Global Artificial Ventilation Market

Market Size in USD Billion

CAGR :

%

USD

2.56 Billion

USD

3.90 Billion

2024

2032

USD

2.56 Billion

USD

3.90 Billion

2024

2032

| 2025 –2032 | |

| USD 2.56 Billion | |

| USD 3.90 Billion | |

|

|

|

|

Artificial Ventilation Market Size

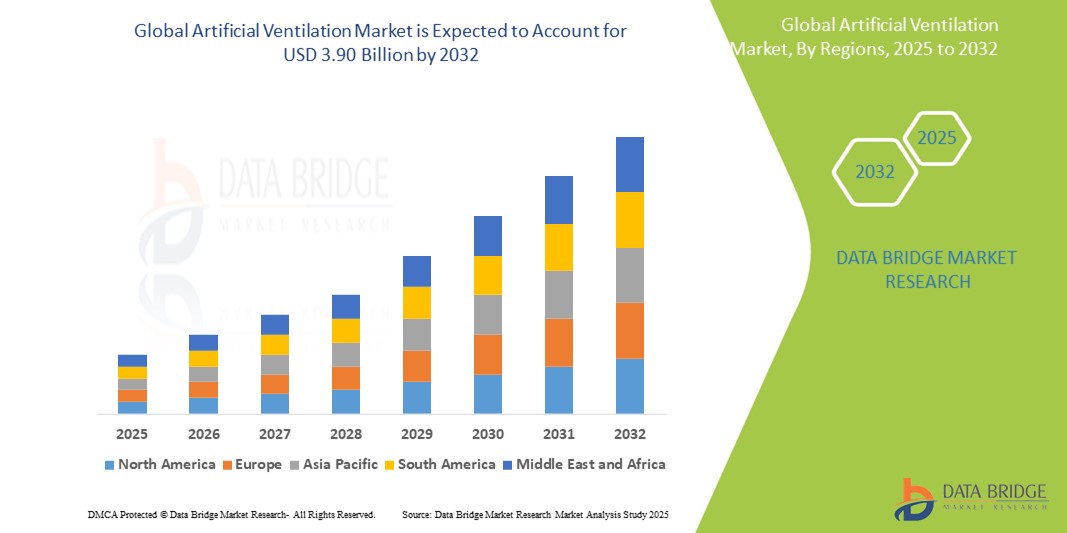

- The global artificial ventilation market size was valued at USD 2.56 billion in 2024 and is expected to reach USD 3.90 billion by 2032, at a CAGR of 5.40% during the forecast period

- The market growth is largely fueled by the increasing incidence of chronic respiratory diseases, rising demand for critical care in both hospital and home settings, and technological advancements in ventilator design and function

- Furthermore, growing geriatric populations, frequent respiratory infections, and heightened focus on emergency preparedness are positioning artificial ventilation as an essential component in modern respiratory care. These converging factors are accelerating the adoption of ventilation systems, thereby significantly boosting the industry's growth

Artificial Ventilation Market Analysis

- Artificial ventilation systems, providing mechanical respiratory support to patients with compromised lung function, are increasingly vital components in modern critical care settings across hospitals, ambulatory centers, and home care environments due to their life-saving role, technological advancements, and adaptability to both invasive and non-invasive applications

- The escalating demand for artificial ventilation is primarily fueled by the rising prevalence of chronic respiratory conditions such as COPD and asthma, increased intensive care admissions, and the growing need for emergency preparedness following global respiratory outbreaks

- North America dominated the artificial ventilation market with the largest revenue share of 35.5% in 2024, characterized by advanced healthcare infrastructure, high healthcare spending, and the presence of major market players, with the U.S. witnessing strong growth in ventilator adoption across critical care units and home-based care, driven by innovation in portable and AI-integrated ventilators

- Asia-Pacific is expected to be the fastest growing region in the artificial ventilation market during the forecast period due to improving healthcare systems, increasing awareness of respiratory care, and expanding access to medical technology

- Constant volume type segment dominated the artificial ventilation market with a market share of 60.5% in 2024, driven by its precise control over tidal volume delivery and consistent performance in managing critically ill patients in intensive care settings

Report Scope and Artificial Ventilation Market Segmentation

|

Attributes |

Artificial Ventilation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Artificial Ventilation Market Trends

“Advancements in AI-Driven Respiratory Monitoring and Personalization”

- A significant and accelerating trend in the global artificial ventilation market is the integration of artificial intelligence (AI) and advanced data analytics to optimize respiratory support through real-time monitoring and personalized ventilation strategies. This evolution is enhancing patient outcomes and improving clinical decision-making in critical care environments

