Global Propanol Market

Market Size in USD Billion

CAGR :

%

USD

4.06 Billion

USD

5.56 Billion

2024

2032

USD

4.06 Billion

USD

5.56 Billion

2024

2032

| 2025 –2032 | |

| USD 4.06 Billion | |

| USD 5.56 Billion | |

|

|

|

|

Propanol Market Analysis

The propanol market has witnessed significant growth in recent years, driven by the increasing demand for both Isopropanol and N-Propanol in various industries such as pharmaceuticals, chemicals, personal care, and industrial solvents. The rapid growth in sectors such as pharmaceuticals and cosmetics, coupled with the need for disinfectants in light of the COVID-19 pandemic, has resulted in a surge in demand for propanol products, particularly Isopropanol. Advancements in the bio-based production of propanol are also shaping the market, with companies focusing on sustainable technologies to reduce the environmental impact. Bio-propanol production from glycerine and other renewable resources is gaining traction, supported by collaborations between leading chemical companies such as BASF and Eni. These innovations aim to meet the growing demand while minimizing the carbon footprint. In conclusion, the Propanol Market is poised for further growth, driven by ongoing innovations, increased industrial demand, and the shift towards more sustainable production processes.

Propanol Market Size

The global propanol market size was valued at USD 4.06 billion in 2024 and is projected to reach USD 5.56 billion by 2032, with a CAGR of 4.00% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Propanol Market Trends

“Rising Demand for Bio-Based Propanol”

The propanol market is experiencing steady growth, driven by the increasing demand for both Isopropanol and N-Propanol across diverse sectors, including pharmaceuticals, cosmetics, industrial solvents, and chemicals. One prominent trend in the market is the rising demand for bio-based propanol, which is being fueled by environmental concerns and the shift toward sustainable production. Companies such as BASF and Eni are leading the way in developing bio-propanol from glycerine, a by-product of biodiesel production, which offers a more eco-friendly alternative to conventional fossil-based propanol. This trend aligns with global sustainability goals and caters to the growing consumer preference for green products. In addition, the demand for Isopropanol surged during the COVID-19 pandemic due to its widespread use in sanitizers and disinfectants. As the market evolves, the integration of sustainable technologies and the growing need for disinfectant products will continue to propel the growth of the propanol market.

Report Scope and Propanol Market Segmentation

|

Attributes |

Propanol Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Dow (U.S.), Bayer AG (Germany), DuPont (U.S.), BASF (Germany), Royal Dutch Shell Plc. (U.K.), Eastman Chemical Company (U.S.), MITSUI CHEMICALS AMERICA, INC (U.S.), CNPC (China), LG Chem (South Korea), OQ Chemicals GmbH (Germany), Kin Sang Chemical Limited (Hong Kong), ISU CHEMICAL (South Korea), Exxon Mobil Corporation (U.S.), JX Nippon Oil & Gas Exploration Corporation (Japan), OQ SAOC (Oman), and Tokuyama Corporation (Japan) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Propanol Market Definition

Propanol is an alcohol compound with the chemical formula C3H8O, existing in two primary forms: Isopropanol (Isopropyl alcohol) and N-Propanol (n-Propanol). Both forms are colorless, flammable liquids widely used as solvents, disinfectants, and in the production of various chemicals. Isopropanol is commonly used in hand sanitizers, cleaning products, pharmaceuticals, and as an industrial solvent, while N-Propanol is often used in the manufacture of plastics, paints, and coatings, and as an intermediate in chemical processes.

