Global Azelaic Acid Manufacturing For Industrial Use Market

Market Size in USD Billion

CAGR :

%

USD

172.50 Billion

USD

266.74 Billion

2024

2032

USD

172.50 Billion

USD

266.74 Billion

2024

2032

| 2025 –2032 | |

| USD 172.50 Billion | |

| USD 266.74 Billion | |

|

|

|

|

Azelaic Acid Manufacturing for Industrial Use Market Analysis

The azelaic acid manufacturing for industrial use market has seen notable advancements in both methods and technologies. One of the key developments is the use of more sustainable production processes. Traditional methods, which primarily rely on the oxidation of oleic acid, are being enhanced with bio-based processes, which utilize renewable resources such as plant oils, reducing environmental impact. The incorporation of catalytic oxidation and green chemistry is driving the market towards more energy-efficient and eco-friendly production techniques. These methods not only improve sustainability but also reduce costs and improve scalability.

Another technological breakthrough is the use of enzymatic reactions, which provide a more selective and efficient approach to producing azelaic acid, with fewer byproducts. This trend is contributing to better yield, reduced waste, and lower operational costs, supporting growth in industries such as personal care, pharmaceuticals, and plastics.

The industrial use of azelaic acid is expanding rapidly due to its growing demand for applications such as acne treatment, polymer production, and the manufacture of plasticizers, which is further fueling market growth.

Azelaic Acid Manufacturing for Industrial Use Market Size

The global azelaic acid manufacturing for industrial use market size was valued at USD 172.50 billion in 2024 and is projected to reach USD 266.74 billion by 2032, with a CAGR of 5.6% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Azelaic Acid Manufacturing for Industrial Use Market Trends

“Increasing Demand for Natural and Sustainable Products”

A key trend driving growth in the azelaic acid manufacturing for industrial use market is the rising demand for natural and sustainable ingredients across various industries. Azelaic acid, known for its antimicrobial and anti-inflammatory properties, is increasingly being sourced from renewable resources. This shift is particularly evident in the cosmetics and skincare industries, where sustainability is a growing concern among consumers. For instance, leading manufacturers such as BASF and Evonik have been adopting green chemistry practices, utilizing bio-based production methods to reduce their environmental footprint. This trend is expected to fuel the market's expansion as both consumers and companies prioritize eco-friendly solutions.

Report Scope and Azelaic Acid Manufacturing for Industrial Use Market Segmentation

|

Attributes |

Azelaic Acid Manufacturing for Industrial Use Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Emery Oleochemicals (Malaysia), Matrica (Italy), BASF SE (Germany), Croda Sipo (Sichuan) Co., Ltd. (China), Nantong Hengxing Electronic Materials (China), Jiangsu Senxuan Pharmaceutical and Chemical Co., Ltd. (China), NINGHAI ZHONGLONG CHEMICAL CO. Ltd. (China), Haihang Industry Co., Ltd. (China), Xi'an Sonwu Biotech Co., Ltd. (China), Matrìca S.p.A. (Italy), Hubei TuoChu Kangyuan Pharmaceutical Co., Ltd. (China), Beyond Industries (China) Limited (China), EnBridge PharmTech (Wuxi) Co., Ltd. (China), Hubei Aoks Trade Co., Ltd. (China), Leader Group (China), and Corbion (Netherlands) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Azelaic Acid Manufacturing for Industrial Use Market Definition

Azelaic acid manufacturing for industrial use involves the production of this dicarboxylic acid through several processes, with the primary method being the ozonolysis of oleic acid. Oleic acid, often sourced from vegetable oils, undergoes a reaction with ozone to form azelaic acid. The process typically includes steps such as hydrolysis, neutralization, and purification to achieve the desired product. Azelaic acid is widely used in various industries, including cosmetics for its skin-brightening and anti-inflammatory properties, and in the production of polyamides, plasticizers, and coatings. Industrial-scale production ensures consistent quality and efficient output for these diverse applications.

Azelaic Acid Manufacturing for Industrial Use Market Dynamics

Drivers

- Increasing Demand in Personal Care

Azelaic acid’s anti-inflammatory and antimicrobial properties have made it a popular ingredient in the personal care industry. It is commonly used in skincare products such as creams, gels, and serums due to its effectiveness in treating acne, rosacea, and hyperpigmentation. The growing consumer preference for skincare solutions that are both effective and gentle on the skin has contributed to the rise in demand for azelaic acid-based products. For instance, brands such as The Ordinary and Paula's Choice have incorporated azelaic acid into their products, reflecting the increasing popularity of this ingredient. This demand in personal care is a significant driver for azelaic acid manufacturing, fostering market growth in the cosmetics sector.

