Global Breast Implants Market

Market Size in USD Billion

CAGR :

%

USD

2.71 Billion

USD

5.20 Billion

2024

2032

USD

2.71 Billion

USD

5.20 Billion

2024

2032

| 2025 –2032 | |

| USD 2.71 Billion | |

| USD 5.20 Billion | |

|

|

|

|

Breast Implants Market Size

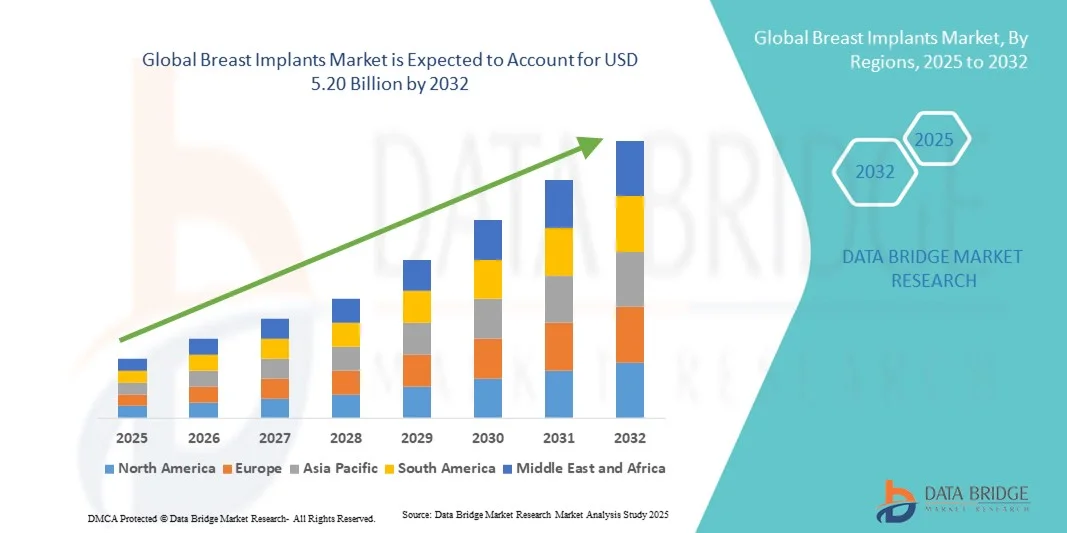

- The global breast implants market size was valued at USD 2.71 billion in 2024 and is expected to reach USD 5.20 billion by 2032, at a CAGR of 8.5% during the forecast period

- The market growth is largely fueled by the rising demand for cosmetic and reconstructive surgeries, increasing awareness about aesthetic procedures, and advancements in implant materials and techniques, which are improving safety and patient outcomes

- Furthermore, growing consumer preference for minimally invasive procedures, combined with the expansion of medical tourism and supportive insurance coverage in some regions, is driving the adoption of breast implant procedures. These converging factors are accelerating the uptake of breast implants, thereby significantly boosting the industry's growth

Breast Implants Market Analysis

- Breast implants, used for both cosmetic augmentation and reconstructive surgeries, are increasingly important in modern aesthetic and reconstructive healthcare due to advancements in implant materials, improved safety profiles, and minimally invasive surgical techniques

- The growing demand for breast implants is primarily fueled by rising awareness of cosmetic procedures, increasing prevalence of breast cancer reconstruction surgeries, and the expanding focus on body aesthetics and self-image

- North America dominated the breast implants market with the largest revenue share of 36.1% in 2024, driven by high consumer awareness, well-established healthcare infrastructure, and the presence of key market players, with the U.S. witnessing significant growth in both elective augmentation and post-mastectomy reconstruction procedures due to technological innovations and improved patient outcomes

- Asia-Pacific is expected to be the fastest growing region in the breast implants market during the forecast period owing to increasing disposable incomes, rising medical tourism, and growing acceptance of cosmetic procedures among younger populations