Propanol Market Dynamics

Drivers

- Increasing Demand in Pharmaceuticals and Healthcare

The increasing demand for propanol, particularly isopropyl alcohol (IPA), in pharmaceuticals and healthcare has been a significant market driver, especially with the rising focus on hygiene and sanitization. During the COVID-19 pandemic, isopropanol became a key ingredient in hand sanitizers, disinfectants, and antiseptics, as it is highly effective in killing bacteria and viruses. This surge in demand was driven by global health measures aimed at preventing the spread of the virus, resulting in increased production of sanitizing products for both healthcare settings and households. Even post-pandemic, the growing awareness about personal hygiene and the importance of sanitation in preventing infections has sustained this demand. For instance, healthcare institutions and pharmaceutical companies continue to use isopropanol in sterilization processes, wound care, and skin antiseptics. The ongoing emphasis on cleanliness in both public and private sectors, coupled with the expansion of healthcare infrastructure in emerging markets, continues to propel the demand for propanol, making it a critical component in public health efforts. This rising demand from the healthcare industry directly supports the growth of the propanol market, positioning it as a key driver for future market expansion.

- Increasing Industrial Growth

Industrial growth plays a crucial role in driving the propanol market, as the demand for propanol in industries such as paints, coatings, printing inks, and chemical manufacturing continues to rise. In the paint and coatings sector, propanol is widely used as a solvent in both solvent-based and water-based formulations due to its ability to dissolve a variety of chemicals. In addition, propanol is used as a chemical intermediate in the production of acetone, a key ingredient in the manufacture of plastics, adhesives, and other chemicals. For instance, Isopropanol is converted into acetone in the chemical industry, contributing to its widespread use in multiple manufacturing processes. The increasing industrial production in sectors such as automotive, construction, and consumer goods further propels the need for propanol-based products, positioning industrial growth as a major market driver.

Opportunities

- Growing Consumer Goods Sector

The growing consumer goods sector presents a significant market opportunity for propanol, particularly isopropyl alcohol, which is widely used in the formulation of cosmetics, personal care products, and cleaning agents. As consumer spending increases and awareness about hygiene and personal care rises, the demand for these products has steadily grown. For instance, isopropanol is commonly found in products such as facial cleansers, makeup removers, deodorants, and shampoos, due to its solvent properties and effectiveness in killing germs. In addition, isopropanol is a key ingredient in household cleaning products such as surface disinfectants, which are increasingly in demand as consumers prioritize cleanliness and sanitation. This trend is particularly evident in the wake of the pandemic, where consumers have heightened their focus on hygiene and self-care. As disposable incomes rise, especially in emerging markets, the expanding middle class is driving the demand for higher-quality personal care products and cleaning solutions, further boosting the propanol market. The consumer goods sector’s sustained growth, coupled with shifting consumer preferences towards more hygienic and high-performance products, presents a compelling market opportunity for propanol producers to meet evolving demand.

- Increasing Technological Advancements

Technological advancements in propanol production are playing a crucial role in expanding the market. Innovations such as the development of more efficient manufacturing technologies and sustainable production methods, such as the use of bio-based feedstocks, are significantly improving the cost-effectiveness and scalability of propanol production. For instance, BASF and Eni have collaborated on a project to produce bio-propanol from glycerine, a by-product of biodiesel production, using a catalytic hydro-treatment process. This advancement lowers production costs and reduces the environmental impact, meeting the growing demand for sustainable chemicals. As more companies adopt these technologies, the ability to produce higher quantities of propanol at lower costs will drive market expansion, providing a significant opportunity for companies to capture new market share while meeting the rising demand across industries such as pharmaceuticals, personal care, and chemical manufacturing.

Restraints/Challenges

- Toxicity and Safety Regulations

Toxicity and safety regulations present a significant challenge to the propanol market, particularly for isopropyl alcohol, which is flammable and toxic when ingested or inhaled in large quantities. Strict regulatory frameworks are enforced across various industries, including pharmaceuticals, cosmetics, and cleaning products, to ensure the safe handling and use of propanol-based products. For instance, in the U.S., the Occupational Safety and Health Administration (OSHA) sets stringent workplace safety standards for the exposure limits of isopropyl alcohol, while the European Union's REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation places limits on its use and mandates detailed labeling for products containing isopropanol. These regulations, while essential for consumer and worker safety, can increase production costs for manufacturers, as they must invest in compliance measures such as safety testing, proper labeling, and secure packaging. In addition, regulatory requirements can limit the ways isopropanol is used in certain products, especially in consumer goods such as cosmetics, where overexposure could lead to skin irritation or other health issues. This adds to the cost of manufacturing and affects the scope of propanol's applications, making safety regulations a key challenge for the market. Manufacturers may face delays in product approvals or restrictions in certain markets, thus influencing production and pricing strategies.

