Global Black Tea Extract Market

Market Size in USD Billion

CAGR :

%

USD

145.26 Billion

USD

225.49 Billion

2024

2032

USD

145.26 Billion

USD

225.49 Billion

2024

2032

| 2025 –2032 | |

| USD 145.26 Billion | |

| USD 225.49 Billion | |

|

|

|

|

Black Tea Extract Market Size

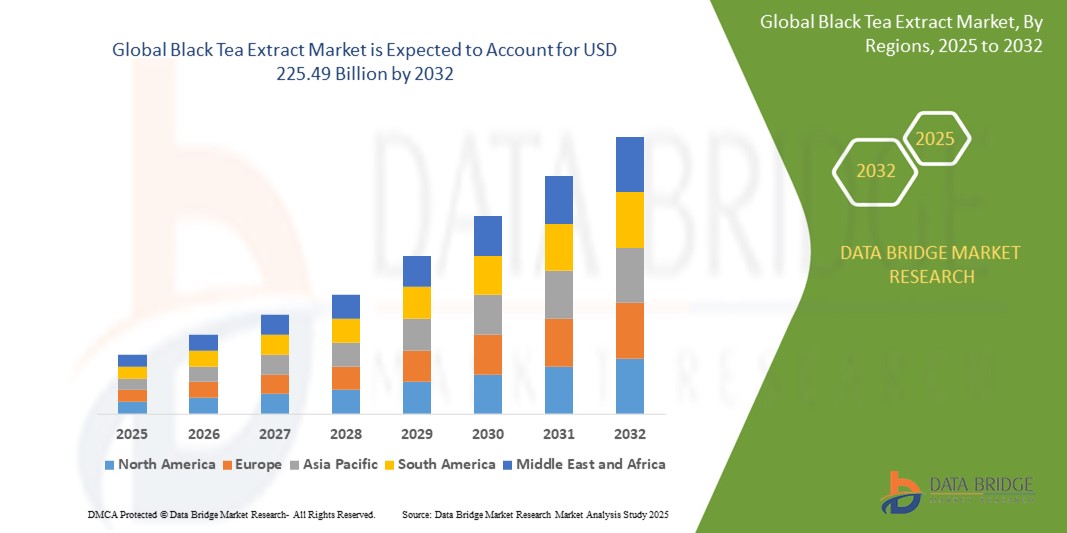

- The global black tea extract market size was valued at USD 145.26 billion in 2024 and is expected to reach USD 225.49 billion by 2032, at a CAGR of 5.65% during the forecast period

- The market growth is largely fuelled by the increasing consumer preference for natural antioxidants and rising demand in the food and beverage industry

- In addition, the growing awareness of health benefits associated with black tea extract, such as improved heart health and weight management, supports market expansion

Black Tea Extract Market Analysis

- The global black tea extract market is growing steadily as more consumers incorporate it into their diets due to its rich antioxidant properties and potential health benefits such as improved cardiovascular health and metabolism support.

- The increasing use of black tea extract in functional foods and beverages is expanding its application across various industries including cosmetics and pharmaceuticals

- North America dominated the black tea extract market with the largest revenue share of 35.7% in 2024, driven by increasing consumer demand for natural health supplements and plant-based beauty products in the U.S. and Canada

- The Asia-Pacific region is expected to witness the highest growth rate in the global black tea extract market, driven by rising health awareness, expanding urban populations, and increased adoption of natural dietary supplements

- The powder segment held the largest revenue share of 44.3% in 2024, driven by its extended shelf life, ease of transport, and compatibility with a wide range of end-use applications such as dietary supplements and functional foods. Powdered extracts are also favored for their ability to retain high concentrations of polyphenols and catechins, offering potent antioxidant properties

Report Scope and Black Tea Extract Market Segmentation

|

Attributes |

Black Tea Extract Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Black Tea Extract Market Trends

“Rising Demand for Natural Ingredients in Functional Beverages”

- Consumers are increasingly favoring beverages made with natural and plant-based ingredients, and black tea extract is gaining popularity for its perceived health benefits and clean-label appeal

- Functional beverage manufacturers are incorporating black tea extract due to its rich content of antioxidants such as theaflavins and polyphenols, which are believed to support immunity and metabolism

- For instance, companies such as Unilever and PepsiCo have introduced ready-to-drink teas and health drinks using black tea extracts to cater to wellness-focused consumers

- The trend aligns with the broader clean-label movement, where consumers seek transparency in sourcing, production, and composition of ingredients in their drinks

