Global Bubble Tea Ingredients Market

Market Size in USD Billion

CAGR :

%

USD

0.70 Billion

USD

1.07 Billion

2024

2032

USD

0.70 Billion

USD

1.07 Billion

2024

2032

| 2025 –2032 | |

| USD 0.70 Billion | |

| USD 1.07 Billion | |

|

|

|

|

Bubble Tea Ingredients Market Size

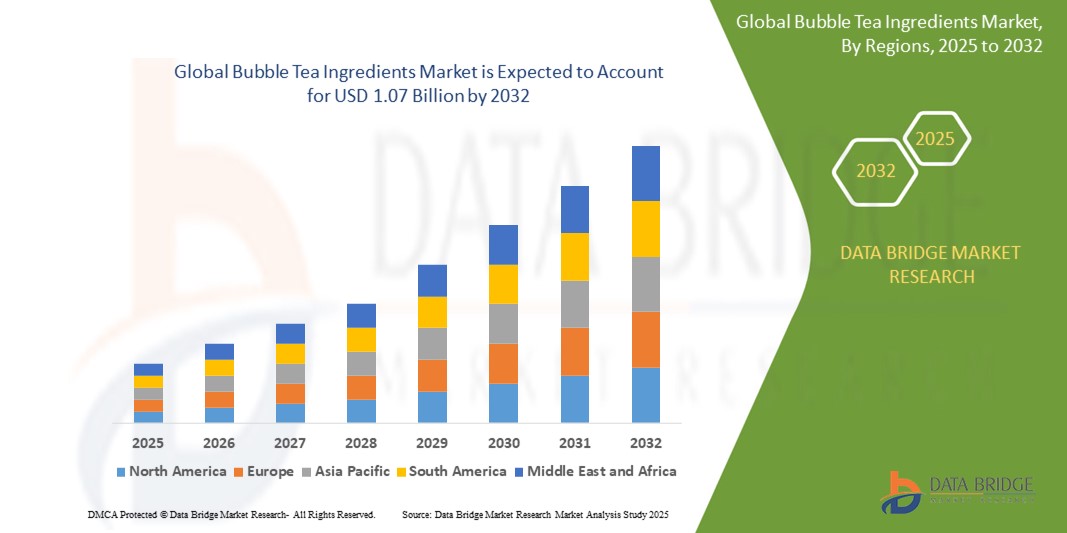

- The global bubble tea ingredients market size was valued at USD 0.70 billion in 2024 and is expected to reach USD 1.07 billion by 2032, at a CAGR of 5.5% during the forecast period

- The market growth is primarily driven by the increasing popularity of bubble tea as a trendy beverage, particularly among younger demographics, coupled with rising consumer demand for customizable and innovative drink options

- The surge in bubble tea shops and cafes globally, along with growing awareness of diverse flavors and health-conscious ingredient choices, is significantly boosting the industry’s expansion

Bubble Tea Ingredients Market Analysis

- Bubble tea, a tea-based beverage originating from Taiwan, has gained widespread popularity due to its unique combination of tea, milk, sweeteners, and chewy tapioca pearls, offering a customizable and refreshing drink experience

- The demand for bubble tea ingredients is fueled by the global expansion of bubble tea chains, increasing consumer preference for exotic and personalized beverages, and the growing influence of Asian food culture in Western markets

- North America dominated the bubble tea ingredients market with the largest revenue share of 38.5% in 2024, driven by a strong presence of bubble tea chains, high consumer spending on specialty beverages, and a well-established food and beverage industry

- Europe is expected to be the fastest-growing region during the forecast period, propelled by increasing adoption of Asian-inspired beverages, rising disposable incomes, and a growing café culture in countries such as the U.K., Germany, and France

- The liquid segment dominated the largest market revenue share of 38.5% in 2024, driven by its foundational role in creating the beverage’s flavor profile and consistency, encompassing tea bases fruit juices, and milk options

Report Scope and Bubble Tea Ingredients Market Segmentation

|

Attributes |

Bubble Tea Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bubble Tea Ingredients Market Trends

“Increasing Integration of Health-Conscious and Sustainable Ingredients”

- The global bubble tea ingredients market is experiencing a significant trend toward incorporating health-conscious and sustainable ingredients

- Consumers are increasingly demanding natural, organic, and low-calorie ingredients, such as plant-based creamers, natural sweeteners such as stevia or honey, and gluten-free or konjac-based tapioca pearls

- These innovations cater to health-conscious consumers, including those with dietary restrictions such as lactose intolerance or vegan preferences, enhancing the appeal of bubble tea

- For instance, companies such as BUBLUV, Inc. have introduced ready-to-drink bubble tea with less than 1 gram of sugar and tapioca pearls made from tapioca starch and konjac, aligning with health and sustainability trends

- The use of eco-friendly packaging, such as recyclable PET cans and biodegradable straws, is also gaining traction, driven by consumer awareness of environmental concerns

- Social media platforms amplify these trends by showcasing innovative ingredients such as fruit-infused tapioca pearls and exotic flavorings, further driving demand for customizable and sustainable bubble tea options

Bubble Tea Ingredients Market Dynamics

Driver

“Rising Demand for Customizable and Innovative Beverage Options”

- The growing consumer preference for customizable and unique beverage experiences is a key driver for the global bubble tea ingredients market

- Bubble tea’s versatility, with a wide range of flavors tea bases and toppings such as tapioca pearls or fruit jellies, caters to diverse tastes and preferences

- The rise of café culture and social media trends, such as the viral #BobaChallenge on TikTok, has increased demand for innovative ingredients such as colorful fruit jellies and vitamin-enriched flavorings

- Urbanization and increasing disposable incomes, particularly in North America, which dominates the market, are boosting the proliferation of bubble tea shops and ingredient suppliers

- The influence of Asian-American communities and the growing popularity of Asian-inspired beverages in Western markets are further driving the demand for high-quality bubble tea ingredients

- Advancements in ingredient formulations, such as plant-based and low-sugar options, are enhancing the market’s appeal to health-conscious consumers and expanding its reach

Restraint/Challenge

“High Production Costs and Health Concerns Related to Sugar Content”

- The high cost of sourcing premium and natural ingredients, such as organic teas, fresh fruit extracts, and sustainable tapioca pearls, can be a significant barrier to market growth, particularly in cost-sensitive emerging markets

- The complexity of producing specialized ingredients, such as plant-based tapioca pearls or low-calorie sweeteners, adds to production costs, which may deter smaller manufacturers or increase prices for consumers

- Health concerns related to the high sugar content in traditional bubble tea recipes pose a challenge, as excessive sugar consumption is linked to obesity, diabetes, and other health issues, potentially limiting market expansion among health-conscious demographics

- The use of artificial preservatives and colors in mass-produced bubble tea ingredients raises additional health concerns, prompting stricter regulations and consumer pushback in regions with high health awareness, such as Europe, the fastest-growing region

- Regulatory variations across countries regarding food safety, labeling, and ingredient standards create complexities for international manufacturers and suppliers, further hindering market scalability

- These factors can reduce consumer adoption in price-sensitive or health-conscious markets, impacting the overall growth of the bubble tea ingredients market

Bubble Tea Ingredients market Scope

The market is segmented on the basis of ingredient type, product type, and flavor.

- By Ingredient Type

On the basis of ingredient type, the global bubble tea ingredients market is segmented into flavoring, creamer, sweetener, liquid, brewed tea, tapioca pearls, and others. The liquid segment dominated the largest market revenue share of 38.5% in 2024, driven by its foundational role in creating the beverage’s flavor profile and consistency, encompassing tea bases fruit juices, and milk options. Its dominance is attributed to the critical role of liquids in delivering customizable and flavorful options that cater to diverse consumer preferences.

The tapioca pearls segment is expected to witness the fastest growth rate of 6.8% from 2025 to 2032, fueled by the rising trend of customization and consumer demand for varied textures and flavors. Innovations such as flavored or colored tapioca pearls and plant-based alternatives such as konjac-based pearls are enhancing their appeal, particularly among health-conscious and vegan consumers.

- By Product Type

On the basis of product type, the global bubble tea ingredients market is into black tea, green tea, oolong tea, and white tea. The black tea segment dominated with a market revenue share of 41.6% in 2024, owing to its robust flavor, widespread availability, and versatility in pairing with various toppings and sweeteners. Its strong taste complements the sweetness of tapioca pearls and syrups, making it a preferred choice for traditional bubble tea recipes.

The green tea segment is anticipated to experience the fastest growth rate of 9.1% from 2025 to 2032, driven by increasing consumer health consciousness and the recognized health benefits of green tea, such as high antioxidant content and support for weight management. The popularity of green tea varieties such as matcha and jasmine further boosts its adoption in innovative bubble tea formulations.

- By Flavor

On the basis of flavour, the global bubble tea ingredients market is into original, chocolate, coffee, fruit, and others. The fruit flavor segment held the largest market revenue share of 40.2% in 2024, driven by its high nutritional value, vibrant aesthetics, and widespread appeal among younger demographics. Popular variants include lychee, mango, passion fruit, and strawberry, with innovations such as real fruit purées and vitamin-enriched infusions further fueling growth.

The chocolate flavor segment is expected to witness the fastest growth rate of 8.5% from 2025 to 2032, driven by increasing demand for indulgent, dessert-such as beverages across all age groups. The rich taste and texture of chocolate-flavored milk tea, often blended with cocoa powder, appeal to consumers seeking a treat-such as experience, coupled with growing awareness of the health benefits of dark chocolate.

Bubble Tea Ingredients Market Regional Analysis

- North America dominated the bubble tea ingredients market with the largest revenue share of 38.5% in 2024, driven by a strong presence of bubble tea chains, high consumer spending on specialty beverages, and a well-established food and beverage industry

- Consumers prioritize bubble tea ingredients for their versatility, taste enhancement, and aesthetic appeal, particularly in regions with diverse culinary preferences

- Growth is supported by advancements in ingredient formulations, such as plant-based creamers and low-sugar sweeteners, alongside rising adoption in both retail and foodservice sectors

U.S. Bubble Tea Ingredients Market Insight

The U.S. bubble tea ingredients market captured the largest revenue share of 75.9% in 2024 within North America, fueled by strong demand for specialty beverages and growing consumer awareness of innovative flavor and texture options. The trend toward beverage customization and the popularity of bubble tea chains drive market expansion. The integration of premium ingredients, such as organic teas and flavored tapioca pearls, complements both retail and café sales, creating a robust market ecosystem.

Europe Bubble Tea Ingredients Market Insight

The Europe bubble tea ingredients market is expected to witness the fastest growth rate, supported by increasing consumer interest in exotic beverages and a focus on health-conscious ingredient options. Consumers seek high-quality teas, natural sweeteners, and plant-based creamers that enhance taste while aligning with wellness trends. Growth is prominent in both retail and foodservice channels, with countries such as the U.K. and Germany showing significant uptake due to rising urbanization and diverse consumer preferences.

U.K. Bubble Tea Ingredients Market Insight

The U.K. market for bubble tea ingredients is expected to witness rapid growth, driven by demand for unique beverage experiences and innovative flavor combinations in urban and suburban settings. Increased interest in beverage aesthetics and growing awareness of health-focused ingredients, such as low-calorie sweeteners, encourage adoption. Evolving food safety and labeling regulations also influence consumer choices, balancing flavor variety with compliance.

Germany Bubble Tea Ingredients Market Insight

Germany is expected to witness significant growth in the bubble tea ingredients market, attributed to its advanced food and beverage sector and high consumer focus on quality and sustainability. German consumers prefer premium ingredients, such as organic teas and eco-friendly packaging that enhance beverage quality and align with environmental goals. The integration of these ingredients in specialty cafés and retail products supports sustained market growth.

Asia-Pacific Bubble Tea Ingredients Market Insight

The Asia-Pacific region is expected to witness rapid growth, driven by the cultural popularity of bubble tea, expanding foodservice industries, and rising disposable incomes in countries such as China, Japan, and India. Increasing awareness of diverse flavor profiles, health-conscious ingredients, and beverage customization boosts demand. Government initiatives promoting food innovation and sustainability further encourage the use of advanced bubble tea ingredients.

Japan Bubble Tea Ingredients Market Insight

Japan’s bubble tea ingredients market is expected to witness strong growth due to consumer preference for high-quality, artisanal teas and innovative ingredient formulations that enhance beverage appeal and taste. The presence of major tea producers and the integration of premium ingredients in both retail and café settings accelerate market penetration. Rising interest in beverage customization also contributes to growth.

China Bubble Tea Ingredients Market Insight

China holds the largest share of the Asia-Pacific bubble tea ingredients market, propelled by rapid urbanization, rising beverage consumption, and increasing demand for customizable and health-focused bubble tea options. The country’s growing middle class and focus on innovative food and beverage trends support the adoption of premium ingredients. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Bubble Tea Ingredients Market Share

The bubble tea ingredients industry is primarily led by well-established companies, including:

- Chatime (Taiwan)

- KUNG FU TEA (U.S.)

- YEN CHUAN INTERNATIONAL CO., LTD. (Taiwan)

- Gong Cha (South Korea)

- Sumo's (M) Sdn Bhd (Malaysia)

- Sunnysyrup Food Co., Ltd. (Taiwan)

- Tapio Tea Company (U.S.)

- Empire Eagle Food Co., Ltd. (Taiwan)

- Vivi Bubble Tea (U.S.)

- Tapioca Express (U.S.)

- Lollicup USA Inc. (U.S.)

- Bubble Tea Supply (U.S.)

- Fanale Drinks (U.S.)

- Bossen (U.S.)

- Kung Fu Tea (U.S.)

What are the Recent Developments in Global Bubble Tea Ingredients Market?

- In February 2025, Boba Bhai, an Indian Korean fusion food brand, introduced its latest packaged fruit-flavored bubble tea on Blinkit, an e-commerce channel. This launch marks a pioneering step in bringing ready-to-drink boba to the quick commerce segment in India, enhancing accessibility for consumers. The product comes in signature flavors such as Guava Chili with Peach Popping Boba and Mango with Passion Fruit Popping Boba, highlighting a focus on locally sourced ingredients and convenient, spill-proof packaging

- In January 2025, iconic Mexican soda brand Jarritos unveiled its new JARRIBOBA line in the U.S. market, blending the vibrant essence of Mexican fruit flavors with Taiwan’s beloved bubble tea tradition. Produced in Taiwan and developed by the Jarritos Flavor House in Mexico, JARRIBOBA features green tea-based popping boba in three bold flavors: Strawberry Guava, Kiwi-Watermelon, and Mango-Passion Fruit. Packaged in 16.4 oz. cans, the launch reflects a growing trend of cross-cultural beverage innovation and marks Jarritos’ entry into the expanding ready-to-drink boba tea segment, targeting Gen Z and flavor-forward consumers

- In November 2024, Blue Tokai Coffee Roasters, India’s premier specialty coffee brand, acquired a bubble tea chain as part of its strategy to diversify product offerings and tap into the fast-growing boba tea segment. The move follows a $35 million funding round led by Verlinvest, aimed at accelerating expansion and innovation. With this acquisition, Blue Tokai seeks to broaden its appeal among younger consumers and capitalize on the rising popularity of flavored tea beverages in India. The integration of bubble tea into its portfolio reflects a wider trend of cross-category growth among established beverage brands

- In March 2024, SPI West Port, a U.S.-based food and beverage firm known for its ALO Drink brand, expanded into the RTD (Ready-to-Drink) boba tea segment with the launch of JENJI. The new line includes flavors such as Mango Latte, Matcha, and Strawberry Latte, available in both the U.K. and U.S. markets through distribution partners such as Unione Trading Europe. Featuring Coco Jelly Boba pearls—a low-carb alternative to traditional tapioca—the drinks are packaged in aluminum cans and designed for shelf stability. This launch reflects growing Western demand for convenient, flavor-forward bubble tea option

- In December 2023, Chinese tea innovator HEYTEA made its official debut in the U.S. market by opening its first store on Broadway in Midtown, New York City. The launch drew enthusiastic crowds, selling 2,500 cups on opening day, and marked a milestone in HEYTEA’s global expansion strategy. Known for pioneering Cheese Tea and using real ingredients such as fresh fruit, premium milk, and hand-brewed tea bases, HEYTEA aims to redefine the American tea experience. This move reflects the growing international influence of Asian bubble tea brands, as they tap into new consumer markets with high-quality, trend-forward offerings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Bubble Tea Ingredients Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Bubble Tea Ingredients Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Bubble Tea Ingredients Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.