Global Bakers Yeast Market

Market Size in USD Million

CAGR :

%

USD

7,714.18 Million

USD

1,722.10 Million

2024

2032

USD

7,714.18 Million

USD

1,722.10 Million

2024

2032

| 2025 –2032 | |

| USD 7,714.18 Million | |

| USD 1,722.10 Million | |

|

|

|

|

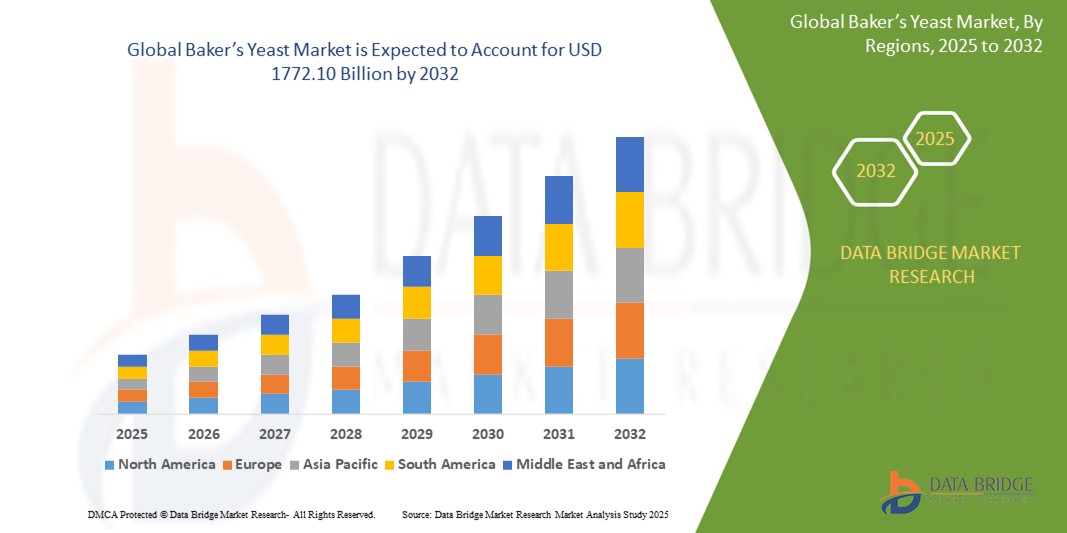

What is the Global Baker’s Yeast Market Size and Growth Rate?

- The global baker’s yeast market size was valued at USD 774.18 million in 2024 and is expected to reach USD 1,722.10 million by 2032, at a CAGR of10.51% during the forecast period

- Baker's yeast was primarily used as a vital ingredient in the bakery market. Bread, brown bread, rye bread, whole wheat bread, buns, white bread, and a variety of other bakery products are in high demand all over the globe

- These dominant factors are expected to drive the market growth forward. Organic food retail sales have augmented as consumer awareness regarding the benefits of organic food has developed

What are the Major Takeaways of Baker’s Yeast Market?

- Baker's yeast is becoming more popular in bakery products as a leavening agent worldwide because it can be stored for extended periods at room temperature without losing any of its properties

- One of the major factors that is expected to drive the growth of the baker's yeast market is the expansion of high-quality baker's yeast to increase its applications as a leavening agent in bakery products

- Europe dominated the baker’s yeast market with the largest revenue share of 44.7% in 2024, driven by a strong tradition of bread consumption, rising demand for clean label bakery products, and significant advancements in yeast innovation. The region's focus on artisanal, organic, and functional baked goods, along with supportive food safety regulations, is accelerating market growth

- North America baker’s yeast market is expected to grow at the fastest CAGR of 13.9% from 2025 to 2032, fueled by rising health consciousness, increased home baking trends, and growing demand for convenient, clean label bakery products

- The Bread segment dominated the baker’s yeast market with the largest revenue share of 48.2% in 2024, driven by the rising global demand for fresh, artisanal, and packaged bread products

Report Scope and Baker’s Yeast Market Segmentation

|

Attributes |

Baker’s Yeast Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Baker’s Yeast Market?

“Growing Popularity of Clean Label and Functional Yeast Solutions”

- A significant and accelerating trend in the global baker’s yeast market is the increasing demand for clean label yeast products made with simple, natural, and recognizable ingredients. Consumers are actively seeking bakery products free from artificial additives, chemicals, and synthetic enhancers

- For instance, companies such as Lesaffre and Angel Yeast have introduced yeast varieties that are non-GMO, organic-certified, and free from unnecessary processing aids to align with clean label trends in bakery production

- Functional yeast ingredients, including yeast extracts enriched with vitamins, minerals, and bioactive compounds, are being integrated into baked goods to meet consumer demand for health benefits such as improved gut health, immunity support, and enhanced flavor profiles

- The market is also witnessing innovation in yeast strains designed to support gluten-free, high-fiber, or reduced-sugar bakery products that cater to health-conscious consumers without compromising taste or texture

- This shift towards clean label and functional yeast reflects broader consumer priorities around wellness, transparency, and sustainability, driving innovation across the baking industry

What are the Key Drivers of Baker’s Yeast Market?

