Global Carbon Steel Tubing In Oil And Gas Lift Applications Market

Market Size in USD Billion

CAGR :

%

USD

4.79 Billion

USD

7.88 Billion

2024

2032

USD

4.79 Billion

USD

7.88 Billion

2024

2032

| 2025 –2032 | |

| USD 4.79 Billion | |

| USD 7.88 Billion | |

|

|

|

Carbon Steel Tubing in Oil and Gas Lift Applications Market Size

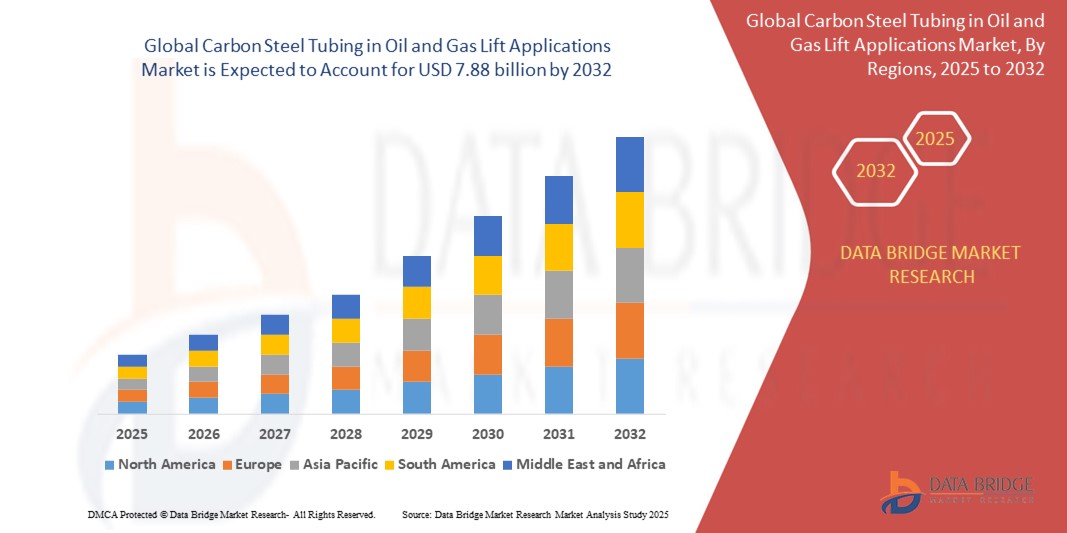

- The global carbon steel tubing in oil and gas lift applications market was valued at USD 4.79 billion in 2024 and is expected to reach USD 7.88 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.40%, primarily driven by advancements in extraction technologies

- This growth is driven by factors such as deepwater & offshore drilling, hydraulic fracturing and artificial lift systems

Carbon Steel Tubing in Oil and Gas Lift Applications Market Analysis

- The carbon steel tubing in oil and gas lift applications market is crucial for oil and gas extraction processes, offering durable, cost-effective solutions for deepwater drilling, enhanced oil recovery (EOR), and artificial lift systems. Known for its strength and resistance to high pressure and corrosion, carbon steel tubing is widely used in challenging environments

- The market is growing due to rising energy demand, technological advancements in extraction methods, and the expansion of oil and gas infrastructure. Increased investment in offshore and unconventional drilling is further driving the demand for reliable carbon steel tubing

- The market is evolving with a focus on improving material performance and corrosion resistance. Companies are investing in advanced coatings and manufacturing innovations to meet the rigorous demands of modern drilling while enhancing sustainability

- For instance, companies such as Tenaris are developing carbon steel tubing with protective coatings to improve corrosion resistance, particularly for offshore and high-pressure applications. This innovation extends the tubing’s lifespan and reduces maintenance costs

- The market is expected to continue its growth, driven by new oil and gas projects, advanced extraction technologies, and the increasing need for efficient, cost-effective solutions in the industry. Carbon steel tubing remains essential for lifting and extraction operations worldwide

Report Scope and Carbon Steel Tubing in Oil and Gas Lift Applications Market Segmentation

|

Attributes |

Carbon Steel Tubing in Oil and Gas Lift Applications Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Carbon Steel Tubing in Oil and Gas Lift Applications Market Trends

“Increasing Adoption of Advanced Coating Technologies”