- Silicone implants dominated the breast implants market with a market share of 52.8% in 2024, attributed to their natural feel, long-term safety, and widespread preference among patients and surgeons for both aesthetic and reconstructive purposes

Report Scope and Breast Implants Market Segmentation

|

Attributes |

Breast Implants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Breast Implants Market Trends

Advancements in Silicone and Customized Implant Technologies

- A significant and accelerating trend in the global breast implants market is the increasing adoption of advanced silicone gel implants and anatomically shaped options, offering more natural aesthetics and improved safety profiles

- For instance, Motiva Ergonomix implants use progressive gel technology to mimic natural breast movement, providing a personalized and realistic appearance while minimizing complications

- Customizable implants and pre-filled options enable surgeons to tailor procedures to individual patient anatomy and preferences, improving surgical outcomes and patient satisfaction

- The integration of imaging technologies, such as 3D simulation and AI-assisted preoperative planning, allows patients to visualize results and select implants that best suit their body type

- Increased use of minimally invasive surgical techniques is reducing recovery time, post-operative pain, and scarring, making breast implants more appealing to a wider demographic

- Rising adoption of implants for reconstructive purposes following mastectomy is driving innovation and demand in specialized implant designs

- This trend towards more natural, safe, and patient-specific implant solutions is fundamentally reshaping consumer expectations in cosmetic and reconstructive breast surgery

- The demand for innovative implants that enhance comfort, appearance, and long-term durability is growing rapidly across both aesthetic and reconstructive procedures, as patients increasingly prioritize personalized outcomes

Breast Implants Market Dynamics

Driver

Rising Demand Due to Cosmetic and Reconstructive Surgeries

- The increasing prevalence of cosmetic breast augmentation and post-mastectomy reconstruction surgeries is a major driver for the growing demand for breast implants

- For instance, in March 2024, Allergan introduced a new line of Natrelle implants designed to enhance reconstructive surgery outcomes, aiming to improve patient satisfaction and safety

- Growing awareness of aesthetic procedures, increased acceptance of cosmetic surgery, and supportive insurance coverage in some regions are boosting market adoption

- Furthermore, expanding medical tourism for breast augmentation and reconstructive procedures is creating new growth avenues, particularly in Asia-Pacific and Latin America

- Rising disposable incomes and urbanization are enabling more women to access elective cosmetic surgeries, increasing overall market size

- The availability of minimally invasive procedures, faster recovery times, and improved surgical techniques are making breast implants increasingly accessible to a wider demographic

- Technological advancements, such as cohesive gel and ergonomically shaped implants, are attracting both new and repeat patients by improving results and safety

- Enhanced safety, durability, and natural appearance of modern implants continue to drive patient preference and adoption across both aesthetic and reconstructive applications

Restraint/Challenge

Risk of Complications and Regulatory Compliance Hurdles

- Concerns regarding post-surgical complications, implant rupture, capsular contracture, and long-term health effects pose significant challenges to market growth

- For instance, reports of rare cases of breast implant-associated anaplastic large cell lymphoma (BIA-ALCL) have made some patients hesitant to opt for implants

- Strict regulatory requirements and approvals in key markets, such as the U.S. FDA and EU medical device regulations, can delay product launches and increase compliance costs

- Addressing patient safety concerns through rigorous clinical trials, improved materials, and post-operative monitoring is crucial for building trust and confidence

- The relatively high cost of premium implants and associated surgical procedures may limit adoption among price-sensitive consumers, especially in developing regions

- Negative publicity and misinformation on social media regarding implant safety can impact consumer perception and slow market growth

- Limited access to skilled surgeons in emerging regions can restrict adoption, as proper technique is critical to achieving safe and satisfactory outcomes

- Overcoming these challenges through innovation in implant materials, patient education, and adherence to global regulatory standards will be vital for sustained market growth

Breast Implants Market Scope

The market is segmented on the basis of type, technology, shape, surface, placement, surgery, end user, and distribution channel.