- For instance, Hamilton Medical’s ventilators incorporate adaptive support ventilation (ASV) with AI-driven algorithms to automatically adjust ventilation parameters based on a patient’s lung mechanics and effort, reducing complications and weaning times. Similarly, Philips’ ventilator systems utilize intelligent analytics to monitor trends and adjust support in home care settings

- AI-enabled features in artificial ventilators offer benefits such as automated detection of respiratory distress, continuous analysis of vital parameters, and dynamic adjustment of ventilation modes to ensure optimal lung protection. This reduces manual intervention while improving precision and responsiveness in treatment

- The integration of artificial ventilation systems with electronic health records (EHRs) and hospital information systems allows for seamless data sharing, predictive analytics, and centralized control over patient monitoring, contributing to more efficient workflows and better coordinated care in ICU and emergency units

- This trend toward intelligent, data-driven, and interconnected ventilator systems is reshaping clinical practices in respiratory care. Consequently, companies such as Medtronic are advancing AI-powered ventilators capable of supporting both invasive and non-invasive modes with adaptive intelligence and remote monitoring capabilities

- The demand for AI-enhanced ventilators is rising across both acute care hospitals and home settings, as healthcare providers seek to improve outcomes, streamline care delivery, and reduce the burden on respiratory therapists and intensivists

Artificial Ventilation Market Dynamics

Driver

“Rising Respiratory Disorders and Need for Advanced Critical Care”

- The increasing global burden of chronic respiratory diseases such as COPD, asthma, and sleep apnea, along with a growing aging population vulnerable to respiratory failure, is a significant driver for the heightened demand for artificial ventilation systems

- For instance, in March 2024, Medtronic launched a next-generation ventilator featuring AI-driven predictive algorithms and enhanced portability, designed to address rising needs in both intensive care and home-based respiratory support. Such innovations are expected to drive artificial ventilation market growth during the forecast period

- As healthcare systems face growing pressure to manage acute and chronic respiratory conditions effectively, artificial ventilators provide life-saving support by ensuring consistent oxygenation and carbon dioxide removal in critically ill patients

- Furthermore, the increasing demand for advanced ICU infrastructure and preparedness for public health emergencies—such as the COVID-19 pandemic—has placed artificial ventilation at the forefront of essential critical care tools in hospitals worldwide

- The availability of sophisticated, user-friendly, and portable ventilators for both hospital and home settings, coupled with growing awareness of the importance of early respiratory intervention, is propelling adoption across a wide range of clinical scenarios. The integration of smart features, telemonitoring, and adaptive ventilation further enhances the relevance of these devices in modern healthcare delivery

Restraint/Challenge

“High Equipment Costs and Risk of Ventilator-Associated Complications”

- The high procurement and maintenance costs of advanced artificial ventilation systems pose a significant challenge to broader adoption, particularly in low- and middle-income regions. These costs encompass not only the ventilator units themselves but also related consumables, staff training, and ongoing technical support

- For instance, critical care ventilators with advanced features such as AI-based monitoring, adaptive ventilation modes, and telemedicine integration often demand substantial investment, limiting access in underfunded healthcare facilities and rural areas

- In addition to cost barriers, the use of artificial ventilators is associated with clinical challenges such as ventilator-associated pneumonia (VAP), barotrauma, and patient-ventilator asynchrony, which can increase morbidity and prolong ICU stays. These complications require intensive monitoring and skilled clinical management, further straining healthcare resources

- Addressing these issues through cost-effective product innovations, wider adoption of non-invasive ventilation techniques, and clinical protocols to minimize complications is essential. Leading companies such as Dräger and GE HealthCare are focusing on developing more affordable, compact ventilator models with safety features to enhance usability in diverse settings

- While technological advancements are helping reduce costs and improve patient outcomes, ensuring proper training for healthcare staff and promoting standardized care practices will be critical for overcoming these adoption challenges and expanding market reach across all regions

Artificial Ventilation Market Scope

The market is segmented on the basis of type, application, ventilators, mode, age group, and interface

- By Type

On the basis of type, the artificial ventilation market is segmented into constant pressure type and constant volume type. The constant volume type segment dominated the market with the largest revenue share of 60.5% in 2024, driven by its widespread use in operating rooms and intensive care units where precise control of tidal volume is critical for patient safety. Clinicians often prefer constant volume ventilators for their reliability in delivering set volumes of air, which is essential for patients with reduced lung compliance.

The constant pressure type segment is expected to witness the fastest growth rate from 2025 to 2032, owing to its increasing adoption in home care and neonatal settings. These ventilators provide consistent pressure to aid spontaneous breathing and are typically easier to manage, offering a gentler ventilation approach, especially for patients with sensitive lung profiles.