- Rising health awareness, increased demand for natural bakery ingredients, and the growing trend of artisanal and organic bread consumption are primary factors fueling the growth of the Baker’s Yeast market worldwide

- For instance, in January 2024, Lesaffre launched a new range of organic Baker’s Yeast products targeting premium and health-focused bakery segments, highlighting clean label positioning and sustainable sourcing

- The surge in demand for fresh, minimally processed bread, coupled with the rising popularity of home baking post-pandemic, has significantly boosted yeast consumption in both retail and commercial bakery sectors

- In addition, the growing preference for fermented food products, valued for their digestive health and probiotic benefits, is driving interest in yeast-based fermentation within the bakery industry

- Expanding availability of baker’s yeast through supermarkets, online channels, and specialty baking stores is further enhancing market penetration across developed and emerging markets

Which Factor is challenging the Growth of the Baker’s Yeast Market?

- Despite positive market momentum, challenges such as supply chain fluctuations, raw material price volatility, and product shelf-life limitations pose barriers to market growth

- For instance, disruptions in molasses supply—an essential raw material for yeast production due to agricultural or logistical constraints can impact manufacturing efficiency and pricing stability

- Furthermore, maintaining yeast viability and consistent fermentation performance, especially under varying storage or transport conditions, remains a technical challenge for both producers and end-users

- Higher production costs associated with organic, non-GMO, or specialty yeast strains can lead to premium pricing, potentially limiting adoption among price-sensitive bakery manufacturers, particularly in emerging economies

- To address these barriers, companies are investing in process optimization, sustainable sourcing, and research to develop robust, high-performance yeast strains suitable for diverse baking applications at competitive prices

How is the Baker’s Yeast Market Segmented?

The market is segmented on the basis of application, form, product, and end users.

- By Application

On the basis of application, the baker’s yeast market is segmented into Cakes, Pastries, Bread, Biscuits, and Others. The Bread segment dominated the Baker’s Yeast market with the largest revenue share of 48.2% in 2024, driven by the rising global demand for fresh, artisanal, and packaged bread products. Increased health consciousness, growing consumption of fortified and functional breads, and the surge in home baking trends have fueled yeast demand for bread-making applications.

The Pastries segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing consumer preference for indulgent, premium, and convenience-oriented pastry products. The growing popularity of specialty bakeries and cafés offering innovative pastry varieties is further propelling this segment.

- By Form

On the basis of form, the baker’s yeast market is segmented into Solid, Liquid/Cream, Dry or Powdered, and Other Forms. The Dry or Powdered segment held the largest revenue share of 42.7% in 2024, attributed to its extended shelf life, ease of storage, and consistent fermentation performance. Dry yeast is widely preferred across both industrial and household baking applications due to its convenience and reliability.

The Liquid/Cream segment is expected to witness the fastest CAGR from 2025 to 2032, supported by its application in large-scale commercial bakeries where liquid yeast offers superior dispersion, improved fermentation control, and higher efficiency in automated production lines.

- By Product

On the basis of product, the baker’s yeast market is segmented into Active Dry Yeast and Inactive Dry Yeast. The Active Dry Yeast segment dominated the market with the largest revenue share of 65.4% in 2024, owing to its widespread use in bread, bakery, and fermentation processes. Its reliable leavening properties, long shelf life, and suitability for both home and industrial baking applications make it the preferred choice.

The Inactive Dry Yeast segment is projected to witness the fastest growth rate from 2025 to 2032, driven by rising demand for nutritional yeast used in functional foods, dietary supplements, and plant-based formulations offering health benefits such as protein enrichment, vitamin content, and flavor enhancement.

- By End Users

On the basis of end users, the baker’s yeast market is segmented into Bakery, Food, Feed, and Others. The Bakery segment held the largest revenue share of 58.9% in 2024, driven by consistent demand from commercial bakeries, artisanal bakeries, and home bakers for yeast used in producing bread, pastries, cakes, and other baked goods.

The Feed segment is expected to register the fastest growth rate from 2025 to 2032, supported by increasing adoption of yeast-based feed additives that enhance animal gut health, improve nutrient absorption, and support overall livestock productivity. The growing focus on sustainable and functional animal nutrition is boosting demand in this segment.

Which Region Holds the Largest Share of the Baker’s Yeast Market?

