Global Brain Implants Market

Market Size in USD Billion

CAGR :

%

USD

6.43 Billion

USD

14.05 Billion

2024

2032

USD

6.43 Billion

USD

14.05 Billion

2024

2032

| 2025 –2032 | |

| USD 6.43 Billion | |

| USD 14.05 Billion | |

|

|

|

|

Brain Implants Market Size

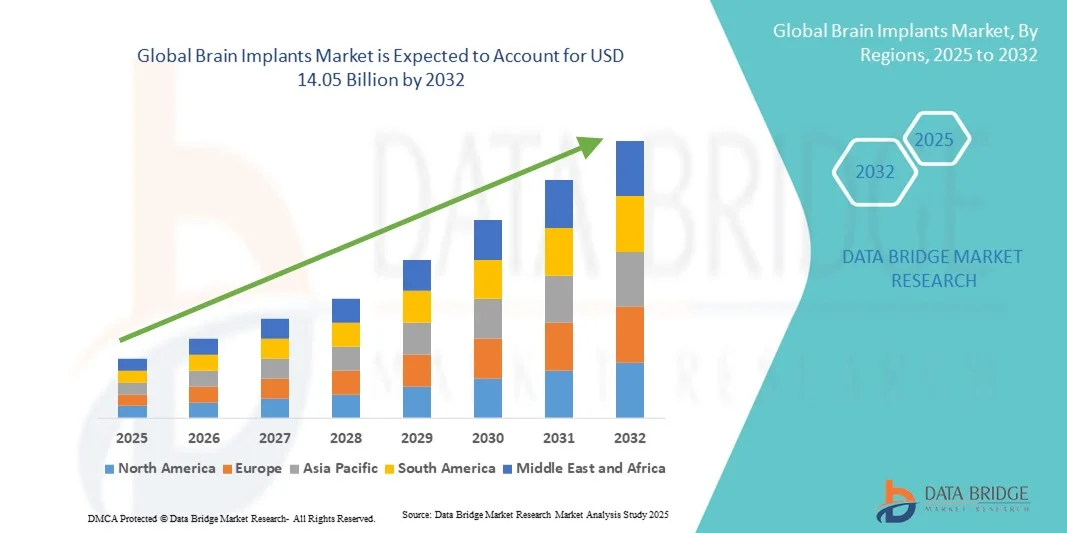

- The global brain implants market size was valued at USD 6.43 billion in 2024 and is expected to reach USD 14.05 billion by 2032, at a CAGR of 10.27% during the forecast period

- The market growth is largely fueled by the rising prevalence of neurological disorders such as Parkinson’s, Alzheimer’s, epilepsy, and depression, alongside technological advancements in brain-computer interfaces (BCIs) and deep brain stimulation (DBS) devices, enhancing treatment outcomes in both clinical and research settings

- Furthermore, the aging population and increasing consumer demand for effective, minimally invasive, and technologically advanced neurological solutions are establishing brain implants as a key intervention for managing complex neurological conditions. These converging factors are accelerating the adoption of brain implant solutions, thereby significantly boosting the industry's growth

Brain Implants Market Analysis

- Brain implants, encompassing devices such as deep brain stimulators (DBS) and vagus nerve stimulators (VNS), are becoming critical tools in the management of neurological disorders in both clinical and research settings due to their ability to provide precise, targeted neural modulation and improved patient outcomes

- The growing demand for brain implants is primarily driven by the rising prevalence of neurological conditions such as Parkinson’s disease, epilepsy, Alzheimer’s disease, and depression, coupled with technological advancements in brain-computer interfaces (BCIs) and minimally invasive neurostimulation devices

- North America dominated the brain implants market with the largest revenue share of 45.33% in 2024, supported by advanced healthcare infrastructure, high adoption of neurotechnologies, and a strong presence of leading medical device companies, with the U.S. experiencing significant growth in implant procedures, particularly in specialized neurology centers, fueled by innovations in DBS, VNS, and AI-assisted neuro-monitoring