- By Type

On the basis of type, the breast implants market is segmented into silicone implant, form-stable implant, saline implant, and structured saline implant. The silicone implant segment dominated the market with the largest market revenue share of 52.8% in 2024, driven by its natural feel, long-term safety, and wide acceptance among surgeons and patients. Silicone implants are preferred for cosmetic augmentation and reconstructive procedures due to their ability to mimic natural breast tissue and reduce visible rippling. Continuous innovations in cohesive silicone gel and ergonomically designed implants enhance patient satisfaction. High demand in North America and Europe, where awareness and accessibility are higher, further strengthens the dominance of silicone implants. Regulatory approvals and positive clinical outcomes support sustained preference for this segment.

The form-stable implant segment is anticipated to witness the fastest growth rate of 23.1% from 2025 to 2032, fueled by increasing adoption in reconstructive surgeries and rising patient preference for anatomically shaped, long-lasting implants. Form-stable implants, also known as “gummy bear” implants, maintain their shape even if the outer shell is damaged, providing both aesthetic and safety advantages. Their reduced risk of deformity and natural contours are attracting more patients globally. Rising elective cosmetic procedures in Asia-Pacific and Latin America contribute to the rapid growth of this segment. Surgeons increasingly prefer form-stable implants for high patient satisfaction and minimal revision rates. Technological innovations and clinical approvals are further boosting adoption.

- By Technology

On the basis of technology, the market is segmented into inframammary, peri-areolar, trans-axillary, and transumbilical techniques. The inframammary segment dominated the market with the largest revenue share of 48.7% in 2024, owing to its precision, minimal scarring, and suitability for most implant types. Surgeons prefer this technique as it provides direct access to the breast pocket, reducing the such likelyhood of implant malposition. It is widely recommended in both cosmetic and reconstructive surgeries due to predictable outcomes. Patient preference for minimal post-operative complications reinforces the segment’s dominance. The technique is compatible with silicone and form-stable implants, supporting long-term use. Continuous training and surgeon familiarity further strengthen market leadership.

The trans-axillary segment is expected to witness the fastest growth rate of 20.4% from 2025 to 2032, driven by its scar-free appearance on the breast and growing popularity among younger patients. This technique allows implants to be inserted through the armpit, avoiding visible breast scars. Endoscopic-assisted procedures enhance surgical accuracy and safety. Rising awareness in Asia-Pacific cosmetic surgery markets fuels adoption. Patient preference for minimally invasive options is a key growth factor. The segment benefits from growing medical tourism in regions emphasizing aesthetic outcomes.

- By Shape

On the basis of shape, the breast implants market is segmented into round implant shape, anatomical implant shape, and gummy bear shape. The round implant shape segment dominated the market with a revenue share of 46.5% in 2024, due to its natural-looking results, predictable outcomes, and compatibility with multiple surgical techniques. Round implants are versatile and widely used for cosmetic breast augmentation, offering fullness and symmetry preferred by patients. Surgeons favor them for ease of insertion and minimal rotation risk. Awareness campaigns and favorable patient outcomes strengthen dominance. The segment is highly compatible with both silicone and saline implants. Global demand is reinforced by long-standing clinical trust and consistent results.

The gummy bear shape segment is expected to witness the fastest CAGR of 22.6% from 2025 to 2032, fueled by increasing adoption in reconstructive procedures and rising patient demand for cohesive, form-stable implants. Their ability to maintain shape under pressure and provide natural contours drives growth. Technological innovations improve safety and durability. Approval in major markets such as the U.S. and Europe supports wider use. Surgeons recommend them for high-risk or revision procedures. Increasing awareness among younger patients also boosts market adoption.

