Global Automated Insulin Delivery Devices Market

Market Size in USD Billion

CAGR :

%

USD

3.29 Billion

USD

7.83 Billion

2024

2032

USD

3.29 Billion

USD

7.83 Billion

2024

2032

| 2025 –2032 | |

| USD 3.29 Billion | |

| USD 7.83 Billion | |

|

|

|

|

Automated Insulin Delivery Devices Market Analysis

The global automated insulin delivery devices market is experiencing significant growth, driven by the rising prevalence of diabetes and advancements in technology. These devices, designed to automatically monitor and regulate blood glucose levels, offer a more convenient and precise solution for managing diabetes compared to traditional insulin injections. Technological innovations, including closed-loop systems, continuous glucose monitoring (CGM) integration, and advanced algorithms, have improved the efficiency and accuracy of these devices. Key players such as Medtronic, Tandem Diabetes Care, and Abbott are at the forefront, continuously enhancing their products to provide better user experiences and outcomes. The market's growth is further fueled by increasing healthcare awareness, the aging population, and the demand for more personalized diabetes management solutions. Moreover, as the adoption of wearable medical devices rises, patients are becoming more inclined to use automated insulin delivery systems. The development of systems that can be used for both Type 1 and Type 2 diabetes patients is expanding the market's reach. In the coming years, continuous innovations, coupled with growing global healthcare needs, are expected to drive the market's expansion, making these devices a crucial part of diabetes management worldwide.

