Global Bloodstream Infection Testing Market

Market Size in USD Billion

CAGR :

%

USD

1.20 Billion

USD

1.87 Billion

2024

2032

USD

1.20 Billion

USD

1.87 Billion

2024

2032

| 2025 –2032 | |

| USD 1.20 Billion | |

| USD 1.87 Billion | |

|

|

|

|

Bloodstream Infection Testing Market Analysis

The bloodstream infection testing market is critical in diagnosing and managing sepsis and other life-threatening infections, which are leading causes of morbidity and mortality worldwide. With advancements in diagnostic technologies, the market has seen significant progress, particularly in rapid diagnostics and early detection. Traditional culture-based methods are being increasingly replaced by molecular diagnostic techniques, such as PCR and nucleic acid testing, which offer faster, more accurate results. The growing demand for Point-of-Care (POC) testing devices and automation in diagnostics further enhances the market's expansion, providing faster results in critical care settings. Key advancements in the market include the development of high-throughput systems, multiplex assays, and advanced platforms such as mass spectrometry, which enable the detection of a wide range of pathogens in a single test. Furthermore, AI and machine learning technologies are being integrated into diagnostic tools to improve accuracy and predictive analytics. The global rise in hospital-acquired infections, the increasing prevalence of chronic diseases, and the growing awareness about the importance of early infection detection are major drivers for the market. North America leads the market, while regions such as Asia-Pacific are expected to witness the highest growth due to improved healthcare infrastructure and rising medical investments.

Bloodstream Infection Testing Market Size

The global bloodstream infection testing market size was valued at USD 1.20 billion in 2024 and is projected to reach USD 1.87 billion by 2032, with a CAGR of 5.76% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Bloodstream Infection Testing Market Trends

“Growing Adoption of Molecular Diagnostic Techniques”

One key trend in the bloodstream infection testing market is the growing adoption of molecular diagnostic techniques, such as PCR and next-generation sequencing (NGS), which provide faster and more accurate results compared to traditional culture methods. These advancements are crucial for the timely detection of pathogens causing bloodstream infections, enabling prompt and targeted treatment. For instance, the T2 Biosystems T2Candida panel, which uses PCR technology, allows for the rapid identification of Candida species in blood samples, significantly reducing diagnostic time and improving clinical outcomes in sepsis patients. The shift toward molecular methods is driven by the increasing demand for rapid diagnostics, particularly in critical care settings where timely intervention is essential. In addition, the rise of Point-of-Care (POC) testing systems, which provide on-site diagnostics, is further enhancing the market's growth. With the continuous improvements in testing technologies, the bloodstream infection testing market is witnessing a transformation towards faster, more reliable, and patient-centric solutions.

Report Scope and Bloodstream Infection Testing Market Segmentation

|

Attributes |

Bloodstream Infection Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Thermo Fisher Scientific Inc. (U.S.), F. Hoffmann-La Roche Ltd (Switzerland), Abbott (U.S.), BD (U.S.), BIOMÉRIEUX (France), Beckman Coulter, Inc. (U.S.), Babson Diagnostics (U.S.), Diazyme Laboratories (U.S.), Cepheid (U.S.), DiaSorin S.p.A. (Italy), Accelerate Diagnostics, Inc. (U.S.), InBios International, Inc. (U.S.), QuidelOrtho Corporation (U.S.), OpGen (U.S.), Bruker (Germany), Grifols, S.A. (Spain), and Danaher (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Bloodstream Infection Testing Market Definition

Bloodstream infection testing refers to diagnostic procedures used to identify the presence of infectious pathogens, such as bacteria, fungi, or viruses, in the bloodstream. These infections, which can lead to conditions such as sepsis, are life-threatening and require rapid detection for effective treatment. Blood cultures, molecular tests (such as PCR), and other diagnostic techniques such as mass spectrometry or nucleic acid testing are commonly used to detect pathogens in blood samples. The goal of bloodstream infection testing is to quickly identify the causative microorganisms, enabling timely and appropriate treatment to improve patient outcomes and prevent complications.