- By Surface

On the basis of surface, the market is segmented into textured and smooth implants. The smooth implant segment dominated the market with the largest revenue share of 55.1% in 2024, owing to its lower risk of complications, natural feel, and wide surgeon preference. Smooth implants are often selected in cosmetic augmentation procedures due to patient comfort and aesthetic appearance. Their adaptability to various surgical placements supports dominance. Smooth implants reduce tissue irritation and minimize revision surgeries. High global awareness and clinical validation further strengthen market leadership. Regulatory approvals and established safety data reinforce confidence among surgeons and patients.

The textured implant segment is expected to witness the fastest growth rate of 19.8% from 2025 to 2032, driven by increased use in reconstructive procedures and anatomical implants. Textured surfaces provide better grip and minimize rotation of implants. Growing adoption in specialized surgical centers is supporting expansion. Technological improvements enhance long-term stability and patient outcomes. The segment is particularly favored for complex surgeries. Rising awareness of the advantages of textured implants fuels growth in emerging markets.

- By Placement

On the basis of placement, the market is segmented into subpectoral insertion, sub-glandular insertion, and sub-muscular insertion. The subpectoral insertion segment dominated the market with a revenue share of 50.4% in 2024, due to reduced visibility, lower risk of capsular contracture, and natural contour outcomes. Subpectoral placement is preferred in cosmetic augmentation and post-mastectomy reconstruction. Patients favor it for natural aesthetics and improved long-term outcomes. The technique is highly compatible with silicone and form-stable implants. Surgeons prefer it for predictable post-operative results. Global clinical training reinforces widespread use.

The sub-glandular insertion segment is expected to witness the fastest growth rate of 21.3% from 2025 to 2032, fueled by shorter recovery times, less invasive surgery, and increasing use in cosmetic procedures. Sub-glandular placement is popular among younger patients seeking faster post-operative recovery. Rising surgeon adoption in emerging markets contributes to growth. The technique is compatible with a wide range of implant types. Patient preference for minimally invasive options drives adoption. Advancements in surgical tools further support market expansion.

- By Surgery

On the basis of surgery, the market is segmented into cosmetic surgery and reconstructive surgery. The cosmetic surgery segment dominated the market with a revenue share of 57.2% in 2024, driven by rising aesthetic awareness, increasing disposable incomes, and social acceptance of cosmetic enhancements. Cosmetic augmentation is highly popular in North America and Europe due to access to advanced facilities. Minimally invasive procedures and personalized implants enhance adoption. Surgeons favor it for predictable outcomes and high patient satisfaction. Global awareness campaigns support sustained growth. Technological advancements and safe materials reinforce dominance.

The reconstructive surgery segment is expected to witness the fastest CAGR of 23.5% from 2025 to 2032, fueled by increasing breast cancer incidence, expanding post-mastectomy reconstruction programs, and government healthcare support. Awareness of reconstruction options and improved clinical outcomes are boosting adoption. Hospitals and specialty centers are increasingly offering reconstruction services. Patient demand for safe and natural results supports growth. Technological innovation in implants drives adoption. Emerging markets are showing rising reconstructive surgery uptake.

- By End User

On the basis of end user, the market is segmented into hospitals and cosmetology clinics. The hospitals segment dominated the market with a revenue share of 60.1% in 2024, owing to advanced surgical facilities, experienced surgeons, and comprehensive post-operative care. Hospitals are preferred for both reconstructive and complex cosmetic surgeries. High patient trust and wide geographic coverage reinforce dominance. Specialized training and advanced equipment support better outcomes. Hospitals can manage complex or high-risk procedures. Regulatory compliance and established protocols further strengthen the segment.

