Global Artificial Saliva Market

Market Size in USD Billion

CAGR :

%

USD

1.42 Billion

USD

4.06 Billion

2024

2032

USD

1.42 Billion

USD

4.06 Billion

2024

2032

| 2025 –2032 | |

| USD 1.42 Billion | |

| USD 4.06 Billion | |

|

|

|

|

Artificial Saliva Market Size

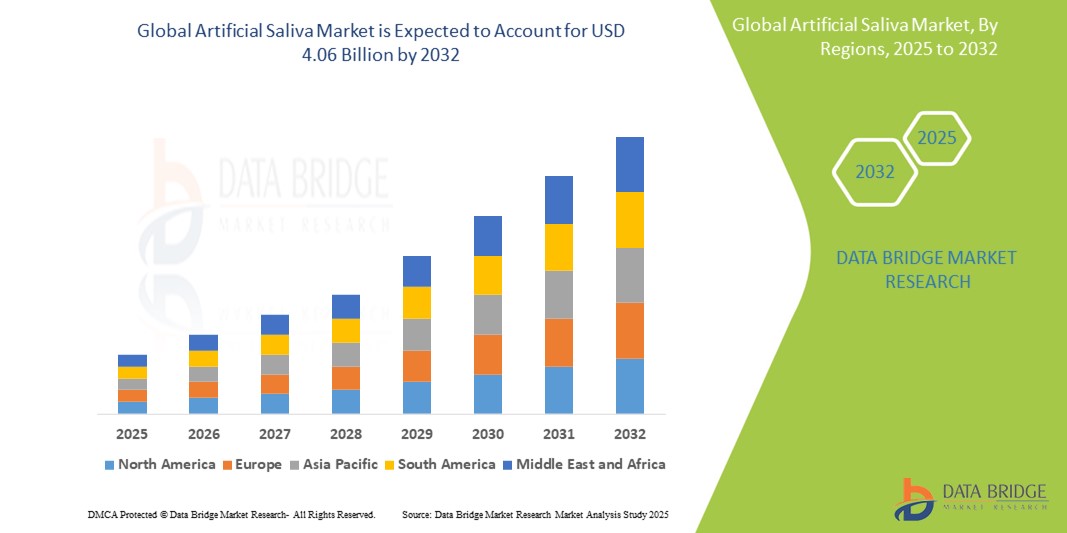

- The global artificial saliva market size was valued at USD 1.42 billion in 2024 and is expected to reach USD 4.06 billion by 2032, at a CAGR of 14.00% during the forecast period

- The market expansion is primarily driven by the rising prevalence of xerostomia (dry mouth), often caused by medications, radiation therapy, or autoimmune diseases such as Sjögren’s syndrome, creating a sustained demand for effective saliva substitutes

- In addition, advancements in formulation technologies and increasing awareness of oral healthcare are contributing to the development of biocompatible, long-lasting artificial saliva products. These innovations, along with a growing elderly population and improved access to supportive treatments, are expected to significantly propel the market forward

Artificial Saliva Market Analysis

- Artificial saliva, formulated to mimic natural saliva and provide moisture and lubrication in the oral cavity, plays a crucial role in managing xerostomia caused by conditions such as Sjögren’s syndrome, radiation therapy, or medication side effects. Its use is vital in improving patient comfort, oral health, and overall quality of life

- The growing incidence of dry mouth, especially among the elderly and cancer patients, coupled with increasing awareness of oral health management, is significantly driving the demand for artificial saliva products globally

- North America dominated the artificial saliva market with the largest revenue share of 39.2% in 2024, characterized by a well-established healthcare infrastructure, rising geriatric population, and greater adoption of supportive care products, especially in the U.S., where dry mouth is a common side effect of prescription medications and cancer therapies

- Asia-Pacific is expected to be the fastest growing region in the artificial saliva market during the forecast period due to improving healthcare access, growing medical expenditure, and increased awareness of xerostomia treatment options in countries such as China, India, and Japan

- Gel segment dominated the artificial saliva market with a market share of 42% in 2024, driven by its longer-lasting moisture retention and ease of use, especially among patients with severe dry mouth or limited manual dexterity

Report Scope and Artificial Saliva Market Segmentation

|

Attributes |

Artificial Saliva Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Artificial Saliva Market Trends