- Increasing Demand for Acne Treatment Solutions

The rising prevalence of acne worldwide has significantly boosted the demand for effective acne treatment solutions, making azelaic acid a key ingredient in various pharmaceutical products. Azelaic acid's ability to reduce inflammation, unclog pores, and inhibit bacterial growth makes it a preferred choice in treating acne. For instance, products such as Finacea, a topical gel containing 15% azelaic acid, are gaining popularity in treating mild to moderate acne, particularly among adolescents and young adults. The growing number of individuals seeking alternatives to harsh chemical treatments is further driving the azelaic acid market. With acne affecting nearly 85% of people at some point in their lives, the demand for azelaic acid-based treatments is expected to continue rising.

Opportunities

- Preference for Natural Ingredients

The growing preference for natural and eco-friendly ingredients in cosmetics and skincare products has created significant opportunities for azelaic acid in the market. Derived from plant-based sources such as grains and rye, azelaic acid fits well within the clean beauty movement, appealing to eco-conscious consumers. Its use in products for acne treatment, pigmentation correction, and anti-inflammatory care further positions it as a sought-after ingredient. For instance, brands such as The Ordinary and Paula's Choice have incorporated azelaic acid into their formulations, capitalizing on its natural origins and effectiveness. This shift toward natural ingredients opens new growth avenues for manufacturers and formulators in the beauty and skincare sectors.

- Increasing Cosmetic Product Innovation

The beauty industry’s continuous innovation in skincare formulations is driving the demand for versatile ingredients such as azelaic acid. Known for its ability to treat acne, rosacea, and hyperpigmentation, azelaic acid is becoming a key component in a wide range of products, from cleansers to serums. For instance, brands such as The Ordinary and Paula's Choice have incorporated azelaic acid into their acne treatment lines, appealing to consumers seeking effective yet gentle solutions. As beauty companies focus on multi-functional skincare products that address various skin concerns, azelaic acid’s inclusion in these formulations provides a significant growth opportunity, catering to a broader market of skin health-conscious consumers.

Restraints/Challenges

- Raw Material Availability

Raw material availability is a significant challenge for azelaic acid manufacturing in the industrial market. The production process requires specific raw materials, such as dodecane and fatty acids, which are sourced from natural oils or petrochemical derivatives. Any disruption in the supply chain—whether due to geopolitical issues, trade restrictions, or environmental factors—can lead to delays in production and higher material costs. This results in increased overall production expenses and potential price volatility, which in turn hinders the market’s growth. Manufacturers may struggle to maintain a steady supply of high-quality raw materials, which affects production timelines and can limit the scalability of azelaic acid for industrial applications.

- High Production Cost

High production costs remain a significant restraint for azelaic acid manufacturing in the industrial market. The process of producing azelaic acid involves complex chemical reactions, which require substantial energy inputs, leading to increased operational expenses. In addition, the procurement of specialized raw materials, such as fatty acids, adds to the cost burden. Labor-intensive operations further contribute to the overall expense. These factors make it difficult for manufacturers to achieve cost-effective mass production. As a result, the high production costs not only reduce profitability but also hinder market growth by limiting the ability to offer competitive pricing and scale production efficiently to meet industrial demand.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions. Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Azelaic Acid Manufacturing for Industrial Use Market Scope

The market is segmented on the basis of application, and grade. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Grade

- Polymer Grade

- Technical Grade

- Pharmaceutical Grade

Application

- Plastics

- Lubricants

- Electronics

- Pharmaceuticals

- Chemicals and Personal Care

Azelaic Acid Manufacturing for Industrial Use Market Regional Analysis

The market is analysed and market size insights and trends are provided by application, and grade as referenced above.