Bloodstream Infection Testing Market Dynamics

Drivers

- Rising Incidence of Sepsis and Infectious Diseases

The rising incidence of sepsis and infectious diseases is a significant driver of the bloodstream infection testing market. Sepsis, a severe and often fatal response to infection, is responsible for an estimated 11 million deaths annually worldwide, making it one of the leading causes of mortality. The prevalence of sepsis is particularly high among individuals with underlying conditions such as diabetes, cancer, and immunocompromised states, which have become more common globally. For instance, the World Health Organization (WHO) reports that over 30 million people worldwide suffer from sepsis each year, and its incidence is expected to increase as population’s age. As a result, there is a growing demand for rapid and accurate diagnostic tools, such as PCR-based tests and multiplex assays, to detect bloodstream infections early and ensure timely, targeted treatments. This increasing need for efficient diagnostic solutions is propelling the market growth, particularly in critical care settings, where sepsis is most prevalent.

- Increasing Prevalence of Hospital-Acquired Infections (HAIs)

The increasing prevalence of hospital-acquired infections (HAIs) is a major factor driving the demand for more effective bloodstream infection testing. According to the Centers for Disease Control and Prevention (CDC), approximately 1 in 31 hospital patients in the U.S. has at least one HAI on any given day, with bloodstream infections being one of the most common types. These infections are associated with longer hospital stays, increased medical costs, and higher patient mortality rates. For instance, bloodstream infections alone are responsible for approximately 250,000 cases and 40,000 deaths annually in the U.S. As healthcare systems worldwide continue to combat the growing burden of HAIs, there is a pressing need for faster, more accurate diagnostic tools to identify pathogens and initiate targeted treatments quickly. This surge in demand for early and reliable detection is driving the development and adoption of advanced diagnostic solutions, such as rapid PCR tests and point-of-care devices, thereby fostering market growth.

Opportunities

- Rising Demand for Rapid Point-of-Care (POC) Testing

The rising demand for rapid point-of-care (POC) testing is a significant market opportunity, particularly in emergency and critical care settings where timely diagnosis is crucial for effective treatment. POC testing systems, which provide fast and accurate results at or near the patient’s bedside, are becoming increasingly popular due to their ability to shorten diagnostic turnaround times, allowing clinicians to initiate treatment immediately. For instance, the use of the T2Candida Panel, a POC PCR-based test, enables the rapid identification of fungal infections in bloodstream samples within hours, which is critical for sepsis management. As the need for immediate diagnostic insights grows, especially in sepsis and other life-threatening infections, POC testing technologies are expected to see broader adoption across hospitals and urgent care centers. This shift is driven by the growing emphasis on improving patient outcomes, reducing hospital stays, and lowering healthcare costs, creating a valuable opportunity for companies offering innovative POC diagnostic solutions to expand their market presence.

- Increasing Improvement of Healthcare Infrastructure

The improvement of healthcare infrastructure, particularly in emerging markets, is creating significant growth opportunities in the bloodstream infection testing market. As countries such as India, China, and parts of Africa make substantial investments in healthcare facilities and diagnostic technologies, access to advanced diagnostic tools is expanding, driving the adoption of rapid and accurate testing solutions. For instance, the introduction of molecular diagnostics and POC testing devices in hospitals across these regions is improving early detection of infections, which is critical for reducing mortality rates and improving patient outcomes. In India, the government’s initiatives to enhance healthcare access through schemes such as the National Health Protection Scheme have led to increased availability of diagnostic tools in rural and underserved areas. As healthcare infrastructure continues to improve in these regions, there is a growing market for diagnostic companies to supply innovative testing solutions, positioning the sector for substantial growth as demand for effective infection management increases.

Restraints/Challenges

- High Cost of Diagnostic Technologies

The high cost of diagnostic technologies is a major barrier to the widespread adoption of advanced methods for bloodstream infection (BSI) testing, particularly in resource-constrained healthcare settings. Technologies such as molecular testing, PCR, and next-generation sequencing (NGS) offer fast and accurate results, but their high price tags make them inaccessible for many hospitals and clinics, especially in low- and middle-income countries. For instance, PCR systems, which are commonly used for pathogen detection, can cost tens of thousands of dollars, and the ongoing expenses for maintenance, reagents, and staff training add further financial burdens. This limits the ability of healthcare providers to implement these advanced diagnostic methods, forcing them to rely on slower and less accurate traditional testing methods such as blood cultures, which can take several days to yield results. Consequently, this high cost of diagnostic technologies stifles innovation, reduces diagnostic accessibility, and delays the proper treatment of bloodstream infections, making it a significant challenge for the global bloodstream infection testing market.

