasing use in dermatological fungal infections and over-the-counter demand.

• By Route of Administration

On the basis of route of administration, the antifungal drugs market is segmented into oral, topical, and others. The oral segment dominated with a market share of 45.6% in 2024, favored for its convenience and systemic efficacy.

The topical segment is expected to register the fastest CAGR of 8.5% from 2025 to 2032, particularly for mild infections and self-treatment in outpatient settings.

• By End-Users

On the basis of end-users, the antifungal drugs market is segmented into hospitals, specialty clinics, homecare, and others. The hospitals segment captured the highest revenue share of 48.1% in 2024, attributed to high volumes of severe and invasive fungal infections requiring intravenous antifungal therapies.

The homecare segment is projected to grow at the fastest CAGR of 9.2% from 2025 to 2032, driven by increasing outpatient treatment and availability of user-friendly formulations.

• By Distribution Channel

On the basis of distribution channel, the antifungal drugs market is segmented into hospital pharmacy, retail pharmacy, online pharmacy, and others. The retail pharmacy segment held the dominant share of 44.3% in 2024, supported by extensive accessibility and widespread OTC antifungal availability.

The online pharmacy segment is expected to grow at the fastest CAGR of 10.4% from 2025 to 2032, due to the surge in e-commerce healthcare adoption, convenience, and increasing digital awareness.

Antifungal Drugs Market Regional Analysis

- North America dominated the antifungal drugs market with the largest revenue share of 37.6% in 2024, driven by a high prevalence of fungal infections, increased healthcare spending, and the widespread availability of advanced antifungal therapies

- The region benefits from a strong presence of leading pharmaceutical companies, well-established healthcare infrastructure, and rising awareness regarding early diagnosis and treatment of fungal infections

- Furthermore, favorable reimbursement policies, a growing geriatric population, and a higher incidence of immunocompromised conditions such as cancer, HIV, and organ transplants continue to fuel demand for antifungal medications across both hospital and outpatient settings

U.S. Antifungal Drugs Market Insight

The U.S. antifungal drugs market accounted for 81% of North America’s antifungal drugs market in 2024, reflecting its dominance due to the high burden of fungal infections and widespread use of systemic antifungal therapies. Adoption of advanced treatment modalities, supportive insurance policies, and a surge in immunocompromised populations (such as, cancer, transplant, HIV patients) are contributing significantly to this leadership. Continuous innovation and new product launches by major pharma companies are expected to sustain the U.S. market’s growth momentum.

Europe Antifungal Drugs Market Insight

The Europe antifungal drugs market is projected to expand at a substantial CAGR throughout the forecast period. Growth is driven by increasing cases of hospital-acquired fungal infections, favorable reimbursement environments, and rising healthcare investments. Demand for topical antifungals and rising geriatric population are also contributing to market expansion across Western and Eastern Europe.

U.K. Antifungal Drugs Market Insight

The U.K. antifungal drugs market is anticipated to grow at a noteworthy CAGR during the forecast period. Factors such as growing demand for non-prescription antifungal creams and a rising prevalence of skin fungal infections are fueling growth. Digital health adoption and increased e-commerce access for pharmaceuticals support retail expansion of antifungal drug sales.

Germany Antifungal Drugs Market Insight

The Germany antifungal drugs market is expected to expand at a considerable CAGR during the forecast period. Its leadership is driven by advanced medical research, high per capita drug expenditure, and growing awareness around antifungal resistance. The presence of strong domestic pharmaceutical players and high hospital use of systemic antifungals support continued growth.

Asia-Pacific Antifungal Drugs Market Insight

The Asia-Pacific antifungal drugs market is projected to grow at the fastest CAGR of 14.8% from 2025 to 2032. Increasing cases of superficial fungal infections, poor hygiene conditions in parts of the region, and expanding health insurance coverage are major contributors. Affordable generic drugs, growing urbanization, and strong growth in India and Southeast Asia make APAC a lucrative market.

Japan Antifungal Drugs Market Insight

The Japan antifungal drugs market accounted for 22.7% of the Asia-Pacific antifungal drugs market in 2024, with a forecast CAGR of 12.3% through 2032. Aging demographics and high healthcare standards are driving increased demand for both prescription and OTC antifungal formulations. Japan’s strong adoption of hospital-based treatments and attention to infection control boosts usage of systemic antifungal agents.

China Antifungal Drugs Market Insight

The China antifungal drugs market captured the largest share of the Asia-Pacific antifungal drugs market in 2024, at 37.5%, driven by widespread use of topical antifungals and high disease burden. Rapid urbanization, government healthcare reforms, and local manufacturing capacity make China a central hub for antifungal drug consumption. The market is further fueled by increased availability through retail and online pharmacy channels.

Antifungal Drugs Market Share

The antifungal drugs industry is primarily led by well-established companies, including:

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Viatris Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sanofi (France)

- Pfizer Inc. (U.S.)

- GSK plc (U.K.)

- Novartis AG (Switzerland)

- Sun Pharmaceutical Industries Ltd. (India)

- Gilead Sciences Inc. (U.S.)

- Apotex Inc. (Canada)

- Amneal Pharmaceuticals LLC (U.S.)

- Zydus Cadila (India)

- Aurobindo Pharma Limited (India)

- Cipla Inc. (India)

- Hikma Pharmaceuticals PLC (U.K.)

- Dr. Reddy’s Laboratories Ltd. (India)

- WOCKHARDT (India)

- Bausch Health Companies Inc. (Canada)

- Lannett (U.S.)

- Torrent Pharmaceuticals Ltd. (India)

Latest Developments in Global Antifungal Drugs Market

- In March 2025, Zydus Lifesciences announced that it has received final approval from the U.S. Food and Drug Administration (USFDA) to manufacture and market Ketoconazole Shampoo, 2%. This generic antifungal medication is used to treat dandruff, fungal infections, and various other skin conditions, the company stated

- In March 2025, Chinese researchers reported in Nature the discovery of mandimycin, a novel glycosylated polyene antifungal that successfully kills drug-resistant fungi, including Candida auris, by targeting fungal lipid membranes—showing promising results in test tubes and animal models

- In June 2024, biotechnology company Biocon Ltd announced that it has received approval from the U.S. Food and Drug Administration (US FDA) for its complex, vertically integrated injectable product, Micafungin, in 50mg and 100mg vial strengths

- In March 2023, the U.S. FDA approved rezafungin (Rezzayo), a long-acting echinocandin, for treating candidemia and invasive candidiasis in adults. It offers once-weekly intravenous dosing and non-inferiority to caspofungin in Phase 3 trials

- In May 2022, Shionogi & Co., Ltd. and F2G Ltd. announced a strategic partnership to develop and commercialize the novel antifungal agent olorofim across Europe and Asia. Developed by F2G, olorofim is an innovative oral therapy designed to treat invasive aspergillosis (IA) and other rare mold infections

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.