Global Betaine Market

Market Size in USD Billion

CAGR :

%

USD

4.47 Billion

USD

7.07 Billion

2024

2032

USD

4.47 Billion

USD

7.07 Billion

2024

2032

| 2025 –2032 | |

| USD 4.47 Billion | |

| USD 7.07 Billion | |

|

|

|

|

Betaine Market Size

- The global betaine market was valued at USD 4.47 billion in 2024 and is expected to reach USD 7.07 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.90%, primarily driven by industrial & chemical applications of betaine

- This growth is driven by factors such as increasing demand for eco-friendly surfactants and growth in the household & industrial cleaning industry

Betaine Market Analysis

- Betaine is a naturally occurring compound derived from sugar beets, seafood, and various plant sources. It plays a vital role in cellular hydration, osmoregulation, and metabolic functions. Its composition and properties vary depending on the extraction method, raw material source, and environmental conditions. In its pure form, betaine appears as a white crystalline substance but may differ in formulation based on industrial applications such as food, animal feed, pharmaceuticals, and personal care

- The market is expanding due to its increasing adoption in industries such as animal nutrition, cosmetics, and pharmaceuticals. The growing demand for natural, sustainable, and bio-based ingredients is fueling its use as an alternative to synthetic additives

- In addition, the rise in health-conscious consumers has accelerated the incorporation of betaine in functional foods and dietary supplements. Regulatory support for clean-label ingredients and eco-friendly formulations further strengthens market growth

- For instance, Evonik Industries and DuPont have been investing in betaine-based solutions for the personal care and animal feed industries, focusing on enhancing product performance while maintaining sustainability

- As industries shift towards sustainable and functional ingredients, betaine continues to gain traction across multiple applications. With ongoing innovations, strategic partnerships, and increasing regulatory support, the market is expected to experience steady growth in the coming years, driven by both consumer demand and industrial advancements

Report Scope and Betaine Market Segmentation

|

Attributes |

Betaine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Betaine Market Trends

“Rising Adoption of Betaine in Personal Care Products”

- One prominent trend in the global betaine market is the rising adoption of betaine in personal care products

- This trend is driven by the rising consumer demand for gentle, chemical-free skincare and haircare solutions, the shift toward sustainable and clean beauty products, and the expanding role of betaine as a hydrating and conditioning agent in personal care formulations

- For instance, BASF and Evonik Industries have incorporated betaine into their personal care product lines, utilizing its moisturizing and mild surfactant properties in shampoos, body washes, and skincare products to enhance product performance while catering to the growing clean beauty movement

- As consumers and brands continue to prioritize eco-friendly and skin-friendly ingredients, betaine is being increasingly integrated into a wide range of personal care products, replacing harsh sulfates and synthetic conditioning agents

- This shift is expected to drive innovation in sustainable and natural beauty, promote the widespread adoption of betaine-based formulations, and contribute to the long-term growth of the market as regulatory authorities and consumers favor safe, biodegradable, and high-performance alternatives

Betaine Market Dynamics

Driver

“Rising Use of Betaine in Dietary Supplements & Functional Foods”

- The increasing use of betaine in dietary supplements and functional foods is a key driver of growth in the betaine market. Betaine is widely utilized in sports nutrition, weight management products, and health supplements because of its vital role in enhancing metabolism, promoting liver health and supporting cardiovascular function

- Betaine has been recognized for its ability to improve muscle performance and reduce homocysteine levels, contributing to its rising popularity among athletes and health-conscious consumers

- As healthcare professionals and researchers continue to explore the benefits of natural and bioactive ingredients, betaine is gaining traction in formulations aimed at gut health, cognitive function, hydration, and endurance

- Properties of betaine as an osmolyte make it particularly effective in maintaining cellular water balance, which is crucial for physical performance and recovery

- The growing demand for natural, science-backed functional ingredients has led to increased investments in betaine-based nutraceuticals, focusing on improving absorption, bioavailability, and formulation stability

- This includes the development of betaine-infused energy drinks, fortified foods, and performance-enhancing dietary supplements that cater to the evolving needs of the health and wellness industry

For instance,

- Cargill has introduced betaine-enriched functional food ingredients to enhance hydration and muscle endurance