“Innovation in Biocompatible and Long-Acting Formulations”

- A significant and accelerating trend in the global artificial saliva market is the advancement of biocompatible and long-acting formulations designed to closely replicate the properties of natural saliva, thereby offering extended relief and enhanced patient comfort in managing xerostomia

- For instance, new-generation products such as XyliMelts and Biotène Moisturizing Gel utilize natural enzymes and mucoadhesive agents such as xylitol and carboxymethylcellulose to retain moisture longer and maintain oral pH, effectively preventing irritation and infections associated with dry mouth

- These innovations enable features such as prolonged hydration, reduced frequency of application, and improved user compliance—especially important for elderly individuals and patients undergoing chemotherapy or radiation. Some advanced gels and sprays are now formulated without alcohol or preservatives to minimize irritation and allergic reactions, making them suitable for long-term daily use

- The development of artificial saliva is increasingly focused on enhancing therapeutic functionality by incorporating antimicrobial properties and supporting mucosal healing, offering a more comprehensive oral care solution beyond basic lubrication

- The seamless integration of artificial saliva with personalized healthcare strategies is also gaining momentum. For instance, product lines tailored to pediatric, geriatric, or oncology-specific needs are being introduced to better serve targeted patient populations

- This trend towards more intelligent, natural, and clinically effective formulations is fundamentally reshaping patient expectations and clinical approaches to xerostomia management. Consequently, companies such as GlaxoSmithKline and ICPA Health Products Ltd. are expanding their portfolios to include alcohol-free, enzymatic, and long-acting artificial saliva variants suited for diverse medical needs

- The demand for artificial saliva that offers prolonged relief, biocompatibility, and enhanced therapeutic value is growing rapidly across both home and clinical care environments, as healthcare providers and consumers increasingly prioritize comfort, safety, and efficacy in oral hydration solutions.

Artificial Saliva Market Dynamics

Driver

“Increasing Prevalence of Xerostomia and Growing Geriatric Population”

- The rising global incidence of xerostomia, commonly associated with aging, polypharmacy, and cancer therapies, is a major driver for the expanding demand for artificial saliva products. This condition significantly affects oral health and quality of life, necessitating effective and accessible treatment options

- For instance, in January 2024, GlaxoSmithKline reported increased demand for its Biotène product line due to growing awareness and usage in oncology care settings. Such strategic focus by key players on xerostomia-linked therapies is expected to boost the artificial saliva market during the forecast period

- As the global elderly population continues to grow—many of whom suffer from medication-induced dry mouth—the demand for saliva substitutes that offer sustained relief and ease of use is accelerating.

- In addition, the increased use of radiotherapy in head and neck cancer treatments, which often leads to salivary gland dysfunction, is creating a consistent need for supportive care products such as artificial saliva across hospitals and home care settings

- Patient awareness about xerostomia and the importance of maintaining oral hygiene is rising, leading to the wider acceptance of over-the-counter saliva substitutes in various forms such as gels, sprays, and lozenges

- The convenience of readily available, easy-to-use products and the shift toward self-care solutions are further propelling the adoption of artificial saliva, especially in aging populations and outpatient oncology care

Restraint/Challenge

“Skin Irritation Issues and Regulatory Compliance Hurdle”

- Concerns over potential side effects such as oral mucosal irritation, allergic reactions, or discomfort associated with certain artificial saliva ingredients present a restraint to broader market adoption. Some formulations contain preservatives, alcohol, or flavoring agents that may not be suitable for all patient groups, especially those with sensitive oral tissues

- For instance, reports of intolerance to specific ingredients in over-the-counter products such as parabens or artificial sweeteners have prompted healthcare professionals to seek more biocompatible options, thereby limiting the use of some commercially available formulations

- Addressing these safety concerns through the development of hypoallergenic, preservative-free alternatives and greater transparency in ingredient labeling is crucial to improving consumer confidence and expanding usage

- In addition, stringent regulatory requirements across different regions for oral healthcare products can slow down product approvals and market entry, particularly for newer, innovative formulations. Companies must navigate diverse compliance standards, including FDA approval in the U.S. and CE marking in Europe, which can result in longer development timelines and higher costs

- The relatively low awareness about xerostomia and the available artificial saliva treatments in emerging markets also limits demand, as many patients remain undiagnosed or untreated

Artificial Saliva Market Scope

The market is segmented on the basis of product, end-user, and distribution channel.

