Global Autonomous Construction Equipment Market

Market Size in USD Billion

CAGR :

%

USD

7.27 Billion

USD

16.17 Billion

2024

2032

USD

7.27 Billion

USD

16.17 Billion

2024

2032

| 2025 –2032 | |

| USD 7.27 Billion | |

| USD 16.17 Billion | |

|

|

|

|

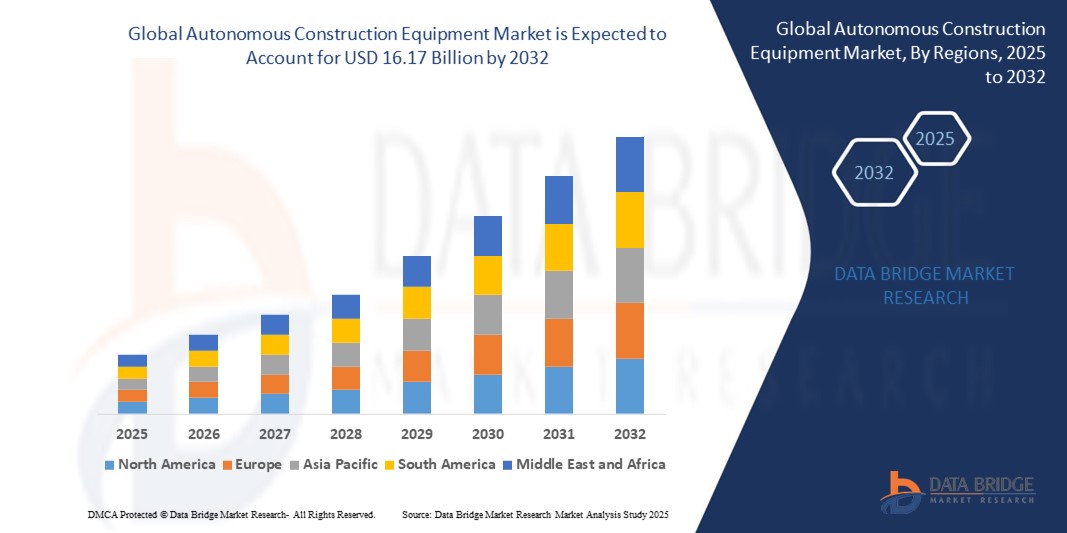

What is the Global Autonomous Construction Equipment Market Size and Growth Rate?

- The global autonomous construction equipment market size was valued at USD 7.27 billion in 2024 and is expected to reach USD 16.17 billion by 2032, at a CAGR of 10.51% during the forecast period

- The market is experiencing rapid growth due to increasing demand for automation in construction activities, rising labor shortages, and the need for enhanced productivity and safety at construction sites. Equipment such as autonomous bulldozers, excavators, and haul trucks are gaining traction across large-scale infrastructure projects

- Technological advancements such as AI-driven machinery, GPS integration, and IoT-enabled equipment are transforming traditional construction processes into smart, data-driven operations. Major players including Caterpillar, Komatsu, and Volvo CE are actively investing in R&D and pilot projects to scale autonomous deployments

- Governments and private firms are also investing in smart city projects and infrastructure upgrades, fueling the adoption of autonomous equipment to meet timelines and reduce operational costs. As automation becomes mainstream, the market is expected to witness sustained momentum across both developed and developing regions

What are the Major Takeaways of Autonomous Construction Equipment Market?