- DuPont Nutrition & Biosciences has integrated betaine into its sports nutrition and cardiovascular health supplements to optimize metabolic performance and reduce fatigue

- With the rising demand for natural and functional dietary ingredients, the betaine market is poised for steady growth as manufacturers continue to innovate and expand their product offerings to align with evolving consumer preferences and regulatory standards. As the focus on preventive health and clean-label nutrition intensifies, betaine-based products are expected to play a significant role in the future of dietary supplements and functional foods

Opportunity

“Expanding Role of Betaine in Animal Nutrition”

- The growing emphasis on animal health and performance enhancement presents a major opportunity for the betaine market. As the livestock and poultry industries seek efficient and sustainable feed additives, betaine is increasingly recognized for its osmoregulatory properties, ability to enhance nutrient absorption, and role in improving feed conversion efficiency

- The shift toward antibiotic-free animal nutrition also opens new avenues for betaine, as it contributes to gut health, immunity, and overall livestock productivity

- With increasing regulatory restrictions on antibiotic growth promoters (AGPs), producers are looking for safe and natural feed ingredients, positioning betaine as a valuable alternative in modern animal nutrition strategies

For instance,

- Evonik Industries has integrated betaine in precision livestock farming, helping optimize animal nutrition with data-driven feed formulations

- Nutreco is incorporating betaine into sustainable aquaculture feed, supporting fish and shrimp farming by reducing stress and enhancing nutrient retention

- As the global focus on sustainable and high-performance animal nutrition continues to rise, the betaine market is expected to experience significant expansion. With ongoing research, technological advancements in feed formulations, and increasing adoption of natural growth-promoting additives, betaine is set to play a critical role in the future of livestock and aquaculture industries

Restraint/Challenge

“Growing Preference Towards Betaine Substitutes”

- The increasing preference for betaine substitutes poses a significant challenge to the betaine market, particularly in food, feed, and personal care applications, where alternative ingredients such as choline chloride, glycine, and trimethylglycine derivatives are being used for similar functional benefits

- Some substitutes, such as choline chloride, are gaining traction in animal nutrition due to their lower cost and widespread availability, while plant-based humectants and amino acid derivatives are being explored in cosmetic and personal care formulations as alternatives to betaine. Additionally, advancements in synthetic and bioengineered ingredients are offering more stable and targeted functional solutions, reducing the dependency on betaine in various industries

- There is also increasing regulatory scrutiny surrounding certain sources of betaine, particularly those derived from genetically modified sugar beets, leading to a shift toward non-GMO and plant-derived alternatives, which may further challenge the betaine market's growth

For instance,

- In the personal care sector, Unilever and Procter & Gamble have incorporated glycerin and amino acid-based humectants in their formulations, reducing reliance on betaine as a moisturizing agent

- With the growing adoption of alternative ingredients across multiple industries, the demand for betaine is facing increasing pressure. As companies continue to invest in research and formulation advancements, the preference for substitutes could further intensify, potentially limiting betaine's market growth and influence in the long run

Betaine Market Scope

The market is segmented on the basis of type, form, application, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Form |