- Regulatory and Standardization Issues

Regulatory and standardization issues present a significant challenge in the bloodstream infection (BSI) testing market, as varying approval requirements across different regions can delay the introduction of innovative diagnostic technologies. For instance, while a new diagnostic device might receive approval from the U.S. Food and Drug Administration (FDA), it may face additional scrutiny and lengthy approval processes in other regions, such as Europe or Asia, due to differing regulatory standards. These inconsistencies can hinder the global distribution of life-saving technologies, as companies may need to conduct multiple rounds of clinical trials or meet different quality standards for each market. Moreover, the lack of standardized guidelines for testing methods and equipment can create confusion, leading to disparities in diagnostic accuracy and patient outcomes. As a result, healthcare providers may face difficulties in choosing the right diagnostic tools, and manufacturers may struggle to achieve market penetration in multiple regions simultaneously. This regulatory complexity delays the development and accessibility of new technologies and raises costs for companies, further limiting innovation in the BSI testing market. Addressing these regulatory and standardization issues is essential to streamline market entry and enhance global healthcare outcomes.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Bloodstream Infection Testing Market Scope

The market is segmented on the basis of product, technique, technology, application, type, and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Consumables

- Instruments

- Software

Technique

- Conventional

- PCR Methods

- Nucleic Acid Testing

- Mass Spectroscopy

- POC (Point-of-Care) Testing

Technology

- Culture-based

- Molecular Proteomic

Application

- Hospital Acquired

- Community Based

Type

- Bacterial

- Fungal

- Mycobacterial

End User

- Hospitals

- Healthcare Centers

- Laboratories

- Independent Diagnostic Centers

- Research or Academic Institutes

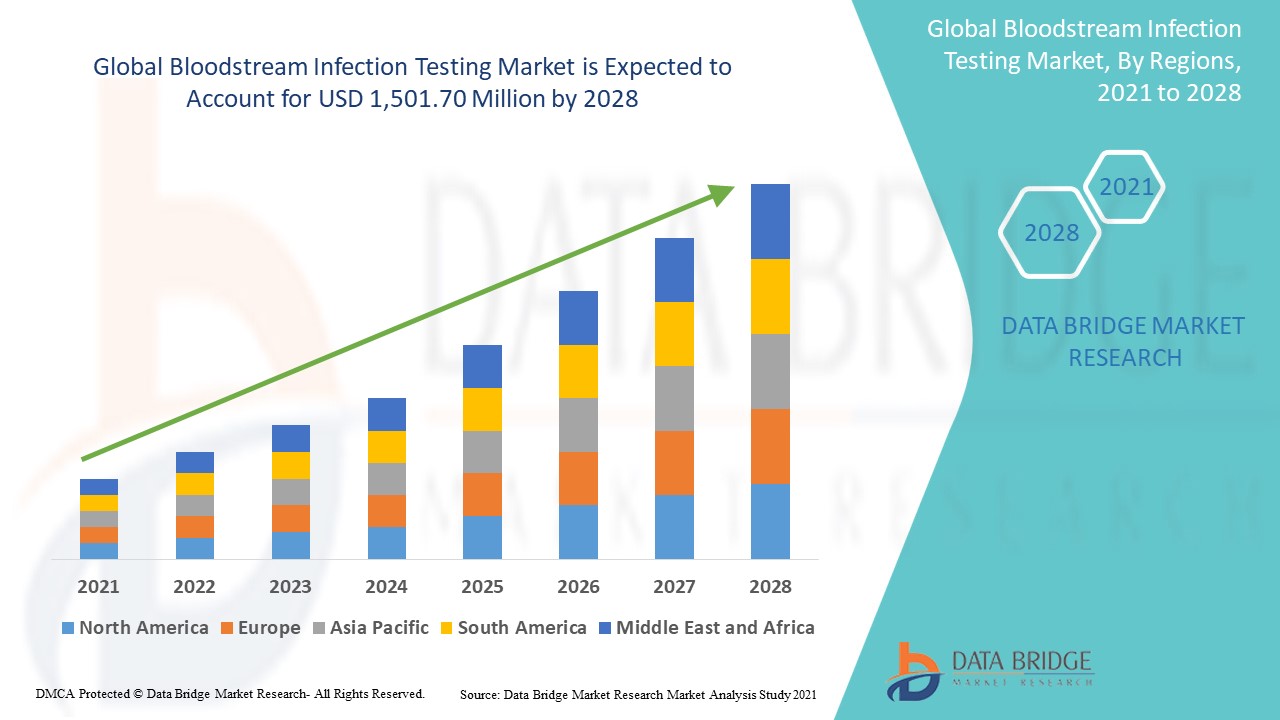

Bloodstream Infection Testing Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, product, technique, technology, application, type, and end user as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the bloodstream infection testing market due to the high demand for diagnostic instruments in hospitals, driven by the increasing prevalence of conditions such as sepsis, chronic diseases, HIV, pneumonia, and various infections. The region’s advanced healthcare infrastructure and readily available medical facilities further contribute to its leadership in the market. In addition, a growing awareness of the importance of early detection and timely treatment has amplified the need for bloodstream infection testing. These factors collectively make North America the most prominent region in this sector.

