Global Automotive Chips Market

Market Size in USD Billion

CAGR :

%

USD

40.60 Billion

USD

102.69 Billion

2024

2032

USD

40.60 Billion

USD

102.69 Billion

2024

2032

| 2025 –2032 | |

| USD 40.60 Billion | |

| USD 102.69 Billion | |

|

|

|

|

Automotive Chips Market Size

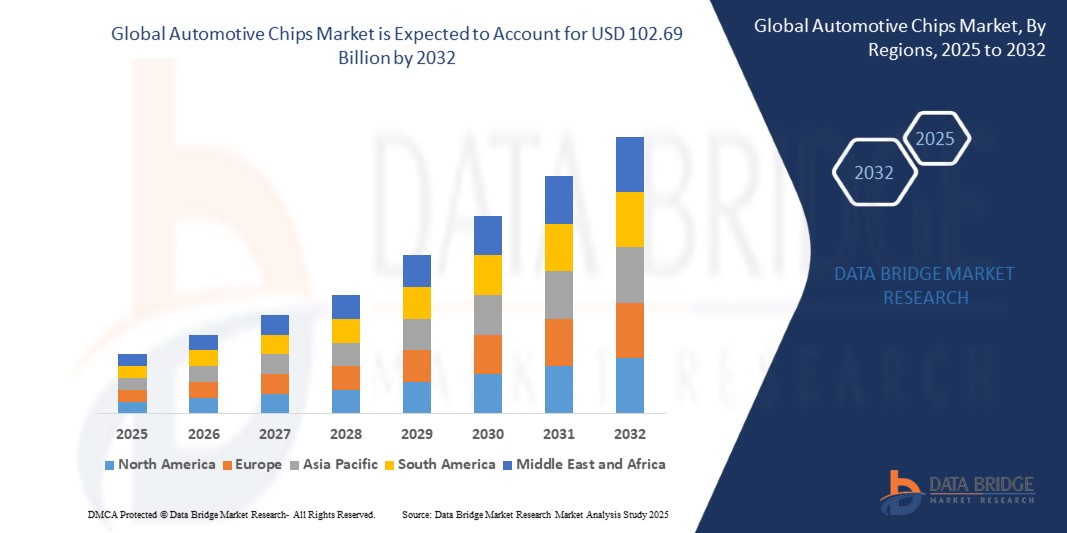

- The global automotive chips market was valued at USD 40.60 billion in 2024 and is expected to reach USD 102.69 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 12.30%, primarily driven by rapid growth of electric vehicles (EVs)

- This growth is driven by increasing integration of advanced driver assistance systems (ADAS) and the rising demand for connected and autonomous vehicles

Automotive Chips Market Analysis

- Automotive chips are witnessing growing adoption globally, driven by the increasing demand for vehicle electrification, autonomous driving technologies, and advanced safety systems. These chips are essential for enabling functions such as ADAS, battery management, and in-vehicle infotainment, supporting the development of smarter, safer, and more energy-efficient vehicles

- The demand for automotive chips is significantly supported by government initiatives promoting electric vehicles (EVs) and hybrid electric vehicles (HEVs), along with strict emission regulations and safety standards. In addition, rising investments in smart cities and connected mobility solutions are boosting the growth of the market, as vehicles increasingly require high-performance semiconductors

- For instance, in March 2024, the U.S. Department of Energy announced funding for semiconductor innovation projects aimed at enhancing EV performance and supporting the development of advanced automotive chip technologies, offering strong growth opportunities for the market

- Technological innovations, such as the development of Silicon Carbide (SiC) and Gallium Nitride (GaN) chips, improved microcontrollers, and power-efficient systems, are driving the growth of the automotive chips market. These advancements are expected to enhance vehicle performance, lower energy consumption, and support the global shift towards electrification and automation in the automotive industry

Report Scope and Automotive Chips Market Segmentation

|

Attributes |

Automotive Chips Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis |

Automotive Chips Market Trends

“Advancements in Autonomous Driving Technologies”

- A key trend in the global automotive chips market is the rapid progress in autonomous driving technologies, which is increasing the demand for advanced semiconductors capable of handling real-time processing, decision-making, and vehicle-to-everything (V2X) communications

- Automotive chips supporting LiDAR, radar, camera systems, and AI algorithms are gaining traction as automakers aim to achieve higher levels of driving automation, such as Level 3 and beyond, enhancing vehicle safety and driving comfort

- For instance, in February 2025, NVIDIA launched its next-generation DRIVE Thor chip, combining autonomous driving, cockpit functions, and infotainment systems into a single platform to power future self-driving vehicles

- The integration of AI-driven chips into automotive systems allows vehicles to make smarter, faster decisions, contributing to safer and more efficient transportation networks

- This trend is revolutionizing the automotive industry, pushing manufacturers to invest heavily in semiconductor innovations to stay competitive in the evolving landscape of autonomous and connected mobility

Automotive Chips Market Dynamics

Driver

“Surge in Demand for Connected Vehicles and Smart Mobility”

- The automotive chips market is experiencing significant growth due to the rising demand for connected vehicles and smart mobility solutions, where real-time data exchange between vehicles and infrastructure is crucial

- With the proliferation of 5G networks and the Internet of Things (IoT), vehicles increasingly rely on semiconductors for functions such as navigation, remote diagnostics, OTA updates, and driver assistance systems

- Automotive chips play a critical role in enabling seamless connectivity and enhancing the overall driving experience, supporting features such as predictive maintenance, traffic management, and personalized in-car services

- For instance, in January 2025, Qualcomm Technologies announced the expansion of its Snapdragon Digital Chassis offerings to provide automakers with comprehensive solutions for connectivity, autonomy, and computing power