Automated Insulin Delivery Devices Market Size

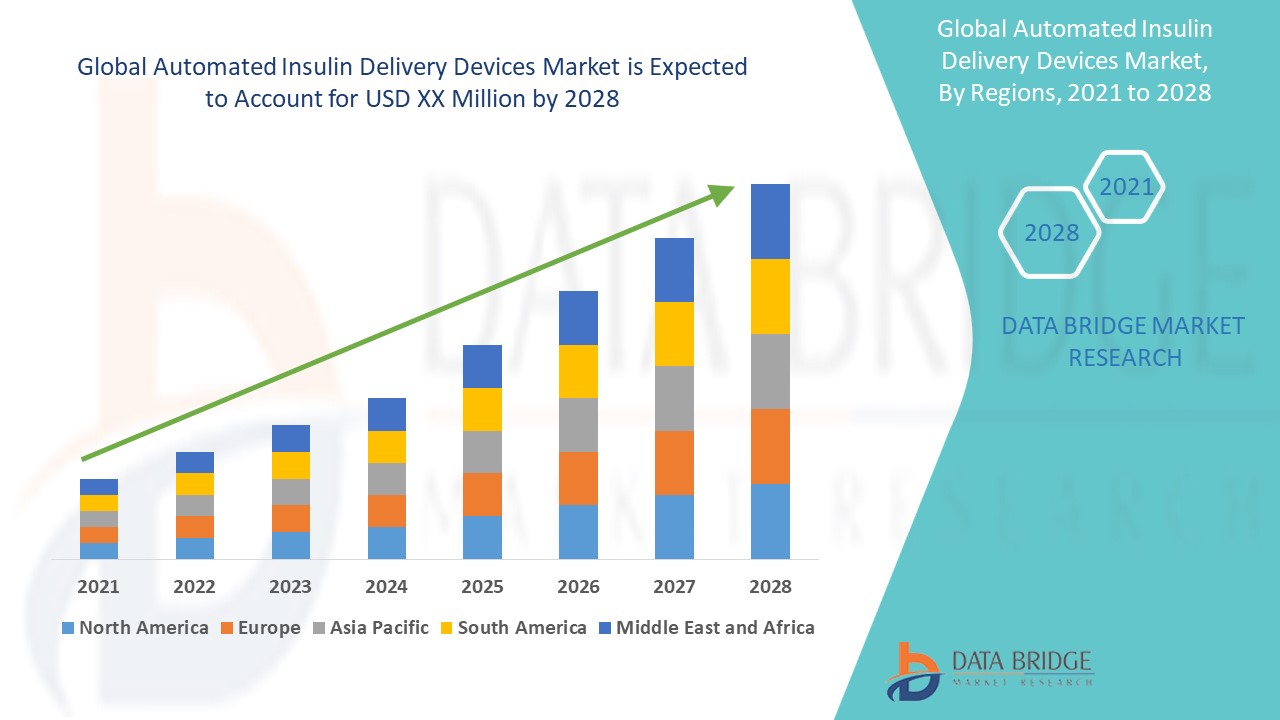

The global automated insulin delivery devices market size was valued at USD 3.29 billion in 2024 and is projected to reach USD 7.83 billion by 2032, with a CAGR of 11.43% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Automated Insulin Delivery Devices Market Trends

“Increasing Integration of Artificial Intelligence (AI) and Machine Learning (ML) Technologies”

A prominent trend in the automated insulin delivery devices market is the integration of artificial intelligence (AI) and machine learning (ML) technologies to enhance the precision and personalization of diabetes management. Companies such as Medtronic and Tandem Diabetes Care are incorporating advanced algorithms into their insulin delivery systems, enabling continuous glucose monitoring (CGM) to automatically adjust insulin doses in real-time based on individual glucose patterns. For instance, Medtronic’s MiniMed 780G system uses AI to deliver automatic insulin adjustments, improving glycemic control while minimizing the risk of hypoglycemia. This trend is improving the overall effectiveness of insulin delivery and offering patients a more tailored approach to managing their diabetes. As AI and ML continue to evolve, the automated insulin delivery devices market is expected to experience further growth, making diabetes management more intuitive and efficient, with better long-term outcomes for patients. This shift towards more intelligent, self-regulating devices marks a significant step in personalized healthcare.

Report Scope and Automated Insulin Delivery Devices Market Segmentation

|

Attributes |

Automated Insulin Delivery Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Novo Nordisk A/S (Denmark), Sanofi (France), Lilly (U.S.), Biocon (India), Ypsomed AG (Switzerland), Wockhardt (India), Abbott (U.S.), Medtronic (Ireland), F. Hoffmann-La Roche, Ltd. (Switzerland), BD (U.S.), Tandem Diabetes Care, Inc. (U.S.), BIGFOOT BIOMEDICAL, INC. (U.S.), DreaMed (Israel), and WTWH Media LLC (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Automated Insulin Delivery Devices Market Definition

Automated insulin delivery devices are advanced medical devices designed to help individuals with diabetes manage their blood glucose levels more efficiently. These systems typically consist of an insulin pump, a continuous glucose monitor (CGM), and an algorithm that automatically adjusts insulin delivery based on real-time glucose readings. The goal of these devices is to mimic the function of a healthy pancreas by continuously regulating insulin levels, reducing the need for frequent manual insulin injections and blood glucose checks. This technology improves glycemic control, minimizes the risk of both hyperglycemia and hypoglycemia, and enhances the overall convenience of diabetes management for patients.

Automated Insulin Delivery Devices Market Dynamics

Drivers

- Rising Prevalence of Diabetes

The rising prevalence of diabetes, particularly Type 1 and Type 2, is significantly driving the demand for automated insulin delivery devices. According to the International Diabetes Federation (IDF), over 460 billion people worldwide were living with diabetes in 2019, a figure projected to surpass 700 billion by 2045. This surge in cases is primarily driven by factors such as aging populations, sedentary lifestyles, and increasing obesity rates, particularly in emerging economies. As a result, there is a growing need for more effective and efficient diabetes management solutions to help control blood sugar levels and prevent complications. Automated insulin delivery devices, which integrate insulin pumps with continuous glucose monitoring (CGM) systems, offer a solution by providing real-time adjustments to insulin dosages based on glucose levels, reducing the need for frequent manual interventions. This shift toward more sophisticated and user-friendly diabetes care is a critical market driver, as these devices offer greater convenience, improved glycemic control, and better long-term health outcomes for patients.