- Asia-Pacific is expected to be the fastest-growing region in the brain implants market during the forecast period due to increasing healthcare investments, rising awareness of neurological disorders, and improving access to advanced medical technologies

- Deep brain stimulators dominated the brain implants market with a market share of 38% in 2024, driven by their established efficacy in treating movement disorders and widespread clinical adoption across neurology centers

Report Scope and Brain Implants Market Segmentation

|

Attributes |

Brain Implants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Brain Implants Market Trends

Advancements Through AI and Closed-Loop Neurostimulation

- A significant and accelerating trend in the global brain implants market is the incorporation of artificial intelligence (AI) and closed-loop neurostimulation systems, enhancing precision in treatment and adaptive modulation of neural activity

- For instance, the Neuralink platform employs AI-based algorithms to optimize stimulation patterns in real time, improving outcomes for patients with movement disorders. Similarly, Medtronic’s Percept™ PC device utilizes brain signal feedback to adjust stimulation parameters dynamically

- AI integration in brain implants enables features such as predictive neural response analysis, automated therapy adjustments, and real-time monitoring of patient neural activity. Some NeuroPace devices leverage AI to detect seizure precursors and deliver targeted stimulation, improving patient safety and treatment efficacy

- The seamless integration of brain implants with external monitoring systems and hospital data platforms allows healthcare providers to track patient progress, adjust therapy remotely, and conduct centralized patient management, enhancing overall clinical workflow efficiency

- This trend toward more intelligent, responsive, and data-driven neurotechnologies is redefining expectations for neurological care. Consequently, companies such as Boston Scientific are developing AI-enabled brain implants with adaptive stimulation and remote monitoring features

- The demand for brain implants with AI and closed-loop capabilities is growing rapidly across both clinical and research sectors, as healthcare providers increasingly prioritize precise, personalized, and minimally invasive neurological interventions

Brain Implants Market Dynamics

Driver

Increasing Prevalence of Neurological Disorders and Technological Adoption

- The rising prevalence of neurological disorders, coupled with rapid adoption of advanced neurotechnologies, is a significant driver of increasing demand for brain implants

- For instance, in March 2024, Abbott Laboratories announced enhancements in neuromodulation therapy for Parkinson’s patients, integrating AI-enabled DBS systems to optimize stimulation protocols. Such initiatives by leading companies are expected to accelerate market growth in the forecast period

- As the incidence of Parkinson’s, epilepsy, Alzheimer’s, and depression rises, brain implants provide targeted and effective treatment options, offering compelling advantages over traditional therapies

- Furthermore, increasing awareness of neurotechnologies and the integration of brain implants into research and clinical care are making these devices essential for improving patient outcomes, monitoring neural activity, and conducting advanced neurological studies

- The ability to provide adaptive, personalized therapy, reduce medication dependency, and improve quality of life for patients are key factors propelling the adoption of brain implants in both hospital and research settings

Restraint/Challenge

High Cost and Regulatory Compliance Hurdles

- Concerns regarding high costs of brain implant procedures and regulatory compliance challenges pose significant barriers to broader market penetration. As devices require complex neurosurgical procedures and advanced monitoring, affordability remains a key constraint

- For instance, high-profile cases of complex neurosurgical interventions have highlighted the resource-intensive nature of brain implant therapies, making some healthcare providers cautious in adopting new systems

- Addressing these cost and regulatory challenges through streamlined approval processes, insurance coverage expansions, and development of cost-effective implant solutions is crucial for wider adoption. Companies such as Medtronic and NeuroPace emphasize safety compliance and clinical trial validation in their marketing to build trust among hospitals and patients

- While technological improvements are ongoing, the premium pricing of advanced AI-enabled and closed-loop brain implants can hinder access, particularly in emerging markets or for budget-constrained healthcare systems

- Overcoming these challenges through regulatory harmonization, cost reduction strategies, and enhanced clinician and patient education will be vital for sustained growth in the global brain implants market

Brain Implants Market Scope

The market is segmented on the basis of product type, application, and end-user.

