Global Arrhythmia Treatment Market

Market Size in USD Million

CAGR :

%

USD

8.85 Million

USD

15.99 Million

2024

2032

USD

8.85 Million

USD

15.99 Million

2024

2032

| 2025 –2032 | |

| USD 8.85 Million | |

| USD 15.99 Million | |

|

|

|

|

Arrhythmia Treatment Market Size

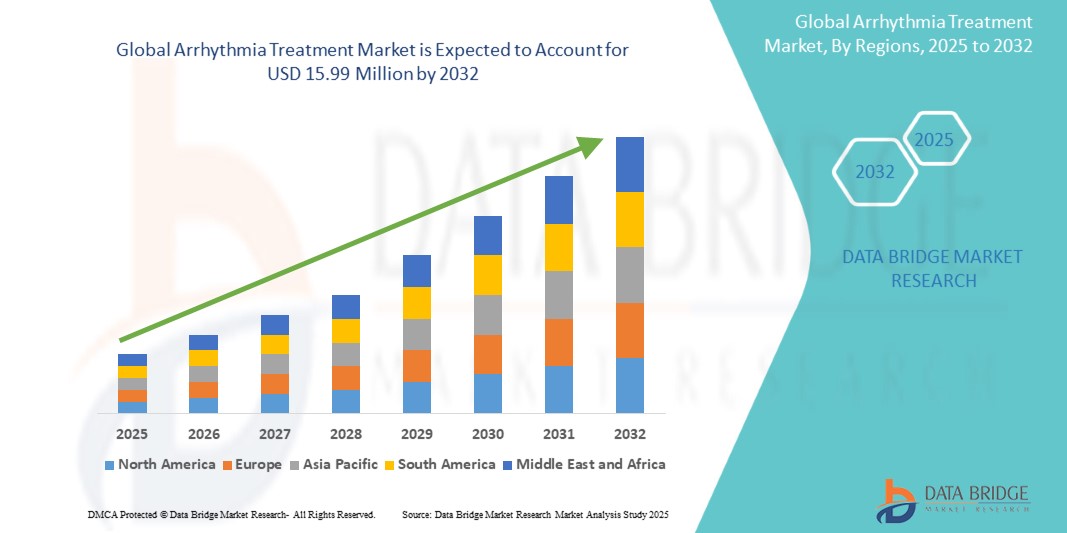

- The global arrhythmia treatment market size was valued at USD 8.85 million in 2024 and is expected to reach USD 15.99 million by 2032, at a CAGR of 7.67% during the forecast period

- The market growth is largely fueled by the increasing prevalence of cardiovascular diseases, particularly atrial fibrillation and ventricular arrhythmias, alongside the rising aging population, which is driving demand for advanced treatment options such as antiarrhythmic drugs, catheter ablation procedures, and implantable devices. Rapid technological progress in electrophysiology and minimally invasive techniques is further enhancing treatment outcomes and expanding adoption

- Furthermore, rising patient and physician demand for safe, effective, and user-friendly treatment solutions—supported by continuous innovations in cardiac ablation systems, next-generation implantable cardioverter defibrillators (ICDs), and AI-driven diagnostic guidance—is establishing arrhythmia treatments as a critical component of modern cardiovascular care. These converging factors are accelerating the uptake of arrhythmia treatment solutions, thereby significantly boosting the industry’s growth

Arrhythmia Treatment Market Analysis

- Arrhythmia treatments, which include a wide range of therapeutic approaches such as antiarrhythmic drugs, catheter ablation procedures, implantable devices, and surgical interventions, are becoming increasingly vital in cardiology due to their ability to manage irregular heart rhythms, prevent complications, and improve patient survival outcomes

- The escalating demand for arrhythmia treatments is primarily fueled by the rising prevalence of cardiovascular diseases, growing awareness about early diagnosis and treatment, and the increasing adoption of minimally invasive and technologically advanced therapies worldwide.