- Growing Aging Population

The aging population is a significant driver for the growth of the automated insulin delivery devices market, as older individuals are more prone to developing diabetes due to factors such as reduced physical activity and declining insulin sensitivity. According to the World Health Organization (WHO), the global population aged 60 years and older is expected to double by 2050, reaching 2.1 billion people. As this demographic grows, so does the prevalence of diabetes among them, with the Centers for Disease Control and Prevention (CDC) reporting that nearly 25% of individuals aged 65 and older in the U.S. have diabetes. For these patients, managing diabetes can be more challenging due to age-related factors such as cognitive decline, physical limitations, and multiple comorbidities. Automated insulin delivery systems, which combine insulin pumps with continuous glucose monitoring (CGM) technology, offer a more efficient, user-friendly, and less demanding way to manage blood sugar levels. These devices reduce the burden of constant monitoring and insulin adjustments, making diabetes management more manageable for elderly patients, thus contributing to the market's growth.

Opportunities

- Growing Technological Advancements in Diabetes Management

Technological advancements in the field of diabetes management are significantly enhancing the functionality and appeal of automated insulin delivery devices, creating substantial market opportunities. Innovations such as continuous glucose monitoring (CGM) integration, AI-driven algorithms, and more efficient insulin pump systems are revolutionizing how diabetes is managed. For instance, Medtronic's MiniMed 780G system integrates CGM data with an AI-based algorithm to automatically adjust insulin delivery, offering tighter glucose control with fewer manual interventions. Similarly, Tandem Diabetes Care's tX2 insulin pump works in conjunction with the Dexcom G6 CGM to deliver personalized, real-time insulin adjustments, further improving patient outcomes. These technological improvements increase the precision and convenience of insulin delivery and reduce the risk of hypoglycemia and hyperglycemia, enhancing overall patient quality of life. As these technologies continue to evolve, they open up new opportunities for market expansion, attracting both healthcare providers and patients seeking more effective and automated solutions for diabetes management.

- Growing Supportive Government Policies and Increased Healthcare Funding

Increasing healthcare awareness is playing a crucial role in driving the growth of the automated insulin delivery devices market. As patients and healthcare providers become more informed about the benefits of advanced insulin delivery systems, there is a greater adoption of these devices, especially for managing chronic conditions such as diabetes. For instance, organizations such as the American Diabetes Association (ADA) and Diabetes UK have significantly raised awareness about the importance of tight glucose control to prevent complications such as neuropathy, retinopathy, and cardiovascular disease. As a result, more patients are seeking out automated solutions such as insulin pumps and continuous glucose monitoring (CGM) systems, which offer a more efficient and precise method for managing insulin delivery. Additionally, public health campaigns and healthcare professionals are increasingly recommending these devices as they help reduce the risk of long-term diabetes-related complications. This growing awareness creates a market opportunity by expanding the customer base for automated insulin delivery systems, making them an attractive solution for both healthcare providers and patients.

Restraints/Challenges

- High Costs of Automated Insulin Delivery Devices

The high costs of automated insulin delivery devices are a significant challenge to their widespread adoption, especially for patients in low-income regions or those without sufficient insurance coverage. Devices such as insulin pumps and continuous glucose monitors (CGMs) can be prohibitively expensive, with patients also needing to regularly purchase consumables such as infusion sets and sensors. This financial burden makes the technology inaccessible to many individuals, particularly in developing countries where healthcare infrastructure is limited. Even in regions with insurance coverage, high co-pays and deductibles often make these devices unaffordable for people who could benefit most from them. This issue limits access to advanced diabetes management and reinforces the gap between those who can afford cutting-edge care and those who cannot. The high cost of these devices remains a major market challenge, emphasizing the need for affordable solutions, broader insurance coverage, and efforts to make these technologies accessible to a larger patient population.