The cosmetology clinics segment is expected to witness the fastest growth rate of 22.2% from 2025 to 2032, driven by increasing demand for elective cosmetic procedures, growing number of specialized clinics, and rising awareness among younger populations. Clinics offer convenience, personalized services, and lower costs. The segment benefits from marketing and social media influence. Clinics increasingly adopt minimally invasive techniques. Urbanization and disposable income growth fuel adoption. Patient preference for quick and convenient procedures supports segment expansion.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct and indirect channels. The direct channel segment dominated the market with a revenue share of 53.8% in 2024, due to direct sales from manufacturers to hospitals and clinics, ensuring authenticity and regulatory compliance. Direct sales allow manufacturers to provide technical support and training to surgeons. The segment ensures timely delivery of high-quality implants. Hospitals prefer direct sourcing for critical surgeries. Manufacturer relationships support long-term adoption. Brand trust and verified products reinforce dominance.

The indirect channel segment is expected to witness the fastest CAGR of 20.5% from 2025 to 2032, fueled by growing online sales, medical distributors, and retail partnerships. Indirect distribution enhances accessibility in emerging regions. Clinics and smaller hospitals can source products conveniently. Partnerships with distributors improve market penetration. Growing e-commerce channels support consumer awareness. The segment benefits from expanding global cosmetic procedure demand.

Breast Implants Market Regional Analysis

- North America dominated the breast implants market with the largest revenue share of 36.1% in 2024, driven by high consumer awareness, well-established healthcare infrastructure, and the presence of key market players, with the U.S. witnessing significant growth in both elective augmentation and post-mastectomy reconstruction procedures due to technological innovations and improved patient outcomes

- Consumers in the region highly value the safety, natural appearance, and long-term durability offered by modern silicone and form-stable implants

- This widespread adoption is further supported by high disposable incomes, increasing social acceptance of cosmetic enhancements, and the availability of highly skilled surgeons, establishing breast implants as a preferred solution for both cosmetic augmentation and post-mastectomy reconstruction procedures

U.S. Breast Implants Market Insight

The U.S. breast implants market captured the largest revenue share of 42% in 2024 within North America, fueled by the high prevalence of cosmetic procedures and advanced reconstructive surgeries. Consumers are increasingly prioritizing natural-looking, safe, and long-lasting implants. The growing preference for minimally invasive augmentation, combined with rising disposable incomes and strong awareness of aesthetic procedures, further propels the breast implants industry. Moreover, continuous innovations in silicone gel, form-stable implants, and 3D preoperative imaging are significantly contributing to market expansion. The presence of leading implant manufacturers and a well-established healthcare infrastructure reinforces adoption across both cosmetic and reconstructive applications.

Europe Breast Implants Market Insight

The Europe breast implants market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by advanced healthcare facilities, strict regulatory approvals, and increasing aesthetic consciousness. The rise in urbanization, along with growing interest in cosmetic surgeries, is fostering the adoption of breast implants. European consumers are increasingly drawn to minimally invasive procedures, improved post-operative outcomes, and the safety of modern implants. The region is witnessing strong growth across cosmetic augmentation and post-mastectomy reconstruction, with implants being incorporated into both private clinics and hospital-based surgical programs.

U.K. Breast Implants Market Insight

The U.K. breast implants market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising awareness of cosmetic enhancement, growing social acceptance, and increasing demand for reconstructive procedures. Concerns regarding post-mastectomy reconstruction and body aesthetics are encouraging both patients and surgeons to choose advanced implants. The U.K.’s strong healthcare infrastructure, coupled with well-trained cosmetic surgeons and access to innovative implant technologies, is expected to continue stimulating market growth. The popularity of minimally invasive techniques and enhanced safety profiles further supports adoption.

Germany Breast Implants Market Insight

The Germany breast implants market is expected to expand at a considerable CAGR during the forecast period, fueled by rising cosmetic surgery awareness, strong healthcare infrastructure, and technological advancements in implant materials. Germany’s emphasis on patient safety, innovation, and high-quality surgical standards promotes adoption of both silicone and form-stable implants, particularly in private clinics and hospital settings. The integration of preoperative imaging, personalized implant selection, and minimally invasive techniques is increasingly prevalent, meeting consumer expectations for natural results and predictable outcomes. Germany also benefits from regulatory support and advanced surgical training programs.