- In another instance, wellness brands have launched energy and detox drinks based on black tea extract, positioning them as healthier alternatives to synthetic caffeine and sugar-laden beverages

Black Tea Extract Market Dynamics

Driver

“Growing Health Consciousness Among Consumers”

- Consumers are becoming more health conscious and are actively seeking natural ingredients with added functional benefits, such as black tea extract found in wellness teas and detox drinks from brands such as Yogi and Traditional Medicinals

- Black tea extract is valued for its high content of polyphenols, catechins, and theaflavins, which contribute to its antioxidant and cardiovascular health benefits, commonly used in supplements marketed by companies such as GNC and Nature’s Way

- There is a notable shift away from sugary beverages, with black tea-infused drinks gaining popularity as healthier alternatives

- For instance, brands such as Lipton and Tazo have launched ready-to-drink black tea beverages with reduced sugar content to meet this demand

- The rise of fitness culture and preventive health awareness is driving demand for plant-based extracts, encouraging the addition of black tea extract to daily dietary routines through functional beverages and protein blends

- For instance, black tea extract is now included in pre-workout drinks and meal replacement shakes marketed for fitness enthusiasts by brands such as Herbalife and Vega

- Innovation in product formats, including black tea gummies and tonics, is expanding the market reach by appealing to younger consumers and those seeking convenience

Restraint/Challenge

“Supply Chain and Raw Material Volatility”

- One of the primary challenges in the black tea extract market is the fluctuation in raw material availability and cost, largely due to climate-sensitive agricultural dependence

- Tea leaf production is highly vulnerable to unpredictable weather, pest outbreaks, and labor shortages, often causing inconsistent yields and variable extract quality

- For instance, droughts in key regions of Assam, India, and pest infestations in Sri Lanka have significantly reduced crop yields in recent years

- Global supply chain disruptions—triggered by geopolitical tensions, trade restrictions, or logistical bottlenecks—can further affect the steady flow of black tea extracts

- For instance, port delays during political unrest in Kenya have impacted black tea export timelines, disrupting international supply chains

- Countries such as India, Sri Lanka, and Kenya dominate black tea production, making the market highly sensitive to regional instabilities

- Processing black tea extract requires specialized facilities and stringent quality checks, and any disruption in these processes can delay product delivery and increase operational costs for manufacturers

Black Tea Extract Market Scope

The market is segmented on the basis of form, type, and application.

- By Form

On the basis of form, the black tea extract market is segmented into powder, liquid, and encapsulated. The powder segment held the largest revenue share of 44.3% in 2024, driven by its extended shelf life, ease of transport, and compatibility with a wide range of end-use applications such as dietary supplements and functional foods. Powdered extracts are also favored for their ability to retain high concentrations of polyphenols and catechins, offering potent antioxidant properties.

The liquid segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by its ease of integration into beverages and its high bioavailability. Manufacturers prefer liquid extracts for ready-to-drink teas and concentrated health tonics, while consumers appreciate the convenience of quick consumption without further processing.

- By Type

On the basis of type, the black tea extract market is segmented into hot water soluble (HWS) and cold water soluble (CWS). The hot water-soluble segment held the largest market share of 57.1% in 2024, driven by its extensive use in traditional tea blends and health beverages. This type is highly favored in applications where high-temperature processing or infusion is standard, offering clear solubility and robust flavor retention.

The cold-water soluble segment is expected to witness the fastest growth rate from 2025 to 2032, owing to its growing demand in ready-to-drink beverages and instant mixes. Its quick-dissolving nature without the need for heat makes it ideal for convenience-focused product lines such as iced teas and functional drinks.

- By Application

On the basis of application, the black tea extract market is segmented into beverages, functional food, cosmetics and beauty supplements, dietary supplements, and others. The beverages segment dominated the market with the largest revenue share of 33% in 2024, due to the strong consumer preference for natural, antioxidant-rich drinks. Black tea extract is widely used in bottled teas, energy drinks, and health shots to enhance both nutritional and sensory profiles.

The cosmetics and beauty supplements segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing awareness of skin health and anti-aging benefits. Black tea extract, rich in antioxidants and anti-inflammatory compounds, is being incorporated into creams, serums, and nutricosmetics to support healthy skin and reduce oxidative stress.