- North America dominated the arrhythmia treatment market with the largest revenue share of 40% in 2024, supported by advanced healthcare infrastructure, high treatment adoption rates, favorable reimbursement policies, and the strong presence of key medical device and pharmaceutical companies. The U.S. is experiencing substantial growth driven by increasing rates of atrial fibrillation, rising healthcare expenditure, and growing use of catheter ablation and implantable cardioverter defibrillators (ICDs)

- Asia-Pacific is expected to be the fastest growing region in the arrhythmia treatment market during the forecast period, fueled by rapid urbanization, rising disposable incomes, expanding healthcare access, and government initiatives aimed at strengthening cardiovascular care infrastructure

- The Oral segment dominated the arrhythmia treatment market with a 64.3% share in 2024, since oral formulations of anticoagulants, beta blockers, and calcium channel blockers remain the mainstay for long-term arrhythmia management. Their ease of use, cost efficiency, and wide availability through pharmacies support sustained demand

Report Scope and Arrhythmia Treatment Market Segmentation

|

Attributes |

Arrhythmia Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Arrhythmia Treatment Market Trends

Transforming Arrhythmia Treatments with AI and Remote Monitoring

- A significant and accelerating trend in the global arrhythmia treatment market is the integration of artificial intelligence (AI) and digital health platforms into treatment pathways. This technological fusion is enhancing convenience for both patients and healthcare providers by enabling more precise diagnostics, treatment personalization, and remote management

- For instance, in 2023, Medtronic introduced AI-driven algorithms integrated with its cardiac mapping and ablation systems, allowing physicians to better identify abnormal electrical pathways and optimize ablation procedures. Similarly, Abbott’s remote monitoring platforms are increasingly using machine learning to detect arrhythmic events earlier and transmit actionable data directly to physicians

- AI integration in arrhythmia treatments enables features such as predictive analytics for atrial fibrillation recurrence, improved accuracy in electrocardiogram (ECG) interpretation, and automated detection of arrhythmic events. Furthermore, mobile applications linked to implantable devices now allow seamless communication of patient health data to clinicians, supporting continuous care and reducing hospital visits

- The seamless integration of arrhythmia treatment devices with telemedicine platforms and electronic health records (EHR) facilitates centralized management of cardiovascular patients. Through a single interface, physicians can track arrhythmia episodes, monitor treatment effectiveness, and adjust therapies in real time

- This trend toward more intelligent, data-driven, and patient-centric treatment approaches is fundamentally reshaping cardiology care. Consequently, companies such as Boston Scientific, Abbott, and Medtronic are developing AI-enabled arrhythmia treatment solutions that combine advanced devices, digital monitoring, and data analytics to improve outcomes

- The demand for arrhythmia treatments that incorporate AI-powered decision support and remote monitoring is growing rapidly across hospitals, diagnostic centers, and ambulatory care settings, as patients and providers increasingly prioritize convenience, accuracy, and preventive care

Arrhythmia Treatment Market Dynamics

Driver

Growing Need Due to Rising Cardiovascular Disease Burden and Aging Population

- The increasing global prevalence of cardiovascular diseases (CVDs), particularly atrial fibrillation and other arrhythmias, combined with the rapidly aging population, is a significant driver of demand for arrhythmia treatments

- For instance, in April 2024, Abbott announced the launch of its next-generation cardiac ablation catheter with advanced mapping capabilities, aimed at improving the treatment of atrial fibrillation. Such innovations by leading companies are expected to accelerate market growth in the forecast period

- As patients and healthcare systems become more aware of the risks associated with untreated arrhythmias, treatments such as antiarrhythmic drugs, catheter ablation procedures, and implantable devices are gaining widespread adoption, offering a compelling improvement over traditional symptom management approaches

- Furthermore, the rising popularity of minimally invasive procedures and the expansion of remote cardiac monitoring are making arrhythmia treatments a central component of modern cardiovascular care, with greater emphasis on prevention and early intervention

- The convenience of less invasive therapies, faster recovery times, and the ability to continuously monitor treatment outcomes are key factors propelling adoption across hospitals, diagnostic centers, and ambulatory care facilities. The increasing availability of patient-friendly treatment options further contributes to market growth

Restraint/Challenge

Concerns Regarding Treatment Costs and Data Privacy in Digital Health Integration

- High treatment costs associated with advanced arrhythmia interventions, such as catheter ablation and implantable cardioverter defibrillators (ICDs), pose a significant challenge to broader adoption, particularly in low- and middle-income countries. Out-of-pocket expenses can discourage patients from seeking timely treatment

- For instance, studies have highlighted that ablation therapy costs can be a barrier for patients without comprehensive insurance or reimbursement coverage, limiting access in regions with less developed healthcare financing systems.