Asia-Pacific Breast Implants Market Insight

The Asia-Pacific breast implants market is poised to grow at the fastest CAGR of 21% during the forecast period of 2025 to 2032, driven by rising disposable incomes, increasing urbanization, and growing acceptance of cosmetic procedures in countries such as China, Japan, and India. The region’s expanding medical tourism industry, combined with availability of advanced surgical techniques, is driving adoption. Rising awareness of aesthetic and reconstructive surgeries, alongside government initiatives supporting medical innovation, is further boosting demand. Moreover, the affordability of implants and growing number of specialized clinics are contributing to wider accessibility across the region.

Japan Breast Implants Market Insight

The Japan breast implants market is gaining momentum due to increasing aesthetic consciousness, rapid urbanization, and the demand for minimally invasive cosmetic procedures. The Japanese market places high importance on safety and natural outcomes, and the adoption of silicone and form-stable implants is supported by advanced surgical techniques. Integration of preoperative 3D imaging and personalized implant planning is fueling growth. Moreover, Japan’s aging population and rising medical tourism are such likely to spur demand for both cosmetic and reconstructive procedures in residential and hospital settings.

India Breast Implants Market Insight

The India breast implants market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the expanding middle class, growing urban population, and increasing awareness of cosmetic and reconstructive options. India stands as one of the fastest-growing markets for aesthetic procedures, and breast implants are becoming increasingly popular in private clinics and hospital settings. The push towards medical tourism, availability of affordable implant options, and strong domestic manufacturers are key factors propelling the market. In addition, rising adoption of minimally invasive techniques and growing accessibility in tier-2 and tier-3 cities support market expansion.

Breast Implants Market Share

The Breast Implants industry is primarily led by well-established companies, including:

- AbbVie (U.S.)

- Medical Device Business Services, Inc. (U.S.)

- Tiger Aesthetics Medical, LLC (U.S.)

- Establishment Labs (Costa Rica)

- GC Aesthetics (Ireland)

- Silimed Indústria de Implantes Ltda. (Brazil)

- Polytech Health & Aesthetics GmbH (Germany)

- Nagor (U.K.)

- HansBiomed Co. Ltd. (South Korea)

- Arion Laboratories (France)

- Cereplas SAS (France)

- Anita Dr. Helbig GmbH (Germany)

- Pofam Poznań Sp.z.o.o. (Poland)

- Shanghai Kangning Medical Device Co., Ltd. (China)

- Bimini Health Tech (France)

- Groupe Sebbin (France)

- Establishment Labs (Luxembourg)

- GC Aesthetics (France)

- Abbott (U.S.)

What are the Recent Developments in Global Breast Implants Market?

- In May 2025, Johnson & Johnson MedTech publicly launched the MemoryGel™ Enhance implant line in the U.S., filling a reconstruction gap for approximately 1 in 7 women post‑mastectomy by offering larger‑volume implant options

- In December 2024, Mentor Worldwide LLC (part of Johnson & Johnson MedTech) announced U.S. FDA approval of its MemoryGel™ Enhance breast implants (volume range 930 cc–1,445 cc) targeting women with larger breasts undergoing reconstruction post‑mastectomy

- In September 2024, Establishment Labs Holdings Inc. received U.S. FDA pre‑market approval for its Motiva SmoothSilk® Round and Ergonomix® silicone‑gel breast implants, marking the first new breast implant approval in the U.S.

- In July 2022, Sientra, Inc. announced that the FDA approved its Low Plus Profile Projection Breast Implant for augmentation and reconstruction, expanding its product portfolio with new sizes (80 cc and 110 cc gel implants) aimed at more customization

- In October 2021, the U.S. Food & Drug Administration (FDA) introduced stricter safety requirements for breast implants, mandating that patients receive more detailed information on potential complications and requiring a “Patient Decision Checklist” to be provided by healthcare facilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.