Asia-Pacific is emerging as a high-growth market for bloodstream infection testing, with projections indicating it will register the highest compound annual growth rate (CAGR) from 2025 to 2032. This growth is driven by increasing awareness of infectious diseases, a large and growing population, and significant improvements in healthcare infrastructure. In addition, ongoing medical investments and government initiatives to enhance healthcare access are further fueling market expansion. These factors position Asia-Pacific as a key region for the future development of bloodstream infection diagnostics.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Bloodstream Infection Testing Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Bloodstream Infection Testing Market Leaders Operating in the Market Are:

- Thermo Fisher Scientific Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Abbott (U.S.)

- BD (U.S.)

- BIOMÉRIEUX (France)

- Beckman Coulter, Inc. (U.S.)

- Babson Diagnostics (U.S.)

- Diazyme Laboratories (U.S.)

- Cepheid (U.S.)

- DiaSorin S.p.A. (Italy)

- Accelerate Diagnostics, Inc. (U.S.)

- InBios International, Inc. (U.S.)

- QuidelOrtho Corporation (U.S.)

- OpGen (U.S.)

- Bruker (Germany)

- Grifols, S.A. (Spain)

- Danaher (U.S.)

Latest Developments in Bloodstream Infection Testing Market

- In October 2022, BD, a global medical technology company, and Magnolia Medical Technologies, Inc. entered a commercial agreement aimed at helping U.S. hospitals reduce blood culture contamination. This collaboration seeks to enhance testing accuracy and improve clinical outcomes by preventing contamination

- In August 2022, Immunexpress, Pty Ltd., a molecular diagnostic company, launched the SeptiCyte RAPID EDTA blood-compatible cartridges in Europe. This new, advanced cartridge is the first-to-market host response technology that uses undiluted EDTA blood as a validated sample type, marking a significant development in sepsis diagnostics

- In July 2022, T2 Biosystems, Inc., a leader in the early detection of sepsis-causing antibiotic resistance genes and microorganisms, received a grant from the U.S. Food and Drug Administration (FDA) for their T2Lyme panel. This panel helps physicians quickly administer appropriate therapy, preventing both the adverse effects of incorrect treatment and the overuse of antibiotics

- In March 2022, Accelerate Diagnostics, Inc., an in-vitro diagnostics company, introduced the Accelerate Arc system, which includes the Arc Module and BC Kit. This system automates the rapid and accurate identification of microorganisms in positive blood cultures

- In June 2021, Accelerate Diagnostics, a biotech firm based in Tucson, Arizona, received up to USD 578,000 in funding from CARB-X to support the development of innovative fiber optic technology aimed at diagnosing or assessing the risk of sepsis

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.