|

|

By Application |

|

|

By End User

|

|

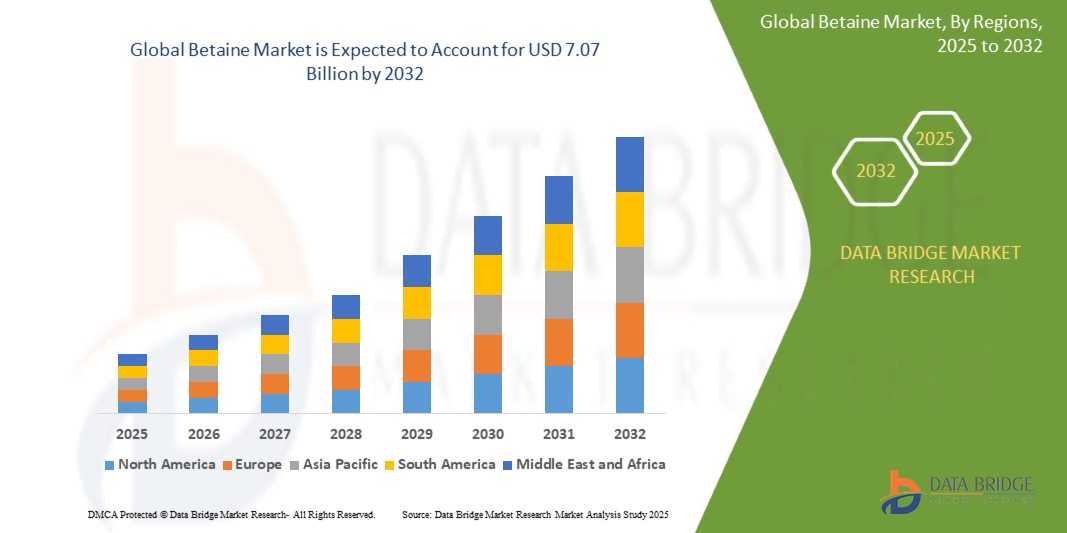

Betaine Market Regional Analysis

“North America is the Dominant Region in the Betaine Market”

- North America dominates the betaine market, driven by the strong demand from industrial sectors, including deicers, detergents, and personal care products, where betaine is widely utilized for its multifunctional properties. The region's well-established chemical, home care, and cosmetic industries significantly contribute to its market leadership

- The U.S. holds a significant share due to robust R&D investments, increasing consumer preference for bio-based products, and advancements in betaine extraction and processing technologies

- In addition, the growing adoption of betaine in functional foods and dietary supplements is further fueling market expansion

- North America also benefits from a well-defined regulatory framework that encourages the use of natural and eco-friendly ingredients, coupled with an extensive distribution network, which ensures seamless availability of betaine-based products across multiple industries. These factors continue to solidify the region’s position as the dominant player in the global betaine market

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the betaine market, driven by increasing consumption of dietary supplements, health drinks, and functional food products. The region’s expanding food and beverage industry, along with rising consumer awareness of nutritional benefits, is a key factor driving demand

- Countries such as China, India, Japan, and South Korea are witnessing rapid growth in the cosmetics, personal care, and pharmaceutical industries, where betaine is increasingly incorporated for its moisturizing, anti-aging, and skin-conditioning properties. The shift toward clean-label, natural, and bio-based ingredients is further accelerating its adoption

- The Asia-Pacific market is benefiting from increased investments in modern processing and extraction technologies, alongside government initiatives promoting sustainable and organic products.

- With a rapidly growing population, changing consumer lifestyles, and the rising popularity of wellness-focused products, Asia-Pacific is positioned as the fastest-growing region in the betaine market, expected to witness substantial expansion throughout the 2025-2032 forecast period

Betaine Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- DuPont (U.S.)

- AMINO GmbH (Germany)

- BASF (Germany)

- Kao Corporation (Japan)

- Stepan Company (U.S.)

- Solvay (Belgium)

- Associated British Foods plc (U.K.)

- Nutreco (Netherlands)

- The Lubrizol Corporation (U.S.)

- INOLEX, Inc. (U.S.)

- Sunwin Biotech Shandong Co., Ltd. (China)

- Merck KGaA (Germany)

- Evonik Industries AG (Germany)

- Fengchen Group Co.,Ltd (China)

- Orison Chemicals Limited (China)

- Prasol Chemicals Limited (India)

Latest Developments in Global Betaine Market

- In 2022, Eton Pharmaceuticals, a leading pharmaceutical business dedicated to commercializing and researching medicines for rare disorders, announced that they purchased betaine anhydrous for oral solution. Betaine anhydrous for an oral solution has a market of fewer than 2,000 patients in the U.S., with a projected annual market of $10 million

- In 2021, the Competition Commission of India approved Betaine B.V.'s acquisition of Hinduja Global Solutions' global healthcare BPO services business. Betaine acquired Hinduja Global Solutions' healthcare business process outsourcing (BPO) services and some assets, employees, contracts, and according to a statement from the fair trade authority

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL BETAINE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL BETAINE MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 SECONDARY SOURCES

2.15 GLOBAL BETAINE MARKET: RESEARCH SNAPSHOT

2.16 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 IMPORT EXPORT SCENARIO