- One prominent trend in the global carbon steel tubing in oil and gas lift applications market is the increasing adoption of advanced coating technologies

- This trend is driven by the need for enhanced durability and resistance to harsh environmental conditions in oil and gas extraction processes. As the industry faces increasingly challenging environments such as offshore and deepwater drilling, there is a rising demand for tubing solutions that can withstand corrosion, high pressure, and extreme temperatures

- For instance, National Oilwell Varco (NOV) is integrating specialized coatings into their carbon steel tubing. These coatings improve resistance to corrosion and wear, particularly in applications involving aggressive substances such as hydrogen sulfide and brine, and help extend the life of the tubing, reducing downtime and maintenance costs

- The growing focus on improving operational efficiency and reducing maintenance expenses is further driving the adoption of these advanced coatings. As a result, carbon steel tubing with innovative coatings is becoming a preferred choice for deepwater drilling, enhanced oil recovery, and artificial lift systems

- As the oil and gas industry continues to evolve, the demand for advanced coating technologies is expected to rise, with manufacturers focusing on enhancing the performance, reliability, and sustainability of their tubing products. This trend is anticipated to play a significant role in the continued growth and development of the carbon steel tubing market

Carbon Steel Tubing in Oil and Gas Lift Applications Market Dynamics

Driver

“Expansion of Oil and Gas Infrastructure”

- The expansion of oil and gas infrastructure is a significant driver for the growth of the carbon steel tubing in oil and gas lift applications market. As global demand for energy continues to rise, the need for advanced infrastructure in oil and gas extraction has become increasingly important, creating opportunities for the use of carbon steel tubing in lift applications.

- The growing investments in oil and gas projects, particularly in offshore and deep-water drilling, are fueling the demand for durable, reliable tubing solutions, such as carbon steel, which are essential in lift applications for oil extraction.

- This trend is most prominent in regions with expansive oil reserves, such as the Middle East, North America, and parts of Asia, where increased drilling and infrastructure development are driving the adoption of high-quality tubing materials capable of withstanding harsh operational environments.

- As oil companies seek to enhance production efficiency, the role of carbon steel tubing in facilitating the transportation and lifting of oil has become more critical, encouraging demand for products that offer both strength and corrosion resistance.

- Innovations in carbon steel production techniques and the growing focus on cost-effective solutions for infrastructure projects are further driving the expansion of carbon steel tubing in lift applications, with manufacturers enhancing the material's performance and durability

For instance,

- Tubular Steel Inc. has been a prominent supplier of carbon steel tubing for oil lift applications, collaborating with energy companies to ensure the quality and durability of tubing used in extreme oil extraction environments

- National Oilwell Varco (NOV) has introduced advanced carbon steel tubing products that are optimized for lift applications, strengthening its position in the growing oil and gas infrastructure market

- As infrastructure projects continue to evolve and the demand for oil rises, the carbon steel tubing market for oil and gas lift applications is poised for sustained growth, reinforcing its critical role in modern energy extraction processes

Opportunity

“Development of Advanced Coatings and Alloys”

- Development of advanced coatings and alloys presents a significant opportunity for growth in the carbon steel tubing in oil and gas lift applications market. As the demand for more resilient materials grows, the ability to improve the durability and performance of carbon steel tubing through advanced coatings and alloys is becoming increasingly important

- Coatings designed to offer enhanced corrosion resistance, as well as alloys that provide improved resistance to harsh environmental conditions, are gaining traction. These innovations are particularly relevant for the oil and gas industry, where tubing must withstand extreme temperatures, pressure, and corrosive substances

- The development of coatings and alloys tailored to specific environments, such as offshore drilling or sour gas wells, is creating opportunities for market expansion, as companies seek to optimize performance and reduce maintenance costs

For instance,

- Valero Energy is collaborating with material science companies to create advanced carbon steel alloys designed for sour gas conditions, improving operational efficiency and reducing wear.