- Fossil Fuels as a Source for Propanol

Sourcing propanol from fossil fuels remains a significant market challenge, as the majority of its production relies on petrochemical feedstocks such as propylene, which contribute to its carbon footprint and environmental impact. This dependency on fossil fuels raises concerns in the context of the global push toward sustainability and green chemistry, where there is increasing pressure on industries to reduce their reliance on non-renewable resources. For instance, the carbon emissions associated with propanol production from fossil fuels contribute to climate change and place manufacturers at risk of falling behind in meeting stricter environmental regulations, such as those set by the Paris Agreement or the EU's Green Deal. Although efforts to develop bio-based propanol produced from renewable resources such as biomass or agricultural waste—are underway, these alternatives are still in the experimental phase and face significant scalability challenges. The production of bio-based propanol remains expensive and inefficient compared to conventional petrochemical processes, making it difficult for manufacturers to transition away from fossil fuels without incurring substantial costs. As sustainability becomes a key driver of consumer and regulatory demands, manufacturers face growing pressure to adopt greener alternatives, presenting a challenge for the propanol market to balance environmental concerns with economic feasibility.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions. Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Propanol Market Scope

The market is segmented on the basis of type, application, and end use. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Isopropanol

- Direct Solvent

- Chemical Intermediate

- Pharmaceuticals

- Household and Personal Care

- Other

- N-Propanol

- Chemical Intermediate

- Direct Solvent

- Others

Application

- Chemical Intermediates

- Pharmaceuticals

- Industrial Solvents

- Others

End Use

- Pharmaceuticals

- Chemicals

- Personal Care

- Printing Inks

- Paints and Coatings

- Others

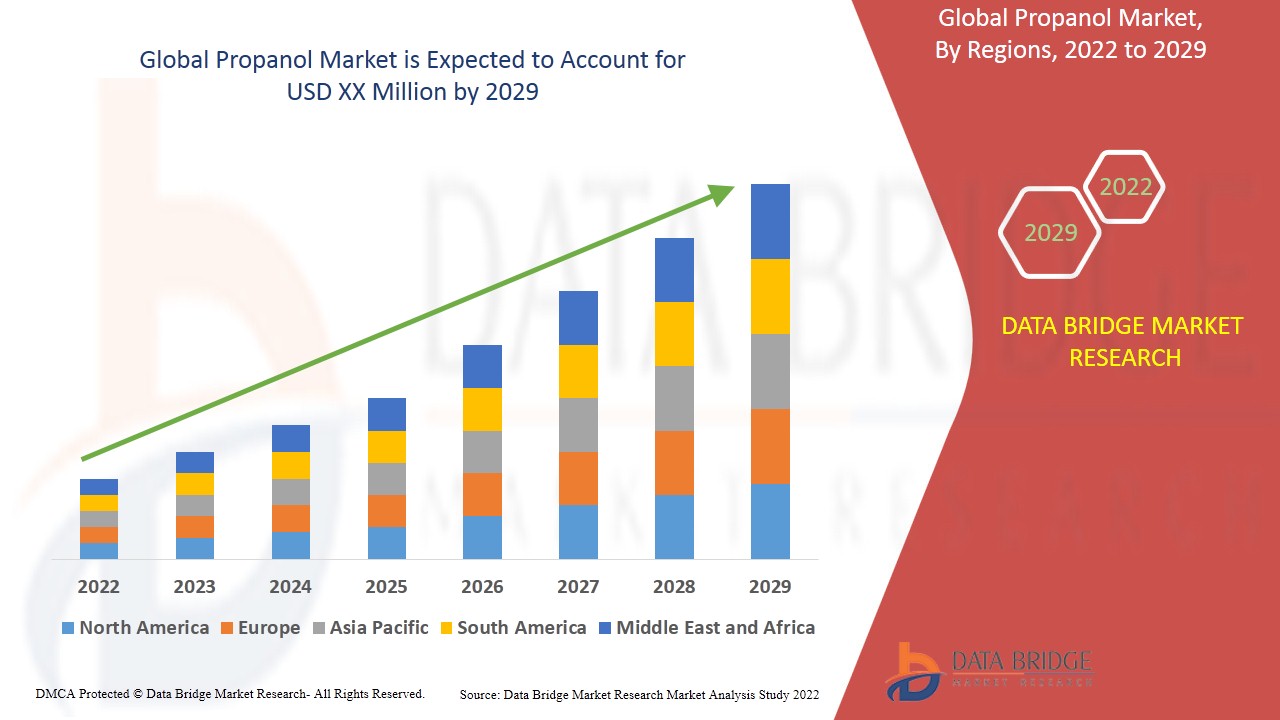

Propanol Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, type, application, and end use as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific is expected to maintain its dominant position in the propanol market and continue to expand its share throughout the forecast period, primarily driven by the growing demand for propanol and its derivatives in countries such as China, India, and South Korea. The rapid pace of infrastructure development and the robust pharmaceutical industry in the region are key factors propelling this growth. In addition, government initiatives aimed at increasing the production of sanitizers, particularly in response to the COVID-19 pandemic, are further boosting demand for propanol. As these economies continue to industrialize and invest in public health, the consumption of propanol is expected to rise steadily across multiple sectors.