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

5.8.1 PRODUCT CODES

5.8.2 CERTIFIED STANDARDS

5.8.3 SAFETY STANDARDS

5.8.3.1. MATERIAL HANDLING & STORAGE

5.8.3.2. TRANSPORT & PRECAUTIONS

5.8.3.3. HARAD IDENTIFICATION

6 PRICE INDEX

7 PRODUCTION CAPACITY OVERVIEW

8 SUPPLY CHAIN ANALYSIS

8.1 OVERVIEW

8.2 LOGISTIC COST SCENARIO

8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

9 CLIMATE CHANGE SCENARIO

9.1 ENVIRONMENTAL CONCERNS

9.2 INDUSTRY RESPONSE

9.3 GOVERNMENT’S ROLE

9.4 ANALYST RECOMMENDATIONS

10 GLOBAL BETAINE MARKET, BY PRODUCT TYPE, (2021-2030), (USD MILLION) (TONS)

(VALUE, VOLUME AND ASP FOR EACH SEGMENT WILL BE PROVIDED)

10.1 OVERVIEW

10.2 BIO-BASED BETAINE

10.3 SYNTHETIC BETAINE

11 GLOBAL BETAINE MARKET, BY FORM, (2021-2030), (USD MILLION)

11.1 OVERVIEW

11.2 COCAMIDOPROPYL BETAINE

11.3 BETAINE ANHYDROUS

11.4 BETAINE MONOHYDRATE

11.5 OTHERS

12 GLOBAL BETAINE MARKET, BY APPLICATION, (2021-2030), (USD MILLION)

12.1 OVERVIEW

12.2 SOLDERING

12.3 RESIN CURING FLUXES

12.4 ORGANIC SYNTHESIS

13 GLOBAL BETAINE MARKET, BY END-USE INDUSTRY, (2021-2030), (USD MILLION)

13.1 OVERVIEW

13.2 FOOD AND BEVERAGES

13.3 ANIMAL HUSBANDRY

13.4 COSMETICS

13.5 OTHERS

14 GLOBAL BETAINE MARKET, BY REGION, (2021-2030), (USD MILLION) (TONS)

14.1 GLOBAL BETAINE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

14.2 NORTH AMERICA

14.2.1 U.S.

14.2.2 CANADA

14.2.3 MEXICO

14.3 EUROPE

14.3.1 ERMANY

14.3.2 U.K.

14.3.3 ITALY

14.3.4 FRANCE

14.3.5 SPAIN

14.3.6 RUSSIA

14.3.7 SWITZERLAND

14.3.8 TURKEY

14.3.9 BELGIUM

14.3.10 NETHERLANDS

14.3.11 DENMARK

14.3.12 SWEDEN

14.3.13 POLAND

14.3.14 NORWAY

14.3.15 FINLAND

14.3.16 REST OF EUROPE

14.4 ASIA-PACIFIC

14.4.1 JAPAN

14.4.2 CHINA

14.4.3 SOUTH KOREA

14.4.4 INDIA

14.4.5 SINGAPORE

14.4.6 THAILAND

14.4.7 INDONESIA

14.4.8 MALAYSIA

14.4.9 PHILIPPINES

14.4.10 AUSTRALIA

14.4.11 NEW ZEALAND

14.4.12 VIETNAM

14.4.13 TAIWAN

14.4.14 REST OF ASIA-PACIFIC

14.5 SOUTH AMERICA

14.5.1 BRAZIL

14.5.2 ARGENTINA

14.5.3 REST OF SOUTH AMERICA

14.6 MIDDLE EAST AND AFRICA

14.6.1 SOUTH AFRICA

14.6.2 EGYPT

14.6.3 BAHRAIN

14.6.4 UNITED ARAB EMIRATES

14.6.5 KUWAIT

14.6.6 OMAN

14.6.7 QATAR

14.6.8 SAUDI ARABIA

14.6.9 REST OF MEA

15 GLOBAL BETAINE MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

15.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.3 COMPANY SHARE ANALYSIS: EUROPE

15.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15.5 MERGERS AND ACQUISITIONS