- By Product Type

On the basis of product type, the brain implants market is segmented into deep brain stimulator (DBS), spinal cord stimulator (SCS), and vagus nerve stimulator (VNS). The deep brain stimulator segment dominated the market in 2024 with the largest revenue share of 38%, driven by its extensive clinical use for treating Parkinson’s disease, essential tremor, and other movement disorders. DBS devices are highly preferred in neurology centers due to their proven efficacy, established safety profile, and ability to provide continuous, adjustable stimulation. Hospitals and research institutions favor DBS implants for their compatibility with advanced neurotechnologies, including AI-assisted programming and closed-loop feedback systems. The segment’s dominance is further reinforced by ongoing innovations that improve battery life, miniaturization, and remote monitoring capabilities. Clinicians often prioritize DBS devices due to their adaptability to various neurological conditions and their integration with patient management software. Consequently, the DBS segment continues to account for the largest revenue share in both developed and emerging markets.

The vagus nerve stimulator segment is anticipated to witness the fastest growth during the forecast period, driven by expanding applications in epilepsy, depression, and emerging neurological indications. VNS devices offer a minimally invasive solution, allowing healthcare providers to modulate neural activity without extensive brain surgery. Growing awareness of alternative neuromodulation therapies and increased clinical adoption in psychiatric and neurological practices are fueling market growth. In addition, innovations in implantable VNS devices, including improved programmability and reduced side effects, are further accelerating adoption. The growing prevalence of mood disorders, epilepsy, and treatment-resistant conditions globally is creating strong demand for VNS therapies. Integration with remote monitoring platforms and AI-assisted programming also enhances clinical utility, supporting the segment’s rapid growth trajectory.

- By Application

On the basis of application, the brain implants market is segmented into chronic pain, epilepsy, Parkinson’s disease, depression, essential tremor, Alzheimer’s disease, and other applications. The Parkinson’s disease segment dominated the market in 2024, accounting for the largest revenue share due to the high prevalence of the disease and the proven efficacy of deep brain stimulators in reducing motor symptoms. DBS therapy has become the gold standard for advanced Parkinson’s, enabling precise modulation of neural circuits and improving patient quality of life. Hospitals and specialized neurology centers prefer DBS for Parkinson’s treatment due to its predictable outcomes, long-term safety, and integration with patient monitoring systems. Rising awareness among patients and caregivers, coupled with increasing geriatric populations in North America and Europe, further strengthens segment dominance. Research initiatives continue to optimize stimulation parameters and improve device longevity, reinforcing the segment’s leading position in the market.

The epilepsy segment is expected to register the fastest growth during the forecast period, fueled by the rising prevalence of drug-resistant epilepsy and advancements in closed-loop responsive neurostimulation devices. Brain implants for epilepsy, such as NeuroPace RNS, can detect abnormal electrical activity and deliver targeted stimulation, reducing seizure frequency. The growing adoption of these advanced neuromodulation therapies, along with increasing patient awareness, is driving rapid uptake. Expanding reimbursement coverage and regulatory approvals in multiple regions further support growth. Integration with digital health platforms for remote monitoring enhances the clinical value of implants, attracting hospitals and healthcare providers. The segment’s expansion is also aided by ongoing research into novel stimulation protocols and device miniaturization for improved patient comfort.

- By End-User

On the basis of end-user, the brain implants market is segmented into therapeutics and drug discovery, biological research, agricultural biotech, and industrial biotech. The therapeutics segment dominated the market in 2024, capturing the largest share due to the widespread clinical adoption of brain implants in hospitals, neurology centers, and specialized clinics. Devices such as DBS, VNS, and SCS are primarily used to treat chronic neurological and psychiatric disorders, offering measurable improvements in patient outcomes. Hospitals prefer these implants for their clinical efficacy, integration with advanced monitoring technologies, and ability to complement pharmacological treatments. Growing investments in healthcare infrastructure and increasing prevalence of neurological disorders support segment dominance. In addition, collaborations between device manufacturers and medical institutions enhance accessibility and training, reinforcing the therapeutic segment’s market leadership.

