Global Biofuels Market

Market Size in USD Billion

CAGR :

%

USD

3.27 Billion

USD

5.62 Billion

2024

2032

USD

3.27 Billion

USD

5.62 Billion

2024

2032

| 2025 –2032 | |

| USD 3.27 Billion | |

| USD 5.62 Billion | |

|

|

|

|

Biofuels Market Size

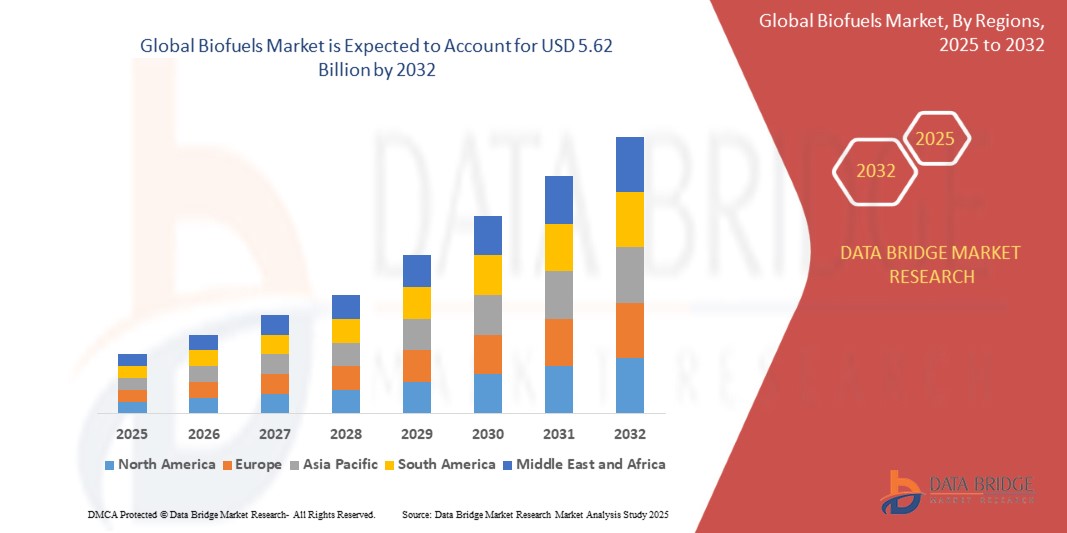

- The global biofuels market was valued at USD 3.27 billion in 2024 and is expected to reach USD 5.62 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 7.00%, primarily driven by increasing government mandates and policies promoting renewable energy

- This growth is driven by the rising concerns over carbon emissions, and the growing demand for sustainable fuel alternatives in transportation and industrial sectors

Biofuels Market Analysis

- Biofuels have gained widespread acceptance due to their renewable nature, lower carbon emissions, and versatility, driving demand in transportation, aviation, and industrial applications. Their ability to reduce reliance on fossil fuels, improve fuel efficiency, and support global sustainability goals has reinforced their significance in the energy transition

- The market is primarily driven by rising biodiesel and ethanol blending mandates, increasing investment in advanced biofuels, and supportive government policies promoting renewable energy adoption. In addition, technological advancements in algae-based biofuels, enzymatic hydrolysis, and waste-to-biofuel conversion are accelerating industry growth.

- For instance, in the U.S. and the E.U., demand for biofuels has surged due to higher biodiesel mandates, expanding adoption of sustainable aviation fuels (SAFs), and strong carbon reduction targets set by regulatory bodies

- Globally, biofuels continue to play a pivotal role in reducing greenhouse gas emissions, with innovations such as synthetic biofuels, lignocellulosic ethanol, and co-processing techniques driving market expansion and long-term sustainability

Report Scope and Biofuels Market Segmentation

|

Attributes |

Biofuels Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Biofuels Market Trends

“Expansion of Biofuels in Sustainable Aviation Fuel (SAF) Production”

- The growing demand for low-carbon aviation fuel is driving the expansion of biofuels in Sustainable Aviation Fuel (SAF) production, as airlines and governments seek to reduce carbon emissions and comply with net-zero targets