15.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

15.7 EXPANSIONS

15.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

16 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

17 GLOBAL BETAINE MARKET - COMPANY PROFILES

17.1 BASF SE

17.1.1 COMPANY SNAPSHOT

17.1.2 PRODUCT PORTFOLIO

17.1.3 PRODUCTION CAPACITY OVERVIEW

17.1.4 SWOT ANALYSIS

17.1.5 REVENUE ANALYSIS

17.1.6 RECENT UPDATES

17.2 AMINO GMBH

17.2.1 COMPANY SNAPSHOT

17.2.2 PRODUCT PORTFOLIO

17.2.3 PRODUCTION CAPACITY OVERVIEW

17.2.4 SWOT ANALYSIS

17.2.5 REVENUE ANALYSIS

17.2.6 RECENT UPDATES

17.3 ASSOCIATED BRITISH FOODS PLC

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 PRODUCTION CAPACITY OVERVIEW

17.3.4 SWOT ANALYSIS

17.3.5 REVENUE ANALYSIS

17.3.6 RECENT UPDATES

17.4 KAO CORP

17.4.1 COMPANY SNAPSHOT

17.4.2 PRODUCT PORTFOLIO

17.4.3 PRODUCTION CAPACITY OVERVIEW

17.4.4 SWOT ANALYSIS

17.4.5 REVENUE ANALYSIS

17.4.6 RECENT UPDATES

17.5 SOLVAY

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 PRODUCTION CAPACITY OVERVIEW

17.5.4 SWOT ANALYSIS

17.5.5 REVENUE ANALYSIS

17.5.6 RECENT UPDATES

17.6 STEPAN COMPANY

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 PRODUCTION CAPACITY OVERVIEW

17.6.4 SWOT ANALYSIS

17.6.5 REVENUE ANALYSIS

17.6.6 RECENT UPDATES

17.7 SUNWIN COMPANY

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 PRODUCTION CAPACITY OVERVIEW

17.7.4 SWOT ANALYSIS

17.7.5 REVENUE ANALYSIS

17.7.6 RECENT UPDATES

17.8 THE LUBRIZOL CORPORATION

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 PRODUCTION CAPACITY OVERVIEW

17.8.4 SWOT ANALYSIS

17.8.5 REVENUE ANALYSIS

17.8.6 RECENT UPDATES

17.9 ORISON CHEMICALS LIMITED

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 PRODUCTION CAPACITY OVERVIEW

17.9.4 SWOT ANALYSIS

17.9.5 REVENUE ANALYSIS

17.9.6 RECENT UPDATES

17.1 ALPSURE LIFESCIENCES PVT. LTD.

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 PRODUCTION CAPACITY OVERVIEW

17.10.4 SWOT ANALYSIS

17.10.5 REVENUE ANALYSIS

17.10.6 RECENT UPDATES

17.11 PRASOL CHEMICALS PVT. LTD.

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 PRODUCTION CAPACITY OVERVIEW

17.11.4 SWOT ANALYSIS

17.11.5 REVENUE ANALYSIS

17.11.6 RECENT UPDATES

17.12 NAVNEET CHEMICAL

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 PRODUCTION CAPACITY OVERVIEW

17.12.4 SWOT ANALYSIS

17.12.5 REVENUE ANALYSIS

17.12.6 RECENT UPDATES

17.13 INOLEX INC.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 PRODUCTION CAPACITY OVERVIEW

17.13.4 SWOT ANALYSIS

17.13.5 REVENUE ANALYSIS

17.13.6 RECENT UPDATES

17.14 MERCK KGAA

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 PRODUCTION CAPACITY OVERVIEW

17.14.4 SWOT ANALYSIS

17.14.5 REVENUE ANALYSIS

17.14.6 RECENT UPDATES

17.15 DUPONT

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 PRODUCTION CAPACITY OVERVIEW

17.15.4 SWOT ANALYSIS

17.15.5 REVENUE ANALYSIS

17.15.6 RECENT UPDATES

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

18 RELATED REPORTS

19 QUESTIONNAIRE

20 CONCLUSION

21 ABOUT DATA BRIDGE MARKET RESEARCH

Global Betaine Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Betaine Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Betaine Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.