- Device Complexity and User Training

Automated insulin delivery devices, while designed to enhance diabetes management, can be complex and require significant user training, which presents a barrier to adoption, especially among older patients or those with limited technical skills. These devices involve intricate setups, including insulin pumps and continuous glucose monitors (CGMs), which necessitate a solid understanding of their functions, settings, and troubleshooting procedures to use effectively. For instance, a patient must be able to program the insulin delivery accurately and interpret data from the CGM, make adjustments based on that data, and address potential malfunctions, such as sensor errors or connectivity issues. This complexity can be overwhelming for users who are not comfortable with technology, leading to potential mistakes in insulin management or failure to use the device to its full potential, hindering the overall growth of the market.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Automated Insulin Delivery Devices Market Scope

The market is segmented on the basis of type and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Pens

- Reusable Insulin Pens

- Disposable Insulin Pens

- Insulin Pumps

- Patch Pumps

- Tethered Pumps

- Pen Needles

- Standard Pen Needles

- Safety Pen Needles

- Insulin Syringes

- Others

End-User

- Homecare

- Hospitals

- Clinics

Automated Insulin Delivery Devices Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, type, and end user as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the automated insulin delivery devices market, driven by the increasing prevalence of diabetes in the region. The growing diabetic population is fueling the demand for innovative solutions that can effectively manage blood sugar levels. Additionally, the region benefits from the availability of advanced insulin delivery technologies, which enhances the adoption of these devices. With ongoing advancements in technology, the market for automated insulin delivery devices in North America is expected to experience significant growth throughout the forecast period.

Asia-Pacific is expected to experience substantial growth in the automated insulin delivery devices market, driven by the region's expanding population. The increasing number of elderly individuals and the rising prevalence of diabetes are key factors contributing to the demand for advanced insulin management solutions. As the region faces a growing healthcare burden, the need for efficient and accurate insulin delivery systems will become more pronounced. Over the coming years, these trends are likely to further accelerate the growth of the automated insulin delivery devices market in Asia-Pacific.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Automated Insulin Delivery Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Automated Insulin Delivery Devices Market Leaders Operating in the Market Are:

- Novo Nordisk A/S (Denmark)

- Sanofi (France)

- Lilly (U.S.)

- Biocon (India)

- Ypsomed AG (Switzerland)

- Wockhardt (India)

- Abbott (U.S.)

- Medtronic (Ireland)

- F. Hoffmann-La Roche, Ltd. (Switzerland)

- BD (U.S.)

- Tandem Diabetes Care, Inc. (U.S.)

- BIGFOOT BIOMEDICAL, INC. (U.S.)

- DreaMed (Israel)

- WTWH Media LLC (U.S.)

Latest Developments in Automated Insulin Delivery Devices Market

- In August 2023, Novo Nordisk A/S reached an agreement to acquire Inversago Pharma for up to USD 1.075 billion, contingent upon meeting specific development and commercial milestones. Inversago, based in Montreal, focuses on therapies targeting the CB1 receptor, with the aim of treating obesity, diabetes, and related metabolic disorders

- In March 2023, Sanofi announced a significant 78% reduction in the list price of Lantus (insulin glargine injection) 100 Units/mL in the U.S. In addition, the company introduced a USD 35 cap on out-of-pocket costs for patients with commercial insurance, reaffirming its commitment to providing affordable access to essential medicines

- In March 2023, Diabeloop entered into a partnership with Novo Nordisk to integrate its self-learning algorithm, DBL-4pen, with Novo Nordisk's reusable insulin pens, NovoPen 6 and NovoPen Echo Plus. In doing so, this collaboration aims to improve Multiple Daily Injections (MDI) therapy for Type 2 diabetes patients, with a clinical study planned to assess its effectiveness

- In November 2022, Novo Nordisk and Abbott formed a partnership to improve diabetes management by making Novo Nordisk’s connected insulin pens compatible with the Abbott FreeStyle LibreLink app. In this way, this integration enables users to sync insulin dosages with glucose levels, offering a comprehensive view for optimized diabetes care

- In January 2022, Insulet Corp., based in Boston, announced that the FDA had cleared its new Omnipod 5 system, marking the company’s entry into the automated insulin delivery (AID) market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.