- Regulatory frameworks and financial incentives are accelerating investments in biorefineries, feedstock development, and advanced biofuel conversion technologies, ensuring a steady supply of SAF

- Innovations in waste-based feedstocks, algae-derived biofuels, and synthetic SAF production are enhancing the scalability and cost-effectiveness of bio-based aviation fuels

For instance,

- In February 2024, United Airlines partnered with Neste to scale up SAF adoption across its fleet, supporting its commitment to net-zero emissions by 2050

- In November 2023, the U.K. government introduced a USD 213.91 million SAF mandate to accelerate the development of domestic bio-based jet fuel production

- In August 2023, Airbus successfully tested a 100% SAF-powered flight, demonstrating the feasibility of biofuels as a primary aviation fuel alternative.

- As aviation decarbonization efforts intensify and the demand for sustainable fuel alternatives grows, biofuels will remain a critical enabler of net-zero emissions in the aviation industry, fostering long-term environmental and economic benefits

Biofuels Market Dynamics

Driver

“Growing Adoption of Biofuels in Marine Transportation”

- The global push for maritime decarbonization is driving the adoption of biofuels in marine transportation, helping the shipping industry reduce greenhouse gas (GHG) emissions and comply with stricter environmental regulations

- Shipping companies and fuel suppliers are investing in bio-based marine fuels, such as biodiesel and bio-methanol, to lower carbon footprints, improve fuel efficiency, and transition away from heavy fuel oils

- Regulatory bodies, including the International Maritime Organization (IMO), are implementing stricter emission limits, incentivizing the shift toward renewable and sustainable fuel alternatives in the maritime sector

For instance,

- In February 2024, Maersk launched its first container vessel powered by bio-methanol, reinforcing its commitment to carbon-neutral shipping by 2040

- In November 2023, Shell announced a partnership with CMA CGM to supply biodiesel-blended marine fuel, enabling lower-emission shipping operations

- In August 2023, the IMO introduced new carbon intensity targets for global shipping, mandating increased use of low-emission and bio-based fuels

- As sustainability becomes a priority in marine transportation, biofuels will continue to play a vital role in achieving net-zero emissions, ensuring compliance with global regulations, and supporting the industry's long-term environmental goals

Opportunity

“Increasing Investments in Biofuels for Hydrogen Production”

- The growing demand for clean hydrogen as a sustainable energy carrier is creating new opportunities for Biofuels as a feedstock for hydrogen production, reducing reliance on fossil-based hydrogen sources

- Biofuels-derived hydrogen is gaining traction in industrial applications, transportation, and power generation, offering a lower-carbon alternative to conventional hydrogen production methods such as steam methane reforming (SMR)

- Governments and energy companies are investing in bio-hydrogen projects, driven by net-zero targets, hydrogen economy expansion, and advancements in biofuel conversion technologies

For instance,

- In February 2024, BP announced plans to develop a bio-hydrogen production facility, leveraging biofuels as a sustainable hydrogen source for industrial and mobility applications

- In October 2023, Air Liquide partnered with a biofuel producer to scale up bio-based hydrogen production, enhancing its clean energy portfolio

- In August 2023, Japan’s government introduced new incentives for biofuels-to-hydrogen projects, supporting its national hydrogen strategy and decarbonization efforts

- As global hydrogen adoption accelerates, Biofuels will play a crucial role in diversifying hydrogen supply chains, enabling low-carbon fuel alternatives, and supporting the transition to a cleaner energy ecosystem.

