Global Bioethanol Market

Market Size in USD Billion

CAGR :

%

USD

87.90 Billion

USD

133.88 Billion

2024

2032

USD

87.90 Billion

USD

133.88 Billion

2024

2032

| 2025 –2032 | |

| USD 87.90 Billion | |

| USD 133.88 Billion | |

|

|

|

|

Bioethanol Market Size

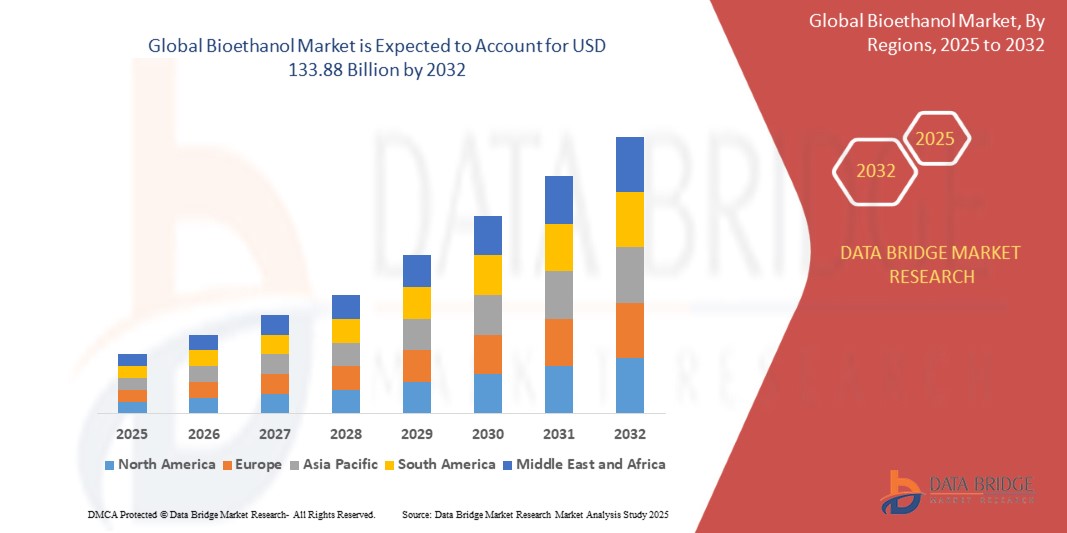

- The global bioethanol market was valued at USD 87.90 billion in 2024 and is expected to reach USD 133.88 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.40%, primarily driven by increasing demand for renewable energy sources

- This growth is driven by stringent government regulations on carbon emissions and the growing adoption of biofuels in the transportation sector

Bioethanol Market Analysis

- Bioethanol has gained widespread acceptance due to its renewable nature, high octane rating, and reduced greenhouse gas emissions, driving demand in transportation, power generation, and industrial applications. Its ability to enhance fuel efficiency, lower dependence on fossil fuels, and support energy security initiatives has reinforced its role in the global energy transition

- The market is primarily driven by rising ethanol blend mandates, increasing adoption of biofuels, and government incentives promoting renewable energy sources. In addition, advancements in cellulosic ethanol technology and investments in next-generation bioethanol production are accelerating industry growth

- For instance, in the U.S. and Brazil, the demand for bioethanol has surged due to higher ethanol blending targets, expansion of flex-fuel vehicle adoption, and strong government policies supporting biofuel production

- Globally, bioethanol continues to play a pivotal role in decarbonization efforts, with innovations such as advanced fermentation techniques, lignocellulosic bioethanol, and integrated bio refineries driving market expansion and long-term adoption

Report Scope and Bioethanol Market Segmentation

|

Attributes |

Bioethanol Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Bioethanol Market Trends

“Rising Adoption of Bioethanol as a Renewable Fuel in Transportation”

- The increasing focus on reducing carbon emissions and promoting cleaner energy sources is driving the adoption of bioethanol as a fuel additive, particularly in the automotive and aviation sectors

- Governments worldwide are implementing higher ethanol blending mandates and supporting the transition to bio-based fuels, encouraging automakers and fuel producers to integrate bioethanol into their energy mix