- ArcelorMittal is leading the way in producing high-performance carbon steel tubing coatings, offering enhanced resistance to extreme pressure and temperature conditions in deepwater oil fields

- As the demand for durable and high-performance tubing continues to rise, the development of advanced coatings and alloys will play a critical role in shaping the future of the Carbon Steel Tubing in Oil and Gas Lift Applications market

Restraint/Challenge

“Impact of Fluctuating Crude Oil Prices”

- Fluctuating crude oil prices present a significant challenge for the Carbon Steel Tubing in Oil and Gas Lift Applications market. As oil prices experience volatility, companies in the oil and gas sector face uncertainty, making it difficult to plan and allocate budgets for long-term infrastructure investments, including carbon steel tubing

- The carbon steel tubing market, closely tied to the oil and gas industry’s capital expenditures, is affected by price fluctuations that impact project timelines, cost estimations, and overall demand for tubing products. These market swings often lead to shifts in production schedules and project delays, complicating the planning process for manufacturers and suppliers

- Rapid changes in crude oil prices can lead to erratic demand for oil and gas infrastructure projects, including lift applications. When oil prices fall, companies may delay or scale back expansion plans, leading to reduced orders for carbon steel tubing, while higher prices can lead to increased demand for infrastructure development, putting pressure on supply chains

For instance,

- Major players such as Tenaris and Vallourec have experienced challenges in adjusting production volumes and pricing strategies to align with fluctuating demand for carbon steel tubing, directly impacted by global crude oil price changes

- As crude oil prices continue to fluctuate, the Carbon Steel Tubing in Oil and Gas Lift Applications market remains vulnerable to inconsistent demand and pricing pressures, making it difficult for manufacturers to forecast and stabilize revenue streams

Carbon Steel Tubing in Oil and Gas Lift Applications Market Scope

The market is segmented on the basis of outer diameter, coating type, and end-use.

|

Segmentation |

Sub-Segmentation |

|

By Outer Diameter |

|

|

By Coating Type |

|

|

By End-Use |

|

Carbon Steel Tubing in Oil and Gas Lift Applications Market Regional Analysis

“North America is the Dominant Region in the Carbon Steel Tubing in Oil and Gas Lift Applications Market”

- North America dominates the carbon steel tubing in oil and gas lift applications market, driven by the region's significant oil and gas reserves, advanced infrastructure, and ongoing investments in energy extraction technologies. The demand for durable and high-quality carbon steel tubing is fueled by continuous exploration and production activities, especially in shale oil fields and deepwater drilling projects

- The U.S. holds a significant share due to its extensive oil and gas industry, high production rates, and strong adoption of advanced tubing solutions for oil extraction. The country’s position as a global energy leader, coupled with high investment in oilfield technologies, continues to drive the demand for reliable carbon steel tubing

- The strong presence of major oil and gas operators, increased drilling activities in regions such as the Permian Basin, and a focus on enhancing production efficiency are key factors contributing to North America's dominance in the market

- With a mature oil and gas industry, increasing focus on energy security, and ongoing investments in infrastructure, North America is expected to maintain its dominant position in the global Carbon Steel Tubing in Oil and Gas Lift Applications market throughout the forecast period

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the carbon steel tubing in oil and gas lift applications market, driven by increasing energy demand, rapid industrialization, and a growing focus on offshore and onshore oil and gas exploration

- Countries such as China, India, and Australia are leading the regional market, supported by expanding oil and gas reserves, growing exploration activities, and rising investments in energy infrastructure. The shift towards enhanced energy extraction capabilities and the adoption of advanced tubing solutions in these countries is boosting demand

- Southeast Asia, including nations such as Indonesia and Malaysia, is emerging as a high-potential market due to increasing exploration projects in offshore oil fields and rising demand for energy resources to support economic growth

- The rapid expansion of energy markets, combined with increasing industrial investments and infrastructure development, positions Asia Pacific as the fastest-growing region for carbon steel tubing in oil and gas lift applications. The region's increasing adoption of advanced technologies and expanding oil and gas reserves are expected to drive market growth throughout the forecast period

Carbon Steel Tubing in Oil and Gas Lift Applications Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Tenaris (Luxembourg)

- Vallourec (France)

- NIPPON STEEL CORPORATION (Japan)

- United States Steel Corporation (U.S.)

- Jindal SAW Ltd (India)

- ArcelorMittal (Luxembourg)

- Webco Industries (U.S.)

- JFE Holdings, Inc. (Japan)

- S.B. International, Inc. (U.S.)

- Continental Alloys & Services (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Carbon Steel Tubing In Oil And Gas Lift Applications Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Carbon Steel Tubing In Oil And Gas Lift Applications Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Carbon Steel Tubing In Oil And Gas Lift Applications Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.