- The demand for autonomous construction solutions is rising significantly in North America, China, Japan, and Europe, driven by mega infrastructure projects and increasing emphasis on site safety and operational efficiency

- Construction companies are leveraging autonomous equipment to address labor shortages, improve fleet utilization, and ensure round-the-clock operations, especially in mining, road building, and heavy infrastructure

- As construction firms embrace digitalization, the integration of machine learning, LiDAR, and telematics is accelerating. The global push for cost-effective, efficient, and safe construction practices positions autonomous construction equipment as a crucial element in the sector’s transformation

- North America dominated the autonomous construction equipment market with the largest revenue share of 41.3% in 2024, driven by robust infrastructure development, early adoption of construction automation, and a strong presence of key industry players

- Asia-Pacific is projected to grow at the fastest CAGR of 12.6% from 2025 to 2032, driven by massive urbanization, growing construction investments, and technological leapfrogging in key economies

- The Earthmoving Equipment segment dominated the market with the largest revenue share of 42.7% in 2024, owing to the widespread adoption of autonomous excavators, bulldozers, and loaders in large-scale infrastructure and mining projects

Report Scope and Autonomous Construction Equipment Market Segmentation

|

Attributes |

Autonomous Construction Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Autonomous Construction Equipment Market?

“Growing Integration of AI and Robotics in Construction Equipment”

- A key trend shaping the autonomous construction equipment market is the increasing integration of artificial intelligence (AI), robotics, and machine learning to automate heavy machinery functions such as excavation, grading, and material transport

- For instance, Built Robotics has developed autonomous retrofit kits that transform standard construction equipment into self-operating machines capable of 24/7 operation with minimal human supervision

- AI-driven systems use LiDAR, GPS, and real-time data analytics to enhance precision, improve safety, and reduce operational costs on construction sites. This automation significantly shortens project timelines and mitigates labor shortages

- In addition, teleoperation and remote monitoring platforms enable operators to control equipment from off-site locations, boosting efficiency in hazardous or remote environments

- The trend is further supported by major OEMs such as Caterpillar, Komatsu, and Volvo, which are investing heavily in autonomous dozers, haulers, and excavators integrated with smart control systems and predictive maintenance features

- Overall, the shift toward fully autonomous and semi-autonomous construction equipment is redefining job site productivity, with technology becoming a core differentiator in the competitive construction machinery space

What are the Key Drivers of Autonomous Construction Equipment Market?

- Increasing labor shortages, rising infrastructure investments, and the demand for safer, cost-efficient construction operations are key drivers fueling growth in the autonomous construction equipment market

- For instance, in March 2024, Komatsu Ltd. expanded its lineup of intelligent dozers featuring fully autonomous operation modes, designed for use in large-scale mining and construction projects

- Government initiatives supporting smart cities, digital construction technologies, and reduced emissions are boosting adoption, especially in North America, Europe, and Asia-Pacific

- The integration of advanced sensors, IoT platforms, and 5G communication enables real-time data exchange, which improves coordination, accuracy, and predictive maintenance in autonomous machinery

- In addition, the rise of modular construction and off-site prefabrication is increasing the need for highly automated equipment that can operate precisely and continuously without human input

- The convergence of AI, robotics, and cloud connectivity is enhancing performance and reducing downtime and lifecycle costs, making autonomous equipment increasingly attractive to contractors and governments

Which Factor is challenging the Growth of the Autonomous Construction Equipment Market?

- The high upfront cost and limited return on investment (ROI) for small and mid-sized contractors remain major barriers in the widespread adoption of autonomous construction equipment

- For instance, fully autonomous bulldozers and haulers from brands such as Caterpillar or Volvo often carry premium pricing and require significant investment in operator training, software integration, and fleet management systems

- Limited skilled workforce for operating and maintaining smart equipment, especially in developing economies, poses another challenge. In addition, site-specific constraints such as unpredictable terrain and poor connectivity can reduce automation efficiency

- Regulatory uncertainty regarding safety, liability, and machine-to-human interaction standards in many countries can delay large-scale deployments

- Manufacturers are addressing these hurdles through scalable automation solutions, AI-powered retrofitting, and subscription-based business models to reduce upfront capital requirements

- Overcoming these barriers, particularly in price-sensitive and infrastructure-scarce markets, is vital for unlocking the full potential of autonomous technologies in construction machinery

How is the Autonomous Construction Equipment Market Segmented?

The market is segmented on the basis of product, application, and autonomy level.