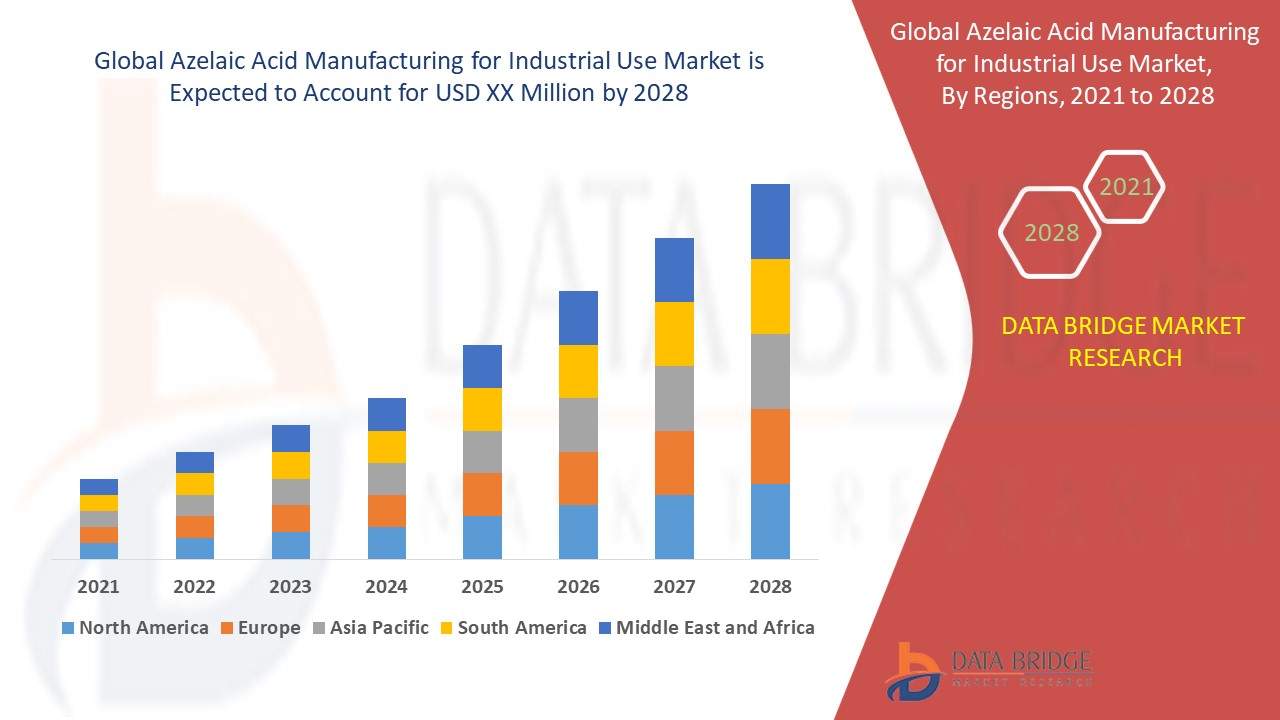

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America is expected to dominate the azelaic acid manufacturing for industrial use market due to the significant opportunities arising from various end-use industries, such as cosmetics, pharmaceuticals, and agriculture. The region's strong presence of key manufacturers and ongoing mergers and acquisitions further contribute to its market leadership. In addition, the growing demand for azelaic acid in skincare products and industrial applications boosts the region's position, fostering innovation and business expansion.

Asia-Pacific is expected to witness significant growth and dominate the azelaic acid manufacturing for industrial use market during the forecast period. This growth is driven by the rapid expansion of manufacturing industries in the region, particularly in sectors such as cosmetics, pharmaceuticals, and agriculture. The increasing demand for azelaic acid in personal care products and its use in various industrial applications are further fueling market growth across countries such as China and India.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Azelaic Acid Manufacturing for Industrial Use Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Azelaic Acid Manufacturing for Industrial Use Market Leaders Operating in the Market Are:

- Emery Oleochemicals (Malaysia)

- Matrica (Italy)

- BASF SE (Germany)

- Croda Sipo (Sichuan) Co., Ltd. (China)

- Nantong Hengxing Electronic Materials (China)

- Jiangsu Senxuan Pharmaceutical and Chemical Co., Ltd. (China)

- NINGHAI ZHONGLONG CHEMICAL CO. Ltd. (China)

- Haihang Industry Co., Ltd. (China)

- Xi'an Sonwu Biotech Co., Ltd. (China)

- Matrìca S.p.A. (Italy)

- Hubei TuoChu Kangyuan Pharmaceutical Co., Ltd. (China)

- Beyond Industries (China) Limited (China)

- EnBridge PharmTech (Wuxi) Co., Ltd. (China)

- Hubei Aoks Trade Co., Ltd. (China)

- Leader Group (China)

- Corbion (Netherlands)

Latest Developments in Azelaic Acid Manufacturing for Industrial Use Market

- In June 2023, Hubei TuoChu Kangyuan Pharmaceutical Co., Ltd. announced the receipt of a patent for a new, environmentally friendly process for producing azelaic acid using renewable feedstock. This innovative method aims to be more cost-effective and sustainable compared to traditional production processes. The company, based in China, is known for producing Chinese medicines and health supplements

- In March 2023, Emery Oleochemicals revealed plans to expand its azelaic acid production capacity at its Cincinnati, Ohio plant, with the expansion expected to complete in 2024. This initiative will double the company’s production output. Emery Oleochemicals, a global leader in specialty chemicals, offers renewable solutions across sectors such as bio-lubricants, eco-friendly polymers, and home wellness

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Azelaic Acid Manufacturing For Industrial Use Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Azelaic Acid Manufacturing For Industrial Use Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Azelaic Acid Manufacturing For Industrial Use Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.