Europe has been experiencing the steadily growth, driven by its widespread use in industries such as specialty chemicals and pharmaceuticals. Consumption of propanol has surged rapidly, primarily due to the heightened demand for sanitizers amid the ongoing health concerns. This large-scale consumption has led to a shortage of isopropyl alcohol, creating challenges in meeting market needs. In response, many companies in the region are optimizing their raw material supply chains and refining their production processes to ensure a steady supply of isopropyl alcohol, helping to stabilize the market and meet the growing demand.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Propanol Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Propanol Market Leaders Operating in the Market Are:

- Dow (U.S.)

- Bayer AG (Germany)

- DuPont (U.S.)

- BASF (Germany)

- Royal Dutch Shell Plc. (U.K.)

- Eastman Chemical Company (U.S.)

- MITSUI CHEMICALS AMERICA, INC (U.S.)

- CNPC (China)

- LG Chem (South Korea)

- OQ Chemicals GmbH (Germany)

- Kin Sang Chemical Limited (Hong Kong)

- ISU CHEMICAL (South Korea)

- Exxon Mobil Corporation (U.S.)

- JX Nippon Oil & Gas Exploration Corporation (Japan)

- OQ SAOC (Oman)

- Tokuyama Corporation (Japan)

Latest Developments in Propanol Market

- In April 2023, Oxea increased its 1-propanol production capacity in Europe by three times to meet the high demand from manufacturers of hand sanitizers and the printing industry. In this expansion, the company will be able to efficiently fulfill customer requirements

- In September 2023, Ningbo Juhua Chemical began operations at its new 1-propanol plant, which has an annual production capacity of 50 kilotons. In addition to 1-propanol, the plant will also manufacture products such as propionaldehyde, positioning the company to enter new markets

- In August 2021, Italian oil and gas company Eni partnered with German chemical and biotech leader BASF to produce bio-propanol from glycerine. In this joint R&D project, the aim was to develop a new technology that converts glycerine, a by-product of biodiesel production, into advanced bio-propanol with high yield and purity

- In July, 2021, BASF SE announced a joint research and development initiative with Eni to reduce the CO2 footprint of the transportation sector. In this partnership, they focus on developing sustainable technologies to produce bio-propanol from industrial residues

- In June, 2020, Sasol announced the start of operations at the Guerbet alcohol unit within the Lake Charles Chemicals Project (LCCP). In this development, the introduction of Ziegler and Guerbet alcohols strengthens Sasol's position as a global leader in integrated alcohols and surfactants

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Propanol Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Propanol Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Propanol Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.