- By Product

On the basis of product, the autonomous construction equipment market is segmented into Earthmoving Equipment, Construction Vehicles, Material Handling Equipment, and Concrete/Road Construction Equipment. The Earthmoving Equipment segment dominated the market with the largest revenue share of 42.7% in 2024, owing to the widespread adoption of autonomous excavators, bulldozers, and loaders in large-scale infrastructure and mining projects. The demand for high-efficiency, self-operating machinery to reduce labor dependency and improve project timelines is fueling this segment.

The Material Handling Equipment segment is projected to grow at the fastest pace during the forecast period due to increasing automation in warehouse operations and construction logistics.

- By Application

On the basis of application, the market is segmented into Road Construction, Building Construction, and Others. The Road Construction segment held the largest market share of 46.5% in 2024, driven by the rapid deployment of autonomous pavers, rollers, and graders to enhance project efficiency and meet government infrastructure development targets.

The Building Construction segment is expected to register the fastest growth, supported by the integration of autonomous cranes and robotic systems for residential and commercial building activities.

- By Autonomy Level

On the basis of autonomy level, the market is segmented into Semi-Autonomous and Fully Autonomous. The Semi-Autonomous segment accounted for the highest revenue share of 61.2% in 2024, as it offers a balanced combination of automation and human supervision, making it more adaptable to existing construction workflows.

However, the Fully Autonomous segment is expected to grow at a higher CAGR through 2032, driven by advances in AI, machine learning, and LiDAR technologies, along with rising investments in autonomous jobsite solutions by major OEMs and construction firms.

Which Region Holds the Largest Share of the Autonomous Construction Equipment Market?

- North America dominated the autonomous construction equipment market with the largest revenue share of 41.3% in 2024, driven by robust infrastructure development, early adoption of construction automation, and a strong presence of key industry players

- The region benefits from high labor costs that encourage automation, widespread integration of telematics and IoT, and supportive government initiatives focused on productivity and safety in construction operations

- In addition, increasing investments in smart cities, a mature construction equipment rental ecosystem, and innovations in autonomous machinery are fueling consistent market demand

U.S. Autonomous Construction Equipment Market Insight

The U.S. held the largest market share in North America in 2024, supported by strong R&D capabilities, an established construction sector, and early adoption of autonomous technologies. The rise in commercial and residential projects, along with growing public-private partnerships for infrastructure upgrades, is creating a favorable environment. Continuous product innovation by leading OEMs and regulatory emphasis on safety and sustainability are further driving adoption of autonomous equipment.

Canada Autonomous Construction Equipment Market Insight

The Canada Autonomous Construction Equipment market is growing steadily due to rising investments in road, bridge, and housing development projects. The demand for labor-saving equipment is encouraging contractors to deploy semi and fully autonomous machinery. Government incentives for digital construction technologies and the country’s emphasis on reducing workplace injuries are reinforcing this trend.

Mexico Autonomous Construction Equipment Market Insight

Mexico is witnessing increased adoption of autonomous construction solutions in the mining, transportation, and logistics sectors. The push toward modernizing outdated construction fleets, alongside initiatives for industrial automation, is strengthening market demand. Affordable leasing options and cross-border collaborations with U.S.-based technology providers are further enhancing access to advanced equipment.

Which Region is the Fastest Growing in the Autonomous Construction Equipment Market?

Asia-Pacific is projected to grow at the fastest CAGR of 12.6% from 2025 to 2032, driven by massive urbanization, growing construction investments, and technological leapfrogging in key economies. Government-led infrastructure megaprojects, rising labor shortages, and increasing digitization in construction workflows are fueling adoption of autonomous equipment. The shift toward smart cities and the rise of public-private partnerships across India, China, and Southeast Asia are creating strong tailwinds for market expansion.

China Autonomous Construction Equipment Market Insight

China is at the forefront of Asia-Pacific's growth, with rapid infrastructure development and strong domestic production capabilities. Smart city initiatives and large-scale projects such as Belt and Road are increasing the deployment of autonomous construction machinery. Local players are investing heavily in R&D, while favorable government policies and tech partnerships are accelerating technology rollout.