- By Application

On the basis of application, the artificial ventilation market is segmented into operation room, intensive care units, emergency room, dental, and home care. The intensive care units (ICU) segment held the largest market share in 2024, due to the high volume of critically ill patients requiring long-term mechanical ventilation and close monitoring. ICUs remain central to advanced ventilator usage with demand sustained by chronic respiratory diseases, surgical recovery, and pandemic preparedness.

The home care segment is projected to grow at the fastest pace from 2025 to 2032, driven by increasing demand for portable, user-friendly ventilators that support aging populations and patients with chronic respiratory illnesses who prefer treatment in home settings. Cost-effectiveness and growing telehealth integration also boost this trend.

- By Ventilators

On the basis of ventilators, the artificial ventilation market is segmented into critical care ventilators, neonatal ventilators, transport ventilators, and portable ventilators. Critical care ventilators accounted for the largest revenue share in 2024 due to their extensive use in ICUs and emergency rooms for managing acute respiratory failure. These ventilators are equipped with advanced settings and monitoring tools necessary for high-acuity patients.

Portable ventilators are expected to witness the highest CAGR during the forecast period, driven by their increasing application in home care, ambulance transport, and outpatient respiratory therapy. Their compact design, battery operation, and smart features make them ideal for flexible and mobile healthcare delivery.

- By Mode

On the basis of mode, the artificial ventilation market is segmented into non-invasive ventilation and invasive ventilation. Invasive ventilation held the dominant market share in 2024, especially in hospital ICU settings where intubation is often necessary for patients with severe respiratory distress or under anesthesia during surgery.

Non-invasive ventilation is projected to register the highest growth rate from 2025 to 2032, driven by its growing use in outpatient settings and among patients with mild to moderate respiratory issues. The mode is increasingly preferred due to fewer complications, lower costs, and improved patient comfort.

- By Age Group

On the basis of age group, the artificial ventilation market is segmented into pediatric, adult, and geriatric. The adult segment captured the highest revenue share in 2024 due to the larger volume of adult ICU admissions and the prevalence of chronic respiratory conditions such as COPD and ARDS in this age group.

The geriatric segment is anticipated to expand at the fastest CAGR over the forecast period, owing to the rising global aging population and their increased susceptibility to respiratory disorders, which often necessitate long-term ventilator support.

- By Interface

On the basis of interface, the artificial ventilation market is segmented into invasive and non-invasive. The invasive interface segment dominated the market in 2024, fueled by high utilization in surgical settings and intensive care units where endotracheal or tracheostomy tubes are commonly required.

Meanwhile, the non-invasive interface segment is expected to grow fastest during forecast period, due to rising adoption of face masks and nasal interfaces in both hospitals and home care, as they offer effective ventilation with reduced risks of infection and greater patient compliance.

Artificial Ventilation Market Regional Analysis

- North America dominated the artificial ventilation market with the largest revenue share of 35.5% in 2024, driven by advanced healthcare infrastructure, high healthcare spending, and the presence of major market players

- The region's high adoption of cutting-edge medical technologies, including AI-integrated ventilators and portable home care devices, plays a pivotal role in driving market growth

- Supportive government funding, favorable reimbursement frameworks, and heightened awareness regarding critical care management further contribute to the widespread use of artificial ventilation systems across hospitals, emergency care, and home settings

U.S. Artificial Ventilation Market Insight

The U.S. artificial ventilation market captured the largest revenue share of 78.3% in 2024 within North America, driven by a high prevalence of respiratory disorders, well-established healthcare systems, and widespread adoption of advanced critical care technologies. The country benefits from strong investments in intensive care infrastructure and a rising demand for both invasive and non-invasive ventilation solutions across hospitals and home care settings. Furthermore, favorable reimbursement policies and increased awareness of ventilator-associated safety standards contribute to market expansion.

Europe Artificial Ventilation Market Insight

The Europe artificial ventilation market is projected to expand at a robust CAGR throughout the forecast period, primarily propelled by an aging population, high incidence of chronic obstructive pulmonary disease (COPD), and stringent ICU protocols. The adoption of advanced ventilators in Germany, France, and the U.K. is accelerating, especially within intensive care and emergency response settings. Public healthcare investments and regional efforts to strengthen preparedness for pandemics and respiratory emergencies also support sustained growth.

U.K. Artificial Ventilation Market Insight

The U.K. artificial ventilation market is anticipated to grow at a noteworthy CAGR, fueled by increasing demand for home-based respiratory support and advancements in portable ventilator technologies. The country’s focus on modernizing NHS facilities and improving access to respiratory care is promoting widespread adoption. In addition, rising awareness of the importance of early intervention in respiratory failure is accelerating the use of ventilation devices across primary, secondary, and tertiary care levels.