The biological research segment is expected to witness the fastest growth during the forecast period, driven by rising demand for neural implants in experimental and preclinical studies. Research institutions and academic centers are increasingly using brain implants to study neural circuits, brain-computer interfaces, and neuromodulation effects. Funding initiatives, growing focus on neurodegenerative disease research, and advancements in implantable neural devices support rapid expansion. The segment benefits from increasing collaborations between biotech companies and research organizations for innovation and data-driven insights. Moreover, miniaturized, AI-enabled implants facilitate more sophisticated experiments, enhancing adoption across neuroscience laboratories. This surge in research applications is expected to drive the fastest growth in the brain implants market.

Brain Implants Market Regional Analysis

- North America dominated the brain implants market with the largest revenue share of 45.33% in 2024, supported by advanced healthcare infrastructure, high adoption of neurotechnologies, and a strong presence of leading medical device companies, with the U.S. experiencing significant growth in implant procedures, particularly in specialized neurology centers, fueled by innovations in DBS, VNS, and AI-assisted neuro-monitoring

- Patients and healthcare providers in the region highly value the precision, efficacy, and advanced features offered by brain implants, including AI-assisted programming, closed-loop stimulation, and real-time neural monitoring, which significantly improve treatment outcome

- This widespread adoption is further supported by well-established neurology centers, strong R&D initiatives, high healthcare spending, and the presence of key medical device manufacturers, establishing brain implants as a preferred solution for both clinical treatment and research applications

U.S. Brain Implants Market Insight

The U.S. brain implants market captured the largest revenue share of 42% in 2024 within North America, fueled by the high prevalence of neurological disorders and the rapid adoption of advanced neurotechnologies. Healthcare providers are increasingly prioritizing minimally invasive, AI-assisted, and closed-loop neurostimulation solutions for Parkinson’s disease, epilepsy, and depression. The growing trend of personalized treatment plans, combined with robust demand for real-time neural monitoring and programmable stimulation devices, further propels the brain implants market. Moreover, the integration of brain implants with hospital data systems and remote patient management platforms is significantly contributing to the market’s expansion.

Europe Brain Implants Market Insight

The Europe brain implants market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing awareness of neurological disorders and supportive healthcare policies. The growing prevalence of Parkinson’s disease, epilepsy, and Alzheimer’s, coupled with the rising focus on precision medicine, is fostering the adoption of brain implants. European healthcare providers are also drawn to the ability of brain implants to improve treatment outcomes and reduce reliance on pharmacological therapies. The region is experiencing significant growth across hospitals, specialized neurology centers, and research institutions, with brain implants being incorporated into both clinical care and ongoing clinical studies.

U.K. Brain Implants Market Insight

The U.K. brain implants market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing adoption of neurotechnologies and a focus on improving patient outcomes. In addition, the rising prevalence of epilepsy, depression, and movement disorders is encouraging both hospitals and research facilities to adopt advanced brain implant solutions. The U.K.’s strong healthcare infrastructure, coupled with government support for neurological research and digital health initiatives, is expected to continue to stimulate market growth.

Germany Brain Implants Market Insight

The Germany brain implants market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of neurological disorders and demand for advanced treatment options. Germany’s well-developed healthcare infrastructure, combined with a strong emphasis on medical innovation and research, promotes the adoption of brain implants, particularly in hospitals and academic medical centers. The integration of brain implants with neuro-monitoring systems and AI-assisted programming is becoming increasingly prevalent, aligning with local clinical expectations for precision and safety.