- By Product

On the basis of product, the artificial saliva market is segmented into oral spray, oral solution, oral liquid, dissolving tablets, gel, and powder. The gel segment dominated the market with the largest market revenue share of 42% in 2024, driven by its superior moisture retention, longer-lasting relief, and ease of application for individuals suffering from severe dry mouth. Gels are particularly favored among elderly patients and those undergoing radiation therapy due to their mucoadhesive properties and extended duration of action.

The oral spray segment is anticipated to witness the fastest growth rate from 2025 to 2032, owing to its convenience, portability, and quick absorption. Oral sprays are increasingly used for on-the-go symptom relief and are preferred by individuals with dexterity challenges or who require frequent reapplication. Advances in spray formulation and delivery systems are further contributing to this segment’s rapid adoption.

- By End User

On the basis of end-user, the artificial saliva market is segmented into adult and paediatric. The adult segment accounted for the largest revenue share in 2024 due to the high prevalence of xerostomia among older adults, individuals with chronic illnesses, and those on polypharmacy. The adult demographic remains the primary user base for artificial saliva, especially in oncology and geriatric care settings.

The paediatric segment is projected to grow steadily during the forecast period, supported by increased attention to oral health in children with congenital conditions or those receiving medications that cause dry mouth. Child-friendly formulations with safe, mild ingredients are being developed to cater to this growing need.

- By Distribution Channel

On the basis of distribution channel, the artificial saliva market is segmented into supermarkets and hypermarkets, and others, which include pharmacies, online platforms, and specialty stores. The supermarkets and hypermarkets segment held a notable share in 2024, driven by the availability of over-the-counter artificial saliva products in retail chains and the growing trend of self-medication among consumers. These outlets provide easy accessibility and visibility for widely recognized brands.

The others segment, particularly online pharmacies, is expected to witness the fastest growth through 2032, driven by rising e-commerce adoption, doorstep delivery, and increased consumer preference for privacy and convenience in purchasing health products. Digital platforms also enable access to a broader range of product options and educational content.

Artificial Saliva Market Regional Analysis

- North America dominated the artificial saliva market with the largest revenue share of 39.2% in 2024, driven by a well-established healthcare infrastructure, rising geriatric population, and greater adoption of supportive care products

- Consumers in the region increasingly seek effective, long-lasting solutions for dry mouth, with a strong preference for clinically validated, over-the-counter artificial saliva products available in pharmacies and online platforms

- The market is further supported by robust healthcare infrastructure, strong awareness of oral hygiene, and rising expenditure on supportive therapies. These factors make artificial saliva a critical component in the management of chronic conditions in both home and clinical care settings

U.S. Artificial Saliva Market Insight

The U.S. artificial saliva market captured the largest revenue share of 79% in 2024 within North America, driven by a high incidence of xerostomia caused by medication use, radiation therapy, and aging. Consumers are prioritizing comfort and oral health through easily accessible over-the-counter solutions. The strong presence of established pharmaceutical companies, increased awareness of dry mouth management, and supportive insurance coverage for oral care products are propelling market growth. Furthermore, advancements in long-acting, biocompatible formulations are encouraging wider adoption in clinical and home care settings.

Europe Artificial Saliva Market Insight

The. Europe artificial saliva market is projected to grow at a substantial CAGR throughout the forecast period, supported by a growing geriatric population and increased focus on supportive cancer care. Regulatory efforts to ensure safer, preservative-free formulations and the rise of specialized oral healthcare clinics are driving product innovation and demand. With higher health awareness and access to advanced healthcare, European consumers are embracing artificial saliva products for long-term xerostomia relief across both outpatient and hospital settings

U.K. Artificial Saliva Market Insight

The U.K. artificial saliva market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by NHS initiatives to support patients with chronic conditions such as Sjögren’s syndrome and oral cancer. Rising public awareness about the importance of oral hydration and a growing preference for non-prescription dry mouth treatments are boosting product adoption. The availability of artificial saliva through pharmacies, supermarkets, and online platforms further contributes to market expansion.

Germany Artificial Saliva Market Insight

The Germany artificial saliva market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s aging population, increasing rates of polypharmacy, and focus on oral health as part of overall wellness. German consumers prefer scientifically validated, high-quality saliva substitutes, with a rising demand for gel and enzyme-based formulations. Germany’s advanced healthcare infrastructure and reimbursement systems also support the widespread use of artificial saliva products in both clinical and home environments.