- Europe dominated the baker’s yeast market with the largest revenue share of 44.7% in 2024, driven by a strong tradition of bread consumption, rising demand for clean label bakery products, and significant advancements in yeast innovation. The region's focus on artisanal, organic, and functional baked goods, along with supportive food safety regulations, is accelerating market growth

- Consumers across Europe are increasingly favoring premium, organic, and minimally processed bakery products, propelling the adoption of high-quality Baker’s Yeast across commercial and home baking sectors

- The expansion of specialty bakeries, coupled with growing health consciousness and innovation in yeast strains for gluten-free and fortified bakery items, is further driving market demand

Germany Baker’s Yeast Market Insight

The Germany baker’s yeast market captured the largest revenue share in Europe in 2024, supported by high bread consumption per capita, a thriving artisanal bakery sector, and rising demand for sustainable food production. Germany’s strong focus on organic, non-GMO, and specialty yeast products aligns with consumer priorities around health and sustainability. In addition, the country’s advanced food technology landscape is fostering the development of innovative yeast solutions, reinforcing Germany’s leadership in the European market.

U.K. Baker’s Yeast Market Insight

The U.K. baker’s yeast market is projected to expand steadily, driven by increasing consumer demand for convenient, clean label bakery products and the growing popularity of plant-based diets. The rise of health-focused bakeries, innovation in gluten-free and fortified baked goods, and growing interest in sourdough and artisanal bread varieties are boosting market growth. Furthermore, heightened awareness around sustainability and ethical food sourcing is accelerating the adoption of premium yeast solutions across the country.

France Baker’s Yeast Market Insight

The France baker’s yeast market is experiencing steady growth, fueled by the country’s rich bakery culture, strong demand for high-quality bread, and increasing consumer preference for organic and functional bakery products. French consumers' emphasis on traditional craftsmanship and premium ingredients is driving demand for specialty yeast varieties, including those suited for clean label and nutritional bakery applications. The market is further supported by rising health awareness and growing innovation in bakery product formulations.

Which Region is the Fastest Growing Region in the Baker’s Yeast Market?

North America baker’s yeast market is expected to grow at the fastest CAGR of 13.9% from 2025 to 2032, fueled by rising health consciousness, increased home baking trends, and growing demand for convenient, clean label bakery products. Consumers in North America are actively seeking organic, fortified, and artisanal baked goods, driving the adoption of premium yeast solutions. The expansion of retail bakeries, a surge in packaged bread and bakery consumption, and significant investments by major food companies in yeast innovation are accelerating market growth across the region.

U.S. Baker’s Yeast Market Insight

The U.S. baker’s yeast market accounted for the largest revenue share in North America in 2024, driven by robust demand for fresh, convenient, and health-focused bakery products. The growing popularity of artisanal breads, gluten-free options, and organic bakery products is boosting yeast consumption across both household and commercial sectors. Furthermore, the presence of key industry players investing in yeast research and sustainable production is reinforcing the U.S. market’s expansion.

Canada Baker’s Yeast Market Insight

The Canada baker’s yeast market is witnessing significant growth, supported by rising health awareness, increased demand for clean label bakery goods, and growing interest in home baking. Canadian consumers' preference for organic, minimally processed baked products is driving the adoption of high-quality yeast solutions. In addition, the country’s expanding artisanal bakery segment and supportive food regulations are fostering innovation and market development.

Which are the Top Companies in Baker’s Yeast Market?

The baker’s yeast industry is primarily led by well-established companies, including:

- Dun and Bradstreet, Inc. (U.S.)

- Conagra Brands, Inc. (U.S.)

- London Dairy Co. Ltd (U.K.)

- Danone SA (France)

- ADM (U.S.)

- Daiya Foods Inc. (Canada)

- Grupo Bimbo S.A.B.de C.V. (Mexico)

- Associated British Foods PLC (U.K.)

- General Mills Inc. (U.S.)

- Lantmännen Unibake (Denmark)

- Aryzta AG (Switzerland)

- Vandemoortele NV (Belgium)

- Europastry S.A. (Spain)

- Cole's Quality Food Inc. (U.S.)

What are the Recent Developments in Global Baker’s Yeast Market?

- In March 2025, Lesaffre introduced an innovative yeast strain developed specifically for cleaner-label bakery applications, enhancing fermentation performance and improving taste profiles while minimizing the need for synthetic additives, reinforcing Lesaffre’s leadership in the global bakery yeast market and catering to the growing demand for natural, sustainable ingredients

- In January 2025, Angel Yeast Co., Ltd. unveiled a high-efficiency dry yeast variant tailored for the craft brewing sector, designed to accelerate fermentation, enhance aroma profiles, and ensure product consistency, positioning Angel Yeast as a key enabler of quality and innovation in the booming global craft beer market

- In November 2024, Chr. Hansen launched an advanced probiotic yeast strain aimed at promoting gut health, utilizing modern fermentation techniques to deliver superior health benefits for functional foods and dietary supplements, strengthening Chr. Hansen’s leadership in microbiome-driven yeast solutions and meeting the surging demand for digestive wellness products

- In June 2020, Lesaffre Group acquired a majority stake in Inner Mongolia Biohymn Biotechnology Co., Ltd., a China-based yeast and yeast extract producer, expanding Lesaffre’s footprint in the Asian market and enhancing its production capabilities to meet the increasing global demand for high-quality yeast solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Bakers Yeast Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Bakers Yeast Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Bakers Yeast Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.