Asia-Pacific Brain Implants Market Insight

The Asia-Pacific brain implants market is poised to grow at the fastest CAGR of 18% during the forecast period of 2025 to 2032, driven by improving healthcare infrastructure, increasing prevalence of neurological disorders, and rising investments in neurotechnology in countries such as China, Japan, and India. The region’s growing focus on advanced medical treatments, supported by government initiatives promoting healthcare innovation, is driving the adoption of brain implants. Furthermore, as APAC emerges as a hub for medical device manufacturing and clinical research, affordability and accessibility of brain implant solutions are expanding to a wider patient base.

Japan Brain Implants Market Insight

The Japan brain implants market is gaining momentum due to the country’s high-tech healthcare environment, rising geriatric population, and increasing demand for precision neurological therapies. The Japanese market places significant emphasis on improving quality of life and treatment efficacy, and the adoption of brain implants is driven by specialized neurology centers and research hospitals. The integration of brain implants with AI-enabled neuro-monitoring systems and connected healthcare platforms is fueling growth. Moreover, Japan’s aging population is expected to spur demand for effective, minimally invasive brain implant solutions in both clinical and research sectors.

India Brain Implants Market Insight

The India brain implants market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s expanding healthcare infrastructure, rising prevalence of neurological disorders, and increasing awareness of advanced treatments. India is emerging as a key market for neurotechnologies, and brain implants are becoming increasingly adopted in hospitals, neurology centers, and research institutions. Government initiatives to promote healthcare modernization, combined with the availability of cost-effective implant solutions and growing medical device manufacturing capabilities, are key factors propelling market growth in India.

Brain Implants Market Share

The Brain Implants industry is primarily led by well-established companies, including:

- Neuralink (U.S.)

- Medtronic (Ireland)

- Boston Scientific Corporation (U.S.)

- Abbott (U.S.)

- NeuroPace, Inc. (U.S.)

- LivaNova PLC (U.K.)

- ALEVA NEUROTHERAPEUTICS (Switzerland)

- MicroTransponder Inc. (U.S.)

- NeuroSigma Inc. (U.S.)

- Pixium Vision SA (France)

- Inbrain Neuroelectronics (Spain)

- Functional Neuromodulation Inc. (Canada)

- Stimwave LLC (U.S.)

- Beijing PINS Medical Co., Ltd. (China)

- Synchron Inc. (U.S.)

- BrainGate (U.S.)

- Renishaw PLC (U.K.)

- SceneRay Co., Ltd. (China)

- NDI Medical PLC (Ireland)

What are the Recent Developments in Global Brain Implants Market?

- In April 2025, NeuroPace presented three-year data from the RNS System Post-Approval Study at the American Academy of Neurology conference. The study showed that the responsive neurostimulation system helped reduce seizures by 62% within the first six months in adults with drug-resistant focal epilepsy, highlighting its long-term effectiveness and safety

- In February 2025, Medtronic received U.S. FDA approval for its Adaptive Deep Brain Stimulation (aDBS) system, the first of its kind for Parkinson’s disease. This closed-loop system self-adjusts stimulation in real time based on individual brain activity, marking a significant advancement in personalized neuromodulation. The approval positions Medtronic at the forefront of brain-computer interface technology in clinical settings

- In October 2024, Synchron reported that its Stentrode brain-computer interface met the primary endpoint in a feasibility trial, with all six patients experiencing no device-related serious adverse events. This minimally invasive device, implanted via the jugular vein, enables patients to control digital devices using thought alone, offering a promising alternative to traditional brain implants

- In August 2024, Blackrock Neurotech's brain-computer interface enabled a 45-year-old ALS patient to communicate at 32 words per minute with a 125,000-word vocabulary. This achievement, published in the New England Journal of Medicine, demonstrates the potential of neural implants to restore speech in patients with severe neurological conditions

- In April 2024, cryptocurrency firm Tether invested USD 200 million to acquire a majority stake in Blackrock Neurotech, valuing the company at approximately USD 350 million. This investment aims to support the commercialization and distribution of Blackrock's brain-computer interface technologies, which have been utilized by over 40 individuals to control computers and prosthetic devices without physical movement

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.