Black Tea Extract Market Regional Analysis

- North America dominated the black tea extract market with the largest revenue share of 35.7% in 2024, driven by increasing consumer demand for natural health supplements and plant-based beauty products in the U.S. and Canada

- The region’s well-established dietary supplement and functional food industries, coupled with growing wellness trends, support the rising adoption of black tea extracts across various applications

- High disposable incomes and expanding e-commerce channels further facilitate market penetration and product availability to health-conscious consumers

U.S. Black Tea Extract Market Insight

The U.S. accounted for the largest share of the North American market in 2024, propelled by rising consumer awareness of the antioxidant and health benefits of black tea extract. The growing preference for organic and clean-label products is encouraging manufacturers to introduce innovative black tea extract formulations in beverages, dietary supplements, and cosmetics. In addition, partnerships between brands and wellness influencers are helping expand market reach.

Asia-Pacific Black Tea Extract Market Insight

The Asia-Pacific is expected to witness the fastest growth rate from 2025 to 2032, due to strong tea-drinking cultures and increasing health awareness in countries such as India, China, and Japan. The region benefits from the presence of major tea-producing countries, which supports raw material availability and cost-effective production, allowing for product innovation and broader consumer adoption. Rising disposable incomes and government initiatives promoting traditional wellness products are further boosting demand in both domestic and export markets.

China Black Tea Extract Market Insight

The China’s market is expanding due to rising health-consciousness and government support for natural and functional ingredients in food and personal care products. Advancements in extraction technology and quality standards also play a vital role in improving product offerings and boosting consumer confidence.

Japan Black Tea Extract Market Insight

The Japan’s market growth is fuelled by a strong cultural affinity for tea and rising demand for antioxidant-rich beauty supplements and functional beverages. The aging population in Japan also drives demand for health-promoting ingredients such as black tea extract in cosmetics and dietary products.

Europe Black Tea Extract Market Insight

The Europe holds a steady market share driven by increasing demand for organic and clean-label health products, with key markets such as Germany and the U.K. showing strong adoption across dietary supplements and cosmetics. Consumers in Europe are increasingly focused on preventive healthcare, which supports consistent growth of black tea extract in functional foods and beverages.

Germany Black Tea Extract Market Insight

The Germany’s market is growing steadily due to increasing consumer interest in natural and organic health products, especially in dietary supplements and functional foods. The country’s well-developed healthcare sector and emphasis on preventive wellness are encouraging the integration of black tea extract in various personal care and food products. In addition, growing awareness of antioxidant benefits is supporting demand across different applications.

U.K. Black Tea Extract Market Insight

The U.K. market is expanding with rising popularity of clean-label and plant-based ingredients in beverages and cosmetics. Consumers’ increasing focus on health and wellness, combined with a robust retail and e-commerce infrastructure, facilitates easy access to black tea extract products. The growing trend of functional foods and natural supplements is driving market growth, supported by innovative product launches targeting diverse consumer segments.

Black Tea Extract Market Share

The Black Tea Extract industry is primarily led by well-established companies, including:

- Synthite Industries Ltd. (India)

- Martin Bauer Group (Germany)

- Tata Consumer Products (India)

- Cymbio Pharma Pvt Ltd (India)

- Kemin Industries, Inc. (U.S.)

- AVT (India)

- Nestlé (Switzerland)

- Haldin (Indonesia)

- Phyto Life Sciences P. Ltd. (India)

- Vidya Herbs Pvt Ltd. (India)

- FIRSD TEA (China)

- Associated British Foods plc (U.K.)

- Finlays (U.K.)

- BLUEBERRY AGRO (India)

- ADM (U.S.)

- Apex Flavors (U.S.)

- Harrisons Malayalam Ltd. (India)

- HÄLSSEN & LYON (Germany)

- Taiyo International (Japan)

- Indena S.p.A. (Italy)

- Dupont (U.S.)

Latest Developments in Global Black Tea Extract Market

- In January 2024, Organic India launched a new range of Assam Black Teas, offering diverse flavor profiles and organic health benefits. This product development aims to cater to health-conscious tea consumers by leveraging the antioxidant-rich nature of black tea. The move enhances the brand’s organic product portfolio and supports the growing preference for clean-label beverages, positively influencing consumer trust and expanding its market share

- In June 2023, Clipper Tea introduced a line of trendy, ethically sourced black teas designed to attract younger, experience-driven consumers. This strategic product expansion blends sustainability with high-quality ingredients, reinforcing the brand’s B-Corp values. The initiative is expected to strengthen its appeal in the premium tea segment and boost its presence among eco-conscious, modern tea drinkers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Black Tea Extract Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Black Tea Extract Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Black Tea Extract Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.