Global Cannabis Market

Market Size in USD Billion

CAGR :

%

USD

32.89 Billion

USD

65.54 Billion

2024

2032

USD

32.89 Billion

USD

65.54 Billion

2024

2032

| 2025 –2032 | |

| USD 32.89 Billion | |

| USD 65.54 Billion | |

|

|

|

|

Cannabis Market Size

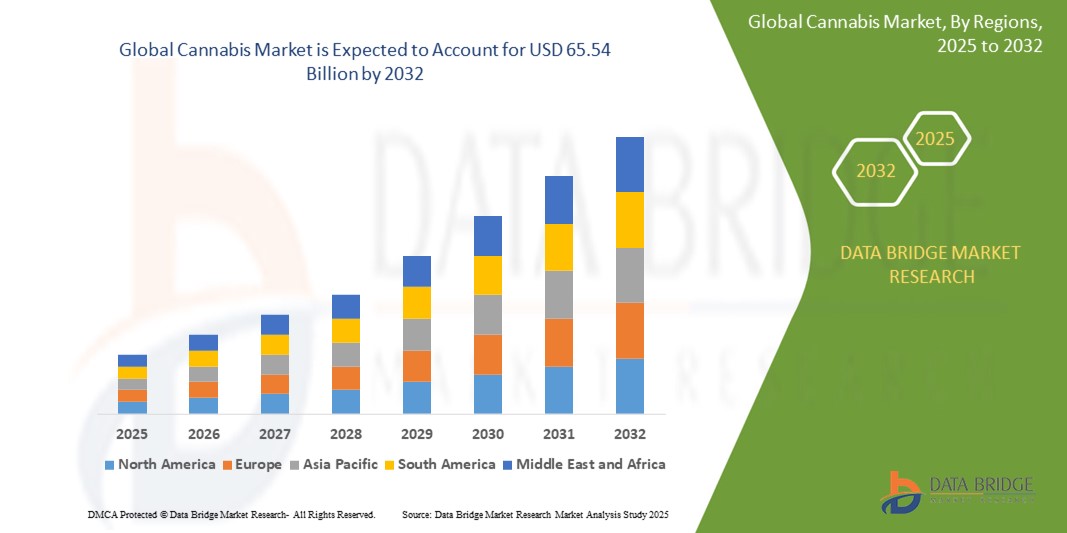

- The global cannabis market size was valued at USD 32.89 Billion in 2024 and is expected to reach USD 65.54 Billion by 2032, at a CAGR of 9.00% during the forecast period

- Market expansion is driven by the legalization of cannabis for medical and recreational use in various regions, along with increasing awareness about its therapeutic benefits.

- In addition, the growing investment in cannabis research, rising demand for CBD-infused wellness products, and expansion of retail distribution channels are accelerating global market penetration and revenue growth

Cannabis Market Analysis

- Cannabis products, including buds, oils, tinctures, and edibles, are playing a transformative role across industries such as pharmaceuticals, wellness, personal care, and food & beverage, due to their medicinal and therapeutic properties

- The rapid rise in demand is primarily supported by the increased acceptance of cannabis-based treatments, advancements in extraction and formulation technologies, and shifting consumer perception toward plant-based, holistic health solutions

- Furthermore, the evolution of regulatory frameworks, especially in North America and Europe, is enabling market players to introduce innovative cannabis offerings, thereby fueling competitive growth and market diversification

- North America dominates the global Cannabis market with a revenue share of 69.57% in 2024. This dominance is driven by widespread legalization, strong consumer acceptance, and a well-established recreational and medicinal Cannabis industry

- Asia-Pacific market is expected to grow at the fastest CAGR of 48.87% from 2025 to 2032, thanks to rising disposable incomes, urbanization, and increased adoption of plant-based diets in key markets such as China, India, and Japan

- The Buds segment held the largest market revenue share of 52.1% in 2024, driven by its widespread usage in both medical and recreational applications. Buds are preferred by traditional consumers for smoking, vaping, and DIY extraction due to their versatility and higher cannabinoid content

Report Scope and Cannabis Market Segmentation

|

Attributes |

Cannabis Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cannabis Market Trends

“Rise of Personalized Nutrition Driving Cannabis-Based Formulations”

- Cannabis protein is gaining momentum in the infant and elderly nutrition sectors due to its hypoallergenic, easily digestible, and nutrient-rich properties, making it suitable for sensitive digestive systems

- Brands such as Sprout Organics and Else Nutrition have introduced formulations incorporating Cannabis protein, promoting it as a plant-based alternative to soy or dairy-based proteins in baby foods and adult nutrition shakes

- A 2024 survey by the Clean Label Project found that over 30% of caregivers preferred plant-based infant formula ingredients, with Cannabis protein ranked among the top three for perceived digestibility and clean-label status

- In elderly nutrition, Cannabis is valued for its mild taste, anti-inflammatory potential, and support in maintaining muscle mass, making it ideal for meal replacements and fortified soups