Germany Artificial Ventilation Market Insight

The Germany artificial ventilation market is expected to expand at a considerable CAGR, driven by the country's emphasis on quality intensive care and strong investment in healthcare technology innovation. Demand for high-performance critical care and neonatal ventilators is growing, especially with the rising burden of chronic respiratory diseases. Furthermore, Germany’s push toward home care for long-term ventilation patients is enhancing demand for portable and user-friendly ventilation systems.

Asia-Pacific Artificial Ventilation Market Insight

The Asia-Pacific artificial ventilation market is poised to grow at the fastest CAGR from 2025 to 2032, fueled by rapidly expanding healthcare infrastructure, increasing healthcare expenditure, and rising cases of respiratory illnesses across countries such as China, India, and Japan. The region's proactive approach to pandemic preparedness and ICU expansion is boosting demand for advanced ventilators. Moreover, domestic manufacturing initiatives and government support for critical care modernization are enabling broader access and affordability.

Japan Artificial Ventilation Market Insight

The Japan artificial ventilation market is gaining momentum due to the country’s rapidly aging population and the increasing prevalence of chronic respiratory disorders such as asthma and COPD. Technological sophistication and strong emphasis on patient safety and comfort are driving the adoption of compact, noise-reducing ventilators in both hospitals and long-term care facilities. Integration of AI and automation into ventilation systems is also gaining interest, especially in tertiary care hospitals.

India Artificial Ventilation Market Insight

The India artificial ventilation market accounted for the largest revenue share in Asia Pacific in 2024, supported by rapid urbanization, increased incidence of air pollution-related respiratory conditions, and government investments in healthcare infrastructure. Rising awareness of intensive and emergency care standards, along with the affordability of transport and home care ventilators produced by local manufacturers, is significantly enhancing market accessibility across both urban and rural healthcare settings.

Artificial Ventilation Market Share

The artificial ventilation industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Drägerwerk AG & Co. KGaA (Germany)

- Getinge AB (Sweden)

- Hamilton Medical AG (Switzerland)

- ResMed Inc. (U.S.)

- GE Healthcare (U.S.)

- Fisher & Paykel Healthcare (New Zealand)

- Mindray Medical International (China)

- Smiths Group plc (U.K.)

- BD (U.S.)

- Vyaire Medical, Inc. (U.S.)

- ZOLL Medical Corporation (U.S.)

- Siare Engineering International Group (Italy)

- SomnoMed (Australia)

- AgVa Healthcare (India)

- Phoenix Medical Systems (U.S.)

- Invacare Corporation (U.S.)

- Sewoon Medical Co., Ltd. (South Korea)

- ConvaTec Group plc (U.K.)

What are the Recent Developments in Global Artificial Ventilation Market?

- In March 2024, Drägerwerk AG & Co. KGaA, a global leader in medical and safety technology, introduced the Evita V600 and V800 ventilators equipped with enhanced intelligent ventilation modes and user-friendly interfaces. These advanced systems support individualized respiratory care, particularly in intensive care units (ICUs), enhancing both clinical workflow and patient outcomes. The launch underscores Dräger's commitment to delivering precision-driven and patient-adaptive ventilation solutions tailored to diverse critical care settings

- In February 2024, Medtronic plc, a key player in respiratory care, launched its portable Puritan Bennett 560+ ventilator aimed at addressing growing demand for reliable home ventilation solutions. This next-generation device offers compact design, long battery life, and advanced alarm features, making it ideal for home-bound patients with chronic respiratory conditions. The launch reflects Medtronic’s strategy to improve accessibility and convenience in long-term respiratory support

- In February 2024, Getinge AB announced a strategic partnership with several European hospitals for clinical trials of its Servo-u ventilator integrated with artificial intelligence to automatically adjust ventilation parameters based on real-time patient data. The collaboration is focused on improving patient outcomes through automation, reducing complications such as ventilator-induced lung injury. This initiative highlights Getinge’s innovation-led approach in intensive care technology

- In January 2024, Hamilton Medical AG introduced upgrades to its HAMILTON-C6 ventilator, integrating enhanced lung protection features and improved graphical interfaces for better patient-ventilator interaction. Designed for high-acuity patients, the device supports advanced modes such as INTELLiVENT-ASV, which automates ventilation based on continuous monitoring of CO₂ and SpO₂. The enhancement supports clinicians in delivering safe, personalized respiratory therapy

- In December 2023, Philips Respironics received FDA clearance for its new-generation Trilogy Evo OBM (hospital-to-home ventilator), designed for pediatric and adult patients requiring long-term respiratory support. This model includes cloud-based data sharing and customizable alarms, ensuring seamless transitions across care settings. The development reflects Philips’ ongoing commitment to bridging gaps in chronic care and enhancing patient mobility through connected health technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.