Asia-Pacific Artificial Saliva Market Insight

The Asia-Pacific artificial saliva market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by improving healthcare access, rising awareness of xerostomia, and increasing life expectancy in countries such as China, Japan, and India. Government investments in elderly care and oral health initiatives are promoting the adoption of saliva substitutes. In addition, the growing presence of local manufacturers and distribution networks is enhancing the affordability and availability of artificial saliva across the region.

Japan Artificial Saliva Market Insight

The Japan artificial saliva market is gaining momentum due to the country’s aging demographics and high prevalence of radiation-related dry mouth in cancer patients. Demand is increasing for mild, long-lasting formulations that suit the needs of elderly users. The integration of artificial saliva into broader elderly care and supportive cancer treatment programs is further stimulating growth. Japan’s advanced R&D capabilities and emphasis on innovation also contribute to the development of next-generation saliva substitutes.

India Artificial Saliva Market Insight

The India artificial saliva market accounted for the largest market revenue share in Asia-Pacific in 2024, supported by rising healthcare awareness, an expanding elderly population, and the growing burden of chronic diseases. Increasing access to oral care solutions, affordability of domestic brands, and the growth of the online pharmacy sector are making artificial saliva more widely available. Government health campaigns and public-private partnerships aimed at geriatric and cancer care are also contributing to market expansion.

Artificial Saliva Market Share

The artificial saliva industry is primarily led by well-established companies, including:

- GSK plc (U.K.)

- Sunstar Suisse S.A. (Switzerland)

- ICPA Health Products Ltd. (India)

- OraHealth Corp. (U.S.)

- Hager Worldwide Inc. (U.S.)

- Fresenius Kabi AG (Germany)

- TAB Labs Inc. (Canada)

- Mission Pharmacal Company (U.S.)

- Biocosmetics Laboratories (France)

- Dr. Fresh, LLC (U.S.)

- TheraBreath (U.S.)

- Colgate-Palmolive Company (U.S.)

- Perrigo Company plc (Ireland)

- Hawley & Hazel (Hong Kong)

- Church & Dwight Co., Inc. (U.S.)

- Laboratoire GILBERT (France)

- Xlear Inc. (U.S.)

- Oral Science International Inc. (Canada)

What are the Recent Developments in Global Artificial Saliva Market?

- In March 2024, GlaxoSmithKline plc expanded its popular Biotène product line with a new alcohol-free, long-lasting gel formulation, specifically targeting patients undergoing cancer treatments and those with chronic dry mouth. This development reflects the company’s commitment to advancing patient care through innovative, gentle, and effective xerostomia management solutions tailored to sensitive users. The launch also emphasizes the growing demand for preservative-free and biocompatible saliva substitutes in clinical and at-home settings

- In February 2024, ICPA Health Products Ltd. introduced Xerodent Pro, a dissolving tablet-based artificial saliva product in India. Developed to offer convenient and portable relief for patients on-the-go, Xerodent Pro is enriched with enzymes and xylitol to support oral health while alleviating dry mouth symptoms. This move highlights ICPA’s focus on product diversification and increasing accessibility to specialized oral care in emerging markets

- In January 2024, Sunstar Suisse S.A. launched a new oral spray variant under its GUM Hydral line, targeting global markets with a preservative-free and pH-balanced formulation. Designed for quick relief and ease of use, the product supports increased comfort for users with radiation-induced xerostomia. The initiative strengthens Sunstar’s position in the preventive and supportive oral care segment

- In November 2023, Cambridge Healthcare Supplies Ltd. announced a strategic collaboration with NHS England to supply its artificial saliva products across public healthcare institutions, ensuring affordable and consistent access for patients dealing with chronic dry mouth. This partnership emphasizes the growing role of public-private cooperation in expanding supportive care services

- In September 2023, Oral Science International Inc. completed clinical trials for its new mucoadhesive saliva substitute gel, formulated with advanced polymer technology for prolonged retention in the oral cavity. The gel showed superior hydration performance and patient satisfaction in comparison to conventional products, marking a significant step forward in xerostomia care. This reflects the industry’s trend toward innovation backed by clinical validation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.