- Concerns over patient data privacy and security in digital health platforms integrated with arrhythmia treatments also add to adoption challenges. Remote monitoring systems and implantable devices that transmit patient data are vulnerable to potential breaches, raising anxieties about sensitive health information

- Addressing these concerns through government reimbursement support, cost-effective device innovations, and compliance with strict data protection regulations (HIPAA, GDPR) is crucial for improving adoption. Leading players such as Medtronic, Boston Scientific, and Abbott are emphasizing affordability, enhanced data encryption, and secure monitoring solutions to reassure providers and patients

- While device and treatment prices are gradually declining due to technological advances and increasing competition, cost sensitivity remains a key barrier, especially in developing regions. Overcoming these challenges through broader reimbursement policies, public awareness campaigns, and lower-cost treatment models will be essential for sustained market growth

Arrhythmia Treatment Market Scope

The market is segmented on the basis of type, drugs, devices, treatment, mode of administration, distribution channel, and end-user.

• By Type

On the basis of type, the arrhythmia treatment market is segmented into supraventricular arrhythmias, ventricular arrhythmias, and others. The supraventricular arrhythmias segment dominated the largest market revenue share of 46.5% in 2024, primarily due to the widespread occurrence of atrial fibrillation (AFib), atrial flutter, and supraventricular tachycardia across the global population. AFib alone represents the most common sustained arrhythmia, significantly increasing the risk of stroke and heart failure, thereby creating a sustained need for effective treatment strategies. Growing awareness among patients and healthcare providers, along with the rising geriatric population susceptible to supraventricular arrhythmias, has further reinforced this segment’s market dominance.

The ventricular arrhythmias segment is anticipated to witness the fastest growth rate of 20.1% from 2025 to 2032, as ventricular tachycardia and sudden cardiac arrest remain major causes of mortality worldwide. The adoption of advanced treatment modalities such as implantable defibrillators, ablation therapies, and intensive monitoring solutions is fueling demand in this category. Increasing clinical studies supporting the use of new-generation therapies and devices further strengthens its growth trajectory.

• By Drugs

On the basis of drugs, the arrhythmia treatment market is segmented into antiarrhythmic drugs, calcium channel blockers, beta blockers, anticoagulant agents, and others. The anticoagulant agents segment held the largest revenue share of 39.2% in 2024, reflecting the indispensable role of anticoagulants in reducing stroke risk among atrial fibrillation patients. The growing shift toward novel oral anticoagulants (NOACs) such as apixaban, rivaroxaban, and dabigatran, which offer improved safety, fewer dietary restrictions, and greater patient compliance compared to warfarin, is driving this dominance. Increasing physician preference for NOACs in both developed and emerging economies ensures sustained growth of this segment.

The antiarrhythmic drugs segment is anticipated to witness the fastest CAGR of 18.9% from 2025 to 2032. Growth is driven by continuous innovations in drug formulations that enhance efficacy while reducing adverse effects, along with improved safety profiles that encourage wider adoption. Increasing use of these drugs in combination with catheter ablation procedures and implantable cardiac devices further strengthens their role in comprehensive arrhythmia management. Moreover, rising R&D initiatives targeting reduced recurrence rates and better patient outcomes are accelerating market expansion.

• By Devices

On the basis of devices, the arrhythmia treatment market is segmented into implantable cardioverter-defibrillator (ICD), pacemaker, cardiac resynchronization therapy (CRT), and others. The implantable cardioverter-defibrillator (ICD) segment accounted for the largest market share of 41.8% in 2024, due to its life-saving role in preventing sudden cardiac death from ventricular arrhythmias. Global guidelines recommending ICD implantation for high-risk patients, coupled with significant improvements in device design, battery life, and remote monitoring capabilities, are fueling adoption. The increasing awareness of sudden cardiac arrest prevention in both developed and developing regions further boosts this segment’s leadership.

The cardiac resynchronization therapy (CRT) segment is projected to grow at the fastest CAGR of 19.7% between 2025 and 2032. CRT devices are increasingly adopted for heart failure patients with associated arrhythmias, offering significant clinical advantages such as improved survival rates, enhanced cardiac output, and reduced hospitalizations. The growing prevalence of heart failure, coupled with technological advancements such as MRI-compatible and remote monitoring-enabled CRT devices, is fueling adoption. Rising awareness and supportive reimbursement policies further strengthen market growth.