- Advancements in cellulosic ethanol production and next-generation biofuels are accelerating the shift toward sustainable fuel alternatives, reducing dependence on fossil fuels and enhancing energy security

For instance,

- In March 2024, the U.S. government raised its ethanol blending requirement to 15% (E15) nationwide, promoting increased bioethanol consumption in the transportation sector

- In December 2023, Brazil announced plans to expand its RenovaBio program, incentivizing biofuel producers to increase ethanol output and reduce carbon intensity

- In September 2023, the European Union set new targets for sustainable aviation fuels (SAF), boosting investments in ethanol-derived jet fuel production

- As global regulations tighten and industries prioritize low-carbon energy solutions, bioethanol will continue to play a key role in transforming the transportation sector, enhancing fuel efficiency, and supporting long-term sustainability goals

Bioethanol Market Dynamics

Driver

“Rising Utilization of Bioethanol in Sustainable Aviation Fuel (SAF)”

- The push for lower carbon emissions in the aviation industry is driving the adoption of bioethanol as a feedstock for sustainable aviation fuel (SAF), reducing reliance on fossil-based jet fuels

- Airlines and fuel producers are investing in bioethanol-derived SAF to meet net-zero emission targets, comply with international aviation regulations, and reduce their environmental impact

- Governments and industry leaders are supporting biofuel research, production incentives, and blending mandates, accelerating the transition toward renewable aviation fuel solutions

For instance,

- In March 2024, United Airlines announced plans to expand its use of ethanol-based SAF to reduce carbon emissions across its fleet

- In November 2023, British Airways partnered with LanzaJet to develop bioethanol-derived aviation fuel, enhancing its sustainability strategy

- In September 2023, the European Union introduced new SAF mandates requiring airlines to incorporate a minimum percentage of bio-based fuels by 2030

- As the aviation sector intensifies its decarbonization efforts, bioethanol-based SAF will play a crucial role in reducing greenhouse gas emissions, promoting energy security, and supporting the transition to cleaner air travel

Opportunity

“Expanding Role of Bioethanol in Renewable Energy Production”

- The increasing focus on renewable energy sources and reducing fossil fuel dependence is creating opportunities for bioethanol as a key component in bio-based power generation

- Bioethanol is being integrated into combined heat and power (CHP) systems, fuel cells, and hybrid renewable energy projects, offering a cleaner alternative to traditional energy sources

- Governments and private sectors are investing in bioethanol-based energy solutions, driven by carbon reduction targets, energy security concerns, and advancements in biofuel technologies

For instance,

- In January 2024, Shell announced a partnership with biofuel producers to develop bioethanol-powered fuel cells for decentralized energy systems.

- In October 2023, Siemens Energy launched a pilot project utilizing bioethanol in CHP plants to enhance energy efficiency and reduce emissions.

- In August 2023, Brazil’s energy sector expanded its bioethanol-blended electricity generation program to support its national renewable energy strategy

- As the global demand for sustainable energy solutions rises, bioethanol will continue to gain traction in power generation, supporting clean energy transitions, grid stability, and lower carbon footprints in energy production.

Restraint/Challenge

“High Production Costs of Bioethanol Compared to Conventional Fuels”

- The high cost of raw materials, fermentation processes, and advanced refining technologies makes bioethanol production more expensive than conventional fossil fuels

- Scaling up bioethanol production requires significant investments in biorefineries, specialized equipment, and supply chain infrastructure, which poses financial challenges for manufacturers

- Fluctuations in feedstock availability, agricultural yields, and global energy prices further impact the cost-effectiveness of bioethanol, creating uncertainties in market growth

For instance,

- In November 2023, U.S. based bioethanol producers faced financial strain due to rising corn prices, increasing overall production costs

- Addressing cost-related challenges through technological advancements, economies of scale, and government incentives will be crucial for improving the economic viability of bioethanol, ensuring long-term market sustainability

Bioethanol Market Scope

The market is segmented on the basis of type, blend, generation, source, application, and end-user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Blend |

|

|

By Generation |

|

|

By Source |

|

|

By Application |

|

|

By End-User |

|

Bioethanol Market Regional Analysis

“North America is the Dominant Region in the Bioethanol Market”