- As smart mobility ecosystems continue to develop, the demand for high-performance automotive chips will accelerate, making them integral to the future of intelligent transportation systems

Opportunity

“Expansion of Electric Vehicle Charging Infrastructure”

- The growing expansion of electric vehicle (EV) charging infrastructure worldwide is presenting a significant opportunity for the automotive chips market, as EVs require sophisticated semiconductor solutions for energy management and battery optimization

- Automotive chips are essential for fast-charging capabilities, smart grid integration, and efficient power conversion systems, improving the performance and adoption of EVs globally

- Governments, utility companies, and private investors are heavily funding the rollout of fast chargers, wireless charging stations, and vehicle-to-grid (V2G) technologies, further driving the demand for specialized automotive semiconductors

- For instance, in November 2024, the European Investment Bank (EIB) announced a USD 552 million investment in expanding EV charging networks across Europe, boosting the need for innovative automotive chip technologies

- As EV adoption surges and charging networks become more advanced, the automotive chips market is poised to experience strong growth, creating new revenue streams and technological breakthroughs

Restraint/Challenge

“Supply Chain Disruptions and Semiconductor Shortages”

- The automotive chips market continues to face challenges due to ongoing supply chain disruptions and semiconductor shortages, affecting production timelines and increasing costs for automakers

- Factors such as geopolitical tensions, natural disasters, and fluctuations in raw material availability have highlighted vulnerabilities in global semiconductor supply chains

- These shortages have led to vehicle production delays, inventory backlogs, and increased competition among industries such as consumer electronics and automotive for critical chip supplies

- To mitigate this challenge, investments in regional semiconductor manufacturing hubs, diversification of supply sources, and strategic partnerships will be crucial for ensuring a resilient and stable supply of automotive chips moving forward

Automotive Chips Market Scope

The market is segmented on the basis of type, vehicle, application, and propulsion.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Vehicle |

|

|

By Application |

|

|

By Propulsion |

|

Automotive Chips Market Regional Analysis

“Asia Pacific is the Dominant Region in the Automotive Chips Market”

- Asia Pacific holds the largest share in the automotive chips market, driven by rapid vehicle production, technological advancements, and the strong presence of semiconductor manufacturers

- China, Japan, and South Korea are key contributors, fueled by increasing demand for electric vehicles (EVs), connected cars, and autonomous driving technologies

- Government initiatives and investments in smart mobility and automotive innovation are further boosting the growth of the automotive chips market in the region

- With a strong manufacturing base, rising EV adoption, and continuous tech innovation, Asia Pacific is expected to maintain its dominance in the automotive chips market over the coming years

“South America is projected to register the Highest Growth Rate”

- South America is projected to register the highest growth rate in the automotive chips market, driven by rising vehicle production and growing demand for advanced automotive technologies

- Brazil and Argentina are leading the market expansion, supported by increasing investments in automotive manufacturing and a shift toward electric and hybrid vehicles

- Government policies promoting sustainable mobility and local semiconductor production are accelerating market growth across the region

- With supportive government initiatives and growing automotive innovation, South America is expected to emerge as the fastest-growing region in the automotive chips market in the coming years

Automotive Chips Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Qualcomm Technologies, Inc. (U.S.)

- Renesas Electronics Corporation (Japan)

- Infineon Technologies AG (Germany)

- STMicroelectronics (Switzerland)

- Texas Instruments Incorporated (U.S.)

- NXP Semiconductors N.V. (Netherlands)

- Broadcom (U.S.)

- Micron Technology, Inc. (U.S.)

- Intel Corporation (U.S.)

- ROHM Co., Ltd. (Japan)

- Toshiba Corporation (Japan)

- Semiconductor Components Industries, LLC (ON Semiconductor, U.S.)

- Robert Bosch GmbH (Germany)

- DENSO CORPORATION (Japan)

- Analog Devices, Inc. (U.S.)

- NVIDIA Corporation (U.S.)

- Taiwan Semiconductor Manufacturing Company (TSMC) (Taiwan)

- MediaTek Inc. (Taiwan)

- Hitachi, Ltd. (Japan)

- Vishay Intertechnology, Inc. (U.S.)

- Marvell (U.S.)

Latest Developments in Global Automotive Chips Market

- In January 2024, Texas Instruments Incorporated launched new semiconductors designed to enhance automotive safety and intelligence, with a focus on ensuring efficient and secure control of power flow in battery management systems, strengthening its position in the automotive technology market

- In March 2024, Sony Semiconductor Solutions Corporation announced the commencement of operations in several production lines at its newly developed facility of Sony Device Technology (Thailand) Co., Ltd., focused on assembling image sensors for automotive applications, reinforcing its expansion strategy in the automotive semiconductors sector

- In June 2023, Nidec Corporation and Renesas Electronics Corporation collaborated to create semiconductor solutions for an advanced E-Axle (X-in-1 system) integrating EV drive motors and power electronics for electric vehicles (EVs), aiming to accelerate innovation in the EV semiconductor landscape

- In May 2023, Infineon Technologies AG and Hon Hai Technology Group (Foxconn) established a long-term partnership to advance electromobility, emphasizing silicon carbide (SiC) technology by combining Infineon’s expertise with Foxconn’s automotive systems capabilities, positioning themselves to lead the electric vehicle semiconductor market

- In February 2023, Wolfspeed Inc. and ZF announced a strategic partnership with a joint innovation lab to advance Silicon Carbide systems for mobility, industrial, and energy applications, alongside ZF’s plan to invest significantly in a cutting-edge 200mm Silicon Carbide device factory in Ensdorf, Germany, further bolstering their leadership in Silicon Carbide technology

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.