• By Treatment

On the basis of treatment, the arrhythmia treatment market is segmented into surgery, drugs, and others. The drug-based treatment segment dominated with a 52.4% market share in 2024, owing to the widespread availability and adoption of anticoagulants, beta blockers, and antiarrhythmic drugs as first-line therapies. Drugs are often the most accessible, cost-effective, and widely prescribed option across global healthcare systems, especially in outpatient and primary care settings.

The Surgery segment, which includes catheter ablation and minimally invasive surgical ablation procedures, is projected to witness the fastest CAGR of 20.4% from 2025 to 2032. Advancements in catheter technology, increasing availability of skilled electrophysiologists, and strong clinical evidence supporting surgical intervention for long-term arrhythmia management are driving this growth. Rising patient preference for minimally invasive solutions also contributes significantly.

• By Mode of Administration

On the basis of mode of administration, the arrhythmia treatment market is segmented into injectable, oral, and others. The Oral segment dominated the market with a 64.3% share in 2024, since oral formulations of anticoagulants, beta blockers, and calcium channel blockers remain the mainstay for long-term arrhythmia management. Their ease of use, cost efficiency, and wide availability through pharmacies support sustained demand.

The injectable segment is projected to expand at the fastest CAGR of 17.8% between 2025 and 2032, making it a vital growth driver in the global market. Its strong momentum is attributed to the essential role of injectable formulations in emergency and critical care, where rapid arrhythmia control is crucial. Intravenous antiarrhythmics and anticoagulants are widely used for immediate intervention during acute arrhythmic episodes, cardiac arrest, or thromboembolic risks. Increasing hospital admissions, advancements in injectable formulations, and rising cardiovascular emergencies are expected to significantly accelerate this segment’s adoption worldwide.

• By Distribution Channel

On the basis of distribution channel, the arrhythmia treatment market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. The Hospital Pharmacies segment held the largest revenue share of 55.6% in 2024, attributed to the higher patient inflow in hospitals for cardiac emergencies and chronic arrhythmia care. Hospitals serve as the primary access points for advanced drug regimens, cardiac devices, and emergency care, consolidating this channel’s dominance.

The online pharmacies segment is expected to register the highest CAGR of 21.2% from 2025 to 2032, emerging as the fastest-growing distribution channel in the global arrhythmia treatment market. Growth is fueled by rapid digitalization of healthcare, greater patient reliance on convenient home delivery, and integration of e-pharmacy platforms with telehealth consultations. Expanding regulatory support and approvals for online drug sales across key regions are also boosting accessibility. Moreover, rising awareness, cost transparency, and subscription-based medication delivery models are enhancing patient adherence, further driving this segment’s strong market expansion.

• By End-User

On the basis of end-user, the arrhythmia treatment market is segmented into hospitals, homecare, specialty clinics, and others. The Hospitals segment dominated with a 61.5% share in 2024, supported by their advanced cardiac care infrastructure, specialized arrhythmia units, and access to both device-based and drug-based treatments. High patient volumes and the availability of skilled electrophysiologists further strengthen hospitals’ leading role.

The Homecare segment is expected to witness the fastest CAGR of 19.4% from 2025 to 2032, as patients increasingly adopt at-home arrhythmia management solutions. This trend is being driven by remote monitoring technologies, telehealth platforms, and implantable devices that provide real-time data for physician oversight. The shift toward patient-centered care and long-term management outside hospitals is fueling this growth.

Arrhythmia Treatment Market Regional Analysis

- North America dominated the arrhythmia treatment market with the largest revenue share of 40 in 2024, supported by advanced healthcare infrastructure, high adoption of treatment solutions, favorable reimbursement policies, and the strong presence of leading medical device and pharmaceutical companies

- Patients and providers in the region highly value the effectiveness, accessibility, and technological integration of arrhythmia treatments, particularly catheter ablation, implantable cardioverter defibrillators (ICDs), and pacemakers

- This strong adoption is further reinforced by rising cases of atrial fibrillation, increased healthcare expenditure, and a high rate of innovation in digital cardiac monitoring solutions, positioning North America as the leading hub for arrhythmia care globally

U.S. Arrhythmia Treatment Market Insight

The U.S. arrhythmia treatment market accounted for nearly 66% of the North American arrhythmia treatment market in 2024, driven by rising prevalence of atrial fibrillation and ventricular tachycardia, coupled with the swift uptake of advanced therapies such as catheter ablation and ICDs. Strong healthcare spending, favorable FDA approvals, and growing demand for minimally invasive and remote monitoring solutions further accelerate growth. Moreover, the U.S. is witnessing rapid integration of AI-powered cardiac monitoring and telehealth platforms, which is strengthening its position as a global leader in arrhythmia management.