Restraint/Challenge

“Limited Feedstock Availability Impacting Biofuels Production”

- The reliance on agricultural feedstocks such as corn, sugarcane, and vegetable oils creates supply chain constraints, especially during periods of crop shortages and climate-related disruptions

- Competing demands for food, animal feed, and biofuels further strain feedstock availability, leading to price volatility and challenges in securing a stable raw material supply

- Land use limitations, environmental concerns, and seasonal variations in biomass yield impact the scalability of Biofuels production, affecting long-term industry growth

For instance,

- In December 2023, European Biofuels producers reported production slowdowns due to lower-than-expected rapeseed harvests, increasing feedstock costs

- Overcoming feedstock constraints through diversification, waste-to-biofuels technologies, and advanced biofuel production methods will be critical to ensuring sustainable growth and long-term stability in the Biofuels market.

Biofuels Market Scope

The market is segmented on the basis of fuel type, application, form, and feedstock type.

|

Segmentation |

Sub-Segmentation |

|

By Fuel Type |

|

|

By Application |

|

|

By Form |

|

|

By Feedstock Type |

|

Biofuels Market Regional Analysis

“North America is the Dominant Region in the Biofuels Market”

- Strong government policies and renewable energy mandates are driving the widespread adoption of biofuels in the region

- The U.S. and Canada lead in biofuel production and consumption, supported by favorable subsidies, blending requirements, and investments in advanced biofuels

- The presence of key industry players, along with technological advancements in ethanol and biodiesel production, strengthens North America's position in the market

For instance,

- In January 2024, the U.S. Environmental Protection Agency (EPA) expanded its Renewable Fuel Standard (RFS), increasing biofuel blending mandates for transportation fuels.

- With continued policy support and advancements in biofuel technologies, North America will maintain its dominant position, driving innovation and sustainability in the global biofuels market.

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Rising energy demand, government initiatives promoting biofuels, and rapid industrialization are fueling market expansion across the region

- Countries such as India, China, and Indonesia are implementing aggressive biofuel policies, including higher ethanol blending mandates and investments in second-generation biofuels

- The expansion of feedstock availability, including sugarcane, corn, and waste biomass, is supporting large-scale biofuel production

For instance,

- In December 2023, India increased its ethanol blending target to 20% by 2025, accelerating domestic bioethanol production and reducing reliance on fossil fuels

- As APAC nations strengthen their renewable energy commitments, the region is set to lead biofuel market growth, driving energy security and environmental sustainability

Biofuels Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Neste (Netherlands)

- Infinita Biotech Private Limited (France)

- Marseglia Group SPA (Italy)

- Glencore (Switzerland)

- Louis Dreyfus Company (Netherlands)

- Chevron Corporation (U.S.)

- Renewable Biofuels (U.S.)

- AG Processing Inc (U.S.)

- Elevance Health (U.S.)

- Marathon Petroleum Corporation (U.S.)

- Evergreen Biofuels Holding Sdn Bhd (U.S.)

- Minnesota Soybean Processors (U.S.)

- CropEnergies AG (Germany)

- ENF Ltd. (U.K.)

Latest Developments in Global Biofuels Market

- In July 2023, Petrobras initiated testing on a B24 bio bunker fuel blend, using it to fuel a ship at the Rio Grande (RS) Terminal. The vessel, chartered by Transpetro, was supplied with 573,000 liters of fuel for performance evaluation

- In July 2023, Gevo, Inc. signed a Master Services Agreement (MSA) with a subsidiary of McDermott International, Ltd. to provide front-end engineering and early planning services for the development of multiple sustainable aviation fuel (SAF) facilities across North America

- In July 2023, Equilon Enterprises LLC, a subsidiary of Shell Plc, partnered with Green Plains Inc. to integrate Shell Fiber Conversion Technology (SFCT) with Fluid Quip Technologies’ precision separation and processing technology. This collaboration aims to enhance the value of Green Plains Inc.’s biorefinery platform

- In May 2023, Neste entered into a licensing agreement with ITOCHU, appointing it as the official distributor of Neste MY Renewable Diesel in Japan, strengthening its market presence in the region

- In February 2023, Neste inaugurated an Innovation Centre in Singapore, reinforcing its global R&D and innovation capabilities. This initiative underscores Asia’s significance as a key market for the company’s continued expansion in the Asia-Pacific region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Biofuels Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Biofuels Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Biofuels Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.