- North America leads the global bioethanol market, driven by strong government mandates, increasing blending requirements, and a well-established biofuel infrastructure

- The U.S. dominates the region, with major bioethanol producers, extensive corn-based ethanol production, and continuous technological advancements in second-generation biofuels

- Rising demand for sustainable fuels, increasing ethanol adoption in transportation, and federal incentives promoting biofuel integration further accelerate market growth

For instance,

- In March 2024, the U.S. Environmental Protection Agency (EPA) increased renewable fuel volume obligations, boosting bioethanol demand

- In October 2023, POET, a leading bioethanol producer, expanded its production capacity to meet rising domestic and international demand

- In July 2023, the U.S. Department of Energy (DOE) invested USD 250 million in advanced biofuel research, focusing on cellulosic ethanol innovations

- As North America continues to emphasize energy security and low-carbon fuel alternatives, the bioethanol market is expected to experience sustained growth and innovation

“Asia-Pacific is projected to register the Highest Growth Rate”

- Asia-Pacific is expected to witness the highest growth rate in the bioethanol market, driven by increasing government mandates, rising ethanol blending targets, and a surge in biofuel investments

- China and India lead the region, fueled by rapid industrialization, expanding bioethanol production capacity, and strong policy support for renewable fuels

- The growing focus on reducing carbon emissions, increasing adoption of E10 and E20 fuel blends, and rising demand for alternative energy sources are key growth drivers

For instance,

- In February 2024, the Indian government advanced its E20 ethanol blending target to 2025, accelerating bioethanol adoption in the transportation sector

- In November 2023, China expanded its ethanol production capacity, aiming to achieve nationwide E10 fuel adoption by 2030

- In August 2023, Thailand announced new incentives for bioethanol producers, encouraging the use of cassava and sugarcane-based ethanol

- As the Asia-Pacific region intensifies its renewable energy transition, bioethanol will play a crucial role in enhancing energy security, reducing emissions, and driving sustainable fuel adoption

Bioethanol Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- DuPont (U.S.)

- POET, LLC (U.S.)

- CropEnergies AG (Germany)

- ADM (U.S.)

- BlueFire Renewables (U.S.)

- Petrobras (Brazil)

- Royal Dutch Shell plc (Netherlands)

- Green Plains Inc. (U.S.)

- Aemetis, Inc. (U.S.)

- The Andersons, Inc. (U.S.)

- Flint Hills Resources (U.S.)

- Cargill, Incorporated (U.S.)

- Fulcrum BioEnergy (U.S.)

- British Sugar plc (U.K.)

- Vivergo Fuels Limited (U.K.)

- Abengoa (Spain)

- Praj Industries (India)

- Tereos (France)

- Pannonia Bio Zrt. (Hungary)

- Cristal Union (France)

Latest Developments in Global Bioethanol Market

- In April 2023, POET LLC (U.S.) signed an exclusive partnership agreement with Midwest Commodities in Detroit, Michigan, enabling Midwest Commodities to provide DDGS truck-to-container transload services exclusively to POET, enhancing the company’s global supply chain efficiency

- In January 2023, United Airlines, Tallgrass, and Green Plains Inc. (U.S.) formed a joint venture, Blue Blade Energy, to develop and commercialize a Sustainable Aviation Fuel (SAF) technology that utilizes ethanol as its primary feedstock

- In May 2022, Blue Biofuels Inc. announced that its fifth-generation Cellulose-to-Sugar (CTS) machine was on schedule, with testing and further engineering underway to increase production capacity. The company also contracted K.R. Komarek Inc. to develop future iterations of the CTS machine for commercialization

- In January 2022, Wolf Carbon Solutions and Archer Daniels Midland Company (U.S.) partnered to advance the decarbonization of ethanol production, focusing on reducing carbon emissions in the industry

- In October 2021, Archer Daniels Midland Company (U.S.) reached an agreement to sell its ethanol production complex in Peoria, Illinois, to BioUrja Group, marking a strategic shift in its ethanol operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Bioethanol Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Bioethanol Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Bioethanol Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.