Europe Arrhythmia Treatment Market Insight

The Europe arrhythmia treatment market is projected to grow at a steady CAGR during the forecast period, supported by an aging population, rising cardiovascular disease burden, and strong government focus on improving cardiovascular outcomes. Increasing adoption of digital health platforms, electrophysiology procedures, and advanced ablation devices are fostering market expansion. The market is further shaped by a growing preference for minimally invasive therapies and hospital investments in advanced monitoring systems across residential and multi-facility healthcare networks.

U.K. Arrhythmia Treatment Market Insight

The U.K. arrhythmia treatment market is projected to grow at a notable CAGR, largely supported by the country’s strong emphasis on improving cardiovascular health outcomes. National initiatives by the NHS aimed at reducing the burden of atrial fibrillation and other heart rhythm disorders are creating a favorable environment for treatment adoption. Growing awareness among both patients and healthcare providers about the risks associated with untreated arrhythmias is further accelerating demand. In addition, the U.K. is witnessing rising adoption of telecardiology and remote patient monitoring solutions, which are improving early detection and personalized care. The increasing demand for minimally invasive procedures such as catheter ablation, coupled with the integration of AI-driven digital health platforms within the NHS framework, is fostering rapid advancements and boosting overall market growth.

Germany Arrhythmia Treatment Market Insight

The Germany arrhythmia treatment market is forecasted to expand significantly during the upcoming years, underpinned by its robust healthcare infrastructure and high focus on medical innovation. The country’s well-structured reimbursement system encourages the adoption of advanced cardiac care technologies, including implantable cardioverter defibrillators (ICDs) and electrophysiology mapping systems. Germany is also at the forefront of adopting novel ablation technologies and minimally invasive procedures, ensuring improved patient outcomes and shorter recovery times. Moreover, the nation’s strong emphasis on precision medicine and sustainability, along with rapid digital integration of healthcare services, has positioned Germany as one of the key leaders in arrhythmia management within Europe. The combination of technological expertise, supportive policies, and patient-centric care models is driving steady market expansion.

Asia-Pacific Arrhythmia Treatment Market Insight

The Asia-Pacific arrhythmia treatment market is anticipated to witness the fastest CAGR between 2025 and 2032, propelled by rapid socioeconomic changes across emerging economies such as China, Japan, and India. Factors such as increasing urbanization, rising disposable incomes, and a growing elderly population are intensifying the need for advanced cardiovascular care. Governments across the region are implementing large-scale initiatives to strengthen healthcare infrastructure, enhance accessibility, and raise awareness about cardiovascular diseases, thereby boosting treatment adoption. The increasing availability of cost-effective treatment devices, combined with the region’s role as a global manufacturing hub for medical technologies, is further expanding access to arrhythmia therapies. These dynamics are making Asia-Pacific a critical growth engine for the global market, offering vast opportunities for medical device manufacturers and healthcare providers.

Japan Arrhythmia Treatment Market Insight

The Japan arrhythmia treatment market is experiencing steady growth, driven by the country’s aging population and high prevalence of cardiovascular diseases. With a strong cultural emphasis on advanced technology, Japan has been an early adopter of minimally invasive cardiac procedures and cutting-edge monitoring systems. The growing integration of IoT-enabled cardiac monitoring solutions, such as wearable devices and AI-based diagnostic platforms, is revolutionizing arrhythmia care by enabling real-time data tracking and proactive interventions. In addition, significant government and private sector investments in healthcare digitization are contributing to better clinical outcomes. Japan’s focus on combining innovation with patient-friendly treatment solutions is positioning it as one of the leading countries in the Asia-Pacific arrhythmia treatment market.