India Autonomous Construction Equipment Market Insight

India is emerging as a high-potential market with a surge in roadways, urban transit, and housing construction. With rising concerns over safety and efficiency, autonomous and semi-autonomous machines are gaining traction. Startups and global OEMs are collaborating to adapt cost-effective automation suited to local needs, helping drive adoption across public and private projects.

Japan Autonomous Construction Equipment Market Insight

Japan continues to demonstrate high technological maturity, with an aging workforce and strong robotics culture supporting the shift toward autonomous equipment. Construction firms are leveraging automation to address labor shortages, and the government is actively funding research into construction site digitization. The country also benefits from local innovations in sensors, AI, and 5G to enhance autonomous system performance.

Which are the Top Companies in Autonomous Construction Equipment Market?

The autonomous construction equipment industry is primarily led by well-established companies, including:

- Caterpillar (U.S.)

- Bobcat Company (U.S.)

- CNH Industrial America LLC (U.S.)

- Built Robotics (U.S.)

- AB Volvo (Sweden)

- Komatsu Ltd. (Japan)

- Hitachi Construction Machinery Co., Ltd. (Japan)

- Royal Truck & Equipment (U.S.)

- Sany Group (China)

- TOPCON CORPORATION (Japan)

- Deere & Company (U.S.)

- SANDVIK (Sweden)

- CNH Industrial (U.K.)

- Raven Industries Inc. (U.S.)

- Doosan Bobcat (South Korea)

- Ouster Inc. (U.S.)

- Trimble Inc. (U.S.)

- Liebherr Group (Switzerland)

- HD Hyundai (South Korea)

- Teleo, Inc. (U.S.)

What are the Recent Developments in Global Autonomous Construction Equipment Market?

- In May 2024, Hitachi Construction Machinery Co., Ltd. introduced its Real-Time Digital Twin Platform, which creates a virtual replica of a construction site using live data. This innovation enables real-time monitoring and control of autonomous construction equipment from remote locations via the Internet. This advancement marks a significant step toward fully remote and connected construction site operations

- In February 2024, Deere & Company unveiled its new 9RX tractor series, including models 9RX 710, 9RX 770, and 9RX 830, offering up to 830 HP. These high-power tractors come with advanced features such as rear implement ethernet, improved visibility tools, a 330-Amp alternator, backup alarm, brake controller and valve, and all necessary controllers, connectors, and harnesses. This launch strengthens Deere’s position in high-performance autonomous agricultural machinery

- In August 2023, New Holland, a brand under CNH Industrial, launched the T4 Electric Power—an electric utility tractor embedded with autonomous capabilities. Equipped with a 110-kWh lithium-ion battery and 74 HP, the tractor supports up to 8 hours of use per charge and fast-charging within an hour. It includes autonomous features such as Follow Me Mode, Invisible Bucket, and 360-degree awareness via a smart roof integrated with cameras and sensors. This marks a transformative step toward sustainable and intelligent farming equipment

- In January 2023, Deere & Company rolled out ExactShot and an electric shovel, both aimed at increasing precision and efficiency for customers. ExactShot uses sensors to detect seed placement and deploys robots to spray a precise 0.2 ml of fertilizer directly on the seed. These innovations highlight Deere’s commitment to automation and resource efficiency in agriculture

- In June 2022, Liebherr launched its R 9600 Generation 8 excavator at the Bauma exhibition. This mid-class model features enhanced automation capabilities, including the Bucket Filling Assistant, an adaptive semi-autonomous function that boosts productivity while reducing operator fatigue. This release underscores Liebherr’s focus on intelligent excavation and operator-assist technology

- In May 2022, Caterpillar introduced its Cat 299D3 Compact Track Loader, capable of operating in semi-autonomous mode or remote locations. Integrated with advanced sensors such as LiDAR and cameras, the loader can detect and avoid obstacles and personnel on-site. This innovation enhances safety and operational flexibility in demanding job site conditions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.