- Healthcare professionals are increasingly recommending plant-based nutritional aids for geriatric patients, contributing to rising clinical acceptance and institutional demand

- With global aging populations and growing demand for natural, allergen-free infant foods, these niche sectors are set to become high-potential growth verticals for the Cannabis protein market through 2030

Cannabis Market Dynamics

Driver

“Rising Acceptance of Cannabis in Mental Health and Wellness Regimens”

- Increasing awareness and social acceptance of Cannabis as a natural aid for managing anxiety, depression, and sleep disorders is fueling product demand in both the medical and wellness markets

- Consumers are shifting away from synthetic medications, preferring CBD- and THC-infused products for relaxation, mood regulation, and emotional well-being

- Mental health apps and telehealth platforms are beginning to integrate Cannabis-based therapies, offering guided use in conjunction with counseling or mindfulness practices

- In 2024, Charlotte’s Web partnered with a mental wellness startup to offer CBD product bundles tailored for stress and sleep support, sold via subscription boxes through digital wellness platforms

- Consumer surveys by Brightfield Group in late 2023 found that over 58% of CBD users in the U.S. used products to manage stress or improve sleep further validating market growth in this segment

- The alignment of Cannabis with holistic wellness, mental health routines, and natural stress management is expected to be a major growth pillar through 2032, especially as stigma declines and health professionals increasingly recognize its therapeutic potential

Restraint/Challenge

“Limitations in Amino Acid Profile and Functional Texture”

- Despite its growing popularity, Cannabis is often criticized for its incomplete amino acid profile, particularly its low lysine content, which may limit its standalone use as a complete protein

- Functional limitations also exist in terms of texture and solubility, which may affect its application in high-protein beverages or creamy food formulations where soy or whey proteins perform better

- To overcome this, manufacturers are increasingly blending Cannabis with pea or quinoa protein to create complete plant-based protein formulations, adding complexity and cost to product development

- In 2023, Roquette reported a 15% increase in R&D spending to enhance the textural and functional properties of Cannabis through enzyme treatments and fermentation techniques

- In addition, concerns exist over gritty mouthfeel or chalky taste, which can negatively impact consumer acceptance in beverages or premium applications such as dairy alternatives

- These sensory and nutritional drawbacks require significant formulation expertise, which can be a barrier for small and medium-sized food manufacturers entering the plant protein space

- Addressing these formulation challenges through advanced processing technologies and protein blending strategies is crucial for unlocking the full potential of Cannabis across all food segments

Cannabis Market Scope

The market is segmented on the basis of product type, usage, crop variety, and distribution channel.

• By Product Type

On the basis of product type, the Cannabis market is segmented into Buds, Oil, Tinctures, and Others. The Buds segment held the largest market revenue share of 52.1% in 2024, driven by its widespread usage in both medical and recreational applications. Buds are preferred by traditional consumers for smoking, vaping, and DIY extraction due to their versatility and higher cannabinoid content.

The Oil segment is expected to grow at the fastest rate from 2025 to 2032, propelled by its integration into edibles, wellness products, and clinical applications owing to ease of dosing and discreet consumption.

• By Usage

On the basis of usage, the Cannabis market is categorized into Medical and Recreational. The Medical segment dominated the market in 2024, accounting for a market share of 58.4%, supported by increasing legalization, clinical trials, and physician recommendations for chronic pain, anxiety, and epilepsy treatment.

The Recreational segment is projected to witness rapid growth from 2025 to 2032, fueled by regulatory relaxation in North America and parts of Europe, coupled with evolving consumer attitudes and premium lifestyle product demand.

• By Crop Variety

Based on crop variety, the Cannabis market is segmented into Cannabis Indica, Cannabis Sativa, and Others. The Cannabis Sativa segment accounted for the largest share in 2024, contributing to 46.7% of the market revenue, due to its popularity in both therapeutic and recreational use for its uplifting and energizing effects.

The Cannabis Indica segment is anticipated to grow at a faster CAGR during 2025–2032, largely because of its sedative qualities, making it suitable for insomnia, pain relief, and anxiety management in medical cannabis applications.

• By Distribution Channel

On the basis of distribution channel, the Cannabis market is segmented into Physical, Digital, and Others. The Physical segment led the market in 2024 with a dominant share of 61.9%, owing to the widespread presence of dispensaries, pharmacies, and retail outlets offering personalized assistance and verified product access.

The Digital segment is expected to expand at the fastest pace through 2032, driven by increasing consumer preference for online purchases, subscription models, and discreet doorstep delivery facilitated by e-commerce platforms and mobile apps.

Cannabis Market Regional Analysis

- North America dominated the global cannabis market with a revenue share of 69.57% in 2024. This dominance is driven by widespread legalization, strong consumer acceptance, and a well-established recreational and medicinal Cannabis industry

- The U.S. and Canada are pioneers, with extensive retail networks, product innovation, and regulatory frameworks supporting growth

- Increasing consumer interest in medical Cannabis, recreational use, and wellness products is expanding the market. The region also benefits from advanced extraction technologies and diversified product portfolios including edibles, concentrates, and topicals

U.S. Cannabis Market Insight

The U.S. represents the largest share of the North American Cannabis market, boosted by ongoing state-level legalization and a booming recreational sector. The rise of CBD wellness products, vape pens, and edibles has broadened consumer bases beyond traditional users. Companies such as Curaleaf and Green Thumb Industries are leading product innovation and market penetration. Expansion of e-commerce and delivery services is also enhancing consumer accessibility.

Europe Cannabis Market Insight

Europe’s Cannabis market is growing steadily, supported by increasing legalization of medical Cannabis and progressive policies in countries such as Germany, the U.K., and Italy. The market is driven by rising consumer awareness of Cannabis’ therapeutic benefits and increased availability of pharmaceutical-grade Cannabis products. The CBD segment is particularly strong, with expanding retail presence and online sales.

U.K. Cannabis Market Insight

The U.K. Cannabis market is evolving rapidly due to growing acceptance of medical Cannabis and increasing consumer interest in CBD-based wellness products. Regulatory bodies are gradually easing restrictions, enabling more research and product launches. The expansion of CBD oils, topicals, and functional beverages is prominent, with companies focusing on education and destigmatization efforts.

Germany Cannabis Market Insight

Germany is the largest medical Cannabis market in Europe, with robust government support and reimbursement policies fueling growth. The country is a key importer of medical Cannabis flower and extracts and is investing heavily in domestic cultivation. German companies are innovating in pharmaceutical formulations and expanding patient access programs, driving steady market expansion.

Asia-Pacific Cannabis Market Insight

Asia-Pacific market is expected to grow at the fastest CAGR of 48.87% from 2025 to 2032, with countries such as Australia, Thailand, and South Korea legalizing medical Cannabis and opening markets for wellness products. Rising consumer awareness and government-backed research programs are propelling the medical segment. Thailand, as a pioneer in Southeast Asia, is developing Cannabis tourism and local cultivation industries.

Japan Cannabis Market Insight

Japan’s Cannabis market is primarily focused on medical research and limited medical Cannabis usage, constrained by strict regulations. However, growing interest in CBD wellness products and functional health foods is encouraging product development and regulatory discussions. The market is expected to expand cautiously, aligned with global health trends.

China Cannabis Market Insight

China maintains strict regulations against recreational Cannabis but is a major player in the global hemp and CBD industries. Chinese companies dominate the manufacturing of hemp-derived products such as textiles, food ingredients, and CBD extracts. The government supports industrial hemp cultivation in specific provinces, contributing to the global supply chain despite restrictive Cannabis laws.

Cannabis Market Share

The Cannabis industry is primarily led by well-established companies, including:

- The Cronos Group (Canada)

- Tilray (U.S.)

- Marley Natural (U.S.)

- Aurora Cannabis (Canada)

- Cara Therapeutics (U.S.)

- ARUMA LABS HOLDINGS PTY LIMITED (Australia)

- Medcan Australia (Australia)

- Sundial Growers Inc. (Canada)

- Canopy Growth Corporation (Canada)

- The Scotts Company LLC (U.S.)

- Aphria Inc. (Canada)

- VIVO Cannabis Inc. (Canada)

- Cannatrek (Australia)

- SpeedWeed (U.S.)

- GW Pharmaceuticals plc. (U.K.)

- Harborside Health Center (U.S.)

- Steep Hill, Inc. (U.S.)

- CBD Einstein (U.S.)

- Weedmaps (U.S.)

Latest Developments in Global Cannabis Market

- In May 2023, Toast, a multi-state cannabis brand, partnered with the Nirvana Group, a leading diversified cannabis company, to introduce innovative cannabis products to consumers in Oklahoma and New Mexico. This collaboration aims to expand Toast’s market presence and bring high-quality cannabis experiences to new regional markets

- In April 2023, Hello Juice & Smoothie, a U.S.-based juice and smoothie retailer, joined forces with The Beleaf Co. to launch a new product line featuring CBD-infused juice shots. This partnership reflects growing demand for functional beverages and bridges wellness trends with cannabis innovation

- In April 2023, PharmaCielo, a Canadian cannabis cultivator and extract producer, announced a partnership with Portugal-based CANNPRISMA - PHARMA, a Contract Manufacturing Organization, to supply EU-GMP1-certified medicinal cannabis flowers to European markets. The agreement strengthens PharmaCielo’s foothold in Europe while promoting access to standardized medical cannabis

- In May 2022, Canopy Growth Corporation expanded its beverage portfolio by launching two new flavors of its cannabis-infused carbonated drinks: orange and grape. This move highlights Canopy Growth’s focus on diversifying product offerings and enhancing consumer appeal in the cannabis beverage sector

- In March 2021, lawmakers in Mexico approved a historic bill legalizing the recreational use of marijuana, allowing adults to smoke and grow cannabis with legal permits, and enabling licensing for cultivators and sellers. This legislative shift positions Mexico to potentially become one of the world’s largest legal cannabis markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cannabis Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cannabis Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cannabis Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.