China Arrhythmia Treatment Market Insight

The China arrhythmia treatment market accounted for the largest share of the Asia-Pacific arrhythmia treatment market in 2024, supported by its expanding middle-class population, rapid urbanization, and growing prevalence of cardiovascular disorders. The country is heavily investing in modernizing its healthcare infrastructure, with a particular emphasis on improving access to advanced cardiac care across both urban and rural regions. Strong domestic manufacturing capabilities are enabling the large-scale production of arrhythmia treatment devices at more affordable price points, significantly increasing accessibility for patients. In addition, the government’s push towards smart city development and digital health integration is fostering the adoption of AI-based monitoring tools and telemedicine platforms. These combined efforts are not only driving higher adoption of arrhythmia treatments but also establishing China as a major global hub for innovation and large-scale healthcare deployment.

Arrhythmia Treatment Market Share

The arrhythmia treatment industry is primarily led by well-established companies, including:

- Pfizer Inc. (U.S.)

- Sawai Pharmaceutical Co., Ltd (Japan)

- Baxter (U.S.)

- Aurobindo Pharma (India)

- Zydus Cadila (India)

- WOCKHARDT (India)

- Teva Pharmaceutical Industries Ltd (Israel)

- Novartis AG (Switzerland)

- Viatris Inc. (U.S.)

- Sun Pharmaceutical Industries Ltd (India)

- Fresenius Kabi AG (Germany)

- GSK plc (U.K.)

- ANI Pharmaceuticals, Inc. (U.S.)

- Nexus Pharmaceuticals, Inc. (U.S.)

- AstraZeneca (U.K.)

- Dr. Reddy’s Laboratories Ltd (India)

- Acesion Pharma (Denmark)

- Johnson & Johnson and its affiliates (U.S.)

- InCarda Therapeutics, Inc. (U.S.)

Latest Developments in Global Arrhythmia Treatment Market

- In August 2021, Abbott announced that it had received U.S. FDA approval for the Amplatzer Amulet Left Atrial Appendage Occluder, a device specifically designed to reduce stroke risk in patients with atrial fibrillation. By effectively sealing the left atrial appendage (LAA), the device prevents blood clot formation, offering a minimally invasive alternative to long-term anticoagulant therapy and significantly improving patient outcomes

- In September 2022, Medtronic received U.S. FDA 510(k) clearance for an expanded indication of its LINQ II insertable cardiac monitor (ICM), making it the first continuous long-term ICM approved for pediatric patients aged two years and older. This development marked a critical milestone in arrhythmia care, enabling clinicians to continuously monitor heart rhythms in younger patients and detect potentially life-threatening conditions earlier

- In May 2023, Abbott received U.S. FDA approval for the TactiFlex Ablation Catheter, Sensor Enabled, a next-generation radiofrequency ablation catheter designed for the treatment of drug-refractory, symptomatic paroxysmal atrial fibrillation. Featuring a flexible-tip design with contact-force sensing technology, the catheter provides improved maneuverability and precision during ablation procedures, enhancing both safety and clinical efficacy

- In May 2023, Abbott also secured U.S. FDA clearance for the Assert-IQ insertable cardiac monitor (ICM), a device built for long-term rhythm monitoring with advanced data connectivity features. The Assert-IQ enables physicians to remotely track patient heart rhythms in real time, providing actionable insights for earlier diagnosis and improved management of arrhythmias, while reducing the need for frequent in-person clinical visits

- In September 2023, Boston Scientific received U.S. FDA approval for the WATCHMAN FLX Pro left atrial appendage closure device, the latest generation of its LAAC platform

- In December 2023, Medtronic obtained the first U.S. FDA approval for pulsed field ablation (PFA) with the PulseSelect PFA System to treat atrial fibrillation, marking a major shift toward non-thermal ablation

- In March 2024, Abbott received CE Mark for an Assert-IQ ICM with up to six-year battery life, broadening long-term ambulatory rhythm monitoring options in Europe.

- In October 2024, Medtronic announced U.S. FDA approval of its Affera Mapping and Ablation System with the Sphere-9 catheter (all-in-one RF/PFA platform), expanding PFA capabilities for AF treatment

- In November 2024, Johnson & Johnson (Biosense Webster) received U.S. FDA approval for the VARIPULSE PFA System to treat drug-refractory paroxysmal atrial fibrillation, adding another major PFA option in the U.S. market

- In July 2025, Boston Scientific gained U.S. FDA approval for expanded labeling of the FARAPULSE PFA System to include persistent AF (pulmonary vein and posterior wall